Suresh Kumar Chaudhary

Civil Engineer, Himalayan Institute of Science and Technology, Kathmandu Purwanchal University, Nepal

Correspondence to: Suresh Kumar Chaudhary, Civil Engineer, Himalayan Institute of Science and Technology, Kathmandu Purwanchal University, Nepal.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

Engineering activities of analysis and design are not ends in themselves. It is essential that engineering proposals be evaluated in terms of worth and cost before they are undertaken and economy feasibility is an essential pre-requisite of every successful engineering application. Engineering economics deals with the selection of best course of action from several technically and financial viable projects. Methodologies consists of techniques and procedures which is used to identify, process and analyses the information. Techniques incorporates principles of engineering economics and tools used in engineering economics are helpful for evaluation of alternatives uses of capital. There may be several alternatives having different pattern of capital investment, revenue flow and cost flow, and the organization has to select the best alternative among the different projects. Project evaluation methodologies helps to develop different alternatives and identify the differences considering all relevant criteria. Decision methodologies of engineering projects are part of decision processes along with principles of engineering economics. Decision makers use project evaluation methodologies during all steps of decision making processes from the beginning of defining of problem to implementation of solution. Here, the study includes the concepts, use and limitations of Accounting Rate of Return (ARR), Simple and Discounted Payback Period methods, net Present Value Method (NPV), Profitability index (PI), Internal Rate of Return (IRR), External Rate of Return (ERR), Capitalized Worth (CW) method, Breakevn Analysis, Sensitivity Analysis, Scenario Analysis, Decision Tree Analysis, Replacement Analysis, Repeatabilty Assumption and Co-terminated Assumption. These methodologies involves in determining a project’s desirability. The review of these methodologies and techniques are very important because each methodologies and techniques have their own uniqueness with their limitation and limitations need improvement.

Keywords:

Breakeven Analysis, Engineering Economy, Internal Rate of Return (IRR), Net Present Value (NPV), Project Evaluation Methodologies

Cite this paper: Suresh Kumar Chaudhary, A Review of Evaluation Methodologies and Techniques in Construction Engineering Projects, International Journal of Construction Engineering and Management , Vol. 12 No. 2, 2023, pp. 35-42. doi: 10.5923/j.ijcem.20231202.01.

1. Introduction

Without use of project evaluation methodologies, financial analysis of any project is not possible and without financial analysis, no projects can be carried out successfully. In past years, engineers were mainly involved in design, construction and only operational areas of project. But in recent years, engineers, project managers and decision makers of top level management are involved in financial analysis because of growing importance of financial feasibility. Nowadays, engineers and decision makers have been more interesting to make skillful financial analysis of the effective implementation. Engineering economy draws upon knowledge of engineering and economics to address problems of allocating scarce resources, selecting the preferred course of action from several technically viable ones and decision making is an essential part of it (Thapa, 2010). Excellent engineering analysis using project evaluation methodologies forms a solid foundation for a sound decision. Methodology is part of the engineering economy consists techniques and procedures from the technical content of the discipline (Adhikari, 2012). As a result of multiplicity of project situations and diversity of roles project evaluation can play, there is a constellation of ways of evaluating projects. This brings a set of issues regarding how projects are really evaluated (Omid, Guzman, & Gustavo, 2019). There is a lack of consensus in the literature regarding how to evaluate projects. Nowadays, project evaluation methodologies such as Accounting Rate of Return (ARR), Simple and Discounted Payback Period methods, net Present Value Method (NPV), Profitability index (PI), Internal Rate of Return (IRR), External Rate of Return(ERR), Capitalized Worth (CW) method, Breakevn Analysis, Sensitivity Analysis, Scenario Analysis, Decision Tree Analysis, Replacement Analysis, Repeatabilty Assumption and Co-terminated Assumption are being used widely to reflect today’s concern for resource conservation and effective utilization of funds of projects. Project evaluation is a systematic and objective assessment of an ongoing or completed project. The aim of project evaluation is to determine the relevance and level of achievement of project objectives, development effectiveness, efficiency, impact and sustainability (ILO). Project appraisal methodologies are methods used to access a proposed project’s potential success and viability. These methods check the appropriateness of a project considering things such as available funds and the economic climate. A good project will service debt and maximize stakeholder's wealth. Project evaluation methodologies are mathematical modeling with emphasis on the economic effects in the primary analytical techniques to select between defined feasible alternatives (Adhikari, 2012). Project evaluation methodologies are especially concerned with the systematic evaluation of costs and benefits of proposed technical and business projects. Use of project evaluation methodologies in engineering and other projects are the perfect estimates of what is expected to occur. Therefore, all government and corporate decisions are highly influenced by financial considerations and they are dependent to project evaluation methodologies. The objective of this review is to present the use of project evaluation methodologies and techniques along with their limitation. The review emphasis for improvement and development of new project evaluation methodologies and techniques for complex economic problems.

2. Methodologies and Techniques

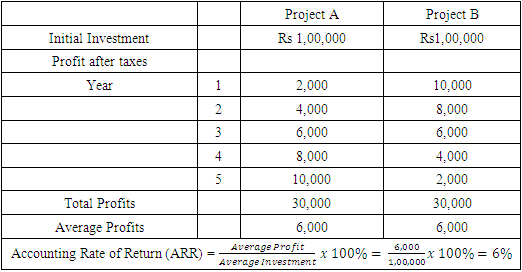

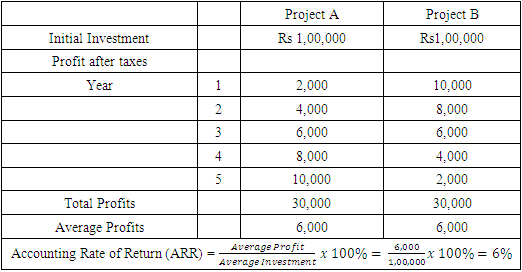

I. Accounting rate of return (ARR) Accounting rate of return is a financial ratio used in a capital budgeting (Mishra, 2010). Accounting Rate of Return calculates the percentage return generated from net income of the proposed capital investment. This method considers entire life time of the project in calculation but does not consider cash flow system and time value of money. As this method does not consider cash flow system and time value of money, it is difficult to select best projects from alternative projects only based on profit after taxes and percentage accounting rate of return. So, this method is not suitable to select best alternative of any project. This method can only find just rate of return.Example 1. Accounting rate of return (ARR)

|

| |

|

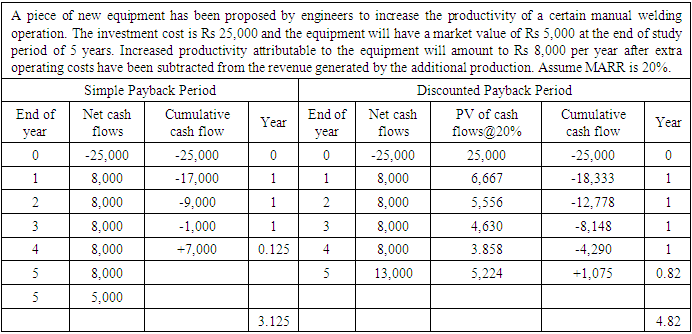

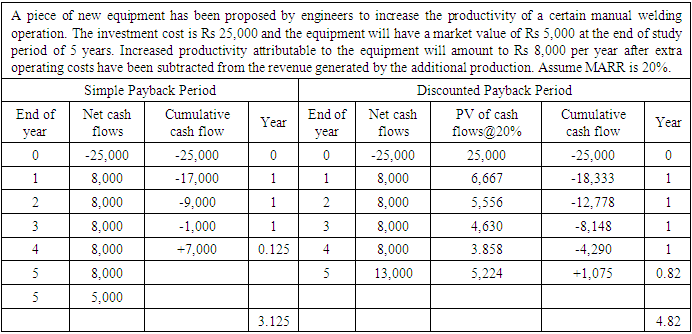

Accounting rate of return is 6% for both projects A and B. But, this method does not give clear picture of which project is to be selected as there is not any pre- determined rate to compare.II. Payback periodThe payback method, which is often called the simple payout method mainly indicates a projects liquidity rather than its profitability. Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the breakeven point (Hasugian, Dewi, & Vandrick, 2020). The investment payback period (X1) refers to the time required for the total amount of income obtained after the investment project to reach the total amount of investment invested in the investment project. That is, the shorter the payback period is, the faster the capital turnover is and the more profitable it is (Wu, 2021). This method is suitable for the firm's or businesses which are suffering from shortage of cash (Liquidity) as this method identifies, how early we will be able to get our money back in our pocket. This method is very suitable where the long term outlook is extremely uncertain and risky as this method lay more emphasis on short term earnings rather than long term growth. Simple payback period method is superior to Accounting Rate of Return (ARR) because payback period considers cash flow system but not after just payback period. The method treats a rupee received second or third year as valuable as a rupee received in first year. Therefore, this method is also not suitable as it only considers cash flow up to payback period but ignores time value of money. This method also ignores the cost of capital and the profitability of a project. This method is only suitable to know time required to recoup the funds expended in an investment. But discounted payback period method includes time value of money. Example 2. Payback period

|

| |

|

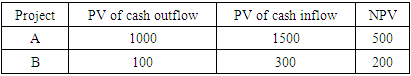

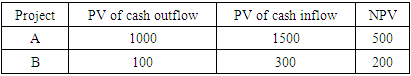

Here, simple payback period is 3.125 years and discounted payback period is 4.82 years. The values are different as discounted payback period considers time value of money. Using only the payback period to make investment decisions should generally be avoided except as a secondary measure of how quickly invested capital will be recovered, which is an indicator of project risk.III. Net present value (NPV)NPV method is one of the discounted cash flow techniques (Hasugian, Dewi, & Vandrick, 2020). Under this method, present value of each cash outflows and cash inflows is calculated and the present value of cash outflows is subtracted from the present value of cash inflows (MÁRIA ILLÉS, 2020). This difference is called Net present value. This method is suitable to select best alternatives as this method considers cash flow and time value of money. This method is suitable to take long term decisions as full life of the project is taken into consideration. Positive NPV is the criteria to accept the project while negative NPV is the criteria to reject project. But, in case of two or more than two projects with unequal initial investment, this method does not give satisfactory result.Example 3. NPV

|

| |

|

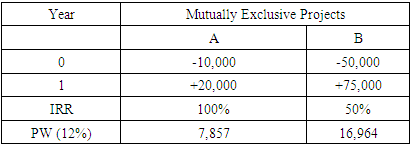

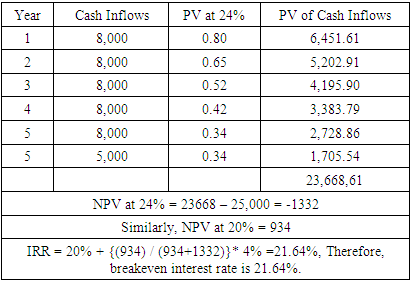

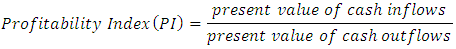

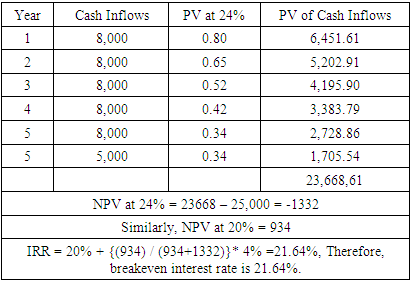

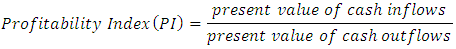

On the basis of NPV method, project A will be selected because of its higher NPV but project A only results in cash inflows of 1.5 times of investment while project B results in cash inflows of 3 times of investment. Therefore, project B should be selected instead of project A. This method does not give satisfactory result in case of two projects with different lives. Sometimes, in comparison of high NPV with high economic life of some projects and low NPV with low economic life of projects, low NPV with low economic life of projects can be selected as frequency of investment can be less in low economic life projects than high economic life of projects. Continue from Example 2: Net present value (NPV)PW = PW of cash inflows – PW of cash outflowsPW (20%) = Rs 8,000(P/A, 20%, 5) + Rs 5,000(P/F, 20%, 5) – Rs 25,000 = Rs 934.29This equipment is economically justified because of positive net present value.IV. Profitability Index (PI) Profitability Index method and NPV method is almost same but profitability Index is especially used when initial investment of different projects are different (Hasugian, Dewi, & Vandrick, 2020). This method is better than NPV because NPV method is suitable where initial investment in various projects are same. Value of profitability index greater than one is criteria to accept the project whereas value of profitability index less than one is criteria to reject the project. V. Internal rate of return (IRR)Internal rate of return (IRR) is a discount rate that makes the Net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. (Ayyub, 2003). The internal rate of return is the rate at which the present value of cash inflows is equal to the present value of cash outflows (Soliyev & Nurmatov, May 30, 2021). This method can be usefully applied in situations with even as well as uneven cash flow at different periods of time. This method considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability. The determination of cost of capital is not a pre- requisite for the use of this method and hence it is better than net present value (NPV) where cost of capital cannot be determined easily. This method provides for uniform ranking of various proposals due to the percentage rate of return. But this method is based upon the assumptions that the earrings are reinvented at the interest rate of return for remaining life of the project which is not justified assumptions particularly when the average rate of return earned by the firm's is not close to the internal rate of return. In this sense, NPV method seems to be better as it assumes that the earrings are reinvented at the rate of firm's cost of capital. The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows. It is believed that in order to provide a loan for a project, its IRR must exceed the lending interest rate (Andros, Akimov, Akimova, Chang, & Gupta, 2021). If IRR > MARR, the project should be accepted, otherwise rejected. When the algebraic sum of the cash flow changes more than one in series, it is possible to obtain multiple rate of return. In such a situation, PW criteria can be used to make decisions. IRR method also does not consider the scale of investment. Therefore, it can be misleading when choosing between mutually exclusive projects than have substantially different outlays.

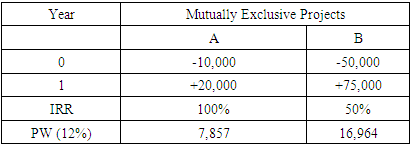

V. Internal rate of return (IRR)Internal rate of return (IRR) is a discount rate that makes the Net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. (Ayyub, 2003). The internal rate of return is the rate at which the present value of cash inflows is equal to the present value of cash outflows (Soliyev & Nurmatov, May 30, 2021). This method can be usefully applied in situations with even as well as uneven cash flow at different periods of time. This method considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability. The determination of cost of capital is not a pre- requisite for the use of this method and hence it is better than net present value (NPV) where cost of capital cannot be determined easily. This method provides for uniform ranking of various proposals due to the percentage rate of return. But this method is based upon the assumptions that the earrings are reinvented at the interest rate of return for remaining life of the project which is not justified assumptions particularly when the average rate of return earned by the firm's is not close to the internal rate of return. In this sense, NPV method seems to be better as it assumes that the earrings are reinvented at the rate of firm's cost of capital. The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows. It is believed that in order to provide a loan for a project, its IRR must exceed the lending interest rate (Andros, Akimov, Akimova, Chang, & Gupta, 2021). If IRR > MARR, the project should be accepted, otherwise rejected. When the algebraic sum of the cash flow changes more than one in series, it is possible to obtain multiple rate of return. In such a situation, PW criteria can be used to make decisions. IRR method also does not consider the scale of investment. Therefore, it can be misleading when choosing between mutually exclusive projects than have substantially different outlays.Example 4. Internal rate of return (IRR)

|

| |

|

Both projects are accepted at MARR = 12% but project B with higher PW is more worthful to the stakeholders whereas from IRR point of view, project A seems better. Hence, IRR method is unsuitable for ranking projects of different scale of investment. Continue from Example 2: Internal rate of return (IRR)

|

| |

|

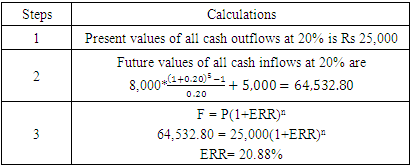

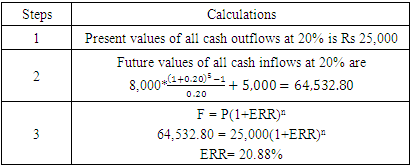

VI. External rate of return (ERR)The reinvestment assumptions of IRR is not always practical. For example, if a firm's MARR is 30% per year and the IRR for the project is 60%, it may not be possible for the firm's to reinvest net cash proceeds from the project at much more than 30%. In this situation, coupled with the computational demands and possible multiple interest rates associated with the IRR method has given rise to other rate of return methods, such as external rate of return (ERR) method. ERR method takes into account the external reinvestment rate (€) at which net cash flows generated by a project over its life can be reinvested outside the firm (Sullivan, Wicks, & Koelling, 2009). ERR method does not need trial and error process to solve for i % and have no possibility of multiple rates of return.Continue from Example 2: External rate of return (ERR)

|

| |

|

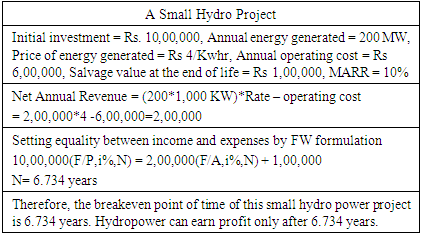

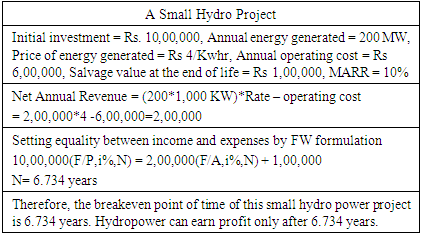

VII. Capitalized worth (CW) methodCapitalized cost is defined as the present worth of a constant annual cost over an infinite analysis period (Brown, 2007). This method is special case of present worth method (PW) criteria when revenue and expenses occur over an infinite length of time. Many long term projects like hydropower, irrigation, road, bridge, hospitals etc. have substantially longer service lives and benefits is also extended over this period. If only expenses are considered, results obtained by this method are sometimes referred to as capitalized cost. Capitalized worth (CW) method is a convenient basis for comparing mutually exclusive alternatives when the period of needed service is indefinitely long. Example 5: Capitalized worth (CW) methodA new bridge across the Bagmati River is being planned near a busy highway intersection in the commercial part of mid-town. The construction (First) cost of bridge is 19, 00,000 USD and annual upkeep is estimated to be 25,000 USD. In addition to annual upkeep, major maintenance work is anticipated every 8 years at a cost of 3, 50,000 USD per occurrence. The town government’s MARR is 8% per year. For this problem, what analysis period (N) is practically speaking defined as forever? If the bridge have expected life of 50 years, what is the capitalized worth of bridge over a 100 year study period?(1) A practical approximation of “forever” (infinity) is dependent on the interest rate. By examining the (A/P, i %, N) factor as N increases in the Appendix C-Discrete compounding(uniform series) tables, we observe that this factor approaches a value of i as N becomes large. For i = 8% (Table), the (A/P, 8%, 100) factor is 0.08.So, N =100 years is, for practical purposes, “forever” in this example.(2) CW(8%) = -19,00,000- 19,00,000 (P/F,8%,50) - 3,50,000 (A/F,8%,8)/0.08-25,000/0.08The CW turns out to be -26, 64,220 over a 100 year study period.VIII. Break even analysisIt is a technique for finding a point at which a project will cover its costs, or break even (Hasugian, Dewi, & Vandrick, 2020). It is often used to make an initial decision on whether to proceed with a project. B/C ratio based on equivalent uniform annual cash flow is used) and it is a more understandable technique relative to rate of return analysis for many financial managers, B/C analysis can be preferred to the other techniques such as present value analysis, future value analysis, and rate of return analysis (Ulukan & Ucuncuoglu, 2010). Breakeven analysis is also a technique of financial control in the sense that further analyses may be necessary as conditions change. Break even analysis in economics refers to the point in which the total cost and total revenue are equal. It is used for analyzing the relationship between sales volumes and profitability. Break-even analysis can work well if no changes occur. Unfortunately, in business changes always occur. Prices for supplies rise and fall, production slows down or picks up, and demand moves under a variety of factors. This makes it difficult for analysts to accurately predict costs, especially in the future. For a very short-term analysis break-even points may be useful, but they cannot be used to plan strategies for an extended period of time.Example 6. Break even analysis

|

| |

|

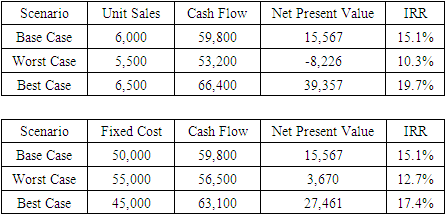

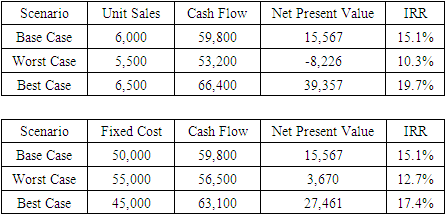

IX. Sensitivity AnalysisIt is the variation on scenario analysis that is useful in pinpointing the area where forecasting risk is special severe (Brown, 2007). The basic purpose is to with sensitivity analysis is to freeze all the variables except one and then see how sensitivity out estimate NPV is to changes that one variable. This analysis reveals that how much the NPV of a project will change in response to a given change in one input variable. But, sensitivity analysis is based on historical data & management assumptions. If these assumptions themselves are wrong, the whole analysis will be wrong, and the future forecast will not be accurate. For example, suppose management assumes that raw material prices will increase in the future and will affect the final price of the product. In that case, the company will purchase additional raw materials at present prices. But if, instead of rising, raw material prices fall, then the company will be at a disadvantage in the market. Sensitivity analysis considers each variable individually and tries to determine the outcome. In the real world, all variables are related to each other. For example, both inflation and market interest rates affect bond prices. Sensitivity analysis will consider how much a change in inflation will affect the bond price and how a change in market interest rate will affect bond price, but it won’t consider how a change in inflation will affect the market interest rate or vice versa. This is actually an incomplete analysis. Thus, we can say this analysis gives depth to the forecast but doesn’t consider its breadth. Example 7. Sensitivity Analysis

|

| |

|

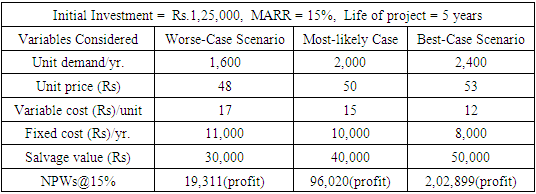

From these two tables, it is seen that NPV is more sensitive to sales than fixed cost.X. Scenario AnalysisScenario Analysis is a technique that considers that sensitivity of NPW due to change in key variables at a time and the range of likely values of other variables. Most business managers use scenario analysis during their decision making process to find out the best -case scenario, as well as worst-case scenario while anticipating profits or potential losses (Brown, 2007). The NPWs under the worse and the best scenario are then calculated and compared with the expected or (base case) NPW. Sometimes, due to difficulty in forecasting what may occur in the future, the actual outcome may be fully unexpected and not foreseen in the financing modeling.Example 8. Scenario Analysis

|

| |

|

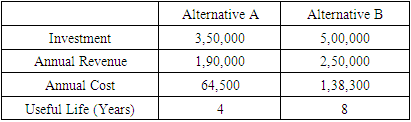

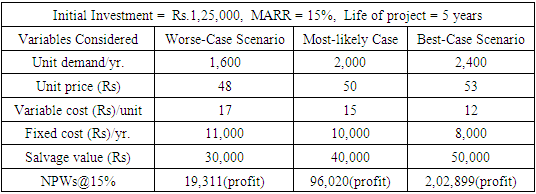

This sensitivity analysis indicates, there is no risks for investment.XI. Decision Tree AnalysisDecision tree analysis involves making a tree-shaped diagram to chart out a course of action or a statistical probability analysis. It is used to break down complex problems or branches. Each branch of the decision tree could be a possible outcome (Decsion Tree Model, 2023). Decision Tree of Analysis are a net present value (NPV) calculation that incorporates different future scenarios based on how likely they are to occur. The cash flows for a given decisions are the sum of cash flows for all alternative options, weighted based on their assigned probability. Decision Tree Analysis involves visually outlining the potential outcomes, costs and consequences of a complex decision. These trees are particularly helpful for analyzing quantitative data and making a decision based on numbers. The branches can easily be evaluated and compared in order to select the best courses of action (Ayyub, 2003). Sometimes, minor data changes can lead a major structure changes, information gain in decision Tree can be biased and decision Trees can often be relatively inaccurate. A popular alternative to decision Tree is the influence diagram which is a more compact, mathematical graphical representation of a Decision situation. This method is most suitable whenever a sequential series of conditional decision must be made under conditions of risk.XII. Replacement AnalysisReplacement analysis is the economic analysis to compare existing and new facilities. It is the decision situation encountered in firm in which an existing asset should be retired from use or continued in service or replaced with a new asset (Leu & Ying, 2020). Replacement study provides the information for sound decisions that improve the operating efficiency and the competitive position of enterprise. Physical impairment of asset, altered requirement, changed technology, depletion are the major reasons of replacement. This method assumes that a firm is continually replacing, and therefore determines a once and for all optimal replacement cycle. In practice this is unlikely to be valid due to changing technology, which can quickly make machines obsolete and shorten replacement cycles. This means that one asset is not being replaced by one exactly similar. The company may decide to replace to asset due to technology update, however, the new asset may require to replace again after purchase. Differential inflation rates are also cause of vary in replacement cycle over time. The effects of taxation was found ignored in this analysis which should be incorporated.XIII. Repeatability assumption methodRepeatability assumption is used to compare mutually exclusive alternatives having different useful life (Couper, 2003). In this assumptions, two alternatives having different useful life are changed into projects having same useful life by expanding their life up to least common year. The study period is equal to the least common multiple (LCM) of the lives of alternatively as study period is not mentioned in this assumption. The analysis period over which alternatives are being compared is either indefinitely long or equal to common multiple of the lives of the alternatives. The cash flows associated with an alternative's initial life span are representative of what will happen in succeeding life spans. The repeatability assumption has limited use in engineering practice, because actual situation seldom meet both condition assumed in repeatability method. XIV. Co-terminated MethodCo-terminated assumption uses a finite and identical study period for all feasible alternatives and analysis is made over this period (Couper, 2003). This method is used when repeatability assumption is not applicable. Study period may be provided for analysis or taken from useful life provided. When study period is greater than useful life, Future worth (FW) is calculated at the end of the study period using MARR. Similarly, when study period is less than useful life, the alternative is truncated at the end of study period using an estimated or imputed market value. This method assumes disposable assets will be sold at the end of study period at that value. Example 9. Co-terminated Method

|

| |

|

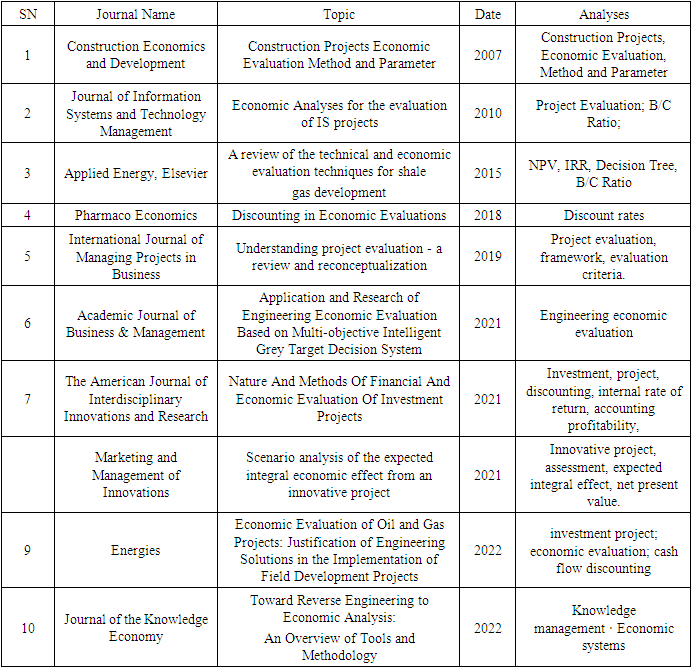

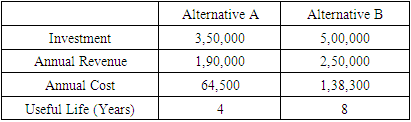

In this example, taking study period as 8 years (the value should be taken in such a way that the study period is either equal or greater than useful lives of all the alternatives), there is no adjustment required to the alternative B but the adjustment is required in case of A, which study period is 4 years greater than its useful life. When study period is greater than useful life it is assumed that the cash flows accumulated at the end of useful life will be reinvested for the extended periods.Table 1. Some Journals used in the literature review

|

| |

|

3. Conclusions

Feasibility study, analysis of different alternatives using different project evaluation methodologies and techniques are very compulsory for any engineering project to proceed. Engineering economy analysis use project evaluation methodologies for better use of limited budget and resources and project planning. These discussed methodologies and techniques have their own merits and have some limitations too. Every methodologies and techniques cannot be used for every types of projects because of methodologies and techniques limitations. Even, these methodologies and techniques have their own limitations, they are useful and these should be used for better analysis of projects. The conclusion reveals that certain project evaluation methods are better suited for specific situations, while other applications should avoid certain methods altogether. It is found that the project evaluation methodologies and techniques which do not consider cash flow system and time value of money are less effective than the methodologies and techniques which considers cash flow system and time value of money. Accounting Rate of Return only calculates the percentage return generated from net income of the proposed capital investment. This method does not compare the profits of companies in respective years. On the other hand, Payback period method mainly indicates a projects liquidity rather than its profitability. Payback period only focuses on required time to recoup the investment and there is still differences in simple payback period method and discounted payback period method because discounted payback period method considers time value of money. The internal rate of return (IRR) method is more suitable than net present value (NPV) in many ways but also use of net present value (NPV) is higher than internal rate of return (IRR) because IRR method is based upon the assumptions that the earnings are reinvented at the interest rate of return for remaining life of the project which is not justified assumptions particularly when the average rate of return earned by the firm's is not close to the internal rate of return. In this sense, NPV method seems to be better as it assumes that the earrings are reinvented at the rate of firm's cost of capital. But, external rate of return (ERR) method takes into account the external reinvestment rate (€) at which net cash flows generated by a project over its life can be reinvested outside the firm and so, this method is also called modified internal rate of return (MIRR). Similarly, capitalized worth (CW) method can be used especially for long term projects like hydropower, irrigation, road, bridge, hospitals etc. The study concludes that breakeven analysis can only be perfect if the available data for analysis is reliable or accurate. The study also concludes that decision tree method, scenario and sensitivity analysis measures the project risk by analyzing the variables of projects like fixed cost, variable cost, salvage value, demands and also prices. Similarly, replacement study provides the information for sound decisions that improve the operating efficiency. The study reveals that Co-terminated method is mostly used than repeatability method for mutually exclusive alternatives having different useful life. Finally, all the project evaluation methodologies and techniques which considers cash flow and time value of money are most important for economic analysis of project. Decision makers must have sound knowledge of the discussed methodologies and techniques. The review study strongly suggest that when some alternatives appear to be very close with each other, then the decision-maker needs to be very cautious. An apparent remedy is to try to consider additional decision criteria which, hopefully, can assist in drastically discriminating among the alternatives. Both subjective and objective aspects of project evaluation is necessary because of increasing complexity projects due to uncertainty, ambiguity and different known and unknown risks. The review will motivate to develop new methods of project evaluation and to improve old methods. Although the search for finding the best new method may never end, research in this area of decision-making method is still critical and very valuable in many scientific and engineering applications.

References

| [1] | Adhikari, D. (2012). Principles of Engineering Economic Analysis. kathmandu: Acme Global Publication pvt. ltd. |

| [2] | Andros, S., Akimov, O., Akimova, L., Chang, S., & Gupta, S. K. (2021). SCENARIO ANALYSIS OF THE EXPECTED INTEGRAL ECONOMIC EFFECT FROM AN INNOVATIVE PROJECT. Marketing and Management of Innovations. |

| [3] | Ayyub, B. M. (2003). Risk Analysis in Engineering and Economics. USA: CHAPMAN & HALL/CRC. |

| [4] | Brown, T. (2007). Engineering Economics and Economic design for process Engineer. Taylor & Francis Group. |

| [5] | Couper, J. R. (2003). Process Engineering Economics. Marcel Dekker, Inc. |

| [6] | Decsion Tree Model. (2023, January 1). THE ECONOMIC TIMES. |

| [7] | Hasugian, I. A., Dewi, E., & Vandrick. (2020). Engineering Economics Evaluation For Manufacturing Competitiveness: A case study. Materials Science and Engineering. |

| [8] | ILO. (n.d.). Technical Cooperation Manual-Version 1. ILO. |

| [9] | Leu, S.-S., & Ying, T.-M. (2020). Replacement and Maintenance Decision Analysis for Hydraulic Machinery Facilities at Reservoirs under Imperfect Maintenance. energies. |

| [10] | MÁRIA ILLÉS, P. (2020). The Positive Net Present Value of Loss-making Projects. Club of Economics in Miskolc. |

| [11] | Mishra, S. (2010). Engineering Economics and Costing. New Delhi: PHI Learning Pvt. Ltd. |

| [12] | Omid, H., Guzman, & Gustavo. (2019). Understanding project evaluation - a review and. International Journal of Managing Projects in Business. |

| [13] | Organisation, I. L. (n.d.). Technical Cooperation Manual-Version 1. International Labor Organisation. |

| [14] | Soliyev, I. I., & Nurmatov, I. I. (May 30, 2021). Nature And Methods Of Financial And Economic Evaluation Of Investment Projects. The American Journal of Interdisciplinary Innovations and Research, 59-64. |

| [15] | Sullivan, W. G., Wicks, E. M., & Koelling, C. (2009). Engineering Economy. Pearson Education Inc. |

| [16] | Thapa, K. (2010). Engineering Economics. Kathmandu: Acme Engineering College. |

| [17] | Ulukan, Z., & Ucuncuoglu, C. (2010). ECONOMIC ANALYSES FOR THE EVALUATION OF IS PROJECTS. Journal of Information Systems and Technology Management, 233-260. |

| [18] | Wu, Y. (2021). Application and Research of Engineering Economic Evaluation Based on Multi-objective Intelligent Grey Target Decision System. Academic Journal of Business & Management. |

V. Internal rate of return (IRR)Internal rate of return (IRR) is a discount rate that makes the Net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. (Ayyub, 2003). The internal rate of return is the rate at which the present value of cash inflows is equal to the present value of cash outflows (Soliyev & Nurmatov, May 30, 2021). This method can be usefully applied in situations with even as well as uneven cash flow at different periods of time. This method considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability. The determination of cost of capital is not a pre- requisite for the use of this method and hence it is better than net present value (NPV) where cost of capital cannot be determined easily. This method provides for uniform ranking of various proposals due to the percentage rate of return. But this method is based upon the assumptions that the earrings are reinvented at the interest rate of return for remaining life of the project which is not justified assumptions particularly when the average rate of return earned by the firm's is not close to the internal rate of return. In this sense, NPV method seems to be better as it assumes that the earrings are reinvented at the rate of firm's cost of capital. The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows. It is believed that in order to provide a loan for a project, its IRR must exceed the lending interest rate (Andros, Akimov, Akimova, Chang, & Gupta, 2021). If IRR > MARR, the project should be accepted, otherwise rejected. When the algebraic sum of the cash flow changes more than one in series, it is possible to obtain multiple rate of return. In such a situation, PW criteria can be used to make decisions. IRR method also does not consider the scale of investment. Therefore, it can be misleading when choosing between mutually exclusive projects than have substantially different outlays.

V. Internal rate of return (IRR)Internal rate of return (IRR) is a discount rate that makes the Net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. (Ayyub, 2003). The internal rate of return is the rate at which the present value of cash inflows is equal to the present value of cash outflows (Soliyev & Nurmatov, May 30, 2021). This method can be usefully applied in situations with even as well as uneven cash flow at different periods of time. This method considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability. The determination of cost of capital is not a pre- requisite for the use of this method and hence it is better than net present value (NPV) where cost of capital cannot be determined easily. This method provides for uniform ranking of various proposals due to the percentage rate of return. But this method is based upon the assumptions that the earrings are reinvented at the interest rate of return for remaining life of the project which is not justified assumptions particularly when the average rate of return earned by the firm's is not close to the internal rate of return. In this sense, NPV method seems to be better as it assumes that the earrings are reinvented at the rate of firm's cost of capital. The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows. It is believed that in order to provide a loan for a project, its IRR must exceed the lending interest rate (Andros, Akimov, Akimova, Chang, & Gupta, 2021). If IRR > MARR, the project should be accepted, otherwise rejected. When the algebraic sum of the cash flow changes more than one in series, it is possible to obtain multiple rate of return. In such a situation, PW criteria can be used to make decisions. IRR method also does not consider the scale of investment. Therefore, it can be misleading when choosing between mutually exclusive projects than have substantially different outlays. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML