-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2013; 2(2): 67-74

doi:10.5923/j.ijfa.20130202.03

The Fiscal Policy and the Public Debt - Cause of the Budget Balance

Miro Džakula , Amir Karalić

Indirect Taxation Authority of Bosnia and Herzegovina, Banja Luka, B&H

Correspondence to: Amir Karalić , Indirect Taxation Authority of Bosnia and Herzegovina, Banja Luka, B&H.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Public debt is defined as the overall state obligations to its creditors. The public debt is closely related to the budget deficit, since they are opposite sides of the same coin. Thus, public debt is a set of different forms of borrowings that are made by the state in order to achieve certain budgetary goals. The public debt is directly related to the budget deficit, as the state increases the public debt when the budget deficit appears. However, the budget deficit occurs over time whereas public debt is the state of indebtedness at a certain time. Therefore, it is dealt with the categories that are in the cause-effect relationship. The state borrowing is determined by its macro-economic policies, political relations, social policy and social conditions. Repayment of the public debt is the state’s budget obligation. The government's ability to repay debt depends on the existing market conditions and trends of key economic variables (inflation, interest rates, exchange rates, the movement of budget incomes and expenditures, the current balance of payments).Public debt sustainability is defined as the ability of the state is to meet its long term financial obligations to creditors, while maintaining a balance between budget incomes and expenditures.

Keywords: Public Debt, Government Securities, Public Debt Sustainability

Cite this paper: Miro Džakula , Amir Karalić , The Fiscal Policy and the Public Debt - Cause of the Budget Balance, International Journal of Finance and Accounting, Vol. 2 No. 2, 2013, pp. 67-74. doi: 10.5923/j.ijfa.20130202.03.

Article Outline

1. Introduction

- Public debt in the context of fiscal policy the government considers it as commitment to cover a part of public expenditure as opposed to using taxes for these purposes. When and to what extent to use the loan to cover public expenditures, depends above all from the overall condition of the national economy. It really means this: the level of economic growth, inflation trends, monetary stability, employment level, etc. Accordingly, during the development of fiscal policy, that is the principle of coverage of public expenditures that have been imposed by certain functions of public debt which is still shown as applicable. The first function indicates a short-term imbalance between the planned public revenues with the planned public expenditures. In this case the government should reach out for short-term loans regarding harmonization of the budgetary positions, which presents a function of bridging.During the budget period, public expenditures are part of the continuity of budget execution, so that the public loan, in the short term, is more than needed to cover planned expenditures. If in the state there is a need for public investments, it is necessary to provide the capital for its financing. The needed capital the state can provide by public loan, where the limit of indebtedness is determined by profitability of public investments. In this case, public debt has a function of the capital. If the economy registers negative trends then a part of expenditures should be financed by the public loans. The reason for this, it would have raised investment demand at a higher level of employment, which means an increase in GDP. Although, there are series of arguments about the negative relations between the public debt and economic growth, numerous studies and theories indicate to the contrary. Economic analyst Gilles[1] using the theorem of endogenous growth, indicates the positive correlation between economic development and financial markets, which indicates the possibility of existed complementary relations between the public debt as part of the financial system and economic growth and development.Resemble private investors and state borrow money at the best conditions, indicates Missale[2]. In this sense, the government in the present circumstances trying to minimize the cost of borrowing, according to their risk preferences.This paper seeks to emphasize the importance of public debt in the current economic circumstances, referring to the EU countries. Do you borrow and how much it might already timeless question, as economists from Adam Smith, Keynes Friedman had varying opinions on this issue.

2. Basic of Public Debt

- Public debt represents the overall of state obligations towards its creditors, which are based on contracts. Repayment of the public debt is obligatory of the state budget. Public or government debt includes all amounts for which the government borrows in aim of financing the budgetary position, which most frequently represent the public expenditure that cannot be covered by regular public revenues. Public debt is one of the main sources of the extraordinary state revenue, which is especially present in developed economies, but recently is also used by developing economies. As a form of financing the government public debt can be determined by economic interventionism in the economy, by the imbalance of public revenues and expenditures, and by continuing of budget deficit. Therefore, during the fiscal year, there may be insufficient collected amount of public revenues necessary to meet ordinary expenses. Since both positions are planned in the budget, the government can reach out for three possible options:- to increase the tax burden,- to reduce public expenditure in the amount of public revenue,- to incur debts on financial markets.If the current tax burden is too high, then the state is not actually able to increase existing taxes or to impose the new ones. 1Another solution is that government reaches out to reduce public expenditure to the amount corresponding to the level of public revenues. Of course, if these two options do not provide adequate result it will reach out for the option of issuing the bonds thereby initiating the public debt, precisely the public loan.State besides indebtedness in issuing of the bonds, 2can be accessed from various international financial institutions and to create an external debt. In addition, the state can get indebtedness and/at the Central Bank by selling its bonds. This type of funding of the state is called monetization of debt, since the government for the purchase of government bonds must issue the money. This form of state funding may cause inflationary effect and therefore is not a convenient way of indebtedness. However, the Central Bank can access to this modality if it wants to keep interest rates at a certain level, which additionally increases the aggregate demand and thus the prices.The increase in public revenues as a result of increasing of GDP can be the basis for issuing of public debt. Therefore, public revenues, which the growth tendency to represent the certain guarantees for the return of public loan in the future, as a result of decreasing the tax pressure that might burden the following generations, or increased the fee collection base. In this way, the public debt has a function of expansion, provided that the loan funds will be used for public expenditures that enable not only the growth but also the development of the economy as a whole. States, and especially those ones with growing markets faced with a particularly large fiscal risks, as they rely on guarantees, non-budgetary funds and state development bank as defined supstitucie by regular budget inflows. This is certainly the model to overlook the budget constraints of government spending and investment expenditures (Mihaljek, Tissot, 2003).

2.1. State Liability Types

- Polackova[3] emphasizes that state is in fact facing with four main financial risks, but each of them defines the appropriate responsibility, as follows:- direct (unconditional)- potential (conditional)- explicit- implicit. Direct liability occurs under almost all circumstances and therefore is predictable.They can be predicted on the basis of some specific fundamental factors that do not depend (are not conditioned) from a separate factor. For example, future pensions, which are stipulated by law presents direct liability whose size reflects the expected amount of benefits, eligibility factors, and future demographic and economic development. Contingent liabilities bring it to financial transaction only if it occurs by a certain factor that is uncertain by its nature. Potential liabilities are liabilities which occur from a separate factor that may or may not have to happen. It is difficult to predict the likelihood of an unexpected factor and the scope of government expenditures that are necessary in regard to settle the accompanying obligations. The likelihood and scope depend on some exogenous conditions, such as the occurrence of certain factors (for example, natural disaster or banking crisis), and of some endogenous conditions, such as creating the government programs (examples for it are contracts with government guarantees and insurance), as well as the quality and enforcement of regulations and controls.Contingent liabilities of the state can be explicit, which appear as a result of the legal obligations of the state to conduct a payment only in case of an occurrence of certain factor. The fiscal costs of these obligations appear at the time of their maturity and, as such a burden for public finances in the future. If the state guarantees for all funds and all risks, and not only for political and commercial, then can occurs the danger of moral hazard in the market. If it can be expected that government guarantees are activated for direct government liabilities, and there is a question of solving problems of liabilities for which the occasion and the amount are state expenditures that cause them. These are potential liabilities that may involve informal character of their origin and may occur only after the bankruptcy of a private or government entity whose commitments undertaken by the state.3Explicit liability is a certain obligation(s) of the state which are regulated by the special law or agreement. The state has the legal authority to settle maturing obligations. Common examples are the settlement of state debt and credit/ loans that do not bring return and that was guaranteed by the state. Explicit obligations the state must settle because they are based by law or by the contract, as opposed to implicit, which represent a moral obligation, and the state settles them due to expectations of the public or political pressure, although it is not based on law. If the state does not settle its direct – explicit obligations in determined deadline (outstanding commitments), it can result in a chain reaction of insolvency as well in the budget and in the economy.Implicit liability represents the expected liability of the state that has not been established by some law or agreement, but instead of it is based on public expectations, political pressures and the overall role of the state towards the understanding of society. Examples of implicit liability are future state pensions that are not stipulated by law, in case of disaster for uninsured victims and unfulfilled commitments by some big bank in connection to unguaranteed financial obligations. In highly indebted countries, there is an objective problem in the market to disclose information about new commitments, and not to misuse it in the sense of speculative actions that lead to increased risks for investment on the one hand, and falling credibility of the state on the other hand. As newly obligations undermine the relationship of debt and GDP, the market perceives it as a serious problem of debt sustainability, and it is developed a tendency to slowly reveal the potential liability, or are not revealed at all.

3. Public Debt as an Instrument of Public Financing

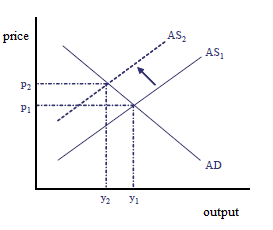

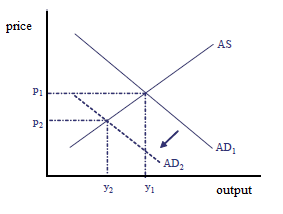

- Contemporary economies are observing the budget deficit and public debt as an instrument of anti-cyclical policies. However, many non economists find the budget deficit and public debt as a negative phenomenon and a threat to the economic system. Historically speaking, classics (classical economists) were also having the opinion that the public debt, and thus the budget deficit are not welcome in the country, but can only be used in a short time to cover the outstanding short-term demands for public spending. Long-term indebtedness of the state they have been justifying only in cases of use of the loan funds in productive purposes. In short terms that would be those capital investments whose rate of return is higher than the interest rate on taken loans. According to them, and private and public indebtedness is directed towards the harmonization of the time streams of income and expenditure. Modern economic analysts do not have a unique viewpoint about the impact of deficit and public debt to economic tendencies and financial system. There are viewpoints that the public debt can stimulate the economic activity, but also and claims that the effect of deficits and public debt is neutral or even detrimental.State debt, whose payout is conditioned by the realization of the primary surplus, should have protected the country from adverse shocks to/on fiscal assets. So for example if we have debt that is indexed by GDP, which acts as a substitute for tax revenues, it could ensure that debt service is moving in the same line with state income. However, as markets are imperfect, it is impossible to have a debt that depends on all conditions, while to the other side is certainly possible to issue debt instruments that depend on certain conditions, including conventional debt instruments. Conventional debt such as nominal debt with fixed rate and inflation-indexed debt has subordinate characteristics, which are conditioned by the nature of economic shocks. A negative demand shock causes a decline in prices along with the fall of the economy. With prices declining, the debt whose payout is indexed to the price level would protect the fiscal position when revenues are decreasing and demand for expenditures grows as a result of the increase in items such as unemployment. Protection of the fiscal position could be also achieved by the nominal debt with fixed rates, where there is a negative supply shock. A negative supply shock will be accompanied by a combination of falling production and increase in price levels.Anti-cyclical fiscal policy implies that tax incomes decrease and expenditures increase with GDP, and debt structure that is characterized by the nominal debt, decreases real payout of debt during recession. Such debt instrument supports anti-cyclical fiscal policy over time in an economy that faces the supply shocks. The connection between the negative shock supply and demand and debt instruments that protect the state finances of these shocks is shown in the following charts.In practice, taking into consideration that the time and nature of the shock are uncertain, it is impossible to know previously what is 'desired' composition of debt, which would protect fiscal position. Therefore, governments are trying to identify such a combination of debt, which would enable the actual debt return is conditioned on future events, results from Togo[4].For example, the debt consisted by a combination of nominal and long-term debt of indexed price that may neutralized the impact of shock supply and demand by minimizing fluctuations of costs in servicing the debt. Furthermore, diversification of debt instruments can help to reduce the cost and risk simultaneously.An alternative for Debt Manager is to ensure that debt servicing, that is, its repayment increases in good times, so that all have the ability to issue an expensive debt, and provide funds for the bad times. Another financial characteristic that can create discord between the state assets and liabilities are cyclical characteristics of risk premiums. 4 Hence, efficient management of public debt implies the creation of an adequate structure of the public debt as pointed out by Malecky[5] in his work.

| Figure 1. Impact of negative aggregate supply shocks and the desired debt instrument |

| Figure 2. Impact of negative aggregate demand shocks and the desired debt instrument |

3.1. Fiscal Solvency and Public Debt

- Historically speaking countries have reached out to public debt for different reasons. In the beginning, there were the reasons of the settlement of public expenditure in exceptional circumstances (economic crisis, wars, natural disasters etc). Over time, more specifically after the Second World War there was an increase in the share of debt to gross domestic product, which was caused by the increase of budget expenditures for capital projects. Since this was the period of the Keynesian economic thought (school), which emphasize that active government intervention in the market and monetary policy ensures the best growth and stability, that indebtedness in this period becomes prominent. On the other hand, the neoclassical school, sets relations to supply and demanding the sense that each agent decides on increasing the production, however, each school supports the long-term macro-economic equilibrium. If there is an imbalance, it comes to long-term various changes and difficulties that can end the crisis, which is then solved in a numerous of economic and non-economic ways.However, in its work and in its terminology Domazet[6] emphasizes, the excessive indebtedness and debt crises are not synonyms, that is in macro-economic terms, the government may be over-indebted, but this does not mean that the debt crisis has occurred. There are several indicators determining the degree of indebtedness. First of all we should know what the purpose is of the intended indicators, and therefore to analyze its (1) solvency, (2) liquidity, (3) the public sector, (4) the financial sector, and (5) corporate sector. Governments must often lend funds in order to fund costs related to public goods and services that promote growth and increase of the national welfare. Fiscal policy determines on how much a loan will be by determining the targeted height of debt based on an analysis of maintenance of state debt. When the government decides how many sources should be collected, the next step is to determine how these funds will be delivered. 5In other words, the current government should decide which debt instruments will be used to collect the required funds. Similarly, to any private creditor, the current government will seek the best conditions for the loan exercise.Of course, that key role would have changes of economic variables that determine the level of indebtedness, as well as the dynamics that is ability of payout. Trends in financial markets will fundamentally shape the method for government indebtedness. If financial markets would be completed and efficient, the debt structure would not be the subject to the differences between long and short-term interest rates, exchange rates, etc. Due to differences in trends of interest rates in long-and short-term loans, in most cases it is considered that debts with longer maturities are safer in terms of risk financing. It is very important that the state as a debtor pays out on time its obligations, so as not to burden the following budgets, and disrupt the harmonization of revenues and expenditures. In this sense, the incomes should be stable and plentiful. New market economies have a need to decrease its fiscal deficit; however few of them have undertaken some significant actions to solve this problem. The basic problem that appears in this context is: how the choose between decreasing of the public spending and increasing of the tax that affects the ability of central banks to maintain price stability. Similar concerns are in regard the price sustainability that appears regarding the timing and size of changes in government compensations, prices that are charged by public (state) enterprises, state subsidies and pension contributions. All these items affect the reduction in total aggregate demand, which has the effect of maintaining price stability. However, in practice is extremely difficult to implement budgetary constraints.Therefore, one of the approaches to reduction of the budget expenditures is the introduction of restrictions on certain budgetary expenditures. Such limits are seldom effective and lead inevitably to demands for their removal, and finally result in pressures on domestic demand. In order to reduce budget expenditure as realistically as possible, another approach is to implement reductions in areas where there is sufficient political support. Examples vary from one country to another, and include expenditures for insurance of unemployment, expenditures for defense, civil servants' salaries, or contracting with private companies for services that have been previously provided by the state. The experience of industrial countries indicates that implementation of such programs is not simple and may result in additional budgetary expenditures. The second basic approach to fiscal adjustment is increasing of taxes and other government incomes. Central Banks are generally less favored due to its direct impact on inflation. It is usually claimed that increase of taxes and regulated of prices of public goods and services have only a temporary impact on inflation. Higher prices for public goods and services produced in public owned companies can also decrease the subsidies that state gives to those companies, and therefore it is considered as a basis for medium-term fiscal adjustment. However, increasing of taxes and other regulated prices of public goods and services that would be sufficient to reduce the large fiscal deficits in many new market economies that are politically unacceptable.Indebtedness on the other hand, also presents a problem for new market economies since it carries out a wide range of both subjective and objective reasons. In their work Toth and Dafflon[7], emphasize the main reasons for the low level of debt in the countries of Eastern and Central Europe:→Lack of technical and administrative capacity to manage debt;→Low predictability of flows of current incomes (due to the macroeconomic and institutional reasons);→Incomes from privatization, inter-governmental grants as a substitute for debt financing;→Cultural aversion against the indebtedness (the existence of the debt is a sign of financial instability, debt is a risky form of financing, a debt takes an unfair burden on future generations);→Rules that limit lending and debt; →Differences n local tax bases and valuable assets, which reduces the chances for units of;→Local self-governments to make debts;→Lack of a mature financial market;→High interest rates caused by the inflation;→Minor role of units of local self-government in investments of public sector.

4. Public Debt Threshold

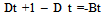

- It is perfectly legitimate concern, as well as how each country observes at the level of public debt This problem is related to the growth of public debt, regardless of the reasons for indebtedness. The question is, to what is indicated the public debt when becomes unsustainable?The growth of debt share to GDP, especially if it is persistent, and not temporary, represents the indicator of fiscal disorder, which requires appropriate intervention.If we want to give emphasis to the indebtedness of a certain country, then the most attention is focused on two indicators:1. ratio to (%) of debt to gross domestic product (GDP)2. ratio of debt and exports.When we are talking about the limit of country indebtedness, usually we focus our attention on the regulations to the Treaty of Maastricht due to the establishment of the European Union and the Protocol to the Treaty from 1992. Online available:http://eur-lex.europa.eu/en/treaties[8]. From EU member states by that agreement it is determined the upper limit of debt related to GDP in the amount of 60%. At the same time it is necessary to know that a relatively small number of EU countries meet this criterion. However, the EU and especially the European Monetary Union (EMU), the greatest attention is dedicated to meeting the criteria under which a budget deficit do not exceed 3% of GDP, which is practically another form of indebtedness.Ratio between debt and export is considered particularly as an important indicator of the macro-economic analysis, since on the one hand, in some way it points out the involvement of the domestic economy in international economic trends, on the other hand in a direct way and the possibility of settlement of external debt. The positive rate of change of ratio between the debt and GDP, particularly if it is permanent, and not just temporary, indicates serious fiscal confusions, which should cause an alarming situation. In its work, Passineti[9] indicates the linking of rate of GDP growth, primary surplus that is deficit and public debt. If the height of public debt, no matter how high, is stable and, more importantly, when the time passes, this implies a primary surplus of the state budget (ie. the state budget without interest rates), sufficient to fully cover payment of interest rates and also to payout a part of the remaining debt. The area of sustainability in the case of public debt can be represented by the ratio between surplus or deficit and public debt for any given rate of GDP growth. Area of sustainability involves stabilizing of the debt at a certain level. In this context, it is necessary to establish the primary budget balance that is needed is to set the level of public debt, interest rates and nominal growth of GDP, to stabilize public debt.Generally speaking, debt sustainability can be seen and as the ability of debtors that with the appropriate structure of budgetary revenues and expenditures of the long term fulfills its obligations toward creditors. Thus, debt will become unsustainable if it grows faster than the debtor's ability to be regularly serviced. Of course that market expectations of key economic variables (interest rates, exchange rates, the rate of economic growth, inflation rate, etc.) would impact on debt sustainability. The debt is considered sustainable if it is expressed in relative number, not increasing with time. To meet the requirement of sustainability, it is necessary that:

| (1) |

| (2) |

| (3) |

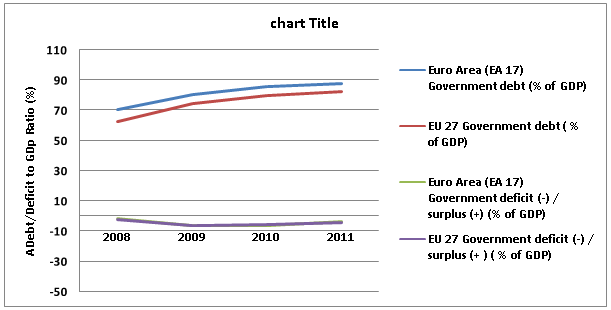

| Figure 3. EU-27 and EA-16 public balance (scale inverted) and debt over the period 2008-2011. Eurostat newsrelease |

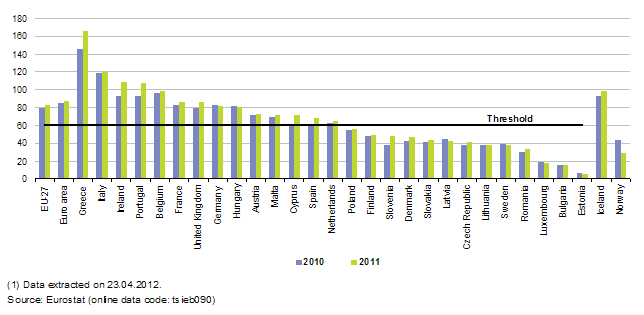

| Figure 4. EU-27 and EA-16 Government debt-to-GDP ratios the period 2010-2011. http://www.epp.eurostat.ec.europa.eu |

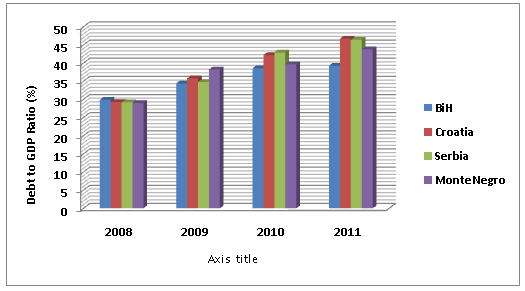

| Figure 5. Debt to GDP Ratio over the period 2008-2011. For BiH, Croatia, Serbia and Monte Negro |

5. Conclusions

- An important determinant in the creation of fiscal policy is harmonization of budget incomes and expenditures. In this sense, the existence of budget deficit refers to the timely intervention of the fiscal authorities. The possibility of creating the public debt in order to cover the budget deficit represents one of the potential instruments. Public debt which is covered by the budget deficit indicates the state's obligation to repay its interest rates and principal interest after the due date. Obligations of state that were generated given debt should be harmonized with the financial risks that are defined in accordance with strategic goals. Historically speaking the public debt and the budget deficit, there was a different approach both in the theory and practice. Economists have historically indicated and explained the various implications of debt in the economy and financial system of the country. So the classics approved indebtedness of the country in the short term only because of the budgetary stabilization, while the long-term indebtedness they have justified it by investments in infrastructure and other state projects, with a higher rate of return from the interest rate on taken loan. Modern economists observe the public debt differently depending on the preferences of the overall macro-economic policy.For fiscal policy as well as the overall condition of the national economy it is necessary to determine the limits of public debt, which should indicate the existence of fiscal imbalance. Analysis of the indicators of indebtedness will enable to creators of economic politics to determine guidelines for fiscal and overall economic policy of the country. For BH, we could say that due to insufficient development of financial markets, primarily the market for government securities, debt management policy is implemented by fiscal policy, which is insufficient in the context of the general economic development.

Notes

- 1. The introduction of a new form of taxation or increase of the existing tax rates in the short term affect negative on businesses, since its concept of operations cannot adjust in a short time to new fiscal pressures.2. Government bonds are long-term securities issued by a state with a maturity over five that is ten years however, the state issues and short-term securities that is treasury bills, which by definition are not bonds, but still represent a state debt, because they are short-term marketable securities with maturities of up to one year. Issued by the State Treasury (Ministries of Finance), government agencies or central banks.3. The government is often forced (even when there is no legal obligation) to finance losses and liabilities, lower levels of government, public and large private enterprises, budgetary and non-budgetary funds and agencies, and other important political institutions. Due to implications of such government actions can have on the amount of state debt, according to the analysis it is necessary to consider potential liabilities for debt sustainability.4. For economies in development recession has a tendency to be associated with a higher premium risk, which means that the premium risk is procyclical.5. The variety of options that are available to the government certainly vary in different countries mainly because of their level of development.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML