-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2012; 1(5): 94-105

doi: 10.5923/j.ijfa.20120105.03

IFRSS in Indian Banking Industry: Challenges Ahead

Sankar Thappa

School of Business, Kaziranga University, Jorhat, 785006, India

Correspondence to: Sankar Thappa , School of Business, Kaziranga University, Jorhat, 785006, India.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The globalization has brought a lot of changes in doing business across the world. The business of multinational companies are being extended and established in various countries with emerging economies .These companies in emerging economies are increasingly accessing the global markets to fulfill their capital needs by getting their securities listed on the stock exchanges outside the country. This results in making the Capital markets global in nature. The use of different accounting frameworks in different countries creates confusion for users of financial statements resulting into inefficiency in capital markets across the world. The increasing complexity of business transactions and globalization of capital markets call the regulators, multinational companies, auditing firm and investors to see the need for common standards in all areas of financial reporting. Thus, the case for a single set of globally accepted accounting standards has prompted many countries to pursue convergence of national accounting standards with IFRS. After the liberalization and tremendous growth of Indian Economy, the Indian MNCs are also going global. These companies have been also raising capital from global capital market. Under these circumstances, it has become imperative for Indian corporate to adopt IFRS for their financial reporting. The Government of India had committed to convergence of Indian Accounting Standards with IFRS from April 1, 2011. With respect to banking companies requires all scheduled commercial banks to convert their opening balance sheets as of April,1.2013. The industry has recognized the need for IFRS convergence. Realizing the need of the time the Indian banks show eagerness towards time bound implementation, giving top priority to the convergence process. Similarly, various Regulators RBI, SEBI, IRDA are also taking interest in relation to frame/revise regulations in consultation with ICAI.The objective of this paper is to examine the impact of IFRSs in Indian banking Industry, the various phases of implementation of IFRSs in the banking sector in India. The paper also highlights on the challenges ahead in the implementation of IFRS in Indian banking sector and the possible ways to address the challenges. The study is primarily based on the secondary data gathered from related literature published in the journals, newspaper, books, statements, reports. The nature of study is primarily qualitative, descriptive and analytical. The IFRSs in Indian Banking Industry would bring many benefits to the industry along with some challenges like changes to the existing law, skilled manpower, increasing cost etc. which are to be taken care of in the future very well.

Keywords: GAAP, IFRS, IAS, SIC, ICAI

Article Outline

1. Introduction

- The globalisation has brought a lot of changes in doing business across the world. The business of multinational companies are being extended and established in various countries with emerging economies .These companies in emerging economies are increasingly accessing the global markets to fulfil their capital needs by getting their securities listed on the stock exchanges outside the country. This results in making the Capital markets global in nature. The use of different accounting frameworks in different countries creates confusion for users of financial statements resulting into inefficiency in capital markets across the world. The increasing complexity of business transactions and globalization of capital markets call the regulators, multinational companies, auditing firm and investors to see the need for common standards in all areas of financial reporting. Thus, the case for a single set of globally accepted accounting standards has prompted many countries to pursue convergence of national accounting standards with IFRS.After the liberalisation and tremendous growth of Indian Economy, the Indian MNCs are also going global. These companies have been also raising capital from global capital market. Under these circumstances, it has become imperative for Indian corporate sector to adopt IFRS for their financial reporting. The Government of India had committed to convergence of Indian Accounting Standards with IFRS from April 1, 2011.The finalized roadmap for the convergence of Indian Accounting Standards with the International Financial Reporting Standards (IFRS) with respect to banking companies requires all scheduled commercial banks to convert their opening balance sheets from April 1, 2013. RBI has emphasized to banks that they need to gear up to adopt the new standards.IFRSs are standards and interpretations adopted by the International Accounting Standards Board (IASB). This includes IFRSs, IAS, and Interpretations originated by the IFRIC or its predecessor the former Standing Interpretations Committee (SIC). IFRSs are increasingly being recognised as Global reporting standards of financial statements. .

1.1. Objectives of the Study

- The objectives of the study are: a) To examine impact of IFRSs in Indian Banking Industry.b) To know the various phases of implementation of IFRSs in India. c) To examine benefits and the challenges ahead in the implementation of IFRS in India and d) To find out the possible ways to address the challenges.

1.2. Methodology of the Study

- The study is primarily based on the secondary data gathered from related literature published in the journals, newspaper, books, statements, reports. The nature of study is primarily qualitative, descriptive and analytical. There is no quantitative tool being used for the study.

1.3. Literature Review

- In the late 1990s, a movement within the international business and accounting professional communities to standardize globally financial accounting reporting methods and practices was initiated. Since that time, both American and international governmental, professional accounting organizations, governing bodies, business leaders and regulatory administrators have written extensively concerning the benefits and disadvantages of the implementation of a single global accounting standard[1].In another study ,it is found[2] that firms adopting IFRS have less earnings management, more timely loss recognition, and more value relevance of earnings, all of which they interpret as evidence of higher accounting quality. The accounting system is a complementary component of the country’s overall institutional system[3] and is also determined by firms’ incentives for financial reporting. Evidence[4] which provide the first investigation of the legal system’s effect on a country’s financial system. They find that common law countries have better accounting systems and better protection of investors than code law countries[5]. Several papers attempted to determine the level of accounting harmonization by examining selected measurement practices used by companies in Europe[6, 7, 8, 9, 10]. These studies analysed the annual reports from companies headquartered in different countries to determine the level of compliance between various accounting practices and the impact of adopting international standards on accounting harmonization[11].Several studies have addressed issues related to accounting harmonization in Europe and its impact on comparability and transparency of financial statements. A study[12] reported that at the beginning of the 1990s, numerous differences existed between international standards and the accounting standards of the major Anglo-American countries. Another study highlighted the significance of the enforcement issue for the IASC as it was seeking an International Organization of Securities Commissions (IOSCO) endorsement[13.A research study also[14] conducted in 1999 distinguishes harmonization from standardization and presents a method for measuring harmonization that allows for choice between alternative accounting treatments. In a study[15] conducted in 2010 of global capital markets summarized that the capital markets of the countries that have adopted IFRS have higher degree of integration among them after their IFRS adoption as compared to the period before the adoption. The study carried out on financial data of Spanish firms revealed that local comparability is adversely affected if both IFRS and local Accounting Standards are applied in the same country at the same time. The study, therefore calls for an urgent convergence of local Accounting Standards with that of IFRS. In a article on Economic Effects[16] of IFRS adoption emphasized on the fact that universal financial reporting standards will increase market liquidity, decrease transaction costs for investors, lower cost of capital and facilitate international capital formation and flows[17].

2. IFRSs – around the World

- The need for a global set of high-quality financial reporting standards has long been apparent. The process of international convergence towards a global set of standards started in 1973 when 16 professional accountancy bodies from Australia, Canada, France, Germany, Japan, Mexico, the Netherlands, the United Kingdom and the United States agreed to form the International Accounting Standards Committee (IASC), which in 2001 was reorganized into the International Accounting Standards Board (IASB). The IASB develops global standards and related interpretations that are collectively known as International Financial Reporting Standards (IFRS).The process gained speed when the International Organization of Securities Commissions (IOSCO) endorsed the IASC standards for international listings in May 2000. It was further facilitated by the Regulation approved by the European Commission in 2002 requiring the preparation of the consolidated (group) accounts of listed companies in the European Union in accordance with IFRS.2 Recently, many more countries have announced their transition to IFRS, in some instances extending the scope of application beyond group accounts to legal entities and incorporating IFRS into their national regulatory framework.The globalisation of business and finance has brought various changes in the world. These changes also brought a tremendous change in the pattern of financial reporting of business activities, which led to more than 12000 companies in more than hundred countries to require or permit IFRS reporting. This was started in 2005 when the European Union (EU) made it mandatory for publicly traded companies to present consolidated financial statements in conformity with International Financial Reporting Standards (IFRS) starting from Jan 1, 2005. Australia, Newzealand, Israel, Brazil, South Africa, Philippines, Singapore have essentially have adopted the IFRS. Malaysia, Pakistan and Thailand have adopted selected IFRSs quite closely. In Nov, 2008 SEC published for public comment proposed IFRSs roadmap. The roadmap outlines milestones that if achieved could lead to mandatory transition to IFRSs starting for fiscal year ending on or after 15 Dec, 2014. Canada required IFRS for publicly accountable entities after Jan, 2011. Japan is also planning to go for convergence after 2011.

2.1. International Financial Reporting Standards (IFRS) in India

2.1.1. Background

- The Institute of Chartered Accountants of India (ICAI) set up the Accounting Standards Board (ASB) in 1977 to prepare accounting standards. In 1982, ICAI set up the Auditing and Assurance Standards Board (initially known as the Auditing Practice Committee) to prepare auditing standards. ICAI became one of the associate members of the International Accounting Standards Committee (IASC) in June 1973. The ICAI also became a member of the International Federation of Accountants (IFAC) since its inception in October 1977. While formulating accounting standards in India, the ASB considers International Financial Reporting Standards (IFRS) and tries to integrate them, to the extent possible, in the light of the laws, customs, practices and business environment prevailing in India[29].The Accounting Standards Board has worked relentlessly to introduce an overall qualitative improvement in the financial reporting in the country by formulating accounting standards to be followed in the preparation and presentation of financial statements. So far, the Board has issued 32 Accounting Standards. Besides this, it has also issued various accounting standards interpretations and announcements, so as to ensure uniform application of accounting standards and to provide guidance on the issues concerning the implementation of accounting standards which may be of general relevance. ICAI, being a full-fledged member of the International Federation of Accountants (IFAC), while formulating the Accounting Standards (ASs), the ASB gives due consideration to International Accounting Standards (IASs) issued by the International Accounting Standards Committee or International Financial Reporting Standards (IFRSs) issued by the IASB, as the case may be, and try to integrate them, to the extent possible. However, where departure from IFRS is warranted keeping in view the Indian conditions, the ASs have been modified to that extent. Further, the endeavour of the ICAI is not only to bridge the gap between ASs and IFRSs by issuance of new AS but also to ensure that the existing ASs are in line with the changes in international thinking on various accounting issues. The National Committee on Accounting Standards (NACAS) constituted by the Central Government for recommending accounting standards to the Government, while reviewing the AS issued by the ICAI, considers the deviations in the AS, if any, from the IFRSs and recommends to the ICAI to revise the AS wherever it considers that the deviations are not appropriate[33].

2.1.2. Regulatory Framework and Enforcement of Accounting Standards

- The regulatory framework of financial reporting and enforcement of accounting standards are being discussed below: (A) Legal Recognition of Accounting Standards issued by ICAI under the Companies Act (1956)The legal recognition to the Accounting Standards was accorded for the companies in the Companies Act, 1956, by introduction of section 211(3C) through the Companies (Amendment) Act, 1999, whereby it is required that the companies shall follow the Accounting Standards notified by the Central Government on a recommendation made by the National Advisory Committee on Accounting Standards (NACAS) constituted under section 210A of the said Act. The proviso to section 211(3C) provides that until the Accounting Standards are notified by the Central Government the Accounting Standards specified by the Institute of Chartered Accountants of India shall be followed by the companies. The Government of India, Ministry of Company Affairs (now Ministry of Corporate Affairs), issued Notification dated December 7, 2006, prescribing Accounting Standards 1 to 7 and 9 to 32 as recommended by the Institute of Chartered Accountants of India, which have come into effect in respect of the accounting periods commencing on or after the aforesaid date with the publication of these Accounting Standards in the Official Gazette. It may be mentioned that the Accounting Standards notified by the Government are virtually identical with the Accounting Standards, read with the Accounting Standards Interpretations, issued by the Institute of Chartered Accountants of India.[33] (Concept paper of ICAI)

2.1.3. Legal recognition of Accounting Standards by other Regulators

- Reserve Bank of IndiaThe Banking Regulation Act (1949) empowers the RBI to regulate financial reporting of the financial sector, including banks and financial institutions. One of the Schedules to the Banking Regulation Act prescribes formats for general purpose financial statements (e.g. balance sheet, and profit and loss accounts) and other disclosure requirements. Banks are also required to comply with requirements of the Companies Act (1956), provided they are consistent with the Banking Regulation Act. The RBI has issued circulars requiring banks to comply with the accounting standards issued by ICAI.Securities and Exchange Board of IndiaListed companies in India are required to comply with the requirements prescribed by the SEBI in its Act of 1992 and the Securities Contracts (Regulation) Act of 1956, which provides for the regulation of securities transactions. To protect investor interests, SEBI has issued a listing agreement which specifies disclosures applicable to listed companies in addition to other applicable auditing and accounting requirements. In particular, it requires compliance with the accounting standards issued by ICAI.The Insurance Regulatory and Development Authority (IRDA)The Insurance Regulatory and Development Authority (IRDA) regulate the financial reporting practices of insurance companies under the Insurance Regulatory and Development Authority Act (1999). Insurance companies and their auditors are required to comply with the requirements of the IRDA regulations of 2002 titled “Preparation of Financial Statements and Auditor’s Report of the Insurance Companies”; in preparing and presenting their financial statements and the format and content of the audit report. IRDA regulations require compliance with the accounting standards issued by ICAI.Results and Analysis of the study: The discussion and analysis of IFRS in Indian banking Industry in relation to benefits and challenges are given below:

3. Benefits of adopting IFRSs in India

- The forces of globalisation prompt more and more countries to open their doors to foreign investment and as businesses expand across borders the need arises to recognise the benefits of having commonly accepted and understood financial reporting standards. Following are some of the benefits of adopting IFRS -

3.1. Better Global Comparability

- IFRS improves the transparency of financial reporting as well as better comparability of performance of business enterprises. Investors, customers, suppliers, bankers would be easily able to compare when two financial statements follow the same reporting procedure. As the Indian companies are becoming global through their operations outside the country and having investor base, IFRS would enable a comparison of Indian companies with global competitor.

3.2. Better Access to International Capital Market and Lower Cost of Capital

- IFRS are being used by the firms of reporting financial results across the world. Currently many firms for expansion of their operations around the world seek to raise capital at cheaper cost which is available in American, European, Japanese capital markets. To meet the regulatory requirements of these markets or the expectations of the investment banker and investors Indian companies should report their financial results as per IFRS. Thus adoption of IFRS would help the Indian companies in accessing international capital markets for raising funds at cheaper cost. It would also help the companies that are raising capital and listed only in stock exchanges in India in attracting the international investors by providing financial information that is more transparent and understandable for the international investor community.

3.3. Easy Cross Border Listing

- Adoption of IFRS would eliminate the obstacles in cross-border listing by ensuring that financial statements are more transparent. Indian firms require funds for their expansion of operations as well as acquisitions around the world. These funds requirements are being met through raising of capital from markets like European and American capital markets. Because of these many Indian companies are listed in the stock exchanges of these markets. One of the major pre-requisites of getting listed on European Markets is preparation of accounts as per IFRS requirements.

3.4. Avoidance of Multiple Reporting

- Currently, many large Indian business groups like TATA,BIRLA,MAHINDRA,AMBANI etc have firms registered in India and also firms outside India in European and American capital Markets. The firms registered in India prepare their accounts as per Indian Accounting Standards whereas firms registered in other countries prepare their financial statements as per Reporting Standards of the respective country. This increases the effort of finance function; introduces complexity in financial reporting and increases costs of the finance function. Group-wise adoption of IFRS would eliminate the need for such multiple financial reporting by the Indian companies as they would be following single set of financial reporting.

3.5. Better Quality of Financial Reporting

- Adoption of IFRS would help the firm in bringing in better quality of financial reporting due to consistent application of Accounting Principles and improvement in reliability of financial statements. Historical cost would be substituted by fair value for various balance sheet items which enable the companies to know its true worth.

3.6. Economic Growth

- The convergence with IFRS benefits the economy by increasing growth of its international business, higher cross-border capital flows and transaction. It facilitates maintenance of orderly and efficient capital markets and also helps to increase the capital formation and thereby economic growth. It encourages international investing.

3.7. Opportunities for Accounting Professional

- Convergence with IFRSs also benefits the accounting professionals in a way that they are able to sell their services as experts in different parts of the world. It offers accountants in public practice them more opportunities in any part of the world if same accounting practices prevail throughout the world. For accounting professionals in industry as well as in practice, their mobility to work in different parts of the world increases. Being a comparatively new subject, professionals like CAs and CFAs with sound theoretical and practical knowledge of IFRS are certain to have more opportunities in the times to come.

4. Challenges on adopting IFRSs in India

4.1. Technical Challenges

4.1.1. Loan Impairment

- Currently the bank recognises the provisioning and writes off method for the valuation of its advances as per the norms of Reserve Bank of India. The impairment of financial assets is currently measured on an ‘incurred loss’ basis. This means that no impairment allowance can be established at initial recognition of a financial asset. Impairment is recognised if objective evidence indicates that an asset is impaired due to events occurring after initial recognition. For financial asset measured at amortised cost, the impairment loss is measured as the difference between an asset’s carrying amount and the present value of the estimated future cash flows, discounted at the asset’s original rate of return. In case of group of loans carrying homogeneous characteristics like credit card receivables, mortgage etc impairment can be assessed on a collective basis. In case of investments also similar analysis is conducted. Only the difference is that the fair value of the investment is also considered as an input in addition to the financial/credit standing of the issuer. The basis of this impairment assessment is a system that considers all the facts and circumstances and requires the most significant difference from Indian GAAP for banks in India. The existing Indian GAAP/RBI guidelines require a limited use of judgement and are mechanistic nature with prescribed loss/provision rates.

4.1.2. Hedge Accounting

- Hedge accounting helps in minimising profit or loss fluctuation arising due to volatility in foreign exchange, interest rates, and other changes in fair values of certain financial instruments and other non financial items. However it requires stringent documentations, mandatory, effectiveness tests as well as determination of fair values based on observable inputs. Under IFRS all derivatives are recognised on the balance sheet at fair values. But Indian GAAP does not address specifically the provisions of fair value and hedge accounting.

4.1.3. Fair Value

- Under Indian GAAP balance sheets are not fair valued but carried out at historical cost. As per IFRS fair value measurement needs to be used.

4.1.4. Consolidation of Financial Statements

- According to the Accounting Standard-23(AS-23) on Consolidation of Financial Statements of entities the consolidation of financial statements are purely based upon the ownership and control over another organisation. Under the existing accounting Standards, consolidation is not mandatory for all organisation. However as per IFRS the consolidation is mandatory for all the organisation. The measurement and test of ownership shall also be changed in the IFRS. It has covered the potential voting rights other than the actual stakeholders. The potential voting rights includes all those whose debts or shares are required to be converted into equity capital of the company. At present the companies in India are not following these practices. Conversion to IFRS will have an impact on this aspect also.

4.1.5. Financial Instrument

- The ICAI has issued AS-30, AS-31, and AS-32 on Financial Instruments. IFRS-9: Financial Instruments prescribes two options for the classification of financial assets i.e. amortised cost or Fair value. Under its requirements financial assets are eligible for accounting at amortised cost only if they are held within a business model whose objective is to collect contractual cash flows and their contractual terms give rise to cash flows that are solely payments of principals and interest on the principal outstanding. When there is more than one infrequent number of sales in a portfolio held at amortised cost the entire portfolio would have to be accounted for at fair value. As per RBI guidelines investment in equity instruments are valued at market price. The net losses are recognised but net gains are ignored under RBI norms. Whereas under IFRS-9 the gains or losses are recognised in the income statement or in the Reserve account the choice is to be made at inception level, on instrument by instrument basis at it is irrecoverable.

4.1.6. Tax Reporting Practices

- Conversion to IFRS the banks have to face the challenges of tax consideration also which would be complex one. These would include pre accounting changes on tax methods, global planning strategies, and tax information systems. If the conversion to IFRS is done properly and well in advance of conversion it has the potential to strengthen providing an opportunity for a detailed review of tax matters and processes. The banks have to find out solution for the following questions:(i) Is the new IFRS is a permissible tax accounting method under Income Tax Act, 1961?(ii) Does the Income Tax Act 1961 allow the new book method?(iii) Is it necessary to report changes in methods of accounting after conversion to IFRS?(iv)Will there be modifications in the computation of permanent and temporary differences of Deffered Tax/(v) Does Income Tax Act 1961 allow losses due to fair valuation as expenditure?

4.1.7. IFRS-1 Fist Time Adoption of IFRS

- An early understanding on the numerous mandatory and optional exemptions from the retrospective application of IFRS that are available to first time adopters of IFRS is paramount for a successful and cost effective implementation of IFRS.

4.2. Other Challenges

4.2.1. Amendment to the existing laws

- The accounting framework in India is deeply affected by laws and regulations. It is mainly the Indian Companies Act, 1956 and Indian GAAP which governs the accounting practices in India. Other existing laws, such as SEBI regulation, RBI Regulation, IRDA regulation also provides guidelines on preparation of financial statements. IFRS do not recognise these laws. For adoption of IFRS these existing laws have to be amended as per the requirements of IFRS. ICAI has to receive co-operation from other regulators (like, SEBI, RBI, IRDA), tax authorities, courts and tribunals to make the adoption successful.

4.2.2. Shortage of Trained and experienced Resources

- It has been observed that at present India does not have enough number of resources with training or experience in IFRS. The adoption of IFRS by the Indian companies would result in huge demand for IFRS trained or experienced resources. Along with professional accountants other resources like Accountants, Govt. Officials, CEOs, would be responsible for smooth adoption of IFRS. This would create a huge demand for training to be provided to a large group. Currently India lacks training facilities and trained or experienced resources to train such a large group.

4.2.3. Creation of Awareness about IFRS

- Adoption of IFRS means a complete set of different reporting standards which will have significant difference with Indian GAAP. Currently there is still absence of awareness of IFRS among the stakeholders. Considerable time and efforts would be required on making complete awareness and communicating to investors, Banks, stock exchanges, Commodity exchanges, the analyst community etc which would be big task for the companies.

4.2.4. Measurement of Business Performance

- Adoption of IFRS would have significant difference with Indian GAAP. This would have significant impact on financial position and financial performance of the Indian companies. The fair value measurement can bring a lot of volatility and subjectivity in the financial statements. As till now the Indian companies have been following Historical Cost basis for preparation of financial statements.

4.2.5. Complexity in financial Reporting

- There will be a need to consider several factors which were not required and relevant as per the Indian GAAP for preparation of financial statements with adoption of IFRS.As already discussed fair value measures would require the companies, auditors, users and regulators to get familiar with fair value. This would initially increase the complexity in financial reporting process and may make financial statements more difficult to understand for certain class of users.

4.2.6. Increased Initial Cost

- Adoption of IFRS would lead to increase initial onetime cost. These costs includes additional cost of modifying IT systems, costs of training internal corporate staff, increased audit cost, costs of educating various constituents like investors, analysts, Board members etc.

5. Conclusions

- The discussion above reveals that the implementation of IFRS shall have the major impact over the Loan impairment, financial instruments, tax reporting practices, hedge accounting etc which will have a significant impact on the financial statement of the banking industry. The environment of high quality corporate financial reporting depends on effective enforcement mechanisms. The Government and the Regulators should establish legal and regulatory environments that provide for compliance with all the IFRSs. The Government should frame/ revise laws in consultation with NACAS to reflect the IFRSs. To conform to the global change and completion the Indian banks have started taking first few steps in the right direction. The industry has recognized the need for IFRS convergence. Realizing the need of the time the Indian banks show eagerness towards time bound implementation, giving top priority to the convergence process. Similarly, various Regulators RBI, SEBI, IRDA are also taking interest in relation to frame/revise regulations in consultation with ICAI. This has been considered as a high priority by Industry associations such as Federation of Indian Chambers of Commerce and Industry (FICCI), Associated Chambers of Commerce (Assocham) and Confederation of Indian Industries (CII) should have to play an important role in preparing their constituents for the adoption of the IFRSs. For increasing awareness ICAI, RBI, SEBI, IRDA should work jointly to design awareness program on importance of compliance with accounting and auditing standards. The industry has to accelerate the training programme to train their staff so that they could face and handle properly the challenges ahead due to IFRSs. In this regard the banking industry could to in forming a trained group of IFRSs who could work along with internationally reputed various audited firm like KPMG, PWC, Ernst and Young in the process of compliance to the IFRSs. Though it is very much demanding to comply with the IFRSs for the industry it is recommended to handle the transition into compliance very carefully .When these challenges are taken care of very well the implementation of IFRSs in the Indian banking industry would be able to make the economy of our country also successful to become one of the best in the world.

Annexure-1

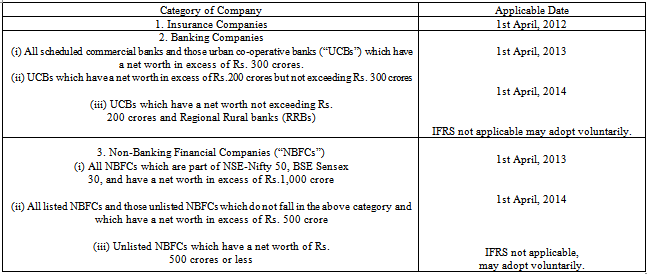

- The roadmap for convergence with IFRS in respect of insurance companies, banking companies and non-banking finance companies is as follows:

Annexure-2

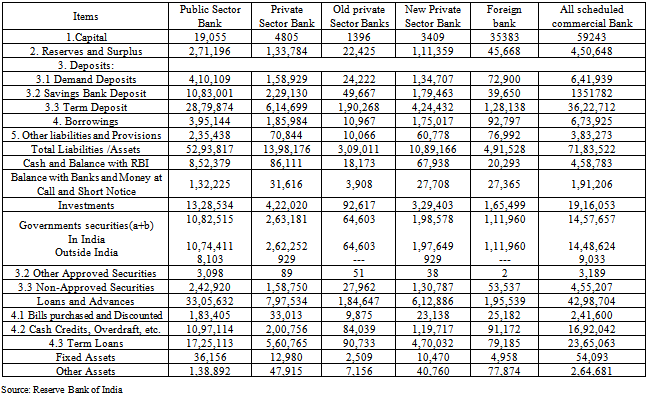

- Consolidate Balance Sheet of Scheduled Commercial Banks (Rs.in Crore)

Annexure-3

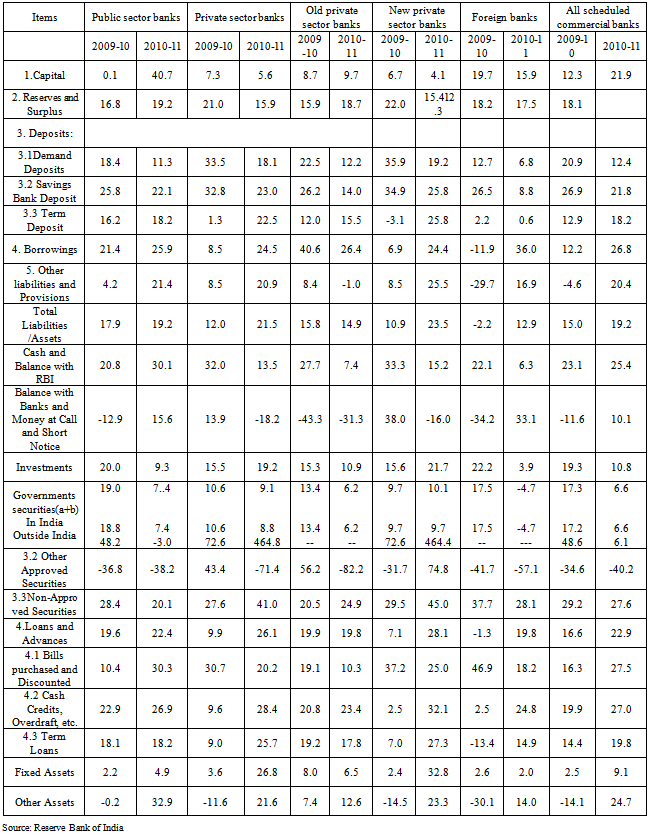

- Growth in Balance Sheet of Scheduled Commercial Banks (in Percentage)

Annexure-4

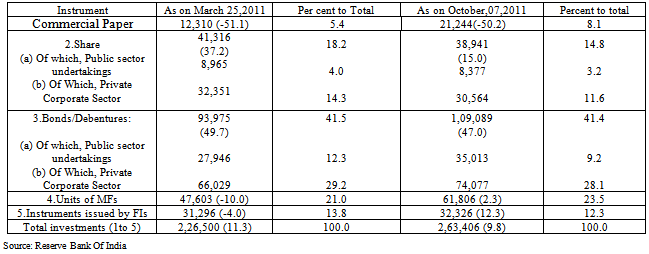

- Non-SLR Investments of Scheduled Commercial Banks (in Crores)

Annexure-5

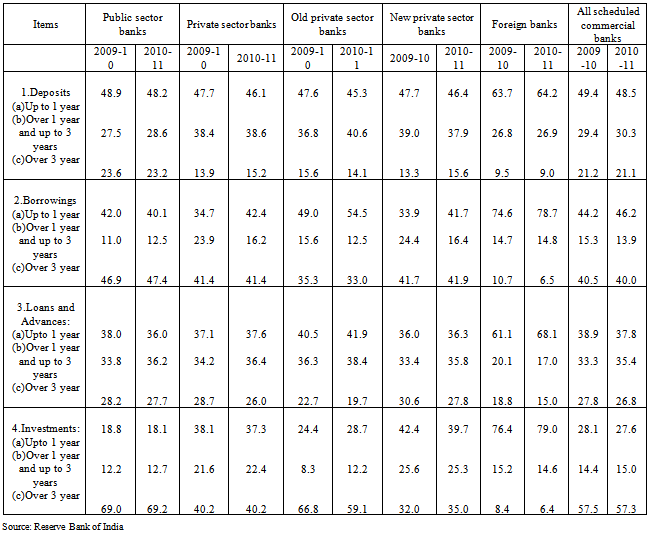

- Bank Group-wise Maturity Profile of Select Liabilities/Assets (as at end-March) (Percentage to total under each item)

Annexure-6

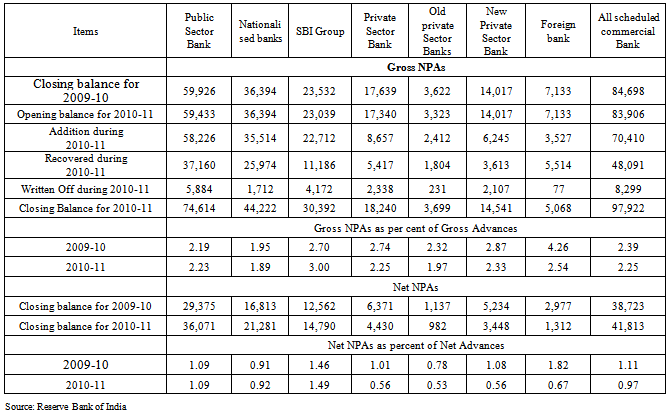

- Trends in Non-Performing Assets-Bank Group wise (Rs.in Crore)

Annexure-7

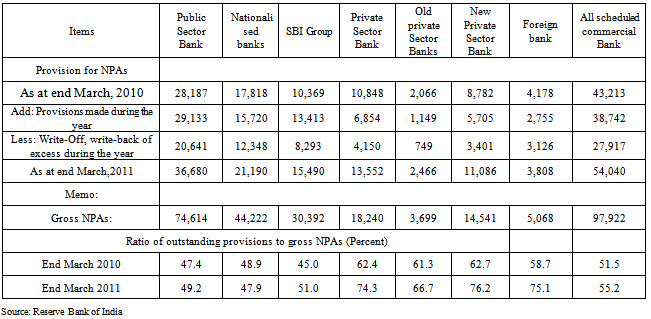

- Trends in Provisions for Non-Performing Assets-Bank Group-wise (Rs.in Crore)

Annexure-8

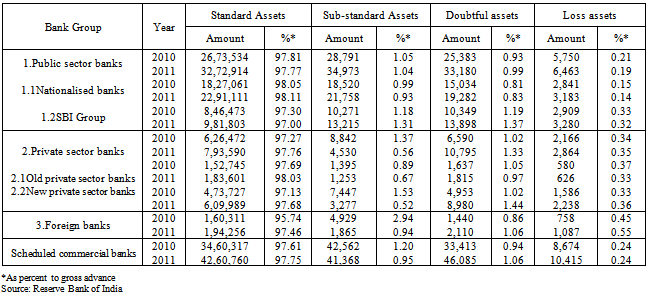

- Classification of Loan Assets-Bank Group-wise[As at end-March] (Rs.in Crore)

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML