-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(8): 452-458

doi:10.5923/j.ijfa.20130208.08

The Mediating Effects of Financial Reporting Quality on Audit Committee Quality and Capital Structure in Omani Firms

Ahmed Sultan Bin Sariman, Azwadi Ali, Mohd Nazli Mohd Nor

Faculty of Management and Economics, Universiti Malaysia Terengganu, 20000 Kuala Terengganu, Terengganu, Malaysia

Correspondence to: Ahmed Sultan Bin Sariman, Faculty of Management and Economics, Universiti Malaysia Terengganu, 20000 Kuala Terengganu, Terengganu, Malaysia.

| Email: | alnahdi_as@yaholo.com |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study examines the effects of board of directors’ quality and audit committee quality on capital structure and the mediating role of financial reporting quality on the relationship between audit committee quality and capital structure using a sample of Omani listed firms during the period 2009-2011. The study used multiple regression analysis under the fixed effects model approach. First, the results show that financial reporting quality has a significant mediating role on the relationship between audit committee quality and a firm’s leverage market value on the one hand, and an insignificant mediating role on the relationship between audit committee quality and a firm’s leverage book value, on the other. Second, the results reveal that leverage market value is significantly influenced by the audit committee quality. Third, the board of directors’ quality is significantly and negatively correlated with a firm’s leverage market value, suggesting that the firms in Oman are usually large family-owned business groups with concentrated ownership. Thus, the board of directors may serve the purpose of family controlling shareholders. Further, directors on the board were influenced by the Arab traditional values and norms (e.g. personal relations and preference for individuals from influential tribes) which might affect their orientation and behavior. Fourth, the results also reveal that audit committee quality and board directors’ quality are not significantly correlated with leverage book value.

Keywords: Capital structure, Corporate governance, Financial reporting quality, Oman, Leverage

Cite this paper: Ahmed Sultan Bin Sariman, Azwadi Ali, Mohd Nazli Mohd Nor, The Mediating Effects of Financial Reporting Quality on Audit Committee Quality and Capital Structure in Omani Firms, International Journal of Finance and Accounting , Vol. 2 No. 8, 2013, pp. 452-458. doi: 10.5923/j.ijfa.20130208.08.

Article Outline

1. Introduction

- Over the last few decades, a large body of literature has addressed the issue of a firm’s financing (e.g.[1],[2],[3]), and such issue is still attracting the attention of many researchers at the present time (e.g.[4],[5],[6]). It has been argued that an important financial decision facing firms is the choice between debt and equity capital, because not only can it maximize returns to various organizational constituencies, but also because of the impact such a decision has on a firm’s ability to deal with its competitive environment ([7],[8]). Further, it is argued that the importance of choosing a portfolio of capital structure for firms comes from the objective of maintaining sustainability and generating more wealth[6]. In addition, as suggested by the agency theory the conflicts between shareholders (principals) and managers (agents) can be solved by the control of corporate resources. It has been argued that a firm’s leverage plays an important internal governance mechanism role to mitigate the costs of the manager-shareholder agency conflict by reducing the cash flow available for spending at the discretion of managers ([2],[3]). Several studies have been conducted to investigate the relationship between corporate governance and capital structure decisions (e.g.[4],[9],[10]). It is argued that the better the corporate governance frameworks the greater the access to financing, lower cost of capital, better performance and more favorable treatment of all stakeholders[11]. Prior studies suggest that corporate governance correlates with the firm’s financing decisions ([4],[12],[6]). In fact, most of the prior research studies on corporate governance and firm capital structure issues have been limited to those of developed economies or large emerging economies. It seems, then, that small economies, such as those of the Gulf Cooperation Council (GCC) countries, including Oman, are very much understudied in the literature. In addition, the previous studies that have been conducted in Oman showed that the leverage ratio in the listed firms on the Muscat Securities Market (MSM) is still below that found in developed countries. For instance, reference[13] reported that the ratio of leverage is relatively low in Omani firms. They found that the ratio of 0.46 is much lower than the 0.73 (Germany), 0.69 (Japan), 0.58 (US), or the 0.54 (UK) reported by[14]. These results are supported by a recent study conducted by reference[15], who reported that the leverage ratio in Omani firms is 0.497 for book leverage and 0.446 for market leverage. Therefore, this paper contributes to the literature by filling this gap by looking at the impact of the board of directors’ quality and audit committee quality on the capital structure of Omani firms. Further, this paper also contributes to the literature by investigating the mediating effect of financial reporting quality on the relationship between audit committee quality and a firm’s debt financing.

2. Literature Review

2.1. Board of Directors’ Quality and Capital Structure

- The theories of corporate governance suggest that the important part of the governance structure of business corporations is the board of directors ([16],[17]). It is argued that the board of directors, as one (if not the only) of the internal control mechanisms of corporate governance, can reduce the agency conflicts by exercising its power to monitor and control management ([16],[18]). Further, the board of directors has the power to resolve conflicts of interest among decision makers and residual risk bearers, which, in turn reduce the level of information asymmetry between the firm and its lenders ([19],[20]). Further, it has been argued that directors on boards exercising their functions include hiring and firing the top managers, determining executive pay and otherwise monitoring managers to ensure that they do not expropriate stockholders’ interests[21]. The board of directors’ characteristics have been identified in previous empirical studies (e.g.[6],[10],[22]) to influencing a firm’s capital structure decisions. For example, reference[10] reported that a larger board size is associated with low leverage, suggesting that larger boards are relatively less effective because coordination, communication and decision-making are more cumbersome in large boards. Further, reference[2] concluded that firms with higher leverage have rather relatively more outside directors on the board due to the fact that outside directors generally care about their reputation and social status, and, thus, have an incentive to monitor management[16]. However, this paper, unlike prior studies, aims to examine the relationship between the board of directors’ quality and capital structure by omitting the direct relationship with board characteristics. It is argued that firms with a high quality of board benefit from higher credit ratings on debt issuance[23]. Empirical studies showed that a high quality of the board was associated with the cost of debt[24]. Their results support the notion that the high quality of board reduces corporate borrowing costs, suggesting that higher quality boards may complement the monitoring role of banks, and, thus, reduce the costs and ameliorate the non-price terms of bank debt. Therefore, the following hypothesis is proposed:Hypothesis1a: There is a positive relationship between the board of directors’ quality and firm leverage (book value).Hypothesis1b: There is a positive relationship between the board of directors’ quality and firm leverage (market value).

2.2. Audit Committee Quality and Capital Structure

- Although prior research has established the positive relationship between the board of directors’ characteristics and a firm’s capital structure (e.g.[6],[10],[22]), few studies addressed the relationship between audit committee and a firm’s financing decisions. It is argued that the existence of the audit committee is to protect shareholders’ interests through its oversight responsibility in the area of financial reporting, internal control, and external auditing activity[25]. The relation between audit committee quality and capital structure decisions is based on the rationale that if the audit committee is effective in performing its oversight duty of the financial reporting process, it will affect the quality of financial reporting, which may lead to the lower cost of debt[26], which serves as a motivation for firms using more debt financing. Moreover, prior studies advanced empirical evidence that suggested that firms that have adopted corporate governance mechanisms have easier and less costly access to loan capital ([27],[28],[29]). It would be expected, therefore, that firms that implement corporate governance mechanisms, specifically audit committees, would be highly leveraged. A number of empirical studies have investigated the relationship between the presence of the audit committee and capital structure (e.g.[30],[27]), and concluded that the presence of the audit committee affects the firm’s financing. Further, reference[26] found that fully independent audit committees, audit committee size and meeting frequency are associated with a significantly lower cost of debt financing. Thus, this paper presents the following hypotheses:Hypothesis 2a: There is a positive relationship between the audit committee quality and firm leverage (book value).Hypothesis 2b: There is a positive relationship between the audit committee quality and firm leverage (market value).

2.3. Mediation the Relationship between Audit Committee Quality and Capital Structure

- As mentioned earlier, a few studies have addressed the relationship between the presence of audit committee and a firm’s financing decisions. For example, a study conducted by reference[27] examined the effect of the audit committee as one of the corporate governance mechanisms on a firm’s financing. The results revealed that corporate governance mechanisms, such as the audit committee are associated with higher a firm’s leverage. However, the important thing for researchers in the area of corporate governance and a firm’s financing decisions is in the understanding of how and why such a relationship occurs. Therefore, this paper expects that financial reporting quality acts as a mediating variable that transmits the effect of audit committee quality to the firm’s capital structure. Prior empirical studies have provided evidence that audit committees can strengthen financial reporting quality. For instance, reference[31] asserted that the audit committee is negatively associated with earnings management. Reference[32] reported that firms with audit committees are less likely to manipulate earnings. Reference[33] also provided evidence that audit committees reduce earnings management. In addition, reference[34] affirmed that audit committees have a positive effect on reliable financial reporting. Further, the investigation of the effect of financial reporting quality on a firm's external finance, specifically debt financing relates to a large body of literature, which recognizes that lenders restrict their flow of loan to the firm or require a higher interest rate for higher risk. According to the trade-off theory, higher risk should be associated with less debt, because future cash flows may not be high enough to repay the debt. This potential bankruptcy cost increases the cost of debt and reduces the firm’s ability to raise debt capital[35]. Thus, firms that have financial information with higher quality experience significantly lower problems with gaining access to external finance than other firms. Prior empirical studies confirm that higher quality of reported accounting numbers is associated with a lower cost of debt (e.g.[36],[37],[38]), which, in turn, increases a firm’s debt financing. Therefore, financial reporting quality should mediate the relationship between audit committee quality and capital structure.Hypothesis3a: Financial reporting quality mediates the relationship between audit committee quality and a firm’s leverage (book value).Hypothesis3b: Financial reporting quality mediates the relationship between audit committee quality and a firm’s leverage (market value).

3. Methodology

3.1. Sample and Variables

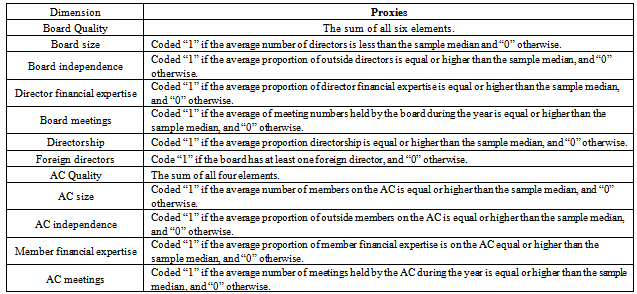

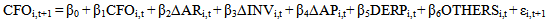

- The sample period covers the years from 2009 to 2011. The sample firms were extracted from the population of all firms listed on the Muscat Securities Market(www.msm.gov.om). Banks, finance, and insurance firms were excluded from the sample because of their special capital structure, which is substantially different from the firms in other industries and due to the differences in the regulatory requirements. Firms with incomplete data were deleted from the sample. The final sample consisted of 78 firms, resulting in 234 firm-years.Two broad definitions of a firm’s capital structure are commonly used in the literature. The first definition is based on book value, which is the ratio of total debt divided by total assets (book leverage). The second definition is based on market value, which is the ratio of total debt to the sum of book debt and the market value of equity (market leverage). The board of directors’ quality index consists of six characteristics. The score for the board of directors’ quality is the sum of all six elements, which means that the maximum possible score for each firm is 6. Meanwhile, the audit committee quality index consists of four characteristics. The score for the audit committee quality is the sum of all four elements, which means that the maximum possible score for each firm is 4. Table 1 presents the measurements of board of directors’ quality and audit committee quality. Following prior studies for example,[39] this paper measures financial reporting quality using the residuals obtained from the following equation:

| (1) |

|

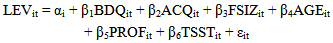

3.2. The Models

- This paper employed a panel data methodology, which was adopted by prior empirical accounting studies (e.g.[5], [15]). This paper used the Hausman specification test to compare the appropriateness of the fixed and random effects method of panel data regression which are able to control for unobserved firm and/or year effects[40]. In all models the null hypothesis is rejected; hence the fixed effects model should be used to estimate Hypotheses 1and 2, which predict a positive relationship between the board of directors’ quality and audit committee quality (independent) variables and capital structure (dependent), and Hypothesis 3 that predict the mediating effects of financial reporting quality on the relationship between audit committee quality and a firm’s capital structure.

| (2) |

4. Empirical Results

4.1. Descriptive Statistics

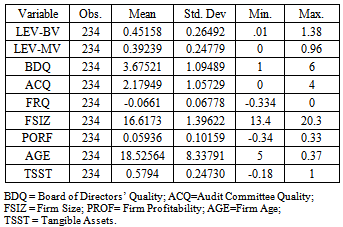

- Table 2 presents the descriptive statistics of all the variables. Descriptive statistics include the mean, standard deviation, minimum and maximum values.

|

4.2. Regression Analysis

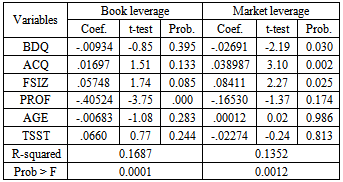

- Table 3 reports the empirical regression results. The result of the first model reports that the independent variables explain the book value of leverage determination of the firms at 16.7% and 13.5% for the second model.

|

|

5. Conclusions

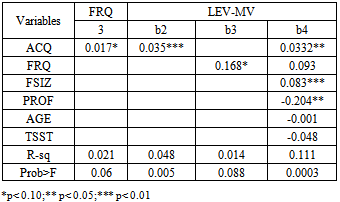

- This paper examines the effects of board of directors’ quality and audit committee quality on a firm’s capital structure decisions of listed firms in MSM. The results, however, report that there is an insignificant relationship between board of directors’ quality and audit committee quality and a firm’s leverage book value. The results show the positive and statistically significant relationship between audit committee quality and firm’s leverage market value, suggesting that audit committee gained the confidence of bondholders, where they believe that a higher quality of audit committee is better able to protect the reliability of the accounting process and ensures that their investments will be used to finance projects that will increase the firm value, which, in turn, will reflect positively on the firm’s ability to meet its obligations and credit worthiness. Further, the result reveals that Hypothesis 1b is rejected, which shows that the board of directors’ quality negatively and statistically significantly correlates with the leverage market value. This paper also examines the mediating role of financial reporting quality between audit committee quality and a firm’s leverage. The results of this paper reveal that Hypothesis 3b is supported, which indicates that the relationship between audit committee quality and a firm’s leverage market value is partially mediated by the financial reporting quality. The results of this paper, however, show that Hypothesis 3a is rejected, which suggests that the relationship between audit committee quality and a firm’s leverage book value is not mediated by the financial reporting quality. However, as with any study, the findings in this paper are subject to at least two limitations. First, financial firms are excluded from the sample because the capital structure of such firms is substantially different from the firms in other industries and the differences in the regulatory requirements. Thus, the findings of this paper cannot be generalized to the financial institutions. Second, this paper examines two internal mechanisms of corporate governance: namely, board of directors and audit committee. It is possible that other external mechanisms also determine the capital structure decisions.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML