-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2012; 1(6): 131-141

doi: 10.5923/j.ijfa.20120106.01

A Study on the Perception of Users of the Accounting and Tax Modules of an Erp System for the Brazilian Freight and Passenger Road Transport Sector1

Ivam Ricardo Peleias 1, José Carlos Trevizoli 1, Pedro Luiz Cortes 2, Napoleão Verardi Galegale 3

1Centro Universitário Álvares Penteado , Master Program in Accountantcy , Avenida Liberdade, 532 , São Paulo City , São Paulo , 01502-001, Brazil

2Universidade de São Paulo , Escola de Comunicação e Artes , Avenida Professor Lucio Martins Rodrigues, 443 , São Paulo City , São Paulo , 05508-900, Brazil

3Pontifícia Universidade Católica de São Paulo , PUC-SP , Master Program in Accountancy , Rua Ministro Godói, 969 - 4. Andar , Sao Paulo City , Sao Paulo , 05015-901, Brazil

Correspondence to: Ivam Ricardo Peleias , Centro Universitário Álvares Penteado , Master Program in Accountantcy , Avenida Liberdade, 532 , São Paulo City , São Paulo , 01502-001, Brazil.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The aim of this research was to identify and describe the users’ perception of the accounting and tax modules of an ERP system developed for the Brazilian freight and passenger road transport sector. The perception was evaluated concerning the implementation impacts and the use of the ERP System. It was an empirical research, of the descriptive type, preceded by a bibliographic review, to identify and analyse relevant aspects of the reality lived by the users of the studied system-object. The field survey was made through a two-part questionnaire, the first one to identify and describe the profile of the users, and the second one containing 30 assertions related to the system use. The respondents were 37 users of the accounting and tax modules employed in companies clients of the software house that developed the system. The descriptive analysis made it possible to identify the users’ profiles, the main use features of the systems and some aspects important to the users. The cluster analysis allowed to identify three groups of users (optimists, realists and pessimists), and the second cluster showed the highest number of users. The results identified aspects to be improved for future enhancement of the system versions.

Keywords: ERP Systems, Transport Sector, Accounting

Cite this paper: Ivam Ricardo Peleias , José Carlos Trevizoli , Pedro Luiz Cortes , Napoleão Verardi Galegale , "A Study on the Perception of Users of the Accounting and Tax Modules of an Erp System for the Brazilian Freight and Passenger Road Transport Sector1", International Journal of Finance and Accounting , Vol. 1 No. 6, 2012, pp. 131-141. doi: 10.5923/j.ijfa.20120106.01.

Article Outline

1. Introduction

- The use of Information Technology (IT) has grown in companies, demanding great investments in needs assessments and the implementation and maintenance of installed equipment. This need requires decision processes to assess on resource applications and the impacts the adoption of new technologies exerts[1, 2].Integrated management systems, also called ERP (Enterprise Resource Planning), are used in companies from different segments and sizes, and their rational use imposes changes in administrative processes, forcing professionals towards optimization. Accounting professionals are part of this context and can benefit from the use of ERPs, obtaining and providing information for operational and management use. Once established and well used, information processing and collection times can be reduced, a situation that allows these professionals to take up new positions and functions, so as to better understand decision models and provide managers with tailor-made information[3].The importance of decisions and investments needed to incorporate new technologies make companies seek guarantees to successfully make feasible IT, so that resources are not used in vain[2]. A research performed by[4], involving 271 companies around the world, appointed that, in that year, investments in IT and especially in ERP system increased by about 71.0%. This indicates that, through IT use, companies work to optimize and speed up business processes, besides improving information production, a situation that affects the accounting and tax areas[3, 5].Other studies have investigated solution choice methods companies can use to selected ERP system that are adequate to their needs[6], the impacts of these systems in specific activity sectors[7,8], on Accounting in general[9] and accounting implications in specific activity sectors[10].Concerning the impacts of ERP system use in accounting, some studies need to be mentioned. Spathis andConstantinides aimed to determine the reasons that made organizations change their conventional systems for ERPs [11]. Besides identifying a series of changes this change enhanced in the accounting area, the companies under analysis obtained reduced operating costs, decreased process times and greater client satisfaction. But ERP systems do not always widely adhere to the accounting processes used in organizations or defined in the legislation in force. In a case study[12] analyzed the inability of an ERP system to respond to accounting requisites in view of legal requirements. Chong analyzed the use of ERP systems to support management accounting, indicating that they produce relevant information for decision making, improving management performance in more uncertain contexts[13].Other studies analyzed the economic and financial impacts of using ERP systems. Velcu studied the economic benefits obtained when using these systems and the impact of ERPs on business processes (for companies that adopted a more technological approach in their business and for those with a more finance-focused view)[14]. In both groups, financial management changes were identified in the organizations studied.Some studies show, among other aspects, the need for a better understanding of accounting and tax processes with a view to the correct use of ERP systems in an organization’s different departments[15].Among research on the implications of using ERPs in the accounting area, no specific studies were found that jointly studied and analyzed the perceptions of the accounting and tax module users in specific activity sectors. This gap offers the opportunity to develop this research.The research question is formulated as follows: What is the perception of accounting and fiscal module users’ in the use of an integrated ERP system, directed at companies from the Brazilian freight and passenger road transport sector? The general aim was to identify and analyze users’ perception on the implementation, performance and use of the accounting and tax modules of an ERP system developed for the Brazilian freight and passenger road transport sector. The specific aims were: to identify and analyze how and to what extent the use of the system under analysis contributed to information production; optimizes month end accounting closing; tax procedures and business processes.

2. Literature Review

- ERP (Enterprise Resources Planning) originate in industrial manufacturing, remotely linked with material control systems. At the start of the 1960’s, early systems like BOMP (Bill of Materials Processor) emerged to facilitate the elaboration of material lists and inventory management. At the end of the 1960’s, the PICS (Production Information and Control System) represented advances on the BOMP, as it took into account cost information and facilitated production and operation value calculations. The launch of the PICS was important, and one of its modules, the MRP (Material Requirements Planning), started to be sold as an independent product in the early 1970’s [9, 16, 17, 18, 19, 20].In the mid 1970’s, the COPICS (Communications Oriented Production Information and Control System) was launched, following the concept of a modular system. The MAPICS (Manufacturing Accounting and Production Information Control System), an evolution of COPICS, included the functions of the MRP II – (Manufacturing Resources Planning), adding inventory, material and cost management, permitting the analysis of the company’s productive capacity. The MRP II permitted analyzing the necessary production resources, mainly manufacturing operation times, facilitating the elaboration of production programming and sequencing[9, 18 , 21, 22]At the start of the 1990’s, the Gartner Group defined the term ERP (Enterprise Resources Planning) to designate systems that broadened the capacities of the MRP II, covering accounting, finance, sales and distribution, human resources and material management modules, among others. Since then, the ERP concept has evolved to a system that integrates business processes in manufacturing environments, cooperating to make interdepartmental processes more flexible, reducing or eliminating doubled efforts[23, 24]. As from this decade, various studies on ERP have been done, in accordance with[25].Due to its origin in the production area, some ERPs still maintain manufacturing-related characteristics. Although this “bias” has been changing in recent years, it still persists in some commercial solutions. This justifies difficulties to use certain integrated systems in non-industrial segments, especially in the services area. This has led to the development of solutions for specific segments, addressing particularities and expanding the number of organizations using this type of system.One example is the study by Feng and Yuan, which indicated that logistics and transport companies consider ERP systems the most useful[8]. Companies in this sector that do not have equivalent solutions yet also consider their acquisition a priority.This remits to the ERP choice and implementation process, about which considerable literature exists, as indicated in[26]. Beheshti reminds that the investment needed to implement an ERP is significant, which makes its choice one of the most important decisions for a manager[27]. This aspect was highlighted in[26], who consider that the implementation process is fundamental for the success or failure of the ERP in companies. Medeiros Jr. recommends that those in charge of ERP system purchases take special care with the implementation, as the results – whether negative or positive – only emerge after a long period[6]. Lindley, Topping and Lindley support this analysis, showing that, over time, ERP systems with low flexibility levels can generate distortions in corporate decisions[28]. ERP systems with low adherence levels to organizational processes induce changes in procedures linked with the company’s core business, leading to the limited launch of new products, increased costs and delays in the execution of processes.To better support the ERP choice process, Medeiros Jr. analyzed the ANP (Analytic Network Process) in depth, as this is a method used in the system selection assessment procedure (SSAP)[6]. The ANP is a mathematical model that verifies the possible existence of dependence relations between decision factors, analyzing – through the use of judgments and scales – resulting feedback effects.Souza and Zwicker, in turn, suggested that companies seeking a system provider should define criteria for assessment and comparison[29]. For each product analyzed, the adopted criteria should be scored. At the end, the best assessed system can be chosen. One alternative the authors considered[29] is to make the choice in two phases. The first, with a larger number of suppliers, would use a small number of criteria (a more generalist approach). Systems that passed through the first screening would be submitted to a deeper analysis, taking into account a larger number of criteria.Other studies appoint the implementation as the moment when the main risks for the success of an ERP system project can emerge, as the company’s expectations do not always coincide with the solutions ERP manufacturers and external consultants actually put in practice[30, 31]. One barrier to be overcome is the resistance to changes the users display. Inherited (or pre-existing) systems are frequently more customized than an ERP. Besides, ERP systems demand that users concentrate more on business processes, with lesser adaptation possibilities[32,33].Another risk factor is the dedication of the internal team responsible for implementing the ERP. Nah and Delgado highlighted the importance of full-time dedication[34]. This is not always possible, as its members end up accumulating the responsibilities of the implementation project with common tasks and functions. In view of the greater pressure this entails, Lau called attention to the increased turnover among implementation team members[35].The actual participation of the company’s topmanagement is a Critical Success Factor. The implementation project of an ERP needs a strong sponsor inside the company, generally a board member. This can guarantee the resources needed and lead to a greater dedication of the different sectors and departments involved[21, 33, 34, 35, 36]. Critical success factors are mentioned in literature on the implementation of ERP systems; often, however, they are treated in a fragmented way and without due depth[37, 38].ERP systems are modular, which allows companies to choose phased or big-bang installment strategies[39]. In the first, the project is divided in phases, during which the implementation of the modules takes place. In the big-bang strategy, all modules are implemented at the same time. Duplaga and Astani appoint phased implementation as the most used in large organizations, while the big-bang strategy is generally adopted in small and medium-sized companies [40]. The decision on the implementation form is a Critical Success Factor that affects the project duration and costs.Training is another critical factor, and responsible for successful or failed ERP implementation[41, 42]. Implementation costs can exceed the initial budget, leading to cuts in training. Murray and Coffin reported that, due to reductions in training programs, between 30 and 40% of final users are in no conditions to adequately operate ERP systems[33]. Lau reported problems concerningunderestimated training deadlines[35]. Hence, operating problems can occur, raising obstacles for the success of the implementation project.

3. Research Method

- The research was developed in the first semester of 2006. It took the form of a survey, aiming to identify and analyze perceptions about implementation, performance and use, among users in distinct organizations, in the same activity sector, concerning the accounting and tax modules of an ERP system. Planning and a script for the research were elaborated[43], together with bibliographic and[44] and field studies[45, 46].The data collected in the selected sample were treated using Qualitative Analysis and Descriptive Statistics[44]. Cluster Analysis and Inter-Cluster Analysis were applied jointly to the answers obtained on the assertions[46, 47, 48]. Through Cluster Analysis, the intent was to identify profiles of users with distinct perceptions of the tax and accounting modules. Comparative Analysis was used to broaden the clusters’ description. In statistical treatment, SPSS (Statistical Package for the Social Sciences) software was used.The ERP system under analysis was developed by a Brazilian technology and consulting company specialized in the freight and passenger road transport sector, founded in 1981. Its clients are Brazilian passenger and freight road transport companies, to which it offers management technologies and solutions. Offices are located in São Paulo and Santa Catarina states and clients are distributed across the country. Besides development, specialized consulting is offered in the transport sector, including integrated system implementation and support services. The ERP comprises more than 30 mutually integrated modules. This research studied the accounting and tax modules.The research sample contained employees from 37 clients of the technology and consulting company, who used the accounting and tax modules. Data were obtained using a questionnaire, which was posted on a home page created especially for this purpose. The questionnaire consists of two parts: the first, including 20 questions, was aimed at characterizing the sample. The second, with 30 assertions, aimed to identify the subjects’ perception of the system, concentrating on the implementation, usage and performance process of the accounting and tax modules, use and performance of the ERP in the production of management information. Assertions in the second part were arranged in a five-point Likert scale, ranging from 1 (I totally disagree) to 5 (I totally agree), to obtain the users’ perceptions.The questionnaire was elaborated, tested and validated[44, 46, 49], which permitted improvements before its application. After studying the strategies used in other studies[50], the decision was made to send two electronic messages to the clients of the technology and consulting company: the first, in April 2006, was aimed at arousing the clients’ curiosity and interest, informed about the research development and that, soon, users would be invited to participate; the second, in May 2006, asked the subjects to access the home page to answer the questionnaire. Orientations by[51] were observed concerning the use of the Internet to develop the research.The obtained results exclusively refer to the research sample. Hence, any generalizations should be made with due caution.

4. Results and Discussion

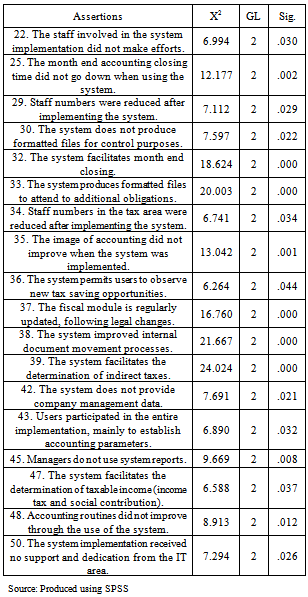

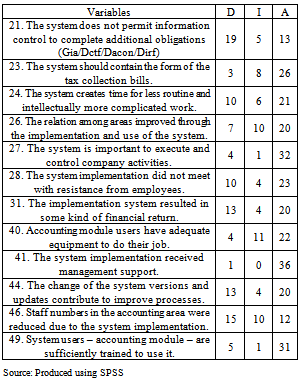

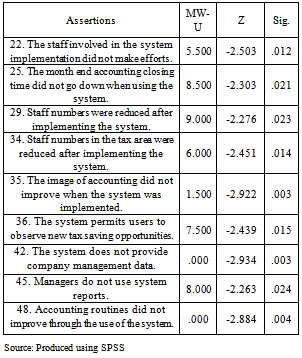

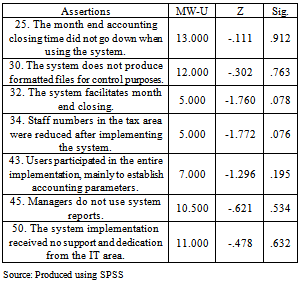

- Part of the findings revealed aspects appointed in the literature review, regarding the users’ participation in the implementation, cost reduction, process improvement, some return from the system implementation, staff turnover and management support for the implementation process. Another part of the findings revealed specific aspects, which are commented on in further detail. Table 1, presented next, starts the presentation of the obtained results.

4.1. Descriptive Analysis

- Out of 37 research subjects, three were in management functions, while 34 occupied other positions; 23 held a higher education degree in Accountancy; four inmanagement and ten in other areas. Most subjects only held an undergraduate degree, six a graduate degree and seven were technicians or had not finished their undergraduate program. Most respondents had been working at the companies for more than three years, which presupposes that they knew the business and were experienced users of the system under analysis.A large majority of the subjects (31 – 83.8% of the sample) had participated in courses, lectures, seminars, workshops and training in the tax and/or accounting area for professional recycling purposes in the last years, and three had been participating for more than three years. Concerning their participating in the system implementation in the companies, eight subjects (21.6% of the sample) did not have that experience. These results partially support observations by[34, 35] about users’ participation in the implementation, the importance of training and the occurrence of turnover after the implementation of the ERP systems.The goal was to identify the number of accounting entries in tax ledgers per month and what percentage was done manually. Results are displayed in Table 1.Less than 5% of manual accounting entries occurred in 12 companies, with the same percentage in tax books in 22 companies. In the range from 5 to 10% of manual entries, 13 companies were found for accounting and eight for tax ledgers. In the range above 10%, 12 companies were identified for accounting and seven for tax books. It is noteworthy than 25 companies display %% or more of manual accounting entries, and that 15 revealed manual entries in tax registers. These results indicate the need for improvements, as some goals of implementing an ERP system are the reduction of administrative costs, improvements in business processes, better understanding in accounting and tax processes, and the elimination of redundancies and double data entry[3, 5, 11, 15].Data were identified as to when the system was acquired, if the purchasing company had an internal IT team, in how much time it was implemented and who performed the implementation. In 20 companies, the system was purchased more than four years earlier and, in five, less than two years earlier. Five companies had no internal IT team. In 18, the system was implemented in less than one year, while four companies took between two and three years to accomplish this. The technology and consulting company implemented the system in 28 organizations together with an internal team; in six companies only the technology and consulting company; in one only the internal team; in two, another consulting company implemented the system together with the internal team.

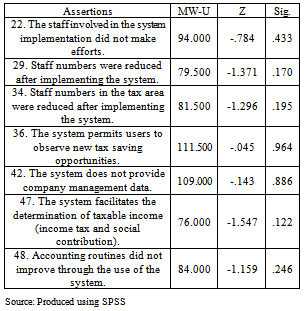

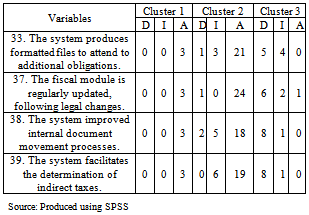

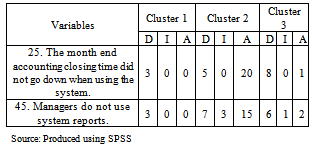

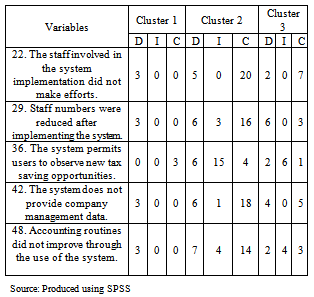

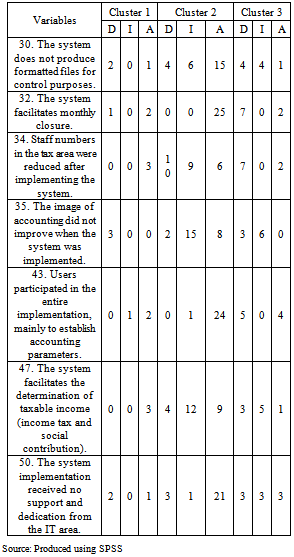

4.2. Cluster Analysis

- To obtain data on the accounting and tax module users’ perception concerning the intended aspects, the second part of the questionnaire was used, comprising questions 21-50. The Cluster Analysis - CA technique was used to identify user groups with distinct perceptions on the modules analyzed. CA is a multivariate technique, used to detect homogeneous data or subject groups. Objects in each cluster tend to be mutually similar and different from objects in other clusters[47, 48].

|

|

|

|

|

|

|

|

|

5. Final Considerations

- This research aimed to identify and describe accounting and tax module users’ perception of an ERP system developed for the Brazilian transport sector. Specific aims were to identify and analyse how and to what extent the use of the system under analysis contributed to accounting data processing, optimizing the month end accounting closing process, tax procedures and business processes.The research question was the following: What is the accounting and tax module users’ perception of an ERP system developed for the Brazilian transport sector?To find an answer for this question, it was made a field survey, by means of a questionnaire containing 20 questions to characterize respondents and 30 assertions related to the specific objects. It aimed to demonstrate the reality of the accounting and tax module users’ perception of an ERP system developed for the Brazilian transport sector.The solution for the main question of this research was given and structured in the answers in the questionnaire. The cluster analysis showed that most ERP users are satisfied with this system and, in some cases, demand improvements. In the descriptive analysis, it was observed that most respondents hold a degree in accounting, while some hold degrees in other areas. The volume of accounting entries is up to 3,000 per month, with 5% manual entries for the tax area. Most companies have used the system for more than 5 years and took less than a year for its implementation.The cluster analysis aimed to group the similar respondents, i.e., those with similarities in their answers. Such procedure allowed the identification of 3 groups with similar opinions. The first is composed of 3 subjects, the second of 25, and the third, 9. The second group, called Cluster2 or Realist, showed the largest number of subjects with similar answers, establishing the following opinions on the use of the integrated system under analysis:a) The top administration supported the implementation of the system.b) Relationships among areas improved. c) Version changes improve processes.d) Staff numbers decreased and the implementation did not meet with employees´ resistance.The accurate perceptions on the use of the accounting module demonstrated that its users are sufficiently trained, use adequate equipment, the system makes time for intellectually more complex activities and facilitates month end accounting closing. Nevertheless, the system did not improve the image of accounting, and some respondents demonstrated indifference to whether the system made it easier to determine taxable income.Another specific aim for the tax module showed the necessity for improvements in the production of magnetic files for control purposes, as well as the need to produce tax collection forms. Subjects in this cluster tend to agree that this module is constantly updated, in line with legal changes, and facilitates indirect tax calculations. The users demonstrated indifference as to the opportunity to identify tax savings through the use of the system. The final specific aim emphasizes the system’s use for company management purposes. The accurate perceptions revealed that the implementation of the ERP entailed some financial return, that the system improved internal document processes and that it is fundamental to control company activities. However, it does not provide data for the management of the company, and the managers do not use its reports.The research demonstrated that clients-users consider and use the integrated system under analysis well. Nevertheless, some aspects must be studied and improved by the supplier company, particularly in the tax module which, according to the subjects, revealed greater problems.The respondents profile is composed of 3 managers and other 34 subjects, who have other positions in the companies clients of the software house; 23 have an accounting graduation degree, 4 a business graduation degree and 10 have graduation degrees in other areas. Most of them (24 subjects) only have the graduation degree, 6 post-graduation and 7 are technicians or did not complete their graduation. Most subjects (24) have been in the company for more than 5 years and 18 have been in their current position for more than 5 years. It was verified that most of them (31 subjects) has taken part in courses, lecturers, workshops and trainings in the accounting/ tax area, to update professionally, for less than a year, and only 3 have been doing it for more than 3 years. The majority of respondents participated in the implementation of the system and only 8 did not. This participation was mainly in accounting parameterization. The obtained results allow some suggestions to improve future versions of the system:Evaluate and implement the accounting and tax modules users´ needs in the production of magnetic files for control purposes, mainly to produce tax collection forms;Analyse and develop a marketing policy to change the users´ opinions, because they understand the system does not provide data for the company management;Analyse and publicize for the companies managers to use the reports extracted from the system.Some opportunities for future works were identified along this research: first, use the research to identify and describe the accounting and tax modules users of ERP systems used in other sectors, as well as replicate the research for other modules users of ERP systems, who work together with accounting and tax modules. One of the reasons for future works is the high financial amount invested by these companies in those systems, and the changing process that demands such implementations.

Notes

- 1. This article was originally published in the Journal of Information Systems and Technology Management, Vol. 6, No. 2, 2009, p. 247-270. Available in

References

| [1] | M. E. Fernandes, “Avaliação da escolha de um sistema de Enterprise Resource Planning (ERP) por empresários de empresas de médio porte do segmento de distribuição na grande São Paulo”. 2002. 125 f. Dissertação (Mestrado em Administração de Empresas) – UNIFECAP, São Paulo, 2002 |

| [2] | F. Frezatti ; E. S. Tavares, “Análise da decisão de investimentos em sistemas integrados de informação: possíveis modelos e suas influências no processo decisório”, Revista de Contabilidade do Mestrado em Ciências Contábeis (UERJ), vol. 8, no. 2, pp. 89-107, 2003. |

| [3] | I. R. Peleias, “Desafios e possibilidades para o contabilista no ambiente dos sistemas integrados”. IN: CONGRESSO BRASILEIRO DE CONTABILIDADE, 16., 2000, Goiânia – GO. Anais ... CFC, 2000. 1 CD ROM. |

| [4] | On line avail:http://computerworld.uol.com.br/AdPortalV5/adCmsDocumentShow.aspx?GUID=7FC1033E-6D9E-413A-AAC2-C20488CB19C9&ChannelID=28 |

| [5] | C. Parisi, “Contribuições e limitações dos sistemas integrados às funções da controladoria no novo ambiente de negócios”. iN: asian pacific conference on International Accounting Issues, 13., 2001, Rio de Janeiro. Anais… FEA-USP, 2001. 1 CD-ROM. |

| [6] | A. Medeiros Jr., “Sistemas integrados de gestão: proposta para um procedimento de decisão multicritérios para avaliação estratégica.’ 2005. Tese (Doutorado) – Escola Politécnica da Universidade de São Paulo. |

| [7] | G. Stefansson, K. Lumsden, ‘Performance issues of Smart Transportation Management systems”, International Journal of Productivity and Performance Management., vol. 58, no. 1, pp. 55 – 70, 2009. |

| [8] | C. Feng, C. YUAN, “The impact of information and communication technologies on logistics management.” International Journal of Management, Poole Dorset, vol. 23, no. 4, pp. 845-850, Dec. 2006. |

| [9] | E. L. Riccio, “Efeitos da tecnologia de informação na contabilidade: estudo de casos de implementação de sistemas empresariais integrados – ERP. 2005”. Tese (livre docência) - FEA/USP – Controladoria e Contabilidade. |

| [10] | J. V. Oliveira Neto, “O impacto sobre a informação contábil após a implementação de um sistema integrado de gestão nas instituições federais de ensino superior”, Revista de Gestão da Tecnologia e Sistemas de Informação / Journal of Information Systems and Technology Management, vol. 2, no. 1, 2005, pp. 39-54, 2005. |

| [11] | C. Spathis, S. Constantinides, “Enterprise resource planning systems’ impact on accounting processes” Business Process Management Journal, vol. 10, no. 2, pp. 234-247, 2004. |

| [12] | A.O.R Kholeif, M. Abdel-kader, M. Sherer, “ERP customization failure: Institutionalized accounting practices, power relations and market forces”, Journal of Accounting & Organizational Change, vol. 3, no. 3, pp. 250-269, 2007. |

| [13] | Chong, V. K. “Job-Relevant Information and its Role with Task Uncertainty and Management Accounting Systems on Managerial Performance”, Pacific Accounting Review, vol. 16, no. 2, pp. 1 - 22, 2004. |

| [14] | O. Velcu, “Exploring the effects of ERP systems on organizational performance: Evidence from Finnish companies”, Industrial Management & Data Systems, vol. 107, no. 9, pp. 1316 – 1334, 2007. |

| [15] | R. G. Jesus, M. O. F. Oliveira, “Implantação de Sistemas ERP: Tecnologia e Pessoas na Implantação do SAP R/3”, Revista de Gestão da Tecnologia e Sistemas de Informação, vol. 3, no. 3, pp. 315-330, 2007 |

| [16] | E. Bendoly, T. Schoenherr, “ERP system andimplementation-process benefits: Implications for B2B e-procurement”, International Journal of Operations & Production Management, vol. 25, no. 4, pp. 304-319, 2005 |

| [17] | S. Bolseth, O. J. Sagegg, “ERP in manufacturing network”, In: UNIVERSITY SYNERGY PROGRAM (USP), 1., 2001, Texas. Proceedings… Texas, 2001. |

| [18] | H. L. Corrêa, H. L, I. G. N. Gianesi, M. Caon, “Planejamento, programação e controle da produção: MRP II/ERP : conceitos, uso e implantação”, 4. ed. São Paulo: Gianesi, Corrêa & Associados, 2001. |

| [19] | F. J. B. Laurindo,M. A. Mesquita, “Material Requirements Planning: 25 anos de história - uma revisão do passado e prospecção do futuro”, Gestão & Produção, vol. 7, no. 3, pp. 320-337, 2000 |

| [20] | G. Halevi, “Production management issues for the next century”, Production Planning & Control, Oxfordshire, vol. 9, no. 8, pp. 735-741, Dec. 1998. |

| [21] | P. L. Côrtes, ”Administração de Sistemas de Informação”, São Paulo: Saraiva, 2007. |

| [22] | C. D. J. Waters, “ An introduction to operations management“, Oxford: Waters, 1991. |

| [23] | M. Chuang, W. H. Shaw, ”A roadmap for e-business implementation”, Engineering Management Journal, Rolla, vol. 17, nol. 2, pp. 3-13, June 2005. |

| [24] | V. A. Mabert, A. Soni, M. A. Venkataramanan, “Enterprise resources planning: common myths versus evolving reality”, Business Horizons, Oxford, vol. 44, no. 3, pp. 69-76, May / June 2001. |

| [25] | E. M. Shehab, M. W. Sharp, L. Supramaniam, “Spedding, T.A. Enterprise resource planning: An integrative review”, Business Process Management Journal, vol. 10, no. 4, pp. 359-386, 2004. |

| [26] | A. P. Kakouris, G. Polychronopoulos, “Enterprise Resource Planning (ERP) System: An Effective Tool for Production Management”, Management Research News, vol. 28, no. 6, pp. 66-78, 2005. |

| [27] | H. M. Beheshti, “What managers should know about ERP/ERP II”, Management Research News, vol. 29, no. 4, pp. 184-193, 2006. |

| [28] | J. T. Lindley, S. Topping, L. T. Lindley, “The hidden financial costs of ERP software”, Managerial Finance, vol. 34, no. 2, pp. 78-90, 2008. |

| [29] | c. A. Souza, R. Zwicker, “O ciclo de vida de sistemas ERP: resultados e recomendações de um estudo de casos múltiplos, In: SEMEAD – seminários em administração da fea-usp, 5., 2001. São Paulo. Anais... São Paulo: FEA-USP, 2001. CD-ROM. |

| [30] | B. Snider, G. J. C. Silveira, J. Balakrishnan, “ERP implementation at SMEs: analysis of five Canadian cases”, International Journal of Operations & Production Management, vol. 29, no.1, pp. 4 - 29, 2009. |

| [31] | P. Helo, P. Anussornnitisarn, K. Phusavat, “Expectation and reality in ERP implementation: consultant and solution provider perspective”, Industrial Management & Data Systems, vol. 108, no. 8, pp. 1045 - 1059, 2008. |

| [32] | S. Kanungo, S. Bagchi, “Understanding user participation and involvement in ERP use”, Journal of Management Research, Delhi, vol. 1, no. 1, pp. 47-63, Sept. 2000. |

| [33] | M. G. Murray, G. W. Coffin, “A case study analysis of factors for success in ERP system implementations”, In: SEVENTH AMERICAS CONFERENCE ON INFORMATION Systems, 2001, Boston, MA. Proceedings… Boston: Bentley College, 2001. |

| [34] | F. F. Nah, S. Delgado, “Critical success factors for enterprise resource planning implementation and upgrade”, Journal of Computer Information Systems, Stillwater, vol. 47, special issue, pp. 99-113, 2006. |

| [35] | R. S. M. Lau, “ERP implementation project at TS Group“, Asian Case Research Journal, Singapore, vol. 9, no. 2, pp. 263-282, Dec. 2005. |

| [36] | S. Bergamaschi, N. Reinhard, “Fatores críticos de sucesso para a implementação de sistemas de gestão empresarial”, In: SOUZA, C. A.; SACCOL, A. Z. (Org). Sistemas ERP no Brasil (Enterprise Resource Planning): teoria e casos. São Paulo: Atlas, 2003. pp. 106-129. |

| [37] | S. Finney, M. Corbett, “ERP implementation: a compilation and analysis of critical success factors”, Business Process Management Journal, vol. 13, no. 3, pp. 329-347, 2007. |

| [38] | F. F. Nah, J. L. S. Lau, J. Kuang, “Critical factors for successful implementation of enterprise systems”, Business Process Management Journal, vol. 7, no. 3, pp. 285-296, 2001. |

| [39] | C. M. Hypolito, E. O. Pamplona, “Sistemas de gestão integrada: conceitos e considerações em uma implantação”, In: Enegep-Encontro Nacional De Engenharia DE Produção, 19., 1999, Rio de Janeiro. Anais... Rio de Janeiro: UFRJ, 1999. |

| [40] | E. A. Duplaga, M. Astani, “Implementing ERP in manufacturing”, Information Systems Management, Oxfordshire, vol. 20, no. 3, pp. 68-75, Summer 2003. |

| [41] | C. Yang, P. Ting, C. Wei, “A study of the factors impacting ERP system performance from the users’ perspectives’, The Journal of American Academy of Business, Cambridge, vol. 8, no. 2, pp. 161-166, Mar. 2006. |

| [42] | T. M. Somers, K. Nelson, “The impact of critical success factors across the stages of enterprise resource planning implementations”, In: HAWAII INTERNATIONAL CONFERENCE ON SYSTEMS SCIENCES, 34., 2001, Island of Maui. Proceedings… 2001. |

| [43] | M. R. Rea, R. A. Parker, “Metodologia de pesquisa: do planejamento à execução”, São Paulo: Pioneira, 2000. |

| [44] | D. R. Cooper, P. S. Schindler, “Métodos de pesquisa em administração”, 7. ed., Porto Alegre: Bookman, 2003. |

| [45] | E. Babbie, “Métodos de pesquisa de survey”, Belo Horizonte: Atlas, 2000. |

| [46] | M. K. Malhotra et al., “Introdução à pesquisa de Marketing”, Traduzido por Robert Brian Taylor, São Paulo: Pearson, 2005. |

| [47] | J. Hair Jr., et al., “Análise multivariada de dados”, Traduzido por Adonai Schlup Sant’Ana e Anselmo Chaves Neto, 5. ed., Porto Alegre: Bookman, 2005. |

| [48] | M. H. Pestana, J. N. Gageiro, “Análise de Dados para Ciências Sociais: A Complementaridade do SPSS”, 2. ed., Lisboa: Silabo, 2000. |

| [49] | M. M. Hill, A. Hill, “Investigação por questionário”, 2 .ed., Lisboa: Sílabo 2002. |

| [50] | D. C. R. Hernandes, “Pesquisa sobre o uso de instrumentos de marketing por escritórios de contabilidade do estado de São Paulo”, 2005. Dissertação (Mestrado em Controladoria e Contabilidade Estratégica) – UNIFECAP, São Paulo, 2005. |

| [51] | R. V. Nascimento Neto, “Impacto da adoção da Internet em pesquisas empíricas: comparações entre metodologias de aplicação de questionários”, In: ENCONTRO NACIONAL DOS PROGRAMAS DE PÓS-GRADUAÇÃO EM ADMINISTRAÇÃO, 28., 2004, Curitiba. Anais... Rio de Janeiro: ANPAD, 2004. 1 CD-ROM. |

| [52] | S. Siegel, “Estatística não paramétrica: para as ciências do comportamento”, São Paulo: McGraw Hill, 1979. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML