-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2018; 7(1): 35-46

doi:10.5923/j.ijcem.20180701.04

Exploring the Significant Cash Flow Factors Influencing Building Projects Profitability in Ghana

Emmanuel A-G. Adjei1, Frank D. K. Fugar1, Emmanuel Adinyira1, David J. Edwards2, Erika A. Parn2

1Department of Building Technology, Kwame Nkrumah University of Science and Technology, Kumasi, Ghana

2School of Engineering and the Built Environment, Birmingham City University, United Kingdom

Correspondence to: Emmanuel A-G. Adjei, Department of Building Technology, Kwame Nkrumah University of Science and Technology, Kumasi, Ghana.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper identifies and explore significant quantifiable cash flow factors influencing building projects profitability in Ghana. A thorough literature was undertaken to unravel the quantifiable cash flow factors which facilitated design of questionnaire. A survey with prime focus on large firms registered with the Association of Building and Civil Engineering Contractors, Ghana was undertaken. A total of 50 questionnaires were received from 63 administered representing 79.36% response rate with a Cronbach Alpha value of 0.895 and Kappa value of 0.743 respectively were attained. One-sample t-test was performed on the rated responses to establish 12 significant factors. Principal component analysis was subsequently employed to reduce factors to the most significant components. Prominent variables selected from rotated and component score matrixes were: wages of labour and staff; progress payment duration; bank interest rate; and replacement of defective works as significant variables. This study was limited to quantifiable cash flow factors and large construction firms hence, recommended further study with focus on qualitative factors, procurement types, broader scope of construction firms and other developing countries. The outcome of this is to aid construction managers effectively manage the significant cash flow factors to maximize profit.

Keywords: Cash flow, Profitability, Building Projects, Construction Industry

Cite this paper: Emmanuel A-G. Adjei, Frank D. K. Fugar, Emmanuel Adinyira, David J. Edwards, Erika A. Parn, Exploring the Significant Cash Flow Factors Influencing Building Projects Profitability in Ghana, International Journal of Construction Engineering and Management , Vol. 7 No. 1, 2018, pp. 35-46. doi: 10.5923/j.ijcem.20180701.04.

Article Outline

1. Introduction

- [40] proffers that construction is a high-risk industry but one of the most important sectors of any economy. Liquidity is the most important resource for construction firms and cash flow forecasting seeks to evaluate the distribution of expenditure and revenues of projects. Poor cash flow negatively impacts upon company profitability which further impacts upon project delivery. [48] suggest that forecasting and management of cash flow are perfect tools to avoid risk of inducing delays or incompletion of construction projects. The construction industry operates in a highly competitive environment and contractors cannot survive without effective management [42]. This therefore motivates contractors to introduce low profit margins in tender bids to compete within the industry [43] and this in-turn affects company liquidity. Previous studies have identified that a lack of liquidity represents a major problem that leads to the failure of construction projects and bankruptcy of construction companies [21]. Countless studies on the management of cash flow have revealed that construction managers pay limited attention to profit but rather contract sums relating to site costs and fixed costs. This may explain why only a third of medium-to-large companies make profits but are low on turnover and capital [40]. [28] reports that the problematic cash flow can also damage the congenial atmosphere shared amongst members of the project management team and negatively influence site productivity, affect the quality of delivery and reduce profit margin. This subsequently impacts upon the industry’s contribution to a nation’s economy. Studies undertaken on models developed to aid contractors’ cash flows are either project specific or fail to consider the negative ramifications emanating from a shortfall in minimum funds required for cash outflow [48]. [32] develop a model that considered financial market constraints such as long and short-term loans from banks, earnings on excess cash deposit and minimum cash reserves for a project. [21] modifies [32] model by considering advance payment and delay on payment for only one period but this model failed to address delays on progress payments. Prompt and consistent payments are prerequisite for the successful delivery of construction projects and the performance of construction firms. [62] identified that delay in payment is a recurrent problem in the construction industry globally. According to [69], an unnecessary financial burden is exerted on contractors whenever delayed payments by clients who avoid sharing the risk are experienced. This in effect impacts greatly on the profitability of projects and further on the survival in the competitive business environment. Given that contractor cash flow shortages remains pervasive and entrenched within the Ghanaian construction industry, this research aims to develop a model(s) that predicts profit. In realizing this aim, the research objectives seek to: i) identify quantifiable cash flow factors; and ii) determine the significant factors that impact upon project profitability. A concomitant aspiration is to ensure that research findings contribute to preserving the invaluable contribution that the construction makes towards a nation’s economic prosperity.

2. The Construction Industry

- [70] report that the construction industry is vital to a nation’s economic health and accounts for circa 7-10 percent of gross domestic product (GDP) value. Within Europe, the United States and Turkey, 7%, 8% and 5.5% of all workers respectively are engaged in the construction sector [36]. Various studies globally have been undertaken to address the performance improvement conundrum through effective cash flow management. For example, [53] investigate the difficulties faced by Vietnam’s construction sector and found that the capital loss ratio accounts for 30% of total construction capital as a result of inefficient management. Increase in competition for jobs and the level of corporate failures in the industry have also resulted in a decline in output and orders [37]. These competitive pressures motivate the diversion of excess resources into other areas of business investment termed as ‘cash farming’ [37]. Under such circumstance, banks and lenders become reluctant in approving loans to contracting firms as there may be insufficient collateral to secure the loan [9, 64, 26]. Industrial sickness has also been identified to be a very sensitive problem which adversely affects the industrial health and the economy at large [52]. This occurs when a company at the end of any financial year, accumulates losses equal to (or exceeding) its entire net worth and has suffered cash losses in such financial year and the financial year immediately preceding such financial year. Empirical studies further reveal that a causal link is apparent between ineffective management of working capital and ‘industrial sickness’ [8]. This affirms the assertion of [63] who found that 17.3% of Malaysian government contracts in 2005 suffered industrial sickness which led to delay or abandonment of projects. This research (ibid) suggests that construction firms are not adequately financially resourced to execute tasks to agreement. This consistent occurrence causes failures in the industry and further contributes to unemployment, none availability of good and services, and soaring prices increases [63]. Similarly, [71] report upon project failure in the US construction industry that was caused by macroeconomic and budgetary issues. Statistics indicate that at least 80% of these construction industry failures (ibid) were contributed by 27% of insufficient profit, 23% weakness in the industry, 18% heavy operating expenses, 8% insufficient capital and 6% burdensome institutional debt. Contractor’s liquidity is essential in the execution of multiple projects simultaneously [50]. Construction firms are confronted by the problem of poor cash flow prediction in undertaking multiple projects and this coupled with an ill-structured progress measurement system weakens firms financially [50].The Ghanaian construction industry is one of the highly regulated industries [7] and contributes about 8.5% to the overall Gross Domestic Product [4]. It is ranked third behind agriculture and surpasses the manufacturing industry [7, 20]. It is positioned ninth to offer employment among the seventeen industries within its economy with an employment rate of merely 2.3% [4]. Although the sector is marked by poor performance [4], it is also one of the fastest growing sectors with an impressive average growth rate of 7%-8% [59]. Yet curiously, little attention has been given to the construction industry compared to agriculture, tourism, information and technology communication sectors and sports sectors as the main economic growth drivers [7]. Studies have unraveled the dominance by small –scales building contractors constituting over 90% of the job market [5] and many of the directors the larger Ghanaian owned firms have little or no knowledge about the industry [4]. This therefore contributes to non-application of basic management techniques in solving project problems and failure to meet performance target [57]. According to [4], a decline in profitability observed is due to a lack of knowledge that leads to inefficient use of financial, material and human resources, and underestimation of building rates. The high inflationary rate which make the industry unstable reduces contractors’ capital further, hence making it difficult to manage firms [18] and this also prevents local small-medium sized contractors from competing with foreign and large firms. [56] proffers that there is lack of measurable targets for enhancing the industry’s general poor performance in developing countries. This negatively influences the financial profitability of firms and employee motivation [72]. Under such circumstances, contractors lose skilled personnel and consequently reduce output and profit generation. For example, statistics gathered between 1995 to 2005 from the South Africa construction industry indicate that 5,907 construction firms were formally liquidated [6, 67]. This therefore underscores the need to address the industry’s cash flow management challenges.

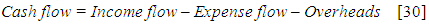

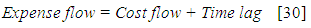

3. Cash Flow and Income

- Guaranteeing project feasibility requires the effective management of incoming and outgoing finance within a construction company throughout the project duration [73]. It comprises of historical data of cash disbursed, shortage of cash, loans and cost of money as well as earnings received. Monitoring and controlling project progress and associated cash flow management are important benchmarks for clients and contractors because they can identify the early warning signs of cost overrun and program delay [17]. An extensive literature review revealed that research into cash flow is often concerned with maximization of profit or minimisation of total project cost [32]. Cash flow is essential to meeting any financial obligations and optimizing short term funding requirements of projects or company [55]. [17] suggest that delivering a successful construction project is dependent upon effective management of its cash flow. Mathematically, cash flow is defined as the difference between the income flow and expense flow and overheads (including both on-site project and office overheads) - refer to equation 1: Thus

| (1) |

| (2) |

3.1. Factors that Influence Cash Flow

- Various factors that influence cash flow have been identified within existing literature [58]. For example, [75], suggested that timely completion of a project measures contractors’ quality performance and their ability to eliminate or minimise delays. The edge of benefit additionally assumes a basic part on the income of any venture as it gauges the monetary quality of the business. [44] concurred and revealed that low profit margins were the 2nd highest ranked financial factor among fifteen factors to influence contractors’ failure. [9] proposes that most contractors are highly dependent upon outsourced capital and this decreases profits due to higher prices paid on credit (e.g. interest charges) which negatively influences the projected cash flow. [28] indicate that a one-week delay is normal in the payment of labour whiles a three to six weeks is also normal for hirers of plant and material supplies. Any duration beyond this range undermines the commercial confidence in a trading company [28]. Studies have identified numerous factors impacting on construction cash flow [15, 42, 55]. However, this study focused on quantifiable factors and it refers to factors that are appreciable and can easily be estimated or quantified.

3.1.1. Financial Risk

- The risky construction environment is exposed to significant uncertainties which involve the need for capital, delays in client payments and varying interest rates during the contract end time and final payment [12]. During periods of high interest rates and inflation levels, cash flow forecasting becomes more important and this makes it a tool to evaluate the distribution of expenditure and revenues for projects with reference to project time [48]. The non-availability or inadequacy of a structure to manage cash flow results in liquidity problems that affect working capital without prior warning and this defies the sustainability of projects. [28] state that the construction industry experiences a greater proportion of bankruptcies than any other industry and this in-turn motivates firms to request bridge loans [51].[9] suggests that most Malaysian contractors are not adequately capitally resourced and this influences the chances of loans acquisition and the contractor’s ability to successfully deliver projects. Contractors therefore disproportionately depend upon outsourced capital from suppliers, subcontractors and advance payments from clients [9]. Under such circumstance, it becomes increasingly difficult to convince creditors and potential lenders of the short-term inadequacy of cash and the unusual remedy is to issue a loan at a high capital cost to cover the risk posed [28]. This increase in loan cost negatively affects cash flow on projects and causes greater operating cost that reduces profitability [14]. Contractors struggle to bear the heavy daily construction expenses that often involve huge sums of money coupled with delayed payment [62, 21]. [24] suggest that a toxic combination of cash flow dependence upon bank loans, high interest rates paid and mismanagement of cash flow is the primary cause of business failure in developing countries. [12] and [32] also state that a firm with higher cash flow variability faces a shorter expected time to a point at which it runs out of cash. This according to [32] increases the level of external financing which attracts high cost of money and introduces a corresponding high cost of project as well.

3.1.2. Retention

- Retention provides funds for clients to rely on when contractors fail to perform due to incompetence and/or bankruptcy [29]. According to [30], most contractors are subjected to cash retention and contractors also withhold part of payments due to subcontractors. Larger contracts tend to be subjected to smaller rates of retention since the application of the smaller rate on the value results in a large sum of cash. The proportion for retention typically varies between 1-15% with a median of 3% (ibid). An increase in the rate of retention from 2.5% to 5.0% would result in a corresponding increase in working capital required from 2.61% to 4.05% of annual turnover [34]. A large retention percentage and delay in releasing retention according to [42], were the fourth and fifth financial management factors respectively affecting project cash flow. [13] suggests that withholding retention due to contractors creates a financial burden upon contractors and other associate partners in the construction industry. [60] also state that contractors’ experience negative cash flow on projects until final payment is effected and when the retention rate is greater than the profit margin. It therefore become difficult for subcontractors to obtain the retention withheld by the main contractors who become insolvent.

3.1.3. Delayed Payment

- Delayed payment is a major and persistent problem that confronts the construction industry [61, 33]. This however affects a contractor’s cash flow due to inadequate working capital to continue the project and hence negatively impacts upon the delivery of work. These challenges further exacerbate the contractor’s financial viability by reducing their ability to acquire ‘starting capital’ to execute new projects and maintain the planned cash flow to execute existing works (as specified by the program of works and contract documents) [66]. External funding source attracts interest thus reducing cash flow and profitability further as the company becomes increasingly highly geared [9]. An induced payment default situation eventually affects cash flow of contractors and others in meeting their respective financial obligation and spirals contractors (and possibly members of their supply chain) towards insolvency [33]. Subcontractors are affected on contracts where a clause of pay-when-paid is inserted because they will only receive payment when the main contractors are paid [49]. According to [62], contractors in the United Kingdom have continuously expressed dissatisfaction on the time lag experienced between the receipt of invoice and final settlement. The inability of clients to honour timely payment is a disreputable practice that unduly places the financial burden (and insolvency risk) upon contractors and members of their supply chain.

3.1.4. Project Claims

- Claims negatively impact upon a project in terms of cost and time [39] and this has a corresponding effect on quality and these primarily arise due to deficiency and ambiguities in contract documentation [54, 16]. Site conditions are a major source of claims particularly when the actual conditions differ greatly from the documented [38]; inclement weather can also be a factor but this is often attributed to force majeure [11]. Claims are sometimes initiated by clients who may require significant modification of the scope of works in terms of size or complexity [47] – such modification invariably has a financial ramification [22]. [68] state that contractors claim for extra work undertaken are not honoured until practical completion thus instigating further constraints upon cash flow. Delay in issuance of drawings and other input impedes progress of works and this has a corresponding effect on progress payment to the contractor. This therefore motives contractors to outsource funds which attracts interest and hence, impacts on cash flow. Clients may claim for liquidated and ascertained damages stipulated in the contract when contractors fail to deliver the project on time [41]. Mark-ups decided by contractors are usually high to compensate for the large sum of deduction to be effected on the project cost should any delay occur [41].

3.1.5. Sectional Completion

- Contract conditions vary and some offer sectional completion where part-payment is made at defined stages of project completion [73]. Sectional completion enables both parties to forecast cash flow because milestone payment dates can be assigned to individual phase completions on the project. These phases will include accompanying retention periods which produce a corresponding unique S-curve of each section or phase [73]. Individual cash flow produced (based on the distinct information such as duration, sum retention etc.) is merged to give an overall cash flow and the time lag between completed sections inevitably impacts upon cash flow (positively or negatively) [73]. Different sectional or phase completed elements may also incur corresponding retention releases and this should be incorporated into the development of the cash flow forecast [73].

3.1.6. Pricing Strategies

- Pricing strategies offer contractors an alternative means of improving cash flow of projects through front-end and back-end rates loading. Front-end rate loading is a technique where work activities to be executed early are artificially overpriced and under-priced activities occurring towards the end of the contract [28]. Capital lock-up is worst at either stage and the possibility of applying front-end loading depends on client awareness [28]. This enhances the effective margin of the early stages of a contract and maintaining the overall margin at a competitive level. Additionally, front-end loading off-sets any borrowing hence, reduces the level of external financing [28]. Back-end rate loading on the other hand is a technique where later activities in the bill carry higher margins than earlier items. Back-end loading increases capital lock-up and in most cases, are not sought by contractors (ibid). [42] revealed that front-end payment was the third highest financial management factor that affected project cash flow from the contractor’s perspective. This finding was confirmed by [15] which found that pricing strategy was the fifth most influential factor on contractors’ cash flow.

3.1.7. Over-measurement and Under-measurement

- Over-measurement is also employed at the early stage of a contract in which certified work are valued more than executed work [28]. It improves project cash flow at the early stage, plays the same role as front-end loading and provides extra cash to execute subsequent works. [10] suggests that contractors have historically attempted to improve project cash flow through over-measurement during the early stages of the contract. Under-measurement (as its name suggests) is the opposite of over-measurement and occurs when certified works at the early stages are less than the actual value of work done. Over-measurement and under-measurement were both identified to be the second most influential factor affecting contractors’ cash flow [15]. According to [28], these are not typically sought by contractors as both situations create capital lock-up. This view (ibid) concurs with [42] who found that over-measurement and under-measurement were the ninth and tenth financial factors respectively that affect a contractor’s project cash flow.

4. Research Approach

- The perception of industry practitioners on the variables that influenced a contractor’s cash flow in executing construction project(s) were sought in the bid to establish a deterministic model. Variables identified from thorough literature review were subsequently used to develop a questionnaire data collection instrument and administered to D1 contractors operating in Ghana. The questionnaire further sought to gather information on the experience and qualifications of the respondents. D1 contractors were targeted as a sample frame because they typically execute large volumes of works that require huge cash in- and out-flow and are well structured. D1 contractors are classified to have a minimum turnover of $500,000.00 within the past three years (M.W.R.W.H. Contactors Classification Guidelines in Ghana) and perceived to be knowledgeable about cash flow management. A list of 63 registered contractors in good standing was acquired from the Association of Building and Civil Engineering Contractors, Ghana. A census survey was employed using the total D1 contractors and senior quantity surveyors at respective company head offices were specifically targeted for their cost management knowledge and experience. The contraction firms’ offices contacted with the contact information on the list for direction and location the offices. The questionnaires were subsequently administered personally and by emails with a follow-up call to the respondents in question. This mode of emails was adopted for respondent who showed interest but were not at the respective head office at the time of exercise. A maximum time of two weeks was agreed to respond to the questionnaires ready for collection.

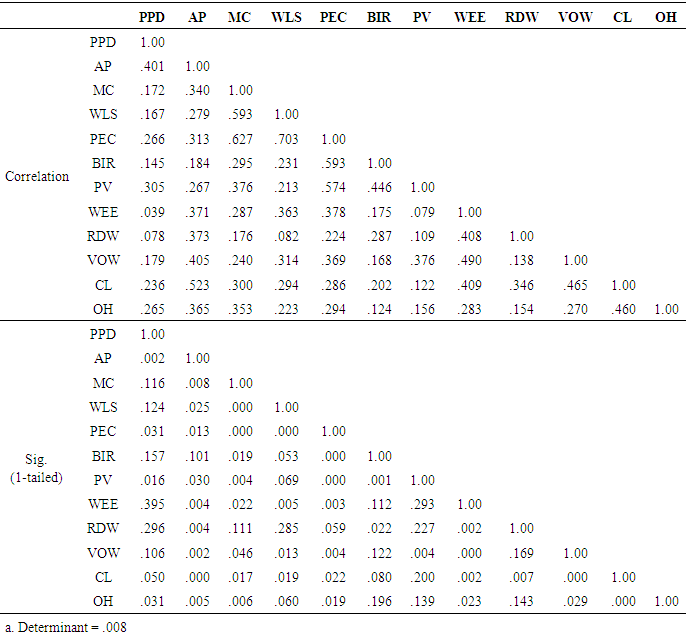

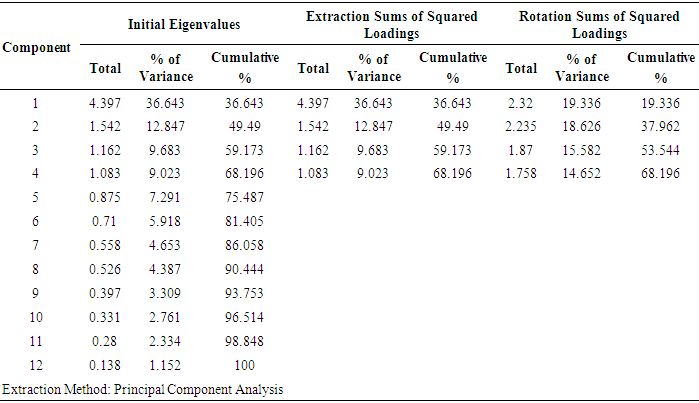

4.1. Data Analysis

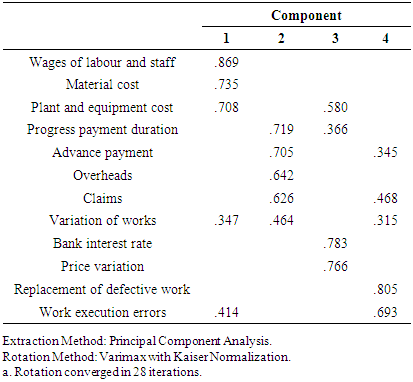

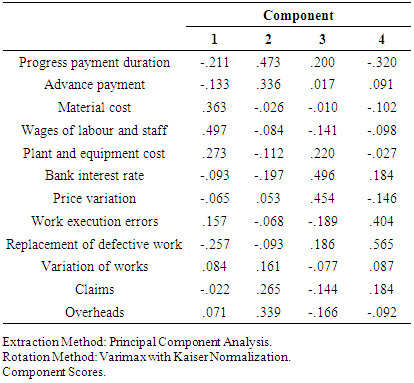

- In testing for response agreement and instrument reliability, Kappa Statistics for Multiple Raters and Cronbach’s Alpha were used respectively. For Kappa, a value ≤ 0.40 indicates a low agreement, 0.40 - 0.70 represents fair to good and above 0.70 represents a strong level of agreements respectively with 1.00 being perfect agreement (Green, 1996). For the Cronbach Alpha test results, values of at least 0.70 - 0.80 is deemed acceptable [65, 25]. A one-sample T-test was employed on the data with a test value set at 3.0 with 5% level of significance to eliminate non-significant variables [1, 23]. Principal component analysis (PCA) was then used to determine the most significant factors and to detect multicollinearity within the data set. According to [25], variables with R > 0.8 were considered very high in correlation. PCA implementation followed three core steps, namely: i) assessing the appropriateness of using PCA and component extraction; ii) determination of the determinant of the correlation matrix which must be greater than 0.00001 [25]; and iii) establishing and choosing the significant variable from output as independent variables for model development. Kaiser-Meyer-Olkin (KMO) was used to test for appropriateness and the adequacy of sample. According to Kaiser (1974), a KMO value of 0.5 is acceptable for the use of PCA. [2] suggest that a KMO value between 0.5 - 0.7 is identified as being mediocre, 0.7 - 0.8 is good and 0.81 - 0.9 is very good while ≥ 0.91 is superb. Bartlett’s test of sphericity test also tests the null hypothesis that the original correlation matrix is an identity matrix with all the correlation coefficients being zero except the diagonal which is unity (1). When the test is significant at p-value < 0.05, the use of PCA is appropriate. According to [3], a number of reduced principal components accounting for most of the variance in a set of variables are extracted. The Eigen values corresponding to each linear component and the generated scree plot are normally used as a guide in establishing the set of principal components accounting for most of the variance. Many authors recommend Eigen values of at least 1 as accepted reduced component accounting for most of the variance [45, 46, 3, 2, 25, 19]. In further establishing the significant variables from the reduced components, the variables with the highest factor loading and component score coefficient in the rotated component and component score coefficient matrixes respectively were selected. [45] adopted [74] selection criterion of using the component score coefficient and subsequently adopted the two significant selection criterion different studies [46]. Hence, variables with the highest factor loading and component score coefficient from the rotated component matrix and component score matrix were selected significant.

5. Results and Discussion

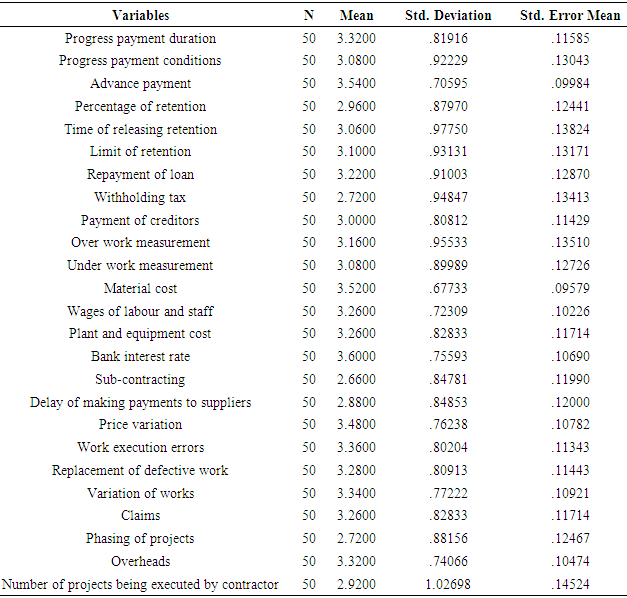

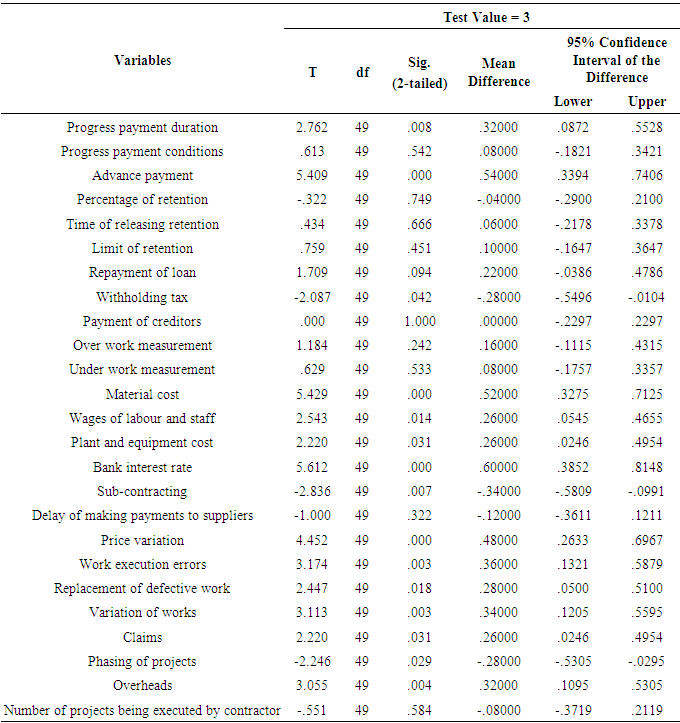

- A total of 51 questionnaires were retrieved and one rejected as it was incomplete, giving a response rate of 79.37%. This was attained through frequent telephone calls and emails sent to respondents to give them reminders and encourage them to participate in this important ‘industry facing’ research. This comprised of 92% of respondent having experience in the industry for not less than 5 years among which 34% and 20% having between 11-15 and over twenty years respectively. In addition, 50%, 30% and 4% hold BSc, MSc and PhD degrees respectively. This gives an indication of the respondents being knowledgeable and able to give reliable responses from experience. Reliability test conducted on the responses produced a Cronbach’s Alpha of 0.895 thus demonstrating a high internal consistency and depicts high inter-relatedness. This gives an indication of a corresponding very low error measurement [65]. The Kappa Statistic for Multiple raters resulted in 0.743 giving an indication of a good agreement and consequently can be inferred that, responses are close to convergence. Tables 1 and 2 present the results generated from a one-sample t-test employed to eliminate non-significant variables. A 3.0 mean test value was set with 95% confidence level and the respective critical value (t) were generated using SPSS 23. From Table 2, a degree of freedom of 49 is observed and hence, an interpolation of between 40 and 60 degrees of freedom was performed under 5% level of significance.

|

|

|

|

|

|

6. Conclusions

- Cash flow is instrumental to the success of any construction project and yet, contractors introduce low profit margins to win tender bids in a competitive environment presuming the smooth execution of the project. In order to adequately predict profitability on projects, this paper reveals the most significant cash flow variables that impact project profitability and therefore need to be addressed prior to/ and during project execution. Though numerous factors are considered in effective cash flow forecasting and with monitoring translate into profit realization, this study was limited to quantifiable factors. This study indicates that profitability can be predicted using the significant factors revealed namely: wages of labour and staff, progress payment duration, bank interest rate. The effect of these variables has great influence on cash flow and ripple effect on profitability. Therefore, labour must be effectively managed through various techniques to maximise usage since progress payment duration (which delay payment) is embedded cannot to eliminated. This will go a long way to minimizing (if not avoiding) the cost of replacement of defective works and other errors are through quality work done with good supervision. Timely payment is needed to prevent excessive outsourcing of funds which attracts high interest rate and hence negatively impacts on profitability. This will avoid unnecessary claim management and disputes as well. The effective management of these revealed factors presents a congenial working environment both for the client and the contractor; where both parties (and employees within) are motivated to enhance project performance and concomitant profitability.

7. Limitations

- There are numerous variables that influence cash flow and this study was limited to quantifiable cash flow considerations only. The study also was limited to procurement types. Further scientific investigation is recommended with focus on qualitative factors such as relation among construction team, construction disputes, communication, plant acquisition decision etc. In addition, the study focused on the most reputable and established D1 contractors and subsequent studies are required to include a broader sample of construction contractors that would include small to medium enterprises and sole traders as well as the inclusion of more developing nations.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML