-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(2): 120-124

doi:10.5923/j.ijfa.20130202.12

Characteristics and Performance of Audit Committee among Listed Government Linked Companies in Malaysia

Rasidah Mohd Rashid 1, Ruzita Abdul Rahim 2, Norliza Che Yahya 3, Rafidah Othman 3

1College of Business, Northern University of Malaysia, Kedah, 06010, Malaysia

2Faculty of Economics and Management, National University of Malaysia, Selangor, 43600, Malaysia

3Graduate School of Business, National University of Malaysia, Selangor, 43600, Malaysia

Correspondence to: Rasidah Mohd Rashid , College of Business, Northern University of Malaysia, Kedah, 06010, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This paper examines the characteristics of the audit committee towards performance before and after the revised code of corporate governance in October 2007.The review of the code is to improve and strengthen the quality, and the effectiveness of the board and audit committee in the public listed company. In this study, we focus on the Government Linked Companies (GLCs) to look at the reinforcement of the revised corporate governance 2007 among the GLCs as past study has shown puzzling results whether GLCs have fulfilled the requirements by the Malaysia Code of Corporate Governance as reported in the Securities Commission in 2007. The finding showsthat there is an improvement in the corporate governance practice specificallyin the characteristics of the audit committee at the firm and itsinfluence to improve the performance of the firm among the GLCs.

Keywords: Corporate Governance, Audit Committee Characteristics, Performance

Cite this paper: Rasidah Mohd Rashid , Ruzita Abdul Rahim , Norliza Che Yahya , Rafidah Othman , Characteristics and Performance of Audit Committee among Listed Government Linked Companies in Malaysia, International Journal of Finance and Accounting, Vol. 2 No. 2, 2013, pp. 120-124. doi: 10.5923/j.ijfa.20130202.12.

Article Outline

1. Introduction

- A number of studies have looked at the corporate governance and firm performance but there is still a contradict finding. One of the reasons for the corporate governance issue arises is because the separation of ownership and control. Besides, the asymmetric information has introduced the conflicts between the principal and agent as they have a different self interest which may lead to the misuse of the corporate assets. To limit the conflicts and costs of the agency, various internal and external mechanisms have been suggested through the code of corporate governance[1][2].In Malaysia the Code of Corporate Governance has been introduced in March 2000 for the companies to use it in their operations towards achieving the optimal governance framework, and it is recommended for the companies to include how they apply the relevant principle in the annual report. Meanwhile, in October, 2007 there is a review of the code of corporate governance in line with the development of the domestic and international capital markets. Our previous Prime Minister, Dato’ Seri Abdullah Ahmad Badawi has announced in the budget in 2008 that Codeis especially revised to improve the quality of the board and the audit committee of the public listed companies[3].Therefore, this paper is trying to study the strength of the characteristics of the audit committee on their performance by looking at the composition of the independent audit committee, frequency of meetings among the committee members in the accounting association.Secondly, so far there is no study looking at the impact of the characteristics of the audit committee towards the performance of firms using share return as a measurement tool, especially after the revised of the code in 2007 using the government linked company in Bursa Malaysia. Therefore, this study is filling in the gap by looking at the characteristics of the audit committee that have been amended in 2007 towards the performance of firms especially in GLCs before and after the revised of the code. In this paper, the dealing period of the study is between 2006 (before revision) and 2009 (after revision). By focusing on GLCs as the past study the finding shows that GLCs corporate governance reporting is still unclear and does not cater to the needs of investors and the annual reports fail to convey the useful information[4].Thirdly, the study is hoped to provide some insights on the governance issue to the government, especially in the government linked company. Meanwhile, the revised code also required all the public listed companies to carry out their own internal audit function and reporting line for the internal auditorswith the board of directors to ensure the adherence to the internal audit functions.To ensure the audit committee serves effectively, the revised code of corporate governance mentioned the detailsin terms of the composition of the audit committees. It should comprise of three members which the majority is independent. As for the frequency of meetings, there should have at least two meetings in a year with some external auditors, and one of the audit committee members isa member tothe body of accounting.The rest of this paper is organized following the normal headings of a reaserch paper. This paper has an introduction, literature review, methodology section for data collection and findings section. Other than that, it also has conclusions, implications and a suggestion for future research.

2. Literature Review

- Corporate governance is developed to reduce the agency problem. In addition[5] mention that audit committee is trying to enhance the ability of a board to fulfil some legal responsibilities and to ensure transparency in the financial reports. Brick and Chidambaran[6] find that independent audit committee is not statically related whether the firm restated their earnings or acquired company in the previous year, and it is not related to the stock performance as well. They also find that the coefficient on committee size is negative and significant. In revising the Corporate Governance Code 2007 they stated that the audit committee shall consist of at least three members who are independent. While[7] find that most common fraud companies such as financial service firms have very weak corporate governance mechanisms due to having fewer audit committees and fewer independent audit committees, and he also finds that having fewer audit committee meetings also contributes to the fraud in the financial statements and affect the value of the firms. Moreover[8] find that quality of the audit committee (those with financial qualification) is not significantly linked with the use of an industry specialist audit firm while an audit committee composition has a positive link. Besides,[9] find that the number of audit committee meetings increases with the audit committee size and there is a positive relationship between the proportion of accounting experts and the number of meetings. While in terms of the audit committee in accounting association[10] find that they are positively related with the meeting frequency when there is a risk in misreporting the financial issue.Brick et al.[6] also find that activity of the audit committee is important in determining the firm performance and governance characteristics. The performance of the firm value is measured by using the Tobins’q. For the activity of the board, they use a large number of annual board meetings and the log book contains the number of meetings.They found the meetings alone do not fully capture the level of the bird activity. They also find that as the board activity increases significantly after controlling the indignity, it increases the firm value by using Tobin’s Q too. Thoopsamut and Jaikengkit[11] examine the relationship between audit committee characteristics and earning management. The audit characteristics in this study include the number of audit committee meetings, tenure of the audit committee and proportion of an audit committee with accounting expertise. They find the number of audit committee meetings and proportion of an audit committee in the accounting association is not significantly related to the earning management, which means it doesn’t influence the performance of the firm. In contrast[12] find that the board and audit committee meeting frequency is associated with the reduced levels of earning management.In addition[13] find that audit committee frequent meetings will increase the audit fees, so they recommend to make greater use of the internal audit. Therefore, they believe it will influence the return of the firm and consequently, the share return. Defond, Hann and Xuesong[14] categorized financial expertise into accounting and non accounting financial experts. They find a positive relationship in an appointment of accounting financial experts and the market value as the financial experts ensure the highest quality of financial reporting. Moreover, the expertise also helps to increase the shareholder value.Most of the past study that studies the roleand characteristics of the audit committee sees it from the perspective of earning management but in this paper I would like to look at the issue in terms of the share return. This is in line with[15] where there is a lower audit committee activity in a highly leverage firm. This means the firms have a low value, and consequently, we believe it also will give impact to the performance of the firms in terms of both accounting and share return.In this paper, we looking into the characteristics of the audit committee which include the composition of independent audit committee, frequency of audit committee meetings and its quality.This is seen from the angles of whether the audit committee is linked to any accounting association body and the impact of the characteristics onto the share return.Other than that, the study also sees whether there is any improvement in both factors after the revised code of corporate governance in 2007. This study is in line with[16] that argues on the effectiveness of the audit committee should be evaluated as it influences the corporate governance debates.

3. Data and Methodology

- In this study, the sample selection process began by selecting 34 companies from the listed GLC (Government linked companies) in Bursa Malaysia. The data on the audit committee is as reported in the annual report for the year 2006 before the announcement and 2009 after the announcement of the revised code of corporate governance while the share return is using the DataStream. This paper didn’t include the data for the year 2008 as the revised corporate governance was not yet fully implemented in all the firms. The data on the share return collected by using the monthly share return was then comparedto the Kuala Lumpur Composite Index (KLCI). Defond, et al.[14] used event study to examine the cumulative abnormal returns (CARs) to look at the impact of the new audit committee directors who have their own financial expertise. They also used multivariate test and found some positive market reaction to the announcement of the new directors with accounting financial expertise, which indicates strong corporate governance. Past study in this area generally used cross section research design. Therefore, this study applies the same design.The data on the characteristics of the audit committee in this study were taken from the number of audit composition, frequency of an audit committee meeting and member to the body of the accounting association.These roles have been revised by the Malaysia's government in the code of 2007 as it believes to be the important factors in strengthening the code ofthecorporate governance sectors.We classify the audit committee as how it has been classified in the revised corporate governance code in 2007. We used the definition that was proposed in the report as well as the guidelines mentioned in the report in describing the audit committee characteristics.a) Number of audit composition- the board should comprise at least three members with majority are independent.b) Frequency of the audit committeemeeting - the committee should meet the external auditor at least twice a year without the executive board member.c) Audit committee in an accounting body- at least one of them should be a member to any accounting body or association.Therefore, hypotheses for this paper are as follows:H1: The characteristics of the audit committee are associated with the stock return before the revised (Pre).H2: The characteristics of the audit committee are associated with the stock return after the revised (Post).H3: The characteristics of the audit committee influence the share return and isbetter after the revising of the Code of Corporate Governance (Post).In this study, we use multiple regression to identify the relationship between the characteristics of the audit committee and the share return before the announcement of the revision in 2006 and after the announcement in 2009. I then eliminate three companies because of the data are unavailable.

4. Findings

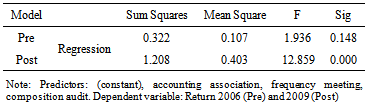

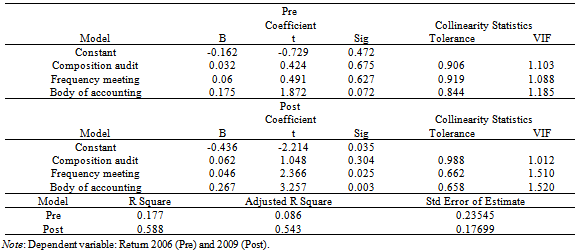

- In Table 1 it shows that performance after the revised process has improved better of about 14.09% compared to the pre return that is 7.28%.

|

| (1) |

|

5. Conclusions

- In this study, we investigate the relationship between the characteristics of the audit committee and share return for the year 2006 (before the revised of the corporate governance code 2007) and for the year 2009 as the most recent year. From the descriptive table, it shows that the average share return improves better in 2009 compared to 2006 where in 2009 the return is about 14.09%, even though the share return is not much, but it shows some improvements after the revised makes the investors havemore confident in investing in those companies. Therefore, this shows that the hypothesis three is supported. This study also focuses on the combined effect of the audit committee as it believes to be one of the important mechanisms thatinfluences the share return. From the empirical results, it shows the first hypothesis is rejected as the characteristics of the audit committee do not influence the share return especially in 2006 where the model is not significant and the R squared is low (17.7%) as this might due to the less awareness of investors on the importance of thegood corporate governance practice which can actually influence performance. According toJoseph F. Hair, Black, Babin and Anderson[17], the sample size should be increased to 20:1,and to get the best R2theminimum sample size is about 50 and preferably 100 observations. This also might be one of the reasons why the results of the model in 2006 are not significant.However, in 2009 the second hypothesis is supported as the characteristic of the audit committee influences the share return whereby the model is significant and the R2is explained by 58.8%. This means that the characteristic of the audit committee explains the share return of about 58%. However, there are other factors that might influence the effectiveness of the characteristics of the audit committee as well. In 2009 the model is significant due to the improvement in the corporate governance practice after the revised of the corporate governance code in 2007.This can be seen from the descriptive table where it goes average to say that the characteristic of audit fails to improve the frequency of meeting, but at least it fulfils the corporate governance amendment in 2007 requirement to have at least three times of meetings and the value is significant. While for the composition of the audit committee is not significant which is in line with[11] where he found that the independent audit composition is not related with the stock performance, and this confirms that the composition is not important for an investor. Overall the result shows that the share return performance in 2009 performs better compared to 2006 as an improvement in the characteristics of the audit committee.The finding implies that the characteristic of the audit committee is an important component in improving the share return. This is based on the second and third hypothesis. In conclusions, all the listed companies and not only the government linked companies should adopt the revised corporate governance. Finally, a future research might want to make an attempt to examine whether other characteristics of audit and its role could impact on the share return and perhaps could also look at the impact in terms ofaccounting return.

ACKNOWLEDGEMENTS

- The authors are grateful to Associate Professor Dr.RasidahMohamad Saidfor the helpful comments and suggestions.

References

| [1] | Jensen, M. C. &Meckling, W. H, “Theory of the Firm: Managerial behavior, Agency Costs and Ownership Structure”, Journal of Financial Economics, vol.3,no.(4),pp.305-360, 1976. |

| [2] | Shleifer, A. &Vishny, R. W, “A Survey of Corporate Governance”, Journal of Finance, vol.52,no.2,pp.737-783, 1997. |

| [3] | SuruhanjayaSekuriti Malaysia, Malaysian Code On Corporate Governance , Revised 2007. |

| [4] | Ismail, A. M, “Corporate Governance Dilemma - Evidence from Malaysia”, SSRN eLibrary, 2010. |

| [5] | Muhammad Zahirul, I., Mohammad Nazrul, I., Sumon, B. & Islam, A. K. M. Z, “Agency Problem and the Role of Audit Committee: Implications for Corporate Sector in Bangladesh”, International Journal of Economics & Finance, vol.2, no.3, pp.177-188, 2010. |

| [6] | Brick, I. E. &Chidambaran, N. K, “Board Meetings, Committee Structure, and Firm Value”, Journal of Corporate Finance, vol.16, no.4, pp.533-553, 2010. |

| [7] | Beasley, M. S., Carcello, J. V., Hermanson, D. R. &Lapides, P. D, “Fraudulent Financial Reporting: Consideration of Industry Traits and Corporate Governance Mechanisms”, Accounting Horizons, vol.14, no.4, pp.441-454, 2000. |

| [8] | Chen, . M., Moroney, R. & Houghton, K, “Audit Committee Composition and the use of An Industry Specialist Audit Firm”, Accounting and Finance, vol.45,no.2,pp.217-239, 2005. |

| [9] | Raghunandan, K. & Rama, D. V, “Determinants of Audit Committee Diligence”, Accounting Horizons, vol.21,no.3. pp.265-279, 2007. |

| [10] | Sharma, V., Naiker, V. &Lee, B, “Determinants of Audit committee meeting frequency: Evidence from a Voluntary Governance System”, Accounting Horizons, vol.23,no.3, pp.245-263, 2009. |

| [11] | Thoopsamut, W. &Jaikengkit, A.-O, “Audit Committee Characteristics, Audit Firm Size and Quaterly Earnings Management in Thailand”,Oxford Journal, vol.8,no.1, pp.3-12, 2009. |

| [12] | Xie, B., Davidson Iii, W. N. &Dadalt, P. J, “Earnings Management and Corporate Governance: The role of the Board and the Audit Committee”, Journal of Corporate Finance, vol. 9, no.3, pp. 295-316, 2003. |

| [13] | Goodwin-Stewait, J. & Kent, P, “Relation between External Audit Fees, Audit Committee Characteristics and Internal Audit”, Accounting and Finance, vol.46,no.3,pp.387-404, 2006. |

| [14] | Defond, M. L., Hann, R. N. &Xuesong, H. U, “Does the Market Value Financial Expertise on Audit Committees of Boards of Directors?”, Journal of Accounting Research, vol.43, no.2, pp. 153-193, 2005. |

| [15] | Méndez, C. F. &García, R. A, “The Effects of Ownership Structure and Board Composition on the Audit Committee Meeting Frequency: Spanish Evidence”, Corporate Governance, vol. 15, no.5, pp. 909-922, 2007. |

| [16] | Spira, L. F, “An Evolutionary Perspective on Audit Committee Effectiveness”, Corporate Governance, vol.6,no.1, pp.29-38, 1998. |

| [17] | Joseph F. Hair, J., Black, W. C., Babin, B. J. & Anderson, R, E. Multivariate Data Analysis: A Global perspective, United States of America: Pearson, 2010. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML