-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2021; 10(4): 116-126

doi:10.5923/j.ijcem.20211004.03

Received: Oct. 9, 2021; Accepted: Oct. 28, 2021; Published: Nov. 1, 2021

Contracting Process on Construction Cost Overruns in Real Estate Projects in Nairobi and Kisumu Counties, Kenya

Joanne A. Kepher, Charles M. Rambo, Raphael O. Nyonje

University of Nairobi, Kenya

Correspondence to: Joanne A. Kepher, University of Nairobi, Kenya.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Cost overruns have provided a significant challenge in the construction industries of both developed and developing countries. The purpose of this study was to investigate the influence of Contracting Process on Construction Cost Overruns of real estate projects in Nairobi and Kisumu Counties. The study was guided by an objective, to establish the extent to which contracting process influence construction cost overruns in real estate projects. The study was based on pragmatic paradigm which provides for the use of both qualitative and quantitative research methodologies. The research adopted descriptive survey and correlational research designs. The study targeted a population of 4000 project professionals that constituted 7 professionals from active real estates in Nairobi and Kisumu Counties and 10 key informants from the real estate industry. Using the Krejcie and Morgan table of sample size determination, the sample size for this study was 351. The study then adopted stratified, simple random and purposive sampling methods to select appropriate sample sizes from the study population strata. Structured questionnaire was the main instrument for data collection, supported by interview guide. Hypothesis was tested at α=0.05 level of significance and the results were: H0: There is no significant relationship between contracting process and Construction Cost Overruns in real estate projects was rejected since P=0.000<0.05. Considering the study findings and conclusions, the following recommendations were made: Project professionals and other relevant real estate project stakeholders should encourage comprehensive contracting process as critical concerns in assembling pertinent information and creating avenues that could be utilized to reduce construction cost overruns in real estate projects.

Keywords: Contracting process, Construction cost overrun, Real estate projects

Cite this paper: Joanne A. Kepher, Charles M. Rambo, Raphael O. Nyonje, Contracting Process on Construction Cost Overruns in Real Estate Projects in Nairobi and Kisumu Counties, Kenya, International Journal of Construction Engineering and Management , Vol. 10 No. 4, 2021, pp. 116-126. doi: 10.5923/j.ijcem.20211004.03.

Article Outline

1. Introduction

- Cost overruns is a significant challenge in construction projects. The significance and linkage of construction industry to economic growth and development of all sectors in a country cannot be underrated ((Durdyev, Omarov, and Ismail, 2017). Constraints of cost, time and quality contribute to performance of projects, the construction industry focuses its lenses on cost constraint as a result of past performances of various studied projects. Overruns in cost and quality have attracted a wide range of research to an extent that it has become a global phenomenon and therefore proper reduction of construction cost is a recommendation by scholars as an aggregate for the successful completion of projects (Ahady, Gupta, and Malik, 2017). Reduction of construction cost overrun is key to project performance despite the fact that it has proved to be laborious in the construction industry (Alias, Zawawi, Yusof, and Aris, 2014). Successful projects are supposedly the ones which meet the triple constraint standard where time, cost and quality are adequately achieved. Project success is subject to efficacy in management of the cost element. The main objective of project owners is to have their projects executed within their approved budgets and this leads them to engage professionals such as quantity surveyors to specifically manage financial aspects of the construction on their behalf; they consider cost certainty very highly. Nevertheless, cost overruns are commonplace on construction projects (Cunningham, 2017).Contracting processes are underpinned by various approaches that are well understood by the executors. One very important role of contracting process is demonstrated through the number of problems identified by the response obtained from internal reviews of contracts carried out by various departments. For instance, out of 60 contracts which were tested for overbilling in Northern Ireland, 34 had issues in the amount billed, and 73 contracts were tested against 8 areas; planning and governance, people, administration, payment and incentives, managing performance, risk, contract development and managing relationships also referred to as ‘Good practice contract management framework’ and management issues were found in all eight areas (Contract Management Principles and Procedures, 2019). This study sets out to confirm the influence of contracting process on construction cost overruns in real estate projects.

1.1. Research Objective

- The objective of the study was to establish the extent to which Contracting process influence Construction Cost Overruns in real estate projects.

1.2. Research Hypothesis

- Ho: There is no significant relationship between contracting process and Construction Cost Overruns in real estate projects.

2. Literature Review

2.1. Construction Cost Overruns in Real Estate Projects

- This study adopted the definition of Construction Cost Overruns as a structured multidisciplinary analysis of control process aiming to reduce excess of actual construction cost over budget in real estate projects (Khodeir and Ghandour, 2018). Construction Cost Overruns refer to processes that include accurate estimates, complete designs, correct scheduling, planning for scope changes and efficient administration. Different scholars have conducted studies to assess the causes of cost overruns in construction projects (Khodier and Ghandour, 2018; Niazi and Painting, 2017; Lind and Brunes, 2015; Doloi, 2013 and Rosenfed, 2013).Out of the studies that were reviewed; Lind and Brunes (2015) and Khodeir and Ghandour, (2018) focused on the importance of competence, skills and value management in the management of cost overruns, Doloi (2013) on the other hand focused on the responsibilities of key stakeholders including clients, consultants, and contractors. On the same note, Niazi and Painting (2017) established that cost overruns were caused by: corruption; delays in progress payment by clients; difficulties by contractors to financing projects; insecurity; decision by the owners to change order during construction; market inflation; mistakes and discrepancies in design documents; and the type of project bidding awards. Also, Rosenfed (2013) found that premature tender documents, numerous changes in the owners’ requirements and unrealistically low tender-winning prices caused construction cost overrun. Construction Cost Overruns in this study was viewed from the perspective of: accurate project estimates; correct plan; complete project designs; planning for changes in project scope; and efficient administration of projects. The findings of this study concurred with the findings of studies by (Khodier and Ghandour, 2018; Niazi and Painting, 2017; Lind and Brunes, 2015; Doloi, 2013 and Rosenfed, 2013). This study’s focus was that low priced projects cost more than expected at the end, project costs are controlled through accepting minimal claims during implementation, strict adherence to comprehensive designs at tendering stage minimize project claim, whenever there is proper coordination at the design level unexpected outcomes during implementation are minimized, escalations are experienced due to errors in project activity scheduling, incorporating scheduling techniques help to save project cost, planning for scope changes is a requisite to minimize project cost, regulation of project cost becomes harder due to wrong initial scope definition, proper coordination of projects minimize project cost and that precisely organized project activities ensure control of un-anticipated expenses. Therefore, this study established key indicators of reduction of cost overruns on real estate projects in Kenya’s Nairobi and Kisumu Counties.

2.2. Contracting Process and Construction Cost Overruns in Real Estate Projects

- Contracting process entails contract need assessment, contract selection and writing, contract execution, contract monitoring and contract closing. Contracting process is an important component in the management of cost overruns in construction projects. In view of this, Suprapto, Bakker, Mooi and Hertogh, (2015) conducted a study on a sample of 450 respondents drawn from the Dutch Process Industry Competence Network to determine how contract types and incentives influence project performance. The study revealed that contracts that were based on incentives were indirectly associated with improved project performance. On the contrary, contracts that did not have incentives had a positive effect on relational attitudes which in turn led to enhanced team work. The study further noted that relationships in projects with lump-sum contracts tended to be more adversarial in nature, as compared to those with reimbursable contracts. However, the response rate was 26.4% with 119 completed responses which fell far below Mugenda and Mugenda (2003) recommendation that a response rate of over 50 percent is adequate. It also failed to meet Kothari (2011) 30 percent threshold for questionnaire return rate. In a different quantitative study that was conducted on a sample of 1,500 respondents drawn from 46 countries, Zou, Brax and Rajala (2018) evaluated how contract structure, contracting process and service complexity influenced supplier performance. The researchers opined that potential benefits of a well-managed service procurement and the inter-organizational exchanges related to business-to-business (B2B) services inevitably involve complexities that make it difficult to align service procurement with the exchange parties’ objectives. In view of the fact that contractors play an important role in the performance of construction projects, Khoso and Yusof (2019) conducted a study titled “Extended Review on contractor selection process”. The study identified: adequacy of equipment available to contractor; general experience of firm; specific experience with respect to type and size of a project; prior working relationship of contractor with the owner and consultant; number of change orders in past contracts, disputes and claims in past projects; and past record of time and budget as factors that were critical in the selection of contractors for project success.Factor analysis of cost and time overruns cited poor construction methods, delays in procuring materials and equipment, contractor’s cash flow problems and unrealistic client budget as components of contractor’s inability. Four of the studies by Suprapto et al., (2015), Zou, et al. (2018), Kagiri, and Wainaina (2013), Odoema and Horita (2017) took quantitative approaches while the studies by Khosu and Yosof (2019) and Alzahrani and Emsley (2013) were qualitative in nature and based on literature review. A close scrutiny of the components used in the studies seem to suggest that these are important constructs of contract processing and project success: contract types (Suprapto et al., 2015), contract structure, contracting process and service complexity (Zou, et al., 2018); cooperative procurement procedures (Eriksson and Westerberg, 2011); contractor selection process (Khosu and Yosof, 2019); contractors inability (Kagiri, and Wainaina, 2013); and contractors attributes (Alzahrani and Emsley, 2013). According to this study, it was concluded that clear contract need assessment should be established before construction work, contract should be properly drafted, administration of up to date contractual agreements is crucial, proper execution of contracts is essential for project success, failure to direct contract implementation leads to more cost than expected, there is need to use logical framework to monitor project progress, use of work plans to achieve project goals, consideration of procedural contract termination in the work and that avoidance of haphazard contract termination of projects positively influence Construction Cost Overruns in Real Estate Projects Kenya’s Nairobi and Kisumu Counties.

2.3. Theoretical Framework

- This study was guided by the Microeconomic Production Theory proposed by Lerner (1968) and focused on the concept of cost function in that theory. This is a build-up of the works of Cantarelli et al. (2010), and adopted from Lind and Brunes (2015). The theory studied the behaviour of individual firms in regards to fixation of price and output and their reaction to changes in the demand and supply conditions; thus it seeks to determine the mechanism by which the different economic units attain the position of equilibrium proceeding from individual units to an industry or a market: in our case being the construction industry and specifically real estate projects.

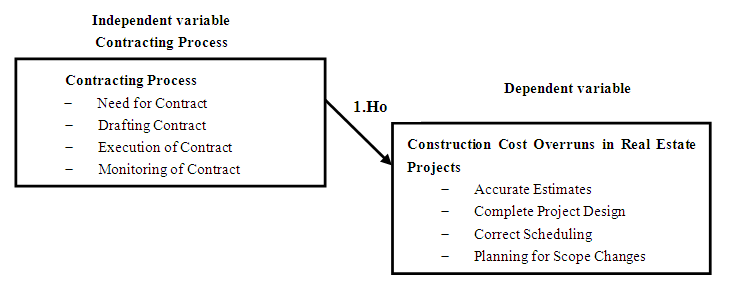

2.4. Conceptual Framework

- This study has adopted a conceptual framework outlined in figure 1 indicating the relationship of independent variable and dependent variable.

| Figure 1. Conceptual Framework for Contracting Process on and Construction Cost Overruns in Real Estate Project |

3. Research Methodology

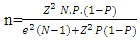

- Data was analyzed using descriptive statistics and inferential statistics. Descriptive statistics used measures of central tendency such as frequency, percentage, mean, standard deviations, composite mean and composite standard deviation. Whereas inferential statistics used spearman correlation and regression analyses. The descriptive research design used in this study helped to explore the link between the variables and report the way it is (Brook, 2013). Target population was based on the register of real estate projects between 2018 and 2019 held by the National construction Authority (NCA) which had 570 active real estate projects comprising of 95 in Kisumu and 475 in Nairobi Counties. In general, a typical real estate project structure comprises Project professionals such as Construction manager, clerk of works, Quantity Surveyor, Architect, Mechanical and Electrical engineer, structural Engineer, Contractor and Subcontractors. The 570 active real estate projects in Kisumu and Nairobi Counties each have at least one of the project professional. Thus a minimum of 7 project professional per real estate project constituted a target population of 4000 = (570×7) project professional as well as 10 key informants.A sample size of 351 was drawn from a target population of 4000 project professional and key informants in Nairobi and Kisumu Counties. The sample size for the study was determined using Krejcie and Morgan table (Krejcie and Morgan, 1970). Based on the table, for a given population of 4000, a sample size of 351 was obtained and was further confirmed through hyper-geometric formula for a sample size as follows;

Proportionate stratified and simple random sampling technique was used to select sample sizes from different strata (project professionals) out of the 570 active real estate projects registered and operating in Nairobi and Kisumu Counties; Purposive sampling was used to select key informants from a targeted population of ten having prerequisite experience in real estate development. Data for this study was collected in phases; pre-field work phase, field work phase and post-field work phase. The data collection was done by using survey questionnaire and interview guide.

Proportionate stratified and simple random sampling technique was used to select sample sizes from different strata (project professionals) out of the 570 active real estate projects registered and operating in Nairobi and Kisumu Counties; Purposive sampling was used to select key informants from a targeted population of ten having prerequisite experience in real estate development. Data for this study was collected in phases; pre-field work phase, field work phase and post-field work phase. The data collection was done by using survey questionnaire and interview guide. 4. Results and Discussions

4.1. Questionnaire Return Rate

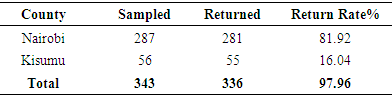

- Out of a sample size of 351 from the target population, 8 key informants were interviewed whereas 343 participants from the seven active real estates licensed to operate within Kisumu and Nairobi Counties by National Construction Authority were issued with questionnaires of which 336 dully filled and returned the questionnaires giving a return rate of 98%. Table 1 shows the Questionnaire Return Rate for the Project professionals from the seven active real estates licensed to operate within Kisumu and Nairobi Counties by National Construction Authority that were responded to and returned.

|

4.2. Demographic Ccharacteristics’ of the Respondents

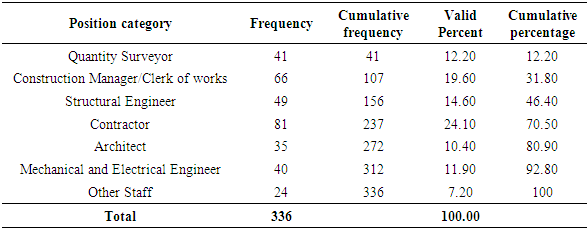

- In order to understand characteristics of participants the researcher was dealing with in the study, their background information was necessary. The study sought information from the participants on distribution by, position category in real estate projects, duration of profession in the organization and kind of construction projects conducted in real estate projects. The participants were asked to provide these demographic information. The results are presented in the following sub-thematic areas: Distribution of Rrespondent’s by Position CategoryIt was imperative to investigate the respondents’ position category to establish how financial and contract management of real estate projects were related with cadre of the project professional whose information were considered to be significance to the construction agencies for policy decision making. The respondents were therefore asked to state their position category and the results are presented in Table 2.

|

4.3. Basic Tests for Statistical Assumptions of Regression Analysis

- The study was based on a set of assumptions of regression analysis that must be met to ensure data collected is appropriate for the statistical analysis. When these assumptions are violated the results of the analysis can be erroneous. The assumptions tested include normality, linearity, multi-collinearity and independence of errors.Assumptions of NormalityAn assessment of the normality of data is a prerequisite for many statistical tests because normal data is an underlying assumption in parametric testing. The test for normality of data distribution was conducted on all the predictor variables, moderating variables using Kolmogorov-Smirnov test statistics (KS-test) and Shapiro-Wilk test (SW-test).

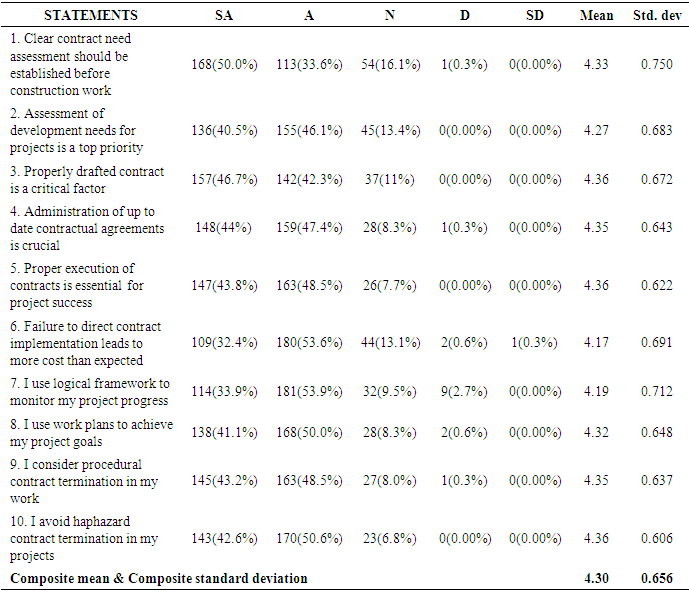

4.4. Contracting Process and Construction Cost Overruns in Real Estate Projects

- Contracting process in this study is defined as a process that entail contract need assessment, contract selection and writing, contract execution, contract monitoring and contract closing. The participants were requested to give their opinions on their level of agreements or disagreements with the ten statements of Contracting process on a Likert scale of 1-5 where Strongly agree(SA)=5, Agree(A)=4 Neutral(N)=3, Disagree(D)=2 and Strongly disagree. (SD)=1. The results were analyzed and presented using frequencies, percentage, means and standard deviation for each response in each item. The item mean as well as the standard deviation were also computed and presented alongside as provided in Table 3.

|

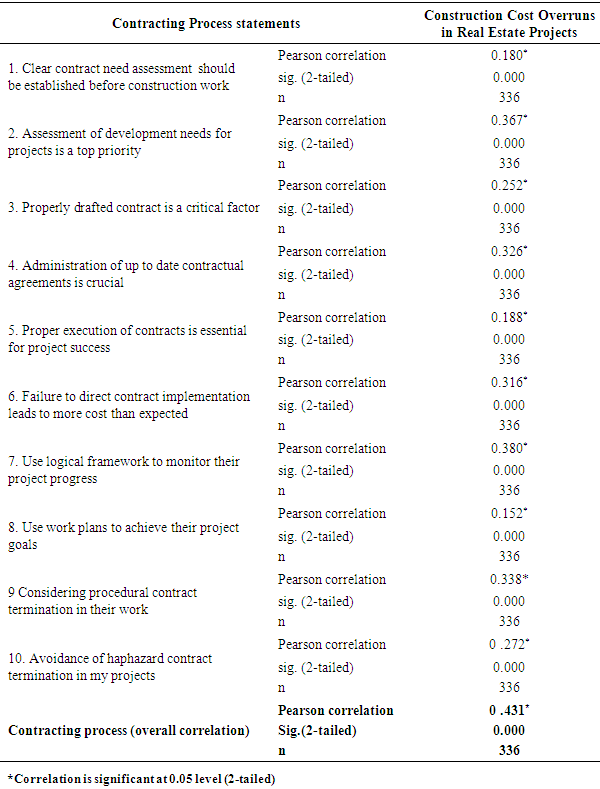

4.5. Correlation Analysis of Contracting Process and Construction Cost Overruns in Real Estate Projects

- The study sought to examine the relationship between contracting process and construction cost overruns in real estate projects. Pearson correlation coefficient was used to test the relationship between contracting process and construction cost overruns in real estate projects at 95% level of confidence. The correlations results obtained are shown in Table 4.

|

4.6. Regression Analysis of Contracting Process on Construction Cost Overruns in Real Estate Projects

- Simple linear regression was adopted to investigate how Contracting Process influence construction cost overruns in real estate projects. It was necessary to get the views of the participants on the influence of Contracting Process on construction cost overruns in real estate projects. The rational of using the simple regression model was to establish how Contracting Process as a predictor significantly or insignificantly predicted construction cost overruns in real estate projects.

4.6.1. Model Summary of Contracting Process on Construction Cost Overruns in Real Estate Projects

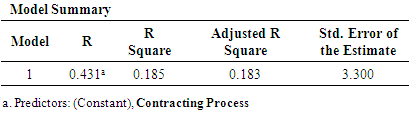

- The model summary sought to determine how Contracting Process is a predictor that significantly or insignificantly predicted construction cost overruns in real estate projects. The regression model summary results are presented in Table 5.

|

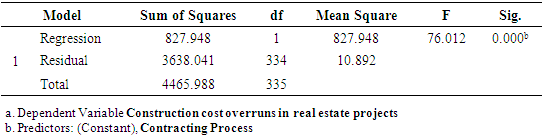

4.6.2. ANOVA of Contracting Process and Construction Cost Overruns in Real Estate Projects

- The study sought to establish if the regression model is best fit for predicting construction cost overruns in real estate projects after use of Contracting Process. The ANOVA results are presented in Table 6.

|

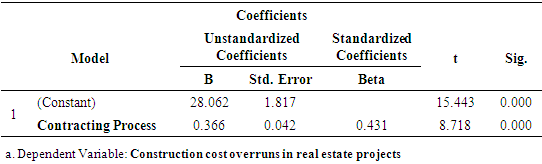

4.6.3. Coefficients for Regression of Contracting Process and Construction Cost Overruns in Real Estate Projects

- The study sought to establish whether there was influence of Contracting Process and Construction cost overruns in real estate projects. The regression coefficients results are presented in Table 7.

|

5. Conclusions and Recommendations

- The research objective was to examine the extent to which Contracting process influence Construction Cost Overruns in Real Estate Projects. The simple linear regression coefficients as well as the Pearson correlation results indicated that there was significant influence of contracting process on Construction Cost Overruns in Real Estate Projects. The small p-values; implied that there was a significant relationship between Contracting process and Construction Cost Overruns in Real Estate Projects. Considering the study findings and conclusions, the following recommendations were made: Project professionals and other relevant real estate project stakeholders should encourage comprehensive contracting process as critical concerns in assembling pertinent information and creating avenues that could be utilized to reduce construction cost overruns in real estate projects.

6. Limitations of the Study

- The study involved project professionals in interviews, these are busy people and therefore adequate time was required to schedule meetings with them. The challenge was mitigated through allocating sufficient time for appointments and increased use of online technology for both communication and data collection. The period when the proposed study was envisioned to take place was marred with great uncertainty of events due to corona virus pandemic but this was mitigated through flexibility of adapting the most effective and functional technology that was used to reach the proposed respondents.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML