-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(8): 446-451

doi:10.5923/j.ijfa.20130208.07

Public Sector Accounting - The Nigerian Experience

Ofordile Uchenna Daniel

Head of Accounting Division, Institute of Management and Technology (IMT), Nigeria

Correspondence to: Ofordile Uchenna Daniel, Head of Accounting Division, Institute of Management and Technology (IMT), Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Public Sector Accounting is used by “all organizations which are not privately owned and operated, but which are established, run and financed by the Government on behalf of the public.” Public sector consists of organizations where control lies in the hand of the public, as opposed to private owners, and whose objectives involves the provision of services, where profit is not a primary objective. R.A Adams (2004) in his book “Public Sector Accounting and Finance made Simple” defines Public Sector Accounting as “a process of recording, communicating, summarizing, analyzing and interpreting Government financial statements and statistics in aggregate and details; it is concerned with the receipts, custody and disbursement and rendering of stewardship on public funds entrusted.

Keywords: Accountability, Public Finance, Public Sector Accounting, Management, Nigeria

Cite this paper: Ofordile Uchenna Daniel, Public Sector Accounting - The Nigerian Experience, International Journal of Finance and Accounting , Vol. 2 No. 8, 2013, pp. 446-451. doi: 10.5923/j.ijfa.20130208.07.

Article Outline

1. Introduction

- Accounting is the book keeping that enables one to keep track of one's assets, liabilities, capital, income and expenditure. In accounting, the public sector consists of the government, governmental organizations, parastatals and non-governmental organizations among others. Therefore, accounting of the aforementioned organizations is referred to as Public Sector accounting. The main objectives of public sector accounting are:● To determine the legitimacy of transactions and their compliance with the statues and accepted norms. Public sector disbursement should accord with the provisions of the appropriation Acts and Financial Regulations.● Providing Evidence of Stewardship: The act of rendering stewardship is being able to account transparently and diligently for resources entrusted. Government operators are obliged to displace due diligence and sense of probity in the collection and disposed of public funds.● Assisting Planning and Control: Mapping out plans prevents organizations from drifting. Control measures are adjusted to skillful planning plans of actions provide focus of activities which are being pursued. The incidence of unforeseen is built into plans so as to prevent or at least reduce corporate failures.● Public sector establishment must act in accordance with the mandate theory of governance.● Ensuring Objectivity and Timely Reporting: The users of public sector accounting such as the executives (President, Governors, Chairman of Local Government Council, Federal Ministers and State Commissioners, National Assembly, members of the public) are anxious to bridge their knowledge gaps of what the Government is doing. They will treasure prompt, timely and accurate statistics to evaluate the performance of Government.● Evaluating the costs incurred and the benefit derivableIt is difficult to measure costs and benefits in financial terms in public sector organizations. The comfort of the citizens is the key and paramount issue. The analysis of cost-benefit assesses the economic and social advantages (i.e. benefit) and disadvantages/inconvenience (cost) of alternative of actions.● Other objectives of public sector accounting includes:i. Providing the means by which actual performance may be compared with the budget or target set.ii. Providing the details of outstanding long term commitments and financial obligationsiii. Proffering solutions to the various bottle necks and problems identified.iv. Ensuring that costs are matched by at least equivalent benefits accruing.v. Identifying the sources of funding capital projects.vi. Evaluating the economy, efficiency and effectiveness with which Public Sector Organization Pursue their goals and objectives.

1.1. The Constitutional and Regulatory Framework of Public Sector Accounting as it Applied to Nigeria

- In Nigeria public sector accounting is government by the following regulatory frame work.1. Nigerian Constitution (1999)The 1999 constitution of the Federal Republic of Nigeria is one of the legal frameworks that regulates the receipts and payment of public funds. Some specific sections of the constitutions are:Section 80: Establishment of the Consolidated Revenue Fund (CRF)Section 81: Authorization of expenditure from the CRFSection 82: Authorization of expenditure in default of appropriations.Section 83: Establishment of the Contingencies FundSection 84: Remuneration of Statutory OfficersSection 84 (4): Comprehensive list of Statutory OfficersSection 85: Audit of Public AccountSection 86: Appointment of the Auditor – General for the\FederationSection 87: Tenure of Office of the Auditor-General for the FederationSection 88: Power to conduct investigation by the National Assembly.Section 89: Power as to matters of evidenceSection 149: Declaration of assets and liabilities and oaths of officeSection 153: List of Statutory CommissionSection 162: Establishment of the Federation AccountsSection 163: Allocation of Other RevenueSection 164: Federal grants - in – aid of state revenue.2. Financial Regulations/ Accounting ManualsIn Nigeria financial regulations are powerful control tools used in the Public sector fund management. They are the accounting Manual of the three tiers of Government (Federal, State and Local Government) designed to guide the management of public funds. These regulations ensure good accountability, prevention and early detection of funds and other financial malpractices. The rules deal with the procedures to be adopted for the receipts and disbursement of public fraud and how to ensure accountability. Financial regulations could be regarded as an accounting manual of Government as they state all the guidelines, rules and instructions to be followed to ensure legal and wise spending.3. Financial/Treasury Circulars: They are administrative tools used to amend the existing provisions of financial regulations, public service rules and the introduction of new policy guidelines.4. Finance/ (Control and Management) Act of 1958: This governs the management and operation of all government funds. It regulates the accounting system, the books of accounts to be followed in the preparation of accounts and financial statements.5. Other laws guiding public sector accounting and finance in Nigeria include the pension, Reform Act of 2004 and the independent corrupt practices and other related offences (ICPC) Act of 2000.Development in Public Sector Accounting Practices The Ghanaian ExperienceResearch in Accounting in emerging economies using evidence from a developing country (Ghana) explores the motivation from such developments from post-independence to date.Findings – “Evidence gathered shows gradual shift from cash accounting to accrual accounting practices (Modified), including computerization of the entire public sector accounting and reporting processes. Indeed, the World Bank and IMF sponsored reform (PUFMARP) instigated many of the major developments in the public sector accounting practices, including the adoption of accrual accounting and deployment of integrated financial management information system.

1.2. Bases of Public Sector Accounting

- a. Cash Basisb. The accrual basisc. The commitment basisi. The cash basis of accounting is where revenue are recorded only when cash is received and expenditures received and expenditures recorded only when cash is paid, irrespective of the fact that the transactions might have occurred in the previous accounting periods.ii. Under the Accrual Basis – revenues are recorded when earned and expenditures acknowledged as liabilities when known or benefits received, notwithstanding the fact that the receipts or payment of cash have taken place wholly or partly in other accounting years. Accrual accounting is practiced in the private sectors because of its profit maximization, where it is necessary to estimate how much profit has been earned in a period with a view to making periodic distributions to shareholders by way of dividends and keeping invested assets intact. In contrast the Mervin consideration in the public sector is the enhancement of the standard of living of the people.iii. Commitment BasisCommitment account is kept on a memorandum basis and takes care of only two areas or contract for the supply of goods or services.i. Issue of order or contract for the supply of goods or servicesii. Consumption of valueIt is a basis that records can anticipate expenditure evidenced by a contract or a purchase order as determine by the administration.Many lovers of this method believes that commitment is regarded as a charge, which has been made on a budget provision.In Nigerian Government records financial transaction on cash basis contrary to accrual basis in the private sector.

1.3. Throwing More Lights on Terminologies in Public Accounting and Finance

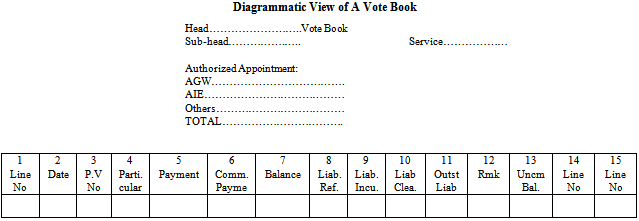

- 1. Vote BookA vote book is a memorandum accounts book used for monitoring government expenditures and ensures that there is no extra-budgetary spending.Reasons For Keeping A Vote Booka. To ensure that there is no extra-budgetary spendingb. Effective monitoring of government expendituresc. To ensure that funds are available in the appropriate head and sub-heads to meet payments dued. To show uncommitted balance at a glancee. To highlight Government creditors/liabilities.

2. Above-The Line AccountsThese are the expenditures budgeted for in the estimate. These can be reasonably ascertained as at the time of preparing the budget as to the exact amount of incomes receivable and expenditures incurable.Examples of such cost which may be budgeted for are salaries and over head expenses; revenues anticipated include collections from the customs and excise duties and other government revenue generating agencies.3. Below-The Line AccountsThese are the accounts created and controlled by the Accountant General of the Federation of which the exact amount of incomes receivable and expenditure incurable cannot be reasonably ascertained as at the time of preparing the budget. Examples of such include:1. Touring advances2. Spectacle advances3. Loans and deposit4. Money held on behalf of third parties5. Remittance and cash transfers in respect of the Nigerian Army, Police, Para-Military organization.4. Federal Pay OfficerThis is an officer who is in charge of a Federal pay office in the State. The Federal Pay Office handles the processing of all financial transactions between the Federal and State Governments, the Local Government Councils and all branches of the Federal Government Ministries located in the State Concerned.5. Budgetary Control ConceptThis concept states that Government should not undertake any action without a prior budget for it. The concept assumes that all Government revenues and expenditures must be budgeted for.6. Modified Cash BasisIn modified cash basis, the books of accounts are left open for a maximum period of three months after the end of the year. This will enable the book to capture substantial amount of income/expenses relating to the previous years which had just ended.7. Modified Accrual BasisIn using modified accrual basis, both the cash and the accrual bases are employed simultaneously where applicable, in order to ascertain the financial viability of a specific Ministry/Extra-Ministerial Department.8. Account CurrentThese accounts is used to take care of transactions between the Federal Government and their Agencies. It shows what is due from Federal Government to States or Local Government Councils. It is a balancing account.9. Children Separation Domicile Allowance (SDR)The allowance is payable to an officer if he is separated from his children as a result of the following developmentsa. If he is an expatriate officerb. Where an officer is being posted to serve overseas10. Compassionate AllowanceThis is money paid to the dependents of an officer who die in active service in addition to the officers normal official entitlement. The Federal Government has issued a circular to standardize the rate of such allowance.

2. Above-The Line AccountsThese are the expenditures budgeted for in the estimate. These can be reasonably ascertained as at the time of preparing the budget as to the exact amount of incomes receivable and expenditures incurable.Examples of such cost which may be budgeted for are salaries and over head expenses; revenues anticipated include collections from the customs and excise duties and other government revenue generating agencies.3. Below-The Line AccountsThese are the accounts created and controlled by the Accountant General of the Federation of which the exact amount of incomes receivable and expenditure incurable cannot be reasonably ascertained as at the time of preparing the budget. Examples of such include:1. Touring advances2. Spectacle advances3. Loans and deposit4. Money held on behalf of third parties5. Remittance and cash transfers in respect of the Nigerian Army, Police, Para-Military organization.4. Federal Pay OfficerThis is an officer who is in charge of a Federal pay office in the State. The Federal Pay Office handles the processing of all financial transactions between the Federal and State Governments, the Local Government Councils and all branches of the Federal Government Ministries located in the State Concerned.5. Budgetary Control ConceptThis concept states that Government should not undertake any action without a prior budget for it. The concept assumes that all Government revenues and expenditures must be budgeted for.6. Modified Cash BasisIn modified cash basis, the books of accounts are left open for a maximum period of three months after the end of the year. This will enable the book to capture substantial amount of income/expenses relating to the previous years which had just ended.7. Modified Accrual BasisIn using modified accrual basis, both the cash and the accrual bases are employed simultaneously where applicable, in order to ascertain the financial viability of a specific Ministry/Extra-Ministerial Department.8. Account CurrentThese accounts is used to take care of transactions between the Federal Government and their Agencies. It shows what is due from Federal Government to States or Local Government Councils. It is a balancing account.9. Children Separation Domicile Allowance (SDR)The allowance is payable to an officer if he is separated from his children as a result of the following developmentsa. If he is an expatriate officerb. Where an officer is being posted to serve overseas10. Compassionate AllowanceThis is money paid to the dependents of an officer who die in active service in addition to the officers normal official entitlement. The Federal Government has issued a circular to standardize the rate of such allowance.1.4. Sources of Government Revenue

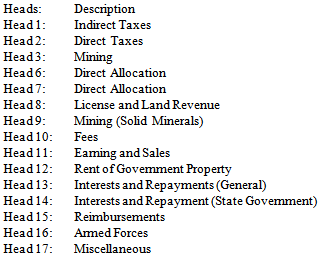

- The Federal Government of Nigeria derives its revenue from the following

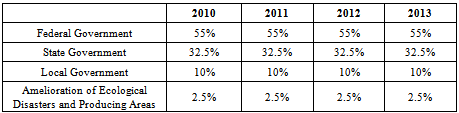

The Federal Government Revenues are classified into two groups:(a) Federation Account Revenue Heads and(b) Federal Government Revenue Heads or Consolidated Revenue Fund Accounts (CRF).Federation Account Revenue HeadsThe Federal Account was established by section 162 of the 1999 Constitution of the Federal Republic of Nigeria. The Constitution spelt it clear that this account shall be paid all revenues collected by the Government of the Federation, except the proceeds from the PAYE of the foreign service officers (Ambassadors etc) and residents of the Federal Capital Territory (Abuja), the Nigerian Police Force and the personnel of the Armed Forces of the Federation. These account is a distributable pool account from which allocations are made to the three tiers of Government via:a. Federalb. 36 State of the federation plus Abujac. 173 Local Government CouncilsIn such terms and condition as prescribed by law.Revenue Allocation Formula

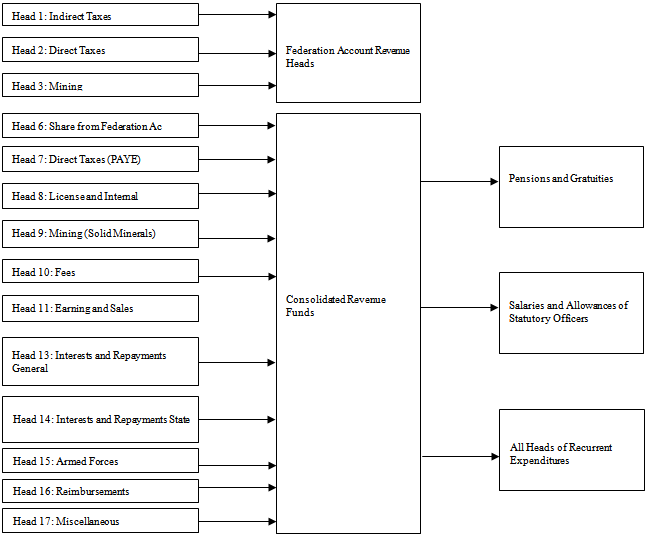

The Federal Government Revenues are classified into two groups:(a) Federation Account Revenue Heads and(b) Federal Government Revenue Heads or Consolidated Revenue Fund Accounts (CRF).Federation Account Revenue HeadsThe Federal Account was established by section 162 of the 1999 Constitution of the Federal Republic of Nigeria. The Constitution spelt it clear that this account shall be paid all revenues collected by the Government of the Federation, except the proceeds from the PAYE of the foreign service officers (Ambassadors etc) and residents of the Federal Capital Territory (Abuja), the Nigerian Police Force and the personnel of the Armed Forces of the Federation. These account is a distributable pool account from which allocations are made to the three tiers of Government via:a. Federalb. 36 State of the federation plus Abujac. 173 Local Government CouncilsIn such terms and condition as prescribed by law.Revenue Allocation Formula Federal Government Account: CR CRFThe CRF was established by Sec 80 of the Constitution of the Federal Republic of Nigeria, 1999. See diagram below showing the finds paid into the CRF.

Federal Government Account: CR CRFThe CRF was established by Sec 80 of the Constitution of the Federal Republic of Nigeria, 1999. See diagram below showing the finds paid into the CRF.1.5. Consolidated Revenue Fund Account Diagram

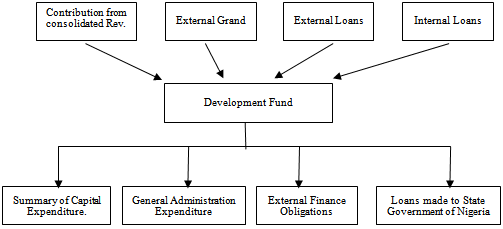

All the revenues in the above diagram are paid into the Consolidated Revenue Fund and the right hand shows the charges thereon.Development FundThe development fund was created by section 25 of the Finance (Control & Management) Act of 1958 but was solidified by the 1999 constitution of the Federal Republic of Nigeria. The fund is established for the purpose of capital development projects. Sources of money occurring to the development fund is as shown in the diagramDevelopment Fund in Diagram

All the revenues in the above diagram are paid into the Consolidated Revenue Fund and the right hand shows the charges thereon.Development FundThe development fund was created by section 25 of the Finance (Control & Management) Act of 1958 but was solidified by the 1999 constitution of the Federal Republic of Nigeria. The fund is established for the purpose of capital development projects. Sources of money occurring to the development fund is as shown in the diagramDevelopment Fund in Diagram Contingency FundThe legality of the contingency fund emanates from section 81 of 1979 and 1989 constitutions and section 83 of 1999 constitution. This fund is set up to meet unforeseen and urgent situations such as natural disasters. A charge on this fund will arise in exceptional cases where virulent is not possible, and where an application for additional provision reveals that the issue of funding cannot be delayed without causing serious injuries to public interest.

Contingency FundThe legality of the contingency fund emanates from section 81 of 1979 and 1989 constitutions and section 83 of 1999 constitution. This fund is set up to meet unforeseen and urgent situations such as natural disasters. A charge on this fund will arise in exceptional cases where virulent is not possible, and where an application for additional provision reveals that the issue of funding cannot be delayed without causing serious injuries to public interest.2. Conclusions

- Accountability is a central concept for governance. Accountability requires that those who hold positions of public trust should account for their performance to the public or their duly elected representatives. Accountability, therefore, implies that decision makers are monitored by, and are responsible to, others, each of whom is, in turn, responsible to the people of the country. In respect of public financial management, there are several mechanisms through which accountability is enforced such as the auditor general, public account committee, and the ombudsman. These accountability mechanisms must be strengthened to reduce the level of corruption in the country. The nation’s annual budget must be an instrument of accountability, a stewardship report of what was done in any given financial year and just a reflection of how money was allocated, unspent and subsequently returned to the coffers of the government or even wasted. Therefore, accountability is the hallmarks for good governance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML