-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(2): 82-87

doi:10.5923/j.ijfa.20140302.04

Effectiveness of Regulatory Pronouncements in Curbing Financial Statements Irregularities in Commercial Banks in Kenya

Oyerogba Ezekiel Oluwagbemiga

Department of Commerce and Economic Studies, School of Human Resources Development, Jomo Kenyatta University of Agriculture and Technology

Correspondence to: Oyerogba Ezekiel Oluwagbemiga, Department of Commerce and Economic Studies, School of Human Resources Development, Jomo Kenyatta University of Agriculture and Technology.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

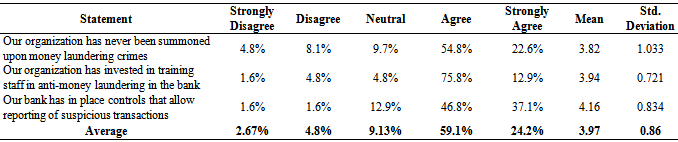

The main objective of the study was to investigate to what extent has regulatory pronouncement been effective in curbing financial statement irregularities in commercial banks in Kenya. Regulatory pronouncements discussed in this paper include systemic risk, credit risk, prudential risk and anti-money laundering guidelines. The population of the study was all the audit and legal managers in the 43 commercial banks in Kenya. Given that the population is not large, a census was conducted. Purposeful or judgmental sampling was used to select the respondents, therefore two managers; one from the auditing and legal departments was picked as the respondents thus the total sample size for the study was 86. Results indicate that banks’ internal systems are effective at detecting fraud, customer-related fraud and employee related fraud. Additional findings indicate that majority of banking institutions in Kenya have put in place good internal audit functions and there is transparency and accountability. Results also show that Kenya’s commercial banks have a responsibility management whose function is to set up a credit administration team to ensure credit granted to a client is properly administered. Majority of banks in Kenya have never been summoned upon money laundering crimes and banks in Kenya have invested in the training of staff in anti-money laundering in the bank. Conclusions made from the study shows that the identified regulatory pronouncements herein, if effective positively affects financial regularities. The unique contribution of this paper is that it clearly addresses the effects of some regulatory pronouncements, upon which majority of commercial banks in a developing economy ought to adapt to mitigate financial irregularities. The findings of these studies may be used to improve the training curriculum of audit and legal professionals in order to capture the important findings of the study.

Keywords: Regulatory Pronouncements, Financial Statements Irregularities, Commercial Banks

Cite this paper: Oyerogba Ezekiel Oluwagbemiga, Effectiveness of Regulatory Pronouncements in Curbing Financial Statements Irregularities in Commercial Banks in Kenya, International Journal of Finance and Accounting , Vol. 3 No. 2, 2014, pp. 82-87. doi: 10.5923/j.ijfa.20140302.04.

Article Outline

1. Background and Research Problem

- (Tun, 2005). Effectiveness represents different competencies and capabilities in organizations which show that the organization is doing the right thing. Theoretical reviews such as the contingency theory is considered appropriate in this case. Financial irregularities can be defined as a deliberate act or deliberate failure to act with the intent to obtain unauthorized financial benefit. Financial fraud includes, but is not limited to, misappropriation of funds or property, authorizing or receiving compensation or reimbursement for goods not received or services not performed, falsification of work/employment records, or unauthorized alteration of financial records (Hall, nd). According to Basel Committee on bank supervision (2012) the identified regulatory pronouncements may include; systemic risk, credit risk, prudential risk and anti-money laundering guidelines.The study aims to appraise the existing literatures on the effectiveness of regulatory pronouncements in curbing financial statements irregularities in commercial banks in Kenya. The specific objectives was to measure the level of compliance of commercial banks with the regulatory pronouncements and also investigate to what extent has regulatory pronouncements assisted in curbing financial statement irregularities in Kenya commercial banks with specific reference to systemic risk, credit risk, prudential risk and anti-money laundering regulatory pronouncements. According to a national budget (2012/2013) the Central Bank of Kenya is responsible for implementing coordinated supervision of banks with cross boarder operations. Another landmark achievement in the history of bank regulation in Kenya is the preparation of a development finance institution bill by the ministry of finance which will facilitate the supervision of Agricultural Finance. Additionally, crime and Anti money laundering in Kenya not only looks at banks but also other financial sectors in the county including insurance and capital market sector. The Capital Markets Authority also has regulatory powers such as formulation of regulations, rules and guidelines required for effective financial regulation and supervision. The bodies also envision collaboration of other regulatory bodies outside Kenya to effectively investigate persons who contravene regulatory or legal requirements.Alleyne and Howard (2005) studied the difference between auditor and users around the responsibility of auditor for fraud detection. Their results revealed that there is a wide expectation gap between auditors and users for fraud detection. MC Enroe and Martens (2002) by comparing audit partners’ and investors’ perceptions of auditors’ responsibilities involving various dimensions of the attest function. The results revealed that an expectation gap currently exists: investors have higher expectations for various facts and assurances of the audit than do auditors in the following areas: disclosure, internal control, fraud, and illegal acts. Koh and Woo (2001) investigated the audit expectation gap between auditors and management and found a significant gap, which management expecting more that auditors in the areas of preventing and detecting fraud, illegal acts, errors, and in guaranteeing the accuracy of financial reports. Little research has been done to establish the regulatory pronouncements in curbing financial statements irregularities in commercial banks in Kenya.

2. Theoretical Review

2.1. Contingency Theory

- Contingency theory means that one thing depends on other things, and for organizations to be effective, there must be a “goodness of fit” between their structure and the conditions in their external environment. As such the correct management approach is contingent on the organization’s situation (Daft, 2001). This study accepts the notion of contingency theory, which suggests that the selected PMS design and use must conform to its contextual factors. Contingency theory represents a rich blend of organizational theory such as organizational decision making perspectives and organizational structure (Lawrence & Lorsch, 2004; Pugh, Hickson, Hinnings & Turner 1969; Donaldson, 2001). The essence of the contingency theory paradigm is that organizational effectiveness results from fitting characteristics of the organization, (such as its cultures) to contingencies that reflect the situation of the organization (Burns and Stalker, 1961; Lawrence and Lorsch, 2004). According to Donaldson (2001), organizations seek to attain the fit of organizational characteristics to contingencies which leads to high performance. Therefore the organization becomes shaped by the contingencies (fit) to avoid loss of performance. Thus, there is an alignment between organization and its contingencies, creating an association between contingencies and organizational contextual characteristics (Burn and Stalker, 1961). This theory is relevant to the study because one thing depends on another to be effective hence to curb financial irregularities in Kenyan banks, there needs to be effective regulatory pronouncements put in place.

3. Empirical Evidence

- This section presents previous studies done by different researchers across the world. The section further provides empirical studies on effectiveness of Regulatory Pronouncement in Curbing Financial Irregularities among banks in developed countries, developing economies and in Africa.

3.1. Effectiveness of Regulatory Pronouncement in Curbing Financial Irregularities among Banks in Developed Countries

- Farell and Franco (1999) examined the role of the auditing in the prevention and detection of business fraud. The researchers found out that the expansion of computers into businesses may make organizations more vulnerable to fraud and abuse. The authors recommended that in order to combat fraud and white collar crime in businesses, a concerted effort must be exerted by the management of the business, external auditors and by all employees of the business. Farell and Franco also indicated that the cost of fraud and theft are shared by all through higher costs and lower corporate profits. Additionally, they also suggested that through adequate internal controls by management, better working environments for employees, more stringent requirements for external auditors and codes of ethics for employees are some of the means where fraud and other irregularities in American corporates can be mitigated. The accounting environment of the real world is complicated, which presents great challenges to system developers to develop accounting information systems to capture the events and activities of the real business environment (Jensen & Meckling, 1976). Some form of structure is present with rigid and established frameworks and standards like the generally accepted accounting principles (GAAP) for transaction processing and financial reporting. However, financial opportunism owing to agency relationships rationalization for fraud and complex nature of business transactions are some of the challenges that AIS fail to curb. This situation means that internal controls associated with the accounting information systems needs constant evaluation and reconsideration. These elements surrounding the system require the same to be dynamic with the capacity for swift reorganization in events of maneuvering threats (Romney & Steinbart, 2011).Major Western economies have been experiencing a deepening banking and financial crisis arising from subprime lending practices by banks, which in turn has restricted the availability of credit and has led to what has been described as the ‘credit crunch’ (Sikka, 2009). Some analysts have attributed this crisis to the unethical practices of corporate bank managers and to the inability of auditors to expose such anti-social practices from previous audits. According to the authors some auditors may have failed to comply with expected standards set by the regulation thus if a company fails shortly after being audited, the auditors may be blamed for conducting an inferior audit (Dopuch, 1988). The involvement and culpability of accountants and auditors in unethical practices and conflicts of interest have long been documented by critical accounting scholars in developed and developing countries (Mitchell & Sikka 2001; Bakre, 2007; Sikka, 2009; Gyénin-Paracini & Gendron, 2010). A number of recent studies have questioned the value of company audits, auditor independence, the quality of audit work to curb financial irregularities (Sikka, 2009). These studies have argued that the issuance of audit reports is subject to organizational and regulatory politics that fee dependency impairs claims of independence and has the capacity to silence auditors, and that the intensification of financial capitalism poses questions about the knowledge base of auditors (Sikka, 2009; Sikkaet al, 2009).

3.2. Effectiveness of Regulatory Pronouncement in Curbing Financial Irregularities among Banks in Developing Countries

- Greece’s’ Arvanitidou, Konstantinidou, Papadopoulos and Xanthi, (nd) carried out a study to examine the relationship and the interactions between three important elements: corruption, corporate governance mechanisms and financial accounting information. The researchers argue that the use of transparent financial accounting information in corporate control mechanisms enhances the effectiveness of the governance process which in turn prevents corruption. The researchers indicated that financial accounting information plays an important role of financial accounting information in corporate control mechanisms in order to eliminate corruption and enhance corporate transparency. The authors argued that transparency, integrity, and quality of financial reporting, for which the entire corporate governance system (board of directors, audit committee, top management team, internal auditors, external auditors, and governing bodies) is considered to be responsible, in effective corporate governance mechanisms.Mhlanga (2011) argued that most of banking sector problems in Zimbabwe can be traced to weaknesses at the central bank through its lack of capacity, lack of vigilance and slow speed to act in cases of identified violations by banks. The over-indebtedness of the commercial banks also provides persuasive evidence of a possible case of regulatory capture. Additionally, the other factor that contributes to recurrent financial sector problems in Zimbabwe can be attributed to institutional weakness in the administration of banks, especially the indigenous ones in terms of adhering to good corporate governance. To improve the operation of the banking system in Zimbabwe, it may be appropriate that measures be taken and implemented in the country. The researcher recommended that financial regulation and supervision needs to evolve by creating incentives for prudent risk-taking by those entrusted with the public’s wealth, while adapting and adopting international standards and best practices. This, according to Mhlanga (2011) will assist banks to remain compliant at all times, thus fostering confidence in the financial systems and the ability to curb external shocks.Otusanya and Lauwo (2010) sought to examine contemporary auditing and the role of accountants and external auditors in the recent banking crisis in Nigeria. The involvement of accountancy firms in anti-social practices in Nigeria has not been exposed or sanctioned by their professional bodies but by regulators. Professionals have been implicated in unethical practices, but their role in such practices has rarely been investigated. The researchers observe that professionals are under systemic pressure to increase profits. They therefore recommended that it is necessary to ensure that audits of major companies, at least banks and financial institutions, are carried out directly by regulators.Ongeri, Okioga and Okwena (nd) assessed the effectiveness of internal audit systems in the management of decentralized funds in Kenya’s Kisiicounty. A descriptive study design was adopted in the study and the targeted population of the study was 124 upper and middle cadre employees and councilors. The researchers concluded that the internal audit systems were averagely effective in the management of local authority transfer funds. Further conclusions were that the internal audit systems needed to be improved, following the recommendations of research. The findings of the research can be used by municipal councils, academicians, and researchers as a source of knowledge. Recommendations provided by the researchers were that Kisii Municipal Council should establish an independent internal audit department.

4. Research Methodology

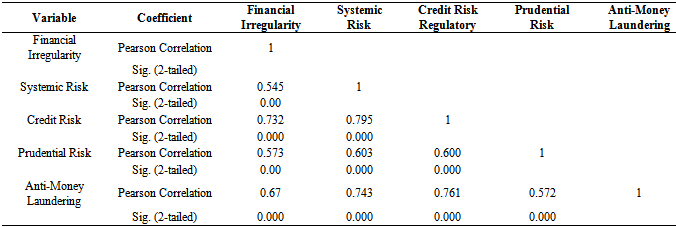

- The study used descriptive survey design. Descriptive studies are essential in many situations especially when using qualitative data in understanding the phenomena. The study had 43 units of analysis which were the commercial banks operating in Kenya as at 31st December 2013. The population of the study was all heads of the auditing and legal departments in the 43 the licensed commercial banks. Given the relatively small number of these banks, a census was conducted. The study used primary data which was collected through use of questionnaires. A five point Likert scale questionnaire was used. Purposeful sampling was used to select the managers from the audit and legal department as the respondents because they were deemed to be in possession of the required information that addresses the objectives of this study. Therefore, 2 managers per entity were chosen, totaling to 86 respondents. The research used self-introductions and also used internal informants. The data collected was analyzed using descriptive statistics and inferential statistics. The descriptive technique used generated mean and percentages while inferential statistics generated the Analysis of variance and bivariate correlation.

5. Results and Findings

- Majority of the respondents were from the auditing firm as they totaled to 59% of the entire sample study while managers from the legal department summed up to 41%.

5.1. Descriptive Statistics

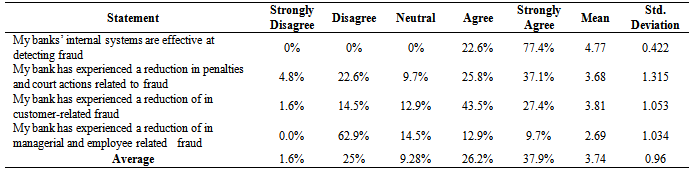

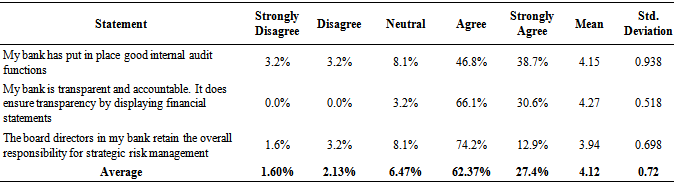

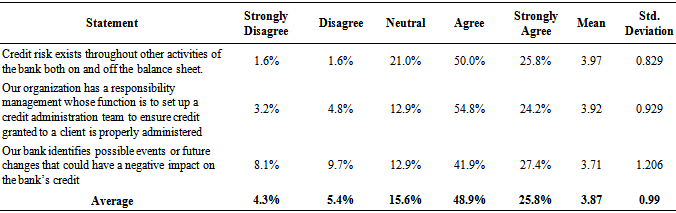

- Table 1 displays the results of views on financial irregularities. All the respondents indicated that their banks’ internal systems are effective at detecting fraud. Sixty three percent of the respondents indicate that they have had a reduction in penalties and court actions related to fraud. Kenyan banks have experienced a reduction of in customer-related fraud as shown by 71% response rate. Additional results indicate that majority of banks in Kenya have experienced a reduction of in managerial and employee related fraud as indicated by 64% response rate. The results herein, agree with those of Farell and Franco (1999) who suggested that through adequate internal controls by management, fraud and other irregularities in American corporates can be mitigated.

|

|

|

|

|

|

6. Conclusions and Recommendations

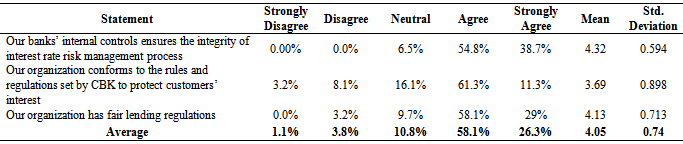

- The objective of the study was to determine the effectiveness of regulatory pronouncements; the study found out that the pronouncements were averagely effective. Conclusions made from the study shows that systemic risk, credit risk, prudential risks and anti-money laundering regulatory pronouncements are some of the regulatory pronouncements upon which their effectiveness positively affects financial regularities. Kenya’s commercial banks have effective regulatory pronouncements in guidelines that aim to reduce the risk to which creditors are exposed to; risk of disruption resulting from major failure in systems banks; risks of banks being used for criminal purposes; risk of credit allocation. Better governance and corporate disclosure enhances the quality and level of monitoring of the firm thus reducing occurrence of financial irregularities. The findings in the study provide recommendations to managers of commercial banks and other audit and legal professionals in the banking and other industry sectors. These professionals may use the findings of the study to improve in their area of expertise and know what is expected of them. Additionally, the findings of these studies may be used to improve the training curriculum of audit and legal professionals in order to capture the important findings of the study. This will enable the inclusion of issues related to ethics and integrity into the syllabus. Commercial Banks in Kenya should ensure good internal processes and systems among the banking institutions in the country so as to maintain continuous improvement to allow for good structures for financial regularities to be maintained. These structures if well done tend to avoid unnecessary costs for example such as costs as a result of corruption which results to court cases that can be very costly to the company. In addition academicians who may use these recommendations as a source for further studies or research in the area.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML