-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2012; 1(6): 208-212

doi: 10.5923/j.ijfa.20120106.10

Enhancing Accountability in Governance through Adoption of International Public Sector Accountability Statement

Jones Orumwense

Senior Lecturer, Kampala International University, Kampala Uganda

Correspondence to: Jones Orumwense , Senior Lecturer, Kampala International University, Kampala Uganda.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The efficiency of good governance rest on the free flow of unbiased objective information from the stewards of capital to its provides. Research as well as recent corporate malfeasance scandals provide ample evidence regarding the importance of high quality financial information to the efficient functioning of the capital markets. The issue of corporate governance and accountability will be a perpetual issue and civil continue to dominate academic seen, until equilibrium is attain.

Keywords: Enhancing Accountability, Governance, Public Sector

Cite this paper: Jones Orumwense , "Enhancing Accountability in Governance through Adoption of International Public Sector Accountability Statement", International Journal of Finance and Accounting , Vol. 1 No. 6, 2012, pp. 208-212. doi: 10.5923/j.ijfa.20120106.10.

Article Outline

1. General Background

- Recent spate of corporate collapse globally, has drawn attention to corporate governance failures in preventing or forewarning these events. Although issues pertaining on how well corporations can be governed can be traced to Adams smith remarks“...being the managers of other people money than of their own, it can not well be expected that they should look over it with the same anxious vigilance with which the partnership of a private carpentry frequently watch over their own....negligence and profusion must always prevail, more or less, in the management of the affairs of such company”.[1]Smith foresaw the potential problem of companies in relation to management owners’ interest since his time. Jensen & Mecklin[6], in their celebrated seminal work, defined firm or a company as “one form of a legal fiction which serve as nexus of contracting relationship which is also characterized by the existence of divisible residual claims on the assets and cash flow of the organization which can generally be sold without permission of the other contracting individuals.The collapsed of notable industrial and financial giants; Enron, Worldcom, Parmalat, etc has brought the subject matter into stiff discourse. An unprecedented number of earnings restatements and claims of blatant earnings manipulation by chief executive of failed corporations resulted in a number of Corporate Governance (henceforth, C.G.) reforms and enactment world over( e.g., Blue Ribbon Committee 1999; Sarbanes-Oxley Act, U.S. House of Representatives 2002; Securities and Exchange Commission 2002; Business Roundtable 2002; SAS No. 89, AICPA 1999a; SAS No. 90, AICPA 1999b).In Nigeria, rules like Prudential guidelines 1990, C.G. codes of SEC, 2003, CBN, 2006 and Insurances code of 2009 were some of efforts to checkmate and correct the governance activities and structure of corporate bodies in the country.The enactment of these rules and guidelines became necessary to safeguard corporate polity from collapse and create an investment atmosphere that is clean and hitch free. Saving the corporations from decaying is as important as saving the polity. As puts by Wei[11], Companies are fundamental cells of commercial society. One of the unique characteristics of corporate economic unit is that those owned them do not involve in running their affairs. Where ownership is disperse directors get more monopoly power in running the affairs of the companies in their own desires. As a fiduciary duty, directors are expected to act in the best interest of the owners; maximize their stake at a reasonable bearable risk. However, from practical point of view conflict of interest might definitely exist. While the owners are after return (dividend & caappreciation) reflected on share price, directors set to target short-term return for lucrative compensation. Persistence of these conflicts led to an agency problem. In early history of there existence, corporations or what was referred then as Join stock companies employed services of professional accountants (auditors) to check the affairs of directors. Moreover, to opine whether the interest of directors was in congruent with that of the owners.Nowadays, corporations occupy and contribute immensely to the development of industrial capitalism. In fact they are the main stay of capitalist ideological paradigm. They are the main powerhouse of wealth creation, accumulation., intermediation, exchange, distribution, and sustenance. Failure of these economic agents may tantamount in to collapse of an economy a nation and a polity. This was evident in the 1990’s Asian crisis in which several governments lost power.Owing to the consequence of collapse of companies and its dilapidating socio political and economic disaster, combined efforts were made internationally and at local level to come up with bench mark rules and guidelines in managing and controlling the affairs of these vital institute. Such efforts are codified and issued mostly by regulatory agencies across the globe in the name of corporate governance code. The sole purpose of the codified rules was to ensure maximum accountability and transparency in the running of the affairs of corporation.Therefore, in line with the title, the presentation aimed to answer two basic questions:What role corporate governance agents and structure plays in sound accountability?What are the synergistic interactions between corporate governance mechanisms and accountability?The rest of the paper was organized as follows: Section two traced the historical development of C. G., concepts of C. G. and Accountability. Section 3 dwelled on synergistic interaction between C.G. components/ mechanisms with Accountability. Section 4 summarizes and concludes the paper.

2. Genesis and Concept of Corporate Governance

- The concept of “governance’ is not new. It is as old as human civilization, Simply “governance” means: the process of decision-making and the process by which decisions are implemented (or not implemented). Governance can be used in several contexts such as corporate governance, international governance, national governance, and local governance.The term ‘corporate governance’ was first used by Richard Ealls in 1960, to denote the structure and functioning of corporate polity. The term was derived from an analogy between cities, nations or states and the governance of corporations. Early writers in finance literature used representative government as an important advantage over partnerships.However, depending on the perspective and theoretical axis viewed, C.G. has attracted so many definitions as thus:

2.1. Angzo- Saxon Perspective

- Here C.G. was viewed from narrower perspective to mean the relationship between corporate managers and shareholders. A complex set of socially defined constraints that affects the willingness to make investments in corporations in exchange of promises (Dyk,2000). Meyer (1997), views the concept as “ways of bringing the interest of investors and mangers into line ensuring that firms are run for the benefit of investors. Ways in which corporations are managed and control[5].“The ways in which suppliers of finance to corporations assure themselves of getting return on their investments (Shlefier & Vishny, 1997). Tn a more elaborate definition Denis and McConnell (2003), view the concept as “Set of mechanisms both institutionally and market based that induced self- interest controllers of a company (those that make decision on how the company can be operated) to make decisions that maximizes the value of the company to its owners( suppliers of capital).All these definitions stressed on investors interest ignoring other stakes of a corporations. In addition, the definitions were rooted from two parties’ conflicts Agent and Principal.

2.2. Franco German Perspective

- Upholding to Franco- German philosophy of governance Aguilera[3], posits C.G. as “the study of distribution of rights and responsibilities among different participants in the corporation such as managers, shareholders, the board of directors, employees and customers. Stressing on the same perspective, Daily et al (2003), view the term as “the determination of the broad uses to which organizational resources will be employed and the resolution of conflicts among myriad, participants in organizations.In essence, C. G. of a firm entails set of relationship between a company, its management, its board, its shareholders and other stakeholders and spells out the rules and procedures for making decision on corporate affairs. It also provides the structure through which the company’s objective and monitoring performance are defined.The basic deference between Anglo Saxon view and Franco German view is that, while the former narrowed C.G. on management , and owners; agency theory. The latter encompasses the whole stakeholders to a corporation, stakeholder theory.However, despite theoretical difference of the two views both stressed and share a common boundary on the issue of how accountable managers are to the interested groups. This brings us to the concept of accountability.

2.3. Accountability

- Accountability is construct that made up of two concepts:“account” and ‘ability”. Understanding each one separately will make us to appreciate the term clearly. Account has its origin from feudalistic period in those days the term was called stewardship meaning “narrating the happenings” .In those days the feudal lords employed stewards to manage their estates the steward narrates the happenings to the lords when he was away. The Accumulation of wealth in various forms transforms the role of a steward from that of a narrator to someone that is expected to be accountable to the owner. The word account therefore means record of events or transaction that has financial implications.Ability refers to a state of one physical arid mental capacity to carry out assigned responsibility. Therefore the term is technically seen as “the liability to reveal, to explain, and to justify what one does, how one discharge his responsibilities assign to him, financial or any other. “Accountability is a legal liability the establishment of a pattern of control over receipts and expenditure that permits a determination either by the executive or by the legislature, that corporate money has been used for the intended purposes.Accountability aimed towards achieving the followings:• To ensure Faithful, efficient, economic, and effective use of funds or what is referred to as value for money.• To provide information necessary for corporate action.• To improve information that aid policy formulation and implementation.• To serve as a mechanism for effective control.A good system of accountability should mandate a person to submit for an examination of the accounts by either the trustee to whom he/she directly accountable or an agent appointed to act on trustees behalf.Accountability is a key requirement of good governance. Not only governmental institutions but also the private sector and civil society organizations must be accountable to the public and to their institutional stakeholders. Who is accountable to who varies depending on whether decisions or actions taken are internal or external to an organization or institution. The major players in C.G. Namely: auditors, management, audit committee, board of directors must work together to ensure that the highest quality of financial information is provided to the stakeholders who make important decisions based on that information. When such is achieved with probity and honesty then accountability is said to be achieved.From wider perspective, accountability should be extended not only to investors but also to general users of financial information.

3. Relationship between C.G. & Accountability

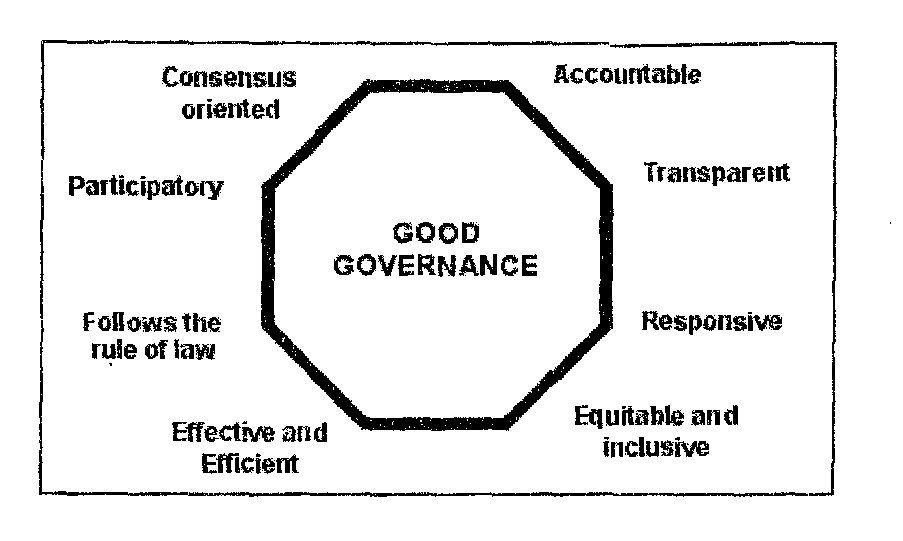

- Good C.G. provide smooth infrastructure for accountability and in turn accountability characterized good governance.Financial report served as a medium of managers accountability to owners in a corporation. This financial accounting information is a product corporate accounting and external reporting systems that measures and publicly disclosed audited, quantitative data concerning the financial position and performance of publicly held firms. Financial accounting systems provide direct input to corporate control mechanisms, as well as providing input to corporate control mechanisms, by contributing to the information contained in stock prices.

| Figure 1. Characteristics of good governance |

3.1. Evolution of Corporate Governance

- Several factors contributed to the growth and interest on corporate governance some major identifiable factors are:• the world wide privatization• pension fund reforms and the growth of private savings• the take over waves of 1980’s• deregulation and the integration of capital markets• the 1998 East Asian crisis• Series of financial crisis in western economies especially U.S.• Current global financial turmoilMoreover, as land history, the aftermath of Cadbury report 2002 led to proliferation of governance codes world over. In Nigeria though some issues relating to C.G. could be traced from CAMA 1990 as well as prudential guidelines of 1990, the celebrated codified governance rules was the NSE code of 2003. The code stressed on three aspects of governance:• Board of directors• Shareholders • Audit committeeTo ensure prudence and accountability the codes set out the followings as benchmark:• Board size between 5 to 15• Board seat to shareholders with 20 % or more of equity stake.• As protection df minority one person to represent them on the board• CEO duality(abolished)• Vice chairman were CEO is also the chairman• Non executive directors to fix the remuneration of the ED’s• Prominence to audit committee, with a single seat for ED”s NED to serve as a chairman.• Board meeting to be distance wise and frequently.However, despite all the provisional measures to ensure accountability, prudence and transparency, the code failed to deter corporate failures and mismanagement by corporate executives.Therefore, another Code was specifically issued in 2006 for banks and further issued was for insurance businesses in 2009. Some of the major areas of improvements and concerns that could be directly related to accountability are:i. Restriction of government stake to 10%ii. Mandatory approval by CBN for equity investments above 5% by any investorsiiii. Abolishing the post of vice chairman and separation of chairman with’ CEO.iv. Limiting board size to 20v. Board composition: NEDTs to be greater than EDs.vi. Directors tenure: maximum three terms of fours yearsvii. Welfare of directors to be determined by shareholders at AGM.viii. Mandatory establishment of specific board committees: remuneration, finance and general purpose, credit risk management and audit.ix. Restriction imposed on the tenor of external auditors to ten years after which the firm will not be eligible for appointment until after ten years. Complying with this codes by banks and insurance companies is mandatory. Nevertheless, with all these provisions financial sector is still not sanitized, Recently, CBN fired some chief executives on the accused of gross mismanagement. Nigerian C.G. was described more of Anglo Saxon mode. However, current modes exist which can be of import to policy makers. These are listed below:• Take over models• Block holder models• Delegated monitoring model• Board model• Executive compensation model• Sharing control with creditors• Sharing control with employees

4. Summary and Conclusions

- Indeed, good governance is crucial not only in preventing major financial reporting disasters, but also i.n ensuring that significant issues impacting the financial reporting process are appropriately accounted for by the corporation. However, ensuring high-quality financial reports requires that all stakeholders, and not just the management, take an active role in the governance process. Indeed this could be attained through sound internal control and check, capital market efficiency and sophisticated reporting and disclosure provisions.The efficiency of capital markets rests on the free flow of unbiased, objective information from the stewards of capital to its providers. Research as well as recent corporate malfeasance scandals provide ample evidence regarding the importance of high-quality financial information to the efficient functioning of the capital markets. The issue of C.G. and Accountability will be a perpetual issue and will continue to dominate academic seen, until equilibrium is attain.

Abbreviations:

- AGM: Annual General MeetingC.G. Corporate GovernanceCBN: Central Bank of NigeriaCEO: Chief Executive OfficerED’s: Executive DirectorNED’s: Non Executive DirectorSEC. Security and Exchanged Commission

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML