Chikoko Laurine1, Pierre Le Roux2

1Lecturer Department of Banking and Finance, Midlands State University, Gweru, Zimbabwe

2Professor Department of Economics Nelson Mandela Metropolitan University, Port Elizabeth, South Africa

Correspondence to: Chikoko Laurine, Lecturer Department of Banking and Finance, Midlands State University, Gweru, Zimbabwe.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The Reserve Bank of Zimbabwe has been revising the minimum capital requirements for banking institutions in line with economic conditions and international banking standards. The paper examines the implications of the Basel Capital Accords minimum capital requirements on Zimbabwean commercial banks lending. In order to ascertain the impact of the minimum capital requirements, panel regression analysis that captures the salient interrelationships between commercial banks lending and capital adequacy requirements was developed. The model includes the commercial bank loans, capital adequacy ratio, bank lending rates and the inflation rates. The results show that stringent capital adequacy requirements have an adverse impact on Zimbabwean commercial banks lending. Reduced bank lending causes a credit crunch in the economy which culminates in stunted economic growth. The results also suggests that commercial banks in Zimbabwe were adjusting their portfolio by switching from higher risk loans to zero risk loans instead of increasing capital provisions. The study recommends the need for the Reserve Bank of Zimbabwe to monitor the financial conditions of the banking sector continuously if monetary policy is to become an effective tool to counter the pro-cyclicality problem inherent in the Basel Accords.

Keywords:

Basel Capital Accords, Minimum Capital Requirements, Zimbabwean Commercial Banks, Lending

Cite this paper: Chikoko Laurine, Pierre Le Roux, The Impact of Minimum Capital Requirements on Zimbabwe Commercial Banks Lending, International Journal of Finance and Accounting, Vol. 2 No. 3, 2013, pp. 131-137. doi: 10.5923/j.ijfa.20130203.01.

1. Introduction

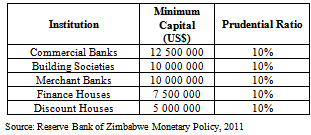

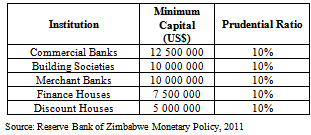

Capital requirements play a key role in the supervision and regulation of banks. Policy makers have put in considerable effort to design bank capital regulation as a way of safeguarding overall financial stability. In Zimbabwe, the Basel Capital Accord was issued in 1988 and market risk was dealt with in 1996 and the Basel II Accord was issued in 2004. Accompanying the policy effort has been the adoption of the Basel capital standards. The main objectives of the Basel Committee on Banking Supervision (BCBS) were to encourage international banks to boost capital positions and to reduce competitive inequalities. According to the BCBS, banks were required to maintain a capital adequacy ratio of 8% measured as net capital divided by total risk weighted assets. In line with this, the Reserve Bank of Zimbabwe (RBZ) adopted formalised capital requirements for banking institutions in 1996. The Reserve Bank of Zimbabwe pegged the minimum capital adequacy ratio at 10%. In addition to the BCBS capital requirements, banking institutions were also required to maintain a minimum level of core capital in accordance with the requirements of the Zimbabwean Banking Act[Chapter 20:24]. The Reserve Bank of Zimbabwe has been constantly changing the minimum capital requirements for banks with the last review being US dollar linked capital requirements. The minimum core capital for banking institutions in Zimbabwe in 2011were pegged as shown in Table 1.Table 1. Minimum Capital Requirements for Different Banking Categories

|

| |

|

A number of developing countries have adopted the Basel Capital Standards with direct consequences on the banks behaviour and the macro-economy[1]. However, there are concerns that this unduly increases volatility in the banks’ capital. Many authors have tried to assess empirically the impact of capital requirements on banks’ behaviour. Most studies concentrate on developed countries and empirical evidence has remained scarce on developing countries and Zimbabwe in particular. It is against this background that this paper provides empirical evidence on the impact of minimum capital requirements on commercial bank lending in Zimbabwe from 1998 to 2010.

2. Literature Review

Capital is defined as the cushion that protects banks and their customers and shareholders against loss resulting from the assumption of risk as shown by[2]. Adequate capital supports future growth, fosters public confidence in the bank’s condition, provides the capacity under the bank’s legal lending limit to serve customers’ needs, and protects the bank from unexpected losses[3]. The primary aim of capital adequacy requirements is therefore to limit risk-taking by banking institutions. Furthermore, the capital adequacy ratio can also assist regulators to define the threshold at which to intervene in the management of the failing bank. Since shareholders’ payoff function is convex with respect to the bank’s net worth, their incentive to take risks increases as its net worth declines. Although this would hurt the interests of the bank’s depositors, they may fail to intervene if they are too small and uninformed about the bank’s management. In view of this, capital adequacy regulation is necessary to protect the depositors against shareholder moral hazard. It is optimal to transfer the bank’s control rights from its shareholders to the regulator who represent the interests of the bank’s depositors, before its capital is depleted[4].There is a general agreement that statutory capital requirements are necessary to reduce moral hazard. The question has been how much bank capital is needed. Despite the debate, capital adequacy is evaluated in relation to supervisory guidelines; overall financial condition; the nature, trend, and volume of marginal and sub-quality assets; intangibles; off-balance sheet activities, and earnings; balance sheet composition, interest rate risk, concentration risk, and non-traditional activity risk, growth trends and prospects; and the strength of management.The macroeconomic concerns surrounding Basel Capital Accords can be divided into two specific categories. The first issue is whether Basel Capital Accords lead to reduced loan supply to certain sectors of the economy. The second concern is whether it impacts the cyclical behaviour of bank lending and affects macroeconomic dynamics. The first concern raised about capital adequacy requirements is that they may cause a credit crunch affecting the macro- economy[1]. According to[2] the broad nature of risk classes gives considerable scope for substitution between more and less risky assets. If a bank’s capital adequacy ratio becomes very low, a banking institution can raise more capital; curtail its lending; and or shift its portfolio towards assets with lower risk-weights. [5] point out, that banks are likely to choose the most cost-effective way of meeting the capital adequacy requirement. Given that the cost of raising new capital is usually very high for financially weak institutions, banks are likely to reduce their lending in order to fulfil the regulatory requirement. If many banks behave in this fashion at the same time, it would lead to a reduction in the aggregate loan supply to the economy. Several empirical analyses ([6];[5];[7];[1];[3]) support that banks subjected to strict capital adequacy requirements curtail their lending in response to a negative shock to their regulatory capital. Such a reduction in bank loans would not affect the real output, as long as firms can quickly find alternative sources of finance. However, given the presence of asymmetric information in the Zimbabwean financial market and a shallow capital market, this may not be feasible for some borrowers, who are forced to curtail their investment. A fall in loan supply is therefore likely to affect the smaller to medium enterprises as they tend to have little access to the stock exchange through listing and private placements. In this regard, a fall in bank capital or an increase in capital adequacy requirement leads to a reduction in aggregate loan supply and output for bank dependant firms.Capital adequacy requirements may also affect the monetary transmission mechanism. If some firms are bank dependent, the responsiveness of loan supply to changes in monetary policy determines the strength of the transmission mechanism. In the presence of capital adequacy requirements, the strength of the monetary transmission mechanism may depend upon how well banks are capitalized. In a simple static model,[8] shows that if the capital adequacy requirement is binding, bank loans may not respond at all to a monetary expansion. The monetary transmission mechanism is weakened if banks are poorly capitalized, or the capital adequacy requirement is very stringent[9]. In a consultative paper published in 2001, the Basel Committee proposed that credit exposures to unrated firms receive a minimum of 100 percent risk-weight under Basel II. This has raised concerns that Basel II may cause a credit crunch affecting unrated firms, most of which are small- and medium-sized enterprises (SMEs). According to the study by[10], Basel II on average lead to a 1 percentage point reduction and a 1.5 percentage point increase in the required capital for lending to an OECD corporation and a corporation in the poorer countries, respectively. Another major concern surrounding Basel II is that it may increase the cyclical volatility of bank loans and output. Given that credit risk tends to fall during booms and rise during recessions, the risk-weights on assets under Basel II are likely to undergo countercyclical fluctuations, so that banks become more capital-constrained during recessions and less so during booms. Raising new capital, on the other hand, tends to be less costly during booms and more expensive during recessions. In view the foregoing, banks operating under Basel II have stronger incentives to expand their lending aggressively during economic upswings and cut it sharply during downturns. Such lending behaviour may in turn exacerbate the cyclical volatility of output.Basel II may also weaken the short-run effect of a monetary expansion during economic downturns as banks may not be able to expand their loan supply n response to an increase in money supply. On the one hand, it is possible that a monetary expansion relaxes banks’ capital constraints after a time lag and stimulates the economy, which in turn may improve borrowers’ balance sheet conditions and their credit quality. If so, the dynamic response of bank loans to a monetary stimulus would be stronger under Basel II, even though this might come with some delay. On the other hand, it is also possible that the initial failure of the monetary expansion to stimulate banks’ loan supply forces some firms to reduce their investments, which could lower firms’ net worth and reduce their credit quality next period. This in turn could discourage banks from lending to these firms, so that it is also possible that a monetary expansion fails to stimulate the economy for a sustained period under Basel II.

3. Methodology

The analysis presented in the study focused primarily on the impact of changes in minimum capital requirements adequacy on lending by commercial banks in Zimbabwe. The study used an explanatory approach and in particular panel research design. Panel data was preferred because it controls for individual heterogeneity, less collinearity variables and tracks trends in the data[10]. Simple time-series and cross-sectional data cannot provide for this. In this study we used quarterly time series data from 1998:Q4-2010:Q2. The population of the study comprised of all the licensed commercial banks in Zimbabwe from 1998 to 2010.

3.1. Method of Estimation

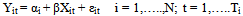

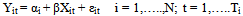

There are a number of approaches that are used in panel data analysis. These include the pooled ordinary least squares (POLS) techniques. This approach is simply an ordinary least squares approach. The approach does not consider the differences among individuals across time periods and thus it does not consider the panel nature of the data set. In addition the estimates obtained by adopting this measure are heavily biased because of the heterogeneity between the error term and the independent variables. It is because of the inadequacy of the POLS to capture the panel nature of the dataset that the use of the fixed effects (FE) and the random effects (RE) model becomes handy.Fixed Effects and Random Effects ModelsThe fixed effects model rests on the assumption that the fixed effects are arbitrarily correlated with the explanatory variables ( and

and ) in the regression model. The error term, which is the source of the differences between the fixed effects and the random effects model, is specified as follows

) in the regression model. The error term, which is the source of the differences between the fixed effects and the random effects model, is specified as follows Where,

Where,  are individual specific errors (defined as unobserved effect, unobserved heterogeneity, latent variable) and

are individual specific errors (defined as unobserved effect, unobserved heterogeneity, latent variable) and  are idiosyncratic errors[10]. The fixed effects model can be estimated using the least squares dummy variable model (LSDV). This model makes use of the dummy variables. Fixed effects models can also be estimated using the within-effect model. The similarity between the two strategies is that they both provide identical slopes for non-dummy explanatory variables. The random effects model defines individual errors as random variables, which are identically and independently distributed (i.i.d random effects). Random effect is synonymous with zero covariance between the observed explanatory variables and the unobserved effect

are idiosyncratic errors[10]. The fixed effects model can be estimated using the least squares dummy variable model (LSDV). This model makes use of the dummy variables. Fixed effects models can also be estimated using the within-effect model. The similarity between the two strategies is that they both provide identical slopes for non-dummy explanatory variables. The random effects model defines individual errors as random variables, which are identically and independently distributed (i.i.d random effects). Random effect is synonymous with zero covariance between the observed explanatory variables and the unobserved effect  . Following[10], the panel regression model is defined according to the following regression model:

. Following[10], the panel regression model is defined according to the following regression model: | (1) |

Yit indicates the dependent variables while Xit determines the vector of k explanatory variables. αi , i = 1,…..,N, are constant coefficients specific to each bank. Their presence assumes that differences across the considered banks appear by means of differences in the constant term. These individual coefficients were estimated together with the vector of coefficients β.In order to validate the fixed effects specification, the question was to prove, according to the empirical application, that individual coefficients αi , i = 1,…..,N, are not equal. This follows to the following joint null hypothesis: | (2) |

In the random effects case, the model is defined as the following: | (3) |

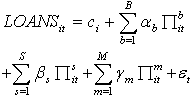

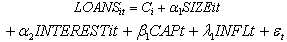

Where εit = μi + υit reflect the error component disturbances. The individual specific effects are random and distributed normally (μi ͠ ͠͠IIN(0, δ2μ)). They are independent of the residual terms υit which are also distributed normally (υit ͠ IIN(0, δ2υ)) . The Hausman test was used to aid in the selection of the method of estimation between the fixed effects and the random effects model. The fixed effects model was used. Following previous literature on modeling loans, ([5];[7];[1];[3]) the determinants of commercial banks loans are bank specific, supervisory and macroeconomic variables. The panel regression model developed is given as:  | (4) |

Where  is the loans of the ith bank at time t, with i = 1… N; t = 1…Ti.

is the loans of the ith bank at time t, with i = 1… N; t = 1…Ti.  are bank specific, macroeconomic and supervisory variables respectively. The main objective was to establish the effect of minimum capital requirements on commercial bank lending. A regression analysis model that includes commercial bank loans, size of the bank, lending rates capital adequacy and inflation was developed. In order to relate the variables to the size of the bank, every variable was taken as a proportion of total assets. This model is represented by the following.

are bank specific, macroeconomic and supervisory variables respectively. The main objective was to establish the effect of minimum capital requirements on commercial bank lending. A regression analysis model that includes commercial bank loans, size of the bank, lending rates capital adequacy and inflation was developed. In order to relate the variables to the size of the bank, every variable was taken as a proportion of total assets. This model is represented by the following. | (5) |

where Ci is the constant for each bank (fixed effects), α are bank specific, β is the supervisory and λ is the macroeconomic variable is commercial bank lending to private and the public sector of bank i at time t, is the size of bank i at time t (bank specific) is the average lending rates at time t (bank specific) is the average capital adequacy ratio at time t (supervisory) is the inflation rate at time t (macroeconomic) is the random error termt = 1998………2010To compliment the panel regression analysis, an event study methodology in the form of graphical presentation is conducted to infer how the explanatory variables behave before and after an event, and to compare these values with how the variables behave during “non-event” (or “tranquil”) periods. In particular, the graphical analysis portrays the movement of each variable prior to the event. In addition, the long-run effects of shocks to the model, which are likely in an environment of high capital requirements with specific focus on bank lending, was conducted using impulse response functions.

4. Findings

4.1. Graphical Analysis

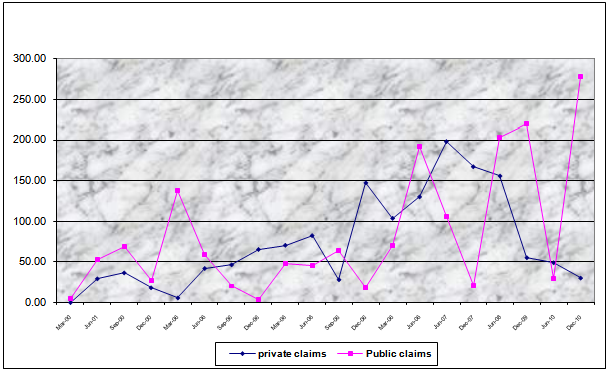

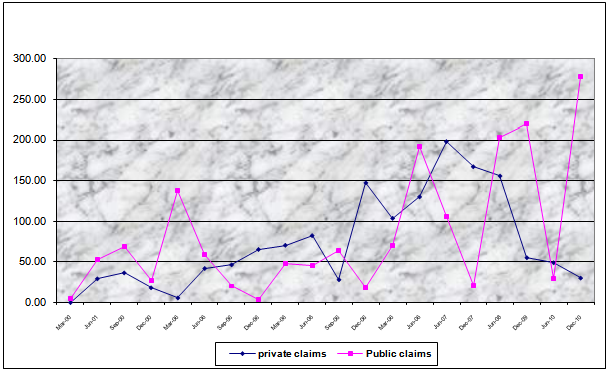

The Reserve Bank has been revising the minimum capital levels for banking institutions in line with economic developments. Figure 1 shows the trend in commercial banks lending to the private sector and public sector: | Figure 1. Trends in Private and Public Credits |

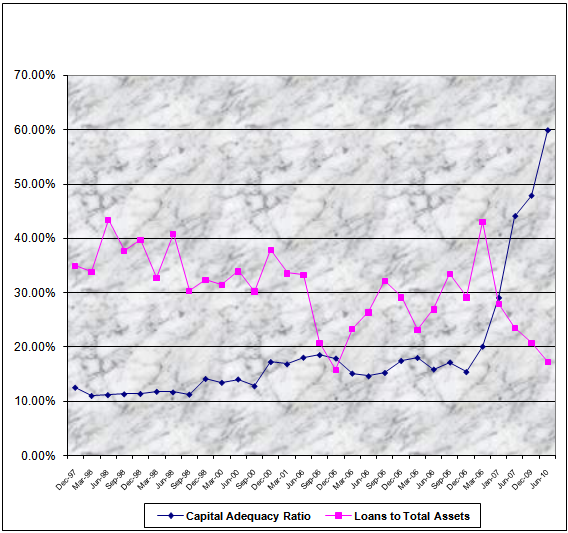

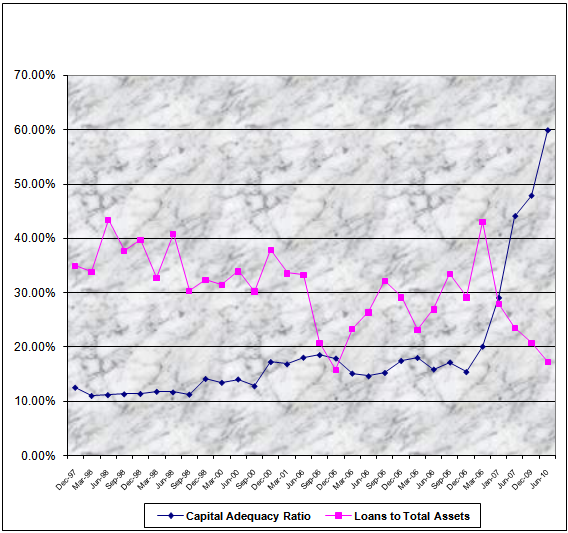

The results of the above graphical analysis show that banks were adjusting their portfolio by switching from private sector loans to public sector loans. The results suggest the existence of a financial crowding out. The development was attributed to the tightening of capital requirements at the end of December 2003, which have induced banking institutions to reduce lending to private firms and individuals. Reduction in private lending affects output through reduced investment and consumption.  | Figure 2. Trends in Capital and Bank lending |

The trends above show the relationship between loans to total assets and minimum capital requirements. When regulators are lax on capital adequacy ratios, commercial banks actively lend. As stringent capital adequacy ratios are imposed, lending declines.

4.2. Regression Results for the Impact of Minimum Capital Requirements on Zimbabwean Commercial Bank Lending

Table 2 presents the fixed effects regression results on loans and minimum capital requirements. | Table 2. Summary of Regression Results |

| | Variable | Coefficient | Std Error | t-statistics | Probability | | C | 0.3726 | 0.0177 | 20.97 | 0.00 | | CAD | -0.3525 | 0.0659 | -5.34 | 0.00 | | SIZE | 0.2743 | 0.0500 | 5.48 | 0.00 | | INTEREST | 0.5897 | 0.4659 | 1.27 | 0.20 | | INFL | -0.0564 | 0.0275 | -2.05 | 0.00 |

|

|

The capital adequacy ratio is significant in explaining commercial bank lending in Zimbabwe. There is a negative relationship between high capital requirements and bank lending. Each percentage increase in capital adequacy ratio will be accompanied by a corresponding decline in bank lending of 0.35%. Results for banks show that reviews in minimum capital adequacy requirements have reduced commercial bank lending in Zimbabwe. The size of bank, interest rate and inflation rate are the control variables.

4.3. Simulation of the Model

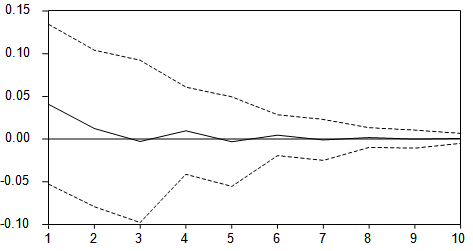

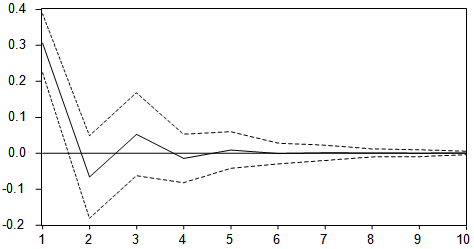

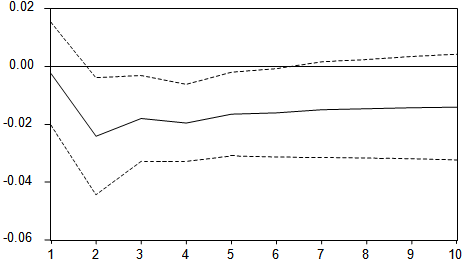

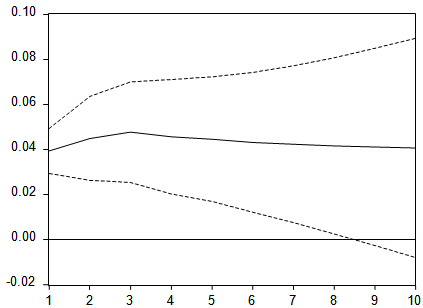

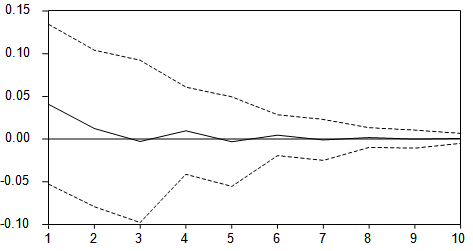

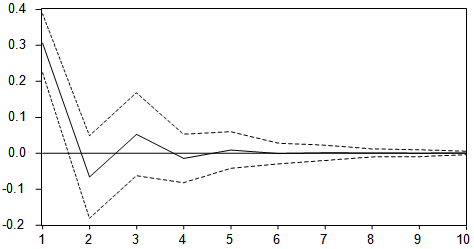

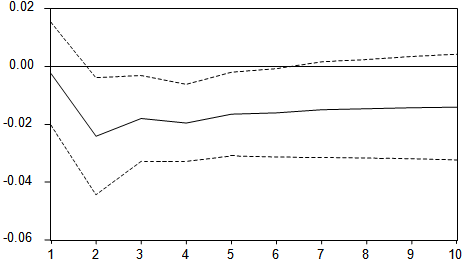

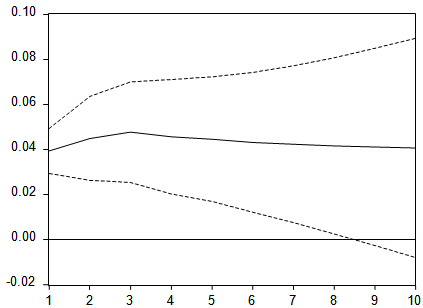

The results of the simulations of a shock to capital adequacy requirements on bank lending behaviour are presented in figure 3, figure 4, figure 5 and figure 6. Simulations were done using impulse response functions. The impulse response function show how a variable responds over time to a shock in explanatory variables. It does this by showing how shocks to any one variable filter through the model to affect every other variable and eventually feedback to the original variable itself. Figures 3, 4, 5 and 6 present the impulse response functions of the two variables to a permanent shock in capital requirements. The responses of these variables were divided by the standard error of their residuals. As depicted by the graphs, bank lending decreases in the short run as a consequence of a permanent capital adequacy shock. Following the increase in the capital requirements, bank lending decreases, but its long run response is positive. The long run response remains relatively constant at 0.00.  | Figure 3. Response of All Commercial Banks Loans to Capital Innovation |

| Figure 4. Response of Capital to Capital Innovation |

| Figure 5. Response of Foreign Owned Bank Loans to One S.D. Capital Innovation |

| Figure 6. Response of Capital to One S.D. Capital Innovation |

5. Conclusions

The Basel capital accords increased the vulnerability of the international financial system to disruptions in national financial markets. The main objectives of the capital accords are to promote of international cooperation of national supervisors and implementation by its members of common prudential rules and in particular, of a common solvency ratio. The study investigated the impact of the imposition of stringent capital adequacy requirements on Zimbabwean commercial banks lending. The results suggest the revision in minimum capital requirements indeed lead to a decline in bank lending. Results from impulse response functions support the same hypothesis. For foreign owned banks, the response is negative and stable in the long runAnalysis of data suggests that, unless properly managed, the introduction of higher minimum bank capital requirements may well induce an aggregate slowdown or contraction of bank lending in Zimbabwe. The analysis of data on individual banks suggests that enforcement of capital adequacy requirements significantly curtailed credit supply. Opening up to foreign investors may be an effective way to partly shield the banking sector from negative shocks.

Recommendations

The recommendations from this study are as follows:• There is need to monitor the financial conditions of the banking sector continuously if monetary policy is to become an effective tool to counter the pro-cyclicality problem inherent in Basel Capital Accords; and• The central bank should give the financial regulators some discretion over the regulatory penalty imposed on banks that violate the capital adequacy requirement.

References

| [1] | Choi, G. (2008), The Macroeconomic Implications of Regulatory Capital Adequacy Requirements for Korean Banks, Economic Notes 29, 111–143. |

| [2] | Basel Committee on Banking Supervision (2008a), Overview of the New Basel Capital Accord, Bank for International Settlements. |

| [3] | Furlong, F. T. (2008), Capital Regulation and Bank Lending, Federal Reserve Bank of San Francisco Economic Review (3), 23–33. |

| [4] | Danielson, J., P. Embrechts, C. Goodhart, C. Keeting, F. Muennich, O. Renault and H. S. Shin (2001), An Academic Response to Basel II, LSE Financial Markets Group and ESRC Research Centre Special Paper No. 130. |

| [5] | Borio, C., C. Furfine and P. Lowe (2001), Procyclicality of the Financial System and Financial Stability: Issues and Policy Options, BIS Papers No. 1. |

| [6] | Chami, R. and T. F. Cosimano (2001), Monetary Policy with a Touch of Basel, IMF Working Paper, WP/01/151. |

| [7] | Griffith-Jones, St., M. A. Segoviano, and St. Spratt (2002), Basel II and Developing Countries: Diversification and Portfolio Effects, Mimeo. |

| [8] | Brunner, Allan D and Steve B Kamin (1998), Bank Lending and Economic Activity in Japan: Did “Financial Factors” Contribute to the Recent Downturn? International Journal of Finance and Economics, 3, pp. 73-89. |

| [9] | Altman, E. I. and A. Saunders (2008), An Analysis and Critique of the BIS Proposal on Capital Adequacy and Ratings, Journal of Banking and Finance 25, 25–46. |

| [10] | Baltagi, B.H (2008), Econometric Analysis of Panel Data, John Wiley & Sons Publish, Chichester |

and

and ) in the regression model. The error term, which is the source of the differences between the fixed effects and the random effects model, is specified as follows

) in the regression model. The error term, which is the source of the differences between the fixed effects and the random effects model, is specified as follows Where,

Where,  are individual specific errors (defined as unobserved effect, unobserved heterogeneity, latent variable) and

are individual specific errors (defined as unobserved effect, unobserved heterogeneity, latent variable) and  are idiosyncratic errors[10]. The fixed effects model can be estimated using the least squares dummy variable model (LSDV). This model makes use of the dummy variables. Fixed effects models can also be estimated using the within-effect model. The similarity between the two strategies is that they both provide identical slopes for non-dummy explanatory variables. The random effects model defines individual errors as random variables, which are identically and independently distributed (i.i.d random effects). Random effect is synonymous with zero covariance between the observed explanatory variables and the unobserved effect

are idiosyncratic errors[10]. The fixed effects model can be estimated using the least squares dummy variable model (LSDV). This model makes use of the dummy variables. Fixed effects models can also be estimated using the within-effect model. The similarity between the two strategies is that they both provide identical slopes for non-dummy explanatory variables. The random effects model defines individual errors as random variables, which are identically and independently distributed (i.i.d random effects). Random effect is synonymous with zero covariance between the observed explanatory variables and the unobserved effect  . Following[10], the panel regression model is defined according to the following regression model:

. Following[10], the panel regression model is defined according to the following regression model:

is the loans of the ith bank at time t, with i = 1… N; t = 1…Ti.

is the loans of the ith bank at time t, with i = 1… N; t = 1…Ti.  are bank specific, macroeconomic and supervisory variables respectively. The main objective was to establish the effect of minimum capital requirements on commercial bank lending. A regression analysis model that includes commercial bank loans, size of the bank, lending rates capital adequacy and inflation was developed. In order to relate the variables to the size of the bank, every variable was taken as a proportion of total assets. This model is represented by the following.

are bank specific, macroeconomic and supervisory variables respectively. The main objective was to establish the effect of minimum capital requirements on commercial bank lending. A regression analysis model that includes commercial bank loans, size of the bank, lending rates capital adequacy and inflation was developed. In order to relate the variables to the size of the bank, every variable was taken as a proportion of total assets. This model is represented by the following.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML