-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(5): 279-286

doi:10.5923/j.ijfa.20130205.01

Corporate Governance Mechanisms and Reported Earnings Quality in Listed Nigerian Insurance Firms

Musa Inuwa Fodio1, Jide Ibikunle2, Victor Chiedu Oba3

1Department of Accounting, University of Abuja, Abuja, PMB 114, Nigeria

2Accounts Department, Oil and Industrial Services Ltd, Port Harcourt, P.O Box 7458, Nigeria

3Doctoral Candidate, Department of Accounting, Nasarawa State University, Keffi Nigeria

Correspondence to: Victor Chiedu Oba, Doctoral Candidate, Department of Accounting, Nasarawa State University, Keffi Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study investigates the effect of corporate governance mechanisms on reported earnings quality of listed Insurance companies in Nigeria. The Nigerian Insurance industry has over the years faced unique challenges precipitated by lack of clear operational guidance, high premium cutting, creative accounting and weak governance dynamics. However, with the introduction of the code of good corporate governance for the industry and adoption of the International Financial Reporting Standards, it is expected that these factors inhibiting the growth of the industry would be mitigated. This study is thus poised at presenting a model aimed at ascertaining the extent to which governance mechanisms associate with creative accounting practices in the industry. Using twenty five (25) quoted insurance firms during the period 2007-2010, the study regressed five governance mechanisms on reported earnings quality proxy. Multiple regressions were employed for the analysis using the software SPSS version 17.0. The study finds that board size, board independence and audit committee size are negatively and significantly associated with earnings management while audit committee independence and independent external audit have positive relationship with discretionary accruals. The study thus recommends that the NAICOM 2009 code of corporate governance regulation on board size and board independence be made stringent and sustained and that future research works investigate other governance dynamics such as ownership concentration, audit committee diligence and institutional investors amongst others in other sectors of the Nigerian economy.

Keywords: Corporate Governance, Earnings Management, Insurance

Cite this paper: Musa Inuwa Fodio, Jide Ibikunle, Victor Chiedu Oba, Corporate Governance Mechanisms and Reported Earnings Quality in Listed Nigerian Insurance Firms, International Journal of Finance and Accounting , Vol. 2 No. 5, 2013, pp. 279-286. doi: 10.5923/j.ijfa.20130205.01.

Article Outline

1. Introduction

- As Nigeria marches forward in her desire to become one of the top 20 economies in the world by the year 2020, one dominant issue that remains on the front burner is how to build investors’ confidence in the domestic economy through good Corporate Governance and transparent financial reporting. The tragic collapses and scandals of giant firms such as the WorldCom, Xerox, and Enron Corporation highlights the critical need to focus on the anchors of sound Corporate Governance both in developed and developing countries. The bankruptcy of these giants inarguably stemmed from earnings manipulation due to fraudulent practices by the board of directors and weak governance mechanisms in place. Consequently, many shareholders lost their confidence in the affected firms and major players globally.[58] Seemingly, Corporate Governance regulations turned out to be the most significant tool to regaining the lost confidence.[2]According to Roodposhti and Chasmi, the role of Corporate Governance is to reduce the divergence of interests between shareholders and managers. Such divergence of interests could border along the management of earnings through the use of accounting accruals.[48] Sound governance mechanisms are expected to be relevant in improving investors’ confidence in the performance of the firm of which earnings is a key index. Accounting earnings, as one of the fundamental constituents of corporate information provided to capital markets is a well-used yardstick to assess firm performance. However, its reliability becomes questionable when managers have an incentive to manipulate reported earnings opportunistically. [13, 14] Such manipulations alter shareholders’ perception of the reliability of reported earnings. Qiang posited that earnings quality is a key ingredient in the corporate governance process, as accounting provides the information required for most governance mechanisms to operate efficiently.[47] However, many of the accounting principles such as historical cost, conservatism, etc cannot be ultimately comprehended unless they are viewed with a corporate governance lens. Ipso facto, there is a fellowship between governance and financial reporting quality of which reported earnings quality is a major ingredient.Almost all the high profile failures are the result of the combined effect of failures in governance and failures in financial reporting.[59] When governance structures fail to detect or prevent improper financial disclosure, a reporting failure results. Sanda et al observe that the need for a study of this nature is even more important in an environment like Nigeria, which is characterized with growing calls for effective corporate governance and financial reporting, particularly for public limited liability companies.[51]This study is thus geared at unfolding the possible relationships that exist between the various corporate governance mechanisms and earnings quality with special reference to the Nigerian Insurance Industry. The choice of the Insurance industry as a reference point is due to its vulnerability to governance and reporting abuse due to its abstract nature and the paucity of governance literature on the insurance sector. The government of Nigeria is taking calculated steps to integrate the insurance sector into the global best practices in financial reporting disclosure through the adoption of the International Financial Reporting Standard.[52] The National Insurance Commission (NAICOM) is closely collaborating with other stakeholders like the Financial Reporting Council of Nigeria (FRC), Securities and Exchange Commission, Institute of Chartered Accountants of Nigeria (ICAN), amongst others towards ensuring a full adoption of IFRS in the Nigeria Insurance sector by 2013.[28] This study is motivated by the interests surrounding the reforms engendered by the corporate governance code in the Nigerian Insurance Sector in response to corporate failures, global best practice and their expected impact on financial reporting.

1.1. Objective of the Study

- One of the most important functions that good corporate governance can play is in ensuring the quality of the financial reporting process. A salient duty of corporate governance is to ensure quality financial reporting [39]. Low et al further argue that sound governance mechanisms can upgrade the quality of financial statements. The objective of this study therefore is to ascertain the extent to which certain governance dynamics in the code of good corporate governance for the Nigerian Insurance industry have able to mitigate earnings management thus strengthening the financial reporting process and quality.

2. Underlying Theory

- This study uses the agency theory as a theoretical background to develop an empirical framework for examining corporate governance and quality of reported earnings of listed Insurance companies in Nigeria.Adelegan observes that the agency relationship arises in any situation involving cooperative effort by two or more people.[4] The relationship between the stakeholders, who are the owners of the company, and the upper echelon and board of directors is a pure agency relationship. Agency theory provides a natural backdrop of this study because financial reporting concerns arise when there are conflicts of interest between managers and owners coupled with information asymmetries. When this agency problem does not exist, financial reporting quality becomes a non-issue since managers do not have any incentive to misreport information. Ibikunle in his study demonstrates that a fundamental target of corporate governance structures is to reduce this agency problem.[28] As such, a natural link exists between corporate governance and financial reporting. Managers in practice may not divulge complete and accurate information to shareholders. This potential gap between information available with managers and what is actually divulged is called information asymmetry, which is the crux of the agency theory. Pandey observes that asymmetrical information occurs when one party or in fact both to a contract has more knowledge regarding critical information required in the contract than the other.[44] An understanding of information asymmetry is crucial for the discussion on corporate governance and reporting quality.[17]A study by Eisenherdt outlines the assumptions of agency theory – .i) Existence of divergent goals between agent and Principal .ii) Existence of Information Asymmetry either before or after contracting the agent and iii) Difference in risk preferences between agent and principal.[23]In a nutshell, the governance role of financial reporting can help mitigate the potential conflicts that exist between the principal and agent. This study aims at examining the effect of governance structures on quality of reported earnings as one of the most important internal control mechanisms in reducing one major effect of the agency relationship: information asymmetry. Agency theory has been utilized extensively by previous studies in assessing governance issues.[12, 17, 27, 43, 50].

2.1. The Insurance Industry in Nigeria

- From time immemorial, the insurance concept has been universally recognized as an essential factor in the protection of national economy since no economy can efficiently function without the support of a disciplined and prolific insurance industry. Managing risks and uncertainties has been a great challenge to humanity and insurance acts as a panacea to this problem. The Nigerian insurance industry has been in existence 30 years before the country became independent on October 1, 1960. The industry has experience ups and downs and remains the weakest link in the financial services value chain. Over the last decade, Nigeria’s financial services markets have witnessed tremendous growth thereby triggering a resurgent economy and increased investor confidence. The banking sector’s assets have grown at an appreciable compounded annual growth rate (CAGR), total value of shares traded on the Nigerian stock exchange have also been commendable. Despite this fast growth environment, actuarial science experts believe that the contribution of the insurance industry to the gross domestic product (GDP) of the nation has been extremely poor with a miserable less than 1 percent contribution. Across the 20 largest markets in the world, total insurance premiums averaged 10.1% of GDP with the UK, South Africa and Taiwan as the top 3. Nigeria ranks in the bottom 3 of global insurance markets measured by total premiums as a share of GDP; ahead of only Saudi Arabia and Algeria ( Afri Invest 2008 Insurance sector Report).Eighty (80) percent of insurers’ income is spent on operating expenses making it the highest in Africa. A huge proportion of premium income ends up as operating expenses which is not a healthy practice. Management expenses of Nigeria insurance companies are the highest in Africa as companies spend 80% of premiums on themselves. As such the insurance industry in Nigeria which ought to be an important player in the financial market has almost remained insignificant in the economy’s growth. The bane of the industry has been its poor image due to a negative claims payment reputation and creative accounting practices. It is common practice for companies in the industry to carry risks in their books for which premiums have yet to be received thus creating a false impression in the books; net operating cash flows become extremely low while such company carries a significant accounts receivable book on its balance sheet. To tackle the challenges bedevilling the industry, the government via its regulatory agency - National Insurance Commission (NAICOM) began an overhauling of the system by announcing new minimum capital requirements in 2005 (which led to mergers and acquisitions) ; setting up a code of good corporate governance for the Insurance industry in Nigeria ( in 2009) and most recently putting in place new quarterly reporting guidelines (in line with IFRS Standards). It is expected that these mechanisms would engender structural soundness, a well capitalised industry, high standards of conduct, reasonable profit declaration, and finally a domino effect on the GDP.

2.2. Prior Research and Hypothesis Development

- The relationship between corporate governance and earnings quality has been strongly debated in the context of developed countries. It is only recently that attention turned to the study of governance and earnings and earnings quality in emerging countries. The integrity of earnings quality is highly anchored on the performance and conduct of those involved in the financial reporting systems, particularly directors, management, audit committee, auditors, etc.[42] In other words, the quality of reported earnings relies on corporate governance dynamics.[28] Macit in his paper commented that governments, international institutions, regulatory agencies, and academics have increased their attention to the two concepts. [40]The link between corporate governance and quality of earnings has been strongly debated in emerging economies. Emphasis has been placed on governance dynamics such as board size, board independence, audit committee independence, audit committee size.[6, 8, 18, 55] A number of studies have reported a positive link between higher proportion of independent non-executive directors on the board and financial reporting quality.[9, 20, 36] Peasnell et al argue that since outside members do not play a direct role in the management of the company, their existence may provide an effective monitoring tool to the board and thus produce higher quality financial reports.[46] Jaggi, Leung and Gul in their paper find significant negative relation between earnings management and the presence of higher proportion of outside directors in Taiwan and Hong Kong sample; therefore suggesting that the inclusion of larger proportion of outside members provide better abilities of management to mitigate earnings management activity.[31] In a study of Malaysian firms, Abdulrahman and Ali did not find any significant evidence of a link between the board’s independence and earnings management.[3] Similarly, Park and Shin did not find empirical support on the association between earnings management and board independence in their study of Canadian firms.[45]A handful of the literature suggests a credibility of an influence of governance mechanisms on reporting quality. In this light, we hypothesize in null form that:H1 - Board Independence has no significant impact on reported earnings quality of listed Nigerian Insurance Companies.The size of the board can be associated with a good quality of financial reporting.[33] Monks and Minow suggest that larger boards are able to commit more time and effort to overseeing management due to their ability to distribute the work load over a greater number of observers. [41] Yu in a related research finds that small boards seem more prone to failure to detect earnings management.[62] A possible explanation for this is that smaller boards may be more likely to be captured by management or dominated by block holders.[63] Abdulrahman and Ali find a positive relationship between the size of the Board and earnings management.[3] Contrarily, Bedard et al identify that board size is not significantly related to the credibility of management earnings forecasts.[10] Based on the foregoing, we hypothesize in null form that:H2 – Board size has no significant impact on reported earnings quality of listed Nigerian Insurance Companies.The audit committee is saddled with the responsibility of ensuring the accuracy of the financial reports. Several studies demonstrate that the presence of audit committees is effective in reducing the occurrence of earnings management which could result in misleading financial statements.[5, 18] Yang and Krishnan find a negative association between the size of an audit committee and earnings management.[61] Ismail et al observe that a larger audit committee is more effective in detecting and preventing earnings manipulations.[30] Similarly, Lin et al find a negative association between the sizes of audit committee and occurrence of earnings restatements.[38] As such, they argue that the audit committee size is a significant factor in mitigating earnings manipulation.Additionally, Abdulrahman and Ali investigate the extent of the effectiveness of the audit committee in reducing earnings management among 97 Malaysian listed firms over the period 2002-2003. Their study reveals no significant relationship between audit committee size and earnings management.[3] In the light of the above, we hypothesize that:-H3 – Audit committee size has no significant impact on reported earnings quality of listed Nigerian Insurance companies.Agency theory suggests that the independence of a non- executive director in the audit committee contributes immensely to the audit committee monitoring function.[24] Previous studies demonstrate that independent audit committees are less likely to be associated with lower earnings management.[10, 36, 60] This is possible because independent audit committee is able to provide unbiased judgments and assessments. Xie et al examine the effect of the audit committee independence on constraining earnings management as measured by discretionary current accruals for a sample of 282 U.S firms. Their results show that audit committee independence is not significantly associated with reduced levels of earnings management.[60] Contrarily, Bedard et al in their study of 300 U.S firms for the year 1996, observe that aggressive earnings management is negatively related to fully independent audit committees. [10] In a study of 97 Malaysian firms, Abdulrahman and Ali reveal an insignificant relationship between independent audit committees and earnings management.[3] This study however hypothesizes in null form:-H4 – Audit committee independence has no significant impact on earnings management.External audit has been the bastion of assurance of the quality of financial reports contained in annual reports. External audit is the controlling mechanism used by the company to address agency problems.[57] Any manipulation of accounting information can be reduced through an audit.[32] Ahmed observes that although company management is primarily responsible for preparing the financial report, the external auditors play a key role in the disclosure practices of their clients.[7] Previous works categorize audit firms based on their size; whether they belong to the ‘big five’ or not.[26, 56] In Nigeria, the big four auditing firms are Price Waterhouse Coopers, KPMG, Delloite and Touche, and Ernst and Young. In a related study, Umoren and Peace provide evidence that the auditor type influences overall disclosure level.[54] This is possibly because large audit firms are able to provide high quality audit services due to their big reputation.[21, 37] We hypothesize therefore in null form that:H5- Audit firm size has no significant impact on the quality of reported earnings of listed Nigerian Insurance companies.This study controls for the effect of firm size in the investigated equation. Larger firms have the likelihood to employ a more sophisticated financial reporting framework which could make the detection of earnings management difficult.[28] However Abdoli and Royaee in their study of 165 Iranian companies find that the relationship between firm size and reported earnings quality is positive and confirmed. Their results indicate that firm size leads to the improvement of earnings reporting which they argued stemmed from the increase in monitoring of corporate performance.[2] This study hypothesizes in null form that:H6 – Firm size has no significant impact on the quality of reported earnings of listed Nigerian Insurance Companies.

3. Methodology

3.1. Population and Sampling Technique

- The population of this study is made up of Insurance Companies listed on the floor of the Nigerian Stock Exchange from year 2007 to 2010. This period is considered important due to the fact that the Corporate Governance Code for the Industry was established within this time frame and this period under review witnessed a lot of outcry for effective governance dynamics and sound financial reporting frameworks. As at 2010, 27 Insurance Companies were listed on the exchange. The Yaro Yamane formula was used to determine the sample size as follows:

| (1) |

3.2. Measurement of Variables

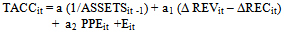

- (1)Earnings Quality – This study uses the cross sectional variation of the modified Jones model[22, 35] to measure discretionary accruals which is a proxy for earnings quality. Discretionary accruals have been extensively used as a proxy for earnings quality/ earnings management. Dechow et al argue that the modified Jones model is the most powerful model for estimating discretionary accruals. Discretionary accruals are obtained as follows:

| (2) |

| (3) |

| (4) |

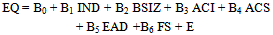

3.3. Model Specification

- To test for the hypotheses of this study, the model using the ordinary least squares regression is specified as follows:

| (5) |

4. Results and Discussions

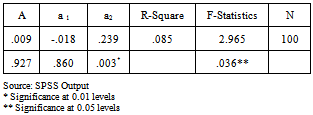

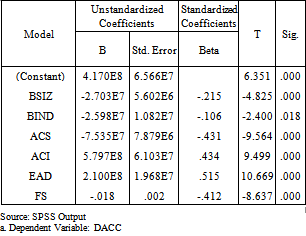

- The modified Jones model[35] model by Dechow et al[22] was used to estimate discretionary accruals. Table 1 below shows the estimated coefficients of the total accruals model. This was then disaggregated into discretionary and non discretionary accruals.

|

|

|

|

|

5. Conclusions and Recommendations

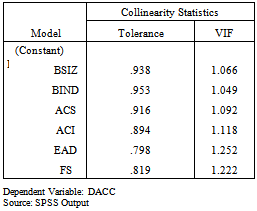

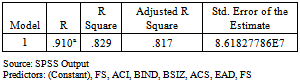

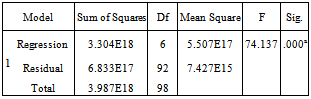

- This study was motivated by the interest surrounding the appropriateness and timeliness of reforms instituted by Corporate Governance Code in Insurance sector in Nigeria in response to corporate failures, global best practice and their implied potency in the face of tangible reform in financial reporting. It was targeted at unveiling the importance of corporate governance mechanisms in enhancing financial reporting credibility and reducing opportunistic behavior in Nigeria Insurance Industry. A multivariate regression analysis was utilized to investigate the hypothesized relationships. In line with previous works, discretionary accrual was used as a proxy for earnings quality. Results revealed that board size, board independence, audit committee size and firm size have negative association with discretionary accruals; an indicator that these variables may reduce the extent of earnings management, hence triggering higher reported earnings quality. However, audit committee independence and independent external audit were found to have a positive relationship with discretionary accruals, which implies that these variables might not reduce the extent of earnings manipulation by managers. Based on the findings of this study, the following policy recommendations are proposed: This study recommends that the SEC’s code of corporate governance (2003) on the size of board of directors (5-15) should be maintained by quoted insurance companies in Nigeria; although NAICOM’s code of corporate governance (2009) for Insurance companies in Nigeria did not make specifications on board size. Also, the study recommends that the 40:60 ratio of executive to non-executive directors as prescribed by NAICOM 2009 should be stringent and sustained. The companies and allied matters act (CAMA) 2004 states that a public limited liability company should have an audit committee maximum of six (6) members of equal representation of three members each representing the management and shareholders in place. Regulations of NAICOM seem to be silent in this area. It is recommended based on our findings, that there is strict compliance with the provision of CAMA since the size of the audit committee is a significant factor in reduction of the level of earnings manipulation. This study equally recommends to regulators that in addition to independence of the audit committee, the chairman of the audit committee should be a person with strong financial analysis background or a professional accountant. Furthermore, the composition of the audit committee should be clearly spelt out so as to enable them perform their oversight functions effectively. NAICOM’s code of corporate governance (2009) states that an auditor could serve a particular client for a maximum of 5 years. We suggest that this time frame be reviewed to a lesser period so as to prevent familiarity and forestall the tendency to compromise standard. For future related research works, we recommend a replication of this research to other sectors of the economy like banking and non financial institutions. Future research might need to investigate other governance dynamics such as ownership concentration, board diversity, and institutional investors, number of board meetings and audit committee diligence / expertise.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML