-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2018; 7(4): 133-152

doi:10.5923/j.ijcem.20180704.02

Forms and Adequacy of Risk Sharing in Building Construction Projects in Tanzania

Novatus A. Mikapagaro, Julieth Germin

Department of Building Economics, Ardhi University, Dar es Salaam, Tanzania

Correspondence to: Novatus A. Mikapagaro, Department of Building Economics, Ardhi University, Dar es Salaam, Tanzania.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Risk sharing is one among the strategies for managing risk and it involves handling risk by selecting the most economical way of sharing based on the characteristics of the risk. Insurance, bond, warranty, surety, subcontracting, subletting and joint venture are among the forms of risk sharing used in building construction projects. This study aimed at assessing risk sharing through examining its forms and determining their adequacy. Moreover the study investigated and put forward measures that could be taken on board so as to attain successful building construction projects based on appropriate forms of risk sharing. The study was conducted in Dar es Salaam Tanzania involving clients, consultants, contractors, sub-contractors, bank institutions and insurance companies. The study found out that, bond, insurance and subcontracting are the most preferred and most adequate forms of risk sharing in construction projects in Tanzania. Besides, subletting, warranty and surety were moderately preferred and moderately adequate forms of risk sharing. Reviewing and approving contents of premium charges and time limits, improving the structure and amendments of conditions of contract to include other forms of risk sharing are some of the measures proposed by the study so as to improve risk sharing for successful construction projects delivery.

Keywords: Forms, Adequacy, Risk Sharing, Building Construction Project

Cite this paper: Novatus A. Mikapagaro, Julieth Germin, Forms and Adequacy of Risk Sharing in Building Construction Projects in Tanzania, International Journal of Construction Engineering and Management , Vol. 7 No. 4, 2018, pp. 133-152. doi: 10.5923/j.ijcem.20180704.02.

Article Outline

1. Introduction

- The Tanzanian construction and real estate sector continues to be the two very exciting and developing sectors in the Tanzanian economy. The construction sector is currently experiencing a period of growth that has primarily been driven by the recent development in roadwork, housing and mining [4]. According to Tanzania Construction Sector Report [48] the share of the construction sector in the Gross Domestic Product (GDP) increased to 13.6% in the year 2015 from 7.8% in the year 2010.Managing risk in the building projects has been recognized as the very important process in order to achieve project objectives in terms of time, cost, quality, safety and environmental sustainability [54]. Authors such as Royer [43] and Turner [50] have mentioned that risk management is an important part of the project management to ensure completion of any building project. Risk management should be its own process in the project processes and phases [11, 25]. Risk management process involves four steps which are risk identification, risk analysis, response development and risk control [1, 6, 25, 10].Risk response is the way of developing strategic options and determining actions to reduce threats to project objectives. Risk response is the third step of risk management process which indicates what actions to be taken towards the identified risks. Most common risk response strategies are avoidance, reduction, retention, transfer or share [52]. As stated by Hillson [21] risk response development is often the weakest part of the risk management process. The proper management of risk requires that they be identified and allocated in well-defined manner; this can only be achieved if the contracting parties in building project comprehend their risk responsibilities, risk event coordinating and risk handling capacities [36].The concept of risk sharing as one of the strategies of the risk response development in managing risk is rapidly gaining acceptance among owners in the construction industry. Risk sharing is a way of handling risk where by the decision does not go deep into the method of handling risk itself, instead discussion is made on the most effective way of handling the risk or selecting for the most economical way of sharing in accordance with the characteristics of the risk [28]. Authors like Florial & Miller [19] suggested establishing shared financial safety reserves for mitigating crises when they happen and others like Zaghloul & Hartman [53] emphasized an adequate risk sharing to be the kind that would give benefits of risks not occurring in all parties in construction contracts.According to Banaitine and Banaitis [7] achievement of objectives of a building construction project requires proper address of the risks that would face the project. Despite having several risk response strategies, building construction projects in Tanzania are still suffering from time delays and cost overruns [24, 12, 23, 31]. In order to improve the performance of the building construction projects some studies signify casual linkage between proper implementation of risk management and project success [47].There exist various forms of risk sharing such as insurance, bond, warranty, surety, subcontracting, subletting, joint venture and partnership. However, despite their existence, there are still a number of contractual claims in building projects [30, 35, 16, 9, 14, 42, 22, 39]. This study therefore, aimed at assessing various forms of risk sharing used in building construction projects and determining their adequacy so that appropriate measures for attaining successful risk sharing among parties involved in building construction projects could be proposed.

2. Literature Review

2.1. Project Risk Defined

- Risk has been defined in different ways by different authors [52, 51, 15, 46, 13, 13] but generally it refers to lack of knowledge of future events or outcome. It is a measure of probability or likelihood of occurrence and magnitude of impact of an event over the project objectives. Risk can also mean a chance of occurrence of an event which can adversely or favorably affect the objectives of the building construction project.

2.2. Project Risk Management (PRM)

- PRM is one among the nine knowledge areas recognized and advocated by the Project Management Institute (PMI) through its famous Project Management Book of Knowledge (PMBOK) Guide [38] Other knowledge areas which are typical to almost all projects are: project cost management, project time management, project quality management, project scope management, project procurement management, project human resource management, project communication management and project integration management. The fact that construction projects can be complex and unpredictable, the project manager can identify key knowledge areas to focus on so that the intended outcome of the project is achieved.

2.3. Risk Management Process (RMP)

- RMP is the systematic approach to risk management which involves four fundamental steps [3, 2, 41, 5, 38, 40, 15, 46], namely: identification of risks, analysis of the impacts of the risks, development of responses to the risks, control and monitoring of risks and risk responses.RMP is important in order to reduce the likelihood of occurrence of risk events and the magnitude of impacts to enable the project manager to take more risks by moving towards a risk- neutral decision making point. Therefore, as a process, RMP should be cyclic and dynamic in nature and is important to be established early in a project and continually be addressed throughout the project lifecycle and it should be proactive rather than reactive [46, 17, 3].

2.4. Risk Sharing

- Being one of the risk response strategies, risk sharing (also known as risk transfer) involves shifting some or all risk responsibilities which are likely to face the building construction project to the party that is in better position in terms of resources and knowledge to manage them [37, 49, 8]. It is advised that risks (such as those related to politics, labour strikes and natural hazards) which occur rarely and are beyond the control of project manager can be transferred to other parties through insurance policies [52].Decisions on the appropriate risk sharing between the parties to contract must be done based on the ability and willingness of the parties to manage risks and bear the associated risk consequences [45, 11, 28]. Ability to manage risks and its associated consequences is determined by the knowledge, resources and experience of the party to which the risks are transferred to. According to Kordas [27] in order to minimize contingency costs of building projects, there is a need for formation f risk sharing agreement between parties so as to attain the optimal risk sharing ratios.

2.5. Forms of Risk Sharing

- Risk sharing between parties in the building construction projects can be done in different modalities. The choice of a form of risk sharing depends on the strength of such particular form of risk sharing. There exist various forms of risk sharing [30, 35, 16, 9, 14, 42, 22, 39] such as insurance, bond, warranty, surety, subcontracting, subletting, joint venture and partnership.

2.5.1. Insurance

- Insurance is coverage by a contract binding a party to indemnify another against specified loss in return for premiums paid. In Tanzania, since independence there was a state monopoly of the insurance business whereby the state owned National Insurance Corporation (NIC) was the only agency dealing with insurance business but the situation changed in the early 1990’s where reforms were done and private insurance companies started venturing into insurance business [30, 22].Building construction projects are prone to many risks but not all risks can be transferred from one party to another by insurance. According to Omidvar, [35] apllicabel risks under insurance include business interruption risk, political risks, construction accidents risks, employee/third party fraud risk, cost overrun risks, interest rate risk, natural hazard risk, health and safety risks, project allocation risk, pollution risks, site security and safety risks, product/service failure risk, vandalism/terrorism risk, third party bodily injury risk, environmental risk and supply chain risk.Inspite of its wide usage as a form of risk sharing in building construction projects, insurance has several limitations such as it excludes many other risks likely to face the projects, large variations between insurance coverage and premium charged, delayed compensations after the risks have occurred and poor service offered by insurance companies.

2.5.2. Bond

- A bond is a promise by deed whereby the one giving the promise (the surety) promises to pay sum of money if the contractor defaults the contract. Deed is signed and usually is a sealed instrument in written form containing some legal transfer which confirms an interest. In building construction projects, bond is undertaken by the third party (surety) that in the event of the contractor failing to perform or being determined under the contract, the surety will complete the works or engage others to complete the works and bear any additional cost to if any (up to the limit of the surety bond amount) or he will pay the employers an amount specified in the contract as amount of surety bond [30, 36, 49]. Applicable risks under bond include inflation where a part of the funding can be provided as an index-linked loan, in which the principal and interest payments are indexed against inflation [35].

2.5.3. Warranty

- Building construction projects are governed by the contracts where employer and contractor are the main parties to the contract. Contractors may further enter into contracts with subcontractors and suppliers for carrying out specialist works and supplying of materials and goods respectively. In this regard, if the subcontractor or supplier guarantees the quality of the works or goods in consideration of the employer in case of any default or loss then warranty agreement becomes binding and the employer can sue the subcontractor or supplier for the breach of warranty. In this case risks are transferred from the contractor to the subcontractor or supplier. Applicable risks under warranty are those related to performance and quality [30, 35].

2.5.4. Surety

- Surety is an agreement providing for monetary compensation should there be a failure to perform specified acts within a stated period. In the context of building construction project, surety bond is a financial instrument used generally when the first party (employer) has an agreement with a second party (contractor). This financial instrument serves as a guarantee to the first party from a third party (Surety Company) that the construction works (the contractor’s obligation) will be completed according to the terms and conditions within a written contract. In other words, a surety bond is a risk transfer mechanism that shifts the risk of contract default from the project owner to the surety. Surety bond may guarantee the performance of the contractor, advance payment, bid/tender, payment by employer and fidelity of the project manager. In practice, surety bond premiums are paid by contractors and premiums rates are influenced by a number of factors such as contractors’ financial strength; past experiences/ performance/ reputation; business capacity; and business continuity [35, 30].

2.5.5. Joint Venture

- Given the nature of the construction activities which are complex, risky and sometimes unpredictable, two or more parties can join efforts to pursue a specific undertaking based on the agreed terms and conditions of forming the joint venture. In the joint venture agreement, clear meeting of minds among parties involved is essential for successful project delivery. A good joint venture agreement is the one drafted in simple language and clearly defines each party’s responsibilities and liabilities. Under joint venture risk sharing agreements, applicable risks include natural hazards, delay in resolving disputes, buildability and constructability, public disorder, cost of legal process, guarantee of existence, change order evaluation and negotiation, delays in resolving contracting issues, conflict in documents [16, 9, 35].

2.5.6. Sub-contracting

- In the context of construction projects, subcontracting involves giving part of the works by the general contractor to another person or organization (i.e. sub contractor) under specific agreements. In practice, specialist works such as electrical, plumbing and mechanical installations are the mostly subcontracted. Sub contracting can be in two arrangements i.e. nomination and domestic. Under nomination arrangement, the project manager is expressly empowered by the provisions of the contract to nominate other persons to carry out specialist works as sub-contractors; the general contractor is then required to enter into contract with the nominated subcontractor. Domestic arrangement involves the general contractor selecting and entering into a contract with the specialist of his own choice. This arrangement is not recognized in the main contract hence passing risks to domestic subcontractors especially with respect to payment [30, 39].Subcontracting arrangements appear to be attractive to general contractors since they transfer some of the risks and uncertainties to subcontractors through the subcontracting agreements which are required to equally allocate risks between the parties. On the other side, subcontracting arrangement may be a burden to general contractor in situations where the subcontractor does not perform well in terms of time and quality which may lead to poor quality and non completion of the works. Some subcontractors however blame the general contractors for imposing more financial risk by pressurizing them to reduce their tender prices through negotiation. General contractors are also blamed for delaying to issue drawings and specifications to subcontractors at the same time pressurizing them to complete the works as per the main work program [14, 39].

2.5.7. Sub-letting

- Subletting refers to a situation whereby general contractor transfers part or whole of his rights and obligations to a third party (i.e. Sublette). This is commonly done in situations where the general contractor feels that someone else (a sublette) is capable of carrying out the works quicker, more effectively and economically. This is not only applicable to specialist works but rather, any parts of the works can be sublet to a Sublette and this is more practical for large contract works. In order to ensure that general contractor does not take advantage of subletting opportunity to escape from his duty of carrying out the works to completion, provisions in the main contract require the general contractor to seek for a consent from the employer and ensure that works are sublet to a competent Sublette [30].

2.5.8. Partnership

- Partnership involves two or more companies or organizations working together across contractual boundaries based on agreed and understood mutual objectives, methodology for quick and cooperative problem resolution and culture of continuous measurable improvements. Despite the fact that partners have common agreement on the objectives and problem resolution methodology, still each partner retains his/her independence and may gain or suffer from the relationship [42, 22, 5]. Critical review and assessment of all pre and post contractual agreement inherent risks must be done carefully and addressed risks need to be shared and managed based on each partner’s responsibilities and liabilities. Areas which are prone to risks in partnership include understanding of partnership objectives, authority and responsibility definition, resilience of the partners and partnership approach towards problem solving [36, 35].

2.5.9. Alliancing

- It involves co-operative arrangement between two or more organizations aiming at achieving the set objectives. In building construction projects, alliancing can be set as one of the criteria for evaluating and selecting tenders so as to encourage more cooperative relationships among construction practitioners. Unlike partnership, in alliancing the alliance parties form a cohesive entity that jointly shares risks and rewards to an agreed formula. It is advised that alliancing must be formed based on trust, commitment, interdependence, communication, cooperation and joint problem solving [42, 22, 57].

2.5.10. Relational Contracting

- Relational contracting is a long term and substantial relations based on recognition of mutual benefits and win-win scenarios through more cooperation between the parties. Relational contracting is said to be appropriate in complex construction projects whose successful completion requires more cooperation among the involved parties [42]. It embraces and underpins various approaches such as partnering alliancing, joint venturing, and other collaborative working arrangements and better risk sharing mechanism [39].

3. Methodology

3.1. Study Design and Population

- The study is descriptive, designed to obtain views from contractors, consultants, public and private clients, subcontractors, bank institutions and insurance companies located in Dar-es-salaam, Tanzania with regards to forms and adequacy of risk sharing as a risk management strategy in building construction projects. Descriptive design was adopted since its major purpose is to describe the state of affairs of situations or phenomenon as they exist [26].In order to maximize strengths and minimize limitations of each, mixed approach i.e. quantitative and qualitative approaches were used where questionnaire and interview surveys were employed as data collection instruments.

3.2. Sample Determination

- Sample was determined in two stages. First stage involved twenty three (23) extreme cases of consultants, public and private clients, subcontractors, bank institutions and insurance companies who were purposively selected based on their knowledge and experience in risk management issues in building construction projects and their willingness to share the required information. Purposive sampling was preferred because the researchers targeted only those respondents believed to be reliable for the study.Second stage involved twenty eight (28) building contractors in classes I – IV located in Dar es Salaam. Stratified random sampling method was adopted to draw a sample from each class of building contractors. This method was preferred because in Tanzania building contractors are registered in seven different classes depending on their financial and technical capabilities.

4. Results and Discussion

- The study assessed forms and adequacy of risk sharing as a risk response strategy in building construction projects in Dar es Salaam, Tanzania. Examination of forms of risk sharing involved establishing the reasons for and extent of their application while their adequacy was determined by establishing relationship between the theoretical knowledge on the adequacy parameters and what is practically done in building construction projects. Moreover the study investigated and put forward measures that could be taken on board so as to attain successful building construction projects based on appropriate form of risk sharing adopted.

4.1. Forms of Risk Sharing Used in Building Construction Projects in Tanzania

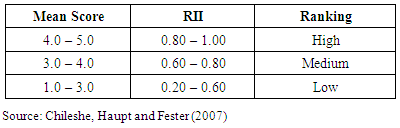

- Based on the literature, the study identified eleven (11) forms of risk sharing namely subcontracting, subletting, warranty, bond, surety, insurance, joint venture, partnering, alliancing, relational contracting and risk partitioning. Thorough examination of the forms of risk sharing was done so as to establish the reasons for and extent of their application.The fact that the sample for the study is relatively small, data was analyzed by combining groups of respondents (consultants, contractors, public and private clients) so as to have significant results. Data was analyzed by calculating frequencies and Relative Importance Index (RII). The RII was calculated as follows: RII =ƩW/AxNWhere: W = Weight given to each factor by respondentsA = Highest weightN = Total number of respondentsFor ranking purposes, the RII comparison table was adopted which considered the mean item scores and the RII as shown in Table 1 below:

|

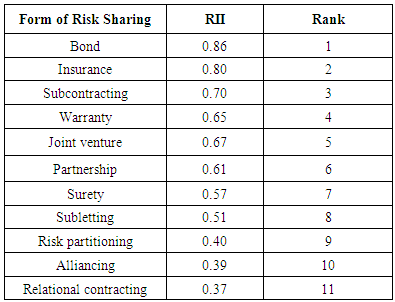

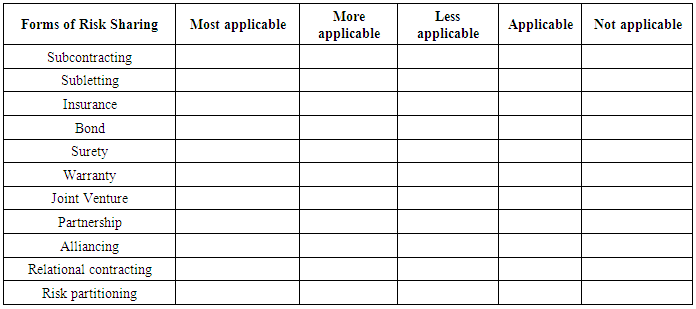

4.1.1. Extent of Application of Forms of Risk Sharing Used in Building Construction Projects in Tanzania

- The identified forms of risk sharing were listed and the respondents were requested to rank them based on the 4 – point scale ranging from 5 – most applicable to 1 – Not applicable. The results were as shown in table 2 below:

|

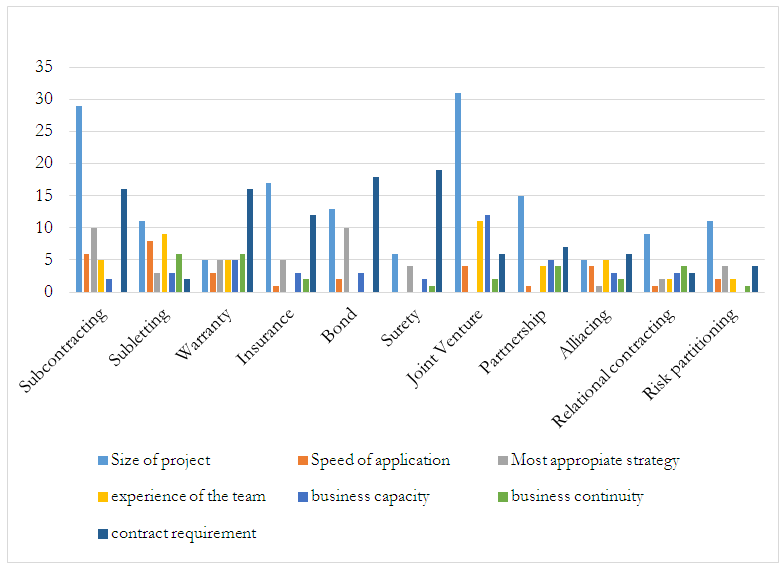

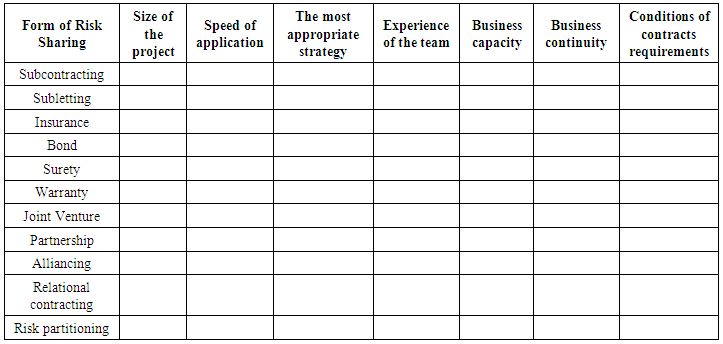

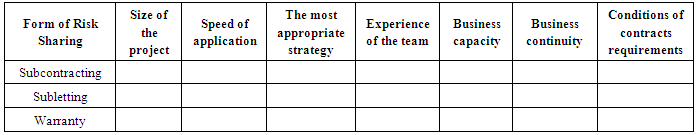

4.1.2. Reasons for Application of Forms of Risk Sharing Used in Building Construction Projects in Tanzania

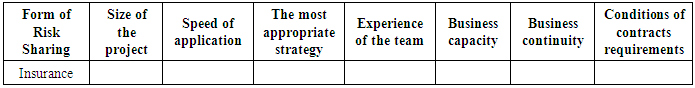

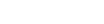

- Figure 2 below shows the results regarding reasons which pushed various practitioners to apply certain form of risk sharing strategy in building projects.From figure 2, results show that, size of project, contract requirement and strategy appropriateness are the major reasons for application of subcontracting as a risk sharing strategy in building projects. These reasons are also reflected in the study by CIDB [14]. Again, size of the project, experience of the team and speed of application stand out as major reasons for application of subletting as a risk sharing strategy in building projects. These findings are also consistence with Lukonge [30] where he noted that subletting is preferred by main contractors who feel that they could not perform on their own rather someone else can carry out the works quicker, more effectively and more economically.Furthermore, requirement by the contract is the major reason for application of warranty, surety and alliancing as risk sharing strategies in building projects. Again, this finding is reflected in the study by Lukonge [30], Omidvar, [35] and Jeffeeries et al., [22] where they noted that all the three risk sharing strategies involve collateral agreements between the party to the contract and the third party. For insurance and bond, major reasons for their application as risk sharing strategies in building projects are size of the project and contract requirements. These findings are also supported by Lukonge [30] and Omidvar [35] in their studies where they noted that, form of contract used in a building project provides for the nature of insurance and bond required.Moreover, size of the project, experience of the team and business capacity are the major reasons for application of joint venture as a risk sharing strategy in building projects and this is also reflected in the study by Bing and Tiong [9] where they noted that clear meeting of minds between contracting parties is paramount for clear definition of party’s responsibilities and liabilities based on their strength and weaknesses. For partnership, relational contracting and risk partitioning, major reason for their application as risk sharing strategies in building projects is the size of the project.

| Figure 2. Reasons for application of forms of risk sharing |

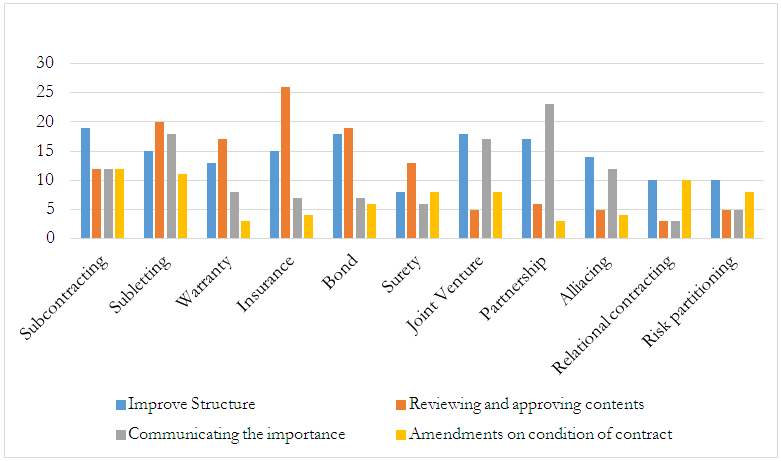

| Figure 3. Measures to improve forms of risk sharing in building construction projects |

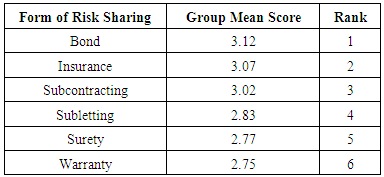

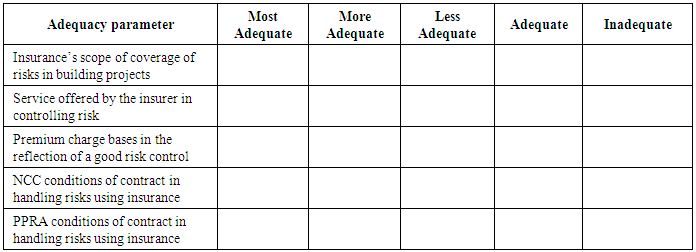

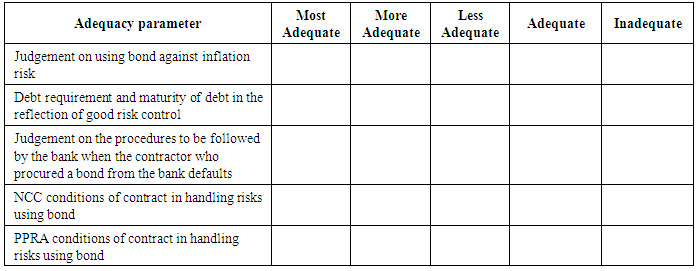

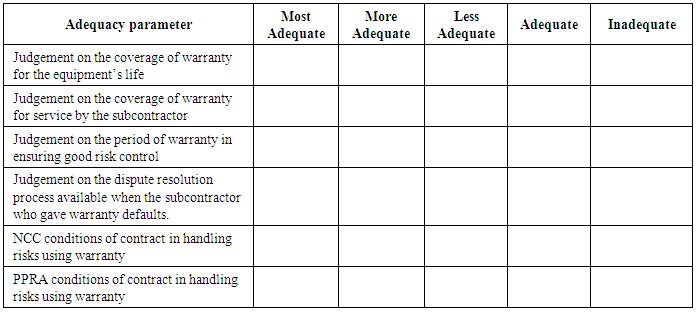

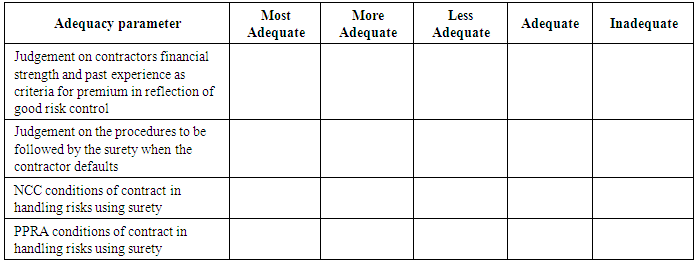

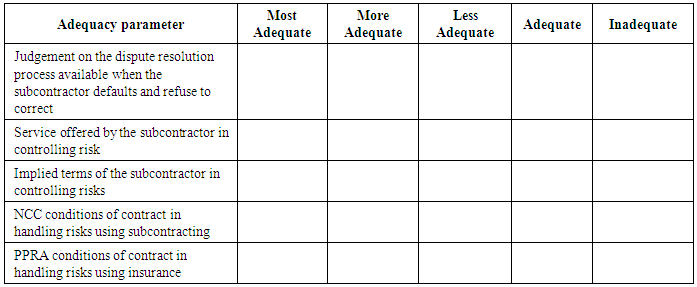

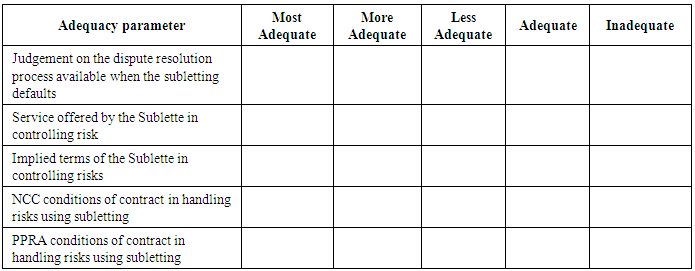

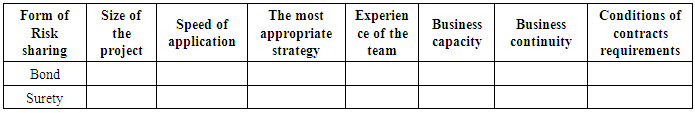

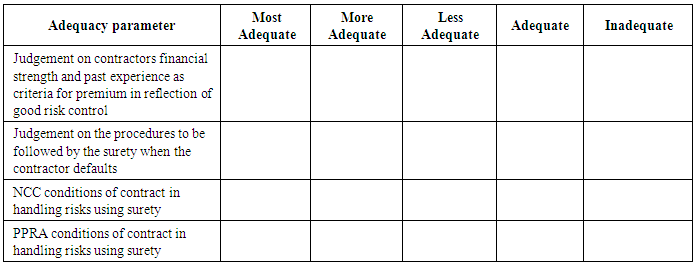

4.2. Adequacy of Forms of Risk Sharing Used in Building Construction Projects in Tanzania

- Adequacy is a concept related to satisfactory or acceptance in quality or quantity. Based on the literature the study identified some parameters for each form of risk sharing and these parameters were used to measure the adequacy. Again, based on the reasons given earlier, data was analyzed by calculating frequencies and mean item score and for ranking purposes group mean scores were calculated and used. Based on the given parameters, respondents were requested to rate each form of risk sharing as per the point scale ranging from 5- most adequate to 1- inadequate. Results are as indicated in table 3 below:

|

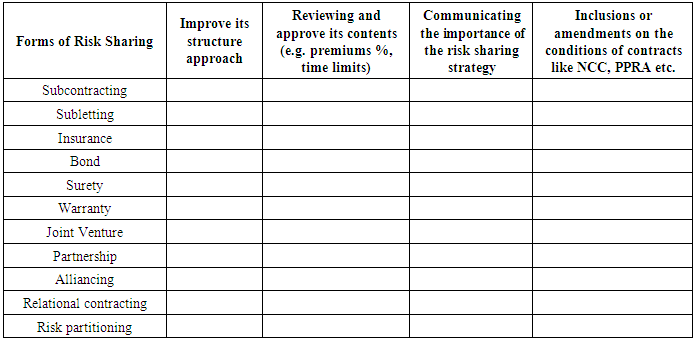

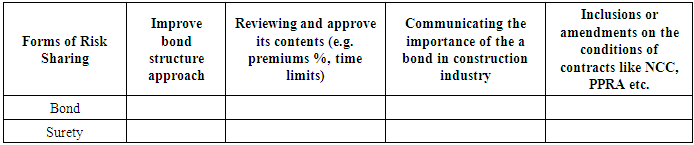

4.3. Measures to Improve Forms of Risk Sharing Used in Building Construction Projects in Tanzania

- Figure 3 above shows the results regarding various measures that could be adopted for improving the examined forms of risk sharing for attainment of successful building construction projects in Tanzania. Results indicate that, reviewing and approving contents is the major proposed measure for improvement of insurance, subletting, bond, warranty and surety as forms of risk sharing in building projects in Tanzania. The contents which need to be reviewed are with regard to premium charges and time limits. For the case of joint venture, partnership and alliancing, the major proposed measures for their betterment were to improve their structure approach to reflect the strengths and weaknesses of the parties to contract and communication of their importance to various practitioners involved in building projects through training and seminars.Major proposed measure for achieving better subcontracting as a form of risk sharing in building construction projects in Tanzania was to improve its structure approach. For the case of relational contracting and risk partitioning risk sharing strategies, major measures proposed for their betterment were amendments on the commonly used conditions of contract (i.e. National Construction Council (NCC) and Public Procurement Regulatory Authority (PPRA) conditions) for their inclusion and improving the structure approach.

5. Conclusions and Recommendations

- The study concludes that, insurance, bond, warranty, surety, subcontracting, subletting and joint venture are forms of risk sharing used in building construction projects in Tanzania. However, bond, insurance and subcontracting are the most applicable and adequate ones. This is so due to the fact that, the commonly used conditions of contract (i.e. PPRA and NCC) require the parties to use them. Additionally, the size of the sample obtained (as addressed in the methodology section) is regarded as a limitation for the study.In order to widen the application of various forms of risk sharing so as to have an effective risk management for successful building construction projects in Tanzania, the study puts forward the following recommendations:

5.1. Creating Awareness on the Importance of Various Forms Risk Sharing

- Forms of risk sharing should be addressed to the professionals in building construction projects through trainings on general professional meetings.

5.2. Improving the Structure Approach and Contents of Risk Sharing

- Procedures to be followed in various forms of risk sharing used in building construction projects should be made smoothly with less tiring, also reviewing and improving the contents of some of the risk sharing strategies like the insurance and bond in terms of the percentages of premiums to be given to the insurance company or the bank.

5.3. Inclusion of Other Forms of Risk Sharing in the Conditions of Contracts

- Amending the commonly used conditions of contract (i.e. NCC and PPRA) so as to include other forms of risk sharing for a more flexible and successful building construction projects.

ACKNOWLEDGEMENTS

- We would like to acknowledge Dr. Neema Kavishe for her invaluable technical contribution which in one way or the other made this article successful.

Appendix I

- Interview Survey1. How many building projects have your company done a joint venture/ partnership/alliancing?2. For what reason have your company joined a joint venture/ partnership/alliancing with other companies in conducting building projects?3. How did your company ensure cooperation and team work in controlling risks in those building projects conducted under joint venture/ partnership/alliancing?4. How did you ensure better relationships in controlling risks on those building projects conducted under joint venture/ partnership/alliancing?5. How did you ensure a good reflection of risk control on the procedures of formulating a joint venture/ partnership/alliancing?6. What measures to be taken to ensure a successful risk control in building projects involving a joint venture/ partnership/alliancing?

Appendix II

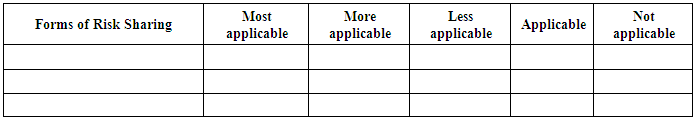

- Questionnaire SurveyFor Consulting Firms, Contracting Companies and ClientsThis questionnaire is designed to be responded by the professionals in construction (i.e. Architects, Quantity surveyors and Engineers) working in consulting firms, contracting companies and clients’ organizations. The information that will be provided in this questionnaire will remain confidential as it is required only for the purpose of statistical analysis and general for academic purpose.1. GENERAL INFORMATIONCompany/Organization……………………………………………………………………Name of respondent (Optional)……………………………………………………………Title/Designation of respondent…………………………………………………………..Class of your company/firm………………………………………………………………Contact Address……………………………………………………………………………

Email……………………………………………………………………………..

Email……………………………………………………………………………..  Website…………………………………………………………………………..

Website…………………………………………………………………………..  Phone……………………………………………………………………………..Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) Below are the forms of risk sharing used in building construction projects, to what extent among the following have been used by your company?(Please put a tick for the appropriate answers in the box provided)

Phone……………………………………………………………………………..Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) Below are the forms of risk sharing used in building construction projects, to what extent among the following have been used by your company?(Please put a tick for the appropriate answers in the box provided) b) Are there any other forms of risk sharing used in building construction projects?(Please specify and put a tick for the appropriate answer in the box provided)

b) Are there any other forms of risk sharing used in building construction projects?(Please specify and put a tick for the appropriate answer in the box provided) c) For what reasons have you used or would you use the forms of risk sharing mentioned in questions (a) and (b) above?(Please put a tick for the appropriate answers in the box provided)

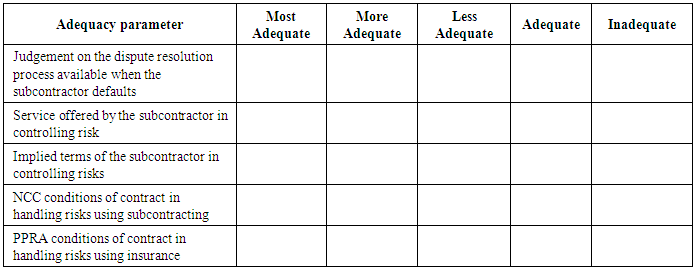

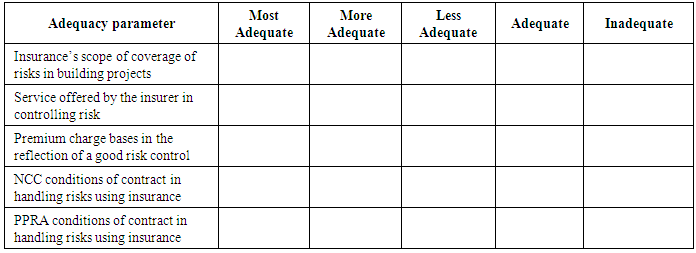

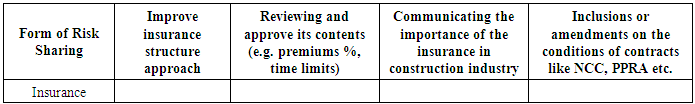

c) For what reasons have you used or would you use the forms of risk sharing mentioned in questions (a) and (b) above?(Please put a tick for the appropriate answers in the box provided) Section 2: Assessment of the adequacy of forms of risk sharing in building construction projectsa) How do you rate the adequacy of the forms risk sharing in achieving the objectives of the building construction projects?• INSURANCE

Section 2: Assessment of the adequacy of forms of risk sharing in building construction projectsa) How do you rate the adequacy of the forms risk sharing in achieving the objectives of the building construction projects?• INSURANCE • BOND

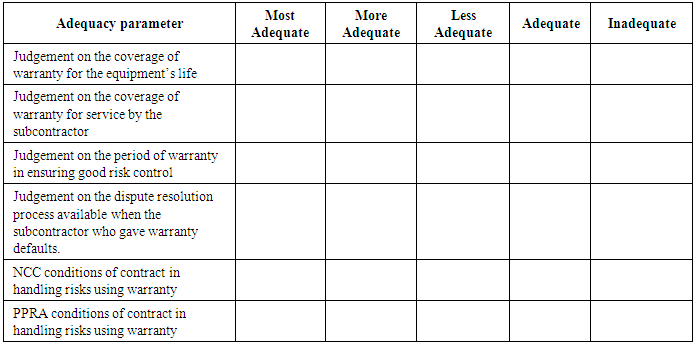

• BOND • WARRANTY

• WARRANTY • SURETY

• SURETY • SUBCONTRACTING

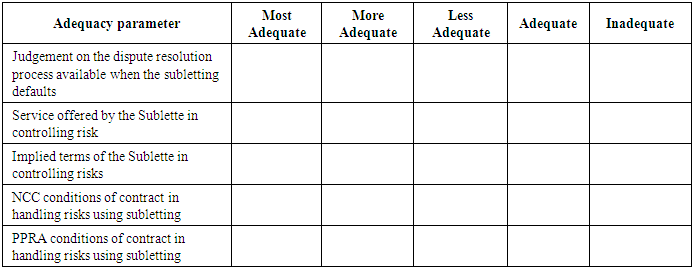

• SUBCONTRACTING • SUBLETTING

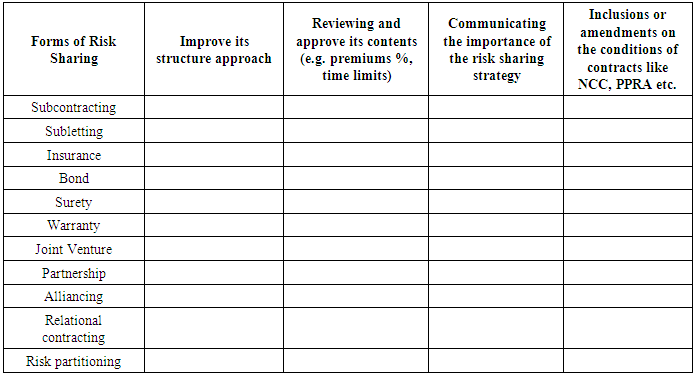

• SUBLETTING Section 3: Recommendations on the ways to attain successful risk sharing in managing risks in the building construction projectsa) What are the possible measures to be taken in order to improve risk sharing on managing risks in building construction projects?(Please put a tick in the most appropriate box in the table below)

Section 3: Recommendations on the ways to attain successful risk sharing in managing risks in the building construction projectsa) What are the possible measures to be taken in order to improve risk sharing on managing risks in building construction projects?(Please put a tick in the most appropriate box in the table below) b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.

b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.Appendix III

- Questionnaire SurveyFor SubcontractorsThe information that will be provided in this questionnaire will remain confidential as it is required only for the purpose of statistical analysis and general for academic purpose.1. GENERAL INFORMATION Company/Organization……………………………………………………………………Name of respondent (Optional)…………………………………………………………….Title/Designation of respondent……………………………………………………………Contact Address…………………………………………………………………………..

Email……………………………………………………………………………..

Email……………………………………………………………………………..  Website……………………………………………………………………………

Website……………………………………………………………………………  Phone……………………………………………………………………………....Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons do you think project team (contractor included) use the following forms of risk sharing in building construction project?(Please put a tick for the appropriate answers in the box provided)

Phone……………………………………………………………………………....Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons do you think project team (contractor included) use the following forms of risk sharing in building construction project?(Please put a tick for the appropriate answers in the box provided) Section 2: Assessment of the adequacy of the forms of risk sharing in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• SUBCONTRACTING

Section 2: Assessment of the adequacy of the forms of risk sharing in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• SUBCONTRACTING • SUBLETTING

• SUBLETTING • WARRANTY

• WARRANTY • INSURANCE

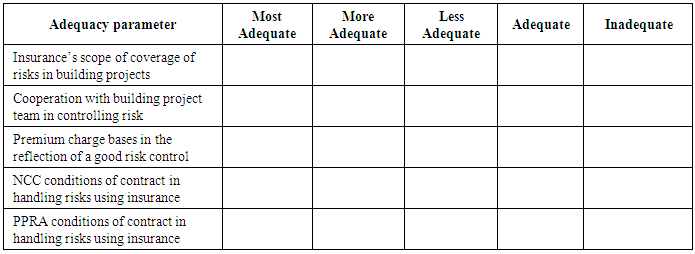

• INSURANCE b) What other parameters do you use to assess the adequacy of forms of risk sharing used in building construction projects?Please specify………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to attain successful risk sharing in managing risks in the building construction projectsa) What are the possible measures to be taken in order to improve risk sharing on managing risks in building construction projects?(Please put a tick in the most appropriate box in the table below)

b) What other parameters do you use to assess the adequacy of forms of risk sharing used in building construction projects?Please specify………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to attain successful risk sharing in managing risks in the building construction projectsa) What are the possible measures to be taken in order to improve risk sharing on managing risks in building construction projects?(Please put a tick in the most appropriate box in the table below) b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.

b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.Appendix IV

- Questionnaire SurveyFor Insurance CompaniesThis questionnaire is designed to be responded by the professionals in insurance companiesThe information that will be provided in this questionnaire will remain confidential as it is required only for the purpose of statistical analysis and general for academic purpose.1. GENERAL INFORMATION Company/Organization…………………………………………………………………Name of respondent (Optional)…………………………………………………………Title/Designation of respondent…………………………………………………………Contact Address…………………………………………………………………………

Email…………………………………………………………………………

Email…………………………………………………………………………  Website………………………………………………………………………

Website………………………………………………………………………  Phone……………………………………………………………………….Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons is insurance used as form of risk sharing in building construction projects?(Please put a tick for the appropriate answers in the box provided)

Phone……………………………………………………………………….Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons is insurance used as form of risk sharing in building construction projects?(Please put a tick for the appropriate answers in the box provided) Section 2: Assessment of the adequacy of forms of risk sharing in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• INSURANCE

Section 2: Assessment of the adequacy of forms of risk sharing in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• INSURANCE b) What other parameter do you use to assess the adequacy of insurance as a form of risk sharing in building construction project?Please specify………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to improve insurance as a form of risk sharing used in building construction projectsa) What are the possible measures to be taken in order to improve insurance as a form of risk sharing in building construction projects?(Please put a tick in the most appropriate box in the table below)

b) What other parameter do you use to assess the adequacy of insurance as a form of risk sharing in building construction project?Please specify………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to improve insurance as a form of risk sharing used in building construction projectsa) What are the possible measures to be taken in order to improve insurance as a form of risk sharing in building construction projects?(Please put a tick in the most appropriate box in the table below) b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.

b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.Appendix V

- Questionnaire SurveyFor Bank InstitutionsThis questionnaire is designed to be responded by the professionals working in bank institutionsThe information that will be provided in this questionnaire will remain confidential as it is required only for the purpose of statistical analysis and general for academic purpose.1. GENERAL INFORMATION Company/Organization…………………………………………………………………Name of respondent (Optional)…………………………………………………………Title/Designation of respondent…………………………………………………………Contact Address…………………………………………………………………………

Email……………………………………………………………………………

Email……………………………………………………………………………  Website…………………………………………………………………………

Website…………………………………………………………………………  Phone……………………………………………………………………………Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons are bond and surety used as forms of risk sharing in building construction projects?(Please put a tick for the appropriate answers in the box provided)

Phone……………………………………………………………………………Section 1: Assessment of the extent of application of forms of risk sharing in building construction projectsa) For what reasons are bond and surety used as forms of risk sharing in building construction projects?(Please put a tick for the appropriate answers in the box provided) Section 2: Assessment of the adequacy of forms of risk sharing used in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• BOND

Section 2: Assessment of the adequacy of forms of risk sharing used in building construction projectsa) How do you rate the adequacy of the following forms of risk sharing in achieving the objectives of the building construction project?• BOND • SURETY

• SURETY b) What other parameter do you use to assess the adequacy of a bond or a surety as a form of risk sharing in building construction project?Please specify each………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to improve bond and surety as forms of risk sharing in the building construction projectsa) What are the possible measures to be taken in order to improve bond and surety as forms of risk sharing in building construction projects? (Please put a tick in the most appropriate box in the table below)

b) What other parameter do you use to assess the adequacy of a bond or a surety as a form of risk sharing in building construction project?Please specify each………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Section 3: Recommendations on the ways to improve bond and surety as forms of risk sharing in the building construction projectsa) What are the possible measures to be taken in order to improve bond and surety as forms of risk sharing in building construction projects? (Please put a tick in the most appropriate box in the table below) b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you.

b) Are there any other measures you consider important?Please specify:………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………Thank you for your cooperation and contributionsGod bless you. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML