-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2022; 11(1): 8-20

doi:10.5923/j.ijcem.20221101.02

Received: Jan. 26, 2022; Accepted: Feb. 22, 2022; Published: Mar. 15, 2022

Opportunities and Challenges of Cryptocurrency as an Alternative Payment Option: Indian Construction Industry Perspective

Basavaraj Chandrashekar Reddy 1, Dr. Rajiv Tyagi 2

1Project Assistant, MACE Group, Gurgaon, India

2Senior Human Resource Manager, MACE Group, Gurgaon, India

Correspondence to: Basavaraj Chandrashekar Reddy , Project Assistant, MACE Group, Gurgaon, India.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Forecasting or exploring the alternative options in any industry for progressively improving previous practice, to be unique, to realistically achieve tangible benefits will certainly help to be better in the key industry. Alternative options convenient and emerging in the industry has some pros and cons, having some background research on it and exploring can benefit the industry to move forward. Payment practices in the construction industry have witnessed a drastic change from bartering/cash to the bank transfer system. The trend of cryptocurrency usage in the market has emerged a few years back, and its considerable expansion in the other markets has been witnessed and heard globally. This empirical study is carried out to carefully explore the opportunities and challenges of cryptocurrency as an alternative payment option: Indian construction perspective. The study consists of a literature review to find the research gap, basic discussion on the cryptocurrency with a brief case study from the informative articles published, the questionnaire survey was floated among the construction industry professionals to get their insights on the topic stated such as current payment practices in the construction industry, awareness, the construction industry-related challenges and opportunities are covered concerning cryptocurrency as an alternative payment option. This study will be valuable for learning graduates, construction professionals looking for alternative payment options, blockchain technology adoption, challenges, and opportunities of cryptocurrency.

Keywords: Cryptocurrency, Construction Project, Blockchain

Cite this paper: Basavaraj Chandrashekar Reddy , Dr. Rajiv Tyagi , Opportunities and Challenges of Cryptocurrency as an Alternative Payment Option: Indian Construction Industry Perspective, International Journal of Construction Engineering and Management , Vol. 11 No. 1, 2022, pp. 8-20. doi: 10.5923/j.ijcem.20221101.02.

Article Outline

1. Introduction

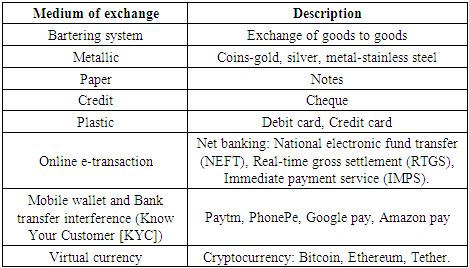

- Human history has witnessed the evolution of currency from barter to digital payments. Acquiring resources required a standard mode of transaction like “medium of exchange, measurement unit, wealth security” [1] to trade goods and services. The medium of an exchange witnessed is bartering system, metallic money, paper money, credit money, mobile payment mode, virtual currency [2].The business activity in the construction industry involves billions of transactions over a period based on the construction project timeline. The construction project deals with many stakeholders that offer goods and services to the employer to develop a unique structure during this course of time the medium of exchange deals from lakhs to billions in rupees. We have come across a common way of payment to the employee from the employer through bank transactions which might be Net banking services such as real-time gross settlement (RTGS), National electronic fund transfer (NEFT), Immediate payment service (IMPS), Cheque’s mode, cash. During the transaction, the employer/contractor faces a few issues from the bank, higher transaction fee, security, frauded transaction, a transaction failure, unethical activity, fraud records. To tackle the issue as much as possible there is an opportunity to go with the other medium of exchange called Cryptocurrency as an alternative payment option.

|

2. Literature Review

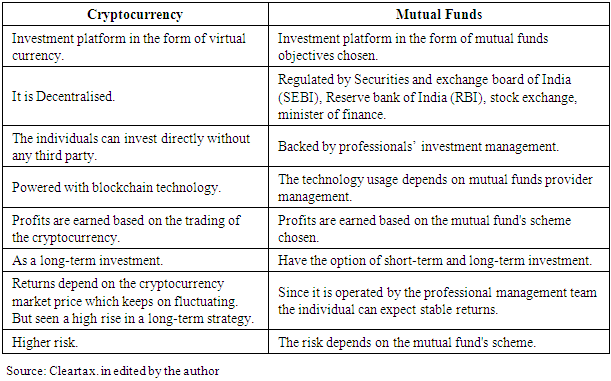

- The literature review of the paper is carried out to accomplish the objectives stated and to understand the amount of study that happened on cryptocurrency which is relevant to the study. The descriptive review method is used for the study. A total number of seven papers are reviewed. The reviews are limited to the papers approached if the number of paper reviews is increased the more aspects can be found out but for the study, we have considered seven literature papers. [5] described the cryptocurrency as a new venue for investment like gold. The paper was all about cryptocurrency in the Indian economy and educating the public through the “Digital assets and Blockchain foundation”. The paper concluded with a note stating that cryptocurrency is an opportunity for investors, great technology, and tool. Indian cryptocurrency users are growing, and there is a future hope in it. [7] explained, the cryptocurrency ‘Bitcoin’ as a reference and its challenges, opportunities in India. The research methodology of the paper is totally on secondary data references. The paper concluded with the note stating that cryptocurrency can fetch revenues, boost companies’ growth, alternative payment methods for financial transactions, opportunities to e-business.[8] explained the history of ‘Bitcoin’ and its characteristics like transaction fee, payment time, risk, decentralized and its mining information, application of bitcoin and its users in the businesses. Also explained about the blockchain technology where the banks are showing interest in it and exploring. The research methodology is based on the secondary data reference. The paper concluded with a note stating the internet era, e-platforms and new technologies emerging, the usage of digital currency as an alternative payment method can be an opportunity. [9] explained, the cryptocurrency history, threats-cybercrime, risks, unethical users, also explained about the fiat currency and banks by comparing them with cryptocurrency. The research methodology is based on secondary data. The paper concluded with a note stating bitcoin and blockchain technology has a bright future, cryptocurrency can eliminate the rate of exchange, can come up as a global currency and its education to the public users is necessary. [10] explained, the cryptocurrency history and its characteristics. The research methodology is based on secondary data with data analysed using a simple statistical tool. The paper concluded with a note stating cryptocurrency is an innovative payment, adoption of crypto is very thin from the public and acceptance criteria of cryptocurrency is a challenge. explained, the cryptocurrency market, virtual currency, and its future. The paper also discussed the laws and regulations from 21 countries regarding cryptocurrency. The research methodology used for the paper is of qualitative method which includes a questionnaire survey for collecting the data, secondary data to explain a few concepts. The paper concluded with a note stating cryptocurrency can be an attractive method of payment, the main concern about cryptocurrency is the lack of legislation, financial risk. [12] explained, the factors that resulted in unfair payment issues in the construction between main contractors and sub-contractors such as interest, transparency, competition, getting paid after the works get done, agreement, late payment, subcontractor rate. The study also showed that the main contractor accounts for 86% of unfair means of payment practices, sub-contractor accounts for 9% and 5% by clients. The research methodology used for the paper is of the combination of qualitative and quantitative analysis, sampling: stratified random, SPPS software for analysis, the study is in preceptive of UK construction industry. The paper concluded with a note stating to minimize these unfair means and suggested an alternative payment method ‘ring-fenced bank’ as a possibility that still required some validation among stakeholders. From the above literature reviews context, the research gap findings are not many studies happened about the cryptocurrency usage in the Indian construction industry perspective, most of the study is about the cryptocurrency information such as history, types, its common basic challenges, issues. But from the construction project perspective, the information is less so considering the research gap the objectives are stated and the paper is on the cryptocurrency as an alternative payment option: Indian construction industry perspective and its associated challenges and opportunities.

3. Discussion

3.1. Cryptocurrency People’s Perspective and Its Status

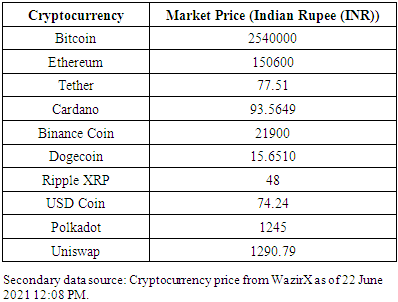

- (a) People’s thinking: ‘New normal’ is something that makes people think about the life they need to live further to cope with the conditions happening around them to achieve the work they used to do before the new normal. But the new normal has taught people to take care of health more often when they are going through their work, social life. People deal with day-to-day transactions for goods and services that they need as a resource consumption/service using the cash in hand were used more often by the public with the small vendors to large merchants, but people have witnessed some cases during the pandemic the virus can also transfer through the fiat money, so people started more involvement in e-transaction, digital wallets when compared to earlier usage. Even the government of India is on a mission of digital India. The global pandemic has created turbulence in the economy and financial products. Cryptocurrency: The new normal has created a platform for digital currency to emerge. But many people are unaware of the cryptocurrency in India however cryptocurrency is legal in India but the awareness among the public has not reached much. The computer and internet access comes in handy to the people and its usage is quite more in numbers which have created an environment for the digital currency. The people’s viewpoint on cryptocurrency as a new normal is that it is been considered as a good investment and a great way to have an asset which has created a tremendous opportunity for the people to have an investment in the cryptocurrency for example Bitcoin has seen value rise of 500% in six months and it is a most valued asset of 2020 [13].Plastic money: Debit and credit cards comes to mind when we come across plastic money. During the new normal people are much concerned about their health, when people come across the payment method, they are tending to have contactless payment where the plastic money in terms of debit/credit cards comes into the picture. Nowadays the cards are embedded with a high technological chip that can be used for wireless transactions with the merchants/vendor's payment machines. e-transactions: It has emerged as most often used by the people in the new normal condition where the online platforms are encouraging the people to use e-transactions like e-wallets, Unified payment interface (UPI), net banking, third-party payment wallets, debit/credit cards in the merchant’s checkout page. The awareness from the social media platform, service providers, merchants regarding the e-transaction and awareness from the people about the contactless payment has been a new normal way of payment practices. “The digital payment grew about 82% by volume in India in the second quarter of 2020” [13].So, the people’s thinking about digital payments like cryptocurrency, plastic money, e-transaction in the new normal has been tremendous growth and an opportunity for the economy to grow. The government of India is on a mission of ‘digital India’ which acts as a key aspect for the people to think about the future of digital currency as a new normal. (b) Awareness among the people: Most of the people in India are unaware of the cryptocurrency picture [13]. But many people have access to the high-speed internet and are aware of ‘digitalization’ which is one of the programmes by the Indian government. There are 10 million cryptocurrency users in India as per the article from ‘Business Line Forex’ [14]. Apart from these 10 million cryptocurrency users in India awareness among people is less. So, to tackle this the awareness of cryptocurrency among the people are brought up with social medial news, articles, blogs. Cryptocurrency service providers like coinswitch kubar have taken the initiative has one of their company mission to educate, empower about the cryptocurrency through a learning centre called ‘Kuberverse’ [13], through ‘Digital asset and blockchain foundation of India’ (DABFI) [15], through advertisement, infographics article are the few modes of technique and steps taken by the social media platforms to make aware of the cryptocurrency to the people. The awareness of the people gives hope for the cryptocurrency market growth [5].(c) Cryptocurrencies legitimacy in India:As of January 2021, there are more than 4000 cryptocurrency existences [16] out of them only a few are popular and good at trading volume. The supreme court of India lifted the ban on cryptocurrency trading (2018 Reserve Bank of India circular which banned cryptocurrency) on March 4, 2020, and allowed the banks to provide the service to the users for the cryptocurrency trading interference.

|

|

3.2. Cryptocurrency Case Study / Practices

- (a) Contractor: Naples Luxury Builders, Inc. Naples, Florida, USAThe ‘Naple’s luxury builders’ contractor company is accepting all kinds of cryptocurrency namely Bitcoin as mentioned by Steven Sunquist founder and the owner of ‘Naple’s luxury builders. The company is accepting all kinds of payments until there is approval from the team of ‘Naple’s luxury builders. Being the contractor company their decision towards accepting cryptocurrency: Bitcoin is paying off. Steven sunquist said that accepting cryptocurrency can increase the net worth by seeing the trend of Bitcoin emerging in its value. The company thinks about providing more payment options like cryptocurrency will lead to more buyers and can make more money. The company believes that they have invested in the cryptocurrency payment option at the right time. The cryptocurrency is new to the real estate market and its outcomes are unfamiliar [37].(b) Relator: COMPASS, Florida Hans Haedelt, realtor COMPASS, Florida said that the home buyers/ people have approached him through phone calls asking about bitcoin as payment for buying a house. Hans also said about the demand for cryptocurrency is what makes people choose the options [37].(c) Contractor: Fire & Ice, Columbus, OhioFire & Ice is the most trusted residential HVAC contractor in Columbus. The company is accepting Bitcoin for all the services related to HVAC. The services related to HVAC such as installation, repair, or any other services can be paid fully through Bitcoins. The company accepts bitcoins through the BitPAY app by QR codes payment window. After receiving the bitcoins from the customers, the company converts the bitcoins into cash because there will be fluctuation of bitcoins price. Any related refunds to the customer will be processed through cash/bank currency only not in bitcoins. The company is way forward to adopting new things like in the payment process even they adopt the future way forward in the HVAC service category also [38].(d) Professor: Tom Smythe, Economics professor at Florida Gulf Coast UniversityProfessor Smythe said cryptocurrency has lots of things to do by the person entering the bitcoin world. Bitcoin can be a top player in the cryptocurrency market over the years. The value of bitcoin can remain higher by using them in day-to-day transactions at restaurants, stores, shops [37].(e) Contractor: Cornerstone Construction, South Carolina‘Cornerstone construction’ is a roofing contractor company in South Carolina it is a subsidiary company owned by ‘SOLAR integrated roofing corporation’. The parent company partnered with ‘coinbase’ as cryptocurrency service providers for the payment process. The cornerstone construction will deal with the testing of accepting the cryptocurrency payment and they completed the financial and technical integration with ‘coinbase’. The type of cryptocurrency accepted by the company is “Bitcoin, Bitcoin Cash, DAI, Ethereum, Litecoin, USD Coin” the payment can be made for all the roofing and solar services, other goods, and services. “The company is looking forward to providing better services to the customers even in the payment scheme also and to be part of cryptocurrency economy,” said David Massey, CEO for solar integrated roofing corporation. The company has noticed more young homebuyers and alternative payment options are required. Massey said “The trial of cryptocurrency payment acceptances through ‘coinbase’ service platform where they can evaluate the cost savings such as processing fee/transaction fee, cost incurred during some fraud/mistakes when compared to the traditional method of payment. The alternative payment method cryptocurrency will add value to the company strategy to attract more customers and provide better service. If this method works out, the company can implement it in other subsidiary companies and even for the investors, shareholders” [39].(f) Construction firm: Orocco, UKOrocco is the first construction company in the UK to accept cryptocurrency payments for projects, client transactions. The company has set up the cryptocurrency payment gateway and digital wallet which accepts Bitcoin, Dogecoin, Ethereum, Stellar, and XRP for the completed projects. The company provides high-end buildings and renovation work. Mark Ivinson managing director of Orocco said, “Cryptocurrency is doing well nowadays, and he had some thought about it and wanted some payment options for the clients, customers”, the company has recognition in the UK as one of the forwarding-thinking companies. In India, there no such construction company has thought about/is in process of adoption/has some theory about the cryptocurrency payment for real estate transactions, construction projects, contractors/ client payment transactions. The reason might be the government’s opinion that is heard on a timely basis as a piece of news regarding access to cryptocurrency, even after the lift of the ban on cryptocurrency usage in India there is less clarity among some people and the firms. RBI is also working on the possibility of adopting central bank digital currency (CBDC) as an Indian rupee. So apart from this, there are few restaurants, merchants are accepting cryptocurrency, but these are heard/seen in fewer numbers.From the above real-time cases/practices/theory of adopting the cryptocurrency in their firms as part of the construction industry. The future of cryptocurrency sounds to be well forecasted, but still, the circumstance of it is unknown which might arise based on the cryptocurrency market condition.

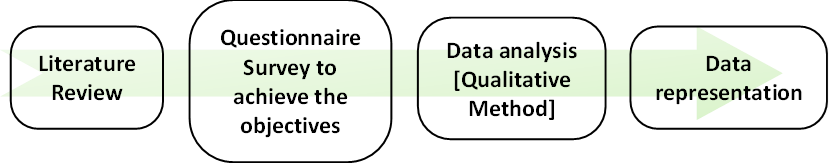

4. Methodology

- The work is carried out successively to full fill the objectives stated. Firstly, the research gap was found out through the literature review method, secondly, the discussion section consists of information detailed about the cryptocurrency. Objective one is achieved through the information written in the discussion section, which is the reference from articles, news blogs, papers about cryptocurrency. Thirdly the questionnaires were framed out from the understanding went through the literature review and discussion on cryptocurrency. The question was made into six sections. The questionnaire form was prepared in a google form to survey the construction professionals through the LinkedIn platform, telecon, text messages. The mixed method of data analysis was done i.e., qualitative, and quantitative methods. The data collected was analysed and represented in which objectives, two and three are achieved. The research methodology was carried out to fulfil the objectives and the research gap stated.

| Figure 1. Research Methodology |

5. Data Collection

- The research data collection was done through a questionnaire survey among construction professionals across India. The questionnaires were prepared in six sections namely section one respondent's info, section two construction project payment info, section three awareness info, section four cryptocurrency challenges info, section five cryptocurrency opportunities info, section six general comments, and feedback. In the questionnaire sections two and three, the questions were objective type. In the questionnaire sections four and five the questions were asked to rate on a Likert scale of 1 to 5 for the elements stated in the challenges and opportunities section. The respondents were also asked to comment as feedback on the research topic. The questionnaires were prepared simple and systematically to make the respondent easier to understand and respond to. The questionnaires were recorded into a google form to conduct the survey. The survey form was circulated among construction professionals through the LinkedIn platform, text messages. A total number of 91 respondents were reached out of which only 54 responded (51 responses were considered as valid responses) with a response rate of 56% which is good to proceed for data analysis. The data was collected from the period 28th June 2021 to 18th Sep 2021. The data collected through the google form is transferred to the excel sheet to analyse the data and represent it. The data analysed and its representation is reported in the results and discussion section.

5.1. The Respondent's Info

- The respondent's demographic is represented in a clustered bar graph as shown in Figure 2. The responses were received among junior, mid, and senior-level management. The management professionals such as Human resources manager, project managers, quantity surveyors, Associates valuation, engineers, structural engineers, technical manager valuation, chartered accountant was part of the survey. The respondents were asked to select the options for the type of organisation working for, the size of the organisation, and years of working experience. From the figure we can observe that 49% of respondents work for consultant organisations, 63% of respondents belong to large enterprises, 61% of respondents have experience of 1-5 years. Further, the data represented is as follows.

| Figure 2. Respondents Info |

6. Results and Discussion

- The details covered in this section are the data analysed and representation from the information collected through respondents to the questionnaire survey. The data was extracted through the excel sheet after validation.

6.1. Construction Project Payment Info

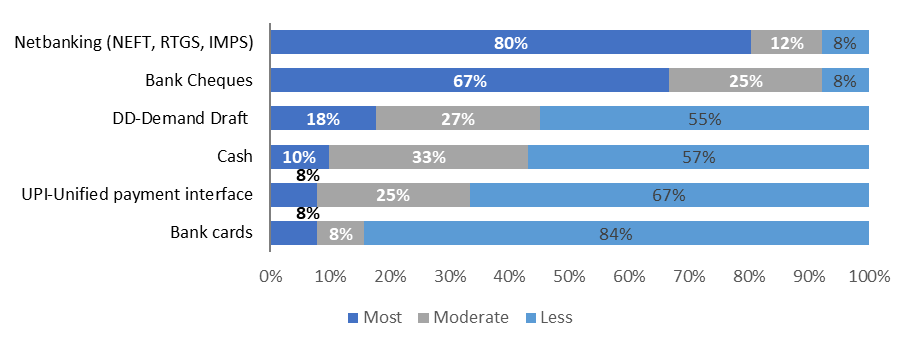

- The invoices generated are the amount of work executed in a construction project by the stakeholders that are needed to be paid on a timely basis by the employer. The transactions must happen through a medium or directly. The banking system is the most found medium for transactions. The amount ranges from smaller to huge in number based on the work executed, type of project, project timeline. Below are the percentages talks about the construction project payment information in brief.(a) Mode of payment used: Based on the survey responses the mode of payment used for the invoices submitted for a work executed in a project is represented in Figure 3. The mode of payment is arranged in descending order of most frequently used in which 80% prefer Net banking mode which includes NEFT, RTGS, IMPS, 67% prefer bank cheques. Demand draft, cash, unified payment interface, bank cards are less frequently used. Interesting to see the cash mode of payment which accounts for 57% less frequently used which can be said that digitalisation is working in the payment program, but it can’t be said that cash payment mode is not completely vanished but from the data, it says 10% to 33% prefer cash mode of payment in which it can be in the smaller projects.

| Figure 3. Mode of payment used |

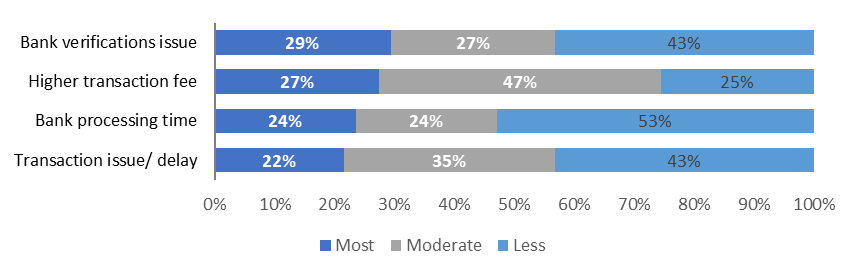

| Figure 4. Payment issues |

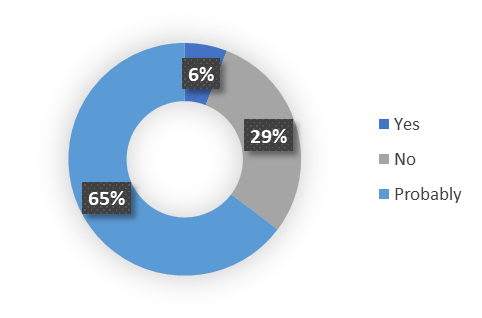

| Figure 5. Cryptocurrency as an alternative payment option |

6.2. Awareness Info

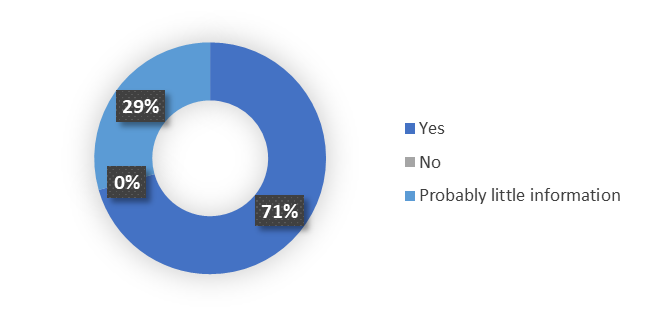

- Any new concepts that are interesting and found to be popular in the field that a person is in should make themselves aware which can add value to the profession in the coming future. Similarly, the respondents were asked about cryptocurrency awareness which will add an advantage for data validation.(a) Aware of cryptocurrency or virtual currency: Based on the survey responses, 71% of respondents are aware of the cryptocurrency, 29% of respondents are probably having little information about the cryptocurrency. So, from this, we can say that the data collected are valid for data analysis. Apart from this, few respondents turned down to fill out the survey form circulated because they are not much aware of or heard about the cryptocurrency.

| Figure 6. Awareness Info |

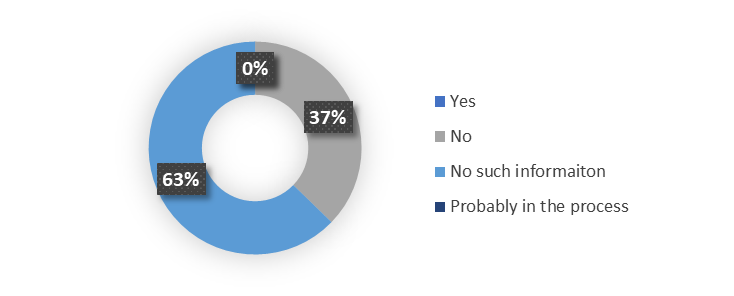

| Figure 7. Cryptocurrency adoption |

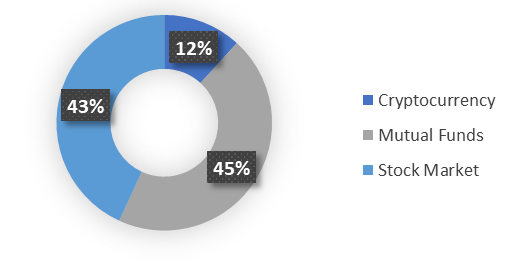

| Figure 8. Investment Choice |

6.3. Cryptocurrency Challenges Info

- The challenges are always part of human life, business, market, organisation, and other domains in some way, it must be faced to stand up in the competing market. Drafting and understanding the challenges in the first place can make the work go well initially and later to be handled on a pro-rata basis and regularly updated. For the research work, the general challenges and construction-related challenges associated with cryptocurrency were drafted based on the study carried out on literature review, articles, blogs, vlogs, news, knowledge, construction competencies, awareness.

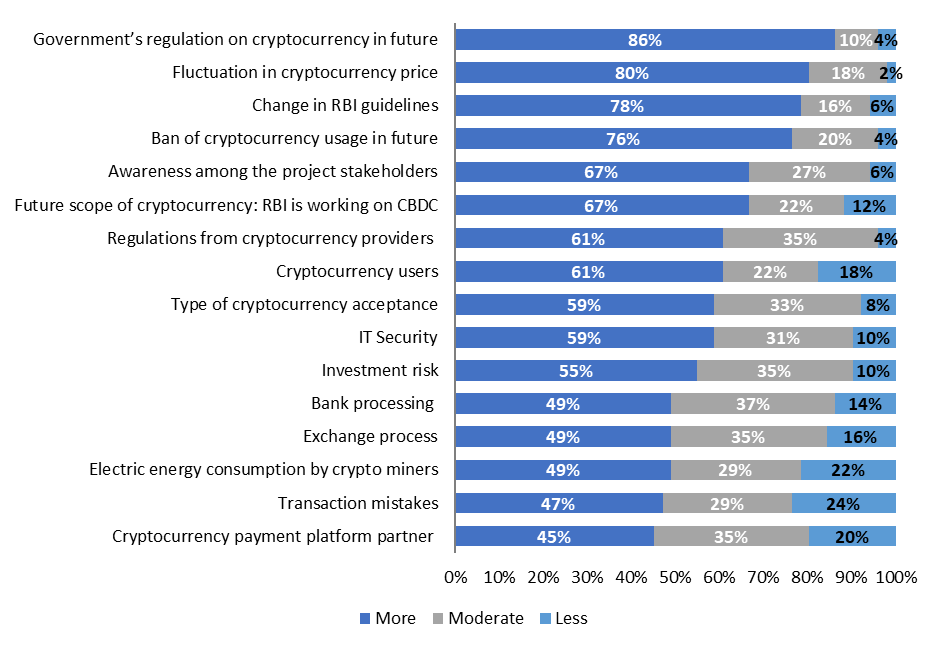

6.3.1. General Challenges

- Some of the general challenges that are associated with cryptocurrency adoption as an alternative payment are discussed in this section. Based on the survey responses the general challenges are arranged in descending order of priority of challenges that are faced.

| Figure 9. General Challenges |

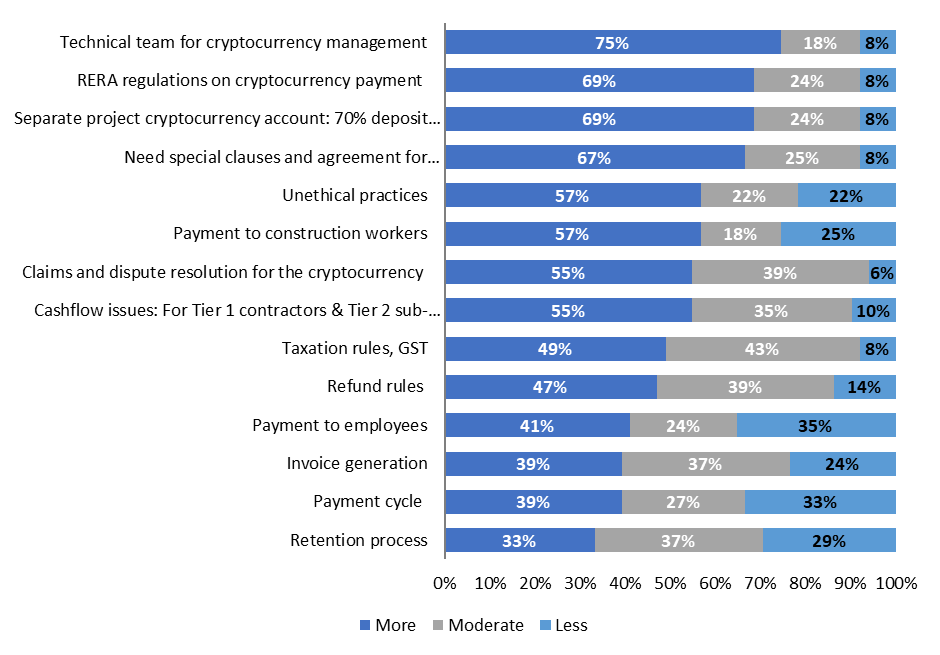

6.3.2. Construction Industry-Related Challenges

- Some of the construction industry-related challenges that are associated with cryptocurrency adoption as an alternative payment are shown in Figure 10. Based on the survey responses the construction industry-related challenges are arranged in descending order of priority of challenges that are faced.

| Figure 10. Construction Industry related challenges |

6.4. Cryptocurrency Opportunities Info

- Opportunities are the chance of getting a new way to the market, work. Every person thinks of opportunities that can be gained from the options available. Opportunities can help to have stability and handle things carefully to gain something out of it. For the research work, the general opportunities and construction-related opportunities associated with cryptocurrency were drafted based on the study carried out on literature review, articles, blogs, vlogs, news, knowledge, construction competencies, awareness.

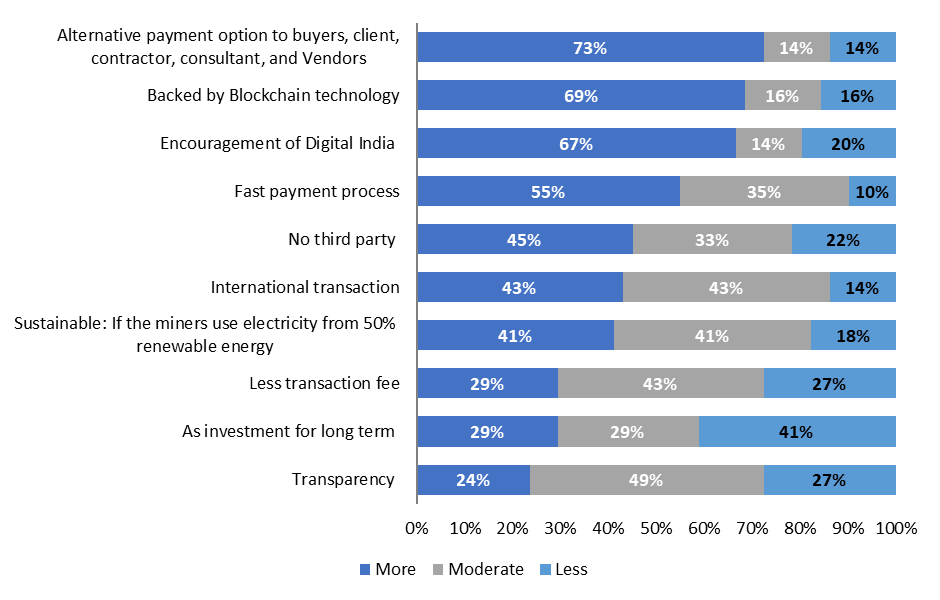

6.4.1. General Opportunities

- Some of the general opportunities that are associated with cryptocurrency adoption as an alternative payment are discussed in this section. Based on the survey responses the general opportunities are arranged in descending order of priority of opportunities.The top five general cryptocurrency opportunities that are faced most as an alternative payment option based on the survey responses the more opportunities aspects are alternative payment option which accounts for 73%, backed by blockchain technology which accounts for 69%, encouragement of digital India which accounts for 67%, fast payment process which accounts for 55%, No third-party interference which accounts for 45%.

| Figure 11. General Opportunities |

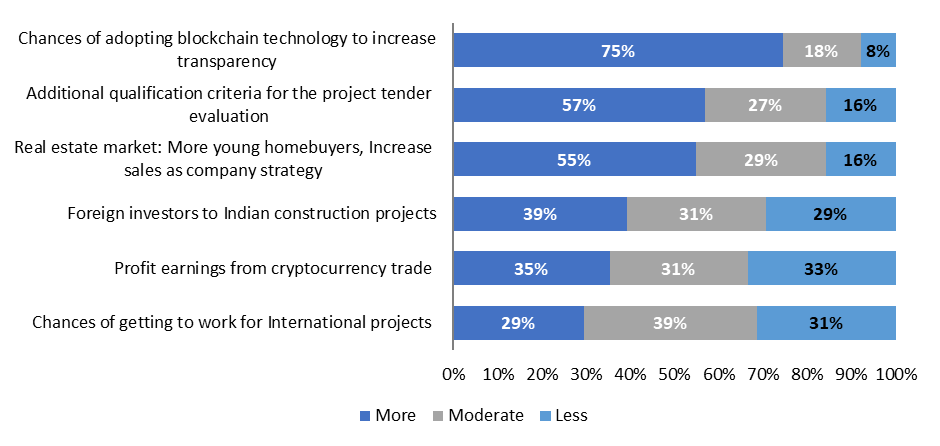

6.4.2. Construction Industry-Related Opportunities

- Some of the construction industry-related opportunities that are associated with cryptocurrency adoption as an alternative payment are discussed in this section. Based on the survey responses the construction industry-related opportunities are arranged in descending order of priority of opportunities.

| Figure 12. Construction Industry related opportunities |

7. Conclusions

- The Indian construction industry has witnessed changes in the work culture from their past practices to best practices. Considering the stakeholder's requirement, the approach towards work pathways has seen a drastic change. Each organisation looks forward to future possibilities plan, concepts that can help them reach the standards that they have set as per stakeholders’ requirements, industry conditions, long term goal preceptive to outstand as a unique organisation. The research and development team in an organisation is one of the important departments that can make the organization unique in the industry and support's future aspects/concepts possible in real-time or create a bridge to reach future trends and to handle them in a better way. Keeping this in mind the research is carried out, from the data collection and analysis we have noticed the key points that are faced for cryptocurrency as an alternative payment option. Based on the analysis of respondent's data the key points discussed are often payment modes used are Net banking, cheques with the common issue related to bank verification, higher transaction fees. There is a chance for cryptocurrency as an alternative payment option but takes time which can’t be predicted due to its market condition and awareness among people. The general challenges that are mostly faced are the government’s regulation on cryptocurrency, fluctuation in cryptocurrency price, Change in RBI guidelines, ban of cryptocurrency usage in the future, Awareness among the project stakeholder and future scope of cryptocurrency apart from this mining of cryptocurrency activities in a sustainable way is a challenging task. The construction industry-related challenges that are mostly faced are the technical team for cryptocurrency management, RERA regulation on cryptocurrency payment, separate project cryptocurrency account, need special clauses and agreement for cryptocurrency usage, unethical practices, cashflow issues. So, from these key challenges noted are to be aware when dealing with the cryptocurrency as an alternative payment option in the construction industry which can help in forecasting the probable factors that can impact the decision made in the payment terms. When the world is choosing the alternative option from its earlier one’s like payment mode, work culture, the trend has some opportunities out of it. similarly choosing cryptocurrency has some opportunities i.e., in general, based on the data analysis there is an opportunity for cryptocurrency as an alternative payment, backed by blockchain technology, encouragement of digital India, fast payment process, and no third-party interference. The construction industry-related opportunities that are mostly faced are chances of adopting blockchain technology, additional qualification criteria for the project tender evaluation, real estate market: more young homebuyers, foreign investors to Indian construction projects. From this, we can say that overcoming the challenges the opportunities out of it can be benefited. Based on the research data represented the challenges are to be managed and solved with the aim of having cryptocurrency as an alternative payment option in the perspective of the Indian construction industry. This research work can help graduates, construction professionals out there in the construction industry looking for blockchain technology, alternative payment options, cryptocurrency challenges and opportunities. This research work can be further carried out in, the demand for cryptocurrency mining data centres in India: A Commercial manager standpoint, to draft the cryptocurrency payment process for stakeholders in a construction project: Blockchain technology in the construction industry perspective. The chances of cryptocurrency emerging in the Indian real estate, construction industry is improbable in the imminent future. The future possibilities of digital currency/Virtual Currency/Cryptocurrency can be with the hand of central bank digital currency (CBDC) of respective countries, like India on its research ground and trails, the chance of ‘Digital Rupee’ can emerge.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML