-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(8): 422-427

doi:10.5923/j.ijfa.20130208.04

Problems and Countermeasures of Chinese Finance Boosting Transformation of Small and Medium Enterprises

Ruijuan Zhao

School of Management, Shanghai University of Engineering Science, Shanghai, 201620, China

Correspondence to: Ruijuan Zhao, School of Management, Shanghai University of Engineering Science, Shanghai, 201620, China.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The current international economic situation is changing, and technology revolution is giving birth to new industries. All of these have lead to the adjustment and upgrading of industrial structure. In this context, financing occupies an important position in the transition and development process of SMES in China. Firstly, taking Shanghai as an example, this paper summarizes the development status of Shanghai economy and small and medium-sized enterprises in Shanghai. Then the author makes a concrete analysis of the present financing situation and the existing problems in China by using the related data. According to the financing problems and combining with China's reality, the author puts forward some related countermeasures from the view of enterprises, banks and government, in order to know how finance can promote the Chinese small and medium-sized enterprises’ transformation.

Keywords: Medium-sized and small enterprises, Transformation and upgrading, Financial help

Cite this paper: Ruijuan Zhao, Problems and Countermeasures of Chinese Finance Boosting Transformation of Small and Medium Enterprises, International Journal of Finance and Accounting , Vol. 2 No. 8, 2013, pp. 422-427. doi: 10.5923/j.ijfa.20130208.04.

Article Outline

1. Introduction

- Development of Shanghai represents the frontier of Chinese economy, and middle and small-sized enterprises which are important participants and implementers of economic transition play an important role in the economy of Shanghai. However, financing difficulty has restricted the development of middle and small-sized enterprises, and it also indirectly hinders industry upgrade in Shanghai. On one hand, adjustment of industrial structure depends on research, development and innovation of technology; on the other hand, the extensive development mode has to be changed, and they should transfer from labor intensive to technology intensive, from resource consumption to green production. Besides, middle and small-sized enterprises should also set up their own brands and develop their own products. But whether research and development or innovation, industrial transformation requires the support of powerful finance. Financial support here not only means support in funds, but also refers to development of financial platforms inside enterprises. Only by completely constructing financial and fiscal platforms, can we further promote transformation and upgrade of enterprises. From another perspective, transformation and upgrade of middle and small-sized enterprises can also promote economic development and prosperity of financial market. Therefore, transformation and upgrade of middle and small-sized enterprises needs support from finance, while transformation development of enterprises will also open up a broader field for financial market.How about the current development situation of SMES? What kind of financing problems they have encountered in the transformation and upgrading? And how should Chinese finance adjust to better boost the development and transformation of SMES? The author hopes to give some answers to all of these.

2. Development Status of Middle and Small-sized Enterprises in Shanghai

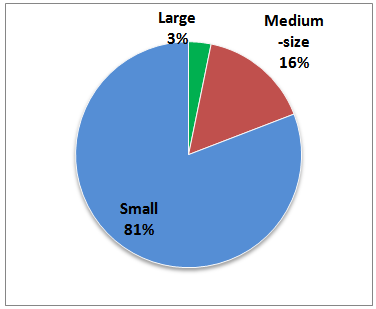

- As one of the most developed cities in China, Shanghai has been faced with multiple severe challenges and opportunities since reform and opening up. When the economic aggregate grows stably, adjustment of industrial structure also presents a progressive adaptive change. Industry is upgraded gradually and structure is optimized continuously. The economic growth pattern has transformed from depending on the drive of secondary industry in the past to relying on two-wheel drive of secondary industry and tertiary industry.Under such economic environment, transformation of secondary industry is still the top priority for the future development of China and Shanghai. Transformation development of middle and small-sized enterprises in secondary industry possesses more important significance. SMES play an irreplaceable role in the economic development. The existence of small and medium-sized enterprises is not only in conformity with the requirements of transaction cost economics, but also can effectively provide more employment opportunities for the society and promote the economic development[1]. From 2007 to 2011, large and medium-size enterprises have a relatively stable quantity among industrial enterprises of Shanghai, while small enterprises have reduced obviously since 2008, and they have decreased from 13,429 in 2007 to 8,054 in 2011. However, quantity of middle and small-sized enterprises has always occupied an absolute advantage. In 2011, there are 8,054 small enterprises[2], occupying 81%; medium-sized enterprises take up 16%; while large enterprises only account for 3%, as shown in Fig. 1.

| Figure 1. Proportion graph of industrial enterprises in Shanghai in 2011 |

3. Current Financing State and Problems in Transformation and Upgrade of Middle and Small-sized Enterprises

3.1. Current Financing State in Transformation Development of Middle and Small-sized Enterprises

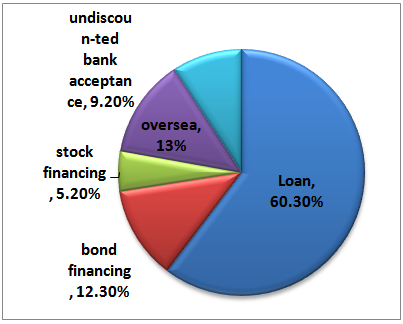

- Owing to the change of domestic and overseas environment, shortage of and scramble for energy and resources, obvious increase of industrialization cost, and upgrade of consumption structure, transformation development of enterprises is necessary. However, most middle and small-sized enterprises in Shanghai are still at the low side of industry chain at present. Their industry chain level is low, additional valve of product is low, there is a lack of core technology, and the capability of independent innovation is insufficient. “Three lows and two shortages” decides that middle and small-sized enterprises have to produce only by simple imitation, and there are few enterprises which have their own brands and mature distribution channels. Most enterprises in the industry are in such situations, so upgrade of industrial structure is slow and overall transformation development in the region is also hindered. The above difficulties before middle and small-sized enterprises can be summarized as “financing difficulty”. According to the financial life-cycle theory of enterprises, which is proposed by Weston and Brigham (1970, 1978) and revised by the American economists Berg and Udall, in the start-up stage, the management of the small enterprises is not stable. Its demand for funds has the characteristics of small amount and high frequency. In addition, the companies mostly rely on internal funds and it is difficult to obtain financing. In the growth stage, enterprises have some capital accumulation. In this period, they mainly rely on external financing. Although they have higher ability of negotiating with the bank than the former stage, the companies are still at a disadvantage of financing[3]. Therefore, the financing problems faced in the two stages of the small and medium-sized enterprises are severe. According to statistics of People's Bank of China, financing gap of non-financial enterprise departments is 4,430 billion Yuan in 2012, increasing by 3,660 billion Yuan when compared with last year[4]. If fund supply cannot satisfy the development demand of enterprises, enterprise transformation will be undoubtedly hindered.At resent, Chinese middle and small-sized enterprises gain financing mainly through investment of their own funds, bank loan, capital market, and bond market, in which bank loan occupies the largest proportion. There are 6,700 billion Yuan new bank loans in non-financial enterprise departments in 2012, occupying 60.3% of total new bank loans[4], as shown in Fig. 2. Bank loan which is the main source of business capital has very harsh conditions. Small scale means hard financing, which makes some enterprises turn to private loan. However, both risk and cost are high in private loan, which has resulted in financing difficulty and capital shortage among middle and small-sized enterprises. Financing difficulty will directly cause insufficient investment of business capital and lack of development power. In addition, financing difficulty will also reduce investment in technology. As a result, enterprises are powerless to support technological innovation, brand building and channel expanding. They can only depend on cheap labor power and short-term development gained through scale economies effect, while industry upgrade and sustainable development cannot be realized. Technological innovation is effective power to push forward transformation development of enterprises, but financing shortage has greatly restricted technology research and development, and thus hindered transformation and upgrade of enterprises. Financing difficulty of middle and small-sized enterprises has already been the greatest obstacle for economic transition in Shanghai.

| Figure 2. Source of new liabilities among non-financial departments in 2012 |

3.2. Financing Problems in Transformation and Upgrade of Middle and Small-sized Enterprises

- Many Chinese scholars have studied the financing problems of small and medium sized enterprises of China. Nan Wu (2013)[5] and Xingyuan Wang, Yifan Zhou (2011)[6] analyzed existing problems from the view of SMES’ financing channels: the financing channel is narrow and the proportion of direct financing is low. Lianjuan Cao (2012)[7] analyzed the problems from the perspective of the financing system. She thought the capital market is lack of hierarchy, and information asymmetry is one of the problems, too. On this basis, this article believes that, the financing problems, existing in the transformation and upgrading of the small and medium enterprises, can be mainly summarized as follows:1. Narrow financing channels, high loan costThough Chinese middle and small-sized enterprises can gain financing through banks and capital market, the selectable financing channels are still narrow when compared with developed countries. From the perspective of quantity, China has few types of financing channels. Developed countries have established special financing institutions for middle and small-sized enterprises except regular financing channels. For instance, SBA that is policy-based financial institution of America and Shinkin Bank that is commercial financing institution of Japan can provide financing and relevant services for middle and small-sized enterprises. Service institutions with pertinence can not only effectively solve financing problems before middle and small-sized enterprises, but also avoid discriminations which might be encountered in competing for financing with large enterprises. This is just what’s required in China. On the other hand, from the angle of quality, capital availability of Chinese financing channels is far lower than similar channels of America. By taking capital market as an example, America possesses multi-level capital market, and NASDAQ can provide financing for middle and small-sized enterprises that grow well. Singapore has also set up multi-level capital market. Multi-level capital market has wider coverage and can meet financing demands of enterprises at different development stages. In this way, enterprises will have more initiative and selectivity. China also has corresponding growth enterprise market and the listing requirements are lower than that on main board market, but compared with the above countries, its access conditions are still quite strict. Middle and small-sized enterprises often have low credit grade and cannot reach the specified standards in assets and financing conditions, so they cannot gain financing through this channel. There are only 74 companies listed on growth enterprise market in 2012[8]. As for thousands of middle and small-sized enterprises that require financing, it still cannot satisfy the financing needs.As is mentioned in the above, most funds of Chinese middle and small-sized enterprises, except self-owned funds, come from bank loan. Bank loan not only has high examination requirements, but also needs a high cost. Loan interest rate of middle and small-sized enterprises will often be increased according to a certain proportion on the basis of benchmark interest rate. The specific rate is related to bank policies and company situations, but generally speaking it will be increased by about 30%-40%[9]. According to data issued by Standard Chartered Bank, loan interest rate for middle and small-sized enterprises has increased by 44.6% in the fourth quarter of 2012, and confidence index of financing among middle and small-sized enterprises has decreased by 47.2%[10]. In the loan process, middle and small-sized enterprises also have to pay handling charges, account management charges, security costs, credit rating fees and information consulting fees. Plus other fees like loan interest, the loan interest rate of some middle and small-sized enterprises will even increase by 70%[11]. Middle and small-sized enterprises cannot bear such a high cost.2. Excessive private loans, high riskWhen formal financing channels are narrow and cost of the selectable financing channel - bank loan is high, fund demand of middle and small-sized enterprises cannot be satisfied, thus private loan market is quite active. Formal financial market is also quite prosperous in China, but under the situation where capital demand exceeds supply, private loan market has also become one of the financing channels for middle and small-sized enterprises. According to monitoring analysis of Wenzhou Sub-branch of People's Bank of China, the scale of private loan in Wenzhou is about 110 billion Yuan in 2012, while middle and small-sized enterprises that can gain loans from formal banks only occupy 20%[12].The financing activities like private loan in China lack complete legal system and departments to standardize and supervise them, thus middle and small-sized enterprises have to bear a high risk when gaining financing through this channel. Besides, cost of private loan is also high. The average interest rate of private loan in Wenzhou is 21.58% in 2012[13]. Similarly, monthly interest rate of private loan of Erdos is 3.5%-7% in 2011[14]. Under such a high loan cost, middle and small-sized enterprises have to run under higher risk and cost; besides, their original operation is instable and they are in shortage of funds. As a result, they will even be bankrupt. On the other hand, enterprises have debtor-creditor relationship with banks, and bankruptcy of enterprises will indirectly affect normal operation of banks, thus risk of banks will also increase. Subprime loans, doubtful loans and loss loans of Shanghai Pudong Development Bank have increased by 0.14% in 2012 when compared with that in 2011[15], and the new bad loans are concentrated in Wenzhou and Hangzhou. This is closely related to the informal private loan in Wenzhou. Under such situations, banks dare not provide loan for middle and small-sized enterprises, so middle and small-sized enterprises fall into a vicious circle of gaining more financing, becoming more difficult.3. Few mortgage guarantees, low credit proportionThe previous part has mentioned that bank loan is an important channel for financing of middle and small-sized enterprises. However, banks often set fund security as the operation principle, so they are more willing to provide loans for state-owned enterprises and large enterprises with stable operation conditions and low risks. Most loans provided for middle and small-sized enterprises are mortgage loans, rather than credit loans. According to data from annual report of Shanghai Pudong Development Bank in 2012, among loans issued by Shanghai Pudong Development Bank in 2012, mortgage loan occupies 40.09%, credit loan only takes up 17.65%[15], and others are pledge and guarantee loans. Even though credit loan is issued, the examination condition is quite strict. However, middle and small-sized enterprises have high market risk, their financial regulations are incomplete, and the credit status is low. Therefore, proportion of middle and small-sized enterprises that can truly gain credit loan is far less than 17.65%.Credit loan is difficult to gain, so middle and small-sized enterprises have to turn to mortgage loan. However, from another angle, assets of middle and small-sized enterprises may have already been mortgaged at the initial stage, so they cannot offer enough mortgages by themselves and cannot find a suitable guarantee either to gain further development. Unreasonable capital structure will not only affect operation and development of middle and small-sized enterprises, but also result in high risks for them. Excessive asset-liability ratio has restricted the refinancing ability of enterprises. This is another dilemma for financing of middle and small-sized enterprises.4. Numerous guarantee institutions, duality of risksMiddle and small-sized enterprises have to gain guarantee from the third party for loan, so guarantee industry has formed. Guarantee industry has been developing rapidly in China during these years, with its quantity increasing ceaselessly. According to investigation and statistics from Ministry of Industry and Information, till 2011, there had been 8,402 credit guarantee institutions for middle and small-sized enterprises, increasing by 39.3% when compared with 2010[16]. But it still belongs to an emerging industry, and it’s unable to resist risks. Moreover, the business object of guarantee industry is dominated by middle and small-sized enterprises, so credit guarantee industry for middle and small-sized enterprises has quite a high risk. High-risk industry provides credit guarantee for high-risk enterprises, and this has formed dual risks in the financing link. This is a big hidden danger for either enterprises or the entire financial system.

4. Approaches for Financial Service to Push Forward Transformation of Middle and Small-sized Enterprises

4.1. Perfecting Financial System, Realizing Industry-finance Development Pattern

- It’s difficult for middle and small-sized enterprises to gain credit loans from banks, but this is caused by their incomplete financial system. Therefore, in order to solve the problem of financing difficulty, middle and small-sized enterprises have to start from themselves. They should perfect their financial system and realize integration of industry and finance by imitating large enterprises. On the one hand, enterprises should perfect their internal financial system and financial structure, increase financial management level, accelerate turnover of working capital through effective accounting and financial management, and eliminate loan “abortion” caused by the fact that banks cannot get clear financial information of enterprises - information asymmetry. On the other hand, enterprises can acquire more operation revenues by constructing their own financial platforms and expanding relevant businesses in financial field. Integration of industry and finance is one of the approaches for transformation development of most enterprises. For instance, financial platform of Shanghai Baosteel Group has already been mature. Integration of industry and finance can not only optimize the financial condition, but also promote development of major industries of enterprises by reasonably applying financial instruments. In this way, risk of major businesses can be reduced.

4.2. Intensifying Interaction and Cooperation between Banks and Enterprises, Innovating Financing Cooperation Mode

- The reason why bank loan is difficult for middle and small-sized enterprises is that information asymmetry makes banks unable to know the operation conditions of enterprises clearly. Therefore, banks cannot provide enough financial support for middle and small-sized enterprises for they don’t want to bear high risks. Under this situation, interaction and cooperation should be intensified between enterprises and banks. Special commercial financing institutions have been established to provide financing for middle and small-sized enterprises in developed countries. For instance, Local Cooperation Bank of Japan, Industrial Bank of Korea and LEFS & RFS of Singapore can all provide financing for middle and small-sized enterprises. These institutions know the operation modes of middle and small-sized enterprises clearly, so they can provide suitable financing products for middle and small-sized enterprises. Besides, they can help middle and small-sized enterprises avoid discriminations which might be encountered in competing for financing with large enterprises.According to the current situations in China, it still needs some time and a development process to set up financing institutions for middle and small-sized enterprises. But interaction and cooperation between banks and enterprises can be intensified on the basis of the existing financing institutions through the following methods: (1) on the basis of daily capital business contact, a worker in charge of the specific enterprise can be arranged to participate in daily operation activities of the enterprise. For instance, the worker can be invited to attend corporate meetings, so as to make banks know more about business operation mode, profit mode and management mode of the enterprise. (2) Information network can be set up between banks and enterprises, so as to make banks carry out rapid and real-time monitoring for fund flow and surplus of enterprises. In this way, capital risk of banks can be reduced, and financial conditions of enterprises can also be supervised. (3) After banks gain some understanding about enterprises, they can work out financial products suitable for middle and small-sized enterprises. On the one hand, special loans can be offered for projects with high technical content, strong innovativeness and ability to help transformation development. On the other hand, loan conditions can be adjusted according to enterprise situations.For example, the “four not lower than” of small loans initiated by Shanghai has improved financing situations of small and micro enterprises greatly. In the first quarter of this year, the loan balance of small and micro enterprises in Shanghai reaches 855.86 billion Yuan, increasing by 20.468 billion Yuan when compared with beginning of the year, with various loans rising by 4.99% when compared with the corresponding period[17]. Such interactive mode between banks and enterprises can effectively reduce cost brought about by information asymmetry, and increase the lending rate among middle and small-sized enterprises. Besides, by innovating financing products suitable for enterprises and opening up a new cooperation mode, a win-win situation can be realized.

4.3. State-owned Enterprise Playing a Leading Role, Constructing Special Financing Platforms

- Neither bank financing nor capital market financing can fully satisfy the financing demands of middle and small-sized enterprises. A special financing platform should be set up based on this. At present, financing of most middle and small-sized enterprises still depends on banks in China, but the effect is limited. China can set up a financing platform for middle and small-sized enterprises through cooperation between the government and the third party by referring to the experience of Japan. Based on practical situations, state-owned enterprise is the suitable candidate of the third party. Large enterprises like state-owned enterprise may have competitive relation with products of middle and small-sized enterprises on the market, but they are not totally opposite. Large enterprises and state-owned enterprises can often occupy a leading position in the industry via their superiority in scale and resources. Therefore, as leader of the industry, state-owned enterprises should set an example in transformation development. Moreover, they should take the responsibility of industry leaders – to help middle and small-sized enterprises in transformation development and provide assistance for financing of middle and small-sized enterprises. SCNSAMIC has established a special financing platform for middle and small-sized enterprises under the guidance of the government in Changning District. By combining demand information of enterprises with supply information of financing products for middle, small and micro enterprises, this platform can design financing plans for both parties and issue relevant policy information timely. Till the middle ten days of April in 2013, this financing platform had disposed 224 enterprise loan demands within 1 year since its establishment, and the amount of successful loans had reached 335 million Yuan[18]. This has relieved the financing difficulty of middle and small-sized enterprises to some extent.

4.4. Establishing Multi-level Financing Policy, Supporting Financing Object Selectively

- Financing of middle and small-sized enterprises requires cooperation between banks and enterprises as well as development of financial market. Besides, it also needs the government to act as go-between, issue support policies, and help middle and small-sized enterprises collect funds. However, under the situation of few fund supplies, faced with numerous middle and small-sized enterprises, we cannot treat all of them equally. Otherwise, the funds still cannot satisfy the demands of enterprises; besides, it will also cause waste of financial resources. Therefore, multi-level financing policy should be established and the financing object should be supported selectively.According to Chinese situations, we should firstly help enterprises during transformation and upgrade, especially those with high scientific & technological content, good operation mode, self-owned brands, and innovation potentials. The government can provide policy support, communicate with banks, and help enterprises gain loans after clearly knowing the enterprise situations. Many small enterprises of scientific and technologic type in Putuo District have benefited from this. Based on the garden counter guarantee platform invested and established by the government, the financing guarantee mode of “garden recommendation, bank financing, third party guarantee, and government support” has formed, to help enterprises gain loans from commercial banks. This is a risk sharing mechanism among several parties. For 2 years, these two platforms have helped 20 asset-light new high-tech enterprises and achievement transformation projects gain 107 million Yuan[19]. Therefore, such financing guarantee mode can effectively promote transformation and upgrade of middle and small-sized enterprises with growth potential in the industry, and thus push forward transformation development of the entire economy.

ACKNOWLEDGEMENTS

- Project A-0903-13-01024 supported by the innovational project of Shanghai University of Engineering Science.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML