-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2014; 3(2): 49-59

doi:10.5923/j.ijfa.20140302.01

An Appraisal of Corporate Governance Mechanisms and Earnings Management in Nigeria

Ndukwe Orji Dibia1, John Chika Onwuchekwa2

1Department of Accounting, Abia State University, Uturu

2Department of Accounting, Rhema University, Aba, Abia State, Nigeria

Correspondence to: John Chika Onwuchekwa, Department of Accounting, Rhema University, Aba, Abia State, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

We examined the association between corporate governance mechanisms and earnings management in Nigeria. The corporate governance variables used in the study are board size, audit committee independence, board independence, CEO shares and audit type while discretionary accrual was used to proxy for earnings management. Simple random sampling technique and a sample size of ninety (90) companies were selected for the period 2006 to 2011. This gives us a total of 540 company years/data observations. The result shows that board size and firm size are associated with earnings management. While board independence, audit committee independence, audit type and ceo shares are not associated to earnings management. The association between board size and earnings management was seen to be negative. This suggests that having a larger board size with more of none executive members could reduce the level of earnings management in Nigeria. Firm size our control variable was seen to be positively statistically significant. This suggests that a larger firm size may not lead to decrease in earnings management. Board independence, audit committee independence, audit type and ceo shares all had a negative but insignificant association with earnings management. This explains that having an independent board and audit committee, employing the services of the big4 and encouraging CEOs to take up shares may reduce the level of earnings management in Nigeria though the impact would be atomic.

Keywords: Board size, Audit committee independence, Board independence, CEO shares, Audit type and discretionary accruals

Cite this paper: Ndukwe Orji Dibia, John Chika Onwuchekwa, An Appraisal of Corporate Governance Mechanisms and Earnings Management in Nigeria, International Journal of Finance and Accounting , Vol. 3 No. 2, 2014, pp. 49-59. doi: 10.5923/j.ijfa.20140302.01.

Article Outline

1. Introduction

- Investors, shareholders and stakeholders obtain performance information from the financial statement prepared by the directors of an organisation. Directors in a bid to fulfil their interest, leverage on the latitude of the generally accepted accounting principles to stage-manage the financial statement thus making it what it is not to those concerned. This is referred to as creative accounting, accounts manipulation, or income smoothing, big bath accounting or the popularly called earnings management. Gulzar, and Wuhan (2011) notes that the kind nature of earnings management provides managers the opportunity to manipulate the financial information of firms in order to get their own benefit. Unlike fraud, earnings management involves the selection of accounting procedures and estimates that confirms to the generally accepted accounting principles (GAAP). This implies that firms that have earnings management can manifest it within the bounds of accepted accounting procedures manipulation (Rahman and Ali, 2006).Earnings management as acceptable as it is within the bounds of (GAAP) has been a concern to investors, policy makers and researchers across the globe. This became topical after the collapse of the world known celebrated companies; the Enron and WorldCom in U.S.A, Northern Rock in the United Kingdom, Metagelshat in Germany, Parmalat in Italy, Global Crossing Limited and Daewoo in Korea. In Nigeria, this was further heightened subsequent to the collapse of several financial and non-financial institutions which include the Afribank Plc, Bank PHB, Spring Bank Plc, Oceanic Bank Plc, Intercontinental Bank Plc, African Petroleum Plc, Lever Brothers and Cadbury plc. An investigation into the cause revealed significant, deep-rooted problems in the account preparation and also the intentional misconduct of managers which led to the concurrent sack of eight bank chiefs by the governor of Central Bank of Nigeria and the call for an investigation of the efficacy of the corporate governance mechanisms in the monitoring and controlling of managerial and financial behaviour of managers. Corporate governance is a system ‘consisting of all the people, processes and activities to help ensure stewardship over an entity’s assets’ (Messier, Glover, and Prawitt, 2008). A good corporate governance structure helps ensure that the management properly utilize the enterprise’s resources in the best interest of absentee owners, and fairly reports the financial condition and operating performance of the enterprise (Lin and Hwang, 2010). Dabor and Ibadin, (2013) notes that corporate governance is a factor, that determine whether management will engage in earnings management or not. Studies on earnings management have shown that weak corporate governance is associated with greater earnings management (Beasley, 1996; Klein, 2002 as cited in Dabor and Ibadin, 2013). The function of the corporate governance formation in financial reporting is to ensure compliance with generally accepted accounting principles (GAAP) and to maintain the credibility of corporate financial statements. Properly structured corporate governance mechanisms are expected to reduce earnings management because they provide effective monitoring of management in the financial reporting process.Corporate governance mechanisms such as CEO duality, directors shareholding, board size, board composition, quality audit committee, executive compensation and board independence have been found to relate to measures of earnings management (Bedard, Chtourou, and Courteau 2004; Tehranian, Cornett, Marens and saunders, 2006; Xie, Davidson and Dadult, 2001; Zhou and Chen,2004).In Nigeria, studies in this area have been scanty with mixed conclusions. Our objective here is to examine the relationship of some corporate governance mechanisms with earnings management, specifically: Board size, Audit Committee Independence, Board independence, CEO shares and Audit type was chosen. However we introduced firm size as a control variable. The study will be of essence to researchers as it shall add to already existing body of knowledge, it will also assist investors in investment decision making while serving as a catalyst to policy makers in policy formulation, implementation and monitoring. Following our introduction the paper is organised thus: section two reviews empirical existing works on company governance attributes and earnings management, section three looks at our sample and the measurement of the discretionary accruals, section four presents our empirical result while section five presents our concluding position.

2. Review of Relevant Literatures

2.1. Theoretical Framework

- One of the dominant theories of corporate governance is the agency theory. Agency theory sees the firm as a nexus of contracts (Fama, 1980). Therefore, the unit of analysis of the firm under agency theory is the contract. In agency theory, the separation of ownership and control, is one of the hallmarks of the modern corporation, which result in many instances to firm managers using their firm-specific knowledge and managerial expertise to gain an advantage over the firm’s owners, who are absent from the day-to-day affairs of the firm. Since the managers are “in control” of the firm, the risk is that they will pursue actions in their own self interest, and not in the interest of the owners (Jensen and Meckling, 1976). Agency theory is therefore concerned with resolving two problems that can occur in agency relationships. The first is the agency problem that arises when: the desires or goals of the principal and agent diverge and it is difficult or expensive for the principal to verify what the agent is actually doing. The second is the problem of risk sharing that arises when the principal and agent have different attitudes toward risk. As the unit of analysis is the contract governing the relationship between the principal and the agent, the focus of the theory is on determining the most efficient contract governing the principal-agent relationship. Agency theory’s validity and lucidity is contingent upon the existence of mechanisms by which firm owners are able to monitor the performance of managers to verify that firm managers are using their own competences, and the firm’s resources, to achieve the best returns for the principals (Fama 1980). Fama and Jensen (1983) note that shareholders have the power to hold management accountable according to the firm results obtained. Therefore monitoring managerial decisions becomes essential for boards of directors to assure that shareholders’ interests are protected (Fama and Jensen, 1983). Berle and Means (1932) submits that the fundamental agency problem for listed companies in emerging markets is not a conflict of interest between outside investors and managers but a conflict of interest between controlling shareholders and minority shareholders. Consequently, effective monitoring from board of directors is very important to ensure reliable and complete financial reporting. Since earnings management misleads users of financial statements by providing them with false information about a firm’s true operating performance, the internal corporate governance of the board of directors serves a monitoring role in constraining the occurrence of earnings management.

2.2. Conceptual Framework and Hypotheses Formulation

- The present study examines the mechanism of corporate governance and how they relate to earnings management in Nigeria. The following paragraphs provide the underlying rationale behind the hypothesized relationship between each of the six variables and earnings management in Nigeria.

2.3. Board Size and Earnings Management

- This is the total number of executive and non-executive directors in the board. A considerable literature exits on the effect of board size on earnings management. Jensen (1993) submits that small boards are more effective in monitoring the Chief Executive Officer (CEO’s) activities than large boards as large boards concentrate more on “politeness and courtesy” and are therefore easier for the CEO to control. This is in line with Yermack (1996) who concludes that small boards are more effective monitors than large boards. Implying that, the size of a firm’s board should be inversely related to earnings management. Therefore if small boards lead to more effective monitoring in a firm, they would also be associated with less use of discretionary accruals. Baysinger and Zardkoohi (1986) suggest that boards of regulated firms have more symbolic directors than boards of less regulated firms. Agrawal and Knoeber (2001) find that outside directors play a political role by providing advice and insight into the workings of government to influence the government directly. Rahman and Ali (2006), documents that large board size is positively related with earnings management. In the same way, Peasnell, Pope, and Young (2004) found that having a large board is better in reducing earnings management compared to smaller boards. This is contrary to Xie, Davidson, and DaDalt (2003) who argue that smaller boards are better able to make timely decisions than large boards. Although, they agree that larger boards with diverse knowledge are more effective for constraining earnings management than smaller boards. In view of the above we therefore state our hypothesis thus; Ho1: Board size does not have significant impact on earnings management.

2.4. Audit Committee Independence and Earnings Management

- Independence is an essential quality required for an audit committee to fulfil its oversight function which includes oversight of the financial statements, external audit and oversight of the internal control system. A common expectation is that a more independent audit committee would provide more effective oversight of the financial reporting process and ensure better quality of earnings reported by the firm by restraining opportunistic earnings management (BRC, 1999; SEC, 1999). The code of best governance practice in Nigeria mandates that the committee should be largely independent, highly competent and possess high level of integrity. Audit committee is responsible for the review of the integrity of financial reporting and oversee the independence and objectivity of the external auditors. Hassan, (2011) observe that more attention has been given to financial expertise as a construct of board competence. DeZoort and Salterio (2001) notice that audit committee members who have accounting experience as well as knowledge in auditing are positively associated with the likelihood that they will support the auditor in an auditor-corporate management dispute. In US Mcmullen and Randghun (1996) show that firms under SEC enforcement actions are less likely to have an audit committee composed entirely of non-executive directors. According to Carcello and Neal (2000) the population of independent external directors on the audit committee is positively associated with the probability of the auditor issuing a going concern report for a firm experiencing financial distress. Chytourou, Bedard, and Courteau, (2001) examine the relationship between audit committee, board of directors characteristics and the extent of corporate earnings management as measured by the level of positive and negative discreationary accruals. Using two groups of US firms, one with relatively high and the other relatively low levels of discreationary accruals. The study find that, earnings management is significantly associated with a larger proportion of outside members who are not managers in other firms; that short-term stocks options held by non-executive committee members are associated with income increasing earnings management; that income decreasing earnings management is relatively associated with the presence of at least a member with financial expertise and a clear mandate for overseeing both the financial statements and external audit. In Indonesia Murhadi, (2009) investigates whether the effect of good governance practice can reduce earnings management practice done by company. The samples taken were made up of companies registered in the manufacturing sector in the Indonesia Stock Exchange for the period 2005-2007. The result shows that audit committee independence do not have any effect to earnings management. Lin (2006) conducted a research to test the effect of audit committee existence with earning management. The result shows a negative effect, this suggest that audit committee can reduce earnings management practice done by the management. García-Meca and Sánchez-Ballesta, (2009) argue that audit committee independence can improve investor confidence by constraining earnings management. In Lin, and Hwang, (2010) a positive association was observed audit committee ownership and earnings management. While Abbott, Park & Parker, (2000) document that audit committee independence decreases the occurrence of earnings management, Choi, Jeon & Park, (2004) find no such effect. In the same vein Xie, Davidson, and DaDalt, (2003) find no significant association between the number of directors on the audit committee and earnings management. Yang & Krishnan (2005) report that audit committee size is negatively associated with earnings management this implies that a certain minimum number of audit committee members may be relevant to quality of financial reporting. Hence we expect that audit committee composed of only independent directors will be negatively associated with the level of earnings management. Ho2. Audit Committee independence does not exert significant effect on earnings management.

2.5. CEO Shares and Earnings Management

- As a result of the separation of ownership and control, publicly traded firms are subject to managerial agency problems. Holdings of stocks and stock options become one important mechanism shareholders use to align the interests of management and long term shareholders. Accounting literatures provides evidence on the impact of COE shares on earnings management. Core and Larker (2002); Hanlon, Rajgopal, and Shevlin, (2003) (2003) show evidence that equity-based incentives encourage CEOs to maximize shareholder value. However, the effectiveness of equity-based incentives has been questioned recently after a mass aggressive earnings management cases and the sudden collapse of several high-profile companies. Since CEOs are free to sell their equity holdings, critics (for instance, Levitt 1998; Brown 2002) argue that equity-based incentives encourage CEOs to manage earnings to inflate short term stock prices at the expense of long term firm value. Matsunaga and Park (2001); Guidry, Leone and Rock, (1999); and Balsam (1998) posit that where stock options represent a significant portion of executive compensation, it is most likely that managers have incentives to opportunistically manipulate stock price through accounting adjustments in order to maximize the value of their stock options. Yermack (1997) investigates the timing of CEO stock option awards and find that CEOs receive stock option awards shortly before significant positive abnormal returns, and argues that managers might be able to time their option awards in advance of favourable corporate news. Aboody and Kasznik (2000) investigated firms’ voluntary information disclosure. They submit that managers delay the announcement of good news and rush forward the announcement of bad news before option awards in order to maximize the value of their option grants. Cheng and Warfield (2005) empirically supported that stock-based incentive leads to higher earnings manipulation and insider trading. Brown (2002) submits that aggressive earnings management is a direct result of the excessive use of equity-based compensation. Ofek and Yermack (2000) find that executives with high stock holdings sell more previously owned shares after receiving new option grants than those with low stock holdings. Bebchuk and Bar-Gill 2002; Crocker and Slemrod 2005; Kadan and Yang 2005) develop models to demonstrate that equity-based incentives can induce CEOs to manage earnings. They demonstrate that CEOs with equity-based incentives also have an incentive to manage reported earnings. Ho3. Ceo shares does not have significant relationship with earning management.

2.6. Audit Type and Earnings Management

- Quite a number of studies have examined whether auditor brand name or auditor type is associated with earnings quality. It is believed that the quality of statutory audit can have a significant influence on the quality of reported earnings, and therefore, constitutes a sign to earnings management. The large international reputable audit firms are reasonably and usually used as the proxy for quality auditing (Becker, Defond, Jiambalvo, & Subramanyam, 1998; Francis, Maydew, & Sparks, 1999) submits that Big 6 auditors are better able to detect earnings management because of their superior knowledge, and act to curb earnings management to protect their reputation. In the same vein, Krishnan (2003) argues that, the large audit firms have greater incentives to protect their reputation due to their larger client base besides more resources and expertise to detect earnings management. Lin and Wang, (2010) observed a negative relationship the audit type and earnings management. However, Antle, Gordon, Narayanamoorthy, & Zhou, (2006) find no such evidence. Gore, Pope, and Singh, (2001) documents that non-big 5 auditors allow more earnings management than big 5 auditors. Francis, et al. (1999) report quality differentiation in controlling aggressive and opportunistic earnings management among international big 6 accounting firms, national firms, and local firms. Francis further explained that the big 6 audited firms tend to report lower levels of discretionary accruals even though they have high level of accruals, suggesting that big 6 auditors mitigate earnings management. According to Payne and Robb, (2000) firms audited by big 5 also report lower levels of discretionary accruals Lennox (1999) also finds that the audit reports issued by large auditors are more accurate and more informative, exhibiting that auditor size is positively related to audit accuracy. It could be seen from these studies that large firms are in a better position than small firms in terms of receiving better audit services from established auditing firms. In Nigeria we have the big four audit type (KPMG, Akintola Williams Delloitte and Touche, PWC and Ernst & Young). Ho4. The big4 audit firm firms has a significant impact on earnings management.

2.7. Board Independence and Earnings Management

- This is the percentage of independent outside directors on the board. According to Dunn (1987) boards dominated by outsiders stand in a better position to monitor and control managers. Outside directors are independent of the firm’s management and they bring in their wealth of experience to the firm (Firstenberg and Makiel, 1980). From an agency standpoint, the ability of the board to act as an effective monitoring mechanism depends on its independence of management (Beasley, 1996). Fama and Jensen (1983) notes that independent directors on boards make boards more effective in monitoring managers and exercising control on behalf of shareholders. While Bradbury, Mak, and Tan (2006) in Singapore failed to find any association between earnings management and board independence. Davidson, Goodwin-Stewart, and Kent (2005) find empirical support for the effective role of independent directors in constraining earnings management in Australian firms. Lin, and Hwang, (2010) observe that the independence of the board of directors and its expertise have a negative relationship with earnings management. Klein, (2002) documents that, boards with more independent outside directors engage less frequently in earnings management through abnormal accruals. Cornett, Marcus & Tehranian (2007), examine the impact of corporate governance and pay-for-performance on earnings management. Using 100 largest firms in the U.S. as ranked by S&P for the period 1994-2003, they find that the presence of independent outside directors reduce earnings management. Also Cornett, McNutt, and Tehranian, (2009) investigated how the impact of corporate governance mechanism affects earnings and earnings management at large publicly traded U.S. companies for the period 1994-2002. The study finds that largely independent boards limit managers’ discretionery behaviour. In the same vein the study carried out by Roodposhti and Chashmi (2010) revealed a negative association between board independence and earnings management. However, Hashim and Devi (2008) observe that large proportions of independent executive directors are associated with higher income-increasing earnings management. Peasnell, Pope and Young (2004) and Vafeas (2000), notes that outside directors play a more effective role in monitoring top managers’ opportunistic behaviours than insiders. Their results show that earnings management is negatively related with a larger proportion of outside directors. Williamson (1981) argues that independence of board is needed to control managerial activities to protect interest of investors. Beasley (1996) documents the evidence of inclusion of large numbers of outside directors in the board can reduce the likelihood of fraud of financial information. Xie et al 2003 board independence has a negative relationship with earnings management. Ho5. Board independence does not exert significant influence on earnings management.

2.8. Firm Size and Earnings Management

- Shen, and Chih (2007) detected that large firms are prone to conduct smoothing, but good corporate governance can mitigate the effect on average. The study also observed that a highly leveraged firm with poor governance is prone to be scrutinised closely and thus finds it harder to deceive the market by manipulating earnings. Naz, Bhatti, Ghafoor, and Khan, (2011) investigated the impact of firm size on earnings management and find no statistical significance between firm size and earnings management in Pakistan. Rhee (2003) examined the relationship between corporate earnings management and the firm size. The earnings of the small, medium and large companies in relation to their size and the beginning of the market value of each year were observed for a sample data of 18 years. They find that company size had a strong impact on the earning management. They also discovered that Small sized companies were avoiding the addition of earnings management as compared to the medium and large companies. On the other hand, Sun and Rath (2009) analyzed the activities of earning management in Australia by taking sample of 4844 firms for the period 2000 to 2006. The result indicates that small companies indulge more in earning management. The study of Burgstahler and Dichev (1997), show that, both small and large sized firms manage earnings to circumvent the small negative or small decrease in earnings. Barton and Simko (2002) indicate that large firms face more pressures to surpass the analysts' expectations. However, Myers and Skinner (2000) after studying earnings growth of large-sized firms for at least 14 quarters assemble empirical evidence that large firms do not report accurate earnings. While, Nelson, Elliott, and Tarpley, (2002) report that, auditors are more likely to waive earnings management attempts by large clients.Ho6. Firm size does not have a significant impact on earnings management.

3. Methodology

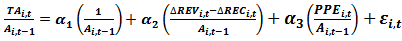

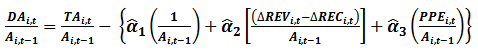

- We examined the association between corporate governance mechanisms and earnings management in Nigeria. Simple random sampling technique and a sample size of ninety (90) companies were selected for the period 2006 to 2011. This gives us a total of 540 company years/data observation. Accruals are accounting adjustments that turn cash flow into earnings. Difference in accruals reflects a company specific condition. Managers have discretion over accruals and this they use to manage earnings. Therefore, earnings management in this study is measured using accounting accrual. Chen, Lin, and Zhou, (2005) document that accruals are likely to capture evidence of earnings management while Dechow, Sloan, and Sweeney, (1995) provide evidence that the modified Jones model of 1991 is the most powerful instrument to detecting earnings management among the alternative models to measure unexpected accruals. In line with the prior studies (such as Dechow et al, 1995; Jaggi and Leung, 2007) a cross sectional regression of the modified Jones model of (1991) is used to obtain the discretionary components of accruals used to proxy earnings management. The discretionary accruals are estimated as follows: Total accruals are measured as net income minus cash flows from operation.

| (1) |

| (2) |

| (3) |

= total accruals for company i in year t, defined as above.

= total accruals for company i in year t, defined as above.  = net income before discontinued segments and extraordinary items.

= net income before discontinued segments and extraordinary items. = cash flow from operation

= cash flow from operation = change in revenue for company i in year t

= change in revenue for company i in year t = change in receivables for company i in year t.

= change in receivables for company i in year t. = net property, plant, and equipment for company i in year t.

= net property, plant, and equipment for company i in year t.  = total assets for company i in year t.

= total assets for company i in year t. = discretionary accruals for company i in year t.Next are the variables for the corporate governance mechanisms: The Board Size, Audit Committee Independence, CEO shares, Audit type is presented. Also we include Firm size as a control variable. The study regression model is therefore:

= discretionary accruals for company i in year t.Next are the variables for the corporate governance mechanisms: The Board Size, Audit Committee Independence, CEO shares, Audit type is presented. Also we include Firm size as a control variable. The study regression model is therefore:  | (4) |

4. Presentation and Analysis of Results

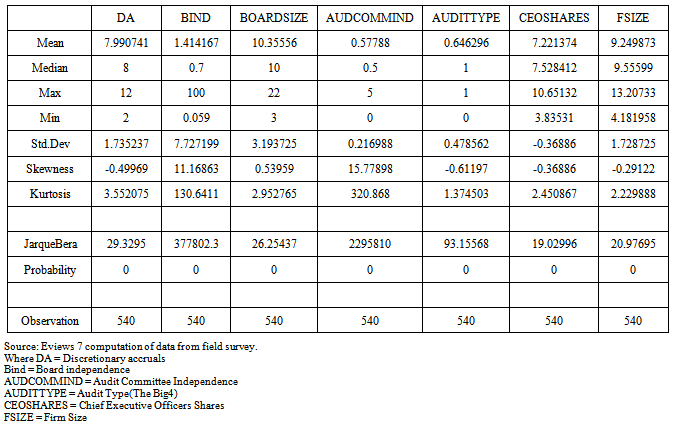

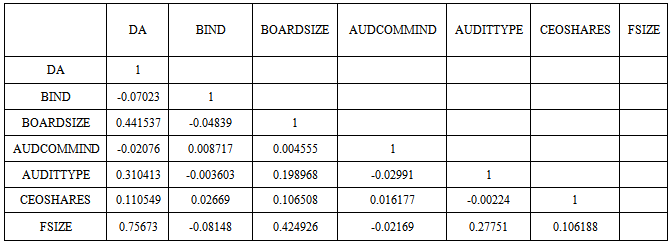

- This section deals with the presentation and analysis of the empirical results obtained from the estimation exercise. The study examines the association between corporate governance mechanisms and earnings management. Specifically it looks at the ability of Board independence, board size, audit committee independence and ceo shares to influence earnings management either negatively or positively, we also introduced firm size as a control variable. Firm size is the natural log of the total assets. We collated our data from the financial statements of various firms across industries for the period 2006-2011. The data collated for the variables were analyzed using descriptive analysis, correlation matrix and the panel least square regression technique. We estimated our model with the aid of computer software (Eviews 7). The hypotheses were tested using the t-ratios from the panel least Square regression results.From the descriptive statistics of the variables as shown in table 1 above, it is observed that DA has a mean value of 7.99074 with maximum and minimum values of 12 and 2 respectively. The standard deviation measuring the spread of the distribution pecked at 1.735237. BIND is observed with a mean value of 1.414167. Board size with a mean value of 10.35556, and standard deviation of 3.193725 shows evidence of clustering around the mean. AUDCOMMIND, AUDITTYPE, CEOSHARES has a mean value of 0.57788, 0.646296, 7.221374 while the standard deviation stood at 0.216988, 0.478562, -0.36886 accordingly. FSIZE is observed to have a mean value of 9.249873 and a standard deviation of 1.728725. The Jacque-Bera statistic stood at 0.000 for all the variables. This suggests that our data is normally distributed at 5% level of significance (p<0.05) and as such selection bias is unlikely in the sample.

|

|

4.1. Regression Result

4.2. Interpretation of Results

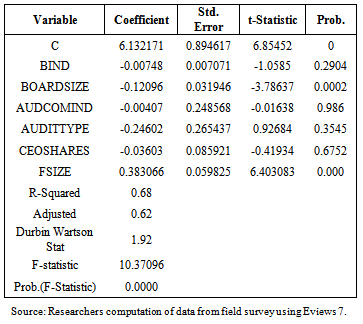

- The coefficients of board independence, Board Size, Audit committee independence, Audit type, chief executive officer shares are -0.00748, -0.12096, -0.00407, -0.24609 and -0.03603 respectively implying that there is a negative impact of board independence, board independence, Board Size, Audit committee independence, Audit type, chief executive officer shares on earnings management in Nigeria. This further suggests that a unit increase in the number of non executive directors in the board, Audit committee independence, Audit type and chief executive officer shares will bring about 0.007, 0.12096, 0.00407, 0.24609 and 0.03603 unit decreases in earnings management accordingly. This is in line with Dunn (1987); Firstenberg and Makiel (1980); Fama and Jensen 1983, and Dividson et al, (2005) who argue that board dominated by outside directors stand in a better position to monitor and control managers. The study is also in agreement with Xie et al (2003) who documents that larger board sizes with diverse knowledge are more effective for constraining earnings management than smaller boards. Lin (2006) finds that, audit committee independence is negatively associated with earnings management.. Becker at al 1998; Francis et al 1999 who documents that the big6 auditors are better able to detect earnings management because of their superior knowledge and act to cut earnings management to protect their interest. However the study disagrees with Hashim and Devi, (2008) who find that large proportion of independent executive directors are associated with higher income-increasing earnings management. Jensen, 1993; Yermark, 1996 and Rahman and Ali 2006 submit that small boards are more effective in monitoring the activities of the CEO than the large board size and also that large board size is positively associated to earnings management. In the same vein However, Carcello and Neal (2000) submit that the proportion of independent directors on the audit committee is positively associated with the probability of the auditor issuing a going concern report for a firm experiencing a financial distress. Gore et al document that the big 5 allow more earnings management. Levitt 1998 and brown 2002 submits that equity based incentives encourage CEOs to manage earnings to inflate short term stock prices at the expense of long term firm value. Also in the same line with Guidry, Leone and Rock (1999) who posit that where stock options represent a significant portion of executive compensation, it is most likely that managers have incentives to opportunistically manipulate stock price through accounting adjustments in order to maximize the value of their stock options.The coefficient of firm size is 0.383066 suggesting that there is a positive impact of firm size on earnings management. This explains that a unit increase in the number of asset will bring about 0.383066 increases in earnings management. This is in line with the works of Shen and Chih (2007) who detected that large firms are prone to conduct income smoothing. However, contrary to Sun and Rath (2009) who observe that small firms indulge more in earnings management. Birtgsterhler and Dicher (1997) also find that small firms manage earnings to circumvent the small negative or small decrese in earnings. Table 2 above presents the paneled fixed least square regression result conducted using Eviews 7. As observed, the R-square and the co-efficient of determination is 68%. This implies that the model explains about 68% of the systematic variations in the dependent variable. The adjusted R-square which controls for the inclusion of successive explanatory variables on the degree of freedom stood at 62%. About 38% of the systematic variation of earnings management was left unaccounted for by the model which has been captured by the stochastic disturbance term in the model. This indicates a good fit of the regression line and also that the model has a high predictive power.On the basis of the overall statistical significance of the model as indicated by the F-statistic, we observe that the model was statistically significant since the calculated F-value of 10.37 is greater than the critical F-value. The Durbin Wartson Statistic of 1.92 indicates absence of autocorrelation. On the basis of individual statistical significance, it was observed that Board Size and Firm size are statistically significant at 5% while Board independence, audit Committee Independence, Ceo Shares and audit type are not statistically significant because their calculated values are less than the critical values.

4.3. Test of Hypotheses

- Ho1: Board size does not have significant impact on earnings management.From our result in table 2, the probability level of board size is 0.002 < 0.05. Consequently, we reject the null hypothesis and affirm that board size has a significant impact on earnings management. Ho2. Audit Committee independence does not exert significant effect on earnings management. We observed that audit committee independence with a probability level of 0.9869 > 0.05. Therefore we accept the null hypothesis that audit committee independence does not exert significant effect on earnings management. Ho3. Ceo shares does not have significant relationship with earning management. The influence of the CEO shares on earnings management is seen with a probability level of 0.6752 > 0.05. Therefore we accept the null hypothesis and confirm that Ceo shares has a positive relationship with earnings management. Ho4. The big4 audit firm firms has a significant impact on earnings management. Audit type is observed with a probability level of 0.3545 > 0.05. Hence we accept the null hypothesis and admit that Ceo shares has a positive relationship with earnings management. Ho5. Board independence does not exert significant influence on earnings management. The effect of board independence on discretionary accruals has a probability level of 0.2904 > 0.05. We accept the null hypothesis and posit that board independence does not exert significant influence on earnings management. Ho6. Firm size does not have a significant impact on earnings management.The impact of firm size on earnings management is observe with a probability level of 0.000 < 0.05. Consequently we reject the null hypothesis and conclude that firm size has a significant impact on earnings management.

5. Conclusions

- We examined the association between corporate governance mechanisms and earnings management in Nigeria. Simple random sampling technique and a sample size of ninety (90) companies were selected for the period 2006 to 2011. This gives us a total of 540 company years/data observation. In the study, discretionary accrual based on the modified jones model 1991 was used as proxy for earnings management. On the statistical significant relationship of the selected corporate governance mechanisms variables on earnings management, we find that board size and firm size are associated with earnings management. While Board independence, audit committee independence, audit type and ceo shares are not associated to earnings management. The association between board size and earnings management was seen to be negative. This suggests that having a larger board size with more of none executive members could reduce the level of earnings management in Nigeria. Firm size our control variable was observed to be positively statistically significant. This suggests that a larger firm size may lead to decrease in earnings management. Board independence, audit committee independence, audit type and ceo shares all had a negative but insignificant association with earnings management. This explains that having an independent board and audit committee, employing the services of the big4 and encouraging CEOs to take up shares may reduce the level of earnings management in Nigeria though the impact would be quite microscopic.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML