-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(6): 307-311

doi:10.5923/j.ijfa.20130206.02

Impact of Intellectual Capital on Corporate Social Responsibility Evidence from Islamic Banking Sector in GCC

Anwar Salem Musibah1, Wan Sulaiman Bin Wan Yusoff Alfa2

1College of Applied Since, Hadhramout University of Science and Technology (HUST), Sayun, 50512, Yemen

2Kulliyyah Muamalat, KolejUniversitiInsaniah (KUIN), Kuala Ketil, Kedah Darul Aman, 09300, Malaysia

Correspondence to: Anwar Salem Musibah, College of Applied Since, Hadhramout University of Science and Technology (HUST), Sayun, 50512, Yemen.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The purpose of this study is to examine and ascertain the effects of Intellectual Capital on Corporate Social Responsibility for Islamic Banking Sector in GCC. Value Added Intellectual Coefficient (VAIC) was used as the efficient measure of intellectual capital. Two regression models were constructed to test the overall VAIC, and each of its three components (Capital Employed Efficiency, Human Capital Efficiency and Structural Capital Efficiency) affects Islamic banks’ Corporate Social Responsibility. The data includes 53 Islamic banks in GCC for the period of 2007-2011. The results showed that intellectual capital (VAIC) has a negative impact on Corporate Social Responsibility of Islamic banks in GCC. In addition, we found that Corporate Social Responsibility is positively associated with Capital Employed Efficiency (CEE) and negatively associated with Human Capital Efficiency (HCE). However, our findings failed to find any significant association between Structural Capital Efficiency (SCE) and Corporate Social Responsibility of the Islamic banks in GCC.

Keywords: Intellectual Capital, Value Added Intellectual Coefficient (VAIC), Islamic Banks, Gulf Cooperation Council (GCC), Corporate Social Responsibility (CSR)

Cite this paper: Anwar Salem Musibah, Wan Sulaiman Bin Wan Yusoff Alfa, Impact of Intellectual Capital on Corporate Social Responsibility Evidence from Islamic Banking Sector in GCC, International Journal of Finance and Accounting , Vol. 2 No. 6, 2013, pp. 307-311. doi: 10.5923/j.ijfa.20130206.02.

Article Outline

1. Introduction

- “Intellectual capital” has been increasingly used in recent years by many researchers in the developed world. However, little research work has been done to explore emerging economies as a case for evaluating the implications of intellectual capital for certain industries[1]. Intellectual capital implications are more notable in these emerging economies since they have abundant human capital at their disposal[1]. Therefore, it becomes very essential to understand whether this resource is being beneficially used by specific sectors to seek their advantages in creating value over a period of time.The sector of banking in any country can play a critical role in setting the economy in motion and in its development process. This sector is considered to be the key factor for development and success of various projects in both industrial and developing countries. Islamic banking perspective can be described as an Islamic mode of financing where people can invest their capital according to Islamic Shariah philosophy. Thus, sharing and transforming of knowledge is critical for knowledge management. This type of banking does not only transfer true knowledge of Islamic modes of financing but also can increase customer retention and satisfaction.The countries comprising the GCC have notable common economic, cultural, and political similarities which counteract the differences they have[2]. Therefore, by adopting suitable economic and financial policies for banking sector efficiency is the main objective of the GCC countries, wherein they plan to transform their current economy into global financial and trade centers[3]. Owing to the essential element of IC as a resource in the success of banking[1];[4].Islamic banks in the GGC control a market share close to 15% of the regional banking system’s assets, and have become great component of financial intermediation in this part of the world[5]. Islamic banks in the Gulf Cooperation Council (GCC) has grown exponentially and become more diverse: there are new entrants, conventional financial banks have been converted to banks that work according to the rules of Shariah, and conventional banks opened Islamic windows, forcing Islamic banks to enhance their commercial entrenchment, increase relevant business models, strengthen their brands and reputation and supply innovative solutions to a growing number of clients attracted by the idea of Riba-free banking.The increasing competition from other countries in the world has put pressure on the GCC`s financial sector to enhance its competitive capabilities and sustain its position as a leading financial sector in the world. Thereby, financial sector in GCC is required to pay more attention to develop its intellectual capital that has a wide recognition as a major source of corporate social responsibility.The purpose of this study is to evaluate the influence of intellectual capital on the corporate social responsibility of Islamic banks in gulf corporation countries (GCC).

2. Literature Review and Hypotheses Generation

- “Intellectual capital”, as a term, has been commonly utilized in the current times in the field of research in the context of the developed world. Unfortunately, studies in the emerging economies concerning intellectual capital, specifically the evaluation of its implications for particular industries are few and far between[1]. The widening gap between firms market and book value has obliterated the wide research attention concerning the invisible value that has been deleted from financial statements[6]. It is commonly noted that the market value is well over the book value and in most current companies; intellectual capital occupies the most part of their market value. Researchers have increasingly acknowledged that the main competitive constraints currently comprise of managers, skilled knowledge workers, effective systems, loyal customers, and strong brands as opposed to what used to be land, labor or capital[7]. There is significant evidence that shows companies which are concentrated on developing intellectual capital have provided great returns to shareholders and are over performing their competitors on each financial measure[7].In the present time, management are taking cognizance of the fact that the advantage a company holds primarily hinges on what the company knows, how it uses knowledge, and the expediency of the company’s learning something new. In addition, most firms are in cognizant of the fact that the underpinning source of future cash flows will stem from the effective management of intellectual capital. Satisfying the requirements customers is what counts and this encapsulates leveraging knowledge for contracts bidding, solving problems, providing superior services and offering customized products as opposed to investing in new productive capacity. For instance, CSR implementation requires the commitment of senior management and board, the engagement of staff and the provision of skills, tools and incentives. It is evident that participation of staff and buy-in to delivering on the aspirations of the company CSR is core to this area’s success. Based on case studies, HR practices including development of competency can assist in embedding CSR in the firm, and in benefitting the bottom line[8]. Companies known for having a reputable CSR are taking advantage of the stakeholder view that a firm’s behavior and its people are consistent with the CSR values. Intellectual capital has been playing an ever more increasing role not only in the corporate financial performance of companies, but also in participating to achieve financial achievements such as marketevaluation [9];[10];[11]. If this link between intellectual capital and financial performance is accurate, then from looking at previous studies which have shown a link between financial performance and CSR, we could conclude that intellectual capital would also have a relationship with CSR[12]. Therefore, it is assumed that that there will be a relationship between intellectual capital and the CSR activities.The intellectual capital and corporate social responsibility in factis the same thing on two different sides of the same coin where both are describing the interface between society and companies. In other words, the multiple aspects of the management and maintenance of intellectual capital within a firm coincide and are complimentary towards the CSR actions of a company[13] ;[14].Based on the resource based theory (RBT), banks rely on a number of different resources and capabilities which is non similar such as financial resources and tangible assets, also intangible assets, such as company's fame, culture, and human capital.When these resources and capabilities are important, rare, inimitable and non substitutable they can generate a sustainable competitive advantage. The followinghypotheses are therefore developed for (VAIC) and its components, Human capital efficiency (HCE), capital employed efficiency (CEE), structural capital efficiency (SCE):H1: There is a positive relationship between Value Added Intellectual Coefficient (VAIC) and Corporate Social Responsibility (CSR) of Islamic banking sector in the GCC.H2: There is a positive relationship between Human Capital Efficiency (HCE) and Corporate SocialResponsibility (CSR) of Islamic banking sector in the GCC.H3: There is a positive relationship between Capital Employed Efficiency (CEE) and Corporate Social Responsibility (CSR) of Islamic banking sector in the GCC.H4: There is a positive relationship between Structural Capital Efficiency (SCE) and Corporate Social Responsibility (CSR) of Islamic banking sector in the GCC.

3. Research Methodology

- Corporate Social Responsibility is a dependent variable in this study and for this purpose, Corporate SocialResponsibility should be measured by many indicators[15].We can measure corporate social responsibility as the log of sum all expenses of the bank used for the activities of Social Responsibility, based on the data availability. Here, the study supposes that more IC leads to better firm social responsibility, The CSR criteria here comprises the amount of donation in a year expenditure on staff training and other working condition improvements and community (Qard Hasan, Zakah, employees expenses, Waqf, Charitable activities, expenditure of training and other work condition improvement, community involvement expenditure, remuneration, cost of Shariah board, Micro and small sized business, social savings and investments, and donation for support scientific research ) involving expenditure disclosed in annual statements. A number of previous studies used a corporate social responsibility as a measure of intellectual capital, as stand-alone measure or added to other measures when they studied the effect of intellectual capital forcompanies[12]; [13];[14].VAIC and its components are independent variables; VAIC used as a measure of the intellectual capacity of companies[16]. It is the sum of the three components of VA efficiency indicators (HCE,CEE,SCE). The procedures to calculate VAIC are as follows:Calculate Value Added (VA):VA= OUTPUT-INPUTWhere OUTPUT = total income from all products and services sold during the particular fiscal year. And INPUT = the total costs and expenses that incurred by the firm during that particular fiscal year (excluding labor expenses, which are employees’ compensation and all expenses that are related to their training and development).The three major components of firm resources; Capital Employed, Human Capital, and Structural Capital are by definition, represented by the following:[16];[17].Capital Employed (CE) = physical capital+financial assets=Total assets – intangible assets.Human Capital (HC) = total expenditure on employees.Structure Capital (SC) = value added -human capital.By definition, the three components of VAIC are calculated as follows:HCE=VA / HCCEE=VA / CESCE=SC / VAVAIC = HCE+CEE+SCEWhere: CEE is an indicator of value added efficiency of capital employed; HCE is an indicator of value added efficiency of human capital; and SCE is an indicator of value added efficiency of structure capital. Bank size is considered as control variable, it is measured by natural logarithm of book value of total assets.There are two regression functions for the study is as follows:a) Value added intellectual coefficient, to corporate social responsibility (CSR)CSR=a0+a1(VAIC)+a2(Control Variable) +

b) Value Added Intellectual Coefficient components (VAIC), to Corporate Social Responsibility (CSR)CSR=b0+b1 (HCE) + b2 (CEE) + b3 (SCE) +b4 (Control Variable) +

b) Value Added Intellectual Coefficient components (VAIC), to Corporate Social Responsibility (CSR)CSR=b0+b1 (HCE) + b2 (CEE) + b3 (SCE) +b4 (Control Variable) +

4. Findings and Discussion

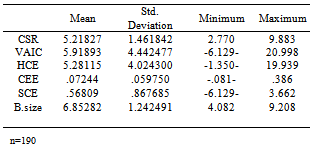

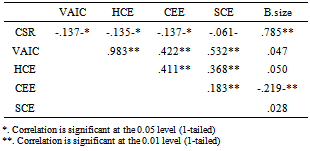

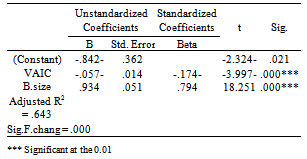

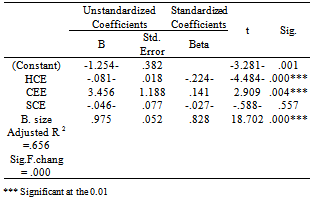

- This section of the paper is devoted to present the results of the analysis performed on the data collected. Analyses were carried out with the aid of the Statistical Package for Social Sciences, (SPSS Version 19.0).Table 1 presents the descriptive statistics of the variables. The CSR ranges from 2.770 to 9.883, with a mean of 5.218 and a standard deviation of 1.461. The mean value of VAIC is 5.918 which indicates that VAIC is not high because the minimum value is -6.129- and the maximum is 20.998. The small standard deviation of 4.442 shows that the values are not widely dispersed.The mean value of capital employed efficiency (CEE) is .072 which means that the CEE is low because the minimum value is -.081- and the maximum is .386. Besides, there are small differences between values of CEE because the standard deviation is low .0597. The mean value of human capital efficiency (HCE) is 5.281. The mean score is low as the minimum and maximum values are -1.350- and 19.939, respectively. The standard deviation is 4.024. The structural capital efficiency (SCE) ranges from -6.129- to 3.662, with a mean score of .568, and a standard deviation is .867.A comparison of CEE (mean = .072; sd = .059), HCE (mean = 5.281; sd = 4.024), and SCE (mean = .568; sd = .867), suggests that during 2007-2011, the sample banks were generally more effective in generating value from its human capital rather than from its physical and structural assets.

|

|

|

|

5. Conclusions

- This study provides evidence that intellectual capital has a negative association with corporate social responsibility of Islamic banks in GCC. Subsequently, when the VAIC is segregated into its three major components, we found that CSR is positively associated with capital employed efficiency and negatively associated with human capital efficiency, but not with structural capital efficiency.The scope of this study is limited to intellectual capital of Islamic banks offering Islamic financial products and services in GCC countries (Kuwait, Bahrain, Qatar, Saudi Arabia and the UAE) for 5 years from 2007-2011. The study excludes Oman as one of the case countries in the GCC region, because there are no Islamic banks until the opening of the first Islamic bank on 10 TheJanuary 2013.Theoretically, this study contributes to fill the gap in the literature by determining the factors that achieving Islamic banks goals to provide high social activity, practically to assist Islamic banks to achieve high level and acceptable for social responsibility to customers, employees and society. And to find solutions for any troubles faced Islamic banks competitive advantage, which leads to help the policy makers in issuing regulations that govern the practices and enhance the relationship between these banks and stakeholders as the pillar of the country’s economic development.Future studies should attempt to come up with a more general platform upon which they can initiate their research while counteracting the limitations of the present study. To do this, future studies have to focus on the data collection method from banks that primarily keep their audited financial statements confidential.Additionally, the probable research on this arising topic can focus on the identification of the changes in the relationship between IC and CSR and the IC components valuation by investors.More importantly, a huge gap exists in studies exploring the issue on the most effective and robust measure of IC as there is still a lack of consensus among scholars. Future studies may focus their investigation to the level of Islamic banking preparedness in better obtaining the IC resources and to which level the macro factors of country are influencing the acceptance and proliferation of the IC resources value creations. The present study’s findings are invaluable for developing countries because IC has been increasingly acknowledged as the primary driver of corporate and national development in these countries as shown in some studies[1]. Also, with regards to the fact that stimulation of investments has become a significant task of government in GCC countries, the findings of this study reveal that the IC resources in these countries is just as important as the capital investments on physical resources while creating value and sustainable advantages. Thus, the GCC countries national policy makers should concentrate more on the issue and to appropriate resources for the expansion of IC resources volume, particularly, structural capital. Moreover, the findings are of interest to various stakeholders including shareholders, institutional investors, scholars and managers. Meanwhile, the relationship between IC and social responsibility assists in encouraging current managers in harnessing and managing IC for higher social activities.The negative association between IC and social responsibility urges management to come up with knowledge based strategies particularly and to maximize the efficiency of social activities that are related to IC. The present study would also assist shareholders in understanding the IC performance of banks and the findings may be used as a benchmark owing to the simple approach to measuring IC level. The IC ranking has also enabled the establishment of priorities and development of strategic plans which improve the bank’s future social performance. This ranking may also assist stakeholders and investors in their assessment of the sample banks’ value creating potential. These findings are essentially significant in the formulation and implementation of IC policies in categories and the identification of the necessary formulation of IC report framework[19]. Consistent with the expected contribution in drawing the research premise, the study adds to the much talked about multiple dimension of the existing IC measure by examining the value added element of the (RBT) Resource Based Theory.Along with the theoretical contribution stated above, the present study also contributes to the ongoing debate in IC literature through its examination of the issue beyond the IC report. More importantly, this study is the pioneering study which examined the possible benefits of IC on CSR in the context of GCC Islamic banking.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML