-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2012; 1(5): 112-119

doi: 10.5923/j.ijfa.20120105.05

Oil Subsidy Removal in Nigeria: Chasing Water Falls

Essien Akpanuko 1, Isacc Ayandele 2

1Department of Accounting, University of Uyo, P. M. B. 1017 Uyo, Nigeria

2Department of Business Management, University of Uyo, P. M. B. 1017 Uyo, Nigeria

Correspondence to: Essien Akpanuko , Department of Accounting, University of Uyo, P. M. B. 1017 Uyo, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This paper addresses the oil subsidy issues in Nigeria and the acclaimed benefits of its removal to the economy. It provides answers to 5 basic questions of the so-called oil subsidy in Nigeria: What is oil subsidy, origin, merits and demerits? Does oil subsidy exist in Nigeria, are all the petroleum products subsidized and who benefits from Nigeria’s oil subsidy? How will oil subsidy removal affect the masses? It argues that although the government is not transparent in the drive to transform the economy, there are essential actions necessary as a way forward to manage and resolve the crises: cut down the cost of governance, make our refineries work at worst 75% capacity and others.

Keywords: Subsidy, Oil, Economy, Government, Poverty

Article Outline

1. Introduction

- The recent oil subsidy removal by the Federal Government of Nigeria on the 1st of January 2012 has been generating a lot of interesting debates and mixed reactions from different quarters. The government and her sympathizers argue that it highly economically to remove oil subsidy. A group disagrees completely with this position while another argues that there is no oil subsidy in Nigeria at all, thus considering its removal as cynical. This last group contends that what the government of Nigeria is funding in the name of subsidy is its inefficiency. They conclude that the government is not sincere in her transformation process. This position is upheld because since the oil subsidy debate began in 1985, government’s arithmetic on the subject, as on all other subjects, has never really agreed with that of its agencies nor has oil transactions been transparent. More so, the government has agreed that a ‘cabal’ is defrauding her of the so called subsidy. In addition to having conflicting statistics it also seems that government would subject ordinary Nigerians to underserved punishment rather than square-up with the members of the “oil cabal” that, on government’s own admission, have profited immensely from the so-called oil subsidy. However, subsidies of different types exist in different countries (developed and developing), for different products and for different reasons. Subsidies have advantages and disadvantages determined by the intent of its introduction and the approach in which the subsidy is used to achieve desired goal. The problem is that the policy makers, observers, and administrators of the economy do not have thesame view of fuel subsidy and its management.The questions arising from the above scenario are:i. What is oil subsidy, origin, merits and demerits?ii. Does oil subsidy exist in Nigeria, are all the petroleum products subsidized and who benefits from Nigeria’s oil subsidy?iii. How will oil subsidy removal affect the masses?iv. What is the way forward for the oil subsidy removal crises?The purpose of this paper is to provide an overview of the literature on this subject, make an effort to provide a common framework to identify key sources of disagreement, appraise the price of fuel in Nigeria, and provide a way forward. This is presented in four sections. The second section is concerned with the conceptual framework. It delineates the concepts of subsidy, origin, merits and demerits. It addresses the first research question. Section three is concerned with principles and issues of fuel subsidy in Nigeria. It also provides an analysis of fuel cost and price. It addresses the second and third questions. Section four presents the way forward.

2. The Conceptual Framework: Oil Subsidy, Origin, Merits and Demerits?

- The Organisation for Economic Co-operation and Development[1] defines a subsidy as “the result of a government action that confers an advantage on consumers or producers, in order to supplement their income or lower their costs.” Thus, energy subsidies come in two main forms: those designed to reduce the cost of consuming fossil fuels; and those aimed at supporting domestic fossil-fuel production[2]. A producer subsidy can have the effect of lowering fossil-fuel prices, thereby serving indirectly as consumer subsidy at the same time. Subsidies aimed at consumers are generally intended to keep fossil-fuel prices low, in order to stimulate certain sectors of the economy or alleviate poverty, by expanding the population’s access to energy[3][4]. These types of subsidies are more common in non- OECD, former eastern bloc countries and developing countries. These subsidies usually take the form of price controls[5] and can involve large price gaps. For example, in Iran, petroleum product prices were kept at 10 per cent of world market prices in 2002[6]. They are generally directed at electricity, household heating and cooking fuels, although some countries also subsidize transport fuels[5].In developed and developing countries, subsidies aimed at producers generally keep costs of production lower or increase revenues, and their effect is to keep marginal producers in business[3]. These subsidies can also be motivated by the desire to reduce import dependency[7]. Production subsidies are more common in developed countries than in developing countries. Subsidies include a wide variety of support measures. They can include cash transfers directly to producers or consumers, as well as less obvious support mechanisms, including tax exemptions and rebates. Price controls, market access limits and trade restrictions are also often a key element of fossil-fuel subsidies. The OECD[8] and the[9] identify the following mechanisms as typical of those used by governments to support the production or consumption of fossil-fuels: i. Direct financial transfers: grants to consumers, grants to producers, low-interest or preferential loans and government loan guarantees;ii. Preferential tax treatment: tax credits, tax rebates, exemptions on royalties, duties or tariffs, reduced tax rates, deferred tax liabilities and accelerated depreciation on energy-supply equipment;iii. Trade restrictions: tariffs, tariff-rate import quotas and non-tariff trade barriers;iv. Energy-related services provided directly by government at less than full cost: government-provided energy infrastructure, public research and development on fossil fuels; andv. Regulation of the energy sector: demand guarantees, mandated deployment rates, price controls, environmental regulations and market-access restrictions. Subsidies provided through direct financial transfers (including tax rebates) are sometimes referred to as “direct transfers,” while those provided through other mechanisms are often referred to as indirect transfers.The most recent quantitative analysis of energy subsidies worldwide carried out by the IEA in 2006, found that energy subsidies are measured by the extent to which actual prices fall short of the full economic cost of supply. The price-gap approach of Energy subsidies estimation compares end-user consumer prices with reference prices corresponding to the full cost of supply or, where available, the international market price, adjusted for the costs of transportation and distribution. This approach captures all subsidies that reduce consumer prices below those that would prevail in a competitive market.Subsidies can be justified in theory if they promote an overall increase in social welfare. However, the consensus of expert opinion is that fossil-fuel subsidies have a net negative effect, both in individual countries and on a global scale[10]. Fossil-fuel subsidies alter fossil-fuel prices, leading to market distortions with consequences that go well beyond the specific policy objective that the subsidy is intended to achieve. These distortions have wide environmental, economic and social impacts, in many cases increasing energy consumption and Green House Gas (GHG) emissions, straining government budgets, diverting funding that could otherwise be spent on social priorities such as healthcare or education, and reducing the profitability of alternative energy sources[11]. On the contrary, its removal is observed to have positive economic, environmental and social impacts on poor in terms or lowering health cost, decrease air pollution and providing funds for reducing poverty[12][9][10].Removing fossil-fuel subsidies is considered by many to be a win-win policy measure that would benefit both the global economy and the environment and therefore a “no regret” option for climate-change mitigation[2]. In theory, eliminating fossil-fuel subsidies would result in higher fossil-fuel prices in countries that currently subsidize consumer prices, which would reduce consumption and thereby GHG emissions. Removing subsidies at the same time, would remove a costly drain on the government budget. Consequently, eliminating subsidies to fossil fuels may be one of the most cost-effective and least distortionary options available to governments for reducing their GHG emissions. However, governments contemplating fossil-fuel subsidy reform should carefully evaluate the environmental and economic benefits of doing so. It is possible that reforms could provoke some unintended negative environmental effects. In some poorer countries, for example, the sudden removal of subsidies for cooking fuels could lead to a reliance on biomass for cooking and heat in some areas, thereby increasing pressure on forests and negatively affecting indoor air quality[10]. At a global level, subsidy removal could result in downward pressure on international prices of fossil fuels, resulting in increases in consumption in regions not subject to a cap on GHG emissions. In addition, there is concern that subsidy removal could have adverse social impacts, or that the social benefits may not be fairly distributed,[13] observes that, by their very nature, subsidies redirect economic rents to certain stakeholders. Thus subsidy removal could, in the short-term, create some economic loses.[14] notes that even if there are some losers from subsidy reform, solutions that increase overall net economic and environmental well-being should still be implemented, and measures to compensate the losers considered. The money saved from subsidies could, in theory, be redirected to transfers or social programs that are better targeted for the poor. The timing and speed of reform is also critical. Many countries that have eliminated food or fuel subsidies in recent years have experienced large-scale civil unrest[15]. For example, when the Government of Indonesia dramatically raised fuel prices twice in 2005—thereby escalating the prices of food andcommodities—demonstrators took to the streets throughout the country, with mobs burning tires and effigies, and throwing stones in protest.

3. Principles and Issues of Oil Subsidy in Nigeria

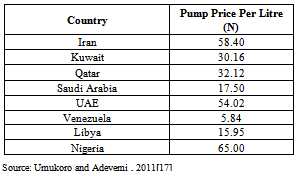

- Nigeria is sub-Saharan Africa’s largest oil producer with oil reserve that far exceeds those of its neighbours. While it is the 11th largest producer globally, Nigeria’s international importance arises from its high quality crude, accessibility to Western markets, continuing exploration potential, and absence of resource nationalisation trends apparent in other oil-producing nations. In 2007, oil earnings comprised 85 percent of government revenues and 99 percent of export earnings[12]. While the Nigerian government has earned over US$ 400 billion in oil revenues since 1970, standards of living have declined within the same period. Nigeria’s massive population, estimated at between 120 and 150 million, faces conditions as harsh as the continental average[16]. Oil wealth also fuels the instability, corruption, and patronage-driven politics which characterise governance in the country. According to OPEC, Nigeria has proven reserve of crude oil of 37.2 billion barrels as at the end of 2010, the tenth largest in the world and the second largest in Africa behind Libya. Nigeria with a daily production averaging about 2.4 million barrels is the 8th largest exporter in the world and number one in Africa. Nigeria’s daily domestic consumption of petrol is estimated at 32 million litres. This is equivalent to about 200,000 barrels of crude oil at 35 imperial gallons or 159 litres per barrel. Assuming Nigeria has adequate capacity for refining locally, the daily consumption will average 8.4 percent of our daily crude oil production. However, due to inadequate capacity to refine crude oil locally Nigeria imports about seventy percent of the country’s daily consumption. Of all the products from crude oil, only petrol and household kerosene are regulated (or supposedly subsidized) in Nigeria while others are deregulated thereby selling at prices dictated by market forces. Those who are to benefit from the current fuel supposed subsidy are private car owners, companies in respect of their light road vehicles, owners of mini buses, tricycles, motorcycles, small businesses and artisans who generate their own power using petrol, and household cooking with kerosene. Other fuel users (coaches and buses for inter and intra city transportation, Lorries and truck for transportation of goods, and industrial plant and machinery) use diesel which has been deregulated since 2003.According to the Petroleum Product Pricing Regulatory Agency (PPPRA), the landing cost of petrol up to Friday 28 October 2011 was N124.06. This however, excludes the N15.49 margin set aside for transporters and marketers. Comparing the total (N139.55) with the regulated pump price of N65 per litre, will show that there is a subsidy of N74.55 per litre. Given the average daily consumption of 32 million litres which translates into about N870 billion per annum. This in addition to the subsidy on household kerosene adds up to about N1.2 trillion per annum compared to only N240 billion allocated to fuel subsidy in the 2011 budget.In 2009 when the issue of fuel subsidy gained momentum, President Yar’Adua’s special adviser on media, Mr. Segun Adeniyi made the following statement:Deregulation doesn't necessarily mean increase in fuel price. As we all know, what government is trying to do is question the rationale behind the subsidy in the first place. What and who are we subsidizing? As the Minister of Finance said last week, we have been subsidizing corruption, inefficiency and fraud in the sector. And these are the things we are tackling. Because even the template of PPPRA[Petroleum Products Pricing Regulatory Agency], there are issues there that are being resolved by government and labor. We believe that government and labor can partner on this issue because at the end of the day, we should ask ourselves questions why fuel price is not going down in our country while it is going down in other countries. This is because of the current global recession that has led to low price of crude oil. So, there are a lot of questions we should ask about the sector that are not being asked. And these are the issues that will be tackled in the coming days. The approach we are taking is that government will partner with labor. The President told labor leaders last week that he will partner with labor on this and every other issue. We are concerned about the welfare of the Nigerian people as labor is. So, I believe we can reach a common position on this issue. And I believe we will, because at the end of the day the essence of the whole dialogue is that we deregulate the market and ensure that we are not held to ransom by cabals.It is clear that in principle and practice, there is no subsidy in Nigeria. For a clear understanding of the Nigerian oil subsidy situation, we shall rely on Chief Olu Falae’s illustration. Chief Olu Falae, an economist, banker and leading politician. In an interview with Sunday Trust (November 8, 2009), he compared the price of Star beer in Nigeria and in the UK. Subsidy in Economics, he pointed out, “is the difference between the price government says you should pay at the cost plus profit of a company producing that product.” If, he said, the Nigerian Breweries sells Star at 130 Naira per bottle, the price covers its cost of production, transportation and profit. Now if government says it should sell the beer at 100 Naira then the 30 Naira difference is the subsidy. “Let’s take the example of beer again,” he said in making his comparison with the cost of Star in the UK. “In London, the last time I was there about a year ago, I bought a bottle of beer (Star) there for one pound and 20 pence. And with today’s exchange rate here it is about N260. That is the price at which Nigerian Breweries sell beer in London. It sells to you here at N130.00. Why doesn’t Nigerian Breweries say because we sell beer in London for N260.00 you should pay N260.00 in Nigeria?And because you are not paying N260.00 you think that is subsidy. There is no subsidy. At N130.00 they are making profit. So similarly if you go to the oil sector, if our refineries are working and they buy crude oil from Nigerian Oil Company at the cost of production plus profit to the company and they refine it and they sell it. By the time they cover these elements of price (i.e. cost of production, transportation and profit), if the price is still N50.00 per litre there is no subsidy. The truth of the matter is that the price of oil in the international market bears little relationship to the cost of production. What this implies s that once the price we pay covers the price of producing the oil, transportation within Nigeria and the profit of the companies, then there is no subsidy even if the price is far lower than the international price.”This illustration exposes the fallacy of the argument of government for the removal of oil subsidy. The government is routinely overbilled for fuel imports, as the scandalous $100 million Trafigura overbilling scandal clearly illustrates. The fuel importers have Nigeria by the jugular. Already rendered incapable of confronting this powerful cartel by its own entanglements, and unwilling to risk an economy starved of imported fuel, the President Jonathan administration is doomed to pay whatever fictitious claims the fuel importers submit. With no regulatory oversight over fuel importation and no independent review of importation claims payments, the importers have been having a bazaar at the expense of Nigeria. They can bill Nigeria many times over their actual expenses and pad their invoices with scandalous margins of profit and Nigeria will pay, as long as importation remains our formula for meeting domestic fuel consumption. On a second thought, one may ask, what makes up the expected retail price of N139.55 per liter? It includes; the profit, cost of the product, the transportation, import duties, custom duties, demurrage, and petroleum profit tax. The last four items are income to the federal government, so how much is government actually subsidizing if any? Where and how did the government arrive at 74 to 80 naira subsidy at 65 naira pump price?If at 65 Naira per litre, it is assumed that there is some amount of subsidy on a litre of oil, now as government itself has admitted in its recurring battle against the subsidy since 1985, the principal beneficiaries are members of the famed oil cabal, not ordinary Nigerians. Therefore, neither the consumers nor the producers are benefiting then, the so-called subsidy is largely a windfall payment to fuel importers. These payments subsidize the insane profits of the fuel importers and are thus not the main reason why fuel is priced at 65 naira a liter. Unless we separate the legitimate costs of importation from the massively inflated costs and then adjust for the abysmal quality of the fuel dumped on Nigerians, any talk of subsidy is deception on a grand scale. For more than three years after Mr. Adeniyi’s statement, government did nothing about the “cabals.” It was reported at that time before Mr. Adeniyi’s statement that President Yar’Adua’s government had instituted a probe into the activities of the Petroleum Products Pricing Regulatory Agency (PPPRA) and all the bodies involved in the regulation of fuel prices. The probe, termed "process auditing," according to government, was aimed at finding out how the agencies arrived at the template they used for the prevailing petroleum products' prices. As at now, neither has the result of that probe been made public nor has the “correct” price template of PPPRA been made available to Nigerians.If the government actually subsidized fuel or if truly subsidy existed, Nigerians would not be paying 65 naira for a liter of petrol. We would be paying much less than 65 naira, which is the highest among the oil-producing countries as shown in table 1. Fuel is neither cheap nor subsidized in Nigeria

|

3.1. Analysis: What is the cost of Fuel per Litre?

- What is the true cost of a litre of petrol in Nigeria? The Nigerian government has earmarked 445000 barrel per day throughput for meeting domestic refinery products demands. These volumes are not for export. They are public goods reserved for internal consumption. We will limit our analysis to this volume of crude oil. At the refinery gate in Port Harcourt, the cost of a barrel of Qua Iboe crude oil is made up of the finding /development cost ($3.5/bbl) and a production/storage /transportation cost of $1.50 per barrel.Thus, at $5 per barrel, we can get Nigerian Qua Iboe crude to the refining gates at Port Harcourt and Warri. One barrel is 42 gallons or 168 litres. The price of 1 barrel of petrol at the Depot gate is the sum of the cost of crude oil, the refining cost and the pipeline transportation cost. Refining costs are at $12.6 per barrel and pipeline distribution cost are $1.50 per barrel. The Distribution Margins (Retailers, Transporters, Dealers, Bridging Funds, Administrative charges etc) are N15.49/litre or $16.58 per barrel. The true cost of 1 litre of petrol at the Mobil filling station in Port Harcourt or anywhere else in Nigeria is therefore ($5 +$12.6+$1.5+$16.6) or $35.7 per barrel . This is equal to N33.36 per litre compared to the official price of N65 per litre. Prof. Tam David West is right. There is no petrol subsidy in Nigeria. Rather the current official prices are too high. Let us continue with some basic energy economics.The government claims we are currently operating our refineries at 38.2% efficiency. When we refine a barrel of crude oil, we get more than just petrol. If we refine 1 barrel (42 gallons) of crude oil, we will get 45 gallons of petroleum products. The 45 gallons of petroleum products consist of 4 gallons of LPG, 19.5 gallons of Gasoline, 10 gallons of Diesel, 4 gallons of Jet Fuel/Kerosene, 2.5 gallons of Fuel Oil and 5 gallons of Bottoms. Thus, at 38.2% of refining capacity, we have about 170000 bbls of throughput refined for about 13.26 million litres of petrol, 6.8 million litres of diesel and 2.72 million litres of kerosene/jet fuel.This is not enough to meet internal national demand. So, we send the remaining of our non-export crude oil volume (275000 barrels per day) to be refined abroad and import the petroleum product back into the country. We will just pay for shipping and refining. The Nigerian government exchanges the 275000 barrels per day with commodity traders (90000 barrels per day to Duke Oil, 60000 barrels per day to Trafigura (Puma Energy), 60000 barrels per day to Societe Ivoirienne de Raffinage (SIR) in Abidjan, Ivory Coast and 65000 barrels per days to unknown sources) in a swap deal. The landing cost of a litre of petrol is N123.32 and the distribution margins are N15.49 according to the government. The cost of a litre is therefore (N123.32+N15.49) or N138.81. This is equivalent to $3.54 per gallon or $148.54 per barrel. In technical terms, one barrel of Nigerian crude oil has a volume yield of 6.6% of AGO, 20.7% of Gasoline, 9.5% of Kerosene/Jet fuel, 30.6% of Diesel, 32.6% of Fuel oil / Bottoms when it is refined.Using a netback calculation method, we can easily calculate the true cost of a litre of imported petrol from swapped oil. The gross product revenue of a refined barrel of crude oil is the sum of the volume of each refined product multiplied by its price. Domestic prices are $174.48/barrel for AGO, $69.55/barrel for Gasoline (PMS or petrol), $172.22/barrel for Diesel Oil, $53.5/barrel for Kerosene and $129.68/barrel for Fuel Oil. Let us substitute the government imported PMS price of $148.54 per barrel for the domestic price of petrol/gasoline. Our gross product revenue per swapped barrel would be(174.48*0.066+148.54*0.207+172.22*0.306+ 53.5*0.095+129.68*0.326) or $142.32 per barrel. We have to remove the international cost of a barrel of Nigerian crude oil ($107 per barrel) from this to get the net cost of imported swapped petroleum products to Nigerian consumers. The net cost of swapped petroleum products would therefore be $142.32 -$107 or $35.32 per barrel of swapped crude oil. This comes out to be a net of $36.86 per barrel of petrol or N34.45 per litre.This is the true cost of a litre of imported swapped petrol and not the landing cost of N138 per litre claimed by the government. The pro-subsidy Nigerian government pretends the price of swapped crude oil is $0 per barrel (N0 per litre) while the resulting petroleum products is $148.54 per barrel (N138 per litre). The government therefore argues that the “subsidy” is N138.81-N65 or N73.81 per litre. But, if landing cost of the petroleum products is at international price ($148.54 per barrel), then the take-off price of the swapped crude oil should be at international price ($107 per barrel). This is basic economic logic outside the ideological prisms of the World Bank. The traders/petroleum products importers and the Nigerian government are charging Nigerians for the crude oil while they are getting it free.So let us conclude this basic economic exercise. If the true price of 38.2% of our petrol supply from our local refinery is N33.36/litre and the remaining 61.8% has a true price of N34.45 per litre, then the average true price is (0.382*33.36+0.618*34.45) or N34.03 per litre. The official price is N65 per litre and the true price with government figures is about N34 per litre (even with our moribund refineries)The government’s deceptive narrative suggests that once “subsidy” (cost that it pays to subsidize the insatiable greed and outrageous profits of the fuel importation cartel) is “removed,” (transferred to the masses) and the fuel industry is “deregulated” this would be the end of the matter and we would not have to deal with the issue again as the price of fuel would be dictated by the forces of demand and supply. This however, is not a case for the forces of demand and supply, as what is claimed to be removed is not subsidy. The result can never be the same but will go in the opposite direction. There are several fallacies in this claim. The first one is that we have heard the same canard many times over the years only for the government to speak glibly a few years down the road about the crippling fiscal effects of subsidy and the need to once again “remove” it.Here is why “fuel subsidy” keeps re-emerging. Once the government transfers the dubious, unconscionably inflated costs of importing fuel into the country to Nigerians, there is no reason why the importers would not inflate their costs and expenses five years from now, especially since they know that, in the absence of a robust domestic refining capacity, the government has no choice but to pay up. In fact, with successive governments being so quick to agree to their fraudulent financial claims, there is a lot of incentive for the importers to keep increasing their profit margins. The importers and their friends in government have been perpetrating this “fuel subsidy” scam for many years. This is the secret of our five-yearly debate on “fuel subsidy.” If this transfer of corruption to the masses is successful, our refineries will never work, so the cabal will stay in control.

3.2. How Oil Subsidy Removal Affects the Masses?

- Since what is to be removed is not subsidy, the effects can never be positive but negative. The bearer of the incidence of the increased cost will be private car owners, companies in respect of their light road vehicles, owners of mini buses, tricycles, motorcycles, small businesses and artisans who generate their own power using petrol. This will increase the cost of production, transportation and reduce the standard of living. Thus increase in fuel prices would, in the short-term and long-term, create more economic loses. Given that the expected saving from such withdrawal will not exist, the expected improvement and solutions in other sectors that should increase overall net economic and environmental well-being will not be implemented, and measures to compensate the losers will not be considered[13][10].The only benefit which is neither to the masses nor to the economy is the shift of the burden of fraud from government spending to the masses, and a worsening of the economic woes of the poor and increase in poverty.

4. Oil Subsidy Removal: The Way Forward

- The fact of the matter is that there is no economy in the world, including capitalist America, where government subsidy in one form or the other does not exist. The difference lies in who the beneficiaries are and how sustainable the subsidy is. The comparative advantage of Nigeria having huge reserves of oil and gas dictates that no Nigerian should pay through the nose to consume petrol and other oil products. And those who say government has no business in the business of commerce and production are obviously not being honest with themselves. As we have seen with Japan and among the so-called Asian Tigers, government can succeed in business just like the private sector. All it takes is good governance and transparency. For President Jonathan to advocate a doubling of the price of petrol - perhaps even more – in the future is to admit that his government has neither the capacity nor the will to bring about positive change in this country. In other words all the talk about transformation is no more than mere empty propaganda.Of course the argument contained caveats, not least of which is efficient refineries. And we all know that our refineries have not been working for decades now, not as much of being efficient. But then we also know why they have not been working; corruption is the word. If President Goodluck Jonathan truly wishes to tackle the problem of fuel subsidy he should know that this is the monster he must confront. As Professor Sam Aluko, in October 9, 2000 observes, something must be wrong with us that we have been unable to make our refineries work. “How,” he asked rhetorically, “can we have four refineries in the country and the four will break down at the same time? Even when we tried to award the contract to Total oil Company, they kept telling us that Total oil Company could not do it. Total oil Company has 17 refineries around the world; they are all working, it’s only our refineries that they cannot put in order. You know something is wrong somewhere.” Without mincing words, it was obvious that the man meant corruption. Professor Aluko “alerted the nation that as long as we continue to import, it would not work. We’ll struggle and it will work temporarily and the problem to come back again. There is a cabal made up of importers who cause the problem.”Fuel is neither cheap nor subsidized in Nigeria. And it is not fuel subsidy that is threatening our economy. To begin with, the official diagnosis of our troubled economy, issued by the government’s economic voice, Ngozi Okonjo-Iweala, contradicts the argument that fuel subsidy is the cause of the government’s financial troubles. Iweala announced with fanfare recently that the culprit in Nigeria’s financial and infrastructural woe was recurrent spending, which she put at an astronomical value of 75 percent of revenues.She was referring to the cost of maintaining the government - salaries, services, and supplies. The biggest chunk of this cost comes from funding the world highest salaries and perks of elected and appointed public officials. This is unsustainable, Iweala argued, as it sucks up resources that should go to investments in education, healthcare, roads, and electricity. She vowed to push for a reduction of this figure by 5 percent. This was a paltry ambition on her part, but she should be applauded her for at least correctly identifying the source of Nigeria’s financial drain.The government cannot have it both ways. It cannot claim that the enemy is government’s bloated recurrent spending and that its reduction holds the key to avoiding bankruptcy and then turn around to cast the blame on so-called fuel subsidy. It is possible that both factors are a drag on our fiscal wellbeing. But why target the price of fuel, which is a strategic national product that has a bearing on the livelihood of all Nigerians while effectively sparing the luxuries of a government incapable of fulfilling even the most rudimentary obligation of governance: public safety? Why seek a solution to our financial predicament that will further decimate the masses while protecting the perks of a tiny political class? The government claims that savings from the transfer cost will be used to develop other areas, but there exist an unconvincing precedent of her concern for the masses. Towards the end of the Obasanjo government, Nigeria earned—yes, earned—“debt forgiveness” from the Paris and London clubs of creditors. Nigerians were told, as it was equally made a condition for the “forgiveness”, that the resulting savings from sovereign debt servicing would be invested in critical sectors such as education, health, and public infrastructural development. In November 2006 (the same year Nigeria formally exited indebtedness to those clubs) President Obasanjo flagged off the construction of a modern dual-track rail network that would cover more than 1,300 km from Lagos to Kano. The completion date for the project was in 2010! The cost of the project was about 8.3 billion US dollars. Trains running on those tracks were to move at about 160 km per hour; that means a trip from Abuja to Lagos would take less than 5 hours, while less than 9 hours would be travel time from Lagos to Kano.Nigerian rulers and politicians, some of whom are still in government, made sure the contract was cancelled after the exit of President Obasanjo. In fact, the national assembly during the days of President Yar’Adua, under the leadership of Senate President David Mark, who still occupies the position, claimed that the project was inflated by as much as 700 US dollars. Later, it was reported that the same national assembly promised to “probe” the cancellation of the project (They never did). In 2009 when the issue of removal of fuel subsidy arose, the chairman of the senate committee on petroleum (downstream sector) at the time, Senator Emmanuel Paulker said this on Yar’Adua’s plans to deregulate the downstream oil sector:On removal of subsidy, we believe that the government would have been compelled by the unsustainable fiscal burden involved in subsidizing petroleum products to the tune of N640 billion in a single year. We have always believed that subsidy should be removed, although not in the abrupt way in which it has been done, but through a gradual phasing-out process. And while that exercise is in progress, the government should adopt immediate measures to tackle those foregoing elements that add to cost. For example, if the refineries were functioning optimally, freight and port charges would be eliminated. Also, if pipelines that make up our distribution network were in order and new ones were built, the enormous cost incurred through haulage by trucks would fall, thereby contributing to reduction in the pump prices of petroleum products. All these will simply result in a less prohibitive and more affordable pump price when the phased deregulation exercise is concluded.The question then is; what has the Nigerian government been using the annual savings from sovereign debts to do in the past 5 years? If the federal government has nothing to show for the debt cancellation or “forgiveness” 5 years after, why should Nigerians trust that same government as it relates to the use of savings from the so called subsidy? It is the same government and the same national assembly. President Jonathan has been around as vice-president, acting president, or president for more than 5 years now. During this period, an important project like the railway construction referred to above was set aside. An efficient railway system of transportation could reduce cost of moving goods such as petroleum products, which, as Senator Paulker said in 2009, would have eased the hardship the removal of oil subsidy would have brought on Nigerian masses.Sad to observe that the investigation Ad hoc committee set up by the government to monitor oil subsidy, which commenced sitting on January 16th 2012 led by Faruk Lawanis involved in bribery scandals of $620,000. Where is the country heading to? However, there are things that can be done to demonstrate to ordinary Nigerians that the government truly has their interests at heart:i. One of these is to cut down the cost of governance.ii. Make our refineries work at worst 75% capacity.iii. Eliminate or tame the cabal, who by definition are prominent members of our society.iv. Stop fuel importation.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML