-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

2012; 1(3): 45-52

doi: 10.5923/j.ijfa.20120103.04

Bank Credits and Rural Development in Nigeria (1982-2009)

Tajudeen Egbetunde

Department of Economics and Financial Studies, Fountain University, Osogbo, Nigeria

Correspondence to: Tajudeen Egbetunde , Department of Economics and Financial Studies, Fountain University, Osogbo, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The paper examines the relationship between commercial bank credits indicators and rural economic growth in Nigeria. Using a double-log equation within the context of Ordinary Least Square (OLS) framework and co-integration test, the study finds that rural economic growth is co-integrated with bank credits indicators in Nigeria. Within the OLS framework, the evidence of positive relationship exist between rural economic growth and commercial bank rural loans as well as commercial bank loans to agriculture and rural economic growth at p < 0.01 in the economy, while deposits of rural dwellers were negatively impacted on rural economic growth at p < 0.01. Based on these results, the paper argues that the rate at which commercial bank credits in terms of loans and deposits of rural dwellers contributed to rural economic growth in Nigeria were very high. Therefore, these indicators of commercial bank credits in the development of economic activities in rural areas should be properly managed in order to improve the well-being of the rural dwellers which in turn improve economic growth in Nigeria.

Keywords: Commercial Bank Credits, Economic Growth and Nigeria

Article Outline

1. Introduction

- In Nigeria, credit has been recognized as an essential tool for promoting Small and Medium Enterprises (SMEs). About 70 per cent of the population is engaged in the informal sector or in agricultural production. The Federal and State governments in Nigeria have recognized that for sustainable growth and development the financial empowerment of the rural areas is vital, being the repository of the predominantly poor in society and in particular the SMEs. If this growth strategy is adopted and the latent entrepreneurial capabilities of this large segment of the people is sufficiently stimulated and sustained, then positive multipliers will be felt throughout the economy. To give effect to these aspirations various policies have been instituted over time by the Federal Government to improve agricultural production capabilities, positively channel the potential of SMEs to enhance their standard of living and to put the sector in the front burner of Government’s development strategy.Reference[33] asserts that a major challenge facing many developing countries, especially in Africa, is devising appropriate development strategies that will capture the financial services requirements of farmers and small and mediumentrepreneurs who constitute about 70 percent of the population. The Federal Government of Nigeria considers this segment critical for its development efforts to be fully realized. The Government has instituted various policies to achieve its aims, including a commercial bill financing scheme; regional commodity boards (later called national commodity boards); an export financing and rediscount facility (1987); the Nigerian Agricultural Cooperative and Rural Development Bank Ltd; community banks, People’s Bank; the Agricultural Credit Guarantee Scheme Fund (ACGSF); and the Small and Medium Enterprises Equity Investment Scheme among others. These policies have contributed to improving the livelihoods of farmers and entrepreneurs.Commercial bank credits play a crucial role in the development of an economy. Reference[26] contends that bank credits influence positively the level of economic activities in any country. It influences what is to be produced, who produces it, and how much is to be produced.Reference[8] postulates that credit is the money that banks give out as loans and advances with future date of repayment. An important role of banks is to design ways of providing loans to informational opaque small business[5].The Central Bank of Nigeria (CBN) Prudential Guidelines of 1990 however provides a wider definition of credit, and this includes aggregate of all loans, advances, overdrafts, bills discounted banks guarantees, banks acceptances, commercial papers, leases and indemnities.Reference[12] identified bank as a monetary institution owned by either government or private businessmen for the purpose of profit making. In pursuit of this profit, the commercial banks perform a number of functions. One of these functions is the acceptance of deposits from the public. These deposits are in turn given as credit to Small and Medium Scale Enterprises among other, which led to more production and provision of employment opportunities in the economy,[13, 18, 19, 39].Rural development is highly essential for an economy aiming at economic prosperity. This will reduce congestion in the urban sector of the economy which in turn gives road to full employment of resources. Moreover, not all contributions in terms of deposits in bank are used for the development of rural sector, hence, this study investigates whether contributions of rural dwellers in financial institution in Nigeria serve as crowd-in effect or crowd-out effect on the living standard of people residing in the area. This study covers a period of 1982 to 2009.

2. Theoretical Perspectives

- For both developing and developed countries, small and medium scale firms play important roles in the process of industrialization and economic growth. Many scholars including reference[38, 35, 41] believe that, one of the instruments that have been identified to tackle poverty and promote economic development is the promotion of small and medium scale enterprises.In many developing countries, the Small and Medium Enterprises (SMEs) constitute the bulk of the industrial base and contribute significantly to their exports as well as to their GDP or GNP[20]. These enterprises have immense contributions to economic growth, job creation and industrial development[7, 16, 24, 29]. According to reference[6], “the potentials of the small and medium enterprises are manifested in their labour-intensive nature, income-generating possibilities, capital saving capacity, potential use of local resources and reliance on few imports, flexibility, innovativeness and strong linkages with the other sectors of the economy.In the mid-1960s a new approach to small and medium-scale enterprise (SME) development began to emerge due to a number of factors. First, there was growing concern over low employment elasticity of modern, large-scale production. It was claimed that even with more optimal policies, this form of industrial organization was unable to absorb a significant proportion of the rapidly expanding labour force[9]. Second, there was widespread recognition that the benefits of economic growth were not being fairly distributed, and that the use of large-scale, capital-intensive techniques was partly to blame[9]. Third, empirical diagnosis showed that the causes of poverty were not confined to unemployment, and that most of the poor were employed in a large variety of small-scale, low-productivity activities. Thus, it was thought that one way to alleviate poverty could be to increase the productivity of those engaged in small-scale production[3].This suggested a new role for small industries, or what has come to be labelled "the urban informal sector". Small, labour-intensive industries were seen not only to increase employment, but also to increase the living standards of the poor. They were also thought to be capable of providing a new dynamic of economic growth. The new objective was not just to stop the retreat, but to promote the small-scale sector[3, 40].Reference[21] sees SMEs as an instrument for urban employment and a provider of inexpensive consumer goods with little or no import content, serving an important pressure-releasing and welfare-augmenting function. SMEs also contribute to long-run industrial growth by producing an increasing number of firms that grow up and out of the small-scale sector. The emergence of wholly modern small/medium-scale Nigerian industries is likely to be a prerequisite for any enduring industrialization.Development of SMEs is seen as an instrument that can be used to generate sustainable development. A sustainable development is one, which ensures that the general population can attain an acceptable level of welfare both at present and in the future. Small and Medium Enterprises have been widely acknowledged as the springboard for sustainable economic development[34].In particular, developing countries including Nigeria have since the 1970s shown increased interest in the promotion of small and medium scale enterprises for three main reasons according to reference[34]: the failure of past industrial policies to generate growth; increased emphasis on self-reliant approach to development and the recognition that dynamic and growing SMEs can contribute substantially to a wide range of developmental objectives. These objectives include efficient use of resources, employment creation, mobilization of domestic savings for investments, encouragement, expansion and development of indigenous entrepreneurship and technology as well as income distribution, among others[32].A study of the trend of commercial banks credit to small and medium enterprises in Nigeria suggest that an increase in commercial banks credit allocation to SMEs, would increase SMEs contribution to total GDP[19]. Therefore, the reasons for the low contribution of the SMEs to the total GDP includes lack of credit facilities, shortage of skills among the entrepreneurs, weak infrastructural facilities, inability of small and medium industrialists to transform ideas into reality, poor demand for finished goods, restricted access to land, difficulties in input procurement and lack of continuity after the death of their owners[42]. But the major problem in Nigeria still remains lack of adequate credit facilities. In fact, reference[27] chronicled several challenges confronting banks in their participation in SMEs programmes to establish why banks have not been able to give the much-needed help to SMEs finance.The World Bank survey on access to finance of Nigerian firms has demonstrated that most banks are reluctant to provide long term credit to small and medium scale industries in Nigeria. It is also obvious from the survey that even when banks extend short-term credit to small and medium scale firms it is often based on high collateral requirements and the facilities do not go beyond a one-year term.Reference[23] contends that one of the major objectives of any government is acceleration of economic growth and development. Each country tries to achieve this by various ways and channels. He conducted an empirical study that analyzes the impact of Small and Medium Enterprises (SME) on economic development in Nigeria for the period 1980-2008. The paper employs a time series econometric approach to assess this impact. The study finds that though SME is a catalyst for development, its impact on the development path in the country is still negligible. This dismal performance may reflect the phase and stage of our economic development, and suggests that the country is still a factor-driven economy. This performance may also be due to several reasons such as poor funding facilities, low level of education and weak government support amongst others. The paper suggests more positive government supports and more enlightenment, for the sector to actually play its expected role of facilitating economic development and for a smooth transition to innovation-driven economy.Despite the contributions of SMEs to economic growth in Nigeria, studies are yet to emerge to look at the contribution of bank credits to economic development of rural areas in Nigeria. Development may take place in rural sectors through the provision of SMEs in the sector, but, the rate of SMEs in rural areas is not adequately stated in the overall SMEs figures in Nigeria. As a result of this, one cannot really rely on the contribution of SMEs to the development of rural sectors of Nigerian economy. Therefore, adequate attention is needed to investigate the amount of resources rural sectors of Nigeria is contributing to the total commercial banks credit and what amount is given back to the sector in order to improve economic activities of rural sectors of Nigeria. Central Bank of Nigeria stated it clearly from the Nigerian economy that resources or funds are being sourced in the rural sectors, but, one cannot say authoritatively if the funds are meant for the development of the rural areas or are concentrated in the urban areas of the economy. Therefore, there is need for this paper to examine the impact of commercial banks credits on the development of economic activities in the rural areas in Nigerian economy between 1982 and 2009. Also this paper investigates whether the deposits in rural areas in Nigeria is a crowd-out effect in the sector or not.Although, in a decade ago, studies have shown that women took a great impact on the development of rural sector in Nigeria. The bedrock of agriculture and agricultural development in developing countries of sub-Saharan Africa is rural development, without which all efforts at agricultural development will be futile[30]. A large majority of the farmers operate at the subsistence, smallholder level, with intensive agriculture being uncommon. A characteristic feature of the agricultural production system in such countries, Nigeria inclusive, is that a disproportionately large fraction of the agricultural output is in the hands of these smallholder farmers whose average holding is about 1.0-3.0 hectares[10]. Also, there is very limited access to modern improved technologies and their general circumstance does not always merit tangible investments in capital, inputs and labour.Household food and nutrition security relies heavily on rural food production and this contributes substantially to poverty alleviation. Consequently, the first pillar of food security is sustainable production of food[28]. It has been noted that in the early 1980s, while the population grew rapidly, food production and agricultural incomes declined in many African countries[15]. In many of the countries the diminishing capacity of agriculture to provide for household subsistence increased the workload shouldered by women as men withdrew their labour from agriculture. Hence the increased attention that is being given to the role of smallholder subsistence agriculture in ensuring food security of the continent, since some 73% of the rural population consists of smallholder farmers[17].The bulk of the poor, some three-quarters according to a recent World Bank estimate, live in rural areas where they draw their livelihoods from agriculture and related activities[22]. Evidently, development, food security and poverty alleviation will not be truly achieved without rapid agricultural growth. Assisting the rural poor to enhance their livelihoods and food security in a sustainable manner is therefore a great challenge. Broadly put, increases in agricultural productivity are central to growth, income distribution, improved food security and alleviation of poverty in rural Africa[14]. In all of these, the rural woman plays a pivotal role and she is crucial to the overall success of efforts directed at agricultural development in rural areas.The role that women play and their position in meeting the challenges of agricultural production and development are quite dominant and prominent. Their relevance and significance, therefore, cannot be overemphasized[25, 36]. Findings from a study financed by the United Nations Development Programme (UNDP) revealed that women make up some 60-80 per cent of agricultural labour force in Nigeria[43], depending on the region and they produce two-thirds of the food crops. Yet, in spite of these, widespread assumption that men – and not women—make the key farm management decisions has prevailed. Sadly, female farmers in the country are among the voiceless, especially with respect to influencing agricultural policies. Such policies, which are aimed at increasing food security and food production, tend to either underestimate or totally ignore women’s role in both production and the general decision-making process within the household. Socio-economic characteristics of the farmers, among other factors, affect their decision-making in agriculture. The various contributions of women to agricultural production in Nigeria have been variously described in the literature[4, 11, 36] but their role in decision-making process in agriculture has not been widely employed or at best, remains minimal[36,11].Ironically, women are known to be more involved in agricultural activities than men in sub-Saharan African (SSA) countries, Nigeria inclusive. As much as 73 % were involved in cash crops, arable and vegetable gardening, while postharvest activities had 16 % and agroforestry, 15 per cent[1]. Their involvement in agriculture in Nigeria has attracted greater attention in recent years. Reasons for their involvement are as many as are diverse. In some states rural women have virtually taken over the production and processing of arable crops[2], being responsible for as much as 80 % of the staple food items. Estimates of women’s contribution to the production of food crops range from 30% in the Sudan to 80% in the Congo[15]; contributing substantially to national agricultural production and food security, while being primarily responsible for the food crops.In recent study, reference[30] contend that most farmers in Nigeria operate at the subsistence, smallholder level in an extensive agricultural system; hence in their hands lies the country’s food security and agricultural development. Particularly striking, however, is the fact that rural women, more than their male counterparts, take the lead in agricultural activities, making up to 60-80 per cent of labour force. It is ironical that their contributions to agriculture and rural development are seldom noticed. Furthermore, they have either no or minimal part in the decision-making process regarding agricultural development. They further argue that gender inequality is therefore dominant in the sector and this constitutes a bottleneck to development, calling for a review of government policies on agriculture to all the elements that place rural women farmers at a disadvantage. The women-in-agriculture programme in Nigeria, which was established in cognizance of this and the shortcoming in extension services for women farmers, has been a huge success. Women’s groups, non-governmental organizations (NGOs) and civil societies have empowered and given rural women farmers a voice and effectively championed their cause. Women farmers now have better access to farm inputs and credits although many barriers remain and would have to be addressed to further enhance their role. Rural women farmers deserve better recognition and greater appreciation of their tangible contributions to agriculture and rural development and food security.Summarily, most of the literatures focused on the commercial bank credits-small and medium scale enterprises-growth nexus in Nigeria. In addition, some literatures examined the contribution of women in economic development of rural sector in Nigeria. However, studies are yet to emerge on the relationship between bank credits and rural development in Nigeria, hence, this paper. This will guide the policy makers in formulating policies that will propel and enhance economic development in rural sector of the economy.

3. Methodology

- This paper used secondary data (time series data). Empirical investigation was carried out on the basis of the sample covering the period 1982 to 2009. The contribution of rural sectors of Nigeria to Gross Domestic Product (GDP) was used as an indicator of economic growth in rural areas, deposits from rural areas; loans (including agricultural loans) to rural areas were also used as indicators of commercial bank credits in rural sector. Data on these variables were sourced for Nigerian economy.Rural economic growth was measured through the contribution of rural sectors to GDP of Nigerian economy. Rural deposit was measured as the total demand deposits of the rural sectors of the economy. Loans to rural areas were measured through the commercial bank credits to rural areas, although, the sum of loans to rural areas was given in the CBN statistical bulletin while that of loans to agriculture was also given. Therefore, this paper makes use of the two (i.e. the sum of loans to rural areas and loans to agriculture) in order to examine the effects of the two on the contribution to the GDP.

3.1. Specification of Model

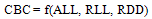

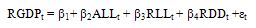

- This paper explores a linear relationship between rural output and bank credits indicators. Following the standard literature, the model is based on the following equation:

| (1) |

| (2) |

| (3) |

| (4) |

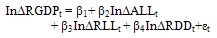

3.2. Unit Root Tests

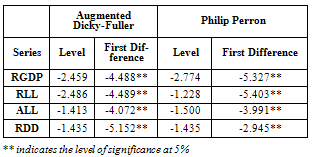

- The preliminary investigation commenced with confirmation of the order of integration of the series, where the series is confirmed to be order 1, then, multiple co-integration can then be performed. Time series analysis involving stochastic trends, Augmented Dickey-Fuller and Philip Perron unit root tests are calculated for individual series to provide evidence as to whether the variables are integrated. This is followed by a multivariate co-integration analysis.Augmented Dickey-Fuller (ADF) and Philip Perron (PP) tests involve the estimation one of the following equations respectively:

The additional lagged terms are included to ensure that the errors are uncorrelated. The maximum lag length begins with 3 lags and proceeds down to the appropriate lag by examining the AIC and SC information criteria.

The additional lagged terms are included to ensure that the errors are uncorrelated. The maximum lag length begins with 3 lags and proceeds down to the appropriate lag by examining the AIC and SC information criteria.3.3.Johansen Co-Integration Analysis

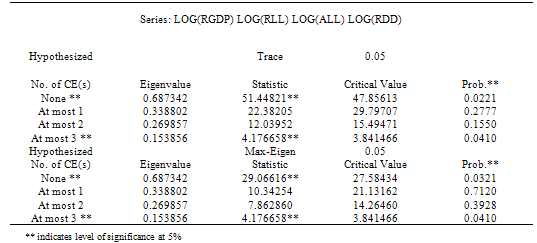

- Since it has been determined that the variables under examination are integrated of order 1, then the co-integrated test is performed. The testing hypothesis is the null of non-co-integration against the alternative that is the existence of co-integrated using the Johansen maximum likelihood procedure. The Johansen method applies the maximum likelihood procedure to determine the presence of co-integrated vectors in non-stationary time series.

3.4. Estimation Technique

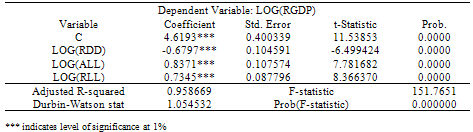

- We perform a unit root test on each variable in our model using the Augmented Dickey-Fuller (ADF) and Phillips Perron (PP) tests. The table 1 below shows the result of the unit root tests for the variables.With evidence of unit roots, the series are said to be integrated of order one – I(1), meaning that they must be modelled in first difference (∆yt = yt – yt -1) to make them stationary. A time series is stationary if it does not change overtime, which implies that its values have constant variability. This enables us to avoid the problems of spurious regressions that are associated with non-stationary time series models.After testing for unit roots, we proceed to test for co-integration (long run relationship between variables). This paper uses Johansen and Juselius’s (1991) definition of co-integration. Johansen’s co-integration procedure was used to test for the possibility of at least one co-integrating vector between variables in the models developed for the Nigerian economy in this paper.After the above testing established, the study adopts a double-log equation using Ordinary Least Square (OLS) to know various effects of commercial bank credits indicators on rural economic growth in the economy.

|

4. Empirical results and discussion

- The results of the co-integration test are reported in table 2 below and this allows the paper to examine the long run relationship among the variables.The result shows that there was at least one co-integration relationship among the variables in the model. The evidence of multivariate co-integration test results suggests that commercial bank credits indicators and rural economic growth indicator are co-integrated. That is, these variables move together in the long run.

|

|

5. Conclusions

- The paper investigates the relationship between commercial bank credits indicator and rural economic growth in Nigeria using a double-log equation within the context of OLS framework. The relationship among the series could be detected for the country for effective policy making.The relationship shows that commercial bank credits in terms of loans to rural areas have positive and significant impact on rural economic growth (at p < 0.01) in Nigeria while deposits of rural dwellers in commercial banks have negative and significant effect on rural economic growth (at p < 0.01) in Nigeria. The paper concluded that the rate at which commercial bank credits in terms of loans and deposits of rural dwellers contributed to rural economic growth in Nigeria are very high. Therefore, these indicators of commercial bank credits in rural areas in the development of economic activities in rural areas should be properly managed in order to improve the well-being of the rural dwellers which in turn improve economic growth in Nigeria.Therefore, the following policies are recommended base on the findings of this paper:The monetary authority in Nigeria should task the commercial banks to concentrate the resources of the rural areas in their domain in order to improve economic activities of the sector of the economy.They should urge the commercial banks to promote small and medium enterprises in the rural sectors in Nigeria so as to serve as an engine of development in the sector.The rural dwellers should be further encouraged to deposit more of their funds with the commercial banks in order to strength the commercial banks to create more credits / wealth in the rural areas.Agriculture should be further developed with appropriate policy in rural areas in Nigeria because it is one of the key determinants that contribute to the growth of rural areas.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML