-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2020; 9(5): 171-181

doi:10.5923/j.ijcem.20200905.04

Received: Nov. 11, 2020; Accepted: Nov. 30, 2020; Published: Dec. 15, 2020

Predicting Cost Over-run of Building Projects Using Public Procurement Requirements- A Case of Uganda

Julius Caesar Kwio-Tamale, Nathan Kibwami, Godfrey Mwesige

Department of Construction Economics and Management, Makerere University, Kampala, Uganda

Correspondence to: Julius Caesar Kwio-Tamale, Department of Construction Economics and Management, Makerere University, Kampala, Uganda.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Cost over-runs of building projects still persist in spite of the considerable research available on the subject. In Uganda, the arbitrary and deterministic contingencies of 0%-10% in building projects are routinely inadequate to contain cost over-runs of up to 52%. The construction industry therefore should not relent on continued research on this challenge. The purpose of this research was to develop a model that predicts cost over-runs of building projects using statutory public procurement requirements of bid time, performance bond, insurance, workload and experience of building contractors. These requirements are set and enforced by public procurement entities hence are relevant, easy to control and measure to high accuracy for predicting cost over-run. The study used change process theory because it forecasts construction changes like cost changes represented in this research by cost over-run. The principle of parsimony in regression modelling was applied to procurement requirements that correlate with cost over-run. Purposive and snow-ball sampling were used in survey of construction professionals, consultants and contractors of building projects with cost over-runs. Correlation and independence of procurement requirements on 37 cost over-run datasets were analysed by Spearman's bivariate correlation co-efficient and variable inflationary factor respectively. The prediction model explains 63% of cost over-runs with 9% margin of error. In the model, bid time, performance bond, workload and experience all reduce cost over-run except insurance amount that increases it marginally. The study demonstrates superiority of probabilistic models over deterministic models in determining cost over-runs. The small regulatory bid times of some procurement methods need to increase to reduce cost over-runs. The main contribution of this paper is the demonstrated potential alternative function of using public procurement requirements for predicting cost over-runs. This approach adds to and departs from the current use of public procurement requirements for only evaluating contractors to undertake building construction contracts.

Keywords: Building Projects, Contingencies, Cost Over-run, Public Procurement Requirements

Cite this paper: Julius Caesar Kwio-Tamale, Nathan Kibwami, Godfrey Mwesige, Predicting Cost Over-run of Building Projects Using Public Procurement Requirements- A Case of Uganda, International Journal of Construction Engineering and Management , Vol. 9 No. 5, 2020, pp. 171-181. doi: 10.5923/j.ijcem.20200905.04.

Article Outline

1. Introduction

- Cost over-runs are endemic in the construction industry in spite of the considerable research on the subject. The construction industry should therefore not relent on continued research to respond to this seemingly unending challenge. Most previous research on cost over-run have concentrated on their causes compared to prediction. Even among prediction studies, the very public procurement requirements used for eliciting services of contractors have not been used as an aggregate set to predict cost over-runs in building projects. This paper presents a novel approach of using public procurement requirements of bid time, performance bond, insurance, workload and contractor' experience as a second alternative function to predict cost over-runs in building projects. This approach adds to and departs from the current use of public procurement requirements for only evaluating contractors to undertake building construction works. [1] disclosed that construction contributes significantly to national economies. According to [2], construction accounts for 6-9% of Gross Domestic Product (GDP) in many countries. In Uganda, construction contributes over 12% of GDP and was the second largest employer after agriculture according to [3]. However, construction industry is faced with the global challenge of cost over-runs that affects over 90% of construction projects [1]. The report of [4] corroborated this global challenge by observing that adversarial pricing models for construction were still persisting in the United Kingdom (UK). This was in contrast to reduction of cost over-run by at least 10% as one of the key performance indicators that had been set by [5] to reform the construction industry in the UK. Governments regulate public procurement change orders through spending limits which is 25% in United States of America (USA) [6] compared to Uganda’s that was initially 20% under the Public Procurement and Disposal Authority (PPDA) Act (2003) and subsequently revised to 25% (PPDA Act, 2014). However, Uganda’s 25% public procurement change order spending limit is inadequate to mitigate the up to 52% cost over-run as reported by [7]. If unresolved, the situation will undermine national development strategies like Uganda Vision 2040 and National Development Programme III (2020-2025) that have construction as one of their key development pillars.[8] observed that construction cost over-runs were almost unavoidable due to the fragmented nature of the construction industry. Subsequent to the [5] report on reforming the construction industry with a 10% target in reducing cost over-runs, [9] reported in the UK that 48% (almost half) of construction industry professionals had acknowledged that cost over-run was still rampant. The unending problem of construction cost over-run was re-affirmed by [1] in observing that 90% of global construction was faced by cost over-run. Subsequently, [10] regretted the inaction on construction cost over-run because it causes disputes among construction project stakeholders. In Croatia, [11] recommended research on quantification of cost over-run of building projects. Several researchers like [12], [13], [14], [15], [16], [17] and [18] have reported extensively on the factors for construction cost over-run. A study by [7] on cost over-run in 30 public-sector projects in Uganda found that cost over-runs ranged from 11% to 52%. However, this study did not develop a model that predicts cost over-run. In contrast, [19] in Egypt developed a prediction model for cost over-run based on nominal variables from 30 water and sanitation projects. Although this study had high co-efficient of determination (83%), it had high double-digit standard error (34.8%) probably because of the dichotomous variables used. No previous studies have used public procurement requirements of bid time, performance bond, insurance amount, workload and experience as an aggregate set of independent quantitative variables to predict cost over-run. In view of this, this study sought to develop a model for predicting cost over-run of building projects based on these public procurement requirements. The main contribution of this paper is a model that uses public procurement requirements to predict cost over-runs. This potential use of public procurement requirements as a second alternative function adds to and departs from the current use for evaluating building contractors for award of undertaking building contracts. Predicted cost over-runs become contingencies to contain cost over-runs in project implementation. The main users of the model would be government procurement entities in ministries, departments and agencies. The model guides users to specify bid times, performance bonds, insurance amounts, workloads and experience in public building construction contracts to contain cost over-runs.

2. Theoretical Framework for Prediction of Construction Cost Over-run

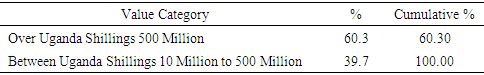

- This study was guided by construction change management model (also known as the Change Process Model) (CPM) advanced by [8]. The Construction Industry Institute (1984) in Austin-Texas (USA) postulated this theory for evaluation of construction changes as a component of project management. The theory forecasts construction changes like cost changes represented in this research by cost over-run. The CPM model uses historical causal factors to forecast construction changes. According to [20], linear regression model is good for the prediction of a scalar (i.e. quantitative) continuous dependent variable that is based on one or more independent variables. For good modeling, [20] argued that data for modeling should be discrete or continuous, relevant and numeric. The predictive importance of linear regression model was also shared by [21]. However, [20] warned that large number of independent variables should be avoided to minimize errors from interaction effects. Similarly, the principle of parsimony of [22] prefers regression with the least number of predictors among models of the same predictive power. In this research, construction change was cost over-run while the historical factors to predict it were public procurement requirements of bid time, performance bond, insurance amount, workload and experience. These procurement requirements are set and enforced by public procurement entities. They are robust, easy to measure with high accuracy, easy to control and therefore relevant for predicting cost over-run. Cost over-run is a quantitative continuous variable hence its prediction by linear regression complies with the rationale of [20]. Similarly, the use of five relevant predictors (i.e. bid time, performance bond, insurance amount, workload and experience) conforms to the principle of parsimony of [22].The principles and sequential stages of change process theory include identification of potential changes (in this case cost changes in form of cost over-runs), evaluation (by measurement), approval, implementation and review. Evaluation phase of change process model theory for cost over-run would be the respective specified quantities of bid time, performance bond, insurance amount, workload and experience set to mitigate cost over-run. The output of evaluation phase provides input for approval phase in terms of government policy in setting public spending order limits in building project budgets equal to or above contingency costs to mitigate cost over-runs. Policy outputs of approval phase provide inputs for implementation phase in enforcing public order spending limits in terms of realistic contingencies for managing cost over-runs. Review phase of the theory emphasizes the need and importance to periodically adjust contingencies through revision of public order spending limits and contingencies to contain cost over-runs that change overtime. In the absence of longitudinal surveys on cost over-runs, the review process is informed by cross-sectional surveys on cost over-run as is the case in this research.The evaluation phase of CPM conforms to the work breakdown structure for project costs of [23] as in Figure 1.

| Figure 1. Workbreakdown structure of typical project costs (Source: Project Management Institute 2013) |

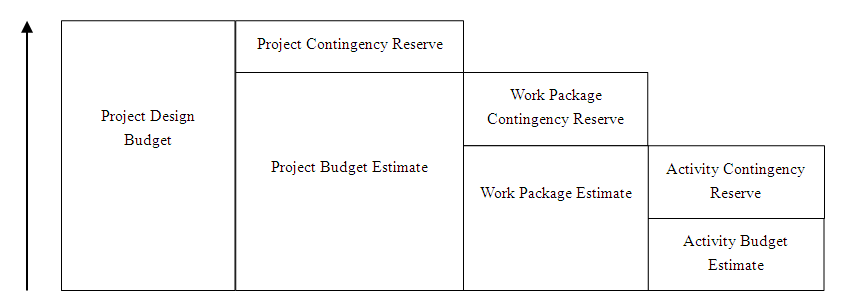

3. Conceptual Framework for Prediction of Cost Over-run in Building Projects

- Using micro-economic theory, [28] identified time as a risk factor for price escalation because of increase in production inputs. The influence of time on costs was also recognized by [19], [29] and [1]. In their studies, [12], [29] and [1] included inexperience as risks in setting inadequate contingencies for mitigating uncertainties that cause cost over-runs. Workload was also evaluated by [7] and [29] as a risk factor for cost over-runs. These three factors i.e. bid time, experience and workload are among the key factors that are set and enforced by public procurement entities in the procurement of contracts for construction works. These procurement requirements or factors are quantitative and easy to measure to high accuracy. Therefore, bid time, experience and workload together with other cost over-run risk factors like performance bond and insurance amount combine to determine cost over-run. The quantitative effect of these procurement requirements as independent variables of cost over-run in multi-linear regression model is shown in Figure 2.

| Figure 2. Conceptual model for predicting cost over-run in buildings |

4. Methods

4.1. Sampling Strategy

- Purposive sampling was used to target past building projects with cost over-run as units of analysis. To complement this approach, snowballing technique was used to identify and reach out to network of data sources in survey of past building projects with cost over-run as study population. Primary cost over-run data was obtained from project engineers, architects, quantity surveyors, design and supervision consultants and contractors who participated in the supervision and management of building projects that had cost over-run.

4.2. Sample Size

- The sample size was determined from the statistical formula of n ≥ (Z. σ / ɛ) ^2 where:n = Sample size,Z = Standardized 95% confidence interval variate,σ = Standard deviation,ɛ = Required error (precision).The 95% confidence interval standardized variate, Z = 1.97 is the minimum standard used in practical engineering and construction industry practice to comply with requirement for minimum "two-sigma" rule. Using the standard deviation obtained from [7] that was the most recent study on causes of cost over-runs in Uganda's public sector construction projects before this research, σ = 29.7%. The required error (precision) adopted was, ɛ = ± 10% (again from practical industry practice and professional experience).Substituting, n ≥ (1.97 x 29.7% / 10%) ^2 ≥ 34.23. The minimum sample size, n = 35. However, sample size used was n = 37 which (1) exceeds 35; (2) exceeds 20 (the required minimum number for regression analysis) and (3) exceeds the lower limit (i.e. 30) for statistically large sample in accordance with the central limit theorem.

4.3. Questionnaire Design

- The dependent variable was cost over-run measured as the positive (incremental) deviation from the original contract sum and expressed as percentage of original contract sum consistent with the definitions of cost over-run of [23], [26] and [1]. The independent variables were bid time, performance bond, insurance amount, workload and contractor' experience. To conform to quantitative study approach, the questionnaire was structured with close-ended questions for each data type. The key questions were: (i) what was the original contract sum?, (ii) what was the final contract amount?, (iii) what was the contingency percentage ?, (iv) what was the site possession date?, (v) how much was pre-contract bid time?, (vi) did the contract have a performance bond?, (vii) was the project insured and if so by what amount?, (viii) were there concurrent projects and if so how many were they? and (ix) what was contractor’s post-incorporation experience up to date of site possession?

4.4. Data Collection

- The change process model theory uses historical data to forecast construction changes. In this research, cost change in form of cost over-run was a construction change. Cost over-run was assessed as the difference between the higher final contract sum and the lower initial contract sum on every typical past building project. The historical data used to forecast cost over-run were public procurement requirements of bid times, performance bonds, insurance amounts, workloads and experience of contractors which were used on past building projects with cost over-runs. These were the five relevant prediction variables consistent with the principle of parsimony [22]. Difference between dates of bid invitation and submission provided bid times. Responses to questions on performance bonds and insurance amounts provided data on these particular variables. Information on the number of concurrent projects in the questionnaire provided workloads of contractors at start of building construction works. The difference between the contractor's year of registration and date of site possession provided contractor's year of experience. Contractor's year of registration was verified by crosschecking their dates of incorporation on the register of providers for works that is available on the website of Public Procurement and Disposal Authority of Uganda. The questionnaires were delivered and received through e-mails and personal deliveries and collections.

4.5. Data Analysis

- The conceptual framework that arose from the change process model theory requires cost over-run measured as percentage of original contract sum. To assess their predictive capacity, the correlation of procurement requirements of bid time, performance bond, insurance amount, workload and experience of contractors with cost over-run was assessed by Spearman's bivariate correlation co-efficient at 5% level of significance. The independence of these procurement requirements from one another as effective predictors of cost over-run to limit modelling error was assessed by collinearity statistics of variable inflationary factor of less than 5 (which is the same as tolerance of greater than 0.2). Analyses for descriptive statistics, inferential statistics and multi-variate regression modelling were performed by IBM SPSS V25.

4.6. Respondents

- Questionnaires were distributed to 23 industry professionals with request for each to provide as many responses on cost over-run from past building projects they had. Of these, 12 respondents provided cost over-run data giving a 52% response rate which is acceptable as per the standards of Ritson et al. (2012). Overall, 37 datasets were obtained that exceeded the minimum 34 sample size requirement as determined in section 4.2.

5. Results

5.1. Cost Contingencies and Cost Over-run of Building Projects

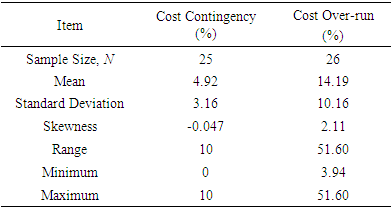

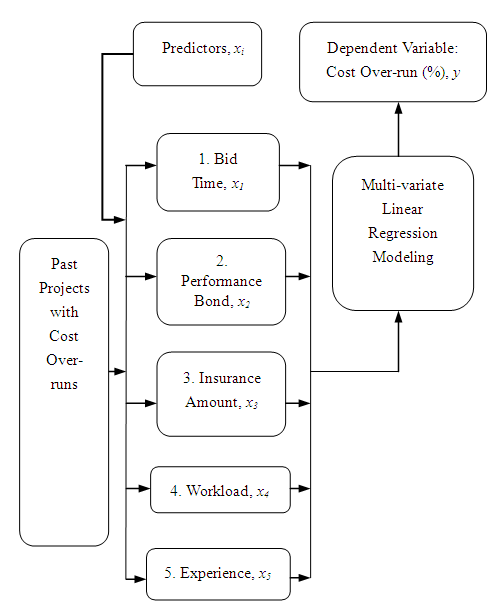

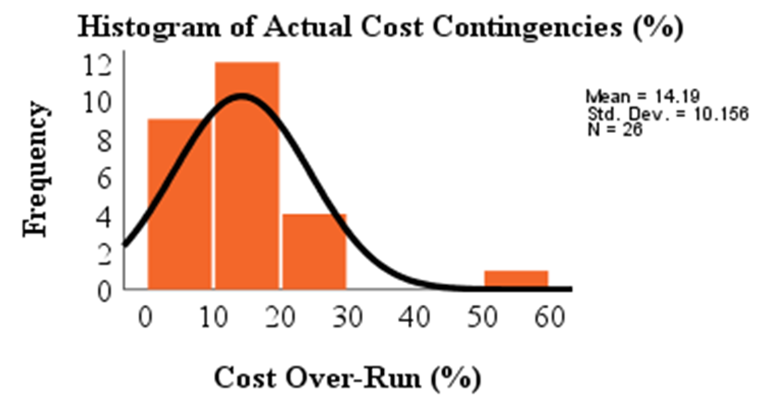

- Table 1 presents the descriptive statistics of design cost contingencies and cost over-run in public building projects.

|

| Figure 3. Frequency Distribution of Contingencies of Building Projects |

| Figure 4. Frequency Distribution of Cost Over-runs of Building Projects |

5.2. Correlation of Public Procurement Requirements with Cost Over-run of Building Projects

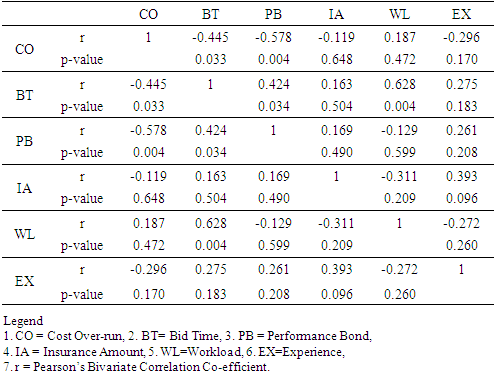

- Table 2 presents how each public procurement requirement relates to cost over-run.

|

5.3. Regression Models for Cost Over-run of Building Projects

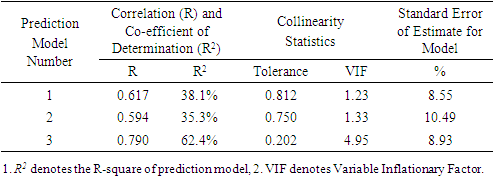

- Three regression models were developed based on (1) statistical significance only, (2) collinearity statistics only and (3) combination of statistical significance and collinearity statistics.

5.3.1. Prediction Model 1: Calibration Based on Statistical Significance

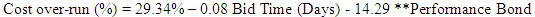

| (1) |

5.3.2. Prediction Model 2: Calibration Based on Collinearity

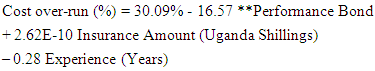

| (2) |

5.3.3. Prediction Model 3: Calibration Based on Statistical Significance and Collinearity

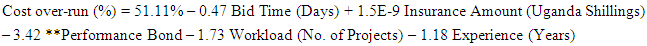

| (3) |

|

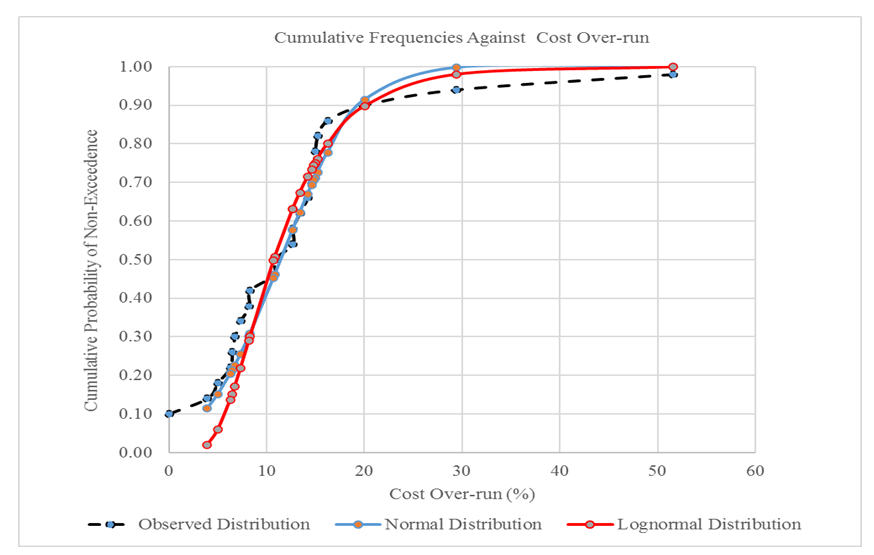

5.4. Frequency Distribution Fitting of Cost Over-run of Building Projects

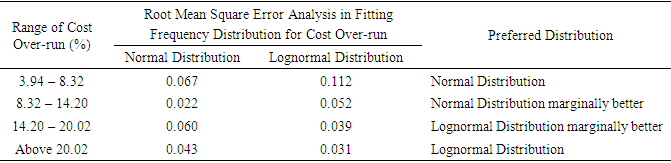

- Normal and lognormal frequency distributions were fitted to cost over-runs to assess which frequency distribution to use in other simulations such as Monte Carlo analysis. The Root mean square error (RMSE) analysis for these distributions is presented in Table 4.

|

| Figure 5. Comparison of Normal and Lognormal Distributions in Fitting Cost Over-run of Building Projects |

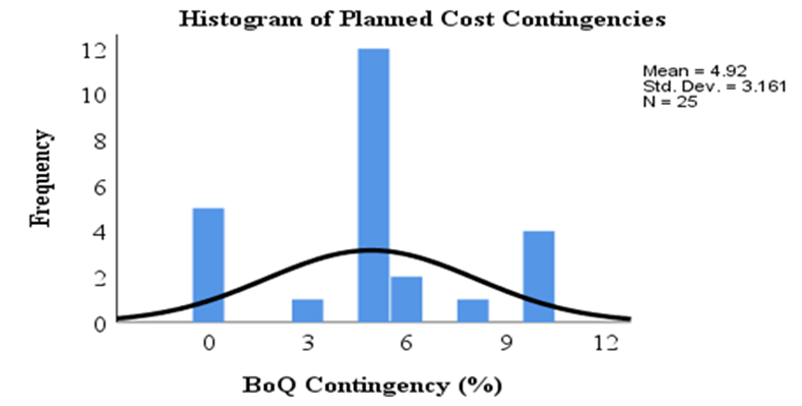

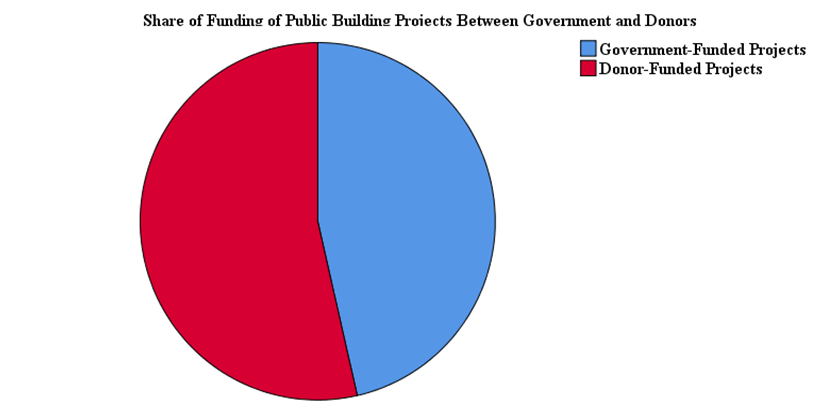

5.5. Funding of Public Building Projects

- The share of funding of public building projects was 46% (Government) to 54% (Development partners) as shown in Figure 6. The category of values of these projects was based on the classification of [30] as shown in Table 5.

|

| Figure 6. Share of Funding of Public Building Projects between Government and Development Partners |

6. Discussion

6.1. Cost Contingencies and Cost Over-run of Building Projects

- Cost contingencies provided in project budgets are assumed to be normally distributed as demonstrated by their skewness of - 0.047 that is marginally close to zero skewness for perfect normality. This current practice is hugely erroneous because cost over-runs are highly skewed at 2.11 that approaches the maximum theoretical positive skewness of 3.00. The implication of this is the persistent cost over-runs due to insufficient contingencies meant to contain cost over-runs. Therefore, the current cost contingencies provided in building project estimated budgets require review to cope up with realities of high cost over-runs.

6.2. Correlation of Public Procurement Requirements with Cost Over-run of Building Projects

6.2.1. Inverse Relationship between Bid Time and Cost Over-run

- As expected, cost-over-run decreased with increase in bid time. This is attributed to long tendering time that allows ample time for contractors to mobilize adequately for prospective contracts. This finding emphasizes the importance of adequate bid time to minimize cost over-runs. Long bid times enable contractors to prepare adequately by sourcing for building materials and equipment at discounted prices. Besides, ample bid time allows for thorough site investigation to understand the risks and challenges presented by construction sites so that mitigation measures for them are identified early enough with alternative low-cost solutions to address them.

6.2.2. Inverse Relationship between Performance Bond and Cost Over-run

- The apriori direct relationship between cost over-run and performance bond did not hold. Contract non-performance is punishable through liquidated damages. Consequently, performance bond restrains contractors from escalating costs due to unjustified claims of extra costs that inevitably would cause cost over-runs. This may be because contractors tend to tolerate current risks in the hope of potential gains from future jobs to offset and compensate current risks. This finding is consistent with the concept of risk attitude of [23].

6.2.3. Inverse Relationship between Insurance and Cost Over-run

- The apriori indirect (i.e. inverse) relationship between cost-over-run and insurance held. Insurance covers operational risks related to implementation of building projects. Insurance of labour, materials, equipment and built works commits financial resources through third parties (e.g. insurance firms and commercial banks) in delivery of contracted works. Insurance costs money which compels contractors to inflate construction budgets to absorb it. This ultimately results in cost over-run.

6.2.4. Direct Relationship between Workload and Cost Over-run

- As expected, the direct relationship between workload and cost over-run held. Heavy workload reduces cashflow and other available resources of contractors from being used effectively and efficiently in managing projects. Inadequate resources distract contractors from complying with contractual specifications. Consequently, costly mistakes result that increase construction cost.This direct relationship between cost over-run and workload corroborates the findings of [7] and [29] on work overload as one of the risk factors for cost over-runs. The reduction of cost over-run by workload supports [23] rationale of risk attitude in terms of risk appetite, risk tolerance and risk threshold. Contractors anticipate reward from high workload that influences them to minimize costs. The practice of specifying limits of workload in bid invitations by procurement entities should therefore be promoted and upheld.

6.2.5. Inverse Relationship between Experience and Cost Over-run

- The apriori inverse relationship between cost-over-run and experience held. Good estimating safeguards against inadequate contingencies for mitigating unpredictable events that cause uncertainties that results in cost over-runs. Construction experience informs construction management about types of risks, when risks are likely to occur and how to mitigate them early enough at low costs. This compares well with [29] and [1] who observed that experience facilitates good project management in general and cost management in particular. Procuring entities are encouraged to uphold the practice of specifying adequate contractor’ experience in undertaking public works.

6.3. Effect of Structure of Prediction Model of Cost Over-run on Building Projects

- Bid time reduces cost over-runs by almost half (47%) of bid time. This property is important for reducing the large additive model constant of 51%. Building contracts procured through long regulatory bid times would perform better in reducing cost over-run in contrast to building works with short regulatory bid times. Sensitivity analysis of building contracts with bid times of 30, 60, 90 and 120 days would according to the developed prediction model reduce cost over-run by 14%, 28%, 42% and 56% respectively. Therefore, on account of bid time alone, building contracts with bid times of 120 and above reduce cost over-run by over 56% that completely neutralizes the high additive model constant of 51%. The reduction of cost over-run by a constant amount of 3.42% due to performance bond is realized significantly on building projects with high contract sums. Regarding experience, sensitivity analysis of building contractor' experience of over 10 years reduces cost over-run by over 12% which is very significant in view of the endemic cost over-runs experienced between 0% - 52%. Increase of cost over-run by insurance is marginal because the Public Procurement and Disposal Authority of Uganda, African Development Bank, International Federation of Consulting Engineers, World Bank and other multi-lateral financing institutions specify insurance amounts that rarely result in high increment of cost over-run as per the structure of this prediction model. Given that four (i.e. bid time, performance bond, workload and experience) out of the five public procurement requirements all reduce cost over-run, the increase in cost over-run by insurance amount that is marginal can be reduced to near zero or completely.

6.4. Annual Procurement Workplans for Building Construction Projects

- The Public Financial Management Act (2015) of Uganda requires that by 30th June of every year, budgets of government ministries, departments and agencies must have been approved by parliament before start of financial year on 1st July of every year. This requirement affects lead times of procurement of public works. According to the models developed in section 5.3, it is prudent to extend bid times of smaller works more compared to those of larger works to reduce the large additive model constant of 51% on cost over-run. Using this model, the combined effect of bid time and performance bond on reducing the high model constant of 51% is pre-determinable at tender stage. The other predictor's namely insurance amount, workload and experience are not known during pre-contract period until after contract award. Consequently, variants of prediction model for cost over-run based on minimum bid times for the different public procurement methods are possible.

6.5. Management of Administrative Actions on Bid Submission Deadlines

- Administrative review is the process of handling complaints on procurement-related matters. One of such complaints often arise from prospective contractors on disputes of adequacy of bid time to submit responsive bids within submission deadlines. Longer bid time allows contractors to prepare adequately and thus reduces incidences of administrative reviews related to adequacy of time to bid. In so doing, the longer bid times neutralize the high model additive constant of 51% as discussed in the structure of prediction model in section 6.3. Depending on different procurement methods, guidelines of the [30] specify bid times from five (5) to 180 working days. The corresponding contribution of bid time alone in reducing cost over-run based on these statutory bid times would range from about 3% to 90%. Evidently, substantial reduction can thus be achieved on procurement methods that offer long bid times.

6.6. Comparison of Prediction Models for Cost Over-run of Construction Projects

- The prediction model of [19] for cost over-run had high co-efficient of determination of 83% with relatively high double-digit margin of error of about 35%. The sample size used by [19] was 30 compared to the 37 in this research. However, this research produced above average co-efficient of determination of 63% with relatively better low single-digit margin of error of about 9%. This difference may be due to the nominal dichotomous variables used in [19] compared to the quantitative continuous variables used in this research. Nominal dichotomous variables tend to capture extremities of variation hence their high co-efficient of determination and high margins of error. In comparison, quantitative continuous variables capture all possible values on the continuum of variation hence their resultant modest co-efficient of determination with low margins of error. The difference in number and type of predictors (i.e. five quantitative predictors in this study compared to eight qualitative predictors in the study of [19]), type of projects (building projects in this study as opposed to water and sanitation projects in the study by [19]), country context (Uganda versus Egypt) and time separation (2019 versus 2015) could have been among some of the factors that account for the differences between these two studies. The several (eight) nominal predictors in the study of [19] could have enhanced their dependence due to autocorrelation. This could have defied the principle of parsimony of [22] and [20] compared to the fewer (five) quantitative predictors in this study whose collinearity statistics were all within the acceptable limits specified by [31]. This probably explains the high model standard error of 34.8% in the study of [19] compared to the much smaller model standard error of 8.93% in this study.

6.7. Neglect of Prediction Model for Cost Over-run of Construction Projects by some Previous Studies

- As observed in section 1, majority of previous works on cost over-run of construction projects have been on the factors that cause them. The economic choice theory for rationale of [28] and the studies of [7] and [29] attest to the shifting significance of cost over-run factors with time. The complex and continuous interactions of socio-economic, political, technological, environmental and legal matters influence procurement and implementation of construction projects is key socio-economic development. Combination of multi-dimensional cost over-run factors and their interactions inevitably introduces temporal scale (time-related) uncertainties that affects model performance. Such changes probably demotivate some researchers in developing models that may not last long before the need to review and redevelop new ones.

6.8. Application of Concept to Other Construction Works in the Country

- There are similarities in different construction sectors such as building works, road works, water and sanitation works. Elements such as foundation works, equipment and even human resource is common to all these construction subdivisions. Indeed, some construction companies engage in all these sectors without specializing in any. This case study was specific to building projects. The findings of the study should be applied with caution to construction projects other than building projects for general planning. Therefore, similar studies are recommended in the road and water sectors.

7. Conclusions

- Previous research on construction cost over-run has focused extensively on their causal factors. These factors, that are moreover treated deterministically, have not been used adequately to predict cost over-runs. Using public procurement requirements of bid time, performance bond, insurance, workload and contractor' experience, this research developed a probabilistic model to predict cost over-runs in building projects. The deterministic contingencies in building project budgets for containing cost over-runs are practically normally distributed with very small skewness of negative 0.047. However, cost over-runs are highly skewed with skewness of 2.11 that tends to the maximum theoretical skewness of 3.00. This demonstrates the inappropriateness of the current use of arbitrary and deterministic contingencies to mitigate cost over-runs in building projects.The structure of the developed model for predicting cost over-run has a high additive model constant of 51% and constant addition of about 4% from insurance amount. For the model to be effective to reduce cost over-runs, this combined approximate 55% should be neutralized as much as possible. The structure of the model uses bid time, performance bond, workload and experience to reduce cost over-run. The implication of this model on public procurement and contract management include the need to revise standard bid and contract documents on amounts of bid time, performance bond, workload and experience. Short statutory bid times should be increased to reduce cost over-runs substantially. If the mix and relative quantities of bid time, performance bond, insurance amount, workload and experience in procurement of building contracts are optimized well, the overall reduction on cost over-run has the potential of achieving desirable cost under-run.Pre-contract knowledge of different bid times and performance bond status for building contracts can be used to develop variants of the developed prediction model for each procurement method. The different variants of prediction model for open international bidding, restricted international bidding, open domestic bidding, restricted domestic bidding and requests for quotations enhances multiple model simulation in evaluating uncertainty of model structure to improve model performance.Assumed normality is potentially erroneous in Monte Carlo simulations that require prior knowledge about the type of probability distribution. It is therefore necessary to first determine the type of probability distribution and their range of application before any Monte Carlo simulations in order to obtain more accurate and desirable results.

ACKNOWLEDGEMENTS

- We are grateful to all the project managers, engineers, architects, quantity surveyors, consultants and contractors of past construction projects who provided us with historical data used in this research.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML