-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(8): 459-464

doi:10.5923/j.ijfa.20130208.09

Effect of Corporate Taxpayers Awareness of Tax Authority’s Responsibilities on Compliance Behaviour under Self-assessment System in Nigeria

Lawan Yahaya1, Idris Lawal2, Amina Jibrin Ahmed2

1Department of Accounting, International Islamic University Malaysia

2Department of Accounting & Finance, Abubakar Tafawa Balewa University Bauchi Nigeria

Correspondence to: Lawan Yahaya, Department of Accounting, International Islamic University Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study examines the relationship between corporate taxpayers’ awareness of tax authority’s responsibilities under self-assessment system and compliance behaviour. A survey questionnaire was distributed to 196 listed domestic companies in Nigeria and 83 responded and were analyzed using general linear model (univariate) statistical tool. The results indicated that corporate taxpayers in Nigeria are aware of the responsibilities of the tax authority (FIRS), especially for its regulatory and audit function. The findings also reveal that awareness of tax authority’s responsibilities has a positive and significant influence on compliance behaviour. Therefore, the researchers’ recommendation is that the tax authority (FIRS) should enhance its enlightenment campaign on SAS so that corporate taxpayers in Nigeria would be more abreast on the system.

Keywords: Tax authority responsibility, Tax compliance behaviour, Self-assessment system, Corporate taxpayers

Cite this paper: Lawan Yahaya, Idris Lawal, Amina Jibrin Ahmed, Effect of Corporate Taxpayers Awareness of Tax Authority’s Responsibilities on Compliance Behaviour under Self-assessment System in Nigeria, International Journal of Finance and Accounting , Vol. 2 No. 8, 2013, pp. 459-464. doi: 10.5923/j.ijfa.20130208.09.

Article Outline

1. Introduction

- Self-assessment system (SAS) has been viewed as a contemporary system of tax administration in most countries [1]. The implementation of SAS in many tax jurisdictions is to provide a better process of tax administration. The administration of SAS has been characterised as a migration from official assessment system (OAS) to self-assessment[2]. Under the SAS, taxpayers are given the opportunity by law to assess themselves and file in accurate tax returns[3]. In order for the taxpayers to be able to assess themselves appropriately, they need to understand and have knowledge on SAS. The understanding of the system would give them the ability voluntarily complies.Moreover, corporate taxpayers’ proper understanding of the tax laws and voluntary compliance are some of the objectives of SAS([4], [5]). For corporate taxpayers to understand the laws and be able to comply effectively, they also need to understand the tax authority’s responsibilities. Reference[6] noted that understanding the responsibilities of tax authority may possibly increase tax compliance. The objective of this study is to examine the relationship between awareness of tax authority responsibilities by the corporate taxpayers and compliance behaviour. Self-assessment system was introduced in Nigeria, in the year 1992 by the Federal Inland Revenue Service (FIRS) after the appropriation law of 1991. The system was not fully implemented until after the FIRS made some necessary modification on the processes and procedures involved in December 19, 2011[3]. After a period of 20 years of rigorous modification of the processes and procedures of SAS, FIRS commenced full enforcement of the SAS law by making it compulsory for corporate entities in year 2012 to start filing in their tax returns. In order for corporate taxpayers to fulfill their civic obligations,it is important for themto be educated on SAS and also to be aware of the responsibilities of FIRS. However, the responsibilities of FIRS could be among others the regulatory functions, educating taxpayers and Audit functions. Tax audit under SAS has been a mechanism used for the enforcement of tax compliance. The federal Inland Revenue Service uses tax audit to make sure that taxpayers adhere to their right and obligations. Reference[7] noted that taxpayers’ obligation comprises of the “obligation to be honest, to be cooperative, to provide accurate information and documents on time, to keep records and to pay taxes on time. Where taxpayers fail to comply with these obligations, appropriate sanctions would be taken out which may include the application of penalties, interests and/or imprisonment where criminal activity is involved. The action of applying penalties is expected to elicit changes in behavior and voluntary compliance in future. Meanwhile, compliance behavior is significantly associated with taxpayers’ attitude towards tax evasion[8]. However, tax defaulters are faced with penalties but non defaulters and tax authorities’ benefits consequently under SAS.The benefits derived from self-assessment system could be for both the taxpayer and tax authority. SAS enable taxpayers to plan their own tax affairs and cash management with regard to payment of the tax. It takes them away from the imposition nature of the official assessment system and the objections and disputes that arise from the official assessment system. It also encourages the taxpayers to maintain good records which enable them to know the exact performance of their business affairs and give proper estimates of the business so as to pay fair and realistic taxes [2]. On the other hand, for tax authority, self-assessment system eventually reduces administrative costs aided by modern technology. Most economies have adopted the principle to drive down cost and ensure timeliness in filing return and Nigeria can also benefit from this trending of revenue collection system. SAS also reduces the discretionary powers of tax officials and reduces opportunities for corruption. However, self-assessment system needs to be properly regulated and implemented, with transparent rules, an automated reporting process, and penalties for noncompliance and risk-based assessment procedures for audit procedures[9]. Thesebenefits could be more and it would motivate corporate taxpayers to comply effectively.

2. Literature Review

- Voluntary compliance and the ability for taxpayers to take full responsibility of their assessment are being encouraged by SAS([3],[5],[10],[11]). Moreover, other aim of SAS comprises of making the system simple and administrative cost reduction[11]. In order for corporate taxpayers to understand SAS better, they need tax knowledge and awareness of the responsibilities of tax authority.Tax authority responsibility is a variable used in this study as not much prior literatures on this compliance variable. However, Reference[12] suggeststhat taxpayer who understands the responsibility of tax authority is more likely to comply. Similarly, Reference[6] found that understanding the responsibility of the tax authority in Malaysia influences compliance behaviour under SAS. Understanding the tax authority’s responsibilities by the corporate taxpayers may possibly increases tax compliance behaviour among corporate taxpayers.Reference[13] found that in Nigeria taxpayers understand the responsibilities of FIRS especially for the enforcement of tax compliance. Meanwhile, Reference[14] argued that tax authority should increase its reporting enforcement on corporate taxpayers to avoid non-compliance. Tax audit is one of the functions and responsibility of tax authority. Under SAS, the tax authority uses tax audit to enforced tax compliance among taxpayers. Taxpayers usually increase their tax compliance because they are afraid to be found guilty by the tax official for not complying. Previous studies had found that tax audit is an effective enforcement mechanism tool.Corporate taxpayer responses to a tax auditor’s visit to their corporate premises can be grouped as open or closed (cautious). Overall, tax audits have also been identified as influencing audited taxpayers’ compliance behavior[11]. Moreover, Reference[15] found that some taxpayers are aware of the tax audit role in enforcing tax compliance. In another study conducted by Reference[16] found that high percentage of corporate taxpayers in Malaysia are aware of the responsibilities of the tax authority as regard to tax audit. On the other hand, some corporate taxpayers’ have this fear perception on tax auditors and most of these taxpayers may be the defaulters (non-compliant) types. They may possible avoid tax for their own personal reasons. The tax auditors in their professional duties among which are to enforce tax compliance on taxpayers any form of non-compliance cannot be entertained. The tax authority uses tax audit as a mechanism for the enforcement of tax compliance.Tax auditors need to enhance their professionalism for effective tax audit for only the guilty taxpayers should be caught in the tax net[17]. Some tax auditors used to abuse the profession by harassing taxpayers because of their personal interest which lead to moral hazard. The tax auditors should lift to their expectation and professional due care. Especially now that tax audit is being perceived as a mechanism for tax compliance under self-assessment system.However, the researchers believed that awareness of tax authority’s responsibilities under SAS on corporate taxpayer could possibly have a positive effect on tax compliance. The basic reason is that under SAS, it is important for taxpayers to understand the role of tax authority and the aim of the system. This is because the system (SAS) gives taxpayers right to file in tax return by themselves, and for effective assessment taxpayers have to be aware of the responsibility of tax authority. These reasons may positively influence compliance behaviour.

2.1. Tax Authority Regulatory Function

- Tax authority (FIRS) is responsible to make appropriate laws with regard to tax related matters and also to educate taxpayers on the changes in the laws. The awareness of the changes in the laws by the taxpayers would possibly encourage them to comply. However, some studies have found that regulatory functions haveeither positive or negative effect on compliance behaviour. Reference[18] found that more regulations may have the likelihood to influence compliance behaviour. Similarly, Reference[19] noted that regulations have positive effect on compliance behaviour. On the other hand, Reference[20] found that uncertainty of regulation have negative influence on compliance behaviour. Based on the inconsistency in the literatures, it is hypothesized that, HI: Regulatory function positively affects compliance behaviour.

2.2. Audit Functions

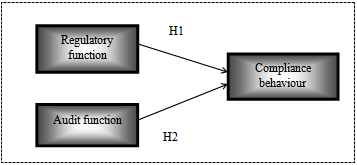

- Tax audit is an important functions under SAS, tax authority uses tax audit as an enforcement mechanism. Corporate taxpayers need to be educated on the functions of tax audit. This would assist the taxpayers to comply effectively. Prior studies have found relationships between tax audit and compliance behaviour. Reference[11] found that tax audit under SAS influences corporate taxpayers compliance behaviour. Similarly, Reference[15] found that tax audit functions have a positive influence on compliance behaviour. Henceit is hypothesized that, H2: Audit functions positively affect compliance behaviour.In figure 1 below, regulatory and audit function are the independent variable and compliance behaviour as dependent variable. It is hypothesized that regulatory and audit functions positively affect compliance behaviour of the corporate taxpayers.

| Figure 1. Conceptual framework |

3. Methodology

- The methodology used in this study is a questionnaire survey. This is because a survey method gives the authors ability to cover a large number of respondents. The research designs “expresses both the structure of the research problem, the frame work, organization, or configuration of the relationships among variables of a study and the plan of investigation used to obtain empirical evidence on those relationships”[21]. This also gave the corporate respondents the ability to responds to the questions asked.

3.1. Sample Size

- The respondents and the population of the study are the domestic listed companies in Nigeria. The total number of the domestic listed companies as at 2012 is 196. The domestic listed companies arecompanies that incorporated listed on the Nigerian stock exchanges at the end of the year[22]. The authors conducted a census study because the population is not very large. The questionnaires were personally distributed to one hundred and ninety six (196) companies. Only eighty three (83) responded, representing (42%). The respondents were the Accountants or Chief Finance Officers of their companies which were drawn from various sectors of the economy. The industry sectors were Agriculture, Banking, Insurance, Natural gas and crude oil, Telecommunication, Transport, Computers and Technology (IT), Health care, Building material, Hotel and resorts, Food, Trading and service sector.

3.2. Research Instruments

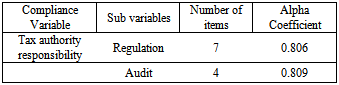

- The questionnaire survey is based on five point likert-scale of that is strongly disagree, disagree, neutral, agree and strongly agree. The statements in the questionnaires were structure-based on tax authority responsibilities. The reliability assessment of the variable and sub variables internal consistency was analysed based on cronbach’s alpha coefficient. According to Reference[23] “Cronbach’s alpha coefficients measure the reliability of a scale that denotes the ability of the scale to produce consistent results when the same entities are measured under different conditions”. Exploratory Factor Analysis (EFA) was carried out for items to reduce the data and fix each item according to the relevant factor. The EFA was conducted on statements on the awareness of the responsibilities of tax authority in Nigeria, and two factors were explored- regulatory and audit functions.Table 1 describes the result of factor analysis for awareness of tax authority responsibility. Majority of the items computed correlated on at least 0.3 indicating absence of multi-collinearity with Kaiser-Meyer-Olkin measure of sampling adequacy was adequate, based on the recommended value of 0.5 ([24],[25]). Similarly, communality is adequate all above 0.5 further confirming that most of the items shared some common variance with other items with majority of the diagonals of the anti-image correlation matrix were all over 0.5. However, Bartlett’s test of sphericity was also significant and majority of the diagonals of the anti-image correlation matrix were all over 0.5 and those with below requirement were removed from the analysis. Finally, the communalities were all above 0.5 further confirming that most of the items shared some common variance with other items. Given these overall indicators, factor analysis was conducted with few items deleted. Principle components analysis was used because the primary purpose was to identify and compute composite involvement scores for the factors underlying the questionnaire. The factor solutions were examined using varimax rotations of the factor loading matrix and the 2 factor solution, which explained 62.37% of the variance as shown in table 1.

|

4. Results and Discussion

- The various respondents were personnel that are saddled with the responsibilities of handling all the tax-related matters of their respective companies. A single respondent represents only one company. The status of the respondents wasChief Finance Officer (CFO) or Accountants of the company they represent. The ability for the tax authority to relate cordially with taxpayers can have a significant effect on the behavior of corporate taxpayers towards tax system. Therefore, it is paramount to understand corporate taxpayers’ awareness of the responsibilities of tax authority. In this study, two sub variables are analyzed towards understanding the respondents’ awareness on tax authority responsibilities. The first sub variable is on the awareness of the regulatory functions of tax authority which has seven items while the second sub variable is on the awareness of Audit functions under SAS which has four items under it.

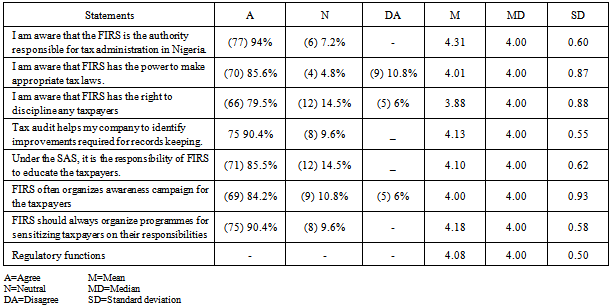

4.1. Regulatory Functions

- Tax authority’s regulatory functions’ statements were channel to respondents to find out their awareness on that effect and seven statements were analyzed. The first statement is on respondents’ awareness of FIRS as tax authority responsible for tax administration in Nigeria. Ninety four percent of corporate taxpayers are fully aware of FIRS as tax authority. The second statement is on the awareness of power of FIRS to make appropriate tax laws and eighty five percent of the respondents agreed that FIRS has power to make tax laws. The third statement is on the right of FIRS to discipline any default taxpayers Seventy nine percent of the respondents are aware of it. The fourth statement is on the awareness of tax audit that helps respondents’ company to identify improvement for records keeping. Ninety percent of corporate taxpayers are fully aware of the role tax audit plays to improve their records keeping. The fifth statement is on role of FIRS to educate taxpayers and eighty five percent of the respondents are aware that FIRS is responsible to educate taxpayers. The sixth statement is on the awareness of FIRS does organize awareness campaign to educate taxpayers and eighty four percent of the respondents agreed that FIRS usually organize awareness campaign. The final statement is on FIRS should always organize programmes for sensitizing taxpayers on their responsibilities and ninety percent of the respondents agreed to it. Interpreting the data from the analysis, indicates that a high mean is obtained from the analysis of 4.08. It shows that corporate taxpayers are aware of the regulatory functions of the tax authority. The summary is shown in table 2.

|

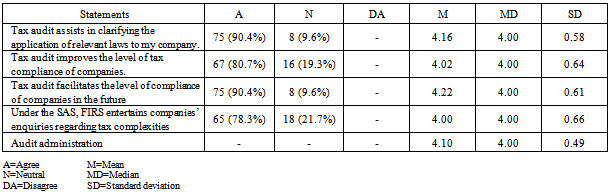

4.2. Audit Functions

- Audit administration is one of the functions of tax authorities, as such the statements were developed towards respondents’ awareness of audit functions and these statements were analyzed. The first statement is on tax audit assists in clarifying the application of relevant laws to my company and ninety percent of the respondents agreed that tax audit assist their companies. The second statement is on tax audit improves the level of tax compliance of companies, eighty percent of the respondents agreed that tax audit had assist their companies to improved their level compliance. The third statement is on tax audit facilitates the level of compliance of companies in the future and ninety percent agreed on it. The final statement is on FIRS entertains enquiries from companies regarding tax complexities and seventy eight percent of the respondents agreed that FIRS entertains enquiries from their companies. Interpreting the data from the analysis, indicates that a high mean is obtained from the analysis of 4.10. It shows that corporate taxpayers are aware of the audit functions of the FIRS. The summary is shown in table 3 below.

|

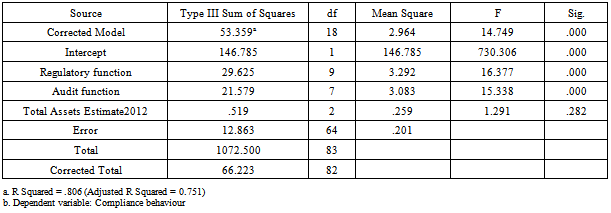

4.3. Hypotheses Testing

- In testing the hypotheses, the study used general linear model (Univariate). The result of the univariate analysis shows that regulatory function positively affect compliance behaviour (F (9) = 16.37, p< 0.05), hence, hypothesis H1, that regulatory function positively affect compliance behaviour is accepted. However, the result is in support of the finding of Reference[18] and[19] found that regulations have positive effect on compliance behaviour. on the other hand, the univariate result of the second sub variable audit function indicated a positive relationship between audit functions and compliance behaviour with the analysis that(F (7) = 15.33, p<0.05), therefore, hypothesis H2 audit function positively affect compliance behaviour is accepted. This has found to be consistent with the result of Reference[11] and[15] argue that audit functions is positively related to compliance behavior. The summary of the hypotheses testing is shown in table 4.

5. Conclusions

- Self-assessment system by its nature encourages voluntary compliance. Corporate taxpayers are expected to understand the system before they can voluntarily comply. By understanding SAS, corporate taxpayers are expected also to be aware of the responsibilities of tax authorities. The responsibilities of tax authorities under SAS are numerous, among which are the regulatory functions, audit functions and educating the taxpayers. Analysis using linear model was conducted on corporate taxpayers in Nigeria. The study determined the relationships between the awareness of tax authority responsibilities by the corporate taxpayers and compliance behaviour.The findings suggest that corporate taxpayers in Nigeria are aware of the responsibilities of tax authority (FIRS). These responsibilities include the regulatory functions and that of the audit functions. However, the result also indicated that there is a positive and significant effect between awareness of tax authority responsibilities and compliance behaviour. Therefore, the Federal Inland Revenue Service needs to increase its level of awareness campaign so that corporate taxpayers can be more enlighten on SAS. This may probably increase their level of compliance.The direction for future research is to examine the awareness of tax education as the responsibility of tax authority. Secondly is to increase the sample size and also apply different methodology to expand the study.

ACKNOWLEDGEMENTS

- The researchers wish to acknowledge all the contributors for the successful completion of this study especially Federal Inland Revenue Service (FIRS) in Nigeria, Abubakar Tafawa Balewa University Bauchi Nigeria and International Islamic University Malaysia.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML