-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2017; 6(2): 46-55

doi:10.5923/j.ijcem.20170602.02

Risk Factors Causing Variations on Forecasted Construction Cash Flows of Building Projects in Dar es Salaam, Tanzania

Kimata N. Malekela1, Juma Mohamed1, Stanslaus K. Ntiyakunze2, Musa I. Mgwatu1

1College of Engineering and Technology, University of Dar es Salaam, Dar es Salaam, Tanzania

2School of Architecture, Construction Economics and Management, Ardhi University, Dar es Salaam, Tanzania

Correspondence to: Kimata N. Malekela, College of Engineering and Technology, University of Dar es Salaam, Dar es Salaam, Tanzania.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The risk factors involved in construction projects make difficulties in attaining an accurate forecast of construction cash flow. Most of construction projects experience large variations on forecasted construction cash flows due to the risk factors involved in these projects. The objective of this research is to analyze and identify the significant risk factors causing variations on forecasted construction cash flows for various work stages/parts of building projects in Dar es Salaam, Tanzania. Also, the effects of project scheduling and resources price changes were investigated. This paper reports part of an on-going research concerned with modelling the construction cash flows. The study was conducted through questionnaire survey and interview administered on different building contractors and consultants respectively in Dar es Salaam, Tanzania. An analysis was carried out using using statistical package for social sciences (SPSS) Version 20.0 for the data's obtained from questionnaires whereby the risk factors causing variations on forecasted construction cash flows in building projects were analyzed. The study found ten significant risk factors that cause variations on forecasted construction cash flows for all work stages/parts in building projects in Tanzania. These risk factors are errors in project documents (Bills of Quantities), poor communication among project participants, consultants’ lack of experience and technical skills, different meanings of specifications, unethical practices to consultants, unclarity of clients’ requirements, clients’ lack of financial resources, design errors, poor/incomplete design and incomplete information at tender stage. The identified effects of project scheduling includes change of project value, delay of the projects, poor workmanship of the project, and conflicts between the parties. While the effects of resources price changes includes delay of the projects, poor quality of the projects and termination of the contract by client. The study recommends proper communication among project participants during execution of building projects for minimizing the significant risk factors, and detailed examination of the identified significant risk factors in causing the variations on forecasted construction cash flows should be done using contract documents such as cash flow projections, Bills of Quantities, interim valuations for payments, work programme and site instructions.

Keywords: Construction cash flows, Risk factors, Variations, Building projects, Tanzania

Cite this paper: Kimata N. Malekela, Juma Mohamed, Stanslaus K. Ntiyakunze, Musa I. Mgwatu, Risk Factors Causing Variations on Forecasted Construction Cash Flows of Building Projects in Dar es Salaam, Tanzania, International Journal of Construction Engineering and Management , Vol. 6 No. 2, 2017, pp. 46-55. doi: 10.5923/j.ijcem.20170602.02.

Article Outline

1. Introduction

- Always client wants to meet up with the contractors’ expectations from a clear and appropriate project cash flow during execution of the works in construction projects especially during the construction phase [20]. The project cash flow is mostly included as monthly cash flow, staged cash flow or Turnkey cash flow [12, 34]. Although, construction cash flow is used as monitoring tool for cost control in the construction projects [12], but there are lots of risk factors which affect those cash flows of the construction projects [20]. Normally, those risk factors cause variations between the actual and forecasted cash flows in construction projects [29]. Also, those risks make difficulties in attaining an accurate forecast of construction cash flows in construction projects [32]. Related studies [26, 29, 30, 32] revealed that most of construction projects experience large variations on forecasted construction cash flows due to risks involved in construction projects. These variations happened on forecasted construction cash flow may cause serious impacts of cash flow on the failure of a construction project. The impacts can be in terms of cost overruns and delays. For instance in Tanzanian construction industry, overall performance in terms of the key project objectives like cost objective is poor whereby most of construction projects are completed with many cost variations compared to their initial budget [8, 18, 24].The aim of this study is to find out the significant risk factors involved in causing variations between forecasted and actual construction cash flows in building projects. Also, this paper investigates the effects of project scheduling and resource price change in execution of building projects.As far as the objective of identifying the significant risk factors causing variations on forecasted cash flows is concerned, this study is delimited to positive construction cash flows derived from staged cash flows in building projects. It should also be noted that wherever the word building projects used in this study implies the building projects that are procured under fixed price contracts.

2. Construction Project Cash Flows

- The cash flow forecast of a construction contract or project deals specifically with the payments under a particular construction contract. In this construction cash flow forecast, it is important to note that cash flow can travel from the employer to the main contractor during execution of construction project [34].

2.1. Concept of Construction Cash Flows

- The cash flow is basically the actual movement of money in and out of a business such as construction business. Money flowing into a business is called the positive cash flow while monies paid out are named as negative cash flow. The difference between the positive and negative cash flows is called the net cash flow [26]. In addition, client is always interested with positive cash flow, which means the movement of money from client to contractor during execution of construction project [20]. Therefore, positive construction cash flows in building projects means the movement of money from client to contractor during construction phase of building project.Furthermore, positive cash flows in construction projects are commonly derived from monies received by contractor in the form of staged cash flows or monthly cash flows [12, 28, 34]. Both forms of positive cash flows include payments to works performed, release of retention, settlements of final account, interest on delayed payments/suspensions of various works and settlements of profit lost due to termination of contract as exhausted from various materials such as [23, 7].

2.2. Payment Systems for Execution of Construction Project Cash Flows

- Basically, there are payment systems which replicate the delivery of payment to contractor during execution of construction project cash flows, such as Turnkey where payment occurs at handover stage only (Turnkey cash flow), but monthly progress payments (or monthly cash flow) and staged payments (or staged cash flows) are commonly used in project financial management [34].

2.2.1. Staged Cash Flow

- In staged payment system (staged cash flow), a builder is entitled only to payments at the completion of certain work stages in the progress of the works [34, 12]. This implies that works done are paid upon completion of various elements. In its simplest form this could constitute a single payment at the completion of the certain stage of construction works, but they will be based on elements (e.g. completion of substructure works, completion of frames) [6]. The more prescriptive the staged payments in execution of the construction project the more accurate the assessment of works will be in that execution. Therefore, in a staged cash flow, certification is done once the work element is completed [34].

2.2.2. Monthly Cash Flow

- In this monthly payment system (monthly cash flow), the periodic positive cash flows are derived mainly from funds received in the form of monthly payments to the construction works performed by contractor. Normally a third party measures and values the works performed at the site [12, 34].

2.2.3. Turnkey Cash Flow

- A single payment is only provided for at the conclusion of the project (i.e. at practical completion of the project). This requires the builder to finance the project during construction phase [12], but this is rarely practiced compared to the previous two payment systems in construction industry [34].

2.3. Methodologies of Forecasting Construction Cash Flows

- There are many methods used in cash flow forecasting, but these methods may be mainly grouped into schedule-based or cost profile methods. Furthermore, the cost profile based method can be divided into value and cost approach to cash flow forecasting [12]. In this study, the forecasting methodologies are discussed basing on the types of construction cash flows.

2.3.1. Positive Cash Flow Methodologies

- A lot of positive cash flow methodologies have been developed. These methodologies are mainly based on S-curve, logit model (idiographic approach) and advanced construction cash flow approach as discussed hereafter. The S-curve stands for ‘standard’ curve, but it appears as the shape of the letter ‘S’ when presented on a graph. It predicts the cash flow forecast for a standard development project type, but their use is diminished when dealing with very complicated projects [34]. Normally, these S-curves are expressed using the polynomial regression or mathematical functions which use data from previously similar construction projects [2]. However, the S-curves can be questioned from the point of accuracy and flexibility [17]. The models based on S-curve include the British Department of Health and Social Security (DHSS) model [34], Bromilow model and Peer model [12]. Also, computer modelling, simulations and artificial intelligence techniques have been employed in developing the standard value curves [34]. Logit model (idiographic approach) is also used for cash flow forecasting. It is based on the hypothesis that each project is unique and the cash-flow model cannot be developed from grouped data. It shows the cash flow forecast in cumulative form which allows progress payments to be identified. This idiographic methodology is applied to fit cash flow data using the logit transformation technique. It is the simplest of the sigmoid transformation that allows S-curve to be presented in linear format [13].Advanced cash flow forecasting approach is the detailed and confident approach to positive cash flow prediction flows [23, 34]. The contract programme and a bill of quantities are normally used to provide a more accurate construction cash flow forecasts compared to other methods of cash flow forecasting [23]. As stated earlier in types of construction project cash flow forecast, advanced cash flow forecasting involves preparation of cash flow which is based on either monthly cash flows or staged cash flows. In case of staged cash flows, preparation of construction cash flows is based on progress payments (cash flows) upon completion of various work elements of construction project [17].

2.3.2. Negative Cash Flow Methodologies

- In forecasting the negative cash flows, researchers have developed the standard cost curves, researchers such Zoisner (1974) (cited by [28]), and [10] developed special cost curves by using mathematical approaches in forecasting costs of projects. Other researchers such as [2] and [3] developed standard cost curves using computerized approach (e.g. fuzzy technique). All these curves were based on periodic cost flow delivery.

2.3.3. Net Cash Flow Methodologies

- For net cash flow methodologies, some researchers have developed standard single net cash flow curves such as O’Keefe (1971) (cited by [28]). These curves were generally based on periodic net cash flows delivery [11]). In spite of some attempts in these methodologies, the developed curves appeared as poor bases to use in forecasting net cash flows because they tend to fluctuate so much depending on the data available in their use.

2.4. Forecasted and Actual Construction Cash Flows

- Specifically, construction project cash flows are the amounts of money that the contractor will receive from client after completion of various work stages of the project [20]. In that manner, forecasted construction cash flows in this study means the estimated/projected amounts of money to be received by contractor from client after completion of various work stages of the project. While actual construction cash flows are the actual amounts of money paid to contractor for the various completed work stages of the project after being valued at the site and certified.

2.4.1. Variations between Actual and Forecasted Construction Cash Flows

- According to [29], the difference between actual and forecasted construction cash flows in executing the construction project is referred as variations. These variations are caused by risk factors as discussed in section 2.5. If the variation is positive, the actual construction cash flow has exceeded the forecasted construction cash flow for the specific work stage performed and vice versa.

2.5. Risk Factors Causing Variations on Construction Project Cash Flows

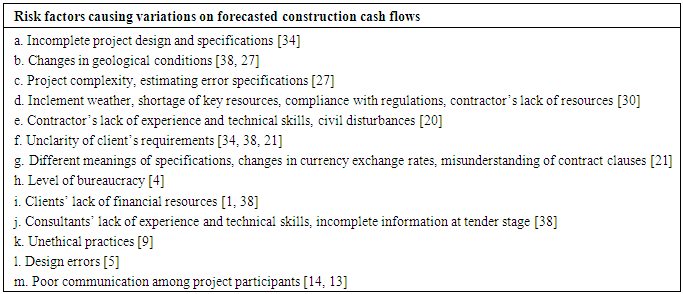

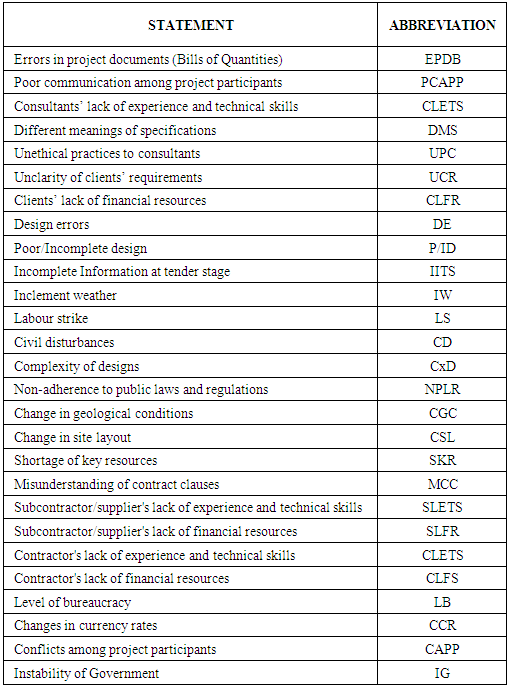

- According to [31], risks are the factors that can cause a project to fail in meeting its goals. For example, as [29] pointed out, positive variations between actual and forecasted cash flows are the impacts of risk factors which occur during construction. It should also be noted that wherever word risk factor used in this study implies the factor that can cause variations on forecasted construction cash flows for a certain work part of building project. Normally, the variations are caused by risk factors inherent in construction cash flow forecast [29]. Moreover, many construction activities are subjected to more risks than other industries [20]. This implies that there are also lots of risk factors affecting the construction cash flows of the projects.During the construction process, there are many influential risk factors on the cash flows related to cost overruns, time delays, variations and technical changes [25]. According to [30], the significant risk factors that cause variations on forecasted construction cash flows include changes to initial design, inclement weather, changes to works, labour shortage, problems with foundations, project complexity, and estimating error. Furthermore, according to [29], three significant risk factors were changes in initial design, inclement weather and changes to works while three least risk factors are labour strikes, civil disturbances and changes in currency exchange rates. Moreover, there is tendency for most of risk factors affecting cost performance in executing construction projects to affect other parameters of construction projects. This has been revealed in the study done by [38], whereby most of risks affect both cost and time aspects in executing the project. This implies that most of the risk factors affecting construction cash flows cause also cost overruns and time overruns in the implementation of construction projects and vice versa because these risk factors have relationships with all project objectives. Therefore, based on broad literature review from different perceptions of the authors on cost issues during executing the construction project, the following are the risk factors causing variations on forecasted construction cash flows as shown in Table 1.

|

2.6. Dealing with Risk Factors Causing Variations to Construction cash Flows

- Since risk factors affecting forecasted construction cash flows are treated the same way as other risks in different types of projects, therefore, dealing with those risk factors during implementation of building projects is the subject matter embedded in risk management. According to [18], risk management is the way of dealing with risks by including planning for risks, identifying and analysing the risk issues, developing risk response action plans, and monitoring project risks. Basically, according to [14], risk management process consists of generic steps which include risk identification, risk analysis, risk controlling (risk response planning) and risk monitoring, but this study focuses mainly on the risk identification and risk analysis.

2.6.1. Risk Identification

- Risk identification deals with identifying which risks can affect the project. Risk can be identified using the recorded experience (historical data) from past projects and the current projects or from experiences based upon knowledgeable experts. Tools and techniques for risk identification includes documentation reviews, interviewing, brainstorming and expert judgement [18].

2.6.2. Risk Analysis

- Risk analysis involves analyzing the risk issues in terms of the potential impacts using either qualitative or quantitative tools for enabling the risk response planning actions to be set. In addition, quantitative tools aim to analyze numerically all the risk issues [14].

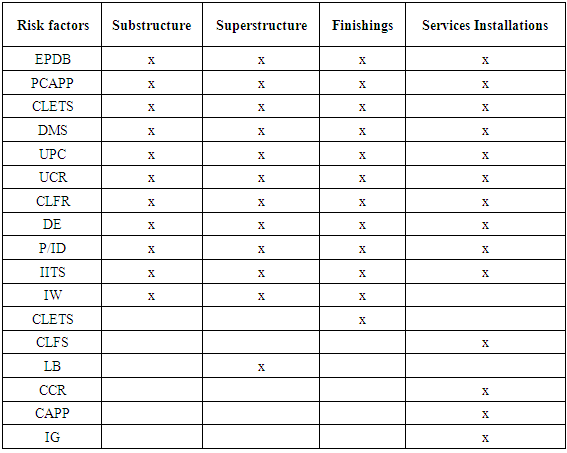

3. Methodology

- Both questionnaires and interview were organized to collect the data for the purpose of addressing the objectives of the research. The questionnaire was divided into two parts; first part was about the general introduction of the respondent, second part focused on risk factors that cause variations on forecasted construction cash flows during construction phase in building projects. All the questions in the second part of questionnaire were delimited to positive construction cash flows derived from staged cash flows as discussed in section 2.2.1 (i.e. based on staged progress payments upon completion of various work stages/parts of building projects). The work parts used in questionnaires of this research are substructure, superstructure, finishing and services installations (see Table 4). The superstructure part consisted of frames, upper floors, stairs, walls, partitions and roof elements of buildings. While finishing consisted of all finishes, doors, windows, fixtures and fittings, and external works. For the case of services installations consisted of electrical, plumbing, fire fighting, air conditioning, data cabling, and lift installations).

3.1. Questionnaire Design

- This study intended to find out the significant risk factors involved in causing variations between forecasted and actual construction cash flows in building projects. The questionnaire design targeted building contractors based in Dar es Salaam City (from class I to class VII). The risk factors were obtained from broad literature review. Then, the questionnaire was finally compiled by basing on the refined list of risk factors causing variations on forecasted construction cash flows after a pilot study. The pilot study was carried out to test the variables used in designing the questionnaire and improve reliability of the questions. The data used were collected using a questionnaire survey through quantitative approach. The closed ended questions were used in questionnaires as they can be analyzed easily [22]. The respondents were asked to provide their views on how the risk factors cause variations on forecasted construction cash flows during construction phase using a 5-point Likert scale. The views were based on the experiences of respondents from the recently completed building projects or on-going building projects executed by them. The ratings used were: Very high = 5; High = 4; Medium = 3; Low = 2; and Very low = 1. Each respondent was asked to rate each of the statements in terms of these rating scales.

3.2. Data Collection

- The data were collected using multiple sources of evidence. These sources have been good in facilitating the data collection process. Literature review was done to identify the risk factors affecting the construction cash flows in construction projects, whereby the list of those risk factors was refined using the pilot study. Questionnaires survey was also used to collect primary data on risk factors causing the variations on forecasted construction cash flows from building contractors. Finally, interview was used to collect the data on the effects of project scheduling and resource price change from consultants. Most of respondents had experience of more than 10 years in executing the building projects. This indicates that most of respondents have enough experience in managing the building projects. Therefore, this study consisted of questionnaires and interview that required information from building contractors and consultants.

3.3. Sample Size

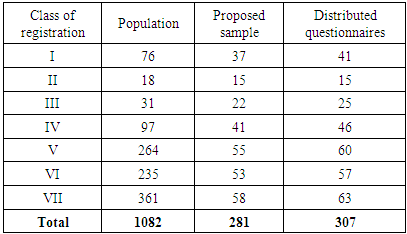

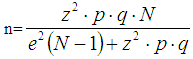

- The proposed sample size for building contractors for questionnaire survey was calculated using the statistical model presented by [16] as shown in equation 1.

| (1) |

|

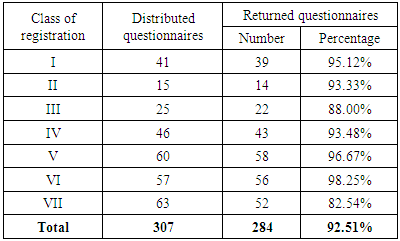

3.4. Response to Questionnaires

- The overall percentage of respondents was 92.51% (284) out of 307 distributed questionnaires as shown in Table 3. The number of respondents was 284 which is still above the proposed sample size (see Table 2). Therefore, the number of respondents was good representation and it was used in the analysis of this study. Respondents’ distribution is as shown in Table 3.

|

4. Results and Discussion

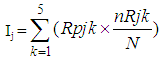

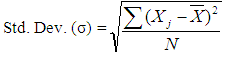

- The method of data analysis was conducted using statistical package for social sciences (SPSS) Version 20.0 for the data's obtained from questionnaires. Basically, various categories of descriptive statistics that measures of central tendency, measures of variability (dispersion) and measures of relative position to analyze its data were used by the researcher. The indices, variance and degree of variability of the data were calculated by using the following formulae:

| (2) |

| (3) |

| (4) |

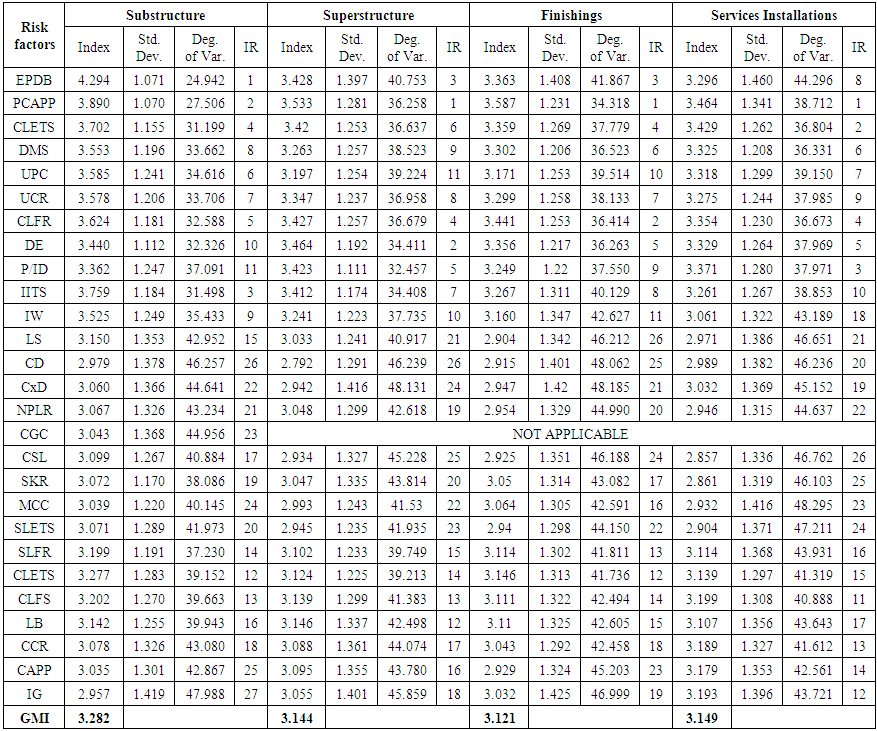

= MeanXj = values of the risk factor jThe analysis was performed on the responses (from 284 respondents) as shown in Table 4 to identify the significant risk factors that cause variations on construction cash flows in various parts of building projects. The risk factors have been presented in abbreviations (short forms) in this study so as to save space during presenting the data in tabulation form. The clarifications of abbreviations are given in Table 6. Other short forms used in this study are Std. Dev. (Standard Deviation); Deg. of Var. (Degree of Variability); Index Rank (IR); and GMI (Grand Mean Index) which is the mean of means of all sub-samples within the sample.

= MeanXj = values of the risk factor jThe analysis was performed on the responses (from 284 respondents) as shown in Table 4 to identify the significant risk factors that cause variations on construction cash flows in various parts of building projects. The risk factors have been presented in abbreviations (short forms) in this study so as to save space during presenting the data in tabulation form. The clarifications of abbreviations are given in Table 6. Other short forms used in this study are Std. Dev. (Standard Deviation); Deg. of Var. (Degree of Variability); Index Rank (IR); and GMI (Grand Mean Index) which is the mean of means of all sub-samples within the sample. | Table 4. Risk Factors Causing Variations on Forecasted Construction Cash Flows for Various Work Stages/Parts of Building Projects |

4.1. Significant Risk Factors Identified through Analysis

- Basing on the passing criteria mentioned above (i.e. the significant risk factors should have indices greater than 3.0 and above grand mean index in the respective activity part). From Table 5, ten significant risk factors namely errors in project documents (Bills of Quantities), poor communication among project participants, consultants’ lack of experience and technical skills, different meanings of specifications, unethical practices to consultants, unclarity of clients’ requirements, clients’ lack of financial resources, design errors, poor/incomplete design and incomplete information at tender stage were identified to cause significantly the variations on construction cash flows for all work parts of building projects (i.e. substructure, superstructure, finishing and services installations). These ten significant risk factors are equivalent to 37.04% of all potential risk factors causing variations on construction cash flows (i.e. 10/27). From Table 5, it shows that ten risk factors were also identified as insignificant factors in causing variations on construction cash flows to any work part of building projects. This is also equivalent to 37.04% of all potential risk factors (i.e. 10/27).

|

|

4.2. Effects of Project Scheduling

- The study also investigated different effects of project scheduling during construction phase. These effects are:

4.2.1. Change of Project Value

- If there is poor project scheduling which resulted into extension of time during construction stage, there is also a tendency of the cost of the overheads and preliminaries of the project to change. Hence, these cost changes affect the total project value in managing the building project. If poor project scheduling is influenced by client side, the contractor will claim more money for extension of time to cover the cost of overheads and some preliminary items as explained earlier. For instance additional works require more time compared to the first proposed schedule, this will cause also extra costs to contractor that would be resulted due to extension of the time. Therefore, those extra costs should be claimed by contractor and added to the total project value.

4.2.2. Delays of the Projects

- The study found that when there is more time required during construction of building project, the project completion period will increase too. Hence, this situation causes the delays in completing the building project. This will affect also the cash flows due to either extension of time or changes of project values influenced by that extension.

4.2.3. Poor Workmanship of the Projects

- It was also found that when there is a tight project schedule, this situation affects the workmanship of the contractor in performing the works at the site. Hence, the value for money is not achieved properly.

4.2.4. Conflicts between the Parties

- The change of the project schedule during construction phase may result into the conflicts between project members. This may happen especially when the client/consultant has added the works which need extension of time, but the client refuse to pay extra costs for overheads and some preliminary items due to that extension of time given to contractor.

4.3. Effects of Resources Price Changes

- The effects of resources price changes were investigated, but the change of project value is not among of those effects because the building projects are procured under fixed price contracts. These effects are:

4.3.1. Delays of the Projects

- The study found that when there are high prices of resources such as labourers and plants in the market (different from the original prices during tendering period), contractor tends to use more time in re-doing market survey and bargaining so that they can get reasonable prices for those resources as per tendered amounts. This situation affects the original schedule and makes the contractor to request extension of time from the consultants. In that manner, the changes of resources prices cause the delays in completing the building project. The periodic cash flows are also affected by this extension of time.

4.3.2. Poor Quality of the Projects

- Also, when there are high prices of resources (materials, labourers and plants in the market) different from the original prices during tendering period, contractor tends to use substandard materials and cheap (unskilled) labourers to execute the works in order to compensate the tendered amounts. This creates poor quality of the work and value for money is not achieved.

4.3.3. Termination of the Contract by Client

- It was found that the performance of contractor in terms of the quality and scheduling are affected due to high prices of resources (materials, labourers and plants in the market) during construction period. Due to this situation, sometimes the clients may terminate the contract due to poor performance of the contractor. The termination of contract will affect also the cash flow projections.

5. Conclusions and Recommendations

- The emphasis of this paper has been on identifying the significant risk factors causing variations on construction cash flows for various work parts of building projects during construction phase. The identified risk factors have been analyzed basing mainly on index analysis. From the risk factors identified as potentially causing variations on forecasted construction cash flows in building projects, only ten risk factors were identified as the significant risk factors which cause variations on forecasted construction cash flows for all work stages/parts of building projects in Tanzania (i.e. substructure, superstructure, finishing, and services installations). Therefore, it can be concluded that errors in project documents (Bills of Quantities), poor communication among project participants, consultants’ lack of experience and technical skills, different meanings of specifications, unethical practices to consultants, unclarity of clients’ requirements, clients’ lack of financial resources, design errors, poor/incomplete design and incomplete information at tender stage are the significant risk factors that cause variations on forecasted construction cash flows for all work parts in building projects in Tanzania.Furthermore, poor communication among project participants is one of the most three significant risk factors which cause variations on forecasted construction cash flows for all work stages/parts in building projects in Tanzania. Also, risk of errors in project documents (Bills of Quantities) was identified to be one of the most three significant risk factors in causing variations on construction cash flows for substructure, superstructure and finishing works.The identified significant risk factors are of important value in providing a reduction of the risk factors and they subsequently provide direction for further analysis in confirming those risk factors to still be significant or not in execution of building projects.The most common effects of project scheduling were change of project value, delays of the projects, poor workmanship of the project, and conflicts between the parties. For the case of effects of resources price changes were delays of the projects, poor quality of the projects and termination of the contract by client. Finally, the study recommends the following measures to be taken so as to minimize the occurrence of unnecessary variations on forecasted construction cash flows and confirm those significant risk factors. Proper communication should be exercised during implementation of building projects so as to link all project participants and necessary documents required for the successful completion of building projects. This will minimize the risk factors which happen due to improper communication or breakdown of communication.Detailed examination of the identified significant risk factors in causing the variations on forecasted construction cash flows should be done using contract documents such as cash flow projections, Bills of Quantities, interim valuations for payments, correspondences, work programme, site instructions, drawing revisions and contractor’s claim. Also, the identified significant risk factors are required to be confirmed by using the recommended confirmatory analysis methods such structural equation modeling (SEM). This will allow further analysis to those identified significant risk factors to check if they are still significant or not. Also it will check their correlations among themselves in execution of building projects.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML