-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(2): 98-103

doi:10.5923/j.ijfa.20130202.08

Key Performance Indicators of Treasury Departments: A Case Study of Local Authorities

Fatimah Hanim Abdul Rauf 1, Asmah Abdul Aziz 2

1College of Business Management of Accounting, Universiti Tenaga Nasional, 26700, Muadzam Shah, Pahang, Malaysia

2Faculty of Accountancy, Universiti Teknologi Mara, 40450, Shah Alam, Selangor, Malaysia

Correspondence to: Fatimah Hanim Abdul Rauf , College of Business Management of Accounting, Universiti Tenaga Nasional, 26700, Muadzam Shah, Pahang, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

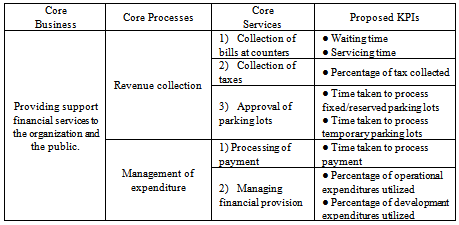

This study aims to propose key performance indicators (KPIs) for Treasury Department of two local authorities in Malaysia based on a model adapted from the Circular on Public Service Progress No. 2 Year 2005. Based on unstructured interviews with the officers and staff of the Treasury Departments of LA1 and LA2, observation of processes, documents and records and a review of relevant literatures, this study managed to propose eight KPIs focusing on efficiency. It was found that both departments have similar core business; providing support financial services to the organization and public, and similar core processes; revenue collection process and management of expenditure process. Since the departments have similar functions, core businesses, core processes and core services, it has been proposed that, they have same set of KPIs.

Keywords: Key Performance Indicators, Treasury Departments, Local Authorities, Malaysia

Cite this paper: Fatimah Hanim Abdul Rauf , Asmah Abdul Aziz , Key Performance Indicators of Treasury Departments: A Case Study of Local Authorities, International Journal of Finance and Accounting, Vol. 2 No. 2, 2013, pp. 98-103. doi: 10.5923/j.ijfa.20130202.08.

Article Outline

1. Introduction

- Local authorities have faced a great pressure to introduce a better comprehensive performance measurement system[1]. Consequently, as argued by[2], KPIs are the outcome of the establishment of performance measures. Therefore, KPI is essential to an organization’s core business. Since government is a service-oriented organization, they have to be monitored on their efficiency and effectiveness in delivering services to the public. Malaysian Government is committed towards encouraging performance-based culture; hence, there is a need to develop KPIs for government agencies[3]. In relation to this, Malaysian Administrative Modernisation and Management Planning unit (MAMPU) has issued a circular namely the Circular on Public Service Progress No. 2 Year 2005[4] entitled “Guidelines in Developing Key Performance Indicators and Implementing Performance Measurement in Government Agencies”. All the government agencies are required to develop KPIs and measure performance to improve the service delivery.Local authority is the closest government agency to the public[5]. However, compared to other countries, local authorities in Malaysia have no direct accountability to the citizens[6]. Reference[7] argued that the use of performance measures in municipalities is quite limited. Therefore, this study tries to propose KPIs for the Treasury Department of two municipalities in Malaysia, Local Authority 1 (LA1) and Local Authority 2 (LA2), which shall remain anonymous to maintain confidentiality. Specifically, this study aims to achieve two objectives. The first objective is to determine core business and core processes of the Treasury Departments of LA1 and LA2. The second objective is to propose KPIs for the Treasury Departments based on the model adapted from[4].

2. Literature Review

- Prior to the issuance of[4], MAMPU has conducted a pioneer project on several government agencies. In the study, Majlis Bandaraya Melaka Bersejarah (MBMB) represented local authorities. KPIs for MBMB have been developed and performance has been measured based on the model and guidelines as in[4]. Vision, mission, core business and core processes of MBMB has been identified. Subsequently, under each core process, core services are determined. Finally, KPIs are developed for every core service. For instance, one of the core services provided under development control process is approval for application of street light. In terms of efficiency, the KPI is the time taken to process the application, whereas, for the effectiveness measures, the KPI is number of application approved[8].In LA2, based on an interview that has been conducted with Assistant Administration Officer of Corporate and Quality Management Unit, most of the departments in LA2 already have its own KPIs. With the assistance of a consultant, LA2 has developed KPIs based on the model from[4]. From the vision and mission of the organization, six core processes have been determined; land development, business control, infrastructure, tax property management, city cleanliness, and community services. Each department developed their KPIs by focusing on three perspectives; core activities, resources and stakeholder. The functions and objective of the Treasury Department has been identified, and later, the core activities of the department are determined. Every core activity had its own KPI, then, indicators are developed for each KPI. The three core activities of the department are budget, revenue collection and collection of arrears. While the KPI for each core activity is the level of management for financial provision, level of maintenance for all types of revenue collection and incremental level of tax collection to total income, respectively. For instance, the indicators for the latter KPI are cost of collection process, total arrears collected and number of notice distributed. Reference[9] in their study proposed two KPIs for collection counters at LA1 and LA2. Consistent with[8], the study has developed two KPIs in terms of efficiency; waiting time to get services and servicing time receives at the counter. Reference[6] conducted a case study of a local authority in Malaysia. She found that the implementation of KPI system in the local council resulted in significant improvement mainly in terms of faster processing time for various types of applications. For example, the time taken to process application of the land workplan has been reduced from 42 days to 48 hours and contractor claims from 30 days to 14 hours. As such, she also found that the use of performance measures also enhancing the staff efficiency.

3. Methodology

- Prior appointment was made and permission was requested to conduct a study in both Treasury Departments of LA1 and LA2. This study employed the qualitative approach as it involves unstructured interviews with the officers and staff of the Treasury Departments of LA1 and LA2, observation of process, documents and records and a review of relevant literatures.Unstructured interview was conducted with the officers and staff of both Treasury Departments. As argued by[10], through unstructured interview, the researchers do not have a planned sequence of questions to be asked to the respondents, with the objective to cause some preliminary issues to surface. At the initial stage, the researcher might ask broad, open-ended questions to respondents. Then, after variables have been identified, the questions would be more specific[10]. The greatest value of personal interviewing lies in the depth of information provided and detail that can be secured[11]. During the interview session, the researchers maintained the neutrality and notes are taken to avoid losing any important information or reporting on inaccurate or incorrect information.The researchers also acquired information through observation. The data obtained through observation are more reliable and free from respondent bias[10]. Besides, it is easier to observe certain groups of individuals from whom it might be difficult to obtain information. Meanwhile, the original data can be collected at the time they occur, hence, the researchers do not need to depend on reports by others[11]. They further argued that, observation is able to capture the whole event as it occurs in its natural setting and it is less restrictive than most other primary data collection methods. In this study, the researchers made observations on activities, documents or records in the departments to determine the core services of the Treasury Departments.

4. Findings and Discussion

4.1. A Brief Background of the Treasury Departments in LA 1 and LA 2

- Treasury Department of LA1 is headed by one Director, assisted by one Deputy Director and two Assistant Directors. This department consists of five divisions, namely; Revenue Division, Expenditure Division, Financial Division, Inspection Division and Administration Division. Each division is headed by its own Assistant Accountant except the Administration Division which is headed by Assistant Administration Officer. Treasury Department of LA2 is headed by one Director and assisted by two Accountants. This department consists of six units, namely; Accounts Unit, Budget and General Administration Unit, Parking Unit, Tax Unit, Counter Unit and e-Payment Unit. Each unit is headed by its own Assistant Accountant.

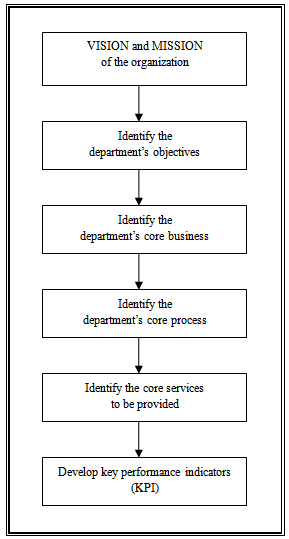

4.2. The Proposed Model

- Figure 1 is an adaptation from a model provided by[4] for government agencies to develop their KPIs, based on a discussion with Deputy Director of Policy and Quality Management Division of MAMPU. The model needs to be adapted in order to be in line with the objective of the study to propose KPIs in the Treasury Department since the original model is based on fundamental processes of the whole organization.According to the Deputy Director of Policy and Quality Management Division, a clear objective is important in order to achieve the mission and vision of an organization. Therefore, a department should start developing their measurement by identifying its core business in line with its objectives. Next the department needs to determine its core process in order to identify services to be delivered by the department. All the services to be delivered to customers should be measured to evaluate its performance. Therefore, it is important for the agency to develop its KPI and set the performance target for each KPI as a base to measure the performance of its services.

| Figure 1. The proposed model for developing KPIs in departments of government agencies |

4.3. Core Business and Core Processes of Treasury Departments

- Interviews have been conducted with the Director of Treasury Department of LA1 and LA2. It was found that both departments have similar core business; providing support financial services to the organization and the public. One of the main functions of the departments is to collect revenue such as taxes, license and compound fees. The departments also control the organization’s expenditures and ensure payments are well managed and within the approved provision. Other functions include approval for application of fixed/reserved and temporary parking lot, managing the parking lot collection, and preparation of organization’s budget and financial statement.According to the Director, two core processes in the Treasury Department of LA1 are revenue collection and management of expenditure. This implies that, the divisions of the department are determined by and in line with the core processes of the department. The other three divisions; financial, inspection and administration, support the activities or services provided by the two important processes. For example, the Inspection Division has to confirm and verify any documents or records from Revenue, Expenditure and Financial Divisions. In processing payments, Inspection Division checks and verifies the validity of payment vouchers, reports and cheques prepared by Expenditure Division. Meanwhile, the Financial Division is responsible towards preparation of financial statements and budgets.Interview also has been conducted with the Director of Treasury Department of LA2. Based on observations and confirmation by the Director, the core processes of the department are revenue collection and management of expenditure. Compared to LA1, the core processes of Treasury Department of LA2 are not determined and in line with the divisions in the department but they are identified based on the processes of the whole department. Nevertheless, both organizations have similar core processes; revenue collection and management of expenditures. Departments are characterized by differentiation due to different tasks and functions that department performs[12] and different services have different set of performance measurement[1]. Therefore, based on these arguments, since the Treasury Department of LA1 and LA2 have similar functions, core business, core processes and core services, they will have same set of KPIs, and this is in line with[9].

4.4. KPIs for the Treasury Departments Based on Core Services Provided

- The process of developing the KPIs is easier since all the workflow procedures have been documented[6]. Based on the model adapted from[4], several core services are determined based on the core processes. Finally, KPIs are developed for each of the core service.

4.4.1. Revenue Collection Process

- Reference[9], in their study found that the first core service for the revenue collection process is collection of bills at collection counters. They argued that the process of revenue collection depends highly on the efficiency of collection counters since the payment counters collect various types of bills. Consistent with[8], they proposed two KPIs for the core service;● Waiting time to get services at counter● Servicing time receives at counterThe front counters play important role in delivering services to the public. Moreover, services delivered by the front counters represent the first direct interaction between the public and the local authorities who are the service provider. Therefore, in the current study, the researchers propose other KPIs in the Treasury Department of LA1 and LA2.According to the Directors of both organizations, taxes represent major source of income for local authorities. This is in line with Section 39 of Local Government Act 1976 (Act 171) where the revenue of a local authority shall consist of taxes. Assessment and Property Management Department is responsible towards assessment of taxes, where bills are issued to the public twice every year. Besides current taxes, action is taken to clear arrears so that backlog can be controlled at minimum level. Due to development in information technology, the Treasury Departments also manage the payment of tax through auto debit, over the bank counters as well as internet banking. Therefore, the second core service for revenue collection process is collection of taxes. According to[13] among the Audit Commission Performance Indicators (ACPIs) for primary local authorities in England and Wales (1993/1994) include percentage of council tax collected. This is similar as in Sheffield City Council[14]. Hence, the proposed KPIs for collection of tax would be:● Percentage of tax collectedIncome from parking lots is also part of the organization’s revenue. Among the activities are processing of application of fixed/reserved parking lot and temporary parking lot, sales of monthly pass and collection from parking lots either privatized or non-privatized. Based on the Assistant Accountant of Parking Unit (LA1) and the Financial Administration Assistant of Parking Unit (LA2), most of the parking lots have been privatised and both organizations have the same privatised agent. Therefore, the sale of monthly pass is on behalf of the agent.Fixed/reserved parking lots are rented to the public in front of their shop lots and business building for a period of one to three months and renewable if necessary. Applications are received directly from the public, processed, and approved by the director. The results of the applications are then informed by phone or mail. However, temporary parking lots are rented for few hours or days, such as, for the purpose of car exhibition, events or transfer of inventory. In LA1, most applications of temporary parking lot are not received directly from the public, but through License Division of Services Management Department. In contrast, the Treasury Department (Parking Unit) of LA2 receives application of temporary parking lots directly from the public. Similarly, after the application has been processed and approved by the Director, the applicant is informed by phone and mail. Therefore, it was found that the third core service for revenue collection process is approval for application of parking lot. Based on[8], the KPI for approval of street light application is time taken to process the application. Meanwhile, among the examples of efficiency measures provided by[15] include the time taken to undertake standard processes. Thus, the proposed KPIs for approval of application of parking lots are:● Time taken to process application of fixed/reserved parking lot● Time taken to process application of temporary parking lot

4.4.2. Management of Expenditures Process

- Processing of payment is crucial in the management of expenditure process. Furthermore, it also ensures that payment is well managed, controlled and within the approved provision and in accordance to treasury instructions. Hence, this process also deals with controlling of organization’s expenditure provisions such as operational expenditures and development expenditures. In LA1, the relevant departments prepare their own payment voucher and not the Treasury Department. If the expenditure submitted by the departments is not provided for in the budget, the integrated system will automatically reject the payment, and payment voucher cannot be issued. The Expenditure Division of Treasury Department will receive a complete document of local order attached with payment voucher from other departments before processes the payment. The target that has been set by the department for the whole process is two weeks. In contrast, the Treasury Department of LA2 prepares the payment vouchers after receiving completed documents of local order from the relevant departments. After necessary checks and balance, cheques are issued and payments are made. The process takes thirty days. The difference in the processing time or target of LA1 and LA2 is due to the differences in the work flow. Therefore, the first core service for management of expenditure process is processing of payment. According to[8], time taken to process application of street light is among the KPIs that has been developed. However, a study by[16] has grouped the KPIs into several measures. In terms of response time statistics, the example of PI is processing claims. Hence, based on the studies, the proposed KPIs for processing of payment would be:● Time taken to process paymentTreasury Circular No. 14 Year 1994[17] has been issued to provide guidelines for government agencies for preparation of budget for operational and development expenditures and measuring yearly expenditure performance. During the preparation of proposed yearly operational expenditures, government agencies need to determine that only required expenditures is considered. This is in line with national fiscal policy and goals to achieve a balanced budget. Even though the performance of expenditures has improved, efforts towards full implementation of development projects and utilization of budget have to be continued. Therefore, it was found that the second core service for management of expenditure process is managing financial provision. Based on an interview that has been conducted with Assistant Administration Officer of Corporate and Quality Management Unit of LA2, the KPI for budget activities is the level of management for financial provision, while the indicator is the total provision used for approved provision. Meanwhile,[15] mentioned that “efficiency is concerned with spending well, with emphasis on the relationship between the outputs and the resources used to produce them”. Hence, the proposed KPIs for managing financial provision would be:● Percentage of operational expenditures utilized● Percentage of development expenditures utilized

4.5. Discussion

- This study only proposed eight KPIs focusing on efficiency measures. The number of KPIs should be small so that everyone’s attention is focused on achieving the same goals[18],[19],[20]. Meanwhile, for external reporting purposes, external government or regulatory agencies require efficiency measures[7]. Reference[21] claimed that efficiency is usually measured in financial terms and data such as costs, volume of service, utilization rate, time targets and productivity, which are relatively simple to quantify. The KPIs that have already developed by the Treasury Department of LA2 are based on core activities of the department, namely; budget, revenue collection and collection of arrears. From these core activities, KPIs are determined. Then, indicators are developed for each KPI. The KPI for revenue collection activities is level of maintenance for all types of revenue collection. While the indicators are total revenue, percentage of revenue received within this period and number of customers per number of services promoted within the specific period. However, since the KPIs proposed in the current study are based on core processes (revenue collection and management of expenditure) and core services of the department, besides focusing on efficiency, they are not the same compared to those already developed by LA2.Meanwhile, the proposed model used in this study has been adapted from[4] based on a discussion with Deputy Director of Policy and Quality Management Division of MAMPU, and it is considered to be in line with several literatures. At the first stage, vision and mission of the organization need to be identified. According to[20], KPIs should reflect organization’s goals. This is supported by[18] who claimed that KPIs must be relevant and reliable, and in line with needs and objectives of the organization. In relation to this,[20] argued that KPIs should be focused differently in different department. Therefore, it is important to determine the objective, core business and core process of the department. Reference[22] claimed that before PIs are developed, key business process need to be identified. Moreover, department are characterized by differentiation due to different tasks and functions that department performs[12]. This would mean that different department has different processes and different services. Thus, different services have different set of performance measurement[1]. Since public sector is a service-oriented organization, it is essential to determine the core services in order to develop KPI which can be used to measure the performance. The reason is that, performance are measured based on services delivered[1],[16],[23],[7].All the eight KPIs focusing on efficiency, which are proposed for the Treasury Department of both organizations has been discussed and agreed upon by the Deputy Director of Policy and Quality Management Division of MAMPU. The core business, core processes, core services and the proposed KPIs are summarized in Table 1:

|

5. Conclusions

- The first objective of the study is to determine core business and core processes of Treasury Department in LA1 and LA2 based on the model adapted from[4]. Both departments have similar core business; providing support financial services to the organization and public, and core processes; revenue collection process and management of expenditure process. The second objective is to develop KPIs in the Treasury Department of both organizations. Since the departments have similar functions, core businesses, core processes and core services, it has been proposed that, they have same set of KPIs. The Malaysian government has taken the right decision to promote KPIs in government organizations. In response to this call, this study is hoped to act as reference to other municipalities in Malaysia to develop their KPIs in their Treasury Department due to the similar processes. Since there is a lack of study regarding development of KPIs in Malaysian local authorities, this study may contribute to knowledge and literature on this area. The recommendations given can also be useful for LA1 and LA2 to review their system and performance. This study can be extended by determining the targets and compare them with actual performance.

ACKNOWLEDGEMENTS

- Special thanks and appreciation goes to all authors of the paper who have given full cooperation in publishing the paper in GCARME 2012. Our sincerest gratitude also goes to our family and friends who have provided their best support. Besides that, we would like to extend our special thanks to Universiti Tenaga Nasional for funding the publication of this paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML