-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(3): 150-163

doi:10.5923/j.ijfa.20130203.03

The Impact of Service Quality on Financial Performance and Corporate Social Responsibility: Conventional Versus Islamic Banks in Egypt

Nevine Sobhy Abdel Megeid

Accounting Lecturer, Ph.D, CMA, Arab Academy for Science, Technology & Maritime Transport, Faculty of Management and Technology, Egypt

Correspondence to: Nevine Sobhy Abdel Megeid, Accounting Lecturer, Ph.D, CMA, Arab Academy for Science, Technology & Maritime Transport, Faculty of Management and Technology, Egypt.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This empirical study seeks to show the impact of bank’s service quality on customer satisfaction and improving financial performance, which in turn will affect the Corporate Social Responsibility implementation in the Egyptian Conventional banks versus Islamic banks to find out which of the banking streams are performing better. For this study, sample of 8 Conventional banks and the 2 major Islamic banks in Egypt were selected. This study compares the profitability, operations and liquidity ratios of Conventional and Islamic banks of Egypt. The study is done on the financial statements analysis for the period 2003-2009, based on Bankscope database. The study found that there is a positive relationship between the profitability and operation levels and liquidity performance, at both conventional and Islamic banks. Also the results reveal that conventional banking has better financial position than Islamic banking, which indicate their higher expenditure ability and commitment toward their Corporate Social Responsibility.

Keywords: Service Quality, Customer Satisfaction, Liquidity, Financial Performance, Corporate Social Responsibility, Conventional and Islamic Banking in Egypt

Cite this paper: Nevine Sobhy Abdel Megeid, The Impact of Service Quality on Financial Performance and Corporate Social Responsibility: Conventional Versus Islamic Banks in Egypt, International Journal of Finance and Accounting, Vol. 2 No. 3, 2013, pp. 150-163. doi: 10.5923/j.ijfa.20130203.03.

Article Outline

1. Introduction

- Egypt is among countries that established Islamic financial systems alongside conventional interest based institutions, as it neither supported nor opposed Islamic finance to operate within its financial system[1]. Islamic banks play a leading role in social services such as the development of human resources, protection of environment, promotion of human rights and constructive participation in community development programs. The religious injunctions interweave Islamic financial transactions with genuine concern for ethical and socially responsible activities and simultaneously prohibit involvement in illegal activities or those, which are detrimental to social and environmental well-being[17].The concept of Corporate Social Responsibility (CSR) has emerged as a trend in banking sector and has closely been associated with the concept of sustainable development and social economy. The role of CSR is very significant in producing a sustainable banking by linking banking operations to the interests of all the stakeholders including management, products and services, community and environment[35]. CSR is considered as a result of the growing consumers groups demand not only quality in products or services but also demand certainty that the productive process is organized following some ethical standards[13].Banks focus on service quality as an input to customer satisfaction for long-term benefits and business success. Banks have realized the importance of service quality for successful survival in today's global and highly competitive environment. Financial sector is becoming more conscious about the performance evaluation regarding quality of products/services according to customers’ expectations, as there is a positive correlation between financial performance and customer service quality scores. Customer satisfaction plays an inter-mediator role in the relationship between service quality and financial performance of the banks[3].The current practices of Islamic financial institutions reveal their divergence from their Islamic and developmental principles besides their modest share in savings and in developmental long-run projects. Although such deviation has been justified by the emergence of Islamic finance within a restrictive framework of governmental policies, Islamic financial institutions themselves share the responsibility of their slowdown in the Egyptian economy. This is because of their policies, which made them similar in operations to conventional banks, seeking to maximize their profits on the account of their socioeconomic developmental mission[1].This paper is organized as follows: Section 1 presents the literature review, objective and research hypotheses development. Section 2 shows the relationship between service quality and customer satisfaction / retention. Section 3 explains the link between customer satisfaction / retention and financial performance of conventional versus Islamic banks. The impact of financial performance on banks expenditure/commitment to Corporate Social Responsibility is discussed in section 4. Data and research methodology are presented in section 5 followed by results analysis and discussion in section 6 and section 7 concludes.

2. Literature Review

- Duncan and Elliott[16] explore empirically the relationships between efficiency, financial performance and customer service quality among a representative cross-section of Australian banks and credit unions and the correlation between these categories of measures. Results show that all financial performance measures (interest margin, expense/income, return on assets and capital adequacy) are positively correlated with customer service quality scores.Farook[21] proposes a structured definition of the social purpose of Islamic Financial Institutions (IFIs) derived from, among other things, Islamic principles of social equity and redistributive justice. It is posited that IFIs are meant to be socially responsible for two interrelated reasons: their status as a financial institution fulfilling a collective religious obligation and their exemplary position as a financial intermediary. Specific responsibilities within this dual role are also framed allowing for a clear structured logic for IFIs to implement policies.Demetriou[15] shows that CSR strategies have been embraced by the international banking community, CSR practices can play a key role in contributing to sustainable development while enhancing innovative potential and competitiveness. CSR is about businesses deciding to go beyond legal requirements attempting to reconcile economic obligations, as well as social and environmental expectations. Nelling and Webb[33] examined the causal relation between CSR and financial performance and found that positive stakeholder relationships can reduce the likelihood of difficulty when dealing with groups such as employees, customers, and the community. In addition, good social performance and good managerial practice may be related, so this in turn may lead to strong financial performance. It was found that firms with strong shareholder rights tend to have a lower cost of equity capital than competing firms, which supports the idea that reducing agency problems between stakeholders and management improves financial performance.Setiawan and Darmawan[39] investigate the CSR and firm FP as well as the relationship between the two variables. The CSR and firm FP are calculated from the annual (sustainable) report of firms listed in LQ45 of the Indonesian Stock Exchange Market. The results show that the CSR activities conducted by firms are still relatively low. Furthermore, the panel data estimation suggests that CSR has the positive effect on the firm financial performance and also indicate that the financial crisis in 2008 reduced the positive effect of the CSR on the firm financial performance.Ahmed[5] examines the relationship between CSR and Corporate Financial Performance (CFP), by investigating the banking sector of Bangladesh. The results of the study revealed that the average return on asset ratios of the banks having high corporate social performance (CSP) is higher compared to that of the banks having low CSP.Alafi and Alsufy[6], their study has three objectives. First is to investigate the set of relationships among the CSR services and Customer Satisfaction (CS); second is to find the relationships between CSR services and Financial Performance (FP); and third is to examine the mediating effect of CS on CSR services and FP. The results suggested that provision of CSR services is associated with CS. This is consistent with results of prior studies reporting a significant positive association between the CSR services and CS as was the positive relationship between CS and FP. Furthermore, this study found CS mediated the relationship between the CSR services and FP. Arshad[9] examines the effect of Islamic CSR disclosure on corporate reputation as well as performance. These relationships are examined based on content analysis of annual reports of 170 Islamic banks in Malaysia for 2008-2010. Results of this study provide evidence that CSR activities communicated in corporate annual reports are significantly positively related with corporate reputation as well as firm performance. These results indicate that CSR activities disclosures from Islamic perspectives are equally important business strategies in creating continuous superior performance for organizations.Nor[34] discusses the concept of CSR from an Islamic view with special reference to the moral values that are essential in Islam. The concept of western CSR that highlights ethical and moral values is inevitably embedded in Shariah. It is suggested that IBF be morally conscious by reexamining the objective of Islamic (moral) economy that upholds the spirit of socio-economic justice. The empirical study shows the practice of CSR in Islamic banking is still incomparable to its conventional counterparts. Islamic banks should come out of the dogma of giving charity and performing Zakah in a traditional manner in order to be socially responsible.Samina[38] try to find out whether the Islamic Banks of Bangladesh are adhering to the prescribed forms of the CSR activities or not. This paper is mainly designed based on the CSR forms to be followed by Islamic banks as has been prescribed by Farook[21] in his study “On CSR of Islamic Financial Institutions” under the light of Islamic Shariah. The research found compliance to the mandatory forms by the 6 full fledged sample Islamic banks in Bangladesh whereas variety in involvement in recommended forms of CSR activities by considering the scenario of banks from 2007 to 2011. The study also founds a strong positive correlation between CSR expenditure and sample banks’ deposit, loan and profitability.

2.1. Objective of the Study

- The literature on Islamic banking is focusing only on commercial and economic aspects of Islamic banking, while social issues pertaining to its practices are not well considered. This literature even goes further to claim that Islamic banks are no different from other commercial banks except in complying with Shariah legal prescriptions concerning product offering. This view posits that Islamic banking is a normal commercial entity which has a sole responsibility of carrying out business in a manner consistent with Islamic law, while social welfare objectives are to be fulfilled by other bodies such as the government.The main objective of this paper is to examine the dependency of Corporate Social Responsibility expenditure/commitment (measured in terms of liquidity levels) on financial performance (measured in terms of profitability and operations levels), through comparing between Conventional versus Islamic in Egypt.This study answers the following research questions:1. What is relationship between service quality and customer satisfaction?2. What is the impact of increasing customer satisfaction / retention / loyalty on the financial performance of Conventional versus Islamic Banking in Egypt?3. What is the relationship between the improvement of the financial performance and the Corporate Social responsibility expenditure ability and commitment of Conventional versus Islamic banks in Egypt?

2.2. Research Hypotheses

- To answer the previous research questions, the following two research hypotheses were developed:H1: There is a positive relationship between service quality, increasing customer satisfaction/retention, improving financial performance and Corporate Social Responsibility expenditure ability/commitment of Conventional versus Islamic banking in Egypt.H2: The financial performance of Conventional banks is better than those of Islamic banks, which positively influence their Corporate Social Responsibility expenditure ability / commitment.

3. Service Quality and Customer Satisfaction

- Islamic banking can no longer regarded as a business organization which is established to fulfill religious duties but what is more important, to be as competitive as possible side by side with the conventional system in alluring more customers and retain them. Competition ensures that the costs of production are minimized and at the same time, it promotes efficiency and could force banks to operate more efficiently in order to survive. It forces the banks to produce products and provide services that are most demanded by the customers more efficiently and with the least cost, so they can make more profits[28].Islamic banks are striving to capture the maximum number of customers to compete with conventional banks by providing a large number of products as an alternative for interest based products[3]. Inevitably, Islamic banks need to understand the perceptions of their customers towards their business operations particularly their quality of service rendered to increase customer satisfaction and ultimately their loyalty[36], by offering a variety of products according to customer’s expectations. It is reported that banking and financial services are the integral part of services industry and its contribution is increasing with the passage of time[4]. It is theorized that competence, communication, commitment, and conflict handling, will directly influence trust and relationship quality, and indirectly influence customer loyalty. Banks must give and keep promises, communicate timely and reliable information to customers on new services, changes in services, and when problems occur, it should keep customers informed on what the bank is doing regarding the problem. Banks must be willing to adjust customers’ needs, be flexible and innovative in providing services[32].Service quality is intangible, and it is defined in terms of subjectivity, attitude, and perception. Service quality is the consumer’s judgment about an entity’s overall excellence or superiority. It is a form of attitude, and results from a comparison of expectations to perceptions of performance received. Delivering quality service means conforming to customer expectations on a consistent basis[29]. Service quality is an antecedent of the broader concept of customer satisfaction and the relationship between service quality and loyalty is mediated by satisfaction, the higher levels of service quality lead to higher levels of satisfaction[37]. Quality of service is essential for customer satisfaction, repeat purchases, winning customer loyalty, and customer retention. It also affects companies’ market share, and thus profitability[26]. Customer loyalty is a deeply held commitment to re-buy or re-patronize a preferred product or service in the future despite there are situational influence and marketing efforts having the potential to cause switching behavior[32]. One of the strategies that would enhance customer loyalty is through service quality and it has been related to success in service organizations including Islamic banks, which will be a significant indicator to differentiate an organization among the rest of the competitors[36]. It is found that the banking industry has a link between service quality and customer satisfaction. Islamic banks working assessed their performance in reference to service quality and customers' responses[3].Banks provide financial inter-mediation, consultancy and agency services that are diversified with the passage of time. Service quality helps to gain competitive advantage for long-term customer relationship. Then service quality was linked with satisfaction of bank customer to assess the magnitude of the relationship[4].Customer satisfaction often depend on the quality of customer services includes factors such as treating customers with courtesy and respect; staff ability to convey trust and confidence; efficiency and effectiveness in handling any transaction; knowledgeable and preparedness in providing solutions and answers concerning bank’s products and services. Despite the most popular claim that Islamic banks are true reflections of Islamic-compatible formulation that the clients themselves respect and believe in, previous empirical studies found that religious motivation is not the sole criterion for the selection of Islamic banking institutions or services. Factors, such as cost and benefits, service delivery (fast and efficient), size and reputation of the bank, convenience, and friendliness of bank personnel, are important criteria for the customers in selecting a particular Islamic or Conventional bank[18].The five dimensions of service quality include[8]:1. Tangibles: Customers make inferences about the service quality on the basis of that surround the service environment (appearance of physical components).2. Reliability: Dependability of service provider and accuracy of performance.3. Responsiveness: Promptness and helpfulness.4. Assurance: Knowledge and courtesy of employees and their ability to inspire trust and confidence.5. Empathy: Caring, individualized attention the bank gives its customers.Banks that excel in quality service can have a distinct marketing edge since improved levels of service quality are related to higher revenues, increased cross-sell ratios, higher customer retention, and expanded market share. Likewise, provision of high quality services enhances customer retention rates, helps attract new customers through word of mouth advertising, increases productivity, leads to higher market shares, lowers staff turnover and operating costs, and improves employee morale, financial performance and profitability and is a must for success and survival in today’s competitive banking environment[2].Banks seeking to maximize profitability have come to realize that good quality helps a bank obtain and keep customers and poor quality will cause customers to leave a bank. Service quality is one of the most effective means of establishing a competitive position and improving profit performance. To establish a competitive position, banks must measure and determine their level of service quality, if they desire to keep their customers and satisfy their needs[2]. Service quality is a factor impacting financial institution performance as measured by profitability. Service quality improvement implies increased spending by organizations. Service quality has a measurable impact on customer retention, market share and profitability (Duncan and Elliott, 2004).

4. Customer Satisfaction and Financial Performance

- Customer satisfaction is a post purchase attitude formed through mental comparison of the quality a customer expects to receive from an exchange, and the level of quality the customer perceives actually receiving. Customer satisfaction results in behavioral outcomes such as customer retention, commitment, creation of a mutually rewarding bond between the user and the service provider, increased customer tolerance for services and products failures, positive word-of-mouth advertising about the organization, increased future customer spending, and it might result in more selling, attracting new customers, lowering costs, and greater profitability[24].Banks interested in acquiring and keeping loyal customers should strive to earn customers’ trust as well as build quality relationship with customers. Customer loyalty apart from profitability; can reduce the cost of business operation by five to six times[32]. The Islamic banking activities should be structured on customer-focused angle and the client’s specific needs and requirements[22].In Islamic banking, customer satisfaction is based on providing CSR based customer service, Islamic banks now focusing on increasing customer satisfaction and customer loyalty through improved quality of customer service[28].Customer satisfaction positively affects customer retention which leads indirectly, together with customer loyalty, to greater profitability because they secure future revenues lower costs and attract new customers, who as valuable assets increase profitability. Reduced customer turnover is advantageous; in particular, have shown that a 5 % increase in customer retention could increase banks profitability by an average of 50 %[6]. Customer satisfaction was related to financial performance by customer retention which secured future revenues, established a better comparative position in the banking industry, increased customer loyalty and its ensuing advantages for stakeholders and all these were mirrored in financial performance[24]. Core value as the development of CSR is used in marketing strategies and in customer retention management in order to create distinctive, long-lasting relationships with customers and stakeholders. CSR can be understood as the voluntary integration of social and environmental concerns into business operations and interactions with stakeholders[19]. CSR incorporates the tenets of; environmental sustainability, business ethics, governance, public relations, stakeholder analysis and relationship marketing[11].

5. Financial Performance and Corporate Social Responsibility

- Two different trends in defining CSR in the literature, the first trend tries to define CSR from the viewpoint of social issue management, and makes great efforts to identify the additional responsibilities of firm beyond making a profit. CSR is the ethical and legal compromises and duties of the enterprise with their groups of interest. These compromises and duties come from the impacts of the enterprise’s activity over the social, labor, environmental, and human rights ambits[13]. The other trend define CSR from the viewpoint of stakeholder management, and argues business have an obligation toward “society/broad stakeholders” beyond the interests of their owners and shareholders. CSR defined as societal expectations of corporate behavior; a behavior that is alleged by a stakeholder to be expected by society or morally required and is therefore justifiably demanded of a business[23]. CSR means bringing corporate behavior up to a level where it corresponds to currently prevailing social norms, values, and performance expectations; it furthermore entails anticipating new societal expectations before they are codified into legal requirements[41].Most definitions of CSR cover combinations of the following themes; treatment of employees, supporting local communities, environmental performance, human rights and ethical conduct with competitors, suppliers and customers [11].CSR is the continuing commitment by business to behave ethically and contribute to economic development, while improving the quality of life of the workforce and their families as of the local community at large[12], examples of CSR include support of local businesses or charities, developing recycling programs, and promoting minority employment. Though these activities certainly result in societal benefits, opinions differ as to whether a firm’s CSR activity enhances financial performance[33].Wood (1991) distinguishes three principles of CSR which each operate on a different level: (1) The principle of legitimacy: This principle operates on an institutional level. (2) The principle of public: This principle operates on an organizational level. (3) The principle of managerial discretion: This principle operates on an individual level[40].Organizations operating within the principles of Islamic moral law (Shariah), such as Islamic banks, are exposed to additional demand with regards to their CSR initiatives[9], it should be undertaken to fulfill religious obligation and to achieve other non-material objectives such as to secure social needs. Islamic banking strives for a just, fair and balanced society as envisioned and deeply inscribed in the objectives of Shariah. Accordingly, the many prohibitions (e.g. interest, gambling, excessive risks, etc.) are to provide a level playing field to protect the interests and benefits of all parties involved in market transactions and to promote social harmony[17].The social well-being function as the objective of Islamic banks serving the tents of maintaining social security, protection of progeny and preservation of the Islamic state, becomes a description of ways and means of financing resource mobilization that establish sustainability and the high ideals of the Islamic faith[14].Conventional banking is fundamentally based on the debtor-creditor relationship between the depositors and the bank on the one hand and between the borrowers and the bank on the other, with interest as the price of credit, that reflect the opportunity cost of money. The creditor should not take advantage of the borrower. When money is lent on the base of Riba (interest), it often leads to the unfairness[10]. Unlike conventional banking system, the Islamic banking system prohibits interest; instead, it promotes profit and loss sharing (PLS) in all conduct of banking businesses. Besides that it also promotes giving Zakat (Islamic tax), prohibition of monopoly, and cooperation for the benefit of society, and development of all Halal aspects of business, that are not prohibited by Islam[20].In a Shariah compliant bank, financial performance is achieving social justice through successful investments where profits are shared with investors and borrowers. It is more a partnership where banks are entrusted to invest, and any profit generated will be shared, PLS is a totally different concept from the conventional depositors’ and borrowers’ relationship where the depositors will receive interest based on the funds deposited into the bank’s account and borrowers pay interest on the loan received[24]. Islamic banks become as much investment oriented financial intermediaries as they are agencies of sustainability of the socio-economic order, the socio-political order and preservation of community assets[14]. Islamic banking is governed by the Islamic Shariah laws which provide rules to encompass the allocation of resources, management, production, consumption, capital market activity, and the distribution of income and wealth[31].Therefore, Islamic banking is much more than just refraining from charging interest and conforming to the legal technicalities and requirements on offering Islamic financial products[17]. Islamic banks are therefore carryout their operations and organize their plans and programs according to such a general outlook of finance with socio-economic development. It would then combine the goals of economic efficiency and social justice into complementary relations with each other[14]. The author agrees that the importance of financial system stability for aggregate economic activity has been increasingly emphasized. This is especially true for a developing economy, where banking sector acts as a dominant source of business financing. Thus, it is important that the intermediary function of banks be carried out at the lowest possible cost in order to achieve greater social welfare. Obviously, lower bank margin will lead to lower social costs of financial intermediation[25].Social responsibility applied to the finance and banking industry is materialized by social responsible investments. This means that only investments that satisfy the socially responsible criteria adopted by the financial institution will be used[31]. Profitability is not the sole criterion or the prime element in evaluating the performance of Islamic banks, since they have to match both between the material and the social objectives that would serve the interests of the community as a whole and help achieve their role in the sphere of social mutual guarantee[17].The service-profit chain concept reinstated the role of quality in superior performance for any service organization. It highlights the following chain of linkages: profitability of a service firm depends on the loyalty of its customers; customer satisfaction brings loyalty; satisfaction depends on the value the customers derive from the firm offerings; customer loyalty is the result of higher satisfaction with service leading towards stimulation of financial performance [30]. CSR reports issued usually go beyond profit maximization to include the company’s responsibilities to a broad range of stakeholders including employees, customers, community, and the environment[23].CSR, including increased profits, customer loyalty, trust, positive brand attitude and combating negative publicity, are well-documented[27]. CSR can be used to strengthen corporate reputation and profitability by signaling to the various stakeholders with whom the organization interacts that it is committed to meeting its moral obligations and expectations beyond common regulatory requirements[15].

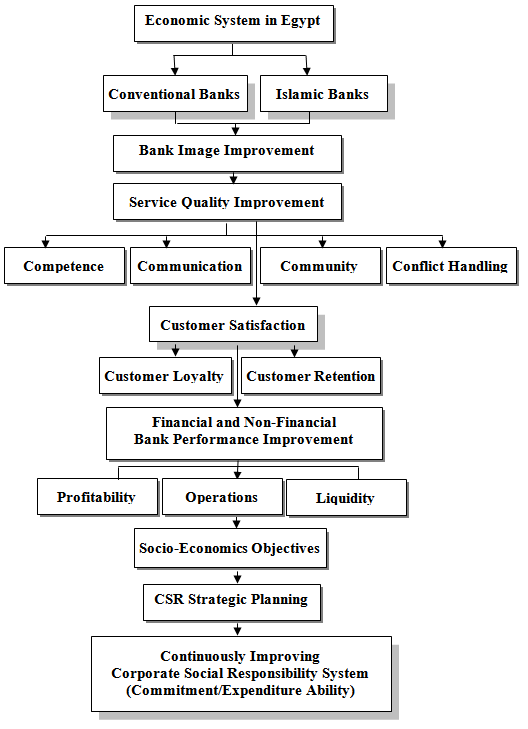

| Figure (1). The relationship between the research variables |

6. Data and Research Method

6.1. Research Data

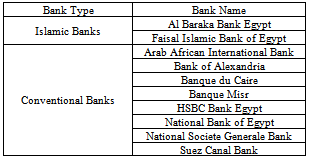

- The data are obtained from the Bankscope database. The sample of the study consists of 8 Egyptian Conventional and 2 Islamic banks covering the period from 2003-2009, it is used to compare between these two systems regarding their ability to implement CSR. Total 2 Islamic banks and 8 Conventional banks are included in the sample, as mentioned in table (1).The researcher used the only two Islamic banks – Faisal and Al Baraka – because they are the only two major well known Islamic banks in Egypt until now, and that is because it is predicated in the future to increase under the new Islamic regime – after the 25 January Egyptian revolution. Also the number of Conventional banks used in the sample is selected proportionately based on the number of Islamic banks, for statistical reasons.The author use Faisal Islamic bank and Al Baraka bank as they are the major Islamic Banks in Egypt. According to the 2012 report of Alexandria bank[7], Egypt has the highest share among the North African countries with Shariah Compliant assets corresponding to USD 7 billion representing 4.9% of its total assets that is equivalent to USD 144 bn., and if it was compared to Algeria and Tunisia as the Shariah compliant assets there reached USD 1 bn. and USD 0.8 bn. respectively. Egypt has the largest Islamic bank in North Africa which is Faisal Islamic bank of Egypt with total assets USD 5087 mn. and its rank is the 43rd among the top Islamic banks in the world, But it remains a relatively small institution if it is compared to National Bank of Egypt which has total assets of USD 46380 mn. Al Baraka Bank in Egypt came in the second place among North Africa countries however its rank is 81st among the Islamic banks in the world with total assets USD 2135 mn[7].

|

6.2. Research Methodology

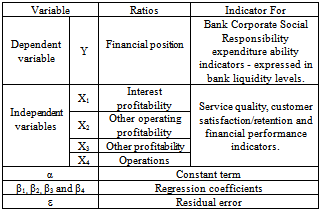

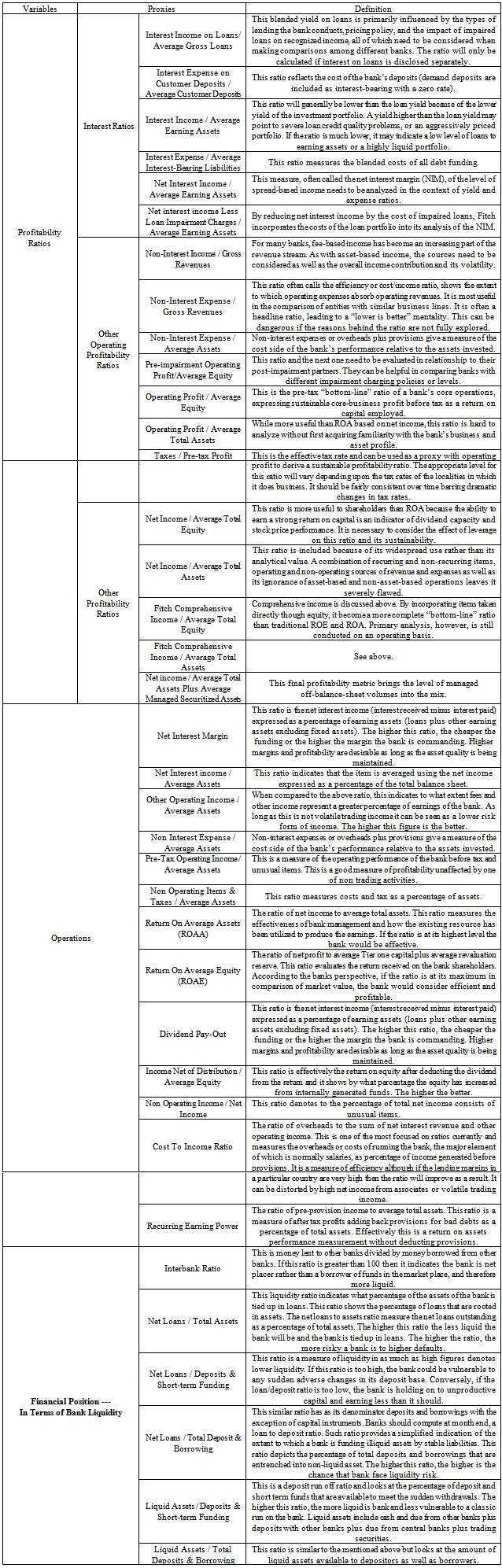

- The following regression model is used to test the research first hypothesis which states that there is a positive relationship between service quality and increasing customer satisfaction/retention and improving financial performance on Corporate Social Responsibility expenditure/commitment of Conventional versus Islamic banks in Egypt.This hypothesis assumes there is a positive relationship between the profitability and operation levels and the financial position - liquidity levels of Islamic banks versus Conventional banks.Y = α + β1 X1 + β2 X2 + β3 X3 + β4 X4 + εThe regression model is applied to estimate the relationship between liquidity and five explanatory variables. Table (2) identify the regression equation variables, all definitions were obtained from the Bankscope database and shown in table (3).The researcher argues that there are many factors affect the Corporate Social Responsibility and also there are many measures used to measure its level in the literature, but in this study we emphasis on the bank CRR expenditure ability, so we examine the impact the bank financial position have on this ability. The study tries to find the relationship between having a strong financial position and high liquidity level and the increase in the expenditure ability of the bank for CSR. The researcher in this study argues that if the bank financial position is weak this in turn increase the chance that bank face liquidity risk, which will affect the bank Corporate Social Responsibility expenditure ability.

|

|

7. Results and Discussion

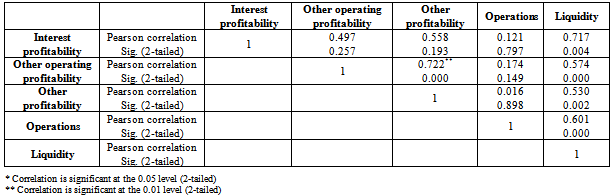

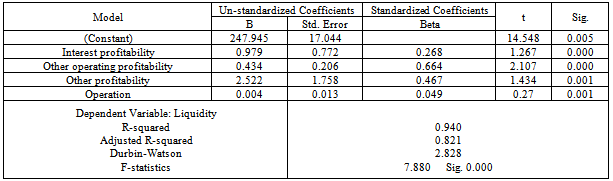

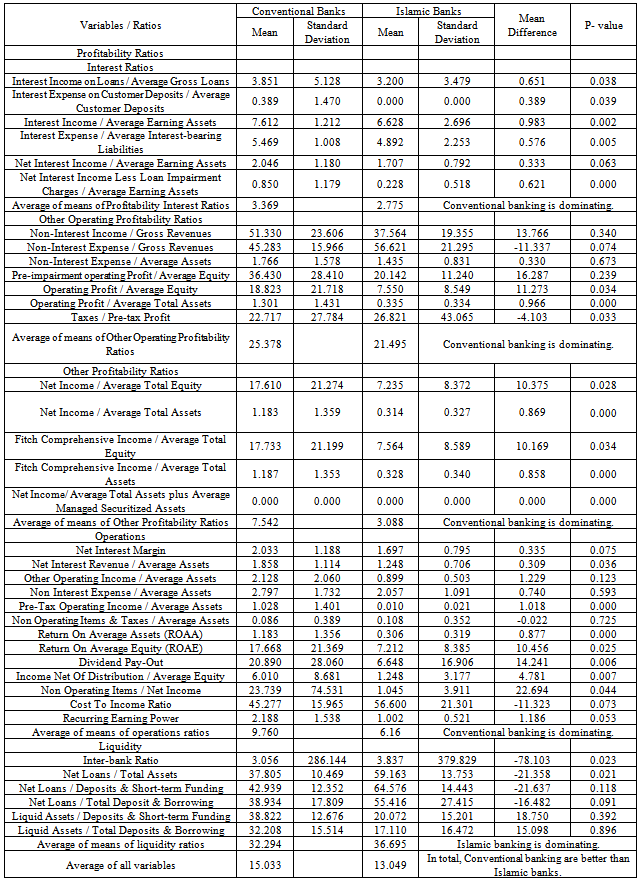

- The ratio analysis on the historical data from the period 2003-2009 of the CBs and IBs of Egypt is done using SPSS. Before hypothesis testing, the testing of some classical assumptions will be made by testing its normality, heteroscedasticity and multicollinearity. A method of analysis used in this study is multiple regression analysis. Multiple regression equation is used to test the first hypothesis and descriptive analysis to verify the second one.The researcher uses these two banks as a representative for the other banks, as they are the oldest major two banks in Egypt for Conventional and Islamic banking sector, and their statistical results can be correctly generalized on other banks in their sectors in Egypt.Tables (4) and (5) reveal the correlation matrix for all explanatory variables. The results of Pearson correlation coefficients show that the problem of multicollinearity among all the explanatory variables is absent. As for the conventional and Islamic bank, the Pearson correlation coefficient shows the positive relationship between the four independent variables and liquidity. Tables (6) and (7) represent the linear regression results of model I and II respectively. For conventional and Islamic banks, there is a positive relationship between profitability and operation levels and liquidity. In model I - conventional banks and model II - Islamic banks, the values of R-square are 51.2% and 94% respectively which signifies the change incur in liquidity due to changes in profitability and operation levels. The Durbin-Watson test of model I and II 1.892 and 2.828 respectively indicates that there was no serial correlation between independent variables and liquidity.The regression model arising from the above data is of the form;Y = 893.431 + 0.935 X1 + 1.900 X2 + 0.380X3 + 0.369 X4 + εThe model means that there is a positive relationship between liquidity, profitability and operation efficiency. The estimated coefficients of interest profitability and other operating profitability (0.935 and 1.900 respectively) indicated that the profitability levels contributes positively to liquidity, and the estimated coefficients of other profitability and operation levels (0.380 and 0.369) indicated that they contributes positively also to liquidity but marginally. The t-test indicates that the liquidity that depends on all the explanatory variables is significant. ANOVA F4,2 statistic of 1.769 is significant with a P-value > 0.05.

|

|

|

|

|

- The regression model arising from the above data is of the form;Y = 247.945 + 0.979 X1 + 0.434 X2 + 2.522X3 + 0.004 X4 + εThe model means that there is a positive relationship between liquidity, profitability and operation efficiency. The estimated coefficients of interest profitability and other profitability (0.979 and 2.522 respectively) indicated that the profitability levels contributes positively to liquidity, and the estimated coefficients of other operating profitability and operation levels (0.434 and 0.004) indicated that they contributes positively also to liquidity but marginally. The t-test indicates that the liquidity that depends on all the explanatory variables is significant. ANOVA F4,2 statistic of 7.880 is significant with a P-value > 0.05. According to Pearson coefficient values that reveal the existence of a positive correlation between variables tested, our first hypothesis will be accepted, leading to the conclusion that the increase in profitability and operation levels (the improvement in service quality and customer satisfaction / retention / loyalty), the higher the liquidity of the bank (improvement of financial performance) and its commitment and expenditure ability toward Corporate Social Responsibility.Considering the research sample comparison between 8 conventional and 2 major Islamic banking in Egypt, in terms of Corporate Social Responsibly, Descriptive statistics analysis is used to test the second hypothesis which states that the financial performance and liquidity position of Conventional banks are better than those of Islamic banks, which positively influence their Corporate Social Responsibility expenditure ability / commitment.The profitability, operation levels and liquidity of both banking systems are compared to identity which have the greater ability and better financial performance for corporate social responsibility commitment / expenditure. Descriptive statistics for the second hypothesis variables are reported in table (8) which shows the values for mean and standard deviation for the variables. The calculated results revealed that the profitability and operation levels of the conventional banks of more than Islamic banks. The average interest profitability mean of Conventional banks (3.369) is better when compared to Islamic banks (2.775). The average of mean for operations is much higher for the Conventional Banks (9.760) compared to the Islamic ones (6.16). The analysis indicates that Conventional Banks are better in managing their operations.For the liquidity performance, the average of mean for the Conventional Banks (32.294) is lower compared to the Islamic ones (36.695). The analysis indicates that Islamic Banks are better in managing their liquidity. It provides clear evidence that Islamic banks are in growing stage and trying to get more benefits from commitment of the funds.As a total, the average calculated for the average of means for the four variables (interest profitability, other operating profitability, other profitability, and liquidity) shows that Conventional Banks (15.033) are performed better regarding these variables compared to Islamic Banks (13.049), which indicates that the Conventional Banks are more effective in managing their corporate social responsibility compared to the Islamic Banks. The second hypothesis test result proved that the conventional banks financial performance has a positive influence on corporate social responsibility expenditures ability/commitment.

8. Conclusions

- The study reveals that service quality is most significant predictor of banking service customer satisfaction. This suggests that management should ensure that the banking environment should concentrate on fair and prompt service to their customers. Service quality is positively related to customer satisfaction which in turn enhances better financial performance. Also the results reveal that customer satisfaction is most significant predictor of banking service quality. This suggests that management should ensure that the banking environment should concentrate on fair and prompt service to their customers. CSR positively influences customer satisfaction toward banking service quality. Based on the results of hypotheses testing and the analysis which has been carried out it is concluded that there is a positive relationship between CSR and financial performance and the descriptive and inferential measures shows that corporate social expenditure depends upon the financial performance of the bank. This positive and direct link found between customer service quality and profitability and liquidity reveal that financial performance is a key motivator for banks to CSRFinancial performance of conventional versus Islamic banks is better, which is positively related to CSR. Good financial performance makes available the funds with which banks can invest in ways that improve their environmental and social performance.The author argues that Islamic banks cannot depend only on financial performance to survive in this ever-changing scenario of global competition, but owes a social responsibility to the various stakeholders in which they exist. Managers need to be convinced that social-welfare and profit maximization objectives need not be conflicting goals. Instead, commitment towards various social-welfare initiatives and programs could be used as a strategic marketing tool to enhance reputation and secure stakeholders allegiance, which is beneficial and profitable for the business in the long run.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML