-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(3): 138-149

doi:10.5923/j.ijfa.20130203.02

Trends of Development and Factors of Competitiveness of Banking Sector in Global Economy – Empirical Study from Slovakia

Dana Kiseľáková1, Jaroslava Hečková2, Alexandra Chapčáková2

1Department of Finance and Accounting, Faculty of Management, University of Prešov in Prešov, 080 05 Prešov, Slovakia

2Department of Economic Sciences and Economy, Faculty of Management, University of Prešov in Prešov, 080 05 Prešov, Slovakia

Correspondence to: Dana Kiseľáková, Department of Finance and Accounting, Faculty of Management, University of Prešov in Prešov, 080 05 Prešov, Slovakia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The main aim of this paper is to investigate development trends and analyze factors affecting competitiveness and growth of banking sector and changes in these factors over time using regression models, selected statistical indicators, balance sheet variables, and bank profit rate in macroeconomic environment with a focus on Slovakia as member of the Euro area. The method of empirical sector and trend analysis, regression and correlation analysis and economic modelling are used. The relationships between the dependence of the banking sector profitability and macroeconomic growth have been surveyed and quantified using regression models spanning a period of seven years (2004-2010) to ten years (2001-2010). Simple or multiple regression models (M1-M6) accurately reflected the real development of the banking sector in Slovakia. Since these sector variables are not dependent on the Slovak historical context, the models can be readily applied to other central European economies. There are found development trends and selected market factors of competitiveness and growth of banking sector that informed the analysis, such as effective liquidity management, quality of balance sheets assets and trend of the assets increase in total with crucial share of earning assets (loans), efficient management of interest policy and net interest margin, and increasing of profitability rate from long-term aspect. These regression models could further be used to improve the profitability of financial enterprises and competitiveness against crises.

Keywords: Factors of Competitiveness, Banking Sector, Macroeconomic Environment, Regression Models

Cite this paper: Dana Kiseľáková, Jaroslava Hečková, Alexandra Chapčáková, Trends of Development and Factors of Competitiveness of Banking Sector in Global Economy – Empirical Study from Slovakia, International Journal of Finance and Accounting, Vol. 2 No. 3, 2013, pp. 138-149. doi: 10.5923/j.ijfa.20130203.02.

Article Outline

1. Introduction

- The competitive banking sector is considered to be as one of the most significant and important component parts of economy in market economies and is a reflection of its degree of development, since it considerably participates in its economic growth. Banking sector in Slovakia can be categorized as an economy branch that has undergone the significant quality-, quantity- and dynamic changes and complicated processes during its development. The processes of restructuralization, recapitalization and privatization, international integration, mergers, acquisitions and entering of foreign capital after 2000 considerably contributed to the formation of a modern banking sector and to the increase of international competitive environment. On the other hand, the efficient regulation of banking sector within the international scope appears to be necessary in connection with the maintenance of its financial stability and liquidity, performance and competitiveness in the global macroeconomic environment. Potential problems of instability of banking sector can have a negative impact on the development of whole economy evidenced by the global crisis, which arose in the banking, financial sector of the US and the global changes on financial markets. The important development trends in the EU in the field of banking regulation, banking supervision and capital management are represented by the international agreements on capital Basel, Basel II and Basel III. The logical result of variability of economic environment and cyclic development are the risks, what became evident also in the global economic and financial crisis within 2007-2009 and its subsequent development as sovereign debt crisis and euro crisis. The development of macroeconomic indicators in 2010 and the development in 2011 showed a stimulation of the global economy with a trend of regression of the global crisis, stabilization of banking sector and reduction of risks. In response to the global crisis and tightening of banking business regulation, new, tighter global regulation rules of capital adequacy have been approved in September 2010 under the name Basel III with effects from 2013. What is main problem of competitiveness of banking sector and which factors determine it most of all? The paper also investigates and points out selected factors of increasing of competitiveness of banking sector in relation to the trends of profitability of commercial banks and to the changes in development of stability and rate of return of banking sector in global environment with the impacts on economy. The development, growth dynamics and competitiveness of banking sector and banks as specific entrepreneurial companies in Slovakia are conditioned by the stability and macroeconomic development of Slovakia within the EU, Euro area and development on global financial markets. The usefulness of competitive environment is not, as one of a few questions, disputed in the economic theory, what is observed in[1] and[2]. These authors,[1] and[2] furthermore emphasize, the competitiveness, quality of competitive environment and performance rate can be measured by various manners and methods (such as Benchmarking, Balanced Scorecard, multi-criteria financial analysis and other). To measure and quantify the competitiveness and performance rate of banking sector as necessary component part of the market economy means to define a way by which the commercial banks will quantify their growth, market share and market power in achieving of set business goals. In assessment and measurement of competitiveness of banks, it is appropriate to create and apply an assessment system in such a way, so as it includes the assessing criteria in three basic dimensions: interbank assessment of internal processes and financial results, market assessment – the assessment of bank performance rate in relation to the actual and future conditions of competition at the bank market, the assessment of the satisfaction rate and loyalty of bank clients[2]. For financial sphere, to which this article is focused, there are the criteria having the nature of global financial indicators of rate of returns such as profit rate, rate of return on equity (ROE), rate of return on banking assets (ROA), net interest margin[1] and others. From long-term aspect, the financial criteria would be selected by a bank’s strategy type. For a growth strategy, the turnover (volume) growth rate in the defined target segments and bank products is one of the important indicators. Within the basic strategy, for expected and quantified growth, it is possible to determine the ROA growth, hence the turnover (volume) growth in the client segments, which is based on the bank balance structure. The indicators of bank rate of return are oriented to the analysis of achieved profit/loss in connection with searching for an optimum relation between profit maximization on one hand and the necessity to account for the riskiness of banking activities and observe the bank liquidity on the other hand[3]. In relation to the growth and competitiveness strategy in the longer term, it is necessary to pay continuous special attention to efficient and quality management of bank profitability[4].Earlier empirical studies (e.g.[5],[6],[7]) deal with these problems and the analysis and investigation of relations between selected macroeconomic indicators from the point of view of economic and financial stability of economies, competitiveness, efficiency and profitability of banks. Additional empirical studies investigate the relations between profit rate, market concentration and competitiveness of banks. The existence of a monopoly in banking sector in Finland in the given period of time pointed out in[8]. The macroeconomic framework, sphere of monetary policy and credit availability at a credit market in relation to the amount and allocation of capital and bank liquidity is surveyed and analyzed in the further studies[9],[10]. A price and market interest rate has the considerable influence on the volume of loans provided and lending rates and this mutual relation of development of interest rates and credit market in the context of global changes is analyzed by Degryse, Havrylchyk, Jurzyk, Kozak[11] and Jorge[12]. He concluded that credit markets response to the changes of interest rate (especially to a decrease) with considerable delay, what can be influenced especially by the amount of equity of the commercial banks. Differences in the quantitative impact of macroeconomic factors among banking sector and loan categories are evident in study by Louzis, Vouldis, and Metaxas[13]. The influences of legislation of Basel II and its necessity for bank capital regulation and quality of credit portfolios were the subject of survey in several European studies[14],[15],[16]. The important presumption of the stability, rate of return and competitiveness of commercial banks is the efficient management of assets-and-liabilities structure[4] and especially the management of prices of credit transactions within the framework of that management and competitiveness[17]. The important instrument of banks in management of bank credit transactions is economic modelling[18]. A model, in an simplified way, means that mutual relation of items within bank assets and between them, as well as factors that influence the most suitable way of solution of return of credit transactions, are specified by mathematical relations and statistical methods with the aim to make a profitable credit transaction and to have profitable bank as a whole. From the point of view of a bank, the moment of completion of a credit transaction is the selection of optimum option and implementation of as highest earnings as possible while observing the appropriate, acceptable risk. Banking models are undergoing continuous development and assume the view on bank as a multidimensional unit with broad variability of options. The quality of commercial bank can be measured, inter alia, by the share of earning assets in total amount of assets those points out in[19]. The aim of the commercial banks is to achieve the requested profitability of the diversification credit portfolio on consistent and long-term basis, in accordance with adopted strategic intentions and targets of the bank, namely by the consistent management of credit risk, accent some authors such as[20] and[21]. The main risks for financial stability of the commercial banks in relation with business activities include credit risk. It is possible to state that the credit risk of banks is one of the main specific problems in banking sector at the management of banking credit transactions for the existence of the risk of banking credit portfolio, highlight[1] and[15]. Furthermore, Polouček in[1] point out that wrong management of credit risk used to be considered the one of most important causes of bank crises. These authors such as Polouček[1] and De Haas[15] came to the opinion that banks have a tendency to approach to the assessment of credit risk and provision of credit transaction less cautiously in the period of economic growth. The result can be a worsened quality of the credit portfolio, which will become evident in the period of a recession by the increase of the share of non-performing, failed loans, what is emphasized by Marcucci and Quagliariello[22]. The management of credit risk of credit portfolios is therefore one the most important tasks for the financial liquidity and stability of banking sector in connection with increased sensitivity of banks to the credit risks and changes in the development of prices of financial instruments at the time of financial crisis, what is stated by Liao[23] and Ebnother and Vanini[24] in their studies. The distinguishing risk of the dynamics of movements at the credit market is therefore a credit risk, the efficient management of which by management models became one of pillars of modern banking management within the framework of Basel II and Basel III. The underestimation of it or insufficient management can logically have the negative impacts on management of banks, banking sector as well as the economy as a whole. The financial situations develop newer and more progressive procedures for making the management of banking risk more efficient[1],[25]. At the same time, they find new financial instruments as a mean of the transfer of financial risks, what is emphasized by Sivák, Gertler, Kováč[26] and many others.

2. Methodology, Methods Applied and Data

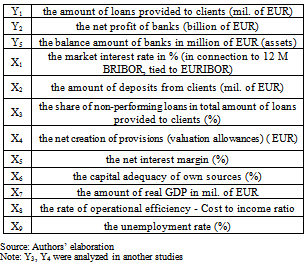

- The objective of this paper is to identify and analyze the development trends and selected factors of competitiveness and growth of banking sector in Slovakia in relation with macroeconomic development using regression models. The following main methods are used to achieve the aim: the method of empirical sector and trend analysis, regression and correlation analysis, economic modelling and synthesis. In processing of study, the information from specialized economic and scientific literature, electronic information sources, statistical data of Statistical Office (SO) of Slovakia, available analytic data from the National Bank of Slovakia (NBS) balances, Analyses of the Slovak financial sector, Monthly bulletin of NBS and the European Central Bank (ECB) and statistics of the Slovak banking association (SBA), Eurostat and the European banking federation (EBF) were used. Within the framework of the methodology the main problematic fields, which create the platform for scientific and economic discussion are analyzed:→the analysis of current status of competitiveness of banking sector (29 commercial banks, incl. branches of foreign banks) in relation to selected indicators of banking rate of return, balance structure and indicators of the growth of economy in Slovakia within the EU, the analysis of financial stability of banking sector of Slovakia from the aspect of profitability – the empirical sector analysis, →the analysis of development of selected macroeconomic indicators – market factors – the growth rate of the volume of assets of balance structure as one of the factors of the competitiveness growth, loans and deposits volume, the change of market interest rates – loan prices, quantification of dependencies between selected parameters by trend, regression and correlation analyses and regression models,→the monitored time period is seven years (years 2004-2010) or ten years (2001-2010) and source data are in economic time series by Arlt, Arltova[27],→ the analysis of trends of development and selected factors of competitiveness and growth of banking sector of Slovakia, in the global macroeconomic environment.The main interest rates present the most important instrument, by which the monetary policy of banks influence the actual economic activity and inflation. It is possible to point out that interest rates of the monetary policy are projected into the market interest commercial banking credits by the instrument of interest rates. It is especially by the reason that the banking sector has the main role in provision of financial sources to economic entities. The risk of changes of interest rates is one of the important risks, influencing the banking business. The cut or increase of the interest rates within the monetary policy is usually consequentially projected on similar movements of interest rates on inter-bank market, which then become evident within trading and interest policy of the commercial banks in costs of economic entities at credit financing. It is needed to note that interest rates of commercial banking credits tend to show some no flexibility in response to the changes of monetary policy in the sense that they response more quickly to the increasing of interest rates with the monetary policy than to their cut. It is supposed that the relation of development of interest rates and credit volume will be inversed, i.e. if the price of credits will be lower, the demand for credits will be higher.The presumptions of the regression analysis, regression modelling and procedure of the regression analysis: →the presumption and quantification of linear dependence between dependent variables (Y) and selected independent variables (X), i.e. parameters from real financial environment of Slovakia which influence the competitiveness of banking sector, identification and quantification of factors, investigation of dependencies and influences of variables by the regression and correlation analyses,→the analysis, whether it is possible to set up a statistically significant regression linear model (M) between dependent variable and independent variables (a simple or multiple linear regression model), which would correspond with the actual development in banking sector of Slovakia,→the construction and description of a linear regression model by following relation, expressed by general equation.The task of modelling is to estimate the regression coefficient β in the equation:

| (1) |

|

3. Results and Discussion

3.1. Macroeconomic Framework of Analysis of Competitiveness of Banking Sector in Slovakia –empirical sector Analysis

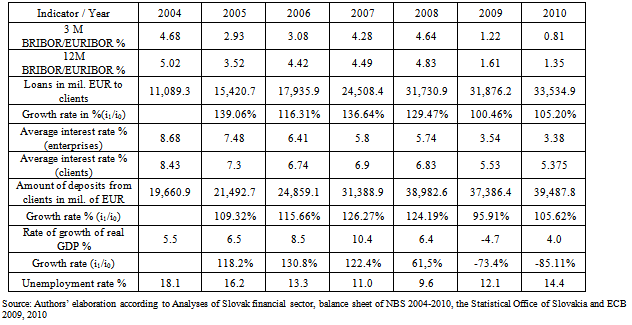

- Slovakia continued in stimulation of economic activity during 2010. The growth rate of real GDP of Slovakia in particular quarters was positive and came under very good results within the euro area. The growth rate was 4.0 % for 2010; however, it is to be assessed in the context of the depression of previous crisis period. Based on global economic development there was the real GDP of Slovakia’s growth rate 3.3 % in 2011. The EU as a whole and the euro area underwent a stimulation in 2010 and a slow growth in 2011, since there was an impact of a risk of sovereign countries (high deficits and increasing sovereign debt of some countries, weakness of banking sector as a result of the global crisis). The positive trend of macroeconomic development of Slovakia, supported by the export in the EU in 2010 was linked by the development in the banking sector. Table 2 documents the course of development selected macroeconomic indicators and banking analytical data in Slovakia[28]. As it results from trend analysis, the trend of development of amount of deposits and loans was positive for period of time 2004 – 2008. As for credit price for entrepreneurial sector, the development trend was also positive (decreasing trend of the interest rate, the simplification of credit standards, and availability of credits). The negative trends, related to the global financial crisis started to be evident in the economy of Slovakia (GDP -4.7%) and in the banking sector during 2009, as well as by gradual worsening of the financial position and performance rate of the entrepreneurial sector, which lasted during 2010. The banks made the credit standards at new credits for enterprises tougher already in the second half of 2008 and took expected economic development into account. Based on skills and development of economic practice, the banks offered lower amounts of credits in 2009 especially to the entrepreneurial sector, for shorter period of time, they require higher collateral for credits and they include the increased risks into interest margins. The banks expect the increasing need to pay attention to defaulted loans, and portfolios of risk credits. A risk of interest rate change impact is one of the major risks the banks and banking sector is exposed to onto financial markets in the context of the global changes. The crisis years 2009 and 2010 were the period of low interest rates, as it is documented by this table.

|

|

3.2. Competitiveness Growth Factors of Banking Sector in Slovakia – regression and Correlation Analysis and Models

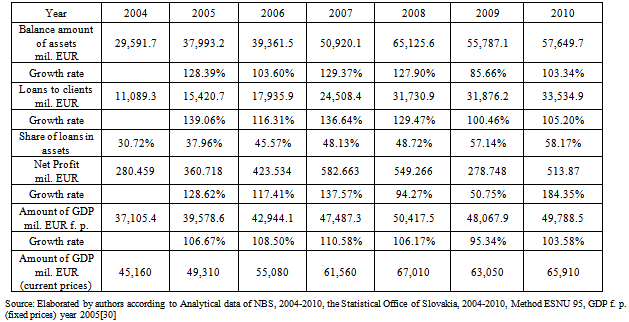

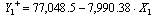

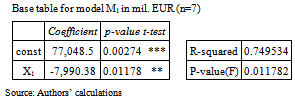

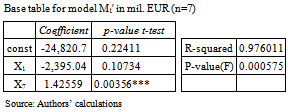

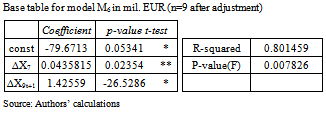

- Based on the economic theory, the development of particular branches and sectors within economies of particular countries is conditioned by the development and advancement of the whole economy. To survey and quantify the dependency for a regression analysis, there are selected indicator a balance amount of banking sector (the total amount of assets, with crucial share of earning assets) and an amount of real GDP. The trend of advancement of the balance amount of banking sector and profitability in banking sector of Slovakia is, to a large extent, similar to, interconnected with, dependent on the advancement of economy depending on economic growth, measured by the increase of amount of real GDP. If the economy grows, there is an assumption of a growth of the banking sector as well, what is documented by the analysis shown in following Table 4.Within the regression modelling, the selected parameters from the given table of input data are analyzed using period of time of seven years for surveying of the dependencies. In connection with searching for an answer for H1, the parameters of the linear regression model M1 (b0,b1) were estimated, in which the dependent variable was the amount of loans provided to clients in million of EUR (Y) and explanatory variable was the average interest rate on credit market for clients in %, connected to BRIBOR/EURIBOR (X1). According to fundamentals of the economic theory, it is expected, that if the price of loans on market is decreasing, a demand for loans will increase, what would result in the increase of total amount of the loans provided to clients (but it could result in a growing of the amount of defaulted loans and credit risk of banks within longer period). The following shape of the regression equation by the method of least squares was estimated:

| (2) |

| Figure 1. Interdependence between balance amount of assets and amount of GDP (current prices) |

| (3) |

|

| (4) |

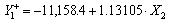

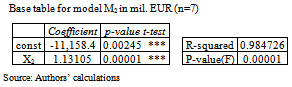

The model as a whole is statistically significant at the selected significance level, likewise the parameter at X2. The model explains 98.47% of the variability of the dependent variable. According to the used tests, there is neither autocorrelation nor heteroskedasticity present in the model. The amount of the loans provided will rise by EUR 1.13105 mil. When the increase of the amount of deposits from clients by 1 mil. EUR occurs. As for numerical values of variables, a slight decrease of total amount of deposits occurred in 2009, what probably was connected with worsened macroeconomic situation caused by spreading impacts of the global crisis and the slump of economic activity. It was found that a general strong dependence was confirmed between the increase of the amount of deposits from clients and the increase of the amount of loans, while the increase of the amount of deposits by a unit results in the increase of the amount of loans by, in average, 1.13105 units. Although, the decrease of the amount of deposits by approx. 10% occurred at the end of 2009 compared to 2008, the change in the amount of deposits resulted in minimum rising of the loans amount. However, at the same time, it may indicate the providing of more toxic credits, which may, in future, have impact on the credit risk of banks of making investment by banks into less toxic assets, than credit transactions. In connection to searching for an answer for hypothesis H3 and quantification of the dependence, it was analyzed and examined the dependence of the development of banking sector on macroeconomic development, on the evolution of the real economy of Slovakia for monitored period of seven years. In the period of economic growth, it was expected also the positive development of banking sector. In the period of economic downturn, a slow-down of growth of economic sectors, as well the banking one is supposed. There were estimated the parameters of the linear regression model M3 (b0, b1), in which the banks’ balance sheet amount in mil. EUR (Y) was the dependent variable and real GDP amount in mil. EUR (X7) was the explanatory variable. The regression equation in the following shape was estimated:

The model as a whole is statistically significant at the selected significance level, likewise the parameter at X2. The model explains 98.47% of the variability of the dependent variable. According to the used tests, there is neither autocorrelation nor heteroskedasticity present in the model. The amount of the loans provided will rise by EUR 1.13105 mil. When the increase of the amount of deposits from clients by 1 mil. EUR occurs. As for numerical values of variables, a slight decrease of total amount of deposits occurred in 2009, what probably was connected with worsened macroeconomic situation caused by spreading impacts of the global crisis and the slump of economic activity. It was found that a general strong dependence was confirmed between the increase of the amount of deposits from clients and the increase of the amount of loans, while the increase of the amount of deposits by a unit results in the increase of the amount of loans by, in average, 1.13105 units. Although, the decrease of the amount of deposits by approx. 10% occurred at the end of 2009 compared to 2008, the change in the amount of deposits resulted in minimum rising of the loans amount. However, at the same time, it may indicate the providing of more toxic credits, which may, in future, have impact on the credit risk of banks of making investment by banks into less toxic assets, than credit transactions. In connection to searching for an answer for hypothesis H3 and quantification of the dependence, it was analyzed and examined the dependence of the development of banking sector on macroeconomic development, on the evolution of the real economy of Slovakia for monitored period of seven years. In the period of economic growth, it was expected also the positive development of banking sector. In the period of economic downturn, a slow-down of growth of economic sectors, as well the banking one is supposed. There were estimated the parameters of the linear regression model M3 (b0, b1), in which the banks’ balance sheet amount in mil. EUR (Y) was the dependent variable and real GDP amount in mil. EUR (X7) was the explanatory variable. The regression equation in the following shape was estimated: | (5) |

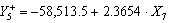

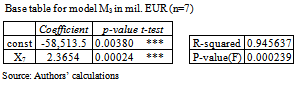

Within the framework of testing of model M3, it was refused the null hypothesis on a zero value of the coefficients at the significance level of 5% based on the result of t-test. Based on the result of F-test for the model, was refused the null hypothesis on a statistical insignificance of the model as a whole at the significance level of 5%. The model as a whole is statistically significant at the selected significance level; also parameter X7 is significant. The coefficient b1 got to a positive value, i.e. if the real GDP increases by 1 EUR, the banks’ balance sheet amount will increase by 2.3654 EUR. This model explains 94.56% of variability of the dependent variable. For this analysis, was found, by testing the dependencies within the framework of the regression analysis, that theoretical assumptions of mutual dependency were proved true in the real practice as well. A strong dependency between the evolution and development of the banking sector and real economy, i.e. the development of balance sheet amount in the banking sector is influenced by the development, growth of real economy to 94.56%. The amount of balance sheet amount is influenced by additional factors, such as the amount of real GDP; however, their influence is represented by a small participation of 5.44% only, what is documented by the analysis implemented. To examine the development of profitability of banks in connection with checking H3, selected parameters, given in the table, for the next regression modelling were used. The parameters of the linear regression model M4 (b0, b1) were estimated, in which the net profit of banks in mil. EUR (Y) was the dependent variable and the share of defaulted loans in the total amount of loans provided to clients (X3) and cost to income ratio (X8) was the explanatory variable. It is expected that the rise in the indicator of operational efficiency and the share of defaulted loans causes a downturn of banks’ profitability, since there is increasing default on loans’ principal and interests, what results in banks’ losses and increasing costs. In the regression equation, parameter X3 was insignificant (reduced), and significant parameter was X8 at the level α=0.08). The regression equation was in the following shape:

Within the framework of testing of model M3, it was refused the null hypothesis on a zero value of the coefficients at the significance level of 5% based on the result of t-test. Based on the result of F-test for the model, was refused the null hypothesis on a statistical insignificance of the model as a whole at the significance level of 5%. The model as a whole is statistically significant at the selected significance level; also parameter X7 is significant. The coefficient b1 got to a positive value, i.e. if the real GDP increases by 1 EUR, the banks’ balance sheet amount will increase by 2.3654 EUR. This model explains 94.56% of variability of the dependent variable. For this analysis, was found, by testing the dependencies within the framework of the regression analysis, that theoretical assumptions of mutual dependency were proved true in the real practice as well. A strong dependency between the evolution and development of the banking sector and real economy, i.e. the development of balance sheet amount in the banking sector is influenced by the development, growth of real economy to 94.56%. The amount of balance sheet amount is influenced by additional factors, such as the amount of real GDP; however, their influence is represented by a small participation of 5.44% only, what is documented by the analysis implemented. To examine the development of profitability of banks in connection with checking H3, selected parameters, given in the table, for the next regression modelling were used. The parameters of the linear regression model M4 (b0, b1) were estimated, in which the net profit of banks in mil. EUR (Y) was the dependent variable and the share of defaulted loans in the total amount of loans provided to clients (X3) and cost to income ratio (X8) was the explanatory variable. It is expected that the rise in the indicator of operational efficiency and the share of defaulted loans causes a downturn of banks’ profitability, since there is increasing default on loans’ principal and interests, what results in banks’ losses and increasing costs. In the regression equation, parameter X3 was insignificant (reduced), and significant parameter was X8 at the level α=0.08). The regression equation was in the following shape: | (6) |

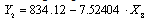

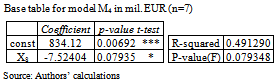

This model was statistically insignificant at α=0.05, and as the significant one it would be at the level α=0.08. If the indicator of operational efficiency increases by 1 percentage point, the net profit will drop by EUR 7.52404 mil. In connection with checking of H2 and H3, were assessed also the influences of additional variables on the development of banks’ profitability with application of selected parameters. The parameters of a multiple linear regression model M5 (b0, b1, b2, b3) with several variables were estimated, in which the banks’ net profit in mil. EUR (Y) was the dependent variable and the capital adequacy (X6), the share of defaulted loans on total amount of loans provided to clients (X3) and the net interest margin (X6) were the explanatory variables. All the parameters were statistically insignificant for the monitored time period, and the regression models did not correspond with real development. There occurred a need to apply more sophisticated survey methods, longer economic time series and a construction of other models.In connection with checking H3 and for the construction of a model of net profit of banking sector, were applied the first differences (absolute increases, year-to-year changes, ∆) in time t, t–1, t+1 of selected variables in the economic series of 10 years (2001-2010). The parameters of the linear regression model M6 were estimated, where the year-to-year change of the net profit of banking sector (Y2) was the dependent variable and the year-to-year change of GDP amount (∆X7 in time t) and the year-to-year change of unemployment rate (∆ X9 in time t+1) were the independent variables. The regression equation in the following shape was estimated:

This model was statistically insignificant at α=0.05, and as the significant one it would be at the level α=0.08. If the indicator of operational efficiency increases by 1 percentage point, the net profit will drop by EUR 7.52404 mil. In connection with checking of H2 and H3, were assessed also the influences of additional variables on the development of banks’ profitability with application of selected parameters. The parameters of a multiple linear regression model M5 (b0, b1, b2, b3) with several variables were estimated, in which the banks’ net profit in mil. EUR (Y) was the dependent variable and the capital adequacy (X6), the share of defaulted loans on total amount of loans provided to clients (X3) and the net interest margin (X6) were the explanatory variables. All the parameters were statistically insignificant for the monitored time period, and the regression models did not correspond with real development. There occurred a need to apply more sophisticated survey methods, longer economic time series and a construction of other models.In connection with checking H3 and for the construction of a model of net profit of banking sector, were applied the first differences (absolute increases, year-to-year changes, ∆) in time t, t–1, t+1 of selected variables in the economic series of 10 years (2001-2010). The parameters of the linear regression model M6 were estimated, where the year-to-year change of the net profit of banking sector (Y2) was the dependent variable and the year-to-year change of GDP amount (∆X7 in time t) and the year-to-year change of unemployment rate (∆ X9 in time t+1) were the independent variables. The regression equation in the following shape was estimated: | (7) |

The model as a whole is statistically significant at α=0.05. If there is year-to-year increase of GDP by 1 million EUR, the banks’ net profit will increase by EUR 0.0435815mil. at time t. If there is a year-to-year downturn of unemployment rate (t+1, t, in next year) by 1 percentage point, the year-to-year increase of net profit of EUR 26.5286 mil. will occur. With increasing unemployment rate the banking sector’s net profit declines, since the ability of clients to pay loans provided by banks also declines with losing the jobs and worsening of clients’ credibility and repay other clients’ liabilities, across the loan portfolios. This regression model is most important for implications in real practice in Slovakia and comparable economic development in other countries in the EU, too.Considering the given analyses, it is possible to state that one of the crucial factors of a growth of rate of return and competitiveness of the banking sector is a management of quality of balance sheet structure, i.e. the amount of assets in total (balance sheet amount) and a trend of the assets increase in total, especially their structure and price with a crucial share of earning assets (loans provided to clients), which, in the upshot, are reflected in the formation of a balance profit. The task of the management of assets and liabilities structure is also to manage a net interest margin, to moderate a risk of changes of interest rates, which are currently most important risks which the commercial banks are exposed to.

The model as a whole is statistically significant at α=0.05. If there is year-to-year increase of GDP by 1 million EUR, the banks’ net profit will increase by EUR 0.0435815mil. at time t. If there is a year-to-year downturn of unemployment rate (t+1, t, in next year) by 1 percentage point, the year-to-year increase of net profit of EUR 26.5286 mil. will occur. With increasing unemployment rate the banking sector’s net profit declines, since the ability of clients to pay loans provided by banks also declines with losing the jobs and worsening of clients’ credibility and repay other clients’ liabilities, across the loan portfolios. This regression model is most important for implications in real practice in Slovakia and comparable economic development in other countries in the EU, too.Considering the given analyses, it is possible to state that one of the crucial factors of a growth of rate of return and competitiveness of the banking sector is a management of quality of balance sheet structure, i.e. the amount of assets in total (balance sheet amount) and a trend of the assets increase in total, especially their structure and price with a crucial share of earning assets (loans provided to clients), which, in the upshot, are reflected in the formation of a balance profit. The task of the management of assets and liabilities structure is also to manage a net interest margin, to moderate a risk of changes of interest rates, which are currently most important risks which the commercial banks are exposed to.4. Discussions

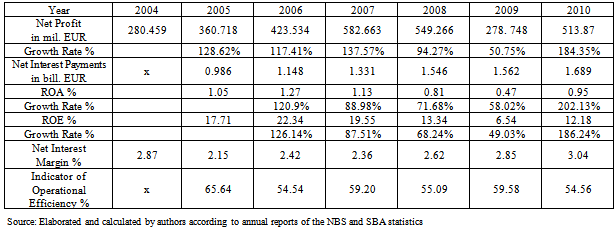

- Several trends in the banking sector of Slovakia from 2010 indicate that this sector met with the improvement in several indicators, especially in the profitability rate and balance sheet structure assets structure. There was proved the dynamics of development of several indicators in economic time series. Banking sectors in some of the EU’s countries met the comparable results as well (Analysis of the Slovak financial sector, NBS, 2011). As it is given above, the profit generation in the long term basis is one of the necessary factors of competitiveness and dynamics of the commercial banks’ growth. It is possible to highlight that increasing rate of profitability and performance rate of banking sector has the positive influence on the stability and banking sector’ growth as well as the stability and growth of whole economy. The profit is subsequently reflected in the development of global financial indicators of profitability, which have met the improvement since 2010. For the growth strategy of banking sector, a year-to-year sales (volume) growth rate in the defined target segments and banking products in connection to a bank’s rate of return. Efficient management of capital allocation, management of long-term rate of return, management of interest rates, management of quality of balance sheet structure, management of credit risk can be considered as additional important factors of the banking sector competitiveness. In connection to the global crisis, it is possible to see a turn of banking sector in following preferences: more efficient management of liquidity, capital allocation and balance sheet structure quality, especially the one of credit portfolio, and management of net interest margin. The trends of development, from the point of view of stability at the liabilities side are faster growth of primary deposits (Loan to deposit ratio, in Slovakia is average 88.1 % according EBF). The development trends at the assets side – continuing trend of standard loans increase, especially in retail sphere, as well as increasing burden of households by credit installments compared to disposable incomes. There was found and considered: The rise in the balance sheet structure amount (Y) influenced by a composition, quality and development of the earning assets amount (loans), net interest payments and development of net interest margin in connection to market interest rates in a stable macroeconomic environment to be the major factors of the banking sector competitiveness growth from the profitability aspect. A price and market interest rate has the considerable influence on the volume of loans provided and lending rates and this mutual relation of development of interest rates and credit market in the context of global changes was analyzed and quantified in banking sector in Slovakia.The amounts of capital of a commercial bank included in a concept of capital adequacy of own sources are a measure of its financial power. It is possible to point out that existing control rules of capital adequacy Basel II were insufficient in the practice, since they failed in a protection of banks as creditors against insolvency at the time of global financial crisis in 2007-2009. Therefore, the central regulators rework the existing rules and a new reform of the regulation of capital rules was approved in September 2010, i.e. the enhancement of world capital standards under the name Basel III, with effect from 2013. Basel III requires banks, inter alia, to hold 4.5% of common equity (Tier 1) at least, of risk-weighted assets, i.e. there is the doubled existing level. A minimum share of common equity to cover the losses from credits and other toxic investments was increased to 7% for all banks, including the US banks. The Basel commission for bank supervision will distribute the fulfillment of new requirements to the capital adequacy and obligatory minimum amount of liquidity by 2019, so as to moderate the impacts on banking sector and financial markets. The main question is, how the new rules influence costs, availability of crediting and banks’ rate of return in a long-term period. The aim is to strengthen the global macroeconomic and financial supervision and to moderate the instability effects.

5. Conclusions

- In this research paper, the changes of macroeconomic conditions, the development of major market factors, existing status and factors of trends of development of competitiveness of banking sector in relation to selected indicators of banking rate of return, balance sheet structure, stability and indicators of a growth of economy by the trend analysis for period of seven years were analyzed. It is possible to highlight that development, growth and trend of evolution of banking sector was positive in 2004-2008 and considerably similar to the positive evolution of the Slovak economy in the period of economic growth. The negative trends in the sector occurred only in 2009, with considerable downturn of activities in the context of spreading impacts of the global financial and economic crisis. While the economic development aggravates in the world, as well as in the Slovak Republic, the costs for covering of credit losses and cost rate of acquisition of banking sources for active transactions increase, what influences also the development of profitability of banking sector in following years. It is possible to point out that the positive change of the development trend occurred in 2010. Year 2010 brought a stimulation of the global economy, improvement of the EU’s economy what was reflected in the stimulation of activities, profitability and performance rate of banking sector. The financial position of the banking sector in Slovakia was gradually improved and the sector reported net profit of 513.9 mil. EUR in 2010, what means the considerable increase compared to 2009. Main findings: Testing the dependencies within the framework of the regression and correlation analysis, it was found, for the second and third hypotheses, that theoretical presumptions of mutual dependency and conditionality of the development of banking sector, measured by an increase of a balance sheet amount and development of real economy measured by a growth of real GDP, for monitored period of seven years, were confirmed in the real practice as well. In construction of regression models, were constructed (created) several regression models (M1-M6) accurately corresponding with real development in Slovakia, which variables have not been considered in interdependence. One of the most important ones is the regression model (M6) of net profit of the banking sector in a macroeconomic environment and determination and quantification of influence of the factors of net profit increase. According to practical experience and theoretical assessments, there are no final models of banking credit management and banking conduct on the market developed. The results demonstrate significant economic and statistical relationships between various determining factors of competitiveness and stability in real financial practice and implications for economic governance. Factors of competitiveness and decreasing risks show common features for banking sectors of other countries EU in context of proceeding impacts of global crisis based on the existence of common relationships and dependences. These can be applied at the building of resistance to risks and competitiveness of banking sectors against crises. It was not possible to deal with other indicators within the banking business and to cover all the changes and dependencies between them, in this study. It results from the outcomes that despite these changes, commercial banks will increasingly have to realize their potential by higher quality and prices of offered products and services with utilization of their competitive advantage such highlights in[31]. The necessity to direct the banking sector to more efficient, active and quality management of liquidity and rate of return, management of quality of balance sheet structure, efficient management of interest policy and net interest margin, management of credit risk in connection to expected development of interbank interest rates on financial markets are the important factors of banking sector competitiveness growth in the market economy in the following period. From the aspect of strategic development and consolidation and integration processes, it is possible to emphasize also the processes of mergers and acquisitions in the international scale, implemented also within the economy of the Slovak Republic in the EU.

ACKNOWLEDGEMENTS

- This study was processed within research project VEGA No. 1/0142/12 „Research of development trends and key determinants of cross-border mergers and acquisitions in common European area“ researched and solved at Faculty of Management, University of Prešov in Prešov, Slovakia, with financial support of Ministry of education, Slovakia.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML