-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(6): 297-306

doi:10.5923/j.ijfa.20130206.01

Time-Driven Activity-Based Costing and Effective Business Management: Evidence from Benue State, Nigeria

Azende Terungwa

Accounting Department, Benue State University, Makurdi-Nigeria

Correspondence to: Azende Terungwa, Accounting Department, Benue State University, Makurdi-Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This paper looks at the practicability of implementing time-driven activity-based costing system (TD-ABC) in service businesses like hotels in Benue State and analyzes profitability of its varying customers. This research is carried out to establish if the application of TD-ABC in service oriented businesses in Makurdi metropolis of Benue State will enhance their performance in terms of profitability. Regarding the goal of this study, the research design is an application research by case study. The researcher purposively selected twenty out of the identified hotel businesses to ascertain the application of TD-ABC. The researcher also chooses one sampled hotel and studied its Restaurant using questionnaires, interviews to get data for this work. The result showed that using TD-ABC system, in comparison with their existing method provides more data on cost and profitability of customers served and that the application level of TD-ABC in Nigeria almost non irrespective of the fact that it was a better costing tool. The result also revealed a profit of N1,441,808 rather than a loss as hitherto reported by the business for the same period using their costing method. Which means TD-ABC gave better opportunity to analyze cost of operation. The conclusion was that managers of hotel businesses can make use of time equations in TD-ABC to calculate necessary time for activities engaged in delivering a unit of service. The recommendation is that service businesses should implement TD-ABC to enhance their cost accumulation process and pricing of services, hence increase their profitability.

Keywords: TD-ABC, Hotel Service Businesses, Customer Profitability Analysis, Business Management

Cite this paper: Azende Terungwa, Time-Driven Activity-Based Costing and Effective Business Management: Evidence from Benue State, Nigeria, International Journal of Finance and Accounting , Vol. 2 No. 6, 2013, pp. 297-306. doi: 10.5923/j.ijfa.20130206.01.

Article Outline

1. Introduction

- In this Era of intense global competition on price and quality of products and services, attention of business organizations is shifting from standardization to customization of their products and services made available. This is possible by the evolving information technology and the continual quest to serve customers profitably. One of the main challenges of successfully managing service businesses especially the hospitality industry is development of cost information for enhanced strategic decision and proper pricing of services. It is this cost information that enable managers to have in-depth requisite knowledge of their operational costs hence better control. It must quickly be emphasized that you can not control what you do not know or understand. It is for this reasons that a suitable costing system to obtain this information is of prime importance to a successful business management. Accumulating proper cost data per customer is necessary because it facilitates managerial decisions that dovetail into total profitability of the business organization. Customer cost data help identify which one is profitable or not[1]. Companies that are able to understand and identify which customers are more profitable and which ones are not, are handy with valuable information needed to make successful managerial decisions to improve the overall organizational profitability[2].Comparatively, the cost of acquiring a new customer is not the same with the cost of maintaining an existing one. In the words of[3], expense of finding a new customer in a service company is five times more than preserving current customer. It is however unwise to just keep a customer because the cost of finding a new one is more than the cost of preserving an existing one. The wise way out is to secure a valid customer cost information to ascertain how profitable he is to the business before the decision to keep him or not comes to play. It is to this respect that[4] and[5], suggest that understanding how current customer relationships differ in profitability enables managers to make better managerial decisions. Thus, knowing customers’ cost information is necessary to maintain profitable relations for service institutions and businesses like the hospitality industry[6]. Nevertheless, obtaining accurate customer cost information about profitability is a function of an appropriate costing system. Competition has resulted to an increased attention to the introduction of various products and services of high quality, all in an attempt to satisfy customer’s profitability. It takes resources of the organization to produce a product or service. These resources carry some cost and as they are consumed cost is incurred, regrettably these resources are scarce and are insufficient in supply. Time is one of those vital resources. Whatever is scarce call for efficient allocation to the competing areas of need. This efficient allocation curtails waste and paves way for accrued commensurate benefit whenever the resources are consumed. They are different activities involved to accomplish the task of delivering different services; the knowledge of the activities involved in making a product or service is invariably having knowledge of the resources each service consumes and the resultant cost so incurred. Before today, customers had less choice to make in satisfying their needs. Presently there is broad range of choices on reasons of quality, cost, modernity, packaging, delivery system etc. thereby making the business arena more complex and competitive.For reasons of growth and survival of any business, the need for accurate cost information is critical be it with respect to pricing policies, product designs, performance reviews, variety of services etc. Regrettably, most companies are still using the same traditional cost accounting system that was developed decades ago. Traditional cost accounting methods do not accurately reflect the contribution of indirect cost to individual services. They pool all indirect cost and then allocate them to the various services in proportion to service volume of direct cost. This approach tends to over estimate the unit cost of high volume services and under estimate the cost of low volume services. Most studies dealt with the deficiencies of this traditional costing system in automated production environments[7];[8].According to[9], the use of activity-based costing (ABC) enhances the traditional contribution margin approach. ABC came as result of the continual quest for a better costing system. It was an alternative to the traditional volume-based system. ABC approach assumes that either products or customers give rise to some activities, and these activities consume resources[9]. ABC therefore allocates costs of resources to the activities then the costs of activities are apportioned to cost objects by means of volume and non-volume related drivers[10]. Put differently, costs of activities are allocated to cost objects based on level of benefits usually called cost drivers. It is this cost drivers that serve as a link between activities and costs objects[9], [10];[11]. For the last two decades, ABC was introduced to enhance proper cost accumulation. The era of ABC led to the understanding that not every customer or product consumes the same level of activities and resources. It was the traditional costing system that uses arbitrary cost allocation of overhead costs. Thus, with ABC, managers are better equipped to understand cost causation and the ability to determine which customer is profitable or not hence better decisions. ABC rather than just listing cost factors and assigning them to products based on artificial allocations, it examines processes and work flows to identify actual activities that add cost there-by providing a trend data on unit cost. This wider and more realistic view of cost allows managers to base strategic decisions on more accurate cost information. ABC estimates the cost of the work activities that consume resources and then links this cost to the services that are provided. Even though ABC system alone may not transform a business into a world-class competitor, it is an important tool to help world-class firms make effective strategic decisions. To[11], the use of ABC by organizations has led to increased profitability.This ABC system which is hereafter referred to as traditional ABC had some flaws which hindered most companies from implementing it. First, it took too long a time to implement the traditional ABC due to the complex nature of the activities performed within the organization[12]. Secondly, the system needed to be updated regularly, it became too expensive to re-interview and re-survey people engaged in the activities[12]. Thirdly, this system did not capture the complexity of the operation of many companies.It was these flaws that gave birth to a new costing method called time-driven ABC (TD-ABC) system to address those limitations as highlighted above. This does not mean the traditional ABC will be abandoned; it is an off-shoot of it intended to correct the envisaged flaws. Proponents of TD-ABC argue that it removes time-consuming and costly interviews which have been a major barrier to the implementation of traditional ABC system, as well as it allows cost driver rates to be calculated based on the practical capacity of the resources supplied[13]. There is more literature on ABC with respect to manufacturing companies as compared to service organizations.[14] asserts that, even though ABC has been applied in service firms such as health care and financial institutions, the use of ABC in the hotel or restaurant is scarce.[15] also echoes that the use of ABC in the hotel industry is limited. CPA was a relevant unique feature of the hotel industry which only ABC was likely to address. It was for this quest that[16] conducted an ABC-based customer profitability analysis in an Irish hotel. The result of this work showed that the traditional costing method was not capable of addressing operational requirements where diverse services are rendered. He concluded that ABC was better in this regard. [17] posited after their study that although there was considerable knowledge of the theory of ABC, there was low understanding of how it might be used in hotels. This he emphasized was based on the envisaged shortcomings of ABC and the believe that it was only for manufacturing organizations. In the same vain[18] further affirms that there is little known about cost accounting and its use in tourism enterprises and especially hotels.[19] still reaffirm that there are rare studies on ABC in service industries especially hospitality industry. Rendering of service is very important because it enhances value of the product. A product could cost the same but the price or value of that product varies proportional to the services rendered as that product gets to the final consumer. For example, a bottle of coke sold at road side kiosk will most likely be priced less than the one sold at a five star hotel. It is clear therefore that services may not be easy to quantify but it is a salient avenue for organizations to tap its numerous benefits. The activities or time involved to deliver service needs to be accurately accumulated so that the cost of that service would be appropriate. The contemporary business environment is characterized with high level of competition. The focus is on the customer and his needs in satisfying them profitably and clamor for market share. Activity based costing is therefore a competitive weapon which service organizations and the hospitality industry can also use to enhance the quality of their services, increase profit and remain competitive. There are hotels all over Nigeria and there is need to nurture them via good management to grow and compete with other economies of the world by exporting their services. The traditional ABC mentioned above fell short as a good management tool because of the identified flaws which mitigated the adoption of this costing system even by big manufacturing companies. The continual search for a better costing system ushered in the TD-ABC and has been used in most manufacturing organizations and found to be useful.[20] points out that the conditions necessary for manufacturing firms to successfully implement ABC are necessary for service companies as well.TD-ABC can also succeed in the hospitality industry. Nigeria is currently pursuing vision 20-20-20. The vision is that by the year 2020, Nigeria will be one among the top 20 most industrialized nations of the world. The onus is on her to address key developmental issues like management of businesses that would help transform the economy for the better. Government efforts for enhancing the economy are sometimes frustrated because of the porous nature of our economic base. There could be many solutions to this problem which one of them is efficient management of businesses and enhancement of entrepreneurship skills.This study is premised on the notion that cost information is an essential ingredient to profitable pricing of services.TD-ABC which is a means of improving the understanding of cost with a view to enhancing better decisions and profits of businesses is hoped to yield good results in the hospitality industry. The researcher wish to unravel in this study the cause for unsuccessful businesses in Nigeria with bias to lack of proper management especially with The statement of the problem is; how are our businesses especially hotels managed in other to enhance profitability and growth with a view to making our lives better and competing with other economies of the world? The research questions are; Does proper cost management enhances better and profitable services in the hospitality industry? and what is the level of adoption of TD-ABC in the Nigerian hospitality industry? The objective of this work is: To show that proper cost management can enhance better services profitably hence customer loyalty and to ascertain the level of adoption of TD-ABC in Nigerian hotels.Based on the statement of the problem and objectives of the study, the following hypotheses were developed to guide this study in the design, collection and analysis of data: H1: There is a positive correlation between proper cost management and profitable service delivery in the hospitality industry. H2: There are statistical significant differences between TD-ABC adopters and TD-ABC non-adopters in the hospitality industry.This study will be beneficial to owners/managers of hotels and other service businesses in Nigeria, since it shall provide them with a useful tool to ascertaining which customer is profitable and which is not with a view to enhancing better strategic operational managerial decisions. To this end the hotel business will be better managed and profitability improved. This work will again be of significant benefit to customers who patronize hotels in the sense that, if hotels understand the beauty of TD-ABC and adopt same, they will render efficient services at a reduced price. This will be possible because this system will enable management easily identify and eliminate non-value added activities which hitherto add cost of rendering services to customers. Authorities cited earlier confirm that there is limited research in this area especially in the hospitality services industry. This is even more pronounced in Nigeria. To this end this work shall serve as a platform upon which other academic exercise will be built. To a larger extent, the entire economy of Nigeria will benefit from this work because of the envisaged multiplier effect of its benefits as highlighted. This will then culminate to right steps towards actualizing Nigeria’s vision 20-20-20.It will be time consuming and expensive to study all the hotels available in Nigeria moreover, from the results of the informal survey conducted on hotels by the researcher, not all of them may be willing to make available their accounts. For this reason the study shall be restricted to selected hotels that are willing to make their accounts available but the geographical spread will be emphasized to achieve external validity. The reason for this is to enhance valid result.

2. Conceptual Clarification and Literature Review

2.1. Costing an Overview

- Cost is an outflow of a resource, whether in cash, as payable, a rendered service, or as a trade or barter, that is consciously made with expectation of benefit to the organization: goods, property, or services required. There is every need to manage cost for the success of any organization. Costing is a mechanism that gives information on the cost structure of an organization. The purpose of cost accounting therefore is to render provide cost information for prudent stewardship of the overall organizational resources. Cost management is therefore the use of cost accounting systems and methods to guide current and future operations towards specified objectives. Costing is the analysis and interpretation of cost data to enhance decision-making process. To[11] units makes up the whole and therefore costing should be primarily concerned with the units cost to tract accurate cost of operation. To[21] Costing is simply the ascertainment of costs. It gives factual information on which management accountants can build up his presentation of planning and control of operations. Costing enables a business not only to find out what various products or service have cost but also what they should have cost by unveiling where losses and waste are occurring.We are experiencing an ever changing business environment, these changes are a function of knowledge and information we are exposed to. The development and use of information especially cost management information is a crucial factor in the effective management of business operations.

2.2. The Concept of Unit Cost

- To[22] Unit cost is the average total cost of producing one unit of output. It is clear that each unit of product has unique demand on the resources of the organization. Resources cost money and as such the cost of a unit could not just be arbitrarily ascertained but in agreement with resources so consumed. To[23], a resource is an economic element that is applied in the performance of activities e.g. salaries, materials etc. In a competitive economic environment these economic elements are scarce and therefore how much a unit of product or service consumes should be the base of ascertaining its costs. To[24] resources are used to perform activities, those activities are the real work carried out in an organization and each unit of product or service requires unique activities which should be traced to it in arriving at cost of production. To[25] an activity is a value adding process which consumes resources. A unit of product or service is therefore a function of the activities performed and resource consumed. It is then truism to say that to know the true cost of a unit is the first step to total cost ascertainment or costing. A good costing system is therefore one that keeps track of the activities needed to complete each unit of product or service and the resources consumed by each activity.

2.3. The Traditional Costing System

- Over the years the most difficult task of management is computing unit cost, the difficulty is in determining the proper amount of overhead cost assigned to each job, unit of product or service. Some approaches exist and have been used to compute unit cost such as – plant wide overhead rate, departmental overhead rate and activity based costing. The first two commonly referred to as the traditional costing system, are both based on output volume to allocate factory overhead cost to products or service. The plant wide rate assures that in proportion to the overhead allocation base used, all products or service benefits from the overhead incurred. On the other hand the departmental rate method used various volume based procedural rates for each department.The idea was that products cost are more likely to reflect different usages in departments, however, this did not take into consideration varying cost of different processes or activities within a department. In the time past total manufacturing cost was dominated by labour and correspondingly, products requiring the highest labour input were driving most of the production costs. All efforts was on measuring and controlling direct labour costs. In such a case the costing system was to measure the resource consumed in production to the volume or individual products produced. The unit cost arrived at using that method of allocation was distorted because products do not necessarily consume most support material in proportion to their production volume. From the foregoing it becomes clear that cost was not ascertained as supposed and the main aim of costing was partially eroded.

2.4. Activity Based Costing

- Information on product cost and product profitability is a prerequisite for cost-conscious management. Only if there is cost information available, is management basically able to make various decisions that take the cost perspective into account. Therefore, to understand causes and effects of product or service cost is vital in terms of a company’s short and long-term planning. The contemporary manufacturing and service business environments are characterized with automation, product diversity and total overhead has increased to the point in some companies that a correlation no longer exist between it and direct labor. It is then clear that resources of an organization liker supervision, set-up, order cost and material handling costs for activities and transactions are unrelated to the physical volume of units produced. The quest for a more reasonable and detailed method of allocating overhead to unit cost continued until the emergence of ABC. The key idea of ABC is that, activities drive costs of any organization by consuming its resources[26]. The design of an ABC system rests on identifying the relationship between an indirect resource and the activity that causes it. Once that is done, the product or service cost is simply the cross product of the activities that were incurred to produce the product and the cost of activity. According to[27], ABC is concerned with the cost of activities within a company and their relationships to the manufacturer of specific products rather than to functional base. The basic technique of ABC is to analyze the indirect costs within a company and to discover the activities that cause those costs. Such activities are called cost-drivers and can be used to apply overheads to specific products. To[28], a cost driver is an event associated with an activity that results in the consumption of the firms resources. Traditional cost accounting uses one cost driver (direct labor or machine hours) as the basis for allocating overhead costs, and this can be inaccurate and misleading because it may apply too much cost to one product and not enough to another. ABC system achieves improved accuracy in the estimation of costs by using multiple cost drivers to trace the cost of activities to those products or services associated with the resources consumed by those activities, hence preferable. To[29] several practical cases indicate that ABC can be of value for product pricing, production decision making, overhead cost reduction, and continuous improvement. To[30] An ABC approach uses multiple drivers to reflect how resources and activities are actually consumed which provides a more accurate assignment of cost than traditional cost systems that typically rely on a limited number of volume based measures, such as direct labour hours or sales volume. To[31] ABC is an examination of activities across the entire chain of value adding organizational processes. It unveils the underlying causes or drivers of cost and profits. To[32] ABC offers a workable and more effective insight into overhead allocation and recovery. It improves the quality of costs and management allocating information; it also gives managers a wider understanding of the economies of production.As many companies have acknowledged that while the improved products cost information provided by ABC is useful, its real power lies in its ability to identify cost reduction opportunities[33]. ABC has been extended from cost view to process view. That is to say according to[34] that ABC has moved from product costing to process improvement. This extension, enable managers to understand their organizations thereby enhancing the quality of their strategic decisions.

2.4.1. Problems/limitations of the Traditional ABC

- This traditional ABC was however more appropriate for pilot studies or department levels. Several problems arose when companies attempted to scale up this seemingly straightforward approach to cover the whole organization. There was problem maintaining the model to reflect changes in activities, processes, products, and customers[12]. The process to interview and survey employees to get their time allocations to multiple activities was time consuming (making it take a long time to implement) and costly. Costly in the sense that, the model needed constant update so as to maintain true activity cost driver rates. The time and cost to estimate an ABC model and maintain it has been a major barrier to widespread ABC adoption. Another problem was that this model did not capture the complexity of the operation of many companies. If heterogeneity is introduced within an activity, it requires re-estimating the amount of cost that should be assigned to the new activity thereby consuming time and incurring more cost.

2.5. Time-Driven Activity Based-Costing

- TD-ABC is an emerging alternative approach for costing that addresses all the problems and limitations of the traditional ABC as highlighted above. It is simpler, less costly and faster to implement, and allows cost driver rates to be based on practical capacity of the resources supplied[12]. Under traditional ABC, cost driver rates are calculated by dividing total cost of activities by volume or quantity of the transaction cost driver like number of setups, number of customer orders. The result of the calculation is therefore per transaction. It assumes in essence that each occurrence of the transaction consumes the same quantity of resources. It is on this assumption that TD-ABC differs. It is of the opinion that duration (time) drivers are more accurate than transaction drivers that are more expensive to measure. [12] articulate the difference between transactional and ‘effort’ cost drivers. Transactional cost drivers count the number of times an activity is performed, like number of set-ups, number of shipment, number of purchase orders, and number of customer orders. When the resources required to perform each of an activity vary, such as when some set-ups are more complex to do than others, or when some customer orders require more time and effort to process than others, then simply counting the number of times an activity is performed gives an inaccurate estimate of the resources required to accomplish a work. Service businesses offer heterogeneous services each with varying degree of consumption of resources. It is good therefore for a cost system to use duration drivers which estimate the time required to render each service. Time is a valuable resource in service businesses and must be used judiciously to enhance profitability. TD-ABC gives service business owners the opportunity to manage time and other resources profitably.[12], argues that the essence of activity-based costing and acivity- based management is the measurement of the organizations capacity. To this end TD-ABC systems requires two estimates: the unit cost of supplying capacity and the consumption of capacity (unit times) by the activities the organization performs for products, services and customers. TD-ABC therefore has two estimates simply put as Unit Cost Estimate and Unit Time Estimate.

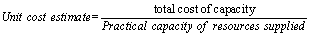

2.5.1. Unit Cost Estimate

- This approach starts by estimating the cost of supplying capacity. This means all the resources required to enable the performance of the varying activity or services is identified. The sum of all these resources in monetary terms is calculated per given period. This cost system also call for the estimation of the practical capacity of the resources supplied. Theoretically the capacity under traditional ABC is put at 100% but under TD-ABC emphasis is on estimating practical capacity than the theoretical capacity. Practical capacity is therefore estimated at 80% of theoretical capacity. This means that if an employee or machine can work 50 hours per week, practical capacity could be assumed to be 40 hours per week. This estimate allows for 20% of employee time for say breaks, answering calls, arrival and departure and other things unrelated to actual work performance. If it is a machine the same time is given for downtime due to maintenance, repair, and scheduling functions[12].The basic objective in all ABC design is to be approximately right so the analysis is not greatly sensitive to small errors in estimating parameters. With estimates of the cost of supplying capacity and practical capacity, unit cost can be calculated by dividing cost of capacity supplied over the practical capacity of resources supplied[12]. It must be emphasized here that the practical capacity is total time in minutes supplied by all the employees in that given period in question.

2.5.2. Unit Time Estimate

- Under TD-ABC there is a need to estimate the time required to perform a transactional activity/service. It therefore means the time required to render each of these diverse services in small businesses will be estimated. This can be obtained either by direct observation or by interviews. Precision is not critical; rough accuracy is sufficient[12].

2.5.3. Time Equations

- In general, not all small business services are the same and require the same amount of time to provide. Each business can conveniently ascertain or predict what makes some transactions or services to be simpler or more complex and time consuming to provide. TD-ABC approach estimates the total resource (time) demanded to render each service by a simple equation generally called ‘Time Equation’. This equation is the sum of all the time taken to render whichever type of service to a particular customer. To[19] building an accurate time-based algorithm in one facility will typically serve as a template that can be easily applied and customized to other plants, or even other companies in an industry. This is to say, service businesses can develop this time equation for some category of services which makes it easier for them to calculate customer service demand of their time. This if well established can be applied to similar businesses in the industry. This approach allows for more variety and services thereby enhancing more accuracy hence addressing one of the limitations of traditional ABC.TD-ABC is quite easy to update to reflect changes in a business operating conditions. If a new variety of service is identified or introduced, the simple thing to do is to estimate the unit time required for that new service. This time will be added to the Time Equation algorithm model of each customer characteristics and total time computed. Hotel businesses can estimate this Time Equation for the services they render to varying customers to enhance proper utilization of resources in line with benefits derivable there from.

2.6. Activity Based Costing in Service Organisations

- The current accounting literature is filed with activity based costing articles about cost drivers in manufacturing settings but very few examples of cost driver applications in service organizations exist. According to[35], a number of the applications of cost drivers in manufacturing plants, however, involve service functions rather than manufactured product. Since cost driver and ABC concepts improve the cost measurement and allocation information for service departments within manufacturing firms, service businesses like hotels could also use cost driver and ABC concept. Services vary from one customer to the other, because of this; allocations should vary with the quality or complexity of service. What then is the issue is how to track these activities involved in each service and the resources consumed by it to arrive at an accurate unit cost of service. The theory behind ‘cost drivers’ is the causal relationship between cost and the resources used by the service, contract or unit. There is therefore every need to unitize service cost[36]. Variable costs vary with change of activity and it is precisely this variation, and the activity that causes the variation, that gives rise to the search for cost drivers. To[37],[38] the broadening of product line increases a company’s power to compete in the market. It leads to higher market share and end performance. However,[37] is of the view that a company may lose its cost advantage at the same time if the operations are not well understood. Most hotels offer variety of services in order to satisfy their customers. This is the same as broadening product line which under normal circumstances should make the business profitable and grow bigger. Borrowing from[37]) that a company may lose its cost advantage as it expands, the researcher is of the opinion that broadening of product/service line should be done wisely. In this case, TD-ABC system is a wise approach to consider along with the variety of services rendered. To[39] it is profitable to increase product variety by making more models out of one product. Which means increasing variety by making a similar product in the same size is unprofitable. Services offered by hotel businesses can differ, first to satisfy customers and secondly to make more profits. Profitability here is a function of the business to be able to get the accurate cost data of each unit of service by effectively allocating indirect cost. The hotel industry is critical to the economy and must be regarded as such. It is for this reason that the area is worth studying.

3. Research Methodology

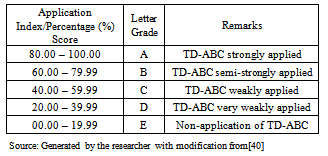

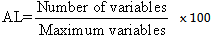

- This research is carried out to establish if the application of TD-ABC in hotel businesses will enhance their performance in terms of better cost management and profitability. The case study method provides opportunity for the researcher to understand the nature of accounting system that is in use in the hotel before the TD-ABC is practicalized comparatively. Regarding the goal of this study, the research design is an application research by case study, using descriptive survey. The researcher chooses to study how hotels are managed because hotels are vital to any economy. Visitors to any country may not spend money on any other thing but majority patronize hotels in that country. Moreover hotels are on the increase in Nigeria. Restaurants are also seen in almost all hotels.A sample of twenty hotels was purposively chosen by the researcher for this study. The researcher again choose one restaurant from one of these sampled hotels to study and practicalize the applicability of TD-ABC with a view to ascertaining its viability or otherwise. The name of the hotels well not mentioned for reasons of confidentiality already agreed with the sampled hotels. The pattern of operation of restaurants is the same in most hotels so the choice of one was deemed appropriate for the purpose of this study. Restaurants are one out of the services rendered to guest. The workability of TD-ABC here is a pointer that It will also work in other departments or service units of the hotel. Which means the whole hotel can apply it.To ascertain the percentage of application of TD-ABC in Nigerian hotels, a table and formula as below was adopted:

|

AL = application level of TD-ABC in NigeriaNumber of variables = number of hotels that are applying TD-ABCMaximum variables = sample size (total number of hotels under investigation) With the help of interview with the staff of the sampled hotels, processes, activities and services were identified to calculate cost of different customer groups and determination of their profitability using TD-ABC model. This helped the in-depth study of the selected restaurant. Interview also helped to identify the time consumed for different activities/services. Time Equations were then estimated and the time of each activity/service was multiplied by the practical cost capacity rate to assign costs to different category of customers. After all these, cost and income per month by traditional costing system and TD-ABC were compared.The method the researcher used in the collection of data in this was a combination of questionnaire, interview and observation. The methods were combined because of convenience for the respondents. For example, questionnaires will not go down well with illiterates that work in such businesses, but one could conveniently interview such persons and also observe what is been done by them. There are also some salient issues observation can not review but a questionnaire could capture answers to them.

AL = application level of TD-ABC in NigeriaNumber of variables = number of hotels that are applying TD-ABCMaximum variables = sample size (total number of hotels under investigation) With the help of interview with the staff of the sampled hotels, processes, activities and services were identified to calculate cost of different customer groups and determination of their profitability using TD-ABC model. This helped the in-depth study of the selected restaurant. Interview also helped to identify the time consumed for different activities/services. Time Equations were then estimated and the time of each activity/service was multiplied by the practical cost capacity rate to assign costs to different category of customers. After all these, cost and income per month by traditional costing system and TD-ABC were compared.The method the researcher used in the collection of data in this was a combination of questionnaire, interview and observation. The methods were combined because of convenience for the respondents. For example, questionnaires will not go down well with illiterates that work in such businesses, but one could conveniently interview such persons and also observe what is been done by them. There are also some salient issues observation can not review but a questionnaire could capture answers to them. 4. Data Presentation and Practical Application of Td-Abc

4.1. Practical application of TD-ABC in a hotel Restaurant in Makurdi-Benue State

- This restaurant is one of the predominant types of restaurants found in most hotels in Makurdi metropolis. Their menu items such as pounded yam, turning food is served with a variety of native soups namely Ashwe, Okoro, Vambe, Genger, Vegetables etc in different plates. They are some staffs that are employed for washing these plates. Customers are served at a time; a plate of food with four native delicacies and then a meat of their choice. With all these, the charge is per plate of food excluding meat. These soups are purchased in village markets by the chef and transported to Makurdi town. Preparing these soups and different type of meat consumes varing time and ingredients. The expenses incurred by the restaurant dovetail to providing capacity to serve their varying customers. The time and other resources taken to serve these customers too are not the same; it varies with the type of service demanded.A flat charge per chosen menu under-charges some customers while others are over-charged which culminate in distorting cost and profit figures of the restaurant. A proper costing system is of paramount importance to the restaurant to enhance the overall profitability of the hotel. All the above information was gathered by the researcher by participant observation and interview of staff of the restaurant. The practice in this restaurant is the same to other similar restaurant in hotels found in Makurdi, Benue State.By interview with the chef and other staff of this restaurant, time consumed for different services was identified. By the strength of this, time equations were estimated and time of each service type was multiplied by the practical cost capacity rate to assign costs to different customer groups. Lastly, cost and profitability of different customer services/group by traditional costing system operative in the restaurant and TD-ABC was compared to establish clear conclusions.

4.1.1. The Existing Costing System in the Restaurant

- An extract was made from the books of the hotel for the month of November, 2011. The extract shows sales income analysis for the month. Customers are served a plate of food with four different native delicacies at a flat charge of two hundred naira only. There is however assorted meat with different prices per piece. Total income from meat and food is added to arrive at total income per sales day. All the days sales are summed up to get the sales per month. The total sales figure for this month was 1,281,500.00. The costs incurred to run this restaurant was put at 1,938,000.00.

4.1.2. Allocation of cost under TD-ABC system

- A study of the restaurant operations revealed several activities in providing the capacity to render their routine services. These include cooking the various menu items, taking orders, preparing the kitchen, washing plates and calculating bills. This restaurant has a total of 22 staff and they work from 8am – 6pm each day. This means each staff work theoretically for ten hours per day. TD-ABC uses time as a main drive of costs, because capacities of most resources like staff and equipment can be measured by time (Kaplan & Anderson, 2007a). The aforesaid shows time required to do an activity is a key input of TD-ABC. Measurement of activities was therefore done by direct observation (time average was calculated during activity execution), interview with staff and the manager.

4.1.3. Unit Time Estimate

- Below were the time measurement revealed. 38 minutes to prepare and serve a plate of food, 20 minutes to prepare and serve each of the four native delicacies, 38 minutes for fish, 29 minutes for goat meat, 27minutes for beef and 38 minutes for chicken. Armed with this information, time equation was developed as follows;Service time=38 min.(for plate of food only)+20min. *(number of plates of the delicacies) + 38min. if Fm + 29min. if Gm + 27min. if Bm + 38min. if Cm.Fm is fish meat, Gm is goat meat, Bm is beef meat and Cm is chicken meat.

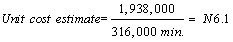

4.1.4. Unit Cost Estimate

This restaurant has 22 staff each work for 10 hrs a day amounting to 600minutes per day and 18,000 minutes per month. Under TD-ABC practical capacity is allowed at 80% of the theoretical capacity. Practical capacity will now be 14,400min. (18,000*80%) per staff and 316,800min from all the staff per month.

This restaurant has 22 staff each work for 10 hrs a day amounting to 600minutes per day and 18,000 minutes per month. Under TD-ABC practical capacity is allowed at 80% of the theoretical capacity. Practical capacity will now be 14,400min. (18,000*80%) per staff and 316,800min from all the staff per month. This unit cost means, every one minute spent to serve a customer is valued at it. Unit time estimate multiplied by the unit cost estimate help cost each customer service. These two estimates are now used to re-compute the sales income of this Restaurant and the result was a sales income of 3,379,808.

This unit cost means, every one minute spent to serve a customer is valued at it. Unit time estimate multiplied by the unit cost estimate help cost each customer service. These two estimates are now used to re-compute the sales income of this Restaurant and the result was a sales income of 3,379,808.4.1.5. Results/Findings

- The results show that income analysis using TD-ABC gave a higher income than the traditional costing system. The new income figure when subtracted from the cost for the month resulted to a profit of N1,441,808 (N3,379,808 – 1,938,000) instead of a loss when traditional costing was used. Among other reasons is that, time which is so vital in rendering a service has been better captured using TD-ABC. TD-ABC is handy managerial tool for proper cost management as can be seen from this result. The more hotels adopt this method, the more they will understand their operations hence better pricing that will culminate to higher profits. This therefore shows a positively correlated relationship. To this end hypothesis one stand a better chance to be accepted. The statement of the problem is also answered by this result. This means if TD-ABC is a tool for proper cost management and its adoption practically gives a higher profit figure then it logically follows that proper cost management enhances profitable service delivery in the hospitality industry.Questionnaires were all returned and the sorting revealed that only three hotels out of the twenty sampled actually applied TD-ABC. Using the formula AL( application level) was arrived at as 15%. That is;

From the table earlier presented, this percentage fall under 00.00–19.99 which is remarked as non-application of TD-ABC. This revealed a significant difference between TD-ABC adopters and non-adopters. Three out of twenty is clearly too low a level of adoption of TD-ABC in the hotel industry in Nigeria. The hotels are profit oriented and TD-ABC is a better were to capture their operational cost; the non-adoption of this costing method is infact inhibiting proper managerial capabilities of hotels in Nigeria.

From the table earlier presented, this percentage fall under 00.00–19.99 which is remarked as non-application of TD-ABC. This revealed a significant difference between TD-ABC adopters and non-adopters. Three out of twenty is clearly too low a level of adoption of TD-ABC in the hotel industry in Nigeria. The hotels are profit oriented and TD-ABC is a better were to capture their operational cost; the non-adoption of this costing method is infact inhibiting proper managerial capabilities of hotels in Nigeria.5. Hypothesis Testing

- Delphi technique was used to test the hypothesis in this work. Experts who were managers/owners and long serving staff of this similar business were identified. Questionnaires were served to them several times. Each round of questionnaires was analyzed to establish if responses were stable. The analyses show that the average of very good and excellent answers gave a significant percentage of 96% which was needed to confirm that the proposed model was a welcome development. With the foregoing analysis the researcher concludes that there is a statistical significant difference between TD-ABC adopters and non-adopters and that there is a positive correlation between proper cost management and profitable service delivery in the hospitality industry.

6. Limitation of the Study

- This work was limited to the extent that it did not cover the whole service units of the hotel like laundry, disco/ entertainment, room service, reception etc. This study did not also went ahead to know why this non-adoption of TD-ABC in Nigeria. It is however hoped that subsequent works will address the highlighted issues.

7. Conclusions and Recommendations

- It is clear that the existing costing system in the case study restaurant not suitable to analyze customer profitability. The system did not capture other services in its cost accumulation process. The difficulties of implementing and maintaining traditional ABC systems have prevented activity- based costing systems from being an effective, timely and up-to-date management tool. TD-ABC has overcome these difficulties. It’s easy and fast to implement, inexpensive, fast to update and it captures the complexities of an organization.Time is a vital resource especially in service businesses. The major recommendation is therefore that TD-ABC which emphasizes time usage in costing services be embraced by service businesses. TD-ABC is hence a better costing system for service businesses like hotels if profitability, growth, sustainability and development are to be emphasized. Awareness seminars with respect to costing of services should be organized by relevant government agencies to educate service business owners and managers of this Time-Driven Activity-based Costing. This will enhance better business management and effective outing at the international scene with export of products and services.The researcher recommends studies on implementation of TD-ABC system to similar service businesses like tailors, car wash, mechanics and dry cleaning outfits.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML