-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(8): 401-405

doi:10.5923/j.ijfa.20130208.01

An Assessment of the Performance of Microfinance Institutions in Nigeria

Mustapha Taufiq

Bursary Department, Student Affairs Division, Ahmadu Bello University, Zaria

Correspondence to: Mustapha Taufiq, Bursary Department, Student Affairs Division, Ahmadu Bello University, Zaria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Microfinance is created in response to the missing credit market for the poor. This is attributed to the fact that Conventional financial sector has not been able to take care of the low income group and the poor. The study finds out if the liabilities of microfinance institutions are more than their assets. The Study obtained secondary data from mix market information exchange and was analyzed using t-test. The result revealed that the liabilities of microfinance institutions are far more than their assets. In conclusion, it is observed that microfinance has not significantly reduced poverty in Nigeria, their liabilities outweigh their assets.

Keywords: Microfinance, Micro-credit, Poverty, Debt/Equity ratio, Nigeria

Cite this paper: Mustapha Taufiq, An Assessment of the Performance of Microfinance Institutions in Nigeria, International Journal of Finance and Accounting , Vol. 2 No. 8, 2013, pp. 401-405. doi: 10.5923/j.ijfa.20130208.01.

Article Outline

1. Background of the Study

- Microfinance is one of the few market- based scale-able anti-poverty solutions. Microfinance refers to providing access to financial services to poor households in rural and urban areas. To most, microfinance is the provision of very small loans (micro credit) to help the poor to invest in or scale up their small business (micro enterprise). Over a period, microfinance evolved a broader range of services like credit, savings, insurance, payment services, money transfer, health care, education and recently in some countries consumer protection. This is because providers have realized that the poor who lack access to traditional formal financial institutions require a variety of financial products[1]. Also, because of the recognition of microfinance, the united Nation Organization celebrated the year 2005 as a year of micro-credit[2]. As a result, this financing instrument (microfinance) is perceived worldwide as a very effective means against hunger and poverty mainly in developing countries. The practice of micro-credit is culturally rooted as it dates back several centuries[3]. The traditional micro-credit institutions provide access to credit for the rural and urban low-income earners. They are mainly of the informal self help groups (SHGs) or the Rotating savings and credit associations (ROSCAs) types[3]. Other providers of micro-credit include savings collectors and co-operative societies. The informal financial institutions generally have limited outreach due primarily to paucity of loan-able funds. Therefore, in order to enhance the flow of financial service to Nigerian rural areas, Government has in the past initiated a series of publicly-financed micro/rural credit programs and policies targeted at the poor with the mandate of providing financial services to alleviate poverty[3]. The latest of such program is the National poverty eradication program (NAPEP)[3]. Also, micro-credit services, especially those sponsored by Government have adopted the traditional supply-led subsidized credit approach basically directed at the agricultural sector and non-farm activities such as trading, tailoring, weaving, blacksmithing, agro-processing, and transportation. These services resulted in an increase level of credit disbursement and gains in agricultural production and other activities, the effect were short-lived due to the unsustainable nature of the programs. Since the 1980s, Non-Governmental organizations (NGOs) have emerged in Nigeria to champion the cause of the micro and rural entrepreneurs, with a shift from the supply-led approach to a demand-driven strategy. They have increased significantly in recent times due largely to the inability of the formal financial sector to provide the services needed by the low income groups and the poor, and also the declining support from development partners among others. The Non-Governmental Organizations obtain their funds from grants, fees, interest on loans and contributions from members. However, they have limited outreach due largely to unsustainable sources of funds[3].In recent times, Microfinance institutions (credit plus services) have evolved in Nigeria with the aim of making these services available to a larger percentage of the poor in both the urban and rural areas of the country. The central Bank of Nigeria started licensing microfinance banks since 1999, their aim being the provision of microfinance services to low income groups with the sole aim of alleviating poverty[3]. Microfinance banks was set up in order to address the problem of weak capital base of community banks, the existence of huge un-served market, economic empowerment of the poor, employment generation and increase savings opportunity so as to alleviate poverty in Nigeria[4].Nigeria with a population of about 150 million and GDP/capita of $641 in 2006, two-thirds of the citizens are still poor despite the existence of microfinance institutions in the country[4]. Nigeria has the third highest number of the poor in the world[5]. Microfinance institutions have not been able to reach the greater number of the poor as it serves less than 1 million people out of the 40 million potential people that need the service[3]. Also, the aggregate micro credit facility account for about 0.2 percent of GDP and less one percent of the total credit to the economy[4]. Equally, according to Anyanwu, the interest rates in the microfinance institutions are much higher than the prevailing rates in the banks. This ranges between 32%-48%, when banks are charging between 19.5% and 21.6%, while money lenders charge interest rate of 100% or more[6].Also, in 2010, the Central bank of Nigeria (CBN) revoked the operating license of 224 microfinance banks for failure to honour their obligations to depositors[7]. N18.2 billion of depositor money was trapped in the bank according to CBN[8]. This shows that some of the microfinance institutions are not financially healthy. How can a poor institution bring out the poor out of perpetual poverty?Microfinance is created in response to the missing credit market for the poor. This is because the conventional financial sector has not been able to take care of the low income groups and the poor. Micro-credit could be obtained through the informal financial institutions. Non-Governmental organizations have also emerged to increase the cause of microfinance though their outreach was limited due to unsustainable sources of funds. In developing countries (Nigeria inclusive), Governments are also incorporating microfinance in their strategies towards achieving the millennium development goals that involve halving poverty by the target date which is 2015. This made the central bank of Nigeria (CBN) to start licensing the formal microfinance banks in 1999.Given the complex nature of poverty together with the current microfinance intermediation approach, it is becoming difficult to judge whether microfinance should be advocated as a means of poverty alleviation. This is because some microfinance institutions are not financially healthy, their liability far outweigh their assets. They are equally struggling to get out of poverty, indeed many of them were declared bankrupt in 2010.In the light of the research topic, the objective of this study is to find out whether microfinance has significantly alleviated poverty in Nigeria. Base on this, the researcher finds out if microfinance institutions are healthy enough to have a significant effect on poverty by looking at the extent to which they are being finance through debt (debt/equity ratio).In line with the problem of the study, the researcher states the research question thus; Are the liabilities of microfinance institutions more than their assets? Base on the research question, the researcher states the following hypothesis; Ho: The liabilities of microfinance institutions outweigh their assets.

2. Literature Review

2.1. Definition of Concepts

- Irobi defines microfinance as the provision of financial services such as credits (loans), savings, micro-leasing, micro-insurance and payment transfers to economically active poor to enable them engage in income generating activities to expand their business[9]. Also, Schreinzer proposed a definition of microfinance as “uncollaterized loans to the poor and small scale entrepreneurs”[10]. A person is considered poor if his consumption level falls below $1 per day, a level necessary to meet basic needs. This minimum level is called poverty line[9]. Also, the CBN views poverty as “a state where an individual is not able to cater adequately for his or her basic needs of food, clothing, and shelter, lack access to gainful employment, skills and economic infrastructure like health and education”[9].

2.2. Empirical Analysis

- Recent studies have shown evidence of positive impact of microfinance in alleviating poverty in Nigeria[13]. Also, Dahiru and Zubair reveal from an empirical study that the poorest can benefit from both an economic and social well-being point of view. A study on microfinance also revealed that microfinance program has the potential to alleviate poverty especially in increasing level of income and reducing vulnerability[9].Also, most of the microfinance institutions pursue multi-sector socially-oriented approaches to community economic development; offering training, education and health services in addition to microcredit and business development services. Though, microcredit may be their dominant activity, their mission has been much broader and they are yet to fully wrestle with the decision to specialize in microcredit[12]. Zeller and Meyer viewed microfinance as a social liability, consuming scarce resource without significantly affecting long-term outcomes. They argued that small enterprises supported by microcredit have limited potential to grow to sustained impact on the poor. They argued that microfinance rather makes the economically poor dependent on the program itself[10].In addition, Hulme argues that microfinance institutions are not cure for poverty. However, they could create and provide a broad range of microfinance services that would support poor people in their efforts to improve their own prospects and the prospects of their families. Hulme believes effective micro financing makes these agencies designed to help the poor more likely to achieve the goals that poor people seek to achieve[13].

2.3. Justification for the Establishment of Microfinance Banks in Nigeria

- From the appraisal of existing microfinance-oriented institutions in Nigeria, the following facts have become evident;

2.3.1. Weak Capital Base

- The weak capital base of existing institutions, particularly the community banks cannot adequately provide a cushion for the risk of lending to micro-entrepreneurs without collateral[3].

2.3.2. The Existence of Huge Un-served Market

- The size of the un-served market by existing financial institutions is large. The average banking density in Nigeria is one financial institutions outlet to 32,700 inhabitants in the rural areas, it is 1:57,000, that is less than 2% of rural households have access to financial services[3] 2.3.3 Economic Empowerment of the Poor, Employment Generation and Poverty ReductionThe baseline economic survey of small and medium industries (SMIs) in Nigeria conducted in 2004 indicated that the 6,498 industries covered currently employ a little over one million workers. Considering the fact that about 18.5 million (28% of the available work force) of Nigerians are employed, the employment objectives/roles of the small and medium industries (SMIs) are far from being attained. One of the hallmarks of the national Economic Empowerment and Development strategy (NEEDS) is the empowerment of the poor and the private sector through the provision of needed financial service to enable them engage or expand their present scope of economic activities and generate employment. Delivering needed services as contained in the strategy would be remarkably enhanced through additional channels which the microfinance bank framework would provide. It would also enable the small and medium industries in raising their productive capacity and level of employment generation[3].

2.3.3. The Need for Increased Saving Opportunity

- The total assets of 615 community banks that made their reports available out of the 753 operating community banks as at the end of December 2004 stood at N34.2 billion. Similarly, their total loans and advance amounted to N11.4 billion while their aggregate deposits liabilities stood at N21.4 billion for the same period. Also, as at end –December 2004, the total currency in circulation stood at N545.8 billion, out of which N458.6 billion or 34.12 percent was outside the banking system.Poor people can and do save contrary to general misconceptions. However, owing to the inadequacy of appropriate saving opportunities and products, savings have continued to grow at a very low rate, particularly in the rural areas of Nigeria. Most poor people keep their resources in kind or simply under their pillows. Such methods of keeping savings are risky, low in terms of returns, and undermine the aggregate volume of resources that could be mobilized and channeled to deficit areas of the economy. The microfinance policy would provide the needed window of opportunity and promote the development of appropriate (safe, less costly, convenient and easily accessible) saving products that would be attracted to rural clients and improve the savings level in the economy[3].

2.4. Challenges of Microfinance Institutions

- Microfinance in Nigeria has not reached a greater number of the poor[13]. Northwest and North eastern part of Nigeria are most affected[12]. Other challenges of microfinance are;1. Specialization is limited with many microfinance institutions offering variety of non-financial services (Training, education, health services); along with the management challenges of offering such diverse services in a high quality way[12].2. Interest rate probably not cost-covering limits ability to achieve sustainability, offer attractive savings product etc[12]. 3. Also it was observed that microfinance institutions charges high interest rate; The objectives of microfinance institutions to combat poverty might be defeated since clients have to repay back double of what they received at all cost (30-100%)[13].

3. Research Methodology

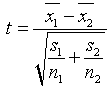

- The dataset employed in this paper was obtained through the microfinance information exchange (MIX) website. MIX is a non-profit institution whose purpose is to provide data on microfinance institutions throughout the world. The subset of the data used ranges over five years, 2007-2011. Mix was incorporated as a non-profit in 2002 as a project between the consultative groups to assist the poorest (CGAP) which is housed in the World Bank and several private foundations[14]. The population of the study is all the microfinance institutions in Nigeria, while the sample is all the microfinance institutions in Nigeria that made their data available to MIX.The study uses the debt-to-equity ratio of different microfinance institutions provided by MIX to see how much they are financed by debt. Debt-to-equity ratio is a measure of the financial leverage of a firm which is equal to total debt divided by shareholders equity. Investing in a firm with a higher debt/equity ratio may be riskier especially in times of rising interest rate that has to be paid out for the debt. It is important to realize that if the ratio is greater than one, assets are mostly financed through debt, if it is lower than one; assets are primarily financed through equity[15].The researcher grouped the data collected on debt/equity ratio into two; X1 for microfinance institutions with debt/equity ratio of less than one, while X2 is for microfinance institutions with debt/equity ratio of more than one. Thereafter, the researcher uses t-test to determine whether there is probably a significant difference between the means of the independent samples. If the calculated t-value is less than the critical t-value, the null hypothesis (Ho) that ‘The liabilities of microfinance institutions are more than their assets’ is accepted, otherwise, it will be rejected. The formula of t-test for independent samples is:

Where

Where  and

and  = means of group 1 and group 2S= Standard deviation n= number of subjects in each group

= means of group 1 and group 2S= Standard deviation n= number of subjects in each group4. Findings

- The findings revealed that in 2007, out of eleven[11] reporting microfinance institutions, only 3 has a debt/equity ratio of less than one while the remaining eight[8] has a debt/equity ratio greater than one. In 2008, out of eight reporting data, X1 is 2 while X2 is 6, Also, in 2009, eleven microfinance data were reported out of which X1 is 4 and X2 is 7. In 2010, there was twenty-four[24] reporting data out of which X1 is 4 and X2 is 20. Lastly, in 2011, out of twenty-two reporting data, X1 is 4 and X2 is 18. After using t-test to calculate the significant difference between the mean of the samples, the following results were obtained; for 2007, at 0.05 level of significance and 9 degree of freedom, the critical t-value is 1.833 while the calculated t-value is -8.2. Also, for 2008, the critical t-value is 1.943 while the calculated t-value is -3.75. For 2009, the critical t-value is 1.833 while the calculated t-value is -5.82, the result for 2010 shows that the critical-t value is 1.717 while the calculated t-value is -5.416. Lastly, the critical t-value for 2011 is 1.725 while the calculated t-value is -6.02.From the above analysis, it will be observed that for all the years under study, the critical t-value is greater than the calculated t-value. Therefore, we accept the null hypothesis (Ho) that says ‘The liabilities of microfinance institutions are more than their assets’. This implies that microfinance institutions are also highly indebted. In 2010, the central bank of Nigeria (CBN) revoked the operating license of 224 microfinance banks for failure to honour their obligations to depositors[7]. N18.2 billion of depositors’ money is trapped in the bank according to CBN[8] this shows that some of the microfinance institutions are not healthy. Also interest rates of microfinance institutions are probably not cost-covering and limit their ability to achieve sustainability and to offer attractive savings product. Also, liquidity constraints limit expansion of microfinance institutions[14].Also, Zeller and Meyer viewed microfinance as a social liability, consuming scarce resources without significantly affecting long-term outcomes. They argued that small enterprises supported by microcredit have limited potential to grow to sustained impact on the poor. They argued that microfinance programs rather make the economically poor dependent on the program itself[10]. In addition, Hulme argues that microfinance institutions are not cure for poverty. However, they could create and provide a broad range of microfinance services that would support poor people in their efforts to improve their own prospects and the prospects of their families. Hulme believes that effective micro financing makes these agencies designed to help the poor more likely to achieve the goals that poor people seek to achieve[13].

4.1. Conclusions

- The study reveals that microfinance has not significantly reduce poverty in Nigeria. Interest rate on their loan is high and not cost covering and their liabilities outweigh their assets. Microfinance programs has the potential to alleviate poverty if more is done in terms of outreach by increasing largely the credit facilities given out to the poor so as to cover the vast majority of poor Nigerians.

4.2. Recommendations

- 1. Government through the central bank should formulate policies to encourage microfinance institutions that do not have the required capital base to come together through merger or acquisition.2. Government should come up with a policy to reduce the interest rate that microfinance institutions are charged by their creditors.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML