-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(2): 94-97

doi:10.5923/j.ijfa.20130202.07

The Effect of Proprietary Costs and Ownership Structure on the Disclosure of Directors’ Share Options

Faizah Darus 1, Khasniza Abdul Karim 2, Roslani Embi 1

1Accounting Research Institute and Faculty of Accountancy, Universiti Teknologi MARA, Shah Alam 40450, Malaysia

2Commerce Department, Politeknik Sultan Salahuddin Abdul Aziz Shah, Shah Alam, 40450, Malaysia

Correspondence to: Faizah Darus , Accounting Research Institute and Faculty of Accountancy, Universiti Teknologi MARA, Shah Alam 40450, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study examines the proprietariness of information and the influence of ownership structure on the disclosure of information on directors’ share options of 140 Malaysian public listed companies over a 2 year period (2004-2005). Results revealed that family and government ownership dominate managers’ disclosure decision of directors’ share options information. The proprietariness of information did not seem to affect the disclosure decisions of managers in providing directors’ share options information.

Keywords: Directors’ Share Options, Proprietary Costs, Ownership Structure

Cite this paper: Faizah Darus , Khasniza Abdul Karim , Roslani Embi , The Effect of Proprietary Costs and Ownership Structure on the Disclosure of Directors’ Share Options, International Journal of Finance and Accounting, Vol. 2 No. 2, 2013, pp. 94-97. doi: 10.5923/j.ijfa.20130202.07.

Article Outline

1. Introduction

- The issue of executives’ remuneration frequently attracts public attention as stakeholders’ are interested to know about directors’ remuneration packages. Performance incentive payments to top executives in the form of share options rather than cash bonuses are popular in practice. Management with information about such payments to directors has the incentive to disclose such information to stakeholders as the disclosure of such information signals that they are acting in the shareholders’ interests. However, the benefit of such disclosure could be outweighed by the proprietary costs of disclosing such information that could potentially lead to a competitive disadvantage to the company. A company’s varying corporate ownership structure could also have differing influence on management’s disclosure strategy. This study examines the proprietary costs of disclosure of directors’ share options and the influence of ownership structure on management disclosure decision for Malaysian public listed companies for a two year period prior to the implementation of Financial Reporting Standards (FRS) 2 – Share-based Payments in Malaysia.

2. Literature Review and Hypotheses Generation

2.1. Investment Growth Opportunities

- To investigate the effect of proprietary costs on the disclosure of directors’ share options, this study will examine the disclosure of directors’ share options information among companies with investment growth opportunities to proxy for proprietary costs. This is because companies with investment growth opportunities indicate the presence of proprietary costs, which could influence the firms’ voluntary disclosure policy relating to directors’ share options. Taylor et al (2007) pointed out that companies with higher growth opportunities would be more cautious about disclosing directors’ remuneration because they are more likely to have competitors looking for such information with a view to attracting these successful directors’ a better remuneration. Therefore, it is hypothesized that:H1: The percentage change in investment growth opportunities is negatively related to the extent of disclosure of directors’ share options information.

2.2. Agency Theory and Ownership Structure

- Jensen and Meckling (1976) suggests that where there is a separation of ownership and control of a firm, the potential for agency costs arises because of conflicts of interest between contracting parties. The effect of the agency theory on the extent of disclosure of directors’ share option is examined by independent variables related to various elements of corporate ownership structure.

2.2.1. Family Ownership

- Family firms are characterized by the founding family’s concentrated ownership and the founding family members’ active involvement in firms’ management either as top executives or as directors (Anderson and Reeb, 2003). Gaining effective control of the company allows the controlling owner to control the production of the company’s accounting information and reporting policies (Fan & Wong, 2002). As such, family owned companies is expected to limit the supply of accounting information flows to outside investors and have less incentive to disclose the extent of payments made to directors.Thus, it is hypothesized that:H2: The percentage of family ownership is negatively related to the extent of directors’ share options disclosure.

2.3.2. Government Ownership

- Consistent with the argument by Eng & Mak (2003) government owned companies have higher incentives to make detailed disclosure of financial information to signal that are acting in the interests of outside investors and the nation. As such government’s commitment to improve transparency on directors’ remuneration information will lead to an increase in managers’ incentives to disclose directors’ share options information. Therefore, it is expected that government owned companies will disclose more information on directors’ share options. It is hypothesized that:H3: The percentage of government ownership is positively related to the extent of directors’ share options disclosure.

2.3.3. Foreign Ownership

- Xiao et. al. (2004) reveals that higher foreign ownership encourages information disclosure. This is because foreign ownership increases dispersion of corporate ownership and managers will have higher incentives to disclose more detailed information to reduce agency conflicts (Barako et al., 2006). Craswell and Taylor (1992) conclude that different shareholders demand different disclosures and the demand is greater when it is foreign owned, due to the separation between management and owners geographically. Thus it is hypothesized that:H4: The percentage of foreign ownership is positively related to the extent of directors’ share options disclosure.

3. Research Methodology

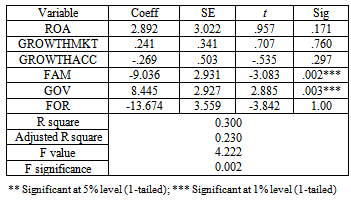

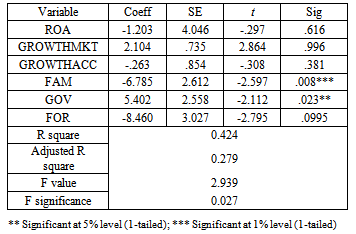

- The data for this study was obtained from content analysis of published annual reports of 140 public listed Malaysian companies for the year 2004 - 2005. The two year window period prior to the adoption of FRS 2 in 2006 in Malaysia was chosen because compensation to directors by the issue of shares or share options during these period were accounted for in equity and would be voluntarily disclosed by management in the companies’ annual reports. Table 1 presents the definition and measurement of the variables for the study. The hypothesized relationships are modelled as follows,DISSHARES = ß0 + ß1 GROWTHMKT + ß2 GROWTHACC + ß3 GOV + ß4 FAM + ß5 FOR + ɛt

4. Findings and Discussion

4.1. Descriptive Analysis

- Table 2 provides the descriptive statistics for the variables.

| ||||||||||||||||||||||||||||||

|

|

5. Conclusions

- Results of the study reveal that the proprietary costs of information on directors’ share options did not inhibit disclosure for government owned companies as the benefits of disclosing such information seems to outweigh the proprietary costs of disclosure. Family owned companies on the other hand are reluctant to make such disclosure since as owner managers they have greater access to internal information and thus have less incentive to voluntarily disclose information to outside investors.

ACKNOWLEDGEMENTS

- The authors would like to express their gratitude to the Ministry of Higher Education, Malaysia, Australian CPA and Universiti Teknologi MARA for funding and facilitating this research project.

References

| [1] | Taylor, D., Darus, F., Liu, J.,“Influences of Proprietary and Political Costs on Disclosure of Directors’ and Executives’ Remuneration and Ownership” Journal Corporate Ownership and Control, 1-24, 2007. |

| [2] | Jensen, M. C., & Meckling, W. H., “Theory of the firm: Managerial Behavior, Agency Costs and Ownership Structure”, Journal of Financial Economics, 3(4): 305-360, 1976. |

| [3] | Anderson, R. C., & Reeb, D. M, “Founding family ownership and firm performance: evidence from the S & P 500”, Journal of finance, 58(3), 1301-1328, 2003. |

| [4] | Fan, J. P. H. & Wong, T. J., “Corporate ownership structure and the informativeness of accounting earnings in East Asia”, Journal of accounting and economics, 33, 401 – 425, 2002. |

| [5] | Eng, L. L., & Mak, Y. T., “Corporate governance and voluntary disclosure”, Journal of accounting and public policy, 22, 325-345, 2003. |

| [6] | Xiao, J.Z., Chee, H.Y., and Chow, W., "The determinants and characteristics of voluntary Internet-based disclosures by listed Chinese companies", Journal of Accounting and Public Policy, 23, (3), 191-225, 2004, |

| [7] | Barako, D. G., Hancock, P., & Izan, H. Y., “Factors influencing voluntary corporate disclosure by Kenyan companies”. Corporate governance, 14(2), 107-125. 2006. |

| [8] | Craswell, A. and Taylor, S., “Discretionary disclosure of reserves by oil and gas companies: An economic analysis”. Journal of Business Finance and Accounting, 19, 295 – 308, 1992. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML