-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2021; 10(1): 17-24

doi:10.5923/j.ijcem.20211001.03

Received: Feb. 8, 2021; Accepted: Mar. 5, 2021; Published: Mar. 15, 2021

A Fuzzy Multi-criteria Approach to Decision-making for Choosing an Investment and Construction Project in an Uncertain Environment

Olexii Tuhai, Tetiana Vlasenko

Department of Construction Organization and Management, Kyiv National University of Construction and Architecture, Kyiv, Ukraine

Correspondence to: Tetiana Vlasenko, Department of Construction Organization and Management, Kyiv National University of Construction and Architecture, Kyiv, Ukraine.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article addresses the problem of selecting an investment and construction project on a variety of criteria in the face of uncertainty. The complex nature of decision-making when justifying significant indicators of investment and construction project requires decision-makers at the stage of choosing an investment and construction project to increase the level of reliability of organizational and technological decisions by taking into account the stochasticity of processes, variability of the external environment and risks. Also, this article presents an approach to pre-selection of investment and construction projects based on the theory of fuzzy sets, the peculiarity of which is to express multiple unclear information linguistically, which allows to evaluate qualitative and quantitative criteria. The most significant criteria affecting the reliability of the investor’s selection of investment and construction project are given.

Keywords: Fuzzy sets, Investment and construction project, Multi-criteria decision making, TOPSIS, Uncertainty

Cite this paper: Olexii Tuhai, Tetiana Vlasenko, A Fuzzy Multi-criteria Approach to Decision-making for Choosing an Investment and Construction Project in an Uncertain Environment, International Journal of Construction Engineering and Management , Vol. 10 No. 1, 2021, pp. 17-24. doi: 10.5923/j.ijcem.20211001.03.

Article Outline

1. Introduction

- The practice of implementing investment and construction projects shows that the influence of uncertainties leads to unforeseen situations, which in turn leads to unexpected costs, even in those projects that were initially deemed economically sound. This happens due to the fact, that unforeseen or unlikely negative scenarios for the development of an investment and construction project can still occur and interfere with its successful implementation of the project.As investment and construction projects are unique, complex, one-of-a-kind and subject to very volatile and sometimes unpredictable factors [1-2], their implementation is becoming increasingly complex due to a rapidly changing world, with risks that are caused by uncertain, incomplete and inaccurate external information. In construction, each of the three main objectives in terms of cost, time and quality is likely to be subject to risk and uncertainty [3]. Uncertainty has also been recognized as one of the most important obstacles to the successful implementation of the projects [4]. Uncertainty means instability, inaccuracy, incomplete information, and unpredictable changes in the circumstances related to the project.Investors often find it difficult to choose reliable investment and construction projects. It is increasingly important for investors in a rapidly changing environment to choose the most reliable project to deliver positive results. In the practice of financing the investment and construction projects, the most important aspect for decision-making by potential investors is the results at the pre-investment stage of the project. Therefore, it is necessary to pay special attention to problem solving at the initial stage of the project and to conduct a thorough, detailed analysis of potential investment and construction projects to ensure that risks are minimized due to the consequences that may have wrong decisions. Early-stage analysis of the project is extremely important because decisions made from this analysis will have a significant impact on future project outcomes. In other words, bad decisions made in the early stages of the project could result in large economic losses in the future [5]. Decision-making means a choice that is almost always made on the basis of imperfect information, and these important decisions require knowledge of threats with a certain degree of certainty [6]. A reliable choice of an investment project requires measuring and analyzing many conflicting factors of the internal and external environment for making investment decisions in the construction industry. It is therefore extremely important to correctly define the criteria for selecting an investment project in the construction industry in the face of inaccuracies and uncertainties. The problem is compounded when the decision-maker does not have an obvious idea of how to reason and decide on the size of the investment based on inaccurate and incomplete data.A review of the literature has shown that little attention has been paid to this issue and, as a consequence, analysis and development of models, methods for assessing the reliability of investment and construction project in the face of uncertainty is a particularly pressing problem.

2. Uncertainty of the Investment and Construction Project

- Investment and construction activity is a complex, multifaceted, dynamic process, which involves many stakeholders, complicated contractual relationships and it is characterized by high costs and duration, which causes risks and uncertainty in the project implementation process. Also, the overall investment activity is always associated with uncertainty and risks in obtaining the expected results when making specific investment decisions. In this regard, uncertainty is the incompleteness or inaccuracy of the information regarding the conditions of implementation of investment and construction projects, including the related costs and expected results. The reasons for uncertainty could be the following ones: incompleteness, insufficiency, unreliability of information about the investment and construction project and the conditions of its implementation, instability of external and internal factors and actions of project participants. If we do not take into account the uncertainty that has been recognized as the main source of construction projects complexity [7], then, as a result, additional costs could occur, non-compliance with deadlines [8]. Research of Boateng et al. [9] has shown that ignoring uncertainty can negatively affect a project's success. In particular, diverse manifestations of the uncertainty factor are associated with [10]:• the impossibility or inexpediency of obtaining sufficient amounts of information with the necessary degree of reliability;• the lack of reliable predictions of the characteristics, properties, and behaviour of complex systems that reflect their responses to external and internal actions;• poorly defined goals and constraints in the design, planning, operation, and control tasks;• the infeasibility of formalizing a number of factors and criteria and the need to take into account qualitative (semantic) information.Attempts have been made to understand the impact of uncertainty on the outcome of the investment and construction activity. Zhong et al. [11] came to the conclusion that technical and financial uncertainty mainly affects the cost of the construction project, uncertainties related to markets, rules and organizational structures affect both the duration of the project and the cost. Liu et al. [12] stated that risk neglect and improper investment decisions can lead to large losses for investors. Petit [13] concluded that the main sources of project uncertainty are technical uncertainty, market, organization, finance, and norms and regulation.Therefore, we believe that the analysis and evaluation of alternative projects at the pre-investment stage of investment and construction activities can help to avoid many negative effects of the uncertainty sources on the result of activity, although it is impossible to predict fully possible consequences of this impact.

3. Models of Pre-selection of Investment and Construction Projects

- Preliminary assessment of investment and construction project can be considered as a multi-critical task, as potential investment and construction projects measure and evaluate according to a set of influencing factors.In solving the problems of selecting investment projects in the construction industry, which is characterized by projects with long investment cycles and implementation dates, there is a problem of determining the division of stochastic factors of calculating reliability. Under such conditions of decision-making in the construction industry, it is important to consider the impact of legislative, demographic, economic, social, environmental, governmental and technological changes in the business world in international, national, regional and local markets. Multi-criteria analysis is a useful tool for solving such problems [14].To solve these problems there are methods such as fuzzy set theory, analytic hierarchy process (AHP), analytic network process (ANP), elimination and choice translating reality (ELECTRE), preference ranking organization method for enrichment of evaluations (PROMETHEE), technique for order of preference by similarity to ideal solution (TOPSIS), vise kriterijumska optimizacija i kompromisno resenje (VIKOR).Fuzzy set theory was created [15] as a useful tool for solving decision-making problems in an uncertain environment, and also allows you to reason and accept on the basis of incomplete and uncertain data. According to Fetz et al. [16], fuzzy set theory provides the basis for solving the problem. The strength of the theory lies in the fact that it allows you to formalize fuzzy data, to represent their fuzziness, which can be entered into calculations, and theoretical interpretation. This allows, when selecting investment and construction projects, not only quantitative factors, but also qualitative ones.1) Xiaoyang Xu et al. [17] developed the triangular fuzzy induced Einstein ordered weighted averaging (TFIEOWA) operator to assess the risk of an investment project by multiple risk-adjusted attributes based on investor sentiment with triangular fuzzy information.2) To assess investment risk in an international engineering project, Liu et al. [18] proposed a model based on the improved risk matrix method, which contains indicators for assessing the investment risk of an international engineering project.3) Ginevičius et al. [19] presented evaluations of the effectiveness of real estate projects, which covers the entire cycle of investment decisions, the hierarchical structure of project evaluation criteria, and risk assessment based on stochastic measurements.4) Guo et al. [20] proposed an AHP-BSC model to identify the smaller risk projects for investors from qualitative and quantitative angles. Firstly used the BSC to select the best possible investment projects, then the investment risk comprehensive assessment is carried out for the rest of the projects using AHP, which is used to select the project with the lowest risk project.5) Teng et al. [21] proposed the fuzzy multiobjective programming for the problem of transportation investment project selection (TIPS) problems. The programming uses the fuzzy spatial algorithm, which calculates the efficiency of goal achievement and the requirement of resource utilization as of fuzziness.

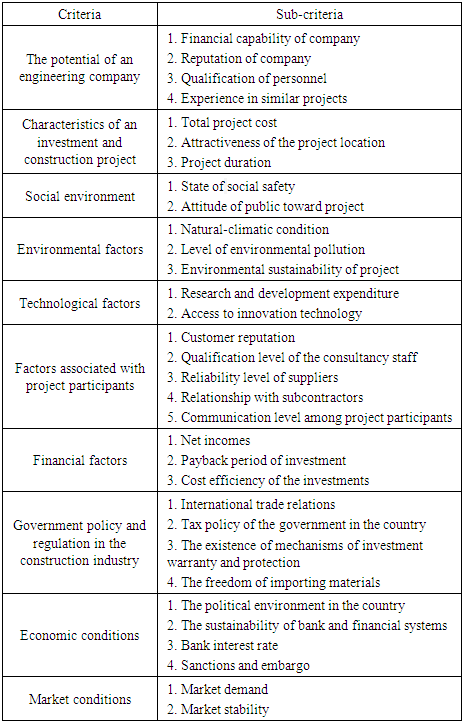

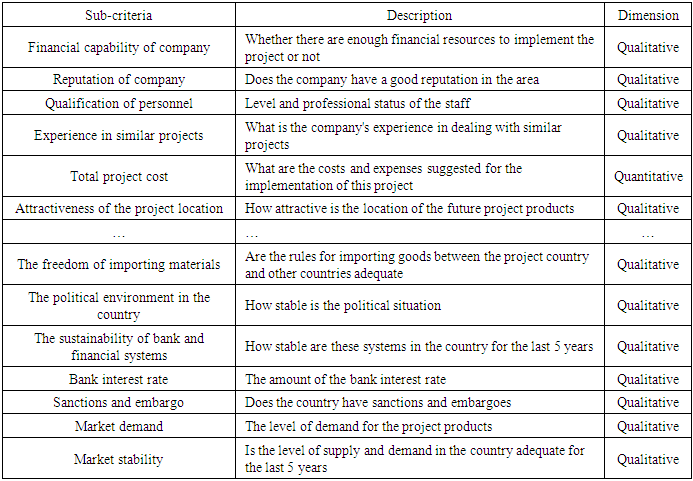

4. Criteria for Choosing an Investment and Construction Project

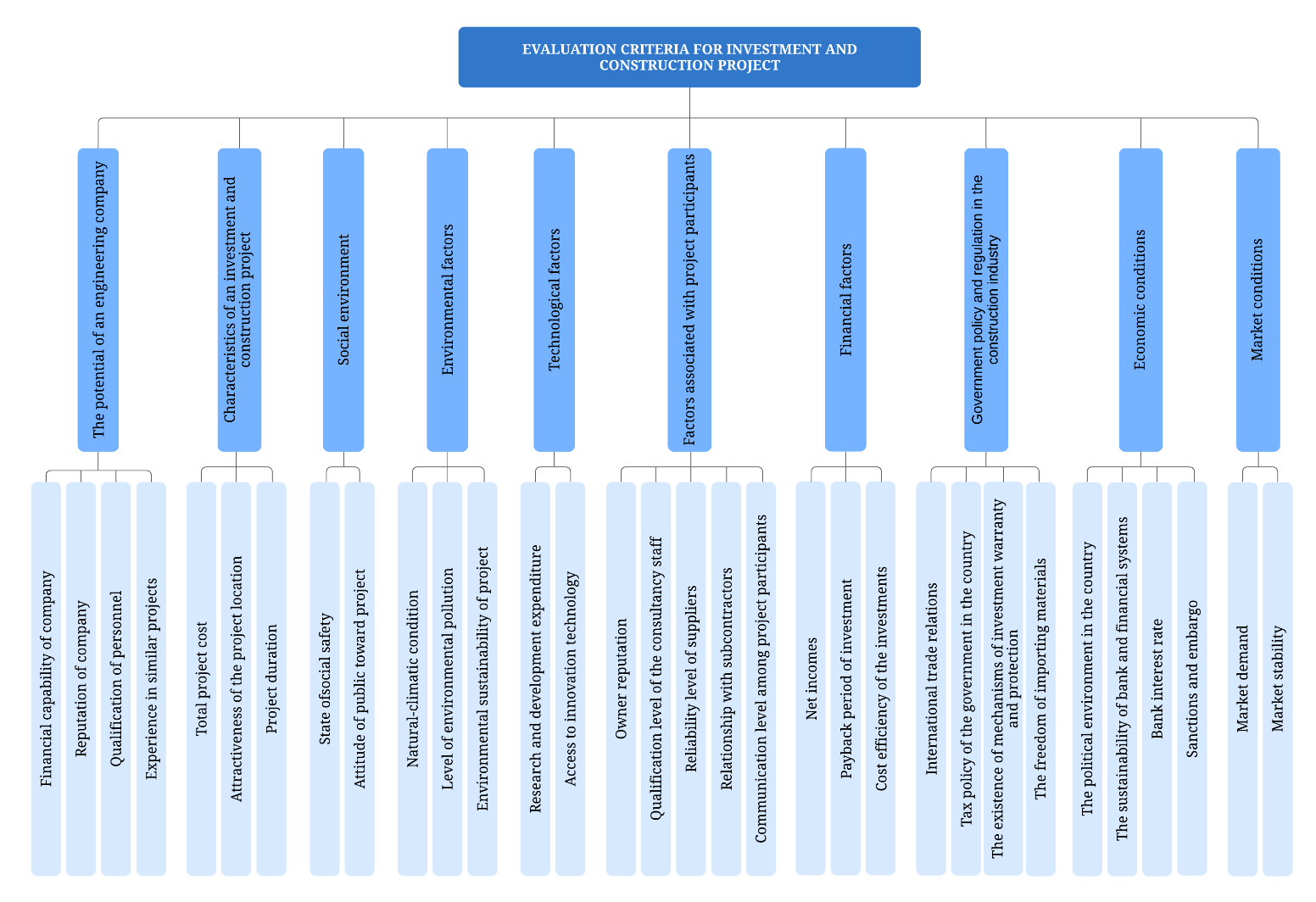

- The most important task in selecting alternative investment and construction projects is to establish a set of decision-making criteria by which the validity of the investment and construction projects is assessed. Knowing these criteria can provide a suitable basis for investors and decision makers to achieve goals in investment and construction activities.Research was conducted to identify the factors of uncertainty influencing the implementation of the investment and construction projects. The research was conducted in two stages. The first stage was to determine all possible criteria from a review of special and scientific literature, followed by a questionnaire with the identified criteria. The second step was to conduct a questionnaire survey of experts to identify the most significant factors of uncertainty.The literature review identified 130 criteria, which were categorized according to their source. Eleven categories were proposed, but were reduced to 10 during the expert survey. 18 experts participated in the survey, including practitioners and scientists related to the construction industry.As result of the study and expert surveys, the authors have selected those factors that are most important in the assessment of investment and construction projects by the investor and related with the following aspects:1. The potential of an engineering company. The engineering company must demonstrate that it has the capacity to implement the proposed project and experience in similar projects.2. Characteristics of an investment and construction project. This criterion acts as the initial attractiveness for the investor in its specified characteristics.3. Social environment. The analysis of the interests of the population, the evaluation of the adaptability of the project and, in general, the analysis of social risks in the chosen location.4. Environmental factors. Assessing the impact of the project on the environment and environmental protection measures.5. Technological factors. Allow determining whether the technology available and the level of availability.6. Factors associated with project participants. Successful completion of a project is largely dependent on the ability of the participants and their ability to work effectively together as a project team.7. Financial factors. Includes forecasting the financial return of an investment and construction project by analyzing investment cash flows.8. Economic conditions. Assessment of the prospects for political stability, the level of the internal demand, the availability of internal credit and prospects for future income.9. Government policy and regulation in the construction industry. Long-term stability of policy and regulation is critical to attract new investment. When rules change rapidly and regulation is unclear, it becomes difficult to decide on investment plans.10. Market conditions. These factors affect the potential commercial success of the project. They cover maintaining a competitive position, gaining market share, increasing sales, the duration of the product life cycle, market demand.The criteria above defined must be decomposed into sub-criteria to be more reliable assessment of investment and construction projects. A decomposition of criteria into sub-criteria is shown in Table 1.

|

|

| Figure 1. Hierarchical structure of criteria |

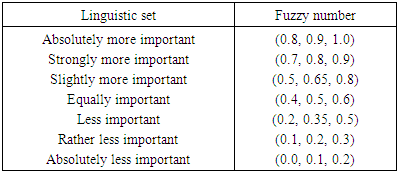

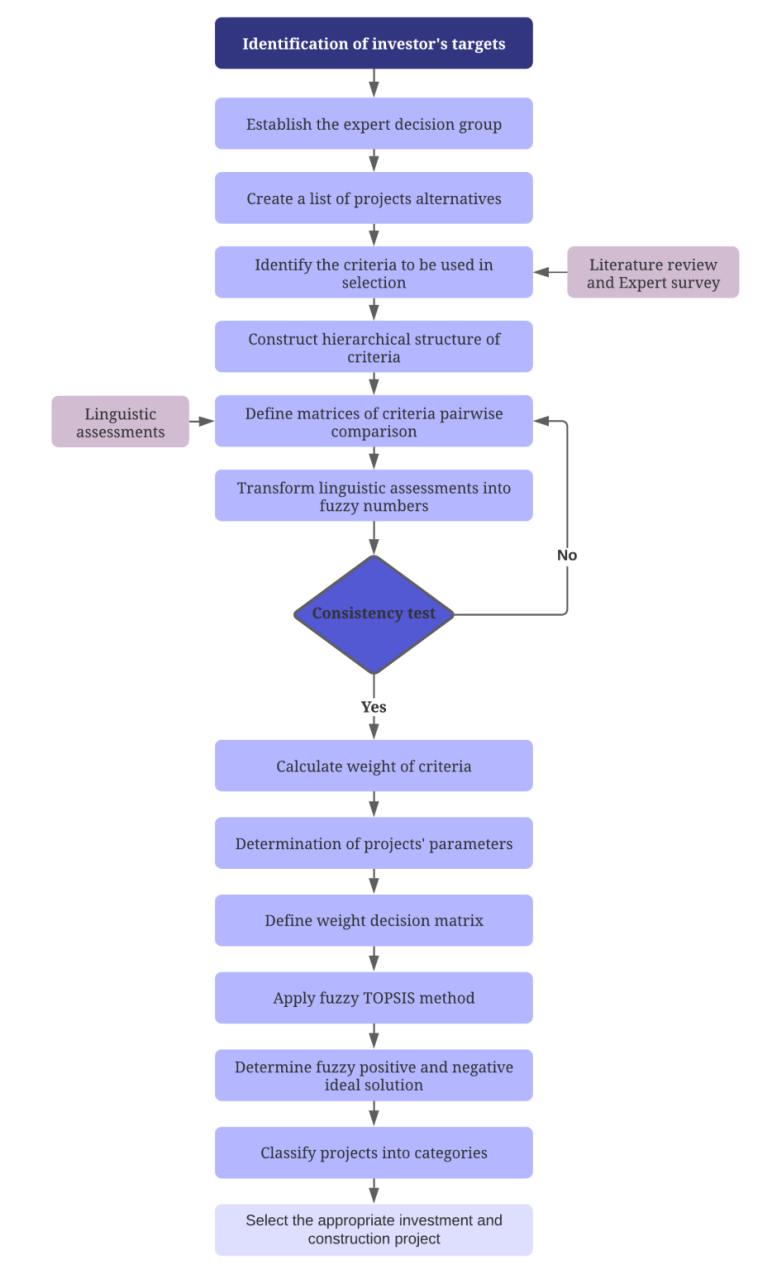

5. Proposed Model

- We propose a solution model for pre-evaluation of investment and construction projects based on fuzzy sets theory. The approach includes a multi-criteria assessment of alternative projects and the definition of their rating on the basis of TOPSIS. The stages of investment and construction project evaluation are shown in the model presented in Figure 2.

| Figure 2. Stepwise procedure for investment and construction project evaluation |

|

| (1) |

| (2) |

| (3) |

| (4) |

is the weight of the j-th criterion,

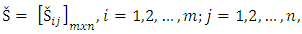

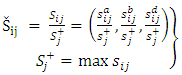

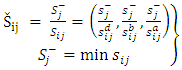

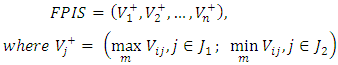

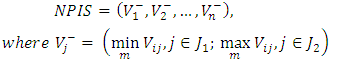

is the weight of the j-th criterion,  are elements of the normalized decision-making matrix.In the TOPSIS approach, an alternative is chosen as the optimal one that is closest to the fuzzy positive ideal solution (FPIS) and farthest from the fuzzy negative ideal solution (FNIS) [24].Step 3. Calculate the fuzzy positive-ideal solution (FPIS) and the fuzzy negative-ideal solution (FNIS) using the following formulas [23]:

are elements of the normalized decision-making matrix.In the TOPSIS approach, an alternative is chosen as the optimal one that is closest to the fuzzy positive ideal solution (FPIS) and farthest from the fuzzy negative ideal solution (FNIS) [24].Step 3. Calculate the fuzzy positive-ideal solution (FPIS) and the fuzzy negative-ideal solution (FNIS) using the following formulas [23]: | (5) |

| (6) |

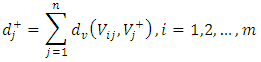

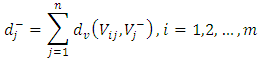

| (7) |

| (8) |

and

and  each alternative, the proximity coefficient is calculated:

each alternative, the proximity coefficient is calculated: | (9) |

CCj is an alternative efficiency measure. Therefore, in accordance with the proximity coefficient, the rating of all alternative projects can be determined, and the best one can be selected from a variety of alternatives.Step 6. Ranking of the alternatives in descending order of CCj value.

CCj is an alternative efficiency measure. Therefore, in accordance with the proximity coefficient, the rating of all alternative projects can be determined, and the best one can be selected from a variety of alternatives.Step 6. Ranking of the alternatives in descending order of CCj value.6. Conclusions

- Construction is an inherently risky and volatile industry. This is an activity with an increased level of risk caused by the uncertainty of a large number of factors. During the life cycle of an investment and construction project, uncertainties and risks arise due to developing and rapidly changing conditions, which, as practice and experience show, are associated with the characteristics of the project, economic, political, physical and social circumstances.Therefore, in such difficult and uncertain conditions of the construction industry, the analysis of the reliability of investment and construction project carried out at the pre-investment stage of construction activities is especially important for the investor in order to achieve successful results. That is, it is necessary to analyze as fully as possible potential investment and construction project in conditions of uncertainty using a reliable tool that would allow the investor to get the most reliable investment and construction project.The proposed approach, based on the theory of fuzzy sets, implies solving the problem of selecting investment and construction projects, which allows us to realistically assess their risk and reliability, taking into account the total influence of significant uncertainty factors.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML