-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Construction Engineering and Management

p-ISSN: 2326-1080 e-ISSN: 2326-1102

2015; 4(6): 248-262

doi:10.5923/j.ijcem.20150406.04

A Theoretical Framework to Enhance the Conversion Process in Convertible Contracts

Mohammad Moazzami, Reza Dehghan, George F. Jergeas, Janaka Y. Ruwanpura

Department of Civil Engineering, University of Calgary, Calgary, Canada

Correspondence to: Mohammad Moazzami, Department of Civil Engineering, University of Calgary, Calgary, Canada.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In convertible contracts, different contract price arrangements such as costs reimbursable, unit rate, and lump sum are used at different levels of project definition and through the project life cycle to allocate cost and performance risks more appropriately between contracting parties. Deciding conversion points through the conversion process is a challenging exercise in managing convertible contracts in oil and gas projects. This paper, through a grounded theory study, introduces a theoretical framework to enhance the conversion process in convertible contracts. The main focus of the study has been on engineering, procurement, and construction (EPC) fast-track projects in the oil and gas industry. The theoretical framework introduces important factors that influence deciding the conversion points, provides practical recommendations to enhance the conversion process, and presents some of conversion strategies in applying convertible contracts.

Keywords: Oil and gas projects, Fast-Tracking, Cost reimbursable, Lump sum, Convertible contracts, Conversion points

Cite this paper: Mohammad Moazzami, Reza Dehghan, George F. Jergeas, Janaka Y. Ruwanpura, A Theoretical Framework to Enhance the Conversion Process in Convertible Contracts, International Journal of Construction Engineering and Management , Vol. 4 No. 6, 2015, pp. 248-262. doi: 10.5923/j.ijcem.20150406.04.

Article Outline

1. Introduction

- In recent years, convertible contracts have been used in some oil and gas projects. In this hybrid contracting strategy, different contract price arrangements such as costs reimbursable, unit rate, and lump sum are used at different levels of project definition and through the project life cycle to allocate cost and performance risks more appropriately between contracting parties. Since convertible contracts are new in the oil and gas industry, important aspects of this contracting strategy have not yet been addressed in academic publications, and few industrial papers present convertible contracts. In particular, deciding conversion points through the conversion process is a challenging exercise. Currently there is no systematic approach to determine the point of conversion in convertible contracts. Through a grounded theory study, the objective of this paper is to present a theoretical framework to enhance the conversion process in convertible contracts. The main focus of the study has been on engineering, procurement, and construction (EPC) fast-track projects in the oil and gas industry. To provide a strong background on the research area, design development and execution phases of oil and gas projects as well as the contractual risk allocation process have been illustrated at the beginning of the paper. Following the explanation of research design and methodology, the process of developing the theoretical framework for the conversion process has been explained in detail. As the main result of this study, the proposed theoretical framework introduces important factors that influence deciding the conversion points, provides practical recommendations to enhance the conversion process, and presents some of possible conversion strategies in applying convertible contracts.

2. Background

- Understanding design development and execution phases of oil and gas projects is essential for discussing the concept of phased contract price arrangement and conversion process through the project life cycle. Moreover, fast tracking as a common execution strategy in oil and gas projects should be discussed and considered in constructing the theoretical framework for the conversion process. The unpredictable and frequently fast-track nature of oil and gas projects requires a flexible contractual framework to balance the high level of risk and uncertainties shared between contracting parties and to minimize potential claims, disputes, and litigation costs during the execution of the project. Project risks are allocated to contracting parties through the project delivery methods and contract price arrangements. These two main pillars of contractual risk allocation are explained in this section. Lastly, the main characteristics of convertible contracts have been described based on the small amount of information in the literature.

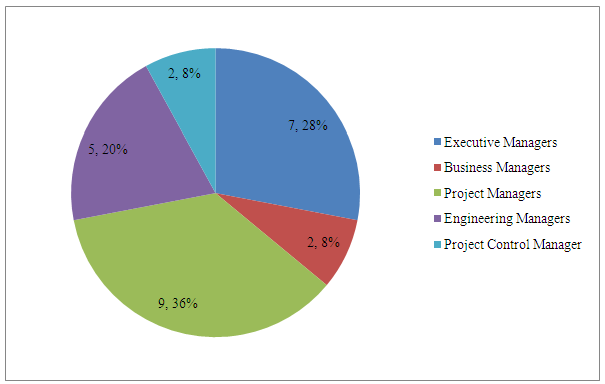

2.1. Development Phases of Oil and Gas Projects

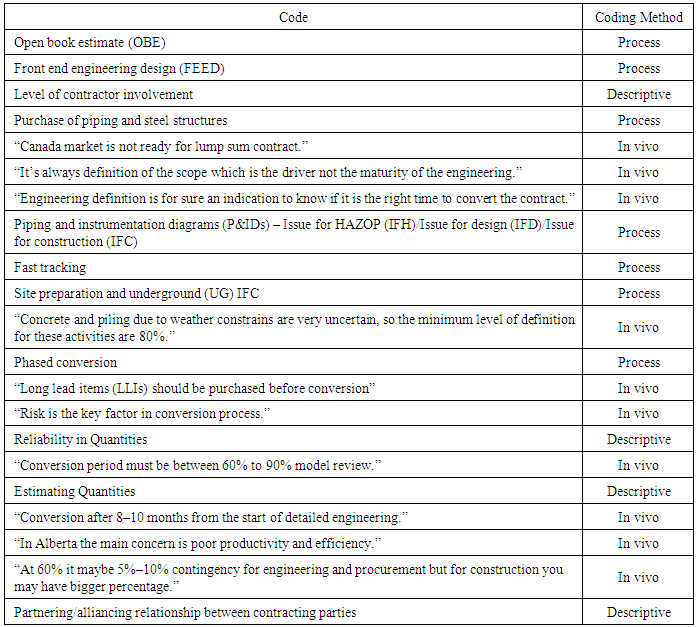

- A clear vision of the phases of defining and executing oil and gas projects provides a better understanding of varying contract price arrangements at different stages of the project. Figure 1 illustrates the typical phases and decision gates in design development and execution of oil and gas projects.

| Figure 1. Typical life cycle of oil and gas projects |

2.2. Contractual Risk Allocation

- Project risks are allocated to the contracting parties through the project delivery methods and contract price arrangements. These two main components of contractual risk allocation are explained in following sections.

2.2.1. Project Delivery Methods

- The project delivery method designates the contract scope, roles, and responsibility of contracting parties. The most common project delivery methods in execution of projects are as follows: ● Design–Bid–BuildIn the design–bid–build project delivery method the owner enters into a contract with an engineering firm that provides design services based on the requirements provided by the owner [7]. The engineering firm provides engineering documents, including equipment specifications and drawings required for building the project. These engineering deliverables will be used by the owner as the basis to make a separate contract with a construction contractor, which is usually called a general or prime contractor. In design–bid–build, engineering and construction activities are performed by two different entities through two separate contracts. There is no direct contractual relationship between engineering and construction contractors. If any problem arises during the construction phase due to design errors, the contractor proceeds with change orders, and the lack of communication between the engineering firm and the construction contractor may result in negative impacts on project performance [8]. However, this approach provides the opportunity to start construction activities with a complete engineering package, which results in less rework in the construction phase. ● Design–Build or EPCIn a design–build strategy, one single organization executes engineering, procurement, and construction phases of the project. In the oil and gas industry, EPC contract is an alternate term for design–build delivery method. If the scope of the EPC contract covers commissioning and start-up in addition to the engineering, procurement, and construction activities of the project, the contract usually is called EPC turnkey. In this approach, there is one single contract between the owner and a design–build or EPC contractor. Using the same organization to perform engineering and construction activities decreases potential claims and disputes in the project life cycle. However, the design–build delivery method gives more power to the contractor and lessens the owner’s control in project management and supervision. The EPC or design–build approach provides the opportunity for fast tracking to reduce the overall project duration. ● Construction management (CM)Construction management (CM) is another form of project delivery in which the contractor performs management activities on behalf of the project owner. The construction manager can act as general contractor (CM as constructor) or as a liaison between the owner and the general contractor (CM as agent). ● Relational contracting strategiesRelational contracting defines relationships among the parties in which they do not always follow the legal mechanism offered by formal contracts and appreciate the mutual benefits and “win-win” scenarios through a more collaborative attitude [9]. The most common forms of relational contracting are: partnering, alliancing, and integrated project delivery (IPD).

2.2.2. Contract Price Arrangements

- Contracts are mainly distinguished by the contract price arrangement and generally fall into one of the three main categories: fixed price, cost reimbursable, and guaranteed maximum price contracts [10]. ● Fixed price contractsLump sum and unit price as two major variations of fixed price contracts are explained as follows.Lump sum or stipulated price: Under a lump sum contract, the contractor is obliged to perform all the project work on a stipulated price basis and assumes most of the project risks and liabilities. The main advantage of this approach is knowing the ultimate time and cost required to complete the project. A lump sum contract requires a well-defined scope of work that completely provides project performance requirements. Unit price: In the unit price arrangement, the contractor performs each unit of work for a fixed rate. In this contract type, the rate of performing each unit of work is fixed, but the quantities are subject to change. ● Cost reimbursable contractsUnder a cost reimbursable contract, the contractor will be reimbursed for all of its costs plus an agreed upon fee. Cost reimbursable contracts are more flexible to changes and unpredictable situations. However, in this contractual framework the owner does not have a clear vision of its financial commitment, and the contractor is not motivated to minimize the project costs [11]. Under this contracting strategy, project risks are mostly transferred to the owner. Selecting a contractor in a cost reimbursable contract is usually a subjective, easy, and fast process, while it is formal, difficult, and slow in lump sum contracts. Several variations are commonly used in the cost reimbursable contracts, including cost plus percentage of cost, cost plus fixed fee, and cost plus incentive fee.● Guaranteed maximum price (GMP) contractsGuaranteed maximum price (GMP) is an alternate contractual approach that comprises features of both cost reimbursable and lump sum contracts. While in GMP the contractor will be reimbursed for the actual costs in addition to an agreed fee, the total cost of project will be guaranteed to a maximum fixed amount.

2.3. Two-Stage Tendering Contracts

- Two-stage tendering has been used in construction projects to achieve the early engagement of a contractor under a pre-construction service agreement (PCSA). The intention of the parties is to work together on a cost reimbursable or unit rate basis during the PCSA to develop the design and enter into a lump-sum construction contract in the second stage [12]. The main advantage of two-stage tendering approach is the participation of potential contractors in design development phase and project scope definition. Involvement of the contractor in the pre-execution phase provides early communication between the owner and the contractor to develop the design package that reflects the contractor’s views regarding constructability, work sequencing, and selecting subcontractors [13].However, there is no contractual obligation for both parties to proceed to the second stage and enter to the construction contract after the completion of PCSA. Lawrence noted that the conversion from a PCSA to a lump sum construction contract will typically occur when the contractor has successfully tendered 70-80 percent by value of the subcontract packages for the project [13].

2.4. Convertible Contracts in Oil and Gas Projects

- As illustrated in section 2.2.1, the EPC or design–build project delivery method provides the opportunity for fast tracking. However, design–build standard contract documents do not quite fit for fast tracking. Saltz supports the argument, “It is not unusual for design-build contracts to be used in fast-track situation but the forms do not really contemplate fast-track construction and must be modified to accommodate that situation” [14]. Lack of adapted contract clauses for fast-track projects in standard forms of contracts results in using exculpatory clauses. Exculpatory clauses are contractual clauses that transfer potential risks from one party to another [15]. Project owners typically use exculpatory clauses in traditional form of contracts to transfer project risks to contractors. The usual consequence of this inequitable risk assignment is consideration of more contingencies by contractors in their bid price, which will end with greater overall project cost [16].Convertible contracts, as hybrid contracting strategies, have been used recently in fast-track oil and gas projects to optimize the risk balance between project owners and contractors [17]. In this contractual model, different contract price arrangements such as cost reimbursable, unit rate, and lump sum are used at different stages of the project life cycle to allocate cost and performance risks between contracting parties more appropriately. The two-stage tendering can be considered as a form of convertible contracts for construction projects. However, the complexity and duration of mega projects in the oil and gas industry require a more dynamic conversion strategy to address different levels of risk and uncertainties through the project life cycle. Compare to the two-stage tendering contracts, convertible contracts in oil and gas projects provide more flexibility of using different contract price arrangements for different work packages during the project phases.Convertible contracts bring several benefits to the project. Use of the cost reimbursable contract at the start of a project with an incomplete scope of work accommodates the needs of fast tracking without absorbing a high level of risk from inadequate scope definition. In other words, this approach reduces the high costs of risk premiums and contingencies that are commonly included in a lump sum price contract. Further, converting the contract when the contractor has more accurate information to bid a realistic fixed price provides a clear vision of the project’s overall cost. Ultimately, convertible contracts combine the initial flexibility of the cost reimbursable methodology with the cost certainty of lump sum contracts [17].

3. Problem Statement and Objective

- Very few industrial papers have discussed general characteristics of the convertible contracts and there is a significant gap in academic studies addressing the most challenging issues in managing convertible contracts. In particular, no systematic approach exists to determine the timing of conversion as a critical element to be decided by project authorities. The main objective of this study is to develop a theoretical framework to enhance the conversion process in convertible contracts. The focus of this study is on oil and gas fast-track projects.

4. Research Design and Methodology

- Because of the investigative nature of the study, a qualitative approach was chosen to accomplish its main objective. As stated by Creswell, grounded theory is a helpful qualitative research design when current theories about a phenomenon are either inadequate or nonexistent and is a way of discovering and developing theories rather than verification of pre-existing theories [18]. Since the main objective of this study is to develop a theoretical framework, grounded theory study was chosen as the main research design.

5. Developing the Theoretical Framework

- The process of identifying, developing, and connecting relevant concepts to produce the grounded theory of this study were conducted through the following data collection and analysis activities.

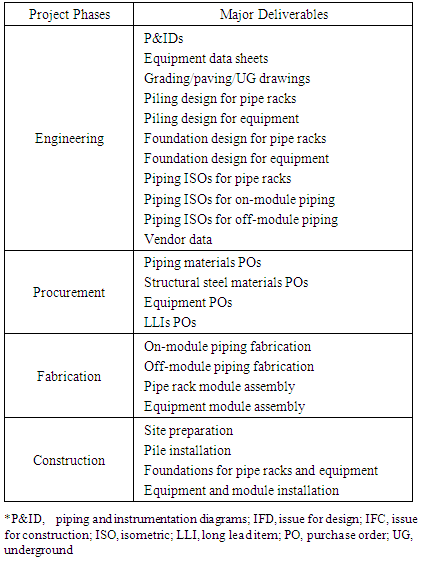

5.1. Data Collection

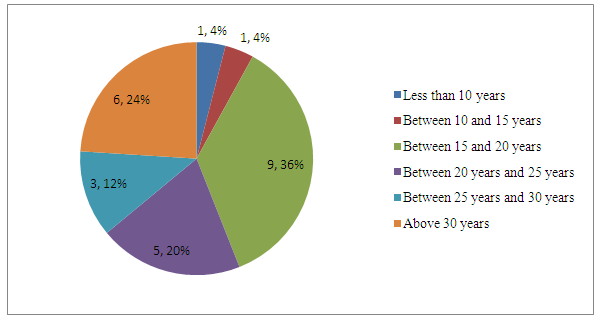

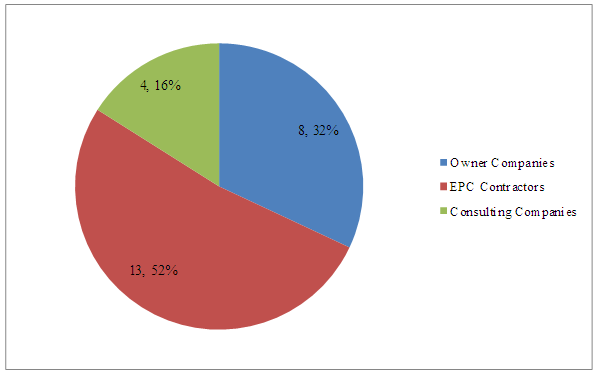

- The interview was chosen as the major instrument to collect the required data and information. Interviewees were selected among those who represent the typical perceptions and perspectives of the research scope. Executive managers, project managers, technical mangers, contract managers, project consultants, and project control managers participated in the study. The grounded theory study requires enough data to generate concepts, patterns, categories, and dimensions of the subject under the study and, therefore; it is essential to obtain an appropriate sample size that will generate sufficient data. Thomson conducted a study on one hundred articles that used grounded theory and utilized interviews as a data collection method [19]. The findings of his study indicate that the average sample size suggested for the grounded theory study was twenty-five interviews. Thus, in this study, the sample size was decided to be 25 in compliance with an acceptable sample size for grounded theory methodology. Figure 2 shows the breakdown of participants by their position.

| Figure 2. Breakdown of participants by their position |

| Figure 3. Participants’ range of experience |

| Figure 4. Breakdown of participants by the type of organizations |

5.2. Data Analysis

- In a grounded theory study, basic-level concepts are the conceptual names given by the researcher to raw data that provide the foundation of a theory [20]. Categories are higher-level concepts and more abstract terms that represent the major theme of a group of basic-level concepts. These higher-level concepts provide the structure or framework of the theory. Coding methods can be used to conceptualize raw data. Codes are the conceptual names given to the raw data. The collected data were analysed through open coding, axial coding, selective coding, and theoretical integration to develop a theoretical framework for conversion process [21]. Analytic memos and diagrams were also used as effective analytic tools in all levels of analysis. Memos and diagrams preserve the dialogues that occurred in the researcher’s mind while interacting with data [20].

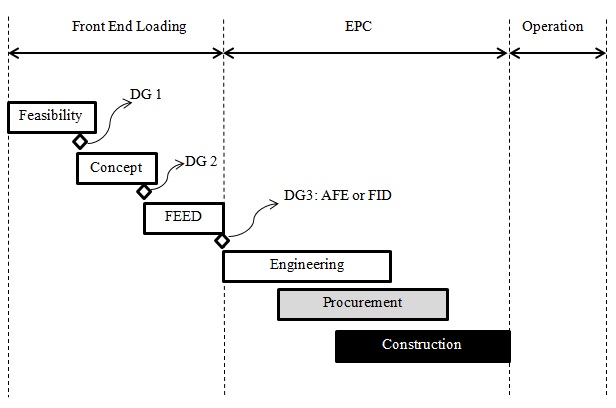

5.2.1. Open Coding

- Open coding is to identify codes and categorize them to a further level of analysis during the initial coding process. Different coding methods can be used during the initial coding cycle depending on the nature of the qualitative study. Descriptive, process, and in vivo coding methods were used in this study for initial coding of the interview transcripts and relevant documents. Descriptive coding summarizes the basic topic of a passage of qualitative data in a word or short phrase and in vivo refers to a word or short phrase from the actual language found in the qualitative data [22]. Process coding specifies words or phrases that capture actions. Examples of coding interview transcripts are shown in Table 1.

|

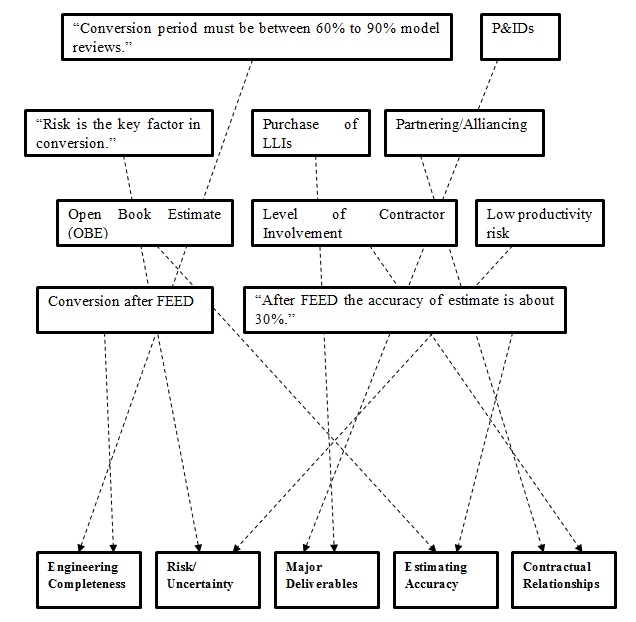

| Figure 5. Categorizing the identified codes and concepts |

|

| Figure 6. Analytic diagram for “engineering completeness” category |

|

5.2.2. Axial Coding

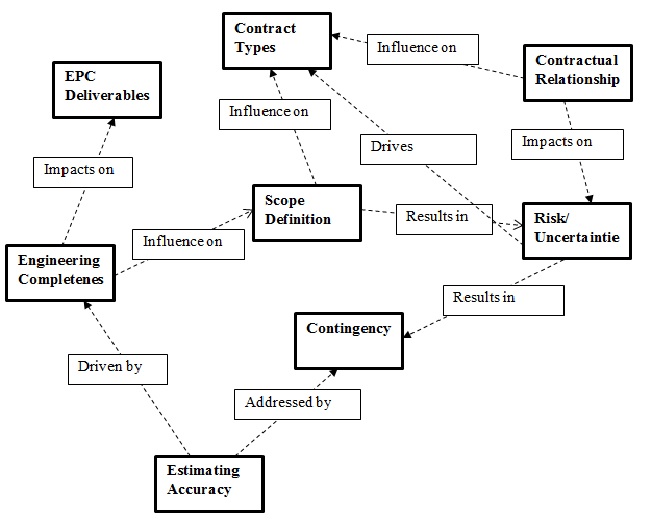

- Axial coding, as a form of intermediate coding, facilitates exploring the interconnections among categories. Figure 7 depicts the axial coding process with possible examples of action–interaction between categories.

| Figure 7. Axial coding approach |

5.2.3. Selective Coding

- Selective coding is an advanced coding process that unifies all categories around a core or central category that has the greatest explanatory power and the ability to link the other categories to it and to each other [20]. The results of analysing collected data through open coding and axial coding show that the engineering completeness is the core category which can be used as a central explanatory concept tying all other categories together. Most of codes and concepts extracted from different categories can be linked together to justify the conversion timing at different levels of engineering completeness. Also, the concept of engineering completeness has been mentioned in most of interviews and a high number of codes and concepts point to this concept. In fact, inherent meaning extracted from actual data represent the engineering completeness as the principal explanatory concept and choosing this category is consistent with the collected data and fulfils the requirement of the core category.

5.2.4. Theoretical Integration

- Theoretical integration generates the final product of the grounded theory study by integrating the findings around the core category. Corbin and Strauss suggest writing descriptive/conceptual summary memos (story line) and integrative diagrams to facilitate the integration process [20]. As an example, following summary memo was created to aid theoretical integration in this study.Theoretical integration: Story line techniquesSummary memo: “The conversion process may occur from FEED and through the EPC phases, depending on the level of contractor involvement in project phases. In this study, influencing concepts in deciding conversion points were identified, developed, and linked through data analysis. Identified concepts were grouped through open coding in the main categories of scope definition, major EPC deliverables, engineering completeness, estimating accuracy, contractual relationships, contract price arrangements, risks, and contingencies. After the concepts were categorized, the interconnections between them were explored through the axial coding. “Engineering completeness” has been identified as the core category of this study. Certain engineering milestones, including end of the FEED phase, after 60% model review session, between 60% and 90% model review sessions, and after 90% model review session are proposed milestones/periods to convert the contracts. These suggested points for conversion have been justified by linking the level of engineering completeness to the estimate of project quantities and delivery of major procurement and construction components. In fact, selecting contract types during the conversion is closely related to the level of residual risks at conversion points, which is driven by engineering progress. Based on the level of engineering definition during the conversion, different contract price arrangements may be used for the same deliverables, work packages, or project phases. Effective management of convertible contracts needs collaborative relationships and a high level of trust in the project environment. Partnering and alliancing strategies can improve the performance of convertible contracts.”This summary memo provides a base for the results of data analysis steps through the open coding, axial coding, selective coding, and theoretical integration have been presented as the theoretical framework in the next section.

6. Theoretical Framework

- The theoretical framework, as the final product of this study, introduces important factors that influence deciding the conversion points, provides practical recommendations to enhance the conversion process, and presents some of the possible conversion strategies in the application of convertible contracts in oil and gas projects.

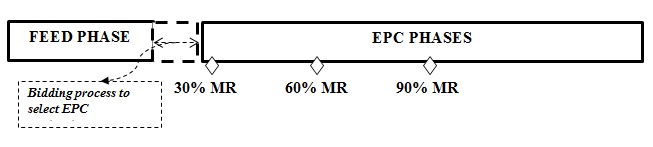

6.1. Important Factors that Influence Deciding the Conversion Points

- ● Risk is a key driver in managing convertible contracts. Deciding conversion points are highly influenced by the risk attitude of contracting parties. ● The degree of engineering completeness is one of the most important factors in deciding the conversion points. Significant engineering milestones such as conducting model review sessions at 30%, 60%, and 90% of engineering completeness are key indicators in deciding conversion points.● Particular deliverables in engineering, procurement, and construction phases such as issue of P&IDs, MTOs for bulk piping and structural steels, ordering LLIs, and subcontracting civil works can influence deciding the conversion points.● Engineering development is a major element of the project scope, but there are other important aspects such as market condition, execution strategy, and the level of complexity that may affect the conversion strategy. ● The values of major equipment and key bulk materials that should be purchased before conversion influence deciding the conversion points.● The amounts of the construction work packages that should be sub-contracted before conversion influence deciding the conversion points.● In construction, the main challenge (risk) for the EPC contractor is that it has to commit on quantities and productivity under the lump sum contract while it does not necessarily have the same commitment from subcontractors.● The level of involvement of the EPC contractor in pre-execution phases of the project can affect the conversion timing.● The performance of the conversion process is highly affected by the level of relationships between contracting parties.

6.2. Recommendations

- ● Convertible contracts require a strict risk management approach. Realistic risk analysis is essential in successfully managing the convertible contracts.● Risks associated with the market condition including regulatory requirements, availability of skilled resources, productivity, local subcontractors, and weather conditions should be evaluated accurately and considered in the conversion process.● Although the percentage of engineering completion is an important indicator for determining the conversion points, the level of scope definition as a more comprehensive factor should be taken into consideration.● Certain engineering milestones, including end of the FEED phase, between 60% and 90% model review sessions, and after 90% model review sessions, are proposed milestones/periods to convert the contracts.● Conversion to a single lump sum contract after FEED is too risky and usually will result in allocating a high amount of contingencies in the lump sum price.● It is recommended to place POs for all LLIs before conversion to lump sum.● It is recommended to place POs for structural steel and piping bulk materials before conversion to lump sum.● It is suggested to placing 70%–80% of equipment POs and 50%–60% of bulk materials POs before conversion to lump sum. This usually happen between 60% and 90% engineering completeness.● Owing to the high level of uncertainty, civil works such as site preparation, piling, and concrete works are suggested to be performed under a unit rate scheme before converting the whole project to the lump sum.● Unit rate is also recommended for pipe and module fabrication activities before conversion to lump sum.● Contracting parties should develop and agree on a change management procedure that accommodates different contracting phases during the project life cycle.● Using the same contractor for both FEED and EPC phases can result in early conversion and less contingency in the lump sum price.● A successful conversion process requires a collaborative and trustworthy environment. Alliancing and partnering strategies are recommended to provide the required environment for convertible contracts.

6.3. Conversion Strategies

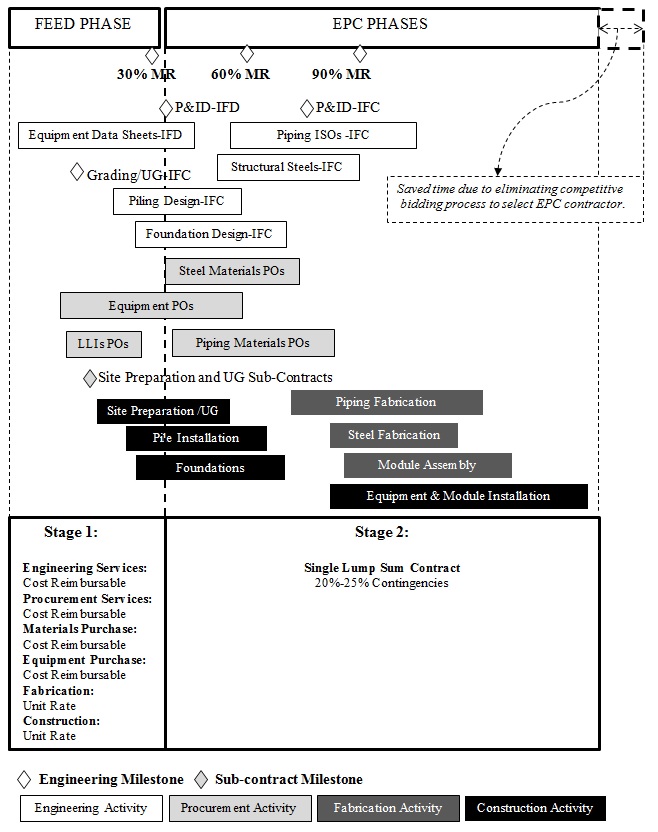

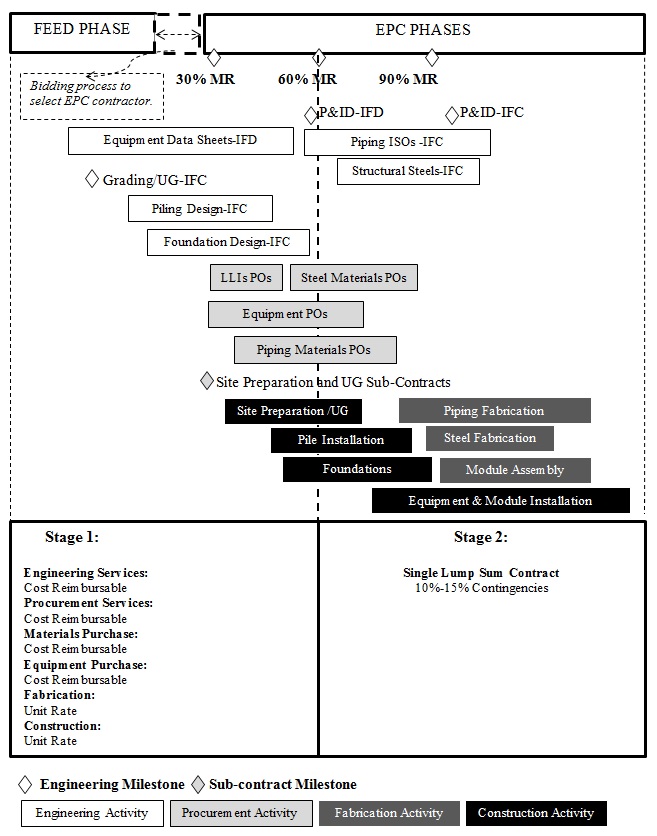

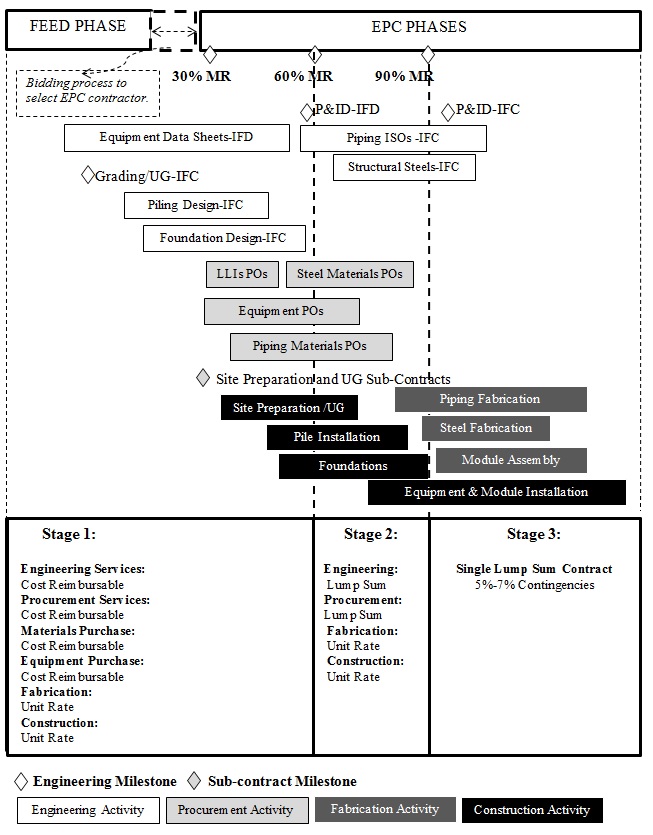

- Based on the results of the study and through use of the analytical memos and diagrams created through the data analysis, some of possible strategies to convert the contract are presented as follows:Strategy 1: With the assumption that contractor involvement is started from the FEED phase, this strategy suggests two contractual stages, as shown in Figure 8. The first stage covers the FEED phase of the project with a mixed contract price arrangement. In the second stage the entire EPC will be performed under a single lump sum contract.

| Figure 8. Conversion process: strategy 1 |

| Figure 9. Conversion process: strategy 2 |

| Figure 10. Conversion process: strategy 3 |

7. Conclusions

- Through a grounded theory study, a theoretical framework has been developed in this paper to enhance the conversion process in convertible contracts. The study focused on EPC fast-track projects in the oil and gas industry. The theoretical framework provides:● important factors that influence deciding the conversion points● practical recommendations to enhance the conversion process● possible conversion strategies in application of convertible contracts To optimize the risk taking/rewarding concept, a phased conversion approach is suggested to use cost reimbursable, unit rate, and lump sum contract price arrangements through the project phases. The results of this study indicate that the engineering completeness is an essential factor in the conversion process. Major engineering milestones such as 60% and 90% of engineering progress are key indicators in deciding the conversion points. However, the degree of engineering completeness is not the only factor to influence deciding the conversion time and the level of scope definition as a whole should be taken into consideration.Although project owners prefer early conversion to minimize the costs risk, immature scope definition may result in higher contingency in the lump sum estimate. The acceptable range of contingency by the project owner is an important factor in deciding the early conversion. Conversion to a single lump sum contract after the FEED phase and from the start of EPC is a highly risky approach.It is recommend to purchase all LLIs and key bulk materials, including piping and structural steels, before conversion to the lump sum. Also, it is recommended to perform the civil work packages, including site preparation, piling, and concrete pouring, under the unit rate contract.An effective risk management approach and realistic risk assessment are vital in successful management of convertible contracts and deciding the right conversion strategy. Project risks should be monitored closely and evaluated through a reliable risk analysis process to accurately estimate the amount of contingencies.Since the conversion process needs a high level of cooperation and transparent interactions between contracting parties, alliancing and partnering strategies are recommended to establish the required project environment. These strategies build effective communications and trust between the project owner and the EPC contractor and expedite the conversion process.In addition, the theoretical framework presents three possible conversion strategies through the project life cycle. Contract price arrangements fit for different scopes of work are suggested in different stages based on the level of scope definition and engineering completeness. Also, the acceptable range of contingencies are suggested for each strategy. Considering its importance, developing an effective and systematic estimating process to reach a more accurate lump sum price in a convertible contract would be a potential subject for a future study on convertible contracts.

ACKNOWLEDGEMENTS

- The authors of this paper gratefully acknowledge all project experts who participated in interviews and supported this study by their valuable knowledge and experience.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML