-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(6): 312-318

doi:10.5923/j.ijfa.20130206.03

EVA’s Improvement on Activity-based Costing and Application in Insurance Company

Lin Chen1, Zhilin Qiao2, Yi He1

1School of Management, Northwestern Polytechnical University, Xi’an, 710072, China

2School of Economics and Finance, Xi’an Jiaotong University, Xi’an, 710061, China

Correspondence to: Zhilin Qiao, School of Economics and Finance, Xi’an Jiaotong University, Xi’an, 710061, China.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Activity-based Costing (ABC) as a kind of advanced cost calculation and management method has been widely used in western countries. But it still has some problems because of not considering cost of capital and other factors. This paper introduced the ideas of Economic Value Added (EVA) into ABC’s calculation and analysis, set up Refined Activity-based Costing (RABC), and analysed its principle and implementation steps. It then applied RABC to Chinese insurance industry to get more accurate cost of single insurance variety. It also helped to analyse the non-value-added activities in insurance business and to improve insurance company’s activity-based management. This is a good try in Chinese non-manufacturing industry.

Keywords: Activity-based Costing, Economic Value Added, Non-value-added Activity

Cite this paper: Lin Chen, Zhilin Qiao, Yi He, EVA’s Improvement on Activity-based Costing and Application in Insurance Company, International Journal of Finance and Accounting , Vol. 2 No. 6, 2013, pp. 312-318. doi: 10.5923/j.ijfa.20130206.03.

Article Outline

1. Introduction

- Activity-based Costing came into being in the late 1980s, which was a huge progress in corporate cost calculation and management. It has been widely accepted and used in many industries of western countries[1]. With intense competition in modern society, ABC still faces many disadvantages although it has been well developed. ①ABC only takes operating costs into income statement. It does not consider capital cost and make incomplete cost calculation. So it will lead to policy mistakes, especially in long-term operation decision making. ②The fundamental goal of business is to create shareholder’s wealth. In reality, value created by products may not be able to cover the opportunity cost, i.e. cost of capital. So shareholder’s wealth creation cannot be realized as they proposed. Thus the information from activity-based costing is not good enough to support a company’s decision of maintaining or enhancing its long-term profitability and competitive ability.Economic Value Added has been widely concerned in recent years. It analyzes shareholder’s wealth creation from economic perspective. The concept of EVA was put forward by Stern Stewart. It equals to net operating profit after tax minus all of the cost of capital including both debt and equity. It also talks about various calculation and adjustment rules of capital cost. EVA is viewed as an excellent financial method, which can better reflect a company's profitability and shareholder value creation. "Fortune" claimed that EVA was the hottest corporate financial concept. Peter F. Drucker pointed out that the prevalence of EVA reflected the demand for total factor productivity in the information age.There are many advantages to introduce economic value added into activity-based costing and establish activity -based management based on EVA. ①It will make up for structure defects of traditional activity-based costing which cannot reflect the cost of capital, then provide more complete cost information for companies. ②It will revise the company’s performance measurement from traditional profit to economic profit by introducing the thought of EVA. Thus make the decision making and performance evaluation more effective and accurate. ③The concept of activity -based management is improved in business operation from reducing cost to optimizing cost management and creating shareholder value.The remainder of the paper is organized as follows. Section 2 is literature review. Section 3 discusses how to use EVA to improve ABC. Section 4 presents an application of refined activity-based costing system to Chinese insurance industry. And conclusion is presented in section 5.

2. Literature Review

- The theory of activity-based costing was put forward by Cooper and Kaplan in 1988. In the 1990s, theoretical researches mainly focused on how to calculate actual cost of the company. After 2000, activity-based costing was widely used in western company’s operation and cost management. The core idea of ABC is activity/value analysis. Implementing ABC needs to reanalyze the whole production processes, which is a dynamic endless process. Activity/value analysis is very helpful in optimizing internal resource allocation, reducing waste and consumption, improving company’s performance, and achieving scientific management. Therefore, ABC plays an important role in many aspects such as recognizing the company’s development opportunities, making product management decisions, improving activity processes. In recent years, the researches mainly focused on: ①Applying ABC theory to product pricing, company’s internal cost management(i.e. ABM or DABM), budget control, and long-term budget, etc.[2~5]; ②Studying basic theoretical problems about idle capacity, total cost and so on[6~9]; ③Time-driven ABC, which has become one of the hottest research topic[10]; ④Combining EVA and ABC, which will be discussed in the following analysis.Economic value added is viewed as the financial indicator of measuring company’s economic value. The relative researches mainly focus on following aspects. ①The growth of EVA. Tully put forward three ways to improve economic value added[11]. Sheehan analyzed the cost problem of using EVA system[12]; ②EVA and performance evaluation. Bacidore et al. believed that refined economic value added (REVA) provided an analytical framework to evaluate shareholder’s value creation and REVA was more effective than EVA[13]. Lieber suggested that market value added will increase if the company's EVA is positive, while market value added will be destroyed if EVA is negative[14]. ③The effectiveness of EVA as a financial indicator. Biddle, Bowen & Wallace analyzed the data of 1000 American corporations from 1983 to 1994 , and compared the relative and incremental information content of EVA , residual income, earnings and operating cash flow. The results showed that EVA did not dominate earnings in relative information content and earnings generally outperformed EVA[15]. Lehn & Makhijia found the value relevance of market value added and EVA was stronger than that of accounting earnings, earnings per share, and earnings per share growth, equity returns, free cash flow or free cash flow growth[16]. O’Byrne used regression model to examine the relationship among market value , EVA and net operating profit after tax, showing that refined EVA model had better explanatory ability if logarithm of capital was used as explanatory variable[17].William first proposed the idea of combining activity-based costing with economic value added. However, the cost calculation was still limited to production cost and capital cost was not allocated to products, so this combination could not clearly reflect the profitability of product and customer though it well showed a company's overall profitability[18]. Cooper et al. analyzed the necessity of integrating ABC and EVA to make company’s long-term decisions and characteristics of capital. But his research did not mention how to implement the integrated system in practice[19]. Roztocki, based on William’s research, put forward a systemic concept of integrating ABC and EVA completely for the first time[20]. Homburg used the concept of relative profit instead of EVA and discussed the integration of relative profit and ABC[21]. Labro and Vanhoucke studied the consumption patterns of various cost resources and the stability of cost calculation, and laid a theoretical base for introducing cost of capital into ABC system and building ABC calculation model based on EVA[22]. Besides, there were some researches directly combining ABC with EVA and applying it to corporate management. For instance, Emblemsvag integrated ABC and EVA to improve primary management in manufacturing enterprises and gave a case study[23]. Although existing researches have made some progresses on integrating ABC and EVA, it is not systematic and deep enough. The following respects should be further discussed. ①The mechanism of integrating EVA and ABC. How does it work? What is its influence? And how about its effectiveness? ②Apply the integrated EVA and ABC to the company’s operation and management control and improve the quality of corporate operating decisions. ③Apply the integrated system to Chinese enterprises, and constantly improve and upgrade in practice.

3. Analysis of EVA’s Improvement on ABC

3.1. Principle of Traditional Activity-based Costing

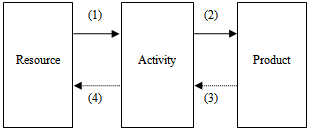

- Activity-based costing is an activity-focused costing and management system, which provides relatively accurate information on product cost and increases scientific nature, effectiveness of decision-making and planning through activity identification, activity cost calculation and choice of cost drivers. At the same time, product-related activities provides valuable information for the elimination of “non-value-added activity”, improvement of “value-added activity”, optimization of “activity chains” and “value chains”, and increasing “customer value ”. As a result, loss and waste are minimized, and business management is improved. The aim of activity-based costing is to calculate the resources consumed by all kinds of activities and make their prices. Its basic principle is that products consume activities and activities consume resources (shown in Figure1).

| Figure 1. Traditional activity-based costing |

3.2. Improvement of EVA on Activity-Based Costing

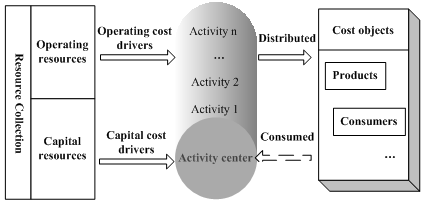

- The paper analyzes the improvement of EVA on activity -based costing referring to two-stage model of investment evaluation in material handling system created by Ioannou. The first stage is to collect input data, and calculate activity costs and capital costs according to ABC principle. The second stage is to build investment decision-making model based on activity costs and capital costs. Then build the model of Refined Activity-Based Costing (RABC). In this model, capital cost drivers are used to allocate capital resources, while operating cost drivers are used to allocate operating resources. At the same time, the hierarchy of cost objects is highlighted in this model (shown in Figure 2).

| Figure 2. Refined activity-based costing |

4. Application of RABC System

- This paper tries to apply RABC system to Chinese insurance industry and make a thorough analysis on insurance product cost.

4.1. Characteristics of Cost Calculation in Chinese Insurance Company

- Insurance is a risk-sharing arrangement whereby one party (insurer) agrees to indemnity another party (insured) against certain losses specified by a contract. Saying in detail, the insurer accepts a fixed payment or premium from the insured in the insurance contract and in return undertakes to make payments if certain events occur[24]. Different from other industries, the cost of insurance is determined in advance, for if certain events occur after policy holder paying the premium, insurance company will make compensation for the insured’s losses in terms of contracts. The characteristics of cost calculation of insurance company are followed[25]:(1) Estimation in cost calculation. Other than manufacturing industry, the insurance cost cannot be determined on the sale of insurance products. Only after the insured consumed the products can it be exactly calculated. So usually insurance cost is first estimated when products sold, then the price of it is determined on this basis. Thus cost calculation of insurance company has the characteristic of estimation.(2) Uncertainty of insurance cost. Risk costs in insurance company depend on the probability of insured events, and their occurrence is contingent. So this kind of uncertainty determines the uncertainty of insurance cost.(3) Costs are calculated according to insurance varieties. Insurance cost includes risk cost and risk operating cost. So policy cost also includes the policy’s risk cost and risk operating cost. But risk cost of per policy is very difficult to calculate because of its uncertainty. Even if the risk operating cost is known, the whole cost of a policy still cannot be achieved. So only the cost of insurance variety is calculated, not the cost of policy.

4.2. Activity Analysis of Insurance Business and Cost Drivers

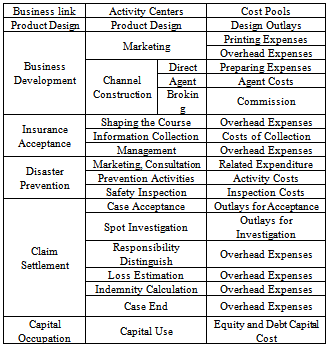

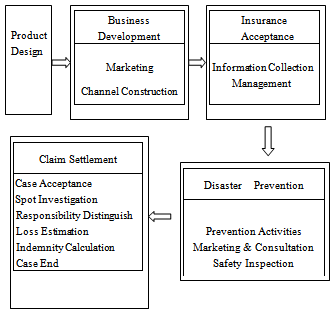

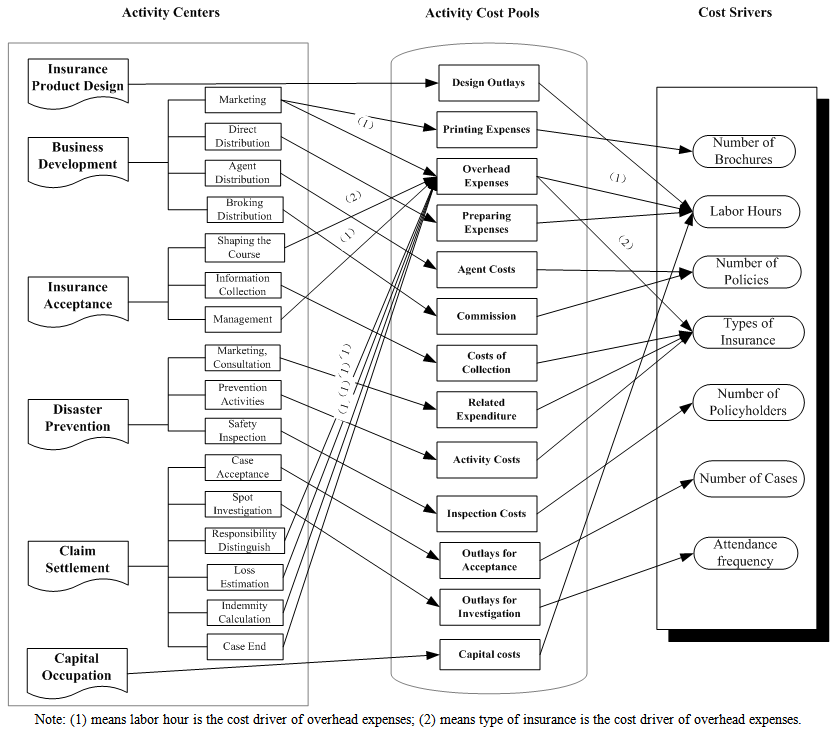

- For insurance companies, it is needed to compute the costs of each activity link and sum them up to calculate the cost of single insurance variety. So it is better to figure out all the main activities in insurance business. It means to identify the activities in the process of insurance operation correctly. Then analyze cost drivers of each activity and calculate the cost of each activity. In general, the main business of insurance operation includes product design, business development, insurance acceptance, disaster prevention, and claim settlement. Figure 3 shows the details:

| Figure 3. Main business of insurance operation |

|

5. Analysis of Activity-based Management in Insurance Company

- Activity-Based Management (ABM) is a kind of cost management based on the information of ABC. It is the extension of activities based costing. The principle is taking cost objects (i.e. insurance variety) as starting point according to the market demand, using backward induction to determine the related activities. Then calculate the whole consumption and costs of activities, identify resource drivers and activity drivers, and perform cost driver management and activity-based management to improve the performance and competition of the company[26]. When performing ABM, all the activities should be identified first in business operation. Then analyze the incremental value of activities, whether they are value-added activities or non-value-added ones. Further, distinguish the efficient activities and inefficient activities, and discuss whether the activity cost could be reduced. After that, ABM makes an effort on process reengineering according to the results of activity analysis in order to eliminate non-value-added activities, improve inefficient activities and increase value-added activities. Finally, activity management system is established, which could improve business performance and reduce waste.When analyzing incremental value of activities, the following conditions should be met: (1) the function of activity is explicit and definite; (2) the activity could add value to final products or services; (3) the activity could not be taken out, combined, or replaced. If one of the conditions doesn’t fit, the activity is not a value-added activity. From the above activity analysis in insurance operation, it can be seen that the activities of information collection, safety inspection, and policy checks are all non-value-added activities.(1) Non-value-added activity of information collection. The department of insurance acceptance will make a judgment on policyholder when deciding whether to accept the policy. And in the course of judgment, the information about the holder is very important. It is influenced by insurance type. For example, the holder’s morality, the insured’s health, and carelessness on disaster prevention should be considered seriously in life insurance. The outlays for collecting these kinds of information are the costs of non-value-added activity, for this activity is only the preventive measure that company has taken for insurance operation. To final products of insurance, it increases the resource consumption, but may not increase its value.Actually the relationship between a policyholder and an insurer is a kind of principal-agent relationship. Agent theory is based on the hypothesis of man’s selfishness, limited nous, and risk-aversion, also on the postulate of conflict of interest between policyholder and insurer, information asymmetry, and high cost of information acquiring[27]. So contracts will become invalid because of agent’s immoral manners, converse choice, and risk apportionment problem when policyholder and insurer have different risk tastes. Thus it is necessary to collect the information about policyholder’s morality when acceptance department makes the decision. But this activity will become useless if all the holders have good morality and will make no converse choices. Although this activity seems to be indispensable at present, it is really a good way to reduce the cost of insurance company. But now we can only improve the efficiency of activity to reduce its consumption of resource.(2) Non-value-added activity of safety inspection. Safety inspection is an important activity in the course of disaster prevention. Disaster prevention is an inevitable work in insurance company. It aims at reducing risk operating cost and increasing economic profit through both the holder’s and the insurer’s great efforts to take measures to reduce or eliminate the factors influencing risk occurrence. The safety inspection of important policyholders is one way to prevent disasters. It is a non-value-added activity and will become unnecessary if all the holders are responsible and would be conscious to prevent disasters. On the other hand, safety inspection will not add value to final insurance products. It is also a preventive measure in insurance operation and increases the consumption of resource, labor, and wealth. But this activity could not be eliminated in short term. We can reduce its cost though extensively publicizing, propagandizing, and so on.

| Figure 4. Cost drivers in insurance operation |

6. Conclusions

- Economic Value Added theory was used to improve traditional activity-based costing in this paper. It analyzed the relationship among resources, activities and outputs, discussed the consumption of operating resources, capital resources and activities, and then established the model of Refined Activity-Based Costing to evaluate the effectiveness and value of activities. Next, RABC was applied to Chinese insurance industry. It discussed whether the consumption of resources for insurance products was necessary, the occurrence of activities in the process of insurance operation was necessary or not. It also evaluated the value increment and effectiveness of insurance activities, introduced activity management to the analysis of company's operating process. So it will do good helps to optimize the allocation of internal resources, reduce waste and consumption, improve performance, and realize the company’s scientific management.

ACKNOWLEDGEMENTS

- Financial supports from National Natural Science Fund (71201125), National Social Science Fund (09CJY038), General Humanities Social Science Research Program of Ministry of Education (10XJC630002), National Natural Science Fund of Shaanxi Province (2013JQ9001), Project of Soft Science of Shaanxi Province (2009KRM073), Humanities Social Science and Management Perking Fund of Northwest Polytechnical University (RW201208) are greatly acknowledged.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML