-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(7): 331-340

doi:10.5923/j.ijfa.20130207.01

Corporate Social Responsibility and Firm Value in Quoted Nigerian Financial Services

Musa Inuwa Fodio1, Abdullahi Musa Abu-Abdissamad2, Victor Chiedu Oba3

1Department of Accounting, University of Abuja, Abuja, PMB 114, Nigeria

2Department of Business Administration, Ahmadu Bello University, Zaria, Nigeria

3Doctoral Student, Department of Accounting, Nasarawa State University, Keffi Nigeria

Correspondence to: Victor Chiedu Oba, Doctoral Student, Department of Accounting, Nasarawa State University, Keffi Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Corporate Social Responsibility (CSR) is a burning issue in Nigeria. Companies are under pressure to operate in a socially and environmentally sustainable way. However, do these socially responsible activities generate benefits to keep the venture sustainable? This study uses parsimonious regression models to examine the impact of CSR on market value of financial services in Nigeria for the period 2004 – 2008. We perform our empirical analyses with a set of control variables – firm size, leverage, growth and dividend payment. Consistent with past studies, we find a robust positive significant impact of CSR proxies (Human Resource Management and Community Development) on market value. However, using the hold-out and combinatorial methods of treating control variables, we document mixed results. The reverse causality concern usually associated with the CSR-financial performance relationship was also addressed. Results show that sector classification and positive earnings in previous year are significant instruments in estimating CSR. We conclude that socially responsible efforts of firms trigger improved market value and that such value is influenced by observable moderating factors.

Keywords: Social Responsibility, Market Value, Endogeneity

Cite this paper: Musa Inuwa Fodio, Abdullahi Musa Abu-Abdissamad, Victor Chiedu Oba, Corporate Social Responsibility and Firm Value in Quoted Nigerian Financial Services, International Journal of Finance and Accounting , Vol. 2 No. 7, 2013, pp. 331-340. doi: 10.5923/j.ijfa.20130207.01.

Article Outline

1. Introduction

- Since the 1960s, corporate social responsibility (hereafter CSR) has become an important issue not only for business but in the theory and practice of law, accounting, finance and economics[18].Originally businesses were accountable to their private shareholders or institutional investors in the financial markets. In recent time however, because of the increasing adverse impact of corporations on aspects of social life and on the environment, a diversity of stakeholders now demand accountability about the impact of corporate activities on the life of the society[18]. These demands are further strengthened by the introduction of legislations/ codes of conduct to ensure that businesses undertake social activities. These include codes of conduct and standards like the Global Reporting Initiative (GRI), The Global Sullivan Principles (1991), Global Compact (2002), AA1000/AA1000S of 1999, the Social Venture Network Standards and the ISO26000. These codes and standards were introduced in response to the pressure by civil rights and environmental activist groups[51].Corporations in Europe, the USA and many other countries are now increasingly stressing the importance of social and sustainability performance[16]. This has been supported by developments in CSR reporting guidelines especially that of the Global Reporting Initiative (GRI). In spite of these developments, debates have continued to rage in literature as to whether or not firms should engage in socially responsible behavior. The neo-classical economists contend that managers should make decisions that maximize shareholders wealth by maximizing the value of the firm[17, 22]. However, some business and society scholars have argued that firms have a duty to society that goes beyond simply maximizing shareholders’ wealth[15, 55]. These scholars argue that it is important for firms to recognize the interest of other stakeholders such as employees, suppliers, customers and the society at large in making managerial decisions.A possible way to resolve the conflict is to observe at least whether some form of socially responsible behavior may actually improve the value of a firm and thus may be consistent with the wealth maximizing interest of a firm’s shareholders[3]. For example, it can enable a firm to avoid costly government imposed fines[19]. It can also act to reduce a firm’s exposure to risk[25]. In recent times, some scholars have attempted to establish a cause-effect relationship between CSR and financial performance. However, empirical evidences to date have been rather conflicting[45]. For example, the returns to CSR are found to be positive in some studies[21, 50] but negative in others[7, 38]. There are two possible explanations that have been provided for these conflicting findings. First, existing studies have largely related CSR to backward-looking firm profitability (that is accounting based returns) rather than forward-looking market value or stock returns[56]. Market value is different from (and probably weightier) than accounting-based returns because accounting measures are retrospective while market values hinge on growth prospects or expected future performance[47]. Second, the unclear link between CSR and firm performance may be due, in part to the omission in some finance literature of control variables such as firm size, growth, leverage and dividend payment in the CSR-performance relationship[48]. Furthermore, the measurement of CSR is complicated by the lack of consensus of measurement methodology. In many cases, subjective indicators have been developed by rating agencies such as the Domini Social Index (DSI) using the Kinder Lydenberg and Domini (KLD) rating system, fortune rankings, Ethical Investment Research Service, and Bovespa Corporate Sustainability Index developed by the Sao Paulo Stock Exchange[2, 46]. These rating agencies use a combination of surveys. KLD for instance uses financial statement data, articles on companies in the press journals and government reports to assess CSR long several dimensions. However, it is unclear exactly what these indicators measure[51]. They seem to be open to impressions and biases.The CSR issue is a growing concern in Nigeria today. In fact, the incessant political and social unrests in the country are sometimes connected with the social and environmental concerns that lie in the heart of the CSR debate[1]. The Shell vs Ogoni saga is a well documented case study in the CSR literature in Nigeria[8]. Despite these concerns, there are only a few number of CSR studies in Nigeria. More so, these studies have mainly focused attention on the phenomenon without examining its financialimplications[13, 23, 24 30, 54]. Although Ngwakwe[42] examined the relationship between environmental responsibility and firm performance in Nigeria, the study used the accounting - based return on total assets (ROTA) which has been criticized as a backward-looking approach[34]. A study based on forward-looking firm market value approach will no doubt be useful in mitigating the problems associated with accounting-based returns. This study contributes to the knowledge base first by utilizing a forward-looking firm market value (Tobin’s Q) approach. Second, the study identifies three CSR proxies- community development (CD), human resource management (HRM) and environmental performance (EP) rather than relying on any subjective indicators developed by rating agencies. Third, the study captures firm size as well as other control variables which have been omitted in previous studies in order to provide an explanation on the CSR- firm performance nexus. The major objective of the present study is to examine the effects of CSR variables on the market value of quoted financial firms in Nigeria. The financial services are the focus of this study because they constitute a significant proportion of the total firms quoted on the stock exchange market and because of their role in the socio economic development of the country. These firms do not significantly and negatively impact the environment like the industrials but however cannot ignore the society in which they operate. Essentially this study is geared at untying any possible value return socially responsible behaviors have on this sector (financial services). In order to achieve the study objective, this paper addresses two fundamental questions (1) What is the effect of CSR on the market value of quoted financial firms in Nigeria? (2) What is the separate and combined effect of size, growth, leverage and dividend payment on the CSR- market value relationship? Accordingly, two null hypotheses have been formulated to address the research questions- (1) CSR has no significant effect on the market value of quoted financial firms in Nigeria and (2) Size, growth, leverage and dividend payment do not have separate and combined effects on the CSR- market value relationship.

1.1. The Nigerian Financial Services

- Nigeria’s financial services have witnessed tremendous growth in the last years, largely on the back on relative political stability, increased investor confidence in the local markets, and a stimulated economy. The banking, insurance and mortgage sectors have had their assets grow at commendable compounded annual growth rates (CAGR). Undoubtedly, the financial services industry is undergoing drastic changes. Globalization, regulatory changes and new technologies have made companies more aggressive as they position themselves for increased market share and profitability. With the recent restructuring of the financial industry in Nigeria, the sector is now driven by advanced competition brought about by an astronomical development in Information and Communication Technology (ICT), deregulation, consumer empowerment, among others. Managers are realizing the need to respond to emerging customer needs and as such, to remain relevant in this industry, the recent progress of the socially responsible movement around the world must be acknowledged as well. The market place is developing both social and environmental factors and related information to supplement the traditional financial criteria used to make investment decisions (social responsible investments). This has brought about an increasing demand for clear and hard facts about the social and environmental performance of the financial services by an increasingly well-informed breed of stakeholders. Professional firms and market indexes now provide information to financial market investors about CSR efforts including environmental protection, health and safety, community development, philanthropic ventures, etc. These indeed are broad issues of CSR which require increased focus by stakeholders due to the volume of funds and resources that flow within the financial services. In fact, firms like the Zenith bank have adopted a policy of dedicating 1% of its profit after tax (PAT) to CSR activities. The devotion of a portion of its after tax profit is to prevent suspicion of any attempt to avoid tax payment by engaging in CSR. The attention of stakeholders on the financial services for socially responsible dispositions is gaining grounds. One question that readily comes to mind is if such CSR activities trigger improved financial performance or if such green engagements end as organizational policies without value relevance. This study is poised to unravel the CSR-Value nexus in the Nigerian financial services.

2. Literature Review

- In spite of the debate on what constitutes CSR, most scholars agree that CSR envelopes the stakeholders which they identify as employees, customers, investors (existing and potential), communities and governments[12, 20]. In line with the stakeholders’ argument, Ngwakwe[42] employs employee health and safety (EHS), Waste management (WM) and Community development (CD) as indicators of social responsibility behaviors in his study of environmental performance of sixty manufacturing companies in Nigeria. Similarly, Oba[43] uses human resource management, community CSR and charitable contributions as CSR proxies in his investigation of CSR performance of conglomerate firms in Nigeria.Recently, companies in Nigeria are encouraged to voluntarily provide narrative information about their CSR activities in their annual reports. The Companies and Allied Matters Act (CAMA, 1990) in Nigeria specifically mandates companies to disclose such information in the directors’ report which is a component of the audited annual financial statements. However, there are doubts as to the validity of the announced CSR investment[51]. As for financial performance, all the previous studies have either employed accounting or market definitions to study the relationship between CSR and firm performance[45]. Accounting–based and market–based measures have different theoretical implications[29]. Accounting-based measures are usually criticized because they capture only historical aspects of firm performance[38]. They are also subject to bias from managerial manipulation and differences in accounting policies and procedures[10]. Market-based measures usually overcome these problems because they are forward looking and focus on market performance. Furthermore, they are less susceptible to different accounting procedures and represent the investors’ evaluation of the ability of the firm to generate future economic earnings[38]. One of the market based measures of performance that has gained popularity in recent time is Tobin’s Q. A major advantage of using Tobin’s Q is that it avoids the challenge involved in estimating the rate of return[43]. Tobin’s Q is actually the ratio of a firm’s market value to the replacement cost of assets. In recent times, a number of scholars have studied the effect of CSR on the market value of firms, measured in terms of Tobin’s Q[4, 5, 9, and 43]. Almost all the studies reported a significant relationship between CSR measures and Tobin’s Q. A study of 60 manufacturing firms in Nigeria using Return on Total Assets (ROTA) as measure of performance showed a significant relationship between community development (CD) and performance., the result revealed a statistically significant relationship (at 5 percent level) between CD and ROTA[42]. The major limitation of the study however, is its use of accounting based rather market- based measure of performance. An earlier study by Oba[43] seems to have overcome the problem. The study examined the link between Community Corporate Social Responsibility (CCSR) and Tobin’s Q (a market based performance measure. The multiple regression result revealed an insignificant relationship between CCSR and Tobin’s Q. The major shortcoming of this study is its use of small sample of 6 conglomerate firms in Nigeria. As often emphasized, the sample size and number of observations have direct impact on the appropriateness and statistical power of multiple regressions[41]. Very large samples make the statistical significance test overly sensitive while small sample size reduces the statistical power of multiple regressions[26]. The present study overcomes this problem by using a larger sample size of 35 firms in the financial services sector. The human resource management variable has been measured in previous studies in terms of health and safety systems, systems for employee training and development and equal opportunity policies. Brine et al[11] demonstrate that companies that account for the interest of their employees by offering good working conditions achieve better performance. Oba[43] however documented an insignificant relation between HRM and market value of conglomerate firms in Nigeria. Previous studies have measured environmental performance in terms of preservation and conservation of natural resources such as conducting recycling activities, noise reduction or action plan to pursue noise improvement initiatives, water and process treatment, pollution prevention and control, phasing out the use of ozone depleting substances and compliance with authority in buildings regulations and requirements. It also includes liaising with suppliers to develop environmental best practices in supply chain and encouraging staff to support initiative towards local, national or global environment in a positive way by raising and maintaining staff awareness on environmental issues. Environmental performance can be achieved by implementing Environmental Management Systems (EMS) by organizations. The system enables an organization to reduce its environmental impact and increase its operating efficiency (U.S EPA, 2006). Margolis et al[37] in their meta-analysis of 167 studies found evidence of a link between environmental dimension of CSR and firm performance. This result has also been confirmed in a study of the value relevance of environmental performance of eighteen environmentally sensitive firms in Nigeria[44]. Using logistic regression, they found out that there is a positive significant association between environmental and financial performance (Return on Capital Employed). Community Development has been measured in previous studies as every effort of the company to develop its immediate environment via community developmental policies, and involvement in issues such as sports, education, social amenities, infrastructural facilities and community health matters. Oba[43] found no significant impact of community CSR on market value of quoted conglomerates in Nigeria.

2.1. CSR-Value Link and Endogeneity Issues

- In a statistical model, a parameter or variable is said to be endogenous when there is correlation between the parameter or variable and the error term. As a general rule, when a variable is endogenous, it will be correlated with the disturbance term, hence violating the GM assumptions and then making our OLS estimates biased. The endogeneity issue is traditionally associated with the CSR- FP link. One question that consistently comes to fore is: Does CSR improve financial performance, or does better financial performance free up resources for companies to engage in CSR ventures? The good management theory suggests that well-managed firms engage in CSR activities which in turn trigger financial performance[46]. The theory supposes a positive link between corporate social performance and financial performance. On the other hand, the link is reversed according to the slack resources theory [52, 53]. The slack resources theory suggests that financially healthy firms can afford to engage in more CSR activities which in turn are likely to improve financial performance further. Efforts have been made to address the endogeneity problem[27, 31, 49], however, the question still lingers whether the firm’s extent of social responsibility involvement causally affects its financial performance. If the endogeneity problem of CSR- financial performance relationship is not addressed, then we might over amplify the benefits of CSR on firm value since well-doing firms ordinarily tend to engage in CSR activities.

3. Methodology

3.1. Sample and Data Sources

- A total of thirty five (35) firms in the financial services listed on the Nigeria Stock Exchange (NSE) are selected for the purpose of this study. Accordingly, the sample includes listed financial firms with the required annual accounts, consolidated and unconsolidated, together with financial profile (balance sheet, profit and loss statements). The financial services have been selected as our research focus because firms in the financial sector are less concerned with environmental and social responsibility issues than firms in the non- financial sector. This is because they do not aggressively impact on the environment negatively. This study is thus poised at unraveling the possible value relevance of CSR efforts by these firms. The study utilizes financial and accounting data mainly from the Nigerian Stock Exchange fact books and the annual reports and accounts of the companies for the period 2004 to 2008.

3.2. Model Specification and Description of Variables

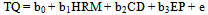

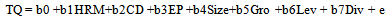

- The most commonly employed statistical technique for CSR-firm performance study is multiple linear regression analysis[33]. As such, this study uses an ordinary least squares regression to test for the research hypotheses. The model is specified as follows:

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

3.3. Endogeity Issues

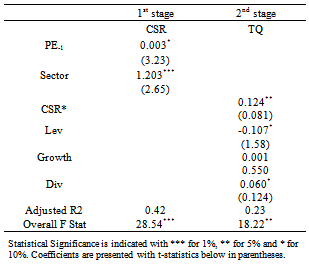

- We use a 2 stage least square regression, to address the causality concern. Instruments, which are variables that are correlated with the firm’s corporate social performance but not correlated with the firm’s value, need to be used in 2sls to predict social performance. The 2sls is a two-step application of the instrumental variables (IV) technique to correct for the correlation of a suspected endogenous explanatory variable with the error term in the equation of interest. In the first stage, the suspected endogenous variable is regressed on all the predetermined exogenous variables in the model. The values of the suspected explanatory variable predicted from the first stage then are used as instruments for the endogenous explanatory variable. After estimating CSR by using these instruments, we can then explain the influence on value without being bothered with issues of causality. To identify an ideal instrument is an uphill task and has therefore made several studies not to make use of 2sls. Along the line of Jiao[31], we select the “positive earnings in the previous year” instrument- where a value of ‘1’ is assigned if earnings were positive in the previous year and ‘0’ otherwise. We also introduce the sector instrument. The financial services in Nigeria are made up of the banking, Insurance, Mortgage and leasing sectors. We hypothesize that the sector classification affects the extent of CSR dispositions by concerned firms. Certain sectors might engage in CSR activities than others. We apply dummies in capturing the sectors, where a sector being treated is assigned ‘1’ while other sectors are assigned ‘0’. The equations to be predicted using the 2sls are as follows:CSR = b0 + b1 PE-1 + b2 Sector + e …… (1st stage)TQ = α0 + α1CSR* + α2 LEV + α3 Div+ α4Growth + e... (2nd stage)We capture CSR as a composite value along the line of Lanis and Richardson[32] based on 52 items of CSR disclosure. The items were recognized using a content analysis; where an item is identified as being implemented and is reported in the annual report, it scores ‘1’ and where otherwise it scores ‘0’. As such a firm could have a maximum of 52 and minimum of ‘0’. The list is found in the appendix.PE-1 = Positive Earnings in the previous year. Sector refers to the sector classification of the financial serviceTQ = Tobin’s q CSR* is the estimate of CSR in equation 1 now incorporated as a predictor in equation 2.LEV = leverage Div = Dividend payment.Growth = firm’s growth rate

4. Results and Discussions

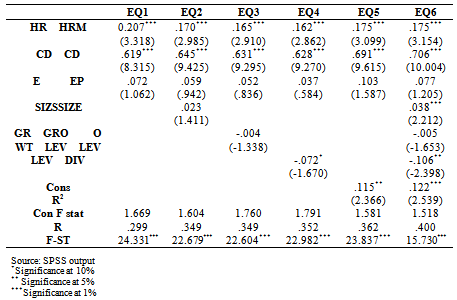

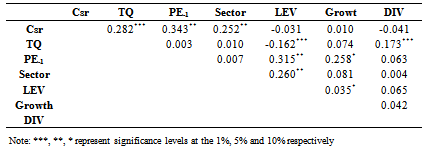

- The regression results using Statistical Package for Social Sciences Version 17.0 is shown below:The first equation investigates the impact core CSR variables (Human Resource Management, Community Development and Environmental Performance) have on market value as represented by Tobin’s Q (TQ). Both HRM (Human Resource Management) and CD (Community Development) were found to be positive significant predictors of market value. Environmental Performance was insignificant in determining Tobin’s Q. the coefficient of determination was .299. In other words, 29.9% of the variation in TQ could be explained by these core CSR variables. The model was statistically significant with the F-Statistic standing at 24.331.Moderating Variables (Size and Growth) were introduced in the second and third equations respectively. Though the predicting power of the regression planes improved to 34.9%, results reveal that these regressors are not statistically significant in predicting firm value. In the fourth equation, leverage was incorporated into the model. While the coefficient of determination moved upwards from .299 to .352, a negative significant impact of leverage on Tobin’s Q was documented. In other words, the higher the debts level of the firm, ceteries paribus, the lower the market value. Dividend payment was ascertained to improve the explained variation of TQ as predicted by CSR proxies. More so, dividend payment was found to positively impact firm value. As such, firms that paid dividends eventually improved the bottom line.

|

|

|

5. Conclusions and Recommendations

- The Nigerian corporate scene has been under attack along the perception that the overwhelming drive for profit maximization may be bad for the society as a whole because of some negative by products on the environment, workers conditions and other community developmental efforts. Corporate Social Responsibility has been offered as a panacea to this plight; more so, with arguments that it triggers improvement on the bottom line. The financial services sector is central in modern economic systems. Though this sector does not aggressively impact negatively on the environment, it is a global industry with numerous business relations with producers and consumers. As such, it is at the crossroads of socially responsible behavior. This study examines if there are possible benefits of CSR efforts by these financial firms. Investigations reveal that Human Resource Management and Community Development efforts of CSR in this sector have significant impacts on market value. These results align with the findings of Ngwakwe[42] who documented a positive relationship between community development and return on total assets of 60 manufacturing firms in Nigeria but however contrasts with the revelations of Oba[43] who demonstrated that community CSR and Human Resource Management have no impact on Tobin’s Q. This study did not record any statistical significant impact of Environmental Performance (EP) on market value of study firms. It corroborates the findings of Mackinlay[35] who find no strong relationship between economic performance and corporate environmental investment. However, our results contravene the findings of Lars and Henrik[33] who in their investigation of listed Swedish firms demonstrate that environmental responsibility has value relevance and is expected to affect the future earning of the sampled companies. We conclude that not all environmental investments may yield return in a financial form; some may be of key importance in stimulating competitive advantage and strategic value. As such, though environmental performance seems to be statistically insignificant in predicting market value, it could still be of corporate strategic relevance.The two stage least squares regressions show that both sector classification and positive earnings in previous years significantly affect the firm’s CSR score without directly influencing value. Test statistics point out that both variables as instruments properly address the reverse causality syndrome. We find that the value of the firm and its total CSR score tend to be mutually reinforcing. We thus conclude that doing well via social responsibilities result in the firm doing better too and as such, the allocation of funds to CSR ventures is not detrimental to the welfare of the firm’s shareholders. We also argue that financial returns to CSR might differ across industries. This study focused on the financial services. Future works might consider investigating whether there is in existence a possible significant difference between financial returns to CSR in various sectors/ industries. We also recommend that future studies investigate the effect of lagged CSR variables on financial performance and determine what number of years time lag is adequate to influence current financial performance and if it is sustainable. This study demonstrates that CSR efforts by financial services have complicated implications; we also document firm size, leverage and dividend payments as important mediating factors in the relationship between market value and CSR.Conclusively, we further corroborate the literature that CSR has bottom line benefits. More so, the financial services cannot healthily operate in a society which they ignore. These firms tap the human and material resources that they use for delivery of their services. It therefore behoves them to be socially responsible in return; for as long this sector remains a part of the society, management is left with no choice other than to be socially responsible most especially since the firm value is enhanced. Firms and policymakers can use the research results to understand the short run market value implications of CSR efforts. However the results must be interpreted with some caveat in mind. The CSR proxy measures are subject to the limitations inherent in the measurement of CSR activities. The content analysis approach employed in the study gives more of an indication of a company’s willingness to report rather than the extent to which social responsibility is considered in making managerial decisions. While acknowledging this limitation, we caution that the usefulness of the content analysis of annual reports approach should not be understated.

Appendix

- Composite CSR disclosure ItemsCorporate and CSR strategy items1 Corporate mission 2 Code of ethics/business conduct 3 CSR strategy statement 4 Record of complaints 5 Relationship with clients 6 Impact on work practice 7 Impact on suppliers 8 Corporate governance statement Staff strategy items9 Staff training 10 Staff career development 11 Staff diversity12 Staff protection (EEO, safety and security)13 Compliance with labor standards14 Employees’ ownership 15 Staff communication16 General staff appointment policy17 Executive appointment policy18 Major appointment for the year19 Breakdown of employees by geographical 20 Breakdown of employees by line of business21 Breakdown of employees by level of qualifications22 Breakdown of employees by ethnic origin23 Discussion of employees’ welfare24 Information on accidents at workplace25 Monitoring of staff and employees work relation policy26 Implement of employees mission statement Social investment items27 Social commitment statement28 Value of social investment and charitable work 29 Assistance to charities and NGOs 30 Community sponsorship (financial support) 31 Staff volunteering Environment items32 Environmental protection statement33 Does the firm recognize environmental protection objectives?34 Do they measure their performance against the objectives?35 Greenhouse gas emissions policy36 Energy consumption37 Water consumption38 Paper recycling 39 Ink recycling Customer and supplier items40 Statement of internal control 41 Value added statement 42 Product safety statement43 Improvement in product quality 44 Improvement in customer service 45 Distribution of marketing network for finished products 46 Customer award /ratings received Community and political involvement items47 Participation in government social campaign 48 Community programs (health and education)49 KPIs linked to CSR (social, community, and environment)50 Assigned specific responsibility 51 Policies on lobbying and political donations 52 Charity/pro-bono work Adapted from Lanis and Richardson (2011).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML