-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(2): 114-119

doi:10.5923/j.ijfa.20130202.11

Impact of Audit Committee Characteristics on Earnings Management in Malaysian Public Listed Companies

Reinushini Chandrasegaram , Mohamed Razeef Rahimansa , Suraya K. A. Rahman , Suhaimi Abdullah , NikKamariah Nik Mat

Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Sintok, 06010, Malaysia

Correspondence to: Reinushini Chandrasegaram , Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Sintok, 06010, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Malaysian public listed companies will attempt to portray a positive outlook of business in order to provide confidence to shareholders and investors regarding the profitability and viability of the company. A key method used by the management to manage earnings and show better performance is through accrual accounting. This method of earnings management is not legally prohibited and is based mainly on the company’s choice of accounting policies. The negative impact on the performance of the company can be directly traced to the level of earnings management in the company. The presence of the Audit Committee is mandated in all Malaysian Public Listed companies by virtue of the Bursa Malaysia Listing Requirements. The monitoring and oversight factor of the Audit Committee provides a check and balance mechanism which may be effective in curbing rampant earnings management. This study of 153 Malaysian Public Listed companies utilises secondary data derived from Annual Reports of Year 2011 to ascertain the impact of Audit Committee characteristics, namely frequency of Audit Committee meetings, size of Audit Committee and independence of the Audit Committee, on earnings management. The proxy for earnings management is discretionary accruals and the modified Jones Model is used to determine discretionary accruals.

Keywords: Audit Committee Characteristics, Earnings Management, Discretionary Accruals, Malaysian Public Listed Companies

Cite this paper: Reinushini Chandrasegaram , Mohamed Razeef Rahimansa , Suraya K. A. Rahman , Suhaimi Abdullah , NikKamariah Nik Mat , Impact of Audit Committee Characteristics on Earnings Management in Malaysian Public Listed Companies, International Journal of Finance and Accounting, Vol. 2 No. 2, 2013, pp. 114-119. doi: 10.5923/j.ijfa.20130202.11.

Article Outline

1. Introduction

- Despite the economic downturn, the financial statements of big corporations showed excellent performance of the company. This resulted from managing earnings that gave a rosy picture of the company’s performance but which did not reflect the underlying financial health. Cases such as Worldcom, Enron, and many others had led to the tightening of regulations on financial reporting. According to literature, earnings, sometimes called the “bottom line” or “net income”, is the most crucial item in a financial statement as they reflect the “health” of an organization at the end of each business year. They are signals that helps channel resource allocation in capital market. Increase in earnings enhances the performance of a company whilst decrease in earnings could raise alarm bells thus inadvertently affecting the company’s value.

2. Literature Review

2.1. Earnings Management

- Earnings management is linked to accruals accounting. Dechow and Skinner[1] note that the border between earnings management and accrual accounting has become ambiguous. It deals with managers choosing accounting policies and accruals, most likely for personal gain. Managers are accountable for the performance of their organization. Accounting regulations do not constrain managers’ choices of accounting policies and procedures completely[2]. Within the boundaries of the accounting practice, managers are given considerable leeway to choose a policy that best fits their private purposes. Earnings management thus takes place without contravening accounting regulation.By having this loophole in choosing policies, management are given the possibility to influence the financial information by managing earnings. Earnings, being the ultimate performance measure of an organization, is used by various stakeholders to base their investment and lending decisions on. Management will thus choose the best policy to achieve good earnings.A frequently used description of earnings management is given by Healy and Wahlen[3]:“Earnings management occurs when managers use judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of the company or to influence contractual outcomes that depend on reported accounting numbers”

2.2. The Audit Committee Relationship to Earnings Management

- An Audit Committee is vital in monitoring the company’s operation and internal control system with the aim of protecting the interest of the shareholders. An effective audit committee would focus on improving the company performance and competitiveness, particularly in a changing business environment which is beyond the control of the company[4],[5].The Malaysian Code on Corporate Governance (the Code)[6] outlines principles and best practices for good governance to be practiced by Malaysian listed companies. The Code provides guidelines on the formation of the Audit Committee, particularly with respect to size, independence, frequency of meetings and financial literacy of members to ensure good practices of corporate governance. These requirements are mandated in the Listing Requirements of Bursa Malaysia Securities Berhad[7]. Companies listed on Bursa Malaysia must comply with the Listing Requirements[7] or face pecuniary and other penalties. Several studies have delved into Audit Committee and among them are the quality of reporting[8],[9],[10], fraudulent reporting[11], the quality of audit[12], or the selection of external auditors[13],[14],[15]. Saleh, Takiah and Rahmat[16] noted that the frequency of Audit Committee Meetings and the size of Audit Committee were not negatively related to the magnitude of earnings. In addition, Saleh, Takiah and Rahmat[16] also found that Independence of Audit Committee (i.e. majority of Independent Directors in Audit Committee) was negatively related to magnitude of earnings management. Their study focused on Year 2001 data.Studies examining Audit Committee characteristics against earnings management specifically in Malaysia have not established a definitive relationship.This study will look at the impact of audit committee size, independence and the frequency of meetings on earnings management across seven industries listed in Bursa Malaysia in Year 2011.

3. Research Framework and Methodology

- Data was collected from published Annual Reports downloaded from Bursa Malaysia website. This study focuses on data from Year 2011, in line with the post 2007 Malaysian Code on Corporate Governance[6] but before amendments were made to the Code in Year 2012.

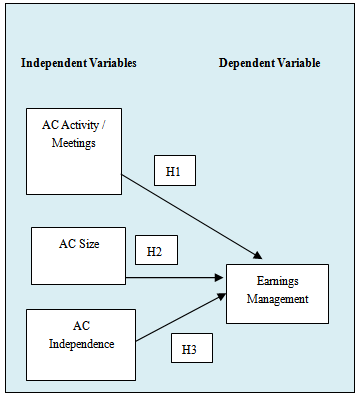

3.1. Hypotheses

- Xie et al.[17] state that well structured and functioning Audit Committees are able to reduce earnings management. They find that the Audit Committee members’ financial knowledge, the meeting frequency of the board, and the meeting frequency of the Audit Committee are associated with lower earnings management. Additionally, Audit Committee independence is negatively associated with earnings management. Their findings are also supported by Bedard et al.[18].

| Figure 1. Conceptual Framework |

3.2. Audit Committee Meetings (ACM)

- Listing Requirements of Bursa Malaysia[7] mandate that the Audit Committee shall meet at least four times per year, or more frequently as circumstances required. Financial expertise of audit committee members has been shown to be important for dealing with the complexities of financial reporting[9] and for reducing the occurrence of financial restatements[8]. Research shows that effective audit committees meet regularly[11],[17]. Saleh, Takiah and Rahmat[16] noted that the frequency of Audit Committee Meetings were not negatively related to the magnitude of earnings.H 1: The frequency of Audit Committee Meetings is negatively related to magnitude of earnings management.

3.3. Audit Committee Size (ACS)

- The Code[6] and Listing Requirements of Bursa Malaysia[7] require that the audit committee to have at least three Directors[16]. According to Abdellatif[19], the larger size of the audit committee can mitigate effectivelyasymmetric information during the seasoned equity offerings. As managers aim to mislead users of financial statements by providing false information about a company’s true financial position and operating performance via earnings management, the larger audit committee may play a vital role in constraining the occurrence of earnings management. A negative significant relationship was found between the size of audit committee and earnings management practice[20]. Thus, there should be a positive effect of large Audit Committees on financial reporting quality. By contrast, Xie, et al.[17] found no significant relationship between audit committee size and discretionary current accruals as proxy for earnings management. H2: The Audit Committee size is negatively related to magnitude of earnings management

3.4. Audit Committee Independence (ACI)

- The Independent Audit Committee, as a sub-committee of the board of directors, has oversight responsibility for the firm’s financial reporting process. The Audit Committee provides a formal communication channel between the board, the internal monitoring system, and the external auditor. Its primary purpose is to enhance the credibility of audited financial statements. The 1999 Blue Ribbon Committee recommends that all members on the audit committee should be independent. DeFond and Jiambalvo[21] find that the overstatement of earnings is less likely among firms with Audit Committees, while Klein[22] provides evidence that there is a significant negative relation between Audit Committee independence and abnormal accruals. Therefore:H3: Audit Committee with majority of independent members is negatively related to magnitude of earnings management

3.5. Industry Sector and Discretionary Accruals, ACM, ACS, ACI

- The likelihood of earnings management (discretionary accruals) being similar for all Industry Sectors may need to be examined. Frequency of Audit Committee Meetings, Size of Audit Committee and Independence of Audit Committee (number of Independent Directors in the Audit Committee) may also not be similar between Industry Sectors. H4a): There is a significant difference in Earnings Management (Discretionary Accruals) between Industry SectorsH4b): There is a significant difference in AuditCommittee Meetings between Industry SectorsH4c): There is a significant difference in Audit Committee Size between Industry SectorsH4d): There is a significant difference in AuditCommittee Independence between Industry Sectors

3.6. Sampling and Measures

- The sample used in this study consists of data of 153 public listed companies on Bursa Malaysia, extracted from both Year 2011 Annual Reports. The sample excludes Government Linked Companies, Financial Institutions and Unit Trusts/Insurance Companies as these industries are highly regulated and the behaviour of accruals in companies within these industries differ from other industries.

3.7. Theoretical Framework: Agency Theory

- Agency theory provides a powerful theoretical framework for analyzing the behaviour of managers in different organizations. In this study, the Audit Committees are designed to mitigate these problems and acts as monitoring mechanism on the preparers of financial statement and shareholders[23].The measurement of discretionary accruals follow Dechow, Sloan and Sweeny[24] which is the Modified Jones Model.

4. Findings

- A review of descriptive statistics indicate that on average, the size of the Audit Committee is 3 to 4 members, the Audit Committee meets about 5 times a year and the number of Independent Directors in the Audit Committee is 3 members.From a review of correlations, the larger the size of the Audit Committee, i.e. the more Directors are included in the Audit Committee, the frequency of the Audit Committee Meetings will increase; i.e. more Audit Committee meetings will be held (Pearson correlation 0.162, p < 0.05). In addition, the larger the size of the Audit Committee, the more Independent Directors are members of the Audit Committee (Pearson correlation 0.539, p <0.01). This finding implies that as one Audit Committee characteristic improves, there will be an improvement in other aspects of the Audit Committee. Lack of significant correlation coefficient at the conventional level between the frequency or number of Audit Committee meetings and the number of Independent Directors are in the Audit Committee indicates that although there may be more Independent Directors in the Audit Committee, this does not encourage more frequent meetings of the Audit Committee. T-test of Independence of Audit Committee against Discretionary Accruals, a proxy for earnings management, revealed that t-test is -0.339 and the p value is 0.735, showing that there is no significant difference in Discretionary Accruals (Earnings Management) between Audit Committees which are made up of 100% Independent Directors and Audit Committees which are not 100% Independent.The regression of the Dependent Variable (Discretionary Accruals) with the Independent Variables (Independent Directors, frequency of Meetings and Size of Audit Committee) indicated the R value of 0.075. There is a very low degree of correlation between Discretionary Accruals and Independent Directors, frequency of Meetings and Size of Audit Committee. The R Square value is 0.006. An extremely small percentage of Discretionary Accruals – i.e. 0.6% - can be explained by the Independent Variables (Independent Director, frequency of Audit Committee Meetings and Size of Audit Committee). There is no linear relationship between Discretionary Accruals andIndependent Director, frequency of Audit Committee meetings and Size of Audit Committee.Coefficients from the regression of DiscretionaryAccruals and the Independent Variables show that Independent Director is negatively related to Discretionary Accruals (t = -0.283, whereby t is negative). However, this relationship is not significant (p = 0.778; i.e. p > 0.001). Therefore the direction is negative but it is not significantly related.Discretionary Accruals is not negatively related to both Size of Audit Committee and frequency of Audit Committee Meetings as reflected by t value which is positive. Discretionary Accruals is not significantly related to these two Independent Variables as shown by the value of p where p = 0.958 for Size of Audit Committee and p = 0.379 for frequency of Audit Committee Meetings, where p > 0.05. Therefore, there is totally no relationship between Discretionary Accruals and Size of Audit Committee and frequency of Audit Committee Meetings.ANOVA of the Dependent Variable (Discretionary Accruals) and the Independent Variables (Size of Audit Committee, frequency of Audit Committee Meetings and Independence of Audit Committee) with the Industry Sectors (i.e. 7 Industry Sectors from Table I) reveals that F statistic is 2.130 for Discretionary Accruals and Sig (p) is 0.053. This significance value for p is slightly above 0.05 and may be considered as 0.05. There is a significant difference between the two groups, i.e. between Discretionary Accruals and the 7 Industry Sectors.The F statistic is not significant for the 3 Independent Variables and the Industry Sectors as the p value is > 0.05. There is no significant difference between the Size of Audit Committee, frequency of Audit Committee Meetings and Independence of Audit Committee and the Industry Sectors.

5. Discussion

- The legal requirement in terms of the Bursa Malaysia Listing Requirements[7] is for three Non-Executive Directors, with majority Independent Directors, in the Audit Committee. Following from this, the more Directors are included in the Audit Committee, the frequency of the Audit Committee Meetings will increase; i.e. more Audit Committee meetings will be held. The larger the size of the Audit Committee, there are more Independent Directors as members in the Audit Committee. From the regression analysis, it is noted that the frequency of Audit Committee Meetings does not have any significant relationship to earnings management as noted by discretionary accruals, which is a proxy for earnings management. As the t value is positive, there is no relationship between the frequency of Audit Committee meetings and the magnitude of earnings management. Hence H1 is not supported. This means that frequency of Audit Committee Meetings is not negatively related to magnitude of earnings management. From the regression analysis, it was noted that there was no significant relationship between the size of the Audit Committee and earnings management. As the t value is positive, there is no relationship between the size of Audit Committee meetings and the magnitude of earningsmanagement. Discretionary Accruals (Earnings Management) is not significantly positively related to size of Audit Committee. Hence H2 is not supported. This means that the Audit Committee size is not negatively related to magnitude of earnings management.The Audit Committee with majority of Independent Directors is negatively related to Earnings Management (discretionary accruals) in respect of the direction of the relationship between Independent Directors and earnings management. However, this relationship is not significant. Therefore, although majority Independent Director in the Audit Committee negatively impacts magnitude of earnings management but the impact is not significant. Hence H3 is not supported. It is thus beneficial for companies to ensure that Audit Committee membership is restricted to Independent Non-Executive Directors to curb company management’s proclivity to engage in earnings management. The data used in this study is gleaned from published Annual Reports. Thus, all the data is historical ratio data. From the regression table, it is apparent that regression may not be the best way to analyse historical ratio data. There is a significant difference in Earnings Management (Discretionary Accruals) between the 7 Industry Sectors. Therefore H4a) is supported.However, there is no significant difference between the frequency of Audit Committee meeting and the 7 Industry Sectors. Therefore H4b) is not supported. There is also no significant difference between Size of Audit Committee and the 7 Industry Sectors. Therefore H4c) is not supported. There is no significant difference between Independence of Audit Committee and the 7 Industry Sectors. Therefore H4d) is not supported. This indicates that the size of Audit Committee, frequency of Audit Committee Meetings and Independence of the Audit Committee is relatively the same across all 7 Industry Sectors. This would be in line with the Listing Requirements of Bursa Malaysia which mandates that public listed companies, regardless of industry sector, would need to have a minimum of 3 Audit Committee Members, have at least 4 Audit Committee meetings annually and majority of the members of the Audit Committee should be Independent Directors.There is no linear relationship between Earnings Management (Discretionary Accruals) and frequency of Audit Committee Meetings, size of Audit Committee and Independent Directors in Audit Committee.

6. Conclusions

- This study focuses on cross sectional data of 1 year, i.e. Year 2011, and is not a longitudinal study. As it is not a longitudinal study made up of several years, there is lack of sufficient data to determine categorically on the impact of Audit Committee characteristics on earnings management. It would be interesting to note what the impact of Audit Committee characteristics on earnings management over several years would be for Malaysian Public Listed companies. Thus a longitudinal study would be beneficial to identify this phenomenon. Additionally, the specific impact of Audit Committee characteristics on earnings management in financially distressed companies over a period of 3 to 5 years would determine the efficacy of the Audit Committee in deterring the practice of earnings management in troubled companies. In view of the market capitalisation of Bursa Malaysia, the propensity for companies to engage in earnings management is much greater. As this study reviewed the data of 153 companies, a more thorough analysis of companies listed on Bursa Malaysia, utilising the data of more than 500 companies, would yield important results.Regression may not be suitable as the form of analyses for historical ratio data therefore another method of analyses needs to be found that would prove to be more suitable and that would provide a better analyses and results. This study was essentially to determine the impact of Audit Committee characteristics on earnings management in Malaysian Public Listed Companies. Audit Committee characteristics such as frequency of Audit Committee meetings, Audit Committee size and the level of independence of the Audit Committee were analysed from 153 companies by reference to the Annual Reports of Year 2011. The study revealed that these Audit Committee characteristics, i.e. frequency of Audit Committee meetings, Audit Committee size and Independence of Audit Committee are not negatively related to the magnitude of earnings management Therefore, these characteristics were not a sufficient deterrent to the practice of earnings management in Malaysian PLCs. There is no significant difference in the frequency of Audit Committee Meetings, size of Audit Committee and Independence of Audit Committee between the 7 Industry Sectors.

ACKNOWLEDGEMENTS

- We would like to thank Prof Dr. Nik Kamariah Nik Mat for her helpful comments and assistance on this paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML