-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2023; 12(1): 1-15

doi:10.5923/j.ijcem.20231201.01

Received: Dec. 17, 2022; Accepted: Dec. 29, 2022; Published: Jan. 31, 2023

Capturing the Latent Structure of the Financial Criteria of the Big-Sized Contracting Enterprises Failure

Ahmed Yousry Akal

Civil Engineering Department, Higher Institute of Engineering and Technology, Kafrelsheikh, Kafrelsheikh City, Egypt

Correspondence to: Ahmed Yousry Akal, Civil Engineering Department, Higher Institute of Engineering and Technology, Kafrelsheikh, Kafrelsheikh City, Egypt.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study sets out to recognize the latent structure of the dimensions behind the financial criteria causing the failure of the big-sized contracting enterprises (B-SCEs). This scope is associated with the developing countries because their unfavorable economic circumstances exacerbate the repercussions of the financial criteria on the stability of their construction companies. Through a questionnaire of 18 financial criteria, linguistic responses from 56 experts of the B-SCEs in Egypt have been collected. Then, Fuzzy Trapezoidal Membership Function and the Failure Criterion Relevance Index have been used for converting the gathered replies into crisp numbers and raking the criteria, respectively. The findings demonstrate that “cash flow mismanagement”, “poor estimating practice”, “national economy recession”, “delayed progress payments from the client”, and “hike in the building materials prices” are the top-five financial criteria of the B-SCEs failure. The further Exploratory Factor Analysis unravel six latent dimensions of the studied financial criteria, comprising “difficulty in collecting the financial dues”, “unsupportive laws and policies of the construction market”, “poor planning and control of capital and cash flow, “government taxes”, “overhead burden”, and “excessive expansion”. The research also determines the percentage of effect of each of these dimensions on the B-SCEs failure. Additionally, it specifies the causative factor(s) and the responsible stakeholder for causing each financial dimension. Ultimately, significant practical recommendations have been presented to define the efforts needed to limit the incidence of the causal factor(s) of each financial dimension. The outcomes introduce implications for stemming the B-SCEs failure for keeping the role of the construction industry in the developing nations towards their economies.

Keywords: Failure, Construction, Big-sized contracting enterprises, Fuzzy theory, Exploratory factor analysis

Cite this paper: Ahmed Yousry Akal, Capturing the Latent Structure of the Financial Criteria of the Big-Sized Contracting Enterprises Failure, International Journal of Construction Engineering and Management , Vol. 12 No. 1, 2023, pp. 1-15. doi: 10.5923/j.ijcem.20231201.01.

Article Outline

1. Introduction

- The construction sector is a project-based sector, which depends significantly on the contributions of its contracting enterprises for executing its projects [1]. Meanwhile, the roles of the construction companies are perceived in any community as important bedrocks for achieving its economic, commercial, and social development plans. Economically, the construction industry through its contracting firms drives the economic activities of the communities by implementing their industrial and mining projects [2]. Commercially, on the other hand, because of the construction enterprises work with various parties such as manufacturers and suppliers [1], it revives the trading in the domestic sectors of the countries. Socially, on the other side, the contracting firms afford the role of executing the community service projects in the housing, educational, and health sectors [2]. More usefully, since the construction industry is a labor-intensive sector [3], it assists in solving the unemployment problem by providing hundreds of thousands of jobs annually. Notably, these priceless contributions have been noticed to be at risk of not being realized due to the increase in the failure rate of the contracting enterprises around the globe. For instance, in Egypt, the records of the Egyptian Federation for Construction and Building Contractors showed that 24,600 construction companies have declared their bankruptcy or changed their careers from 2010 to 2014 [4]. In the same vein, in 2021, the construction news in the UK declared that there are 40,000 national contracting enterprises at risk of insolvency, putting their construction sector in a critical situation [5].Unfortunately, the aforesaid numbers of the failed construction companies have been exacerbated in conjunction with an increase in the failure-based literature of the contracting enterprises. So why have several researches on the contracting firms’ failure, but they did not assist in limiting this issue? The answer to this question includes the next reasons. • First, the failure analysts in the construction industry (e.g., [6,7]) reported that although there are many classifications of the failure criteria of the construction enterprises, the factors of the financial nature are the prime culprit of exposing the firms to failure. Disappointingly, this critical result has not received a broad response from the academics to present a comprehensive list of the pertinent financial criteria of the construction firms’ failure, except Halim et al. [8] and El-Kholy and Akal [9]. However, neither Halim et al. [8] nor El-Kholy and Akal [9] have touched on uncovering the latent factors behind arising the financial criteria they identified. Certainly, this lack of interest constitutes huge knowledge gaps for recognizing: (1) the structure of the underlying financial dimensions of the contracting firms’ failure, (2) the parties associated with their incidence, and (3) the corrective actions that should be taken by the responsible parties toward the dimensions they cause. • Second, in general, there is a dearth in the failure studies of the big-sized contracting enterprises (B-SCEs). Correspondingly, the small-sized contracting enterprises (S-SCEs) have the greatest attention. This tendency of the failure analysts may stem from the information that the B-SCEs have more managerial and financial resources than the S-SCEs; accordingly, their probability of failure is too small. Hence, the S-SCEs should receive more concern. This standpoint runs counter to two facts: (1) the failure hits even the well-established B-SCEs [10,11] and (2) the B-SCEs are severely influenced by the criteria of the financial nature than the S-SCEs [12]. Regrettably, ignoring these facts informs that the research directions of the failure literature do not consider, reflect, and analyze the actual cases of the failure of all the construction companies. Therefore, the current scholarly-based knowledge of the failure can not sufficiently limit the increase in the failure rate of the contracting firms.The aforementioned gaps confirm that it is difficult to stem the failure in the construction community without doing more researches on the financial criteria in general focusing on the B-SCEs in specific. With this in mind, the author of this paper seeks to capture the latent structure of the dimensions behind the financial criteria leading to the B-SCEs failure. By profoundly analyzing and discussing this objective, this research contributes to enrich the knowledge of the construction industry stakeholders with: (1) the ranking of the financial criteria in terms of their relevance for dragging the B-SCEs to failure, (2) the underlying conception of the financial dimensions of the B-SCEs failure, (3) the percentage of effect of each financial dimension on the B-SCEs failure, (4) the potential causative factor of each financial dimension, (5) the responsibility and contribution percentage of each stakeholder toward each financial dimension, and (6) the role of each stakeholder in addressing the consequences of the dimension it caused. Achieving these findings constitutes a pioneering work to recognize the latent mechanism of the B-SCEs failure owing to the criteria of the financial nature and the efforts needed to limit their incidence. To this end, this paper surveys 56 experienced practitioners from 14 B-SCEs in Egypt to collect linguistic data on the relevance of 18 financial criteria. Subsequently, it uses Fuzzy Trapezoidal Membership Function to convert the gathered linguistic data into crisp numbers. Then, it utilizes the Failure Criterion Relevance Index and the Exploratory Factor Analysis for ranking the relevance and structuring the latent dimensions of the studied criteria, respectively. Exploring the case of Egypt as a developing economy setting for this study stems from the information that, unlike the developed construction markets, the developing ones experience severe persistent managerial, financial, and economic challenges such as: (1) poor project planning and management skills, (2) difficulty in getting loans, (3) fluctuations in material price, (4) changes in the interest and taxes rates, and (5) inflation [2,13-15]. These challenges, in turn, limit the ability of any construction company to encounter the failure, regardless of its managerial and financial capabilities. Consequently, studying the case of Egypt reveals the real challenges of the failure of the construction enterprises, making the study findings more objective, either for Egypt or the developing countries which have the same attributes and challenges. The remainder of this research surveys, in section 2, the relevant literature of the contracting enterprises’ failure. Then, section 3 outlines the methodology and presents the findings. Section 4 analyzes and discusses the outputs and shows their implications. Finally, section 5 sums up the paper and considers future work based on clarifying the limitations of this study.

2. Literature Review

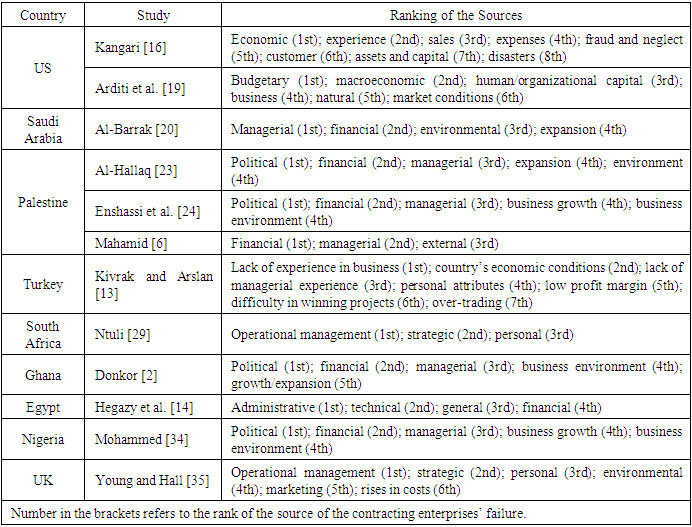

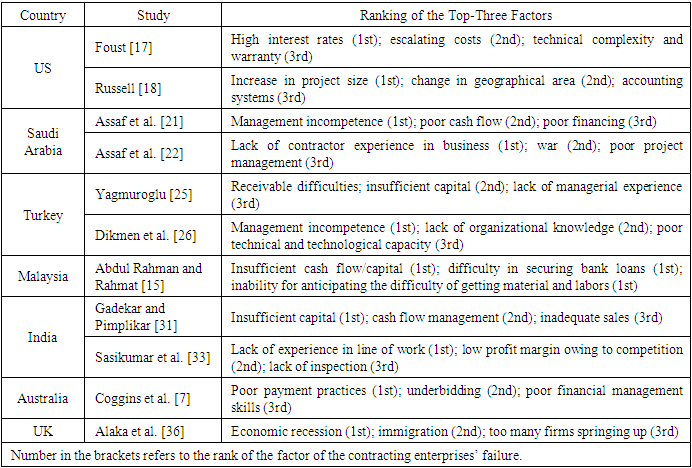

- Generally, considerable efforts have been exerted to define the pertinent sources and causes of the contracting enterprises’ failure. These contributions have explored the cases of the US [16-19]; Saudi Arabia [20-22]; Palestine [6,23,24]; Turkey [13,25,26]; South Africa [27-30]; Malaysia [15]; Ghana [2]; India [31-33]; Egypt [14]; Australia [7]; Nigeria [34]; the UK [35,36]; and Rwanda [37,38]. The scopes of these studies have been concentrated on three contexts: (1) the socio-economic environment of the construction community with a major focus on the developing countries (e.g., [14]) and minor attention regarding the developed ones (e.g., [17]); (2) the size/grade of the contracting enterprise, mainly the small- and medium-sized construction companies (e.g., [2]) and very little concerning the big-sized enterprises (e.g., [24]); and (3) the specialization field of the contracting firm, encompassing the industrial [22], residential [32], building and housing [7,13], and road and bridge [38] contractors. In accordance with these contexts, the failure factors of the construction companies have been identified relying upon: (1) examining archived documentation of bankrupt companies (e.g., [35]); (2) surveying the contracting enterprises’ failure-related literature (e.g., [6]); and (3) interviewing owners/employees of insolvent construction firms [36]. Based on the data derived from these methods, the scholars have been enabled to determine the key sources of the failure of the construction companies along with their relevant causes. Importantly, this information, in turn, has geared the researchers to address two significant research directions, including specifying the degrees of impacts of the identified sources and factors on the contracting firms’ failure for knowing the topmost affecting sources and causes. Notably, the aforesaid research directions have been realized by: (1) studying statistics and reports on the bankruptcies of the construction companies (e.g., [16]) and (2) interviewing and surveying the construction industry practitioners (e.g., [22]). Further, the information collected from these statistics, interviews, and surveys have been analyzed, using: (1) the traditional analysis methods of the Severity Index (e.g., [20]), Mean Score (MS) (e.g., [23]), and Relative Importance Index (RII) (e.g., [21]) and (2) the advanced techniques of the Analytical Network Process [26] and the Exploratory Factor Analysis [36]. Table 1 illustrates the findings of the first research direction, indicating that the financial nature-related groups such as economic [16] and budgetary [19] and the financial set (e.g., [2]) are usually the chief sources of the contracting enterprises’ failure in most of the explored studies. Similarly, the results of the second research direction (see Table 2) imply that in the majority of the investigated cases at least one of the top-three causes of the contracting firms’ failure is a financial factor. Building on these severe outcomes, another research group has directed their endeavors to deeply scrutinize the failure of the construction companies owing to the factors of the financial nature.

|

|

3. Research Methodology

- To prudently realize the research scope, a multistep research methodology of seven steps has been developed. It includes defining the financial criteria, developing and distributing an online survey to assemble linguistic data from the Egyptian experts on the relevance of the financial criteria, and checking the adequacy and consistency of the survey responses. Additionally, it illustrates how the experts’ replies have been analyzed on the basis of: (1) Fuzzy Trapezoidal Membership Function (FTMF) to convert the collected linguistic data into concrete numbers, (2) the Failure Criterion Relevance Index (FCRI) to rank the criteria in terms of their relevance, and (3) the Exploratory Factor Analysis (EFA) to uncover the underlying dimensions of the studied financial criteria. The next subsections will clearly demonstrate these steps along with their outcomes.

3.1. Defining the Financial Criteria of Contracting Enterprises Failure

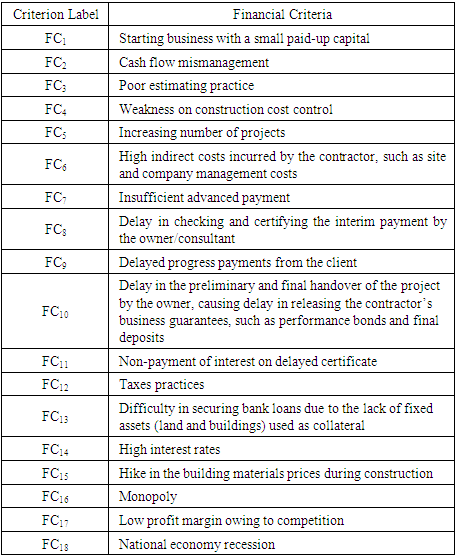

- Recently, El-Kholy and Akal [9] have identified 18 financial criteria pertaining to the failure of the B-SCEs in Egypt. Fifteen of these criteria have been determined depending on an extensive examination of papers published in peer-reviewed academic journals and dissertations. Yet, three criteria have been added during interviewing 8 Egyptian experts to recognize their standpoints regarding the suitability of the criteria identified from the conducted review with respect to Egypt’s construction sector. These 18 criteria appear in Table 3. Further, they will be deemed in this research because, first, they have been defined according to a comprehensive study of the pertinent literature. Second, they have been refined by experts experienced in the Egyptian construction community, which is the context of the current work.

|

3.2. Survey Development and Distribution

- In this study, the target population is the Egyptian B-SCEs, mainly the first-grade contracting enterprises. Relying upon the Egyptian Federation for Construction and Building Contractors (EFCBC), which has the authority to classify the contractors in Egypt, a firm can be graded as a first-grade construction company if its capital and expertise are not less than L.E 20 million and 15 years, respectively. These firms have been selected to represent the population of the present work because their experts are sufficiently familiar with nature of the Egyptian construction community and the challenges faced by their companies [9]. To survey the experts of these enterprises, the validated questionnaire of El-Kholy and Akal [9] has been utilized. The questionnaire has three sections. Section one comprises an introduction to describe the purpose of the survey. Section two encompasses questions related to the background information of the participant and his/her construction company. Finally, section three provides the expert with a linguistic scale of five terms, comprising 1 = not-relevant, 2 = somewhat-relevant, 3 = relevant, 4 = very-relevant, and 5 = extremely-relevant to define the relevance of each financial criterion regarding the failure of the B-SCEs. Subsequently, an online survey has been developed, using Google Form to engage the experts in the survey. To distribute the questionnaire, the non probability-based purposive and snowball sampling techniques have been used. Considering the non probability-based purposive strategy is owing to the author’s inability to get from the EFCBC the current number of the first-grade contracting firms and their contacting addresses to randomly involve them in the survey. Yet, utilizing the non probability-based snowball technique is to gather a large number of the responses in a fast pace and economic manner [43]. On the basis of these sampling strategies, the author has sent the questionnaire link to his engineer colleagues and friends who: (a) owning a bachelor’s degree in engineering, (b) experienced in the Egyptian contracting sector, and (c) his/her company has considerable contributions as a first-grade contracting firm in Egypt’s construction market throughout the last three years. Moreover, the author has asked his colleagues and friends to further send the questionnaire link to their colleagues and friends. Depending on these approaches, 77 questionnaires have been collected from 11 May to 3 June 2022. Of the received questionnaires, 21 have been neglected because the background information of the participants and their companies do not meet the aforementioned criteria. Yet, the other 56 usable questionnaires have been included in the analysis of the current study. By checking the usable questionnaires, it has been turned out that the experts represent 14 first-grade contracting firms. Their firms have considerable contributions for more than 25 years in Egypt’s construction market as prime contractors responsible for executing countless mega national projects, such as highways, bridges, water and sewage plants, power plants, and gas and oil treatment plants. Further, the business size of each company over the last three years is more than L.E 200 million. Indeed, these characteristics denote that the engineers of these firms have the knowledge required to answer the questions of the survey. This clearly appears in the experts’ profiles. While 42 experts have experience up to 10 years in Egypt’s construction sector, the other 14 ones are with expertise ranging from 11 to 25 years. As for their job titles, 49 of the experts have engineering positions, comprising: 22 executive engineers, 15 technical office engineers, 10 quality control engineers, 1 planning engineer, and 1 design engineer. Yet, the other 7 ones have management positions, encompassing: 4 project managers, 1 technical office manager, 1 general safety manager, and 1 sector manager. Essentially, such broad experiences and job titles signify that the assembled data exemplify perspectives of engineers and managers having hands-on working expertise in the Egyptian contracting sector and its first-grade construction companies which can be relied upon for fulfilling further analysis.

3.3. Survey Responses Adequacy

- Prior to analyzing the replies of the experts, their sample size has been empirically and statistically tested to verify its adequacy to represent the first-grade contracting enterprises in Egypt and its number is appropriate to carry out the EFA. Empirically, several works have been achieved, either nationally in Egypt or internationally in leading construction markets such as the US, using small sample sizes, including 37 experts [44] and 48 experts [45], respectively. In the same vein, the EFA has been utilized by many academics in the construction management researches based on small sample sizes of 43 experts [46] and 45 experts [47]. This information, in turn, proves that the assembled sample size (i.e., 56 questionnaires) is empirically adequate to be considered and the EFA can be performed on its basis. Statistically, on the other hand, Abdul Nabi and El-adaway [45] calculated the minimum needed sample size to assure the representation of a survey-based data, utilizing the frequently used sampling formula of Cochran [48]. The finding showed that the minimum norm of a sample size should be equal to or greater than 43. Additionally, as stated by Mundfrom et al. [49], to fulfill the EFA on a statistical basis, the satisfactory sample size must be three times the number associated with the variables of the study. Ultimately, such standard statistical norms demonstrate that the realized sample is statistically valid to represent the first-grade Egyptian contracting enterprises and apply the EFA. This is owing to its size (i.e., 56 questionnaires) exceeds the minimum required proportion of Cochran [48] along with a sample-to-variables ratio of 3.11 (56 questionnaires ÷ 18 financial criteria), satisfying the acceptance ratio of Mundfrom et al. [49].

3.4. Survey Responses Consistency

- To further examine the reliability of the survey, the author has utilized the test of Cronbach’s alpha. This test has a numerical scale and it ranges from 0 to +1. On this scale, values above 0.7 are deemed acceptable; however, scores above 0.80 are preferable [50]. By using the SPSS version 16.0, Cronbach’s alpha has been determined and the result designates that its value is 0.851, depicting high reliability and internal consistency of the compiled data.

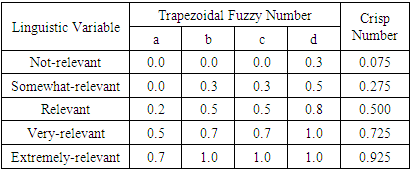

3.5. Fuzzy Trapezoidal Membership Function

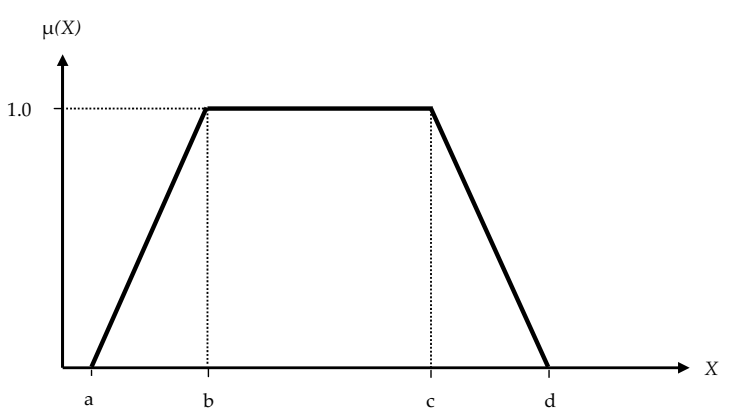

- After checking the adequacy and consistency of the survey, the linguistic evaluations of the entrants have been defuzzified into concrete numbers relying upon Fuzzy Trapezoidal Membership Function (FTMF). Generally speaking, Fuzzy Set Theory (FST) plays an important role in enhancing the accuracy of the expected findings by allowing the researchers to investigate the standpoints of the respondents on a linguistic basis as they prefer. Then, through its membership functions, it converts the experts’ linguistic assessments into crisp numbers for being numerically analyzed. Hence, it provides a reliable tool for measuring the vagueness existed in the natural language for being represented meaningfully [51]. Owing to these valuable advantages, FST has been widely used in the construction management branches, such as public-private partnership (e.g., [52]) and safety (e.g., [51]). In the same vein, its popular and simple TMF has been adopted in this study to convert the participants’ linguistic evaluations into crisp data outputs for being employed as inputs for developing the FCRI and the EFA in the coming sections. The processes followed to achieve this purpose according to Gunduz et al. [51] and literature therein are: 1) Determining the Trapezoidal Fuzzy Number (TFN) of each linguistic variable (LV). In this research, five linguistic terms, including not-relevant, somewhat-relevant, relevant, very-relevant, and extremely-relevant have been adopted to evaluate the relevance of each financial criterion. Figure 1 explains the TFN of each LV, implying that each LV is parameterized by four numbers (a, b, c, d). In addition, Table 4 demonstrates the TFN of each LV.2) Defuzzifying the TFN of each LV to define its concrete number. Equation (1) exemplifies how the Crisp Number (CN) of the TFN can be computed. Moreover, the last column of Table 4 includes the CNs of the TFNs of the utilized LVs. These CNs are the main inputs of the analysis of the FCRI and the EFA.

| (1) |

| Figure 1. Fuzzy trapezoidal membership function |

|

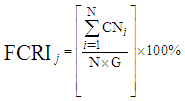

3.6. Failure Criterion Relevance Index and Rating

- To reflect the experts’ perspectives concerning the relevance of the financial criteria, the Failure Criterion Relevance Index (FCRI) of Equation (2) has been relied upon. This index computes the relevance of each financial criterion with respect to the failure of the B-SCEs, where the higher the FCRI of a financial criterion is, the higher the relevance it has towards to failure of the B-SCEs and vice versa. Previously, Alaka et al. [36] adopted such index to rank the insolvency factors of the S-SCEs. However, the inputs of their index have been associated with a five-grade Likert scale, not a linguistic appraisal scale. To address this remark, the index of Alaka et al. [36] has been modified, utilizing the CNs of Table 4 instead of their five-point Likert scale. Equation (2) presents this modification and the independent data of the FCRI.

| (2) |

|

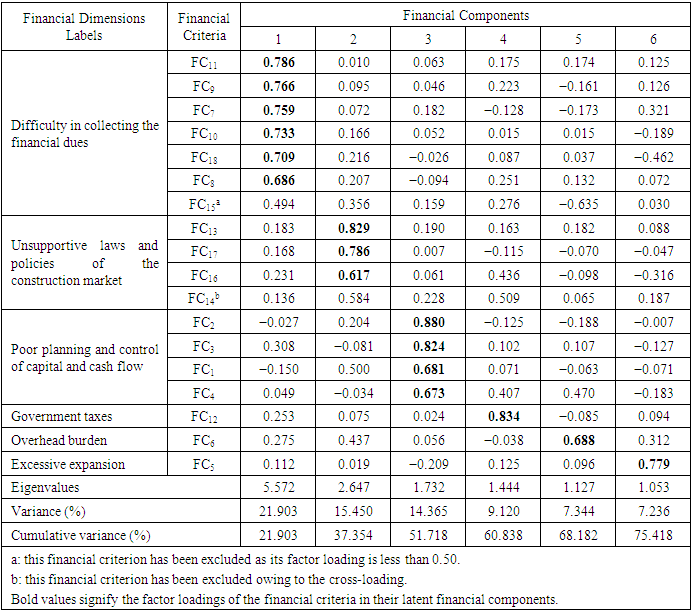

3.7. Exploratory Factor Analysis

- Relying upon the outputs of the TMF, an Exploratory Factor Analysis (EFA) has been conducted, employing the SPSS version 16.0, to capture the latent structure of the dimensions behind the 18 financial criteria of the B-SCEs failure. Appreciating this end, the EFA has been performed following a sound scientific basis as has been found in Alaka et al. [36], Ye et al. [53], Ozorhon and Karahan [54], and Ma et al. [55]. As a result, the Kaiser-Meyer-Olkin (KMO) adequacy test together with the Barlett’s test of sphericity has been applied to firstly check the fitness of the compiled data to apply the EFA. Thereafter, the Principal Component Analysis (PCA) and Varimax have been utilized as techniques of factor extraction and rotation, respectively [36]. As has been extracted from the SPPS, the KMO and the significance of Barlett’s test are 0.679 and 0.000 with χ(153) = 502.438, respectively. These outcomes imply that given the KMO is more than 0.60 and the significance of Barlett’s test is less than 0.05, the data set is acceptable for the EFA [50]. On the basis of these positive results, the rotated component matrix has been generated (see Table 6), utilizing the PCA and Varimax for extracting and rotating the financial criteria, respectively.

|

4. Analysis and Discussion

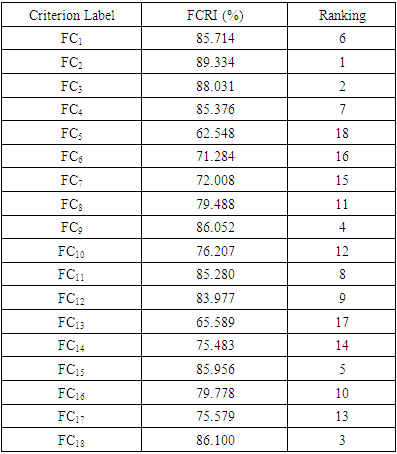

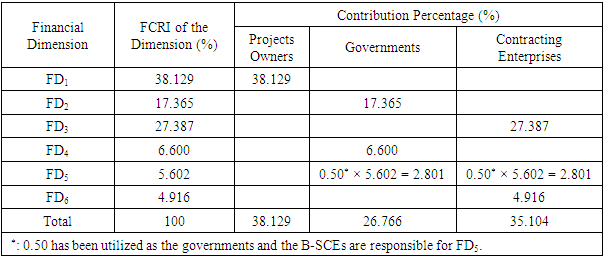

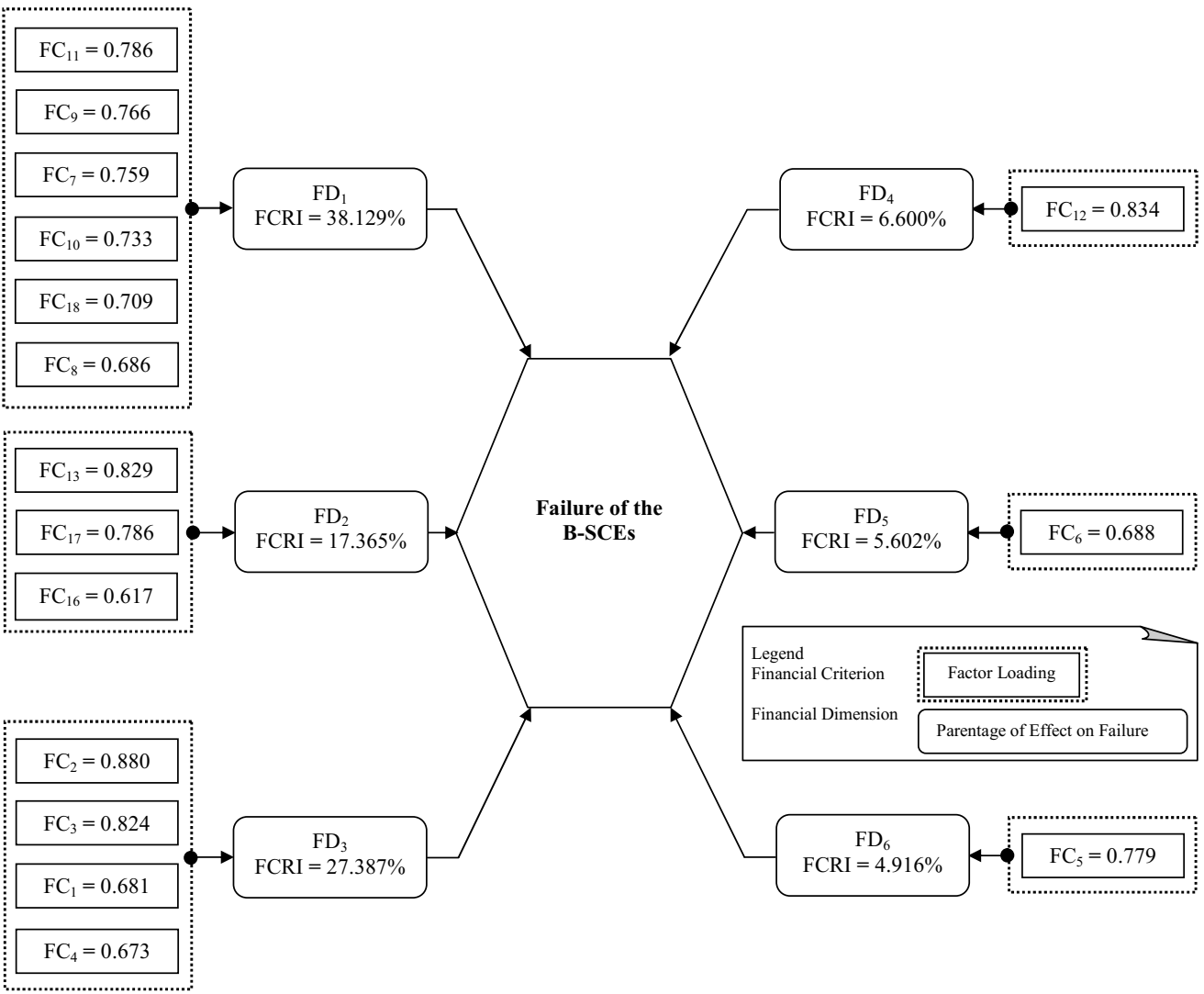

- Failure of the contracting enterprises, particularly the B-SCEs has become a main article in the construction news. The construction industry researchers, additionally, have specified the criteria of the financial nature to be the major component of this issue. However, neither the key components of these criteria nor their encompassed factors have been captured yet. This study, therefore, has scrutinized 18 financial criteria in four steps: (1) questionnaire survey: to collect linguistic data on the relevance of 18 financial criteria; (2) FTMF: to convert the gathered data into crisp numbers; (3) FCRI: to determine the relevance of each financial criterion concerning the failure of the B-SCEs; and (4) EFA: to reveal the latent dimensions of the financial criteria and their related factors. These methodological steps constitute a strong foundation for discussing the failure of the B-SCEs in other contexts because they have been cited in several researches worldwide. Tables 5 and 6 present the findings of these steps. According to Table 5, each financial criterion has its FCRI and ranking, indicating that “FC2: cash flow mismanagement” (FCRI = 89.334%), “FC3: poor estimating practice” (FCRI = 88.031%), “FC18: national economy recession” (FCRI = 86.100%), “FC9: delayed progress payments from the client” (FCRI = 86.052%), and “FC15: hike in the building materials prices” (FCRI = 85.956%) are the top-five financial criteria of the B-SCEs failure. This output adds a crucial implication to the knowledge body: the contractors, projects owners, and governments are together responsible for the failure of the B-SCEs. Importantly, it highlights the weaknesses in their systems for being addressed to control the most relevant financial criteria of the B-SCEs failure. These weaknesses are associated with: (1) the contractors when they poorly estimate and manage their cash flows; (2) the projects owners in terms of their delay in freeing the contractors’ receivables; and (3) the governments in terms of the slump of their economies and their ineffective policies for controlling the fluctuations in the building materials prices. Away from the results of Table 5, Table 6 demonstrates the latent financial dimensions of the B-SCEs failure. To the best of the researchers’ knowledge, such finding has not been reached before, illustrating the valuable contribution of this paper towards the scholarly-based account of the B-SCEs failure. As shown in Table 6, the failure of the B-SCEs results from six underlying financial dimensions along with sixteen influencing criteria. These dimensions are: “FD1: difficulty in collecting the financial dues”, “FD2: unsupportive laws and policies of the construction market”, “FD3: poor planning and control of capital and cash flow”, “FD4: government taxes”, “FD5: overhead burden”, and “FD6: excessive expansion”. To get more knowledge about these dimensions in terms of the proportion of effect of each dimension on the B-SCEs failure, Figure 2 has been developed. This figure, through its dotted rectangles, elucidates the criteria of each financial dimension in a descending order of their factor loadings as has been drawn from the EFA. Then, its rounded rectangles define for each financial dimension its percentage of consequence on the B-SCEs failure. This has been determined by aggregating the FCRI of the criteria of each financial dimension and divides their sum by the total of the FCRI of all the criteria of Figure 2. Following these calculations, the ranking of the financial dimensions (from the highest to the lowest relevant) is: FD1 (FCRI = 38.129%), FD3 (FCRI = 27.387%), FD2 (FCRI = 17.365%), FD4 (FCRI = 6.600%), FD5 (FCRI = 5.602%), and FD6 (FCRI = 4.916%).

| Figure 2. Percentage of effect of each financial dimension on the failure of the B-SCEs |

|

5. Conclusions

- Focusing on the developing countries’ socio-economic environment, this research provides the knowledge body with the latent structure of the financial criteria of the B-SCEs failure. Targeting these contexts stems from the fact that the B-SCEs are severely influenced by the criteria of the financial nature than the S-SCEs, particularly under the unfavorable circumstances of the developing markets. Using Egypt as a developing country, linguistic data on the relevance of 18 financial criteria have been collected from 56 experts of 14 B-SCEs. Subsequently, FTMF and the EFA have been utilized to convert the linguist data into crisp numbers and establish the underlying structure of the financial criteria of the B-SCEs failure, respectively. The EFA pinpoints six dimensions of these criteria, comprising “difficulty in collecting the financial dues”, “unsupportive laws and policies of the construction market”, “poor planning and control of capital and cash flow”, “government taxes”, “overhead burden”, and “excessive expansion”. The study further determines the percentage of effect of each of these six dimensions on the B-SCEs failure. Moreover, it discusses the potential causative factor(s) and the responsible party for causing each financial dimension. Relatedly, the projects owners, B-SCEs, and governments have been defined to be the three culprits of dragging the B-SCEs to failure, where the projects owners afford 38.129% of the B-SCEs failure. Yet, the B-SCEs and governments are responsible for 35.104% and 26.766% of the B-SCEs failure, respectively. To move forward to limit the causal factor(s) of each financial dimension, several practical recommendations have been directed to each responsible stakeholder. These findings of this paper frame a pioneering work to stem the failure in the construction community because they grasp the latent mechanism of the financial criteria of the B-SCEs failure and the efforts needed to curb their incidence. Despite the significance of this work, the following limitations have to be addressed. First, the dimensions of the financial criteria of the B-SCEs failure have been established, using a sample of not very large size by considering the context of Egypt only. Therefore, involving more practitioners and investigating other contexts than Egypt in future research streams can afford more inclusive and generic latent perception of the financial criteria of the B-SCEs failure. Second, relying upon the author’s analysis only for the criteria of the financial dimensions, the responsible parties have been specified. This limitation underlines another future research direction, including surveying the financial dimensions and criteria of the B-SCEs failure among the construction practitioners to determine their involved liable parties to ensure the reliability of the obtained results.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML