Min Hwan Lee1, Mi Joung Yoon2

1Division of Global Finance and Banking, Inha University, Incheon, 402-751, Korea

2Department of Business, Graduate School of Inha University, Incheon, 402-751, Korea

Correspondence to: Min Hwan Lee, Division of Global Finance and Banking, Inha University, Incheon, 402-751, Korea.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

In this paper, 21 life insurance companies operating in Korea were analyzed in order to understand demand factors of variable insurance and the results are as follows. The total assets, the operating expenses, the interest rates, and the risk weighted asset rate were revealed to be significant variables of domestic insurance companies, and the number of insurance solicitors, the stock price index and the total assets were significant variables of foreign insurance companies. It might be due to that foreign insurance companies are more likely to make profits through relatively more aggressive investment. Moreover, for insurance subsidiaries of banks, the operating expense, the risk weighted risk rate and the total assets were shown to have a negative relationship, but the number of insurance solicitors and the stock price index have a positive relationship. In addition, the bancassurance, the interest rate, the stock price index and the operating expense were revealed to have a positive relation but the total assets have a negative relationship for insurance subsidiaries of non bank.

Keywords:

Variable Insurance, Written Premiums, Insurance Demand, Panel Data, Balanced Panel Model

Cite this paper: Min Hwan Lee, Mi Joung Yoon, A Study on the Determinant of Variable Insurance Demand in Korea, International Journal of Finance and Accounting , Vol. 2 No. 4, 2013, pp. 259-266. doi: 10.5923/j.ijfa.20130204.09.

1. Introduction

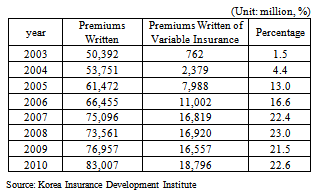

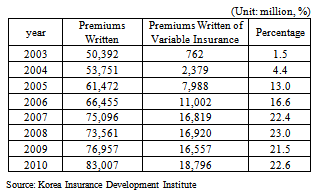

A variable insurance, first introduced in Korea in 2001 has grown at the substantially fast speed due to its unique feature of allowing insurance holders to participate in various types of investment options and the written premiums of variable insurance reached 1.88 billion won in 2006, increased from 1.1 billion won, about 1.7 times, in 2005 despite of that the written premiums was increased by 1.3 times from 6.6 billion won to 8.3 billion won for the same period. Especially, people tended to switch over to variable insurance as the inflationary hedge amid the low interest phenomenon raised by global recession. Moreover, the percentage of variable insurance has been consistently increased and reached 22.2% in 2010, and the most of variable insurance is composed with variable annuity and variable universal insurance. Interestingly, the written premium of variable annuity has exceeded of variable universal insurance. In case of conventional insurance, fixed amounts of the indemnification are paid for specified events, but variable insurance allocates a portion of premiums to various types of investment options and depending on the performance of the investment, the investment benefit would be allocated back to policy holders. However, since rate of return for variable insurance is highly sensitive for various economic variables, it is really hard for policyholders to understand the compensations of the insurance products unlike any other financial products. In other words, it could be highly susceptible for financial frauds as well as the violation of interests of policyholders so it is essential to provide a proper institutional strategy. Moreover, due to the short history of variable insurance in South Korea, methodical study on variable insurance should be executed in order to develop variable insurance as a proper asset investment product in which insurance and investment are integrated. Table 1. Total Premium Income and Premium Income of Variable Insurance

|

| |

|

Our purpose is to analyze how demand factors of variable insurance are varied over 21 life insurance companies in South Korea. These 21 life insurance companies have been divided into domestic insurance companies and international insurance companies. And we also have divided into insurance subsidiaries of bank and insurance subsidiary of non bank. In the following section, various studies on variable insurance should be properly organized, and it should be followed by the section 3 which emphasizes the analysis of demand factors of variable insurance through a verification model. As for the conclusion, the aforementioned analysis results should be organized and future study topics should be explained.

2. Survey of the Literature

As a role of the insurance industry is getting emphasized in the financial institutions, studies of the insurance industry are getting additional attention recently. Unlike any other advanced nations, a study of the insurance industry was started in 1990 since until then there were no sufficient data of the insurance industry of South Korea. In this section, previous studies on demand factors of variable insurance should be reviewed and theoretical ground for a hypothesis of this study should be suggested1. First,[1] suggested that a child support percentage, a senior support percentage, income and social welfare expenditure are positively related with insurance demand and inflation and premiums written are negatively related.[2] considered age, education background, career, income, property and years of marriage as important variables for the purchasing of life insurance and husbands play a role of a decision maker. Moreover,[3] employed a regression analysis with data of 1953 and 1962 and the analysis of correlations of variables including insurance premium and income, property, career and number of children showed that most of variables have significant influences within 1% error accuracy level.[4] analyzed demand factors of life insurance with time series data of Malaysia from 1968 till 2001 and they found that demand for life insurance is negatively related with premiums but not related with birth rate and death rate.[5] analyzed the effects of the influences of macroeconomics variables and demographic variables on insurance demand with panel data of 12 Asia nations from 1994 till 2004, and it showed that insurance demand and life expectancy are positively related and negatively related with living cost, urbanization degree and senior support percentage but the relationship with actual interest rate was assumed to be insignificant.[6] analyzed demand factors of life insurance in OECD nations and Asia nations and it revealed that the correlation of the development of the insurance market and the economy development could be varied over nations. In other words, no specific correlation was revealed in these two variables in nations including the U.S.A and U.K, but in certain nations, actual premiums was found to be positively correlated with actual GDP, and in one study of the Asian insurance market, it was shown that the legal system is a critical variable of the market. There have been a number of studies on demand factors of life insurance and variable insurance in Korea as well.[7] chose income, age, career, residential area, and the number of family members and children as an independent variable to analyze correlations between these variables and premiums. According to this analysis, income level is a variable with the largest influence over life insurance demand and that is why the economy development exerts the biggest influence over the growth of life insurance demand.[8] evaluated the income elasticity with data from 1961 to 1991 and his analysis of the relationship between per capita total premium amount per person and per capita GDP shown that the income elasticity of insurance demand is 1.6187, which can be translated as that insurance demand is increased along with the increase in national income.[9] analyzed determinant factors of insurance demands of advanced insurance nations and South Korea, and it shows that, in advanced insurance nations, the income level does not have any significant relation with the insurance demand in the life insurance industry, but expected inflation and real interest rate were found be negatively related with insurance demands. On the other hand, in South Korea, income level is positively related with insurance demand but expected inflation and real interest rate are not significantly related with insurance demand. [10] studied policyholders of variable insurance to understand how specificity of a policyholder including sex, age, education background, marital status, and income are related with variable insurance. He argued that financial organizations in Korea should have a proper management system which allows hedge against the insurance reserve goes under a specified minimum coverage by a life insurance company since it would be reasonable to expect that the insurance reserve becomes less than the specified minimum coverage amid current global financial crisis. On the other hand,[11] analyzed effects of 10 economic indicators on life insurance demands from 1971 to 2003. As for these independent variables of economic indicators, the number of insurance solicitors, disposable income, birth rate, marriage rate, aging index, interest rate, saving rate, unemployment rate, consumer price index, and stock price index, and two types of life insurance- term insurance and saving insurance- were selected. Through theoretical reviews of studies conducted in overseas and South Korea, determinant factors of life insurance demand were analyzed. This analysis showed that the number of insurance solicitors, the disposable income, the birth rate, and the saving rate have significant influence over both life insurances, but employment is a significant variable for only saving insurance. Also, the number of insurance solicitors, the birth rate and the saving rate were found to be negatively related with term life insurance demand, but the income level was shown to be positively related with it. For saving insurance demand, it was revealed that it is positively related with the income level, the number of insurance solicitors, the saving rate, and the unemployment rate. Besides them, the other variables did not affect significant influence. Lastly,[12] divided variable insurance into variable annuity and variable universal insurance and analyzed a relationship with macroeconomic variables and variable insurance with a vector error correction model. It revealed that the stock index is positively related but the interest rate is positively related temporarily and then negatively related in a consistent manner. Moreover, the unemployment rate is positively related with variable annuity but negatively related with variable universal insurance.

3. Demand Factors of Variable Insurance and Empirical Result

In this section, demand factors of variable insurance are analyzed using quarterly data with variables which show unique characteristics of companies and macroeconomic variables for empirical analysis.

3.1. Research Model and Hypothesis

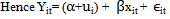

In this study, panel analysis has been adopted to understand feature of time-series and cross-section and through this model, the effects of variables such as the size of an insurance company and the number of insurance solicitors and macroeconomic variables on variable insurance demand. Panel analysis is one of regression analysis methods which can execute time-series analysis and cross-section analysis concurrently. Most of all, its biggest strength would be that it is possible to acquire additional information which cannot be gained through either time-series analysis or cross-section analysis. Due to this advantage, it has been widely applied in economic analysis. To understand the influences over variable insurance demand, the following equation has been developed.  | (1) |

Where i= 1, 2,…, n and t= 1,2,…, T | (2) |

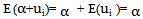

Panel model is divided into a fixed effect model and a random effect model. For a fixed effect model, it is based on a hypothesis that each company has unique variables which do not change over period, and a random effect model is built upon a hypothesis that each company has unique variables but they are changed over period. In a fixed effect model, ui is assumed to be a variable to be estimated and constants are fixed for each panel. In other words, the slope () is fixed for every panel but a constant variable (+i ) is varied over panels. On the other hand, in a random effect model, ui is assumed to be a random variable and i, an error term, is considered to be i~N(0,2u), it~ N(0,2). And for a fixed effect model, (+i ) is considered to be a fixed variable, but a random variable for a random effect model. Expectation value of a random variable (+i ) is as follows.  | (3) |

If a random effect model of the equation (1) is estimated with OLS(ordinary least squares), first-order autocorrelation of an error term might be arisen so it would not be possible to get a proper estimation with OLS. Thus, GLS (generalized least squares) should be used for a random effect model. Generally, Hausmam test is adopted to determine which a model would be proper. If p-value of the test is .1 or less, a fixed effect model should be chosen, and of the test is bigger than .1, it is reasonable to choose a random effect model. In case of this study, p- value of Hausman test was found to be bigger than .1 .Therefore, a random effect model was estimated to be proper.

3.2. Definition of Variables and Statistics Analysis Methods

3.2.1. Definition of Variables

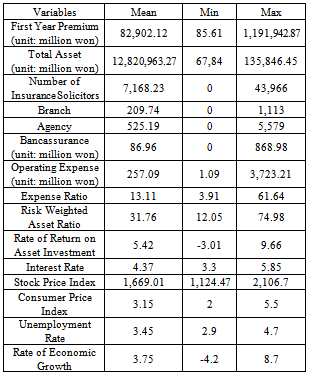

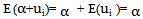

1) Dependent VariablesWritten premiums, a general index of variable insurance demand, is divided into first year premiums and the premiums after the second payment, but if premiums after the second payment is applied, the compounding effect would be risen by the continuous premium. Due to that, first year premium should be chosen as a dependent variable for this study. 2). Independent Variable (1) Total Assets Total asset of life insurance companies at the end of June 2012 is 505 trillion 409.1 billion won and since it is reasonable to assume that a company with larger assets is more stable, it would exert a positive effect on variable insurance demand. (2) Number of Insurance Solicitors According to a study of[13], people are more likely to buy a life insurance product of a life insurance company with exclusive insurance solicitors than a company without. Since insurance is a product which requires the continuous management, it is reasonable to assume that insurance solicitor plays a significant role. Thus, the number of insurance solicitors would exert a positive influence over the sales of variable insurance. (3) Agency/BranchIt is not unusual to see that life insurance companies tend to increase in both the number of insurance solicitors and agencies for sales increasing. Thus, the number of agencies and branches would exert a positive influence over the sales of variable insurance.(4) BancassuranceBancassurance is a system which allows insurance companies to use the bank sales channel in order to sell insurance products. At the beginning, it was limited to an uncomplicated sales relationship between a bank and an insurance company, but it has been evolved as that a bank and an insurance company develop a mutual insurance product or a bank establishes a subsidiary insurance company and it sells insurance products of the subsidiary insurance company.2 With bancassurance, an insurance company can decrease its operation costs since it can secure a bank sales channel to sell its products and no additional sales organization is required, and such decrease in the operation costs could result in the reduction in insurance premiums. Moreover, one-stop service would be allowed for customers to purchase financial products and insurance products at one place. Despite of such strengths, there are some significant drawbacks as well. There is a high possibility that a bank advertises its investment products in an unjust manner by forcing a customer to purchase the insurance products if the customer applies for loan, and small/medium insurance companies would go insolvency since it would be challenging for them to establish a strategic alliance with a bank. As for the conclusion, the increase in bancassurance would exert a positive influence over variable insurance demand and such effect would be more significantly shown by foreign insurance companies rather than major domestic insurance companies. (5) Expense RatioGenerally, high operating expense could be interpreted as that the ratio of benefit and insurance premium is less. In other words, there would be less benefit. Thus, it would affect the decision of customers. According to the Financial Supervisory Service of Korea, Ace Life Insurance has the highest operating expense at the end of March 2012. The expense ratio of ACE Life Insurance is 42.33%, which is about 4.5 times of the average operating expense of the industry, 9.76%, and it is followed by MET Life Insurance and PCA Life Insurance of 31.22% and 22.59%, respectively. In case of foreign insurance companies, revenue raised by special accounts is higher than those from domestic insurance companies but it is not included in written premiums calculated by the Financial Supervisory Service of Korea to estimate the operating expense, and it might be the reason that foreign insurance companies seem to have a higher expense ratio. Therefore, a special account is included in the earned premium of this study. It is not certain how the increase in operating expenses would influence on the sales of variable insurance, because even though the increase in operating expenses exerts a negative influence to revenue of policyholders, it might still exert a positive effect on the overall insurance sales since it could motivate insurance solicitors. (6) Risk Weighted Asset RatioA high risk weighted assets rate can be interpreted as that the asset quality of an insurance company would be deteriorated. Thus, the increase in a risk weighted assets would exert a negative effect on variable insurance demand. (7) Rate of Return on Asset InvestmentAn insurance company makes profits by investing the premiums it collect from policy holders and then, it pays the benefit to policy holders. Therefore, the rate of return on asset investment of an insurance company is used as a credibility index.[14] argued that the rate of return on asset investment is positively related with life insurance demand, and also[12] insisted that variable insurance demand would increase if there is higher expectation for reserve money. Thus, the rate of return on asset investment would exert a positive effect on variable insurance demand. (8) Interest RateGenerally, if an interest rate increases, demand for replacement asset would increase as well so life insurance demand would decline consequently. Therefore, the interest rate would exert a negative effect on variable insurance demand. (9) Stock Price Index Since stock is one investment mean of a life insurance company, the written premiums of variable insurance would be highly sensitive to a stock price index. If the stock price index inclines, it would exert a positive effect on variable insurance demand. Table 2. Definitions and descriptive statistics for variables

|

| |

|

(10) Consumer Price Index The choice of assets made by customers is heavily affected by the fluctuation in retail prices. Therefore, variable insurance demand would be increased in order to hedge against inflation if the consumer price index increased. In other words, the consumer price index would exert a positive effect on variable insurance demand. (11) Unemployment Rate [15] argued that if the unemployment rate goes up and there are higher probabilities that person would go into financial crisis, that person would cancel an insurance contract to get cash in the hand. The increase in an unemployment rate means the decline in an income level. Thus, the increase in an unemployment rate would exert a negative effect on variable insurance demand. (12) Rate of Economic Growth Rate of economic growth is the increase in the economic scale of one nation over a specific period (quarter or year). It expected that variable insurance demand would increase as a rate of economic growth increases. Therefore, a rate of economic growth would exert a positive influence over variable insurance demand.

3.2.2. Statistical Analysis Method

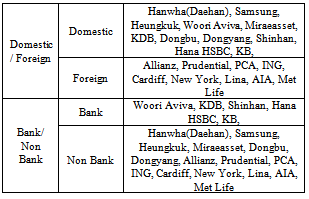

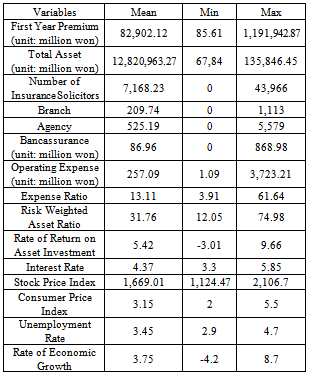

For this study, variables including total assets, the number of insurance solicitors, agencies and branches, bancassurance, operating expenses, risk weighted assets, and rate of return on asset investment of 21 life insurance companies3 in Korea were estimated with quarterly data from the first quarter of 2006 until the second quarter of 2012 and they were used as independent variables. Add to these, interest rate, stock price index, consumer price index, unemployment rate and rate of economic growth as macroeconomic variables, were subject to panel analysis to see how they would affect variable insurance demand. First of all, there were significant differences between domestic insurance companies and foreign insurance companies from various aspects. Therefore, they were distinctively separated. Also, in order to understand the sales effect of bancassurance, insurance companies were divided into an insurance subsidiary of bank and an insurance subsidiary of non bank and analyzed as well. Table 3. Classification of Insurance Companies

|

| |

|

3.2.3. Empirical Analysis Result

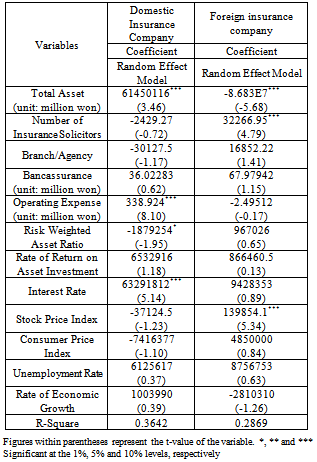

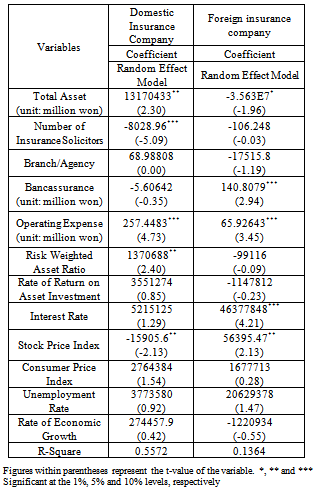

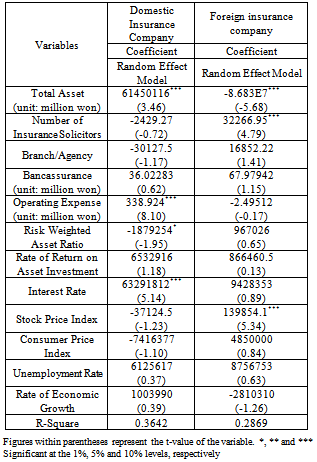

1) Domestic Insurance Company In case of a domestic insurance company, Hausmam test of the premium income of variable insurance showed that a random effect model would be proper and the total assets, the operating expenses, the interest rate and the risk weighted asset rate were estimated to be significant variables. The total assets, the operating expenses and the interest rates showed a significant positive relationship at the 1% level and the risk weighed asset rate revealed to have a significant negative effect at the 10% level and its R-Square was 0.6109. It was shown that variable insurance demand increases as the total assets and the operating expenses increase. It might be due to that the increase in the total assets would be consequently resulted in the increase in both financial stability and profits. Also, even though the increase in the operating expenses is easily assumed to have a negative influence over variable insurance demand, it could promote the motivation of insurance solicitors since marketing / advertising expenses and incentives are included in operating expenses, and at the end, it would lead to the increase in variable insurance demand. Table 4. Empirical Results

|

| |

|

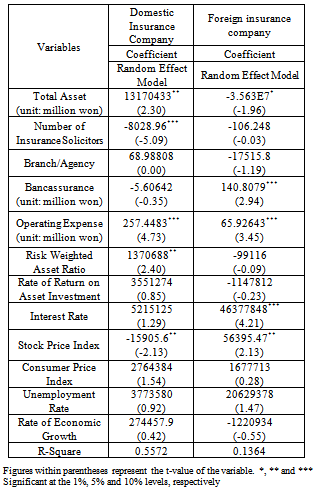

2) Domestic Insurance Company In case of foreign insurance companies, Hausmam test of the premium income of variable insurance showed that a random effect model would be proper and the total assets, the number of insurance solicitors, and the stock price index were evaluated to be significant variables. The number of insurance solicitors and the stock price index showed a significant positive relationship at the 1% level and total asset revealed to have a significant negative effect at the 1% level. It was shown that variable insurance demand is negatively related with total asset and it might be due to that sales of insurance products of foreign insurance companies are more likely affected by the increase in the number of insurance solicitors or the stock price index rather than total asset. When foreign insurance companies entered the insurance market of Korea for the first time, they emphasize the expertise of insurance solicitors with male. It was very effective because domestic insurance companies rely on insurance solicitors of medium aged women who are not experts. That might be why the increase in the number of male insurance solicitors exerted a positive effect over variable insurance demand. Interestingly, the increase in total assets seemed to have a positive effect on variable insurance demand of domestic insurance companies, but a negative effect on foreign insurance companies. It could be resulted by the difference in an organization structure. A foreign insurance company possesses only limited assets in Korea in general, so total assets of the company in Korea would exert a limited effect over insurance demand. In other words, foreign insurance companies are more likely to promote products based on the reputation of a parent company and capability of insurance solicitors rather than total assets. 3) Insurance Subsidiaries of Bank In case of an insurance subsidiaries of bank, Hausmam test of the written premiums of variable insurance showed that a random effect model would be proper. R-square was 0.5572 and the total assets, the number of insurance solicitors, the operating expenses, the stock price index and the risk weighted asset were evaluated to be significant variables. The total assets and the operating expenses were revealed to have a positive relation with variable insurance demand at the 1% level and the risk weighted asset rate at the 5% level. Moreover, the number of insurance solicitors showed a negative relationship with variable insurance demand at the 1% level and the stock price index at the 5% level. It is widely believed that insurance subsidiaries of bank are relatively stable comparing to insurance subsidiary of non bank since most of them are affiliated companies of a bank, but despite of such beliefs, the size of an insurance subsidiary of bank is not sufficient enough to assure its stability. Therefore, potential customers for an insurance subsidiary of bank are highly sensitive to not just reputation of the corresponding bank but also the size of the insurance company. Also, it is shown that the increase in operating expenses has a positive influence over variable insurance demand and it might be due to that advertising/marketing cost of an insurance subsidiary of bank exerts relatively larger influence over insurance sales. Table 5. Empirical Results

|

| |

|

Interestingly, it is showed that there is no significant effect of bancassurance on variable insurance demand. It could be interpreted as a result of the regulation on the sales of insurance products of an insurance company at a parent bank and aggressive sales of small/medium insurance companies. 4) Insurance Subsidiaries of Non bank In case of an insurance subsidiaries of non bank, Hausmam test of the written premiums of variable insurance showed that a random effect model would be proper. R-square was 0.1346 and the operating expense, the bancassurance, and the interest rate were revealed to have a positive relation with variable insurance demand at the 1% significance level and the stock price index at the 5% significance level. On the other hand, total asset was shown to have a negative effect at the 10% level and the bancassurance have a positive effect at the 1% level in contrary to an insurance subsidiary of bank, and it might be resulted by the regulation on the sales of insurance products of an subsidiary insurance company at a parent bank and aggressive sales of small/medium insurance companies, as explained above. [12] insisted that the increase in the interest rate shows a positive effect temporarily and then exerts a negative effect afterwards and in this study, it was found that the increase in the interest rate has a positive effect over variable insurance sales since the most of variable insurance reflects the actual interest rate and the increase in the interest rate resulted in the increase in the dividend. As the aforementioned, the increase in the operating expenses was found to lead the increase in variable insurance demand. Even though the increase in the operating expense is easily assumed to have a negative influence over variable insurance demand, it could promote the motivation of insurance solicitors since marketing/advertising expenses and incentives are included in operating expenses, and at the end, it would lead to the increase in variable insurance demand. In addition, it was shown that the increase in the number of insurance solicitors rather exerts a negative effect on variable insurance sales in insurance subsidiaries of bank.

4. Conclusions

In this study, 21 life insurance companies operated in Korea were analyzed in order to understand demand factors of variable insurance and the results are as follows. First of all, the total assets, the operating expenses, the interest rate, and the risk weighted asset rate were revealed to be significant variables of domestic insurance companies, and only the risk weighted asset rate was shown to have a negative relationship with variable insurance demand. The risk weighted asset rate represents the degree of troubled assets so the decrease in the risk weighted asset rate could be interpreted as that financial stability is enhanced and that is why it could act as a positive factor for variable insurance demand. The number of insurance solicitors, the stock price index and the total assets were significant variables of foreign insurance company and only the total assets were found to have a negative relationship with variable insurance demand. It might be due to that foreign insurance companies are more likely to make profits through relatively more aggressive investment. Moreover, for insurance subsidiaries of bank, the operating expenses, the risk weighted risk rate and the total assets were shown to have a negative relationship, but the number of insurance solicitors and the stock price index have a positive relationship. In addition, the bancassurance, the interest rates, the stock price index and the operating expense were revealed to have a positive relationship but the total asset have a negative relationship for insurance subsidiaries of non bank. The interesting part is that the interest rate has a positive relation and it contradicts with the previous studies which insisted that customers are more likely to switch to other financial products providing higher interest rates than insurance products.4 [16] claimed that the actual interest rate is rather directly reflected on dividend insurance products so the increase in the interest rate would consequently lead to the increase in variable insurance demand. Even the operating expense was revealed to have a positive relationship despite of a common belief that high operating expense is not beneficial to customers. Higher operating expenses could be interpreted as more investment is made for sales/management as well. Thus, it could exert a positive effect on variable insurance demand. Also, it was drawn that the written premiums of variable insurance increase along with the increase in the stock price index and it might be due to the natural feature of variable insurance that the profitability of variable insurance increases as the stock price index increases. From the aforementioned, it would be possible to deduce that it would be more beneficial for an insurance subsidiary of bank to make more investment on marketing or advertising rather than hiring insurance solicitors since the number of insurance solicitors is inversely related with variable insurance demand in case of an insurance subsidiaries of bank. On the other hand, when insurance companies are divided into domestic/foreign insurance companies, it would be reasonable to assume that the increase in the operating expenses is positive for a domestic insurance company and the increase in the number of insurance solicitors for a foreign insurance company. Variable insurance is an insurance product highly sensitive to macroeconomic variable and internal regulations, because variable insurance makes a profit by investing the collected premiums and returns it to policyholders. Therefore, the decrease in the stock price index and/or negative internal policy could exert a negative influence over not only policyholders but also potential customers. Accordingly, insurance companies should establish proper sales strategies upon this study result to have a competitive edge. Various factors have an influence over variable insurance demand because of the complicated structure of variable insurance, but only limited variables have been analyzed in this study. Therefore, in the future study, more various types of factors including political and economic factors should be selected. Also, domestic insurance companies should be divided into major insurance companies and small/medium insurance companies and/or variable insurance should be classified into permanent variable insurance, variable annuity and variable universal insurance to get more accurate analysis results.

ACKNOWLEDGEMENTS

This work was supported by INHA UNIVERSITY Research Grant.

Notes

1. There have been only few studies on variable insurances so studies on demand factors of life insurance have been referred as well. 2. Kookmin Bank, the largest bank of South Korea, entered the insurance market with its subsidiary company ‘KB Life’ after taking over Hanil Life. Also, Shinhan bank and Hana bank entered the insurance market with 'SH&C' and ‘Hana Life’, which are subsidiary companies established after taking over the existing insurance companies. 3. Hanwha(Daehan), Samsung, Heungkuk, Woori Aviva, Miraeasset, KDB, Dongbu, Dongyang, Shinhan, Hana HSBC, KB, Allianz, Prudential, PCA, ING, Cardiff, New York, Lina, AIA, Met Life 4. It is an interpretation that customers are more likely purchase an investment product to hedge against inflation even if there is some risk if the interest rate is low, so the decrease in the interest rate would lead the increase in variable insurance demand.

References

| [1] | M.J. Browne and K. Kim, “An International Analysis of Life Insurance Demand”, the Journal of Risk and Insurance vol. 60, 1993 |

| [2] | T. L. Childers and O. C. Ferrell, “Communications and Notes Husband Wife Decision Making In Purchasing and Renewing Auto Insurance”, Purchasing and Renewing Auto Insurance, 1981 |

| [3] | J. D. Hammond, D. B. Houston and R. Melander, “Determinants of Household Life Insurance Premium Expenditure: An Empirical Investigation.”The Journal of Risk and Insurance vol. 34, 1967 |

| [4] | C. C. Lim and S. Haberman, ‘Macroeconomic Variables and the Demand for Life Insurance in Malaysia’, Working Paper, CASS Business School, City University of London, 2003 |

| [5] | S. Sen, “An Analysis of Life Insurance Demand Determinants for Selected Asian Economics and India”, Working Paper, Madras School of Economics, India, 2008 |

| [6] | D. Ward and R. Zurbruegg, “Does Insurance Promote Economic Growth? Evidence from OECD Countries”, the Journal of Risk and Insurance 67, 2000 |

| [7] | Young June Kwan, “Dynamic analysis of Korean life insurance demand-the change of the propensity in 80s”(Korean), monthly research papers, Insurance supervisory Service, 1990.1 |

| [8] | Dong Min Na,” The implication of life insurance industry under financial deregulation” (Korean), research paper series 95-01 KDI, 1995 |

| [9] | Jong Hyup Shin and Dai Gyo Seo, “The Determinants of Insurance Demand in Selected Developed Countries Including Korea”(Korean), Journal of Insurance and Finance, vol. 20 no. 3, 2009 |

| [10] | Kyoung Heon Song, “The studies of contract of variable annuities based on contract characteristics”(Korean). The Graduate School of Kyounghee University, 2010 |

| [11] | Mi Hyun Lee, “An Empirical study on the demand for life insurance products in Korea”(Korean), The Graduate school of Sogang University, 2005 |

| [12] | Jin Tae Hwang and Dai Gyo Seo, “Impact of macroeconomics variables on initial premiums in variable life insurance with a vector error correction model”(Korean), Journal of Insurance and Finance, vol.21 no.3, 2010 |

| [13] | J. J. Burnett and B. A. Palmer, “Examining life insurance ownership through demographic and psychographic characteristics”, The Journal of Risk and Insurance vol. 51, 1984 |

| [14] | T. F. Cargill and T. E. Troxel, “Modeling Life Insurance Savings: Some Methodological Issues”, Journal of Risk and Insurance, vol. 46, 1979 |

| [15] | J. F. Outreville, “Hole-life insurance lapse rates and the emergency fund hypothesis, Insurance Mathematics and Economics 9, 1990 |

| [16] | Soon Jae Lee and Seong Moon Yang, “An Analysis on Determinants of Life Insurance Dema nd Using Panel Data: Focusing on Whole Life, Sickness & Accident and Variable Life”. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML