Martin Henry Asare, Yousong Wang, Yufan Zhang, Jing Kuang Liu

South China University of Technology, Guangzhou, China

Correspondence to: Martin Henry Asare, South China University of Technology, Guangzhou, China.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The construction industry has been one of China’s economic backbones. Desperate cities in Construction like Beijing and Shanghai have risen on the architectural stage with buildings such as the CCTV headquarters and the Olympic Village. China’s expenditure in a year is about $375 billion on construction, almost 16% of its Growth Domestic Product (GDP). This study shows some of the weaknesses and threats of china’s construction in Africa and how they can be improved for a more integrated and sustainable construction. After a SWOT analysis some of the identified weaknesses included poor communication, low working conditions, low wages of workers, low quality of imported materials, do not encourage the purchase of locally produced materials, low level of team work with locals. Some of the threats outstanding threats were local protectionism, political changes, climatic changes, fluctuation of fuel prices, shortage of gas and petrol, and disputes with community. The SWOT allows for development of strategies in order to exploit its competitive advantages or defend against its internal weaknesses or provide possible remedial measures. Buying of locally produced materials and avoiding gross importation of materials was a measure given in the study to control local protectionism. Measures to control threats of political changes included enforcing that projects are independent of political influences and completion of projects are within the period of a specific government regime. These findings may also be useful to other firms in Asia and those from different continents. Some specific aspects of risk management are elucidated and distinctively outlined. Although there have been abundant research on risk assessment in general, there are very few attempts of risk assessment of construction in Africa and almost none on Ghana. Therefore, the research findings of this study can enrich and improve the contents of other related topics or subjects.

Keywords:

Threats, China, Risk Assessments, Construction, Ghana

Cite this paper: Martin Henry Asare, Yousong Wang, Yufan Zhang, Jing Kuang Liu, Threats Encountered by Chinese Construction Firms in Africa: Case Study on Ghana, International Journal of Construction Engineering and Management , Vol. 4 No. 3, 2015, pp. 61-72. doi: 10.5923/j.ijcem.20150403.01.

1. Introduction

In August 1979 China’s State Council introduced legislation permitting specialized Chinese companies to operate overseas. Prior to this, Chinese companies operating overseas were restricted to projects that provided economic and technical aid with funds provided by the Chinese government. This exposure enabled Chinese companies to gain international market experience that was to their benefit following the Chinese government’s adoption of an open-door policy. Overseas contracts undertaken by Chinese companies can be categorised as follows: Projects funded through Chinese government loans or financial aid to developing countries; Projects funded by loans from the World Bank, African Development Bank (ADB), Islamic Development Bank (IDB) and other such institutions; Projects obtained through governmental bilateral trade agreements; Projects won through international bidding; Projects obtained through local clients, and Projects obtained through local branch offices of Chinese enterprises (Low & Jiang, 2003). Industries considered economically or militarily strategic are often heavily subsidized.Reasons for China’s ExpansionChinese corporations, have a number of motivations to expand into international markets. (Deng Ping, 2003) These are:a. Resources - In spite of China’s wealth of natural resources, by global standards and per capita, these resources are thinly spread, especially in terms of energy, forestry and fisheries. Energy, in particular, is required to fuel China’s burgeoning economy. China’s rapid growth almost doubled domestic oil consumption in the last 10 years such that the country’s demand outstripped supply even though in the 1990s there were signs of the industry reaching near self-sufficiency. As a result in 2004 China became the second largest oil importer after the US (WWI, 2006). It is noteworthy that the largest Chinese multinationals are not only state-owned, but also energy-related.b. Technology - To develop its industries, the Chinese government has made the acquisition of new technologies from the west a priority, actively encouraging technology upgrades in multinationals (Deng Ping, 2003).c. Markets – China suffers from industrial over-production and market saturation in a variety of sectors, including textiles, footwear and electronics. This has necessitated entry into new markets. In addition, following the opening up of the domestic market, Chinese companies no longer have the market monopoly they once enjoyed and now need to expand into new markets.d. Diversification – Before 1985, SOEs had exclusive rights to import-export and foreign exchange, maintaining strict sector dictated mandates. But with the relaxation of these laws, enterprises need to diversify their role in the economy. Expansion into international markets offers this opportunity.e. Strategic Assets – As they become part of the global economy, the necessity for strategic assets, particularly in the energy sector has arisen. As noted earlier, with the Chinese government offering substantial subsidies and soft loans, many enterprises are able to purchase ailing ventures in strategic locations without the burden of being cost-efficient. This is evident in Africa with regards to energy purchases. | Figure 1. Showing reasons for China’s expansion |

Chinese construction companies discovered that most of these goals can be attained by expanding into new African markets. The majority of the larger Chinese construction firms interviewed in this study are state-owned. This is largely because SOEs have more experience in the international market, having been allowed to operate in the global arena for longer than the few private companies that may have existed. It is also due to a more structurally entrenched government access and the preferential assistance afforded by the Chinese government to the SOEs that have been ear-marked as more likely to be successful pioneers of China’s “going global” or “go out” strategy.This does not however, mean that only Chinese SOEs operate in the African construction market. Many companies which are considered private do have a presence in Africa. It is important to note however, that especially with the ongoing restructuring and privatization of SOEs undertaken by the Chinese government, the exact shareholder structure of these companies is difficult to ascertain.

2. Literature Review

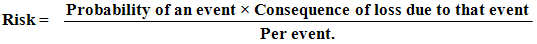

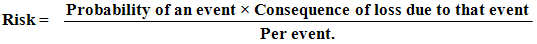

In order to determine the threats in any construction project or any other project, a thorough risk management is important. Project risk management in a project surpasses denoting determining factors that could impact negatively the cost of a project’s schedule or quality baselines; quantifying the associated potential impact of the identified risk; and implementing measures to manage and mitigate the potential impact. The more risky the activity is, the more costly the consequences if the wrong decision is made. Businesses would like to quantify risk for many reasons. Knowing how much risk is involved will help decide if costly measures to reduce the level of risk are justifiable. It can also help to decide if sharing the risk with an insurance company is justified. Some risks, such as natural disasters, are virtually unavoidable and affect many people. All choices in life involve risk. Risks cannot be totally avoided, but the choice can beam so that risk is minimized.  Graphical representation of risk ratings can be made by plotting graph between probability and degree of impact or seriousness, figure 2. gives a further explanation of this concept.

Graphical representation of risk ratings can be made by plotting graph between probability and degree of impact or seriousness, figure 2. gives a further explanation of this concept. | Figure 2. Graphical representations of risk rating |

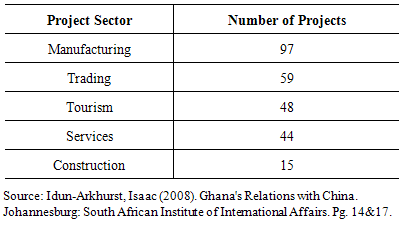

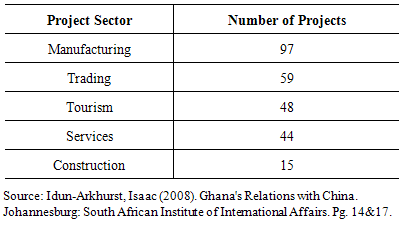

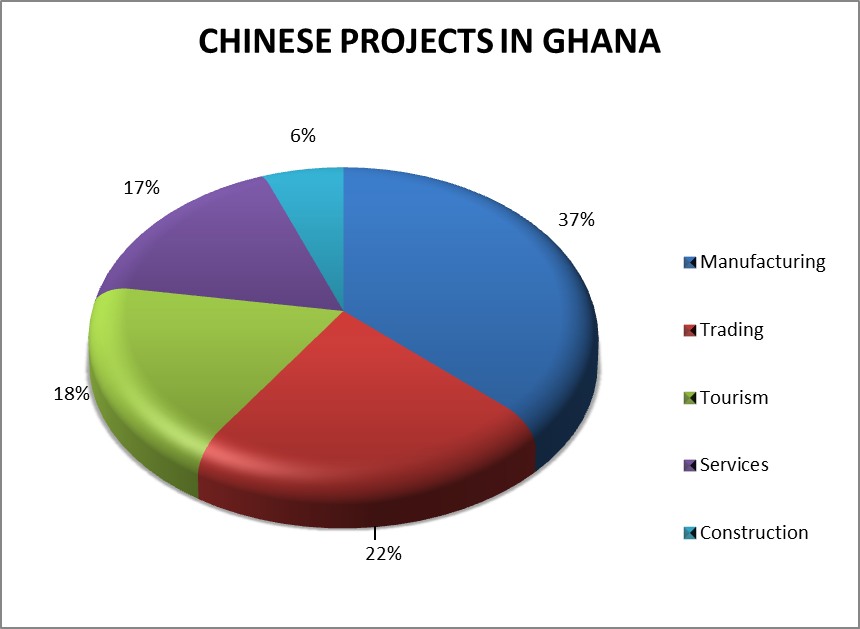

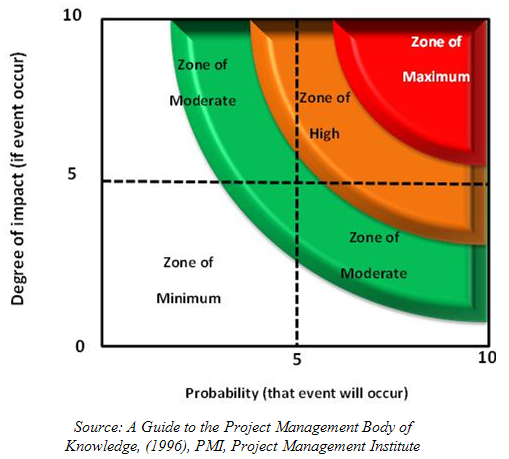

Sino-Ghanaian Construction ProjectsChina is currently the second largest exporter to Ghana. In 2005 US$433.74 million worth of imports come into Ghana from China with Ghana exporting US$31.26 worth of exports. This reflects a sharp rise in two way trade between the two countries from $93.13 million in 2000 to $433.74 million in 2005. Most of China's foreign direct investment in Ghana is focused on manufacturing, construction, tourism, trading and services with total investments worth US$75.8 million in 2008. Of 283 projects that Chinese nationals and SOEs have investments in, 97 are in manufacturing, 59 in trading, 48 in tourism, 44 in services and 15 in construction.Table 1. Showing various sectors and number of projects embarked by the Chinese in Ghana

|

| |

|

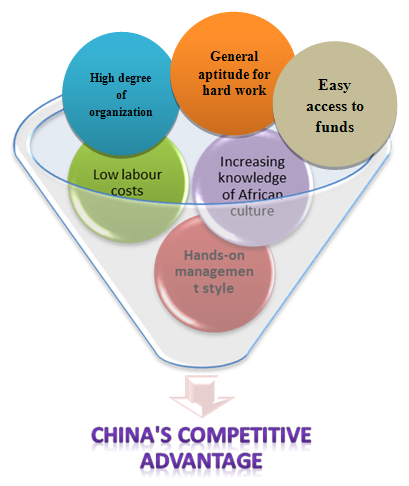

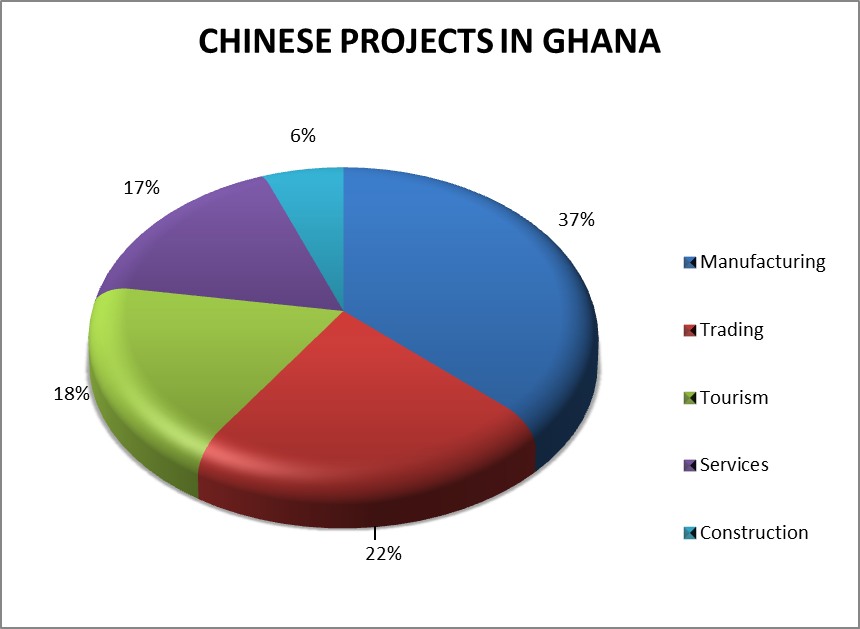

China’s Competitive advantageMany Chinese project managers have affirmed to the fact that competitiveness of Chinese firms results from their: • Increasing knowledge of African culture, • Low labour costs; • Hands-on management style; • High degree of organization; and • General aptitude for hard work. Almost every African country has a cuisine of Chinese food and this exposes these Chinese to relevant cultural differences in the particular setting. As companies come in to these countries for construction purposes transfer of such information spreads easily as they locate these restaurants. Many do not however allude to relatively cheap capital, which is perhaps the single biggest challenge that their competitors face, as part of their comparative advantage. SOEs can secure the necessary funds for advance payment and performance bonds from their head offices in China. They and other smaller private companies can also secure loans at flexible rates from Chinese banks such as the Bank of China, the China Development Bank and the China Exim Bank. Chinese worksites are usually highly organized and all the personnel, from the executive down, invariably live and work on the site full time. This “hands on” style of management saves considerable time and provides management with a profound understanding of the project and the ability to handle challenges as they occur. While local and foreign construction companies operate on profit margins of 15-25 percent, Chinese companies usually operate on margins of under 10 percent, thereby making them extremely competitive. An executive representative of a large SOE interviewed in Tanzania (and speaking on condition of anonymity) disclosed that his company and many other SOEs operate on profit margins as low as five percent. There have also been reports of a large Chinese SOE in Ethiopia slicing projected profit margins to as low as three percent. | Figure 3. Pie Chart showing Chinese Projects in Ghana |

| Figure 4. Showing China's competitive edge over other foreign companies |

Chinese companies may occasionally undercut competitors by up to 50 percent on the price of the overall bid. However, such low prices are the exception rather than the rule. This was observed with the losing bid by a Chinese company based in Guinea for a road construction project in Sierra Leone that was twice as high as the winning bid from an Italian company. The differences between Chinese bids and the traditional market players’ are usually considerably less than perceived, especially where private Chinese companies are concerned. The list of 16 tenders submitted for the construction of a school in Zambia where eight Chinese companies were relatively evenly spread through the middle of the field is common, especially in markets where the Chinese presence is more mature. Chinese companies are also quickly earning a reputation for good quality and timely work, rendering them popular in both the public and private sectors. Each of the countries examined had Chinese Trade Centres that provided information to both local and Chinese businesses wishing to enter the respective market either through trade or investment options. These Centres also provided limited logistical support assisting with the organization of accommodation, transportation and, in some instances, telecommunications. Such services are usually offered for a fee. The Economic and Commercial Counsels, which are attached to PRC Embassies but have a larger degree of autonomy than other desks, restrict their assistance to providing information. None were able to provide solid information on trade or investment figures between China and the respective countries. They also authenticate and provide translations of official documents issued in China - such as company registrations and academic qualifications. The Chinese government is clearly very supportive of Chinese construction companies. All Chinese diplomatic representatives interviewed were adamant that this support was in line with free trade practices and was limited to what several described as “political support”. In practical terms the latter means assisting Chinese nationals with administrative problems that they may encounter with local authorities.Challenges in some African CountriesChinese construction companies experience many of the same challenges faced by their local and foreign competitors. The most widely cited challenge in Africa is the serious shortage of locally-sourced skilled workers and reliable labour. This problem is commonly offered as the rationale by most companies for their lack of local recruitment, particularly in Angola. Another serious challenge is the lack of infrastructure as a result of protracted civil wars. One challenge unique to the Chinese was the issue of communication. In countries where they have been established for some time, the Chinese workers generally communicate in English or, at times, local languages. In Angola, communication continues to be a problem purely because English is not widely spoken, and it has only been two years since the Chinese construction companies entered the market in 2004. In Sierra Leone a number of government officials and subcontractors complained that the building plans used by the Chinese were written in Chinese script. These were incomprehensible to the local engineers and required the continued involvement of the Chinese in on-going maintenance. It is anticipated that this problem will diminish over time. In Tanzania for example, Chinese companies regularly use building plans written in both Chinese and English to overcome this problem.

3. Case Study: Bui Dam Construction

Ghana is a democratic country located in West Africa. It is bordered by Côte d'Ivoire (Ivory Coast) to the west, Burkina Faso to the north, Togo to the east, and the Gulf of Guinea to the south. Its capital is Accra and has a geographical area of about 238,538 sq. km. (92,100 sq. mi.) with a population of 24million people (2011 est.). This is about twice the size of the population in Guangzhou city, China. The official language is English with other local dialects spoken by the different ethnic groups. Ghana’s recent discovery of oil has released leverage for economic empowerment and development. The oilfield which is reported to contain up to 3 billion barrels (480,000,000 m3) of light oil was discovered in 2007. Oil and Gas exploration is ongoing, and the amount of both oil and gas continues to increase... The oil is expected to account for 6% of the revenue as of 2011. Ghana is believed to have up to 5 billion barrels (790,000,000 m3) of oil in reserves, which is the 6th largest in Africa and the 25th largest proven reserves in the world.The construction of the Bui Dam is one of the major projects of Chinese construction in Ghana after the construction of the Ghana National Theatre in Accra. The Bui dam will be the third major dam in the country after the Akosombo Dam and the Kpong Dam. It would flood about 20% of the Bui National Park and impact the habitats for the rare Black Hippopotamus as well as a large number of the native wildlife species. It will also require the forcible resettlement of 1,216 people, and affect many more.

4. Methodology

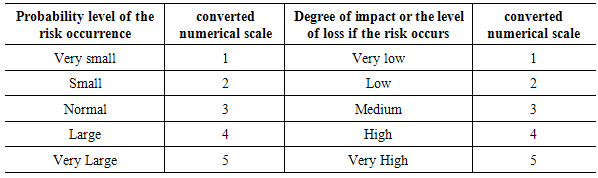

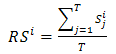

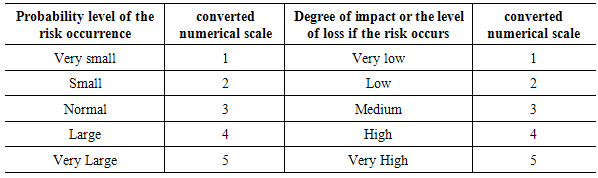

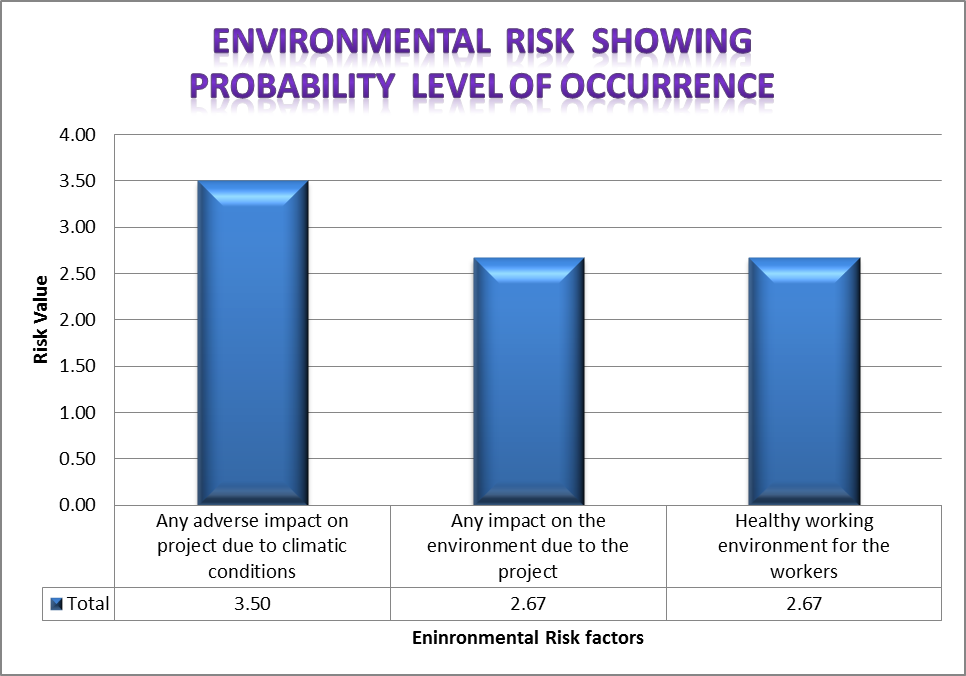

The general research methodology for this project comprised basically of a survey questionnaire which was issued out to 8 interviewers at various locations and centers by postage and emails. They in turn went to the various construction firms in Ghana to conduct the study. It also consists of a statistical analysis of the data obtained. The firms interviewed involved both contractors and consultants engaged in various projects. Some of these companies interviewed had the following businesses: 1. Building, Construction and Engineering, Contractors and Tradesmen, Building Contractors, 2. Transportation, Distribution, Haulage 3. Manufacturing and Wholesale, Chemicals, Oil and Gas Extraction Companies 4. Transportation, Road, Oil and Gas Extraction Companies The questionnaire is made up of two parts. The risk factors section and the personal details which sought for general personal data about the respondents. For the overall risk values obtained, the risk is given a rating ranging from 1 (no severity and unlikely to happen) to 25 (just waiting to happen with disastrous and wide-spread results) by the product of the scores for the severity and likelihood.Pilot StudyThese risks were mainly sourced from Ahmed et al. (1999), Chapman (2001) and Wang and Liu (2004) and were put into nine categories, with 13 risks related to clients being the financial and legal risks, 23 related to the designers and technical workers, 11 related to contractors, 9 related to subcontractors/suppliers, 4 related to government bodies, 4 related to superintendents, 9 related to external issues such environment, language and social risks.The research team conducted the survey from September 2011 to February 2012. Prior to disseminating the questionnaire, a pilot study was conducted with one academic and one project manager to test whether the questions are intelligible, easy to answer, unambiguous, etc. Very useful and valuable feedbacks were obtained to ameliorate the quality of the questionnaire. After further refinement and corrections, the questionnaires were conducted to 15 construction firms in Ghana. Some respondents were contacted beforehand to make sure that they were familiar with construction projects and were willing to join this survey. Others were reluctant and did not want to give any information which they considered confidential and classified. Feedbacks were obtained after waiting for 12 weeks 15 feedbacks were received in which 3 feedbacks were identified as invalid due to incomplete or invariable answers. This represents a valid response rate of 33%, which is acceptable according to Moser and Kalton’s assertion (1971).Assessment of Risk factorsThe risk assessment tool created from this work is intended to provide a quasi-quantitative guide to risk assessments based on the data obtained. After the pilot study and studying the various situations at the construction sites some risk factors like legal, technical, financial and environmental risks were spotted as possible factors to help determine certain threats encountered by the Chinese firms. For a particular category of risk that was interviewed for example: "Bankruptcy of project partner", some Chinese companies answered "Small" (2), others also answered "Normal" (3) for the same question. The average of all those who answered "small" for a particular company were calculated to be "2". The worst Probability level of the risk occurrence is 5, and the worst Degree of impact or the level of loss if the risk occurs is also 5. The product of the probability level of risk and the degree of impact is used to obtain the expected risk value. To assess the relative significance among risks, previous literatures study suggests establishing a risk significance index by calculating a significance score for each risk. The method for calculating the significance score is to multiply the probability of occurrence by the degree of impact. Thus, the significance score for each risk assessed by each respondent can be obtained through the model where  | (2) |

Where:Si = significance score assessed by respondent j For risk i; αj = probability of occurrence of risk i, assessed by respondent j; andβi = degree of impact of risk i, assessed by respondent j. By averaging scores from all the responses, it is possible to get an average significance score for each risk, and this average score is called the Risk Index Score or Risk Significance as was previously defined. This is used to rank all categories of risks factors. The model for the calculation of Risk Index Score can be written as (Shen et al, 1998): | (3) |

Where:RSi = index score for risk I or expected value of risk; Si = Significance score assessed by respondent j for risk i from Equation (2) and T = Total number of responses. To calculate Si, the five point scales for α and β was converted into numerical (Likert scale) scales as shown in the table below:Table 2. Showing converted point scales

|

| |

|

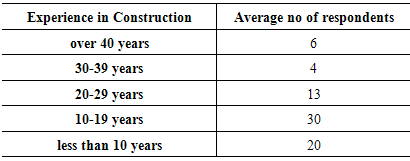

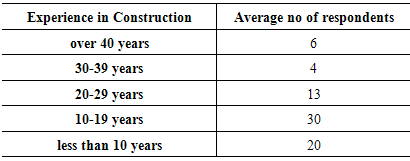

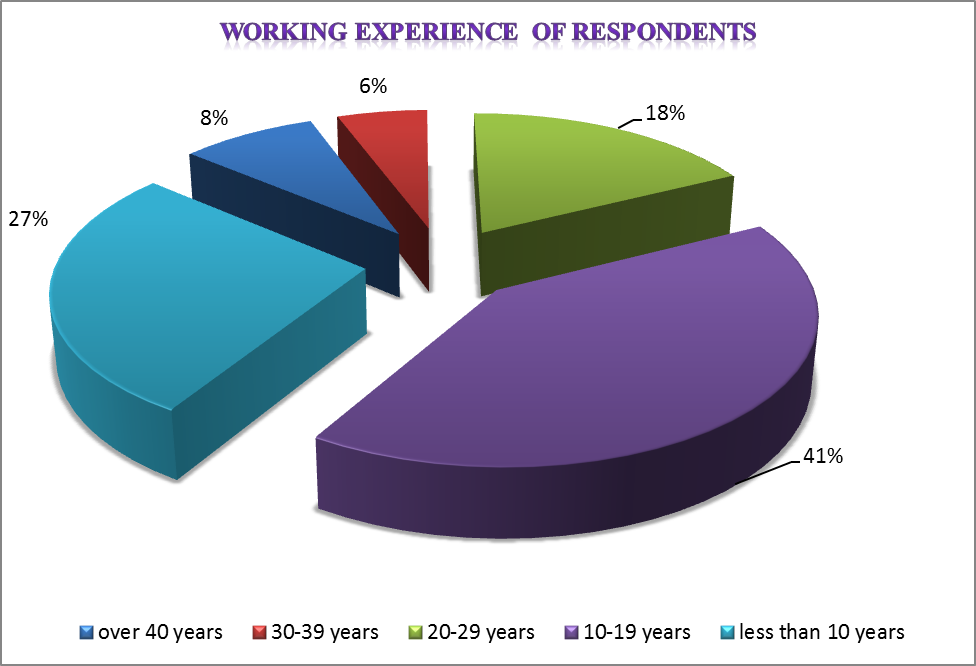

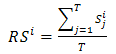

Sample compositionAll the interviewed respondents were industry practitioners, including public and private developers, project managers, main contractors and subcontractors, senior consultants and engineers, and top management personnel. Obviously there were some difficulty in communication with some of the Chinese workers and officials due to language barrier. The questionnaire was translated into Chinese language (simplified Chinese, Mandarin) to cater for this difficulty in communication. They had an average of 22 years’ work experience in the construction sector. It is evident that 80% of respondents have worked more than 10 years in the industry. Some of the respondents have received tertiary education whiles others are laborers who have not had any higher education. It is clear that some of the top managers are well aware of the dangers and risks of construction at the site whiles the less educated and even some learned ones do not have adequate knowledge of construction projects and the associated risks.It should be noted that the sample size is relatively small in this survey. This may be due to two reasons. Firstly, the questionnaire aimed to explore 73 risk factors related to construction projects, which is time-consuming and may retard respondents from participation. Secondly, some of the questions administered were not answered as they were considered confidential questionnaire content is broad and may not be within the knowledge context of some industry practitioners. The small sample may weaken the effectiveness of the questionnaire survey. However, the handpicked sample pool of industry practitioners and their profound knowledge and ample experience can compensate the aforementioned weakness.

5. Results of Survey Analysis

The questionnaire was given out to a total of 15 companies but effective reply was obtained from 12 companies. Within each company, 10 questionnaires were administered to uphold the consistency of the data. A total of 120 questionnaires were issued out for the survey. Therefore the response rate was about 80% which is classified as considerably good in this type of survey. Better responses came from these companies as they were promised that specific names will not be mentioned especially to the media. Most of the questionnaire surveys were done from project manager of the project or project engineer at the site. Where the manager was not available, experienced workers helped to answer and complete the questionnaires. The Chinese version of the questionnaire was given to the Chinese professionals to evaluate and answer questions from the questionnaire.Table 3. This table shows the experience in construction of respondents

|

| |

|

| Figure 5. Sample composition of Survey |

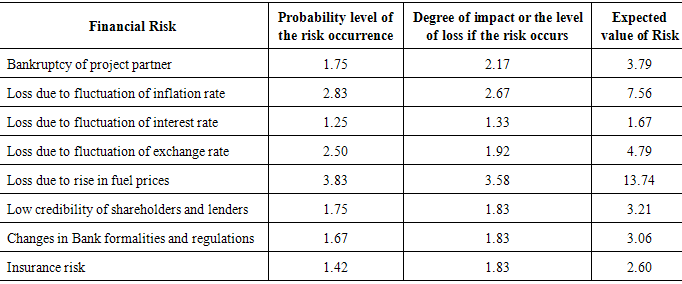

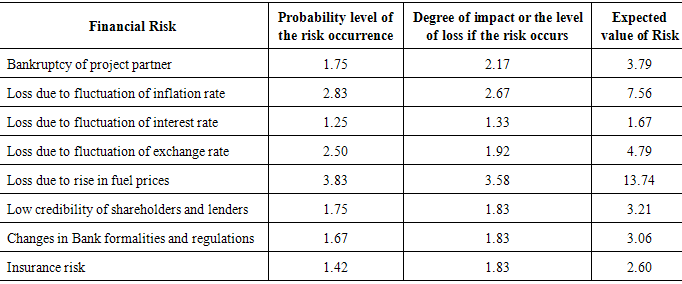

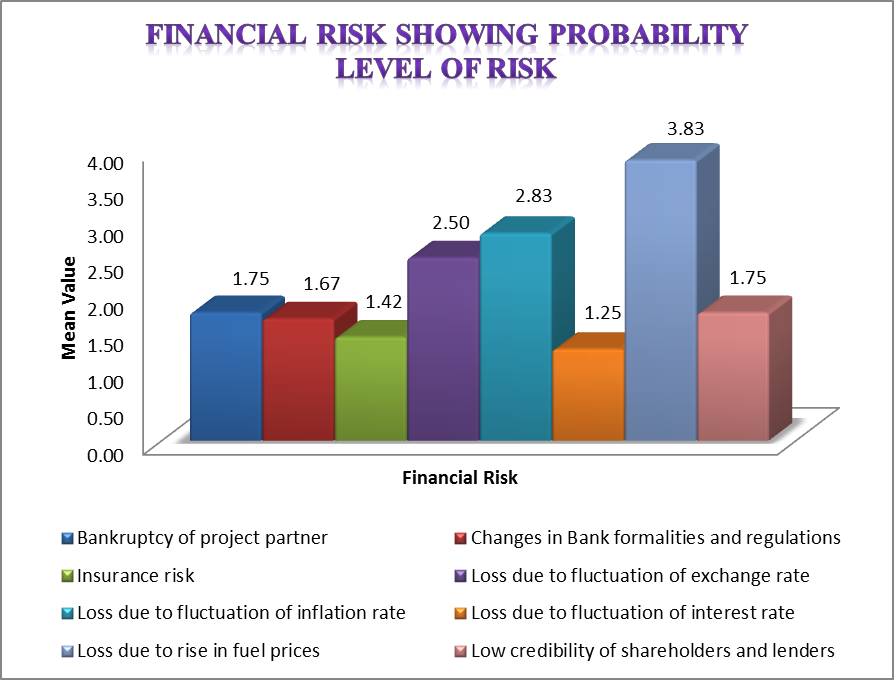

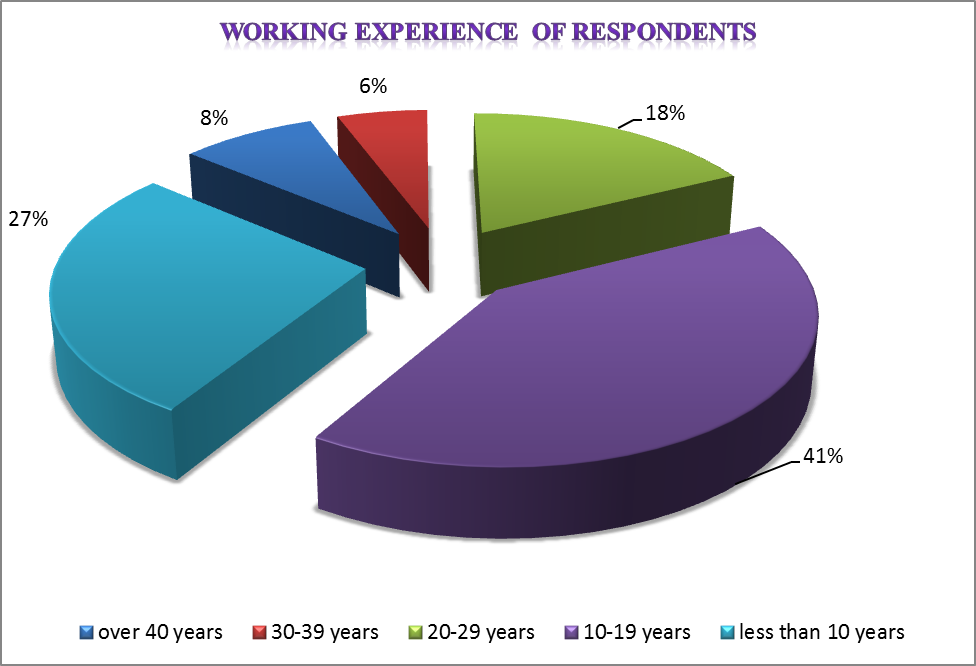

For some of the construction firms the consultant gave the answers on behalf of their clients, both from the owner and the contractor side. Email and Skype responses were accepted since it was sometimes difficult to get the direct one to one meeting with the Project managers. Policy and political related issues, Sub-contractor related problems, power supply and fuel issues, and increase in inflation were the major problems concerned with both the contractor and owner. There were local Ghanaians who also helped with the survey since some of them occupied notable positions to be able to respond appropriately to the questionnaires.From the ranking of the financial risk, loss due to risk in fuel prices comes in as the highest financial risk being 34% of the total financial risk distribution. This is considered as a high risk and requires prompt action and attention. One of the measures to control this risk is to factor in and consider the high possibility of fuel prices during the budgeting of the project so that it does hamper construction progress. In Ghana fuel prices may go up several times in a year so being aware of this trend and making adequate provision for it can greatly enhance the project’s budgetary considerations. Table 4. Showing probability level, degree of impact and the expected values of financial Risk

|

| |

|

| Figure 6. Column chart showing probability level of financial risk |

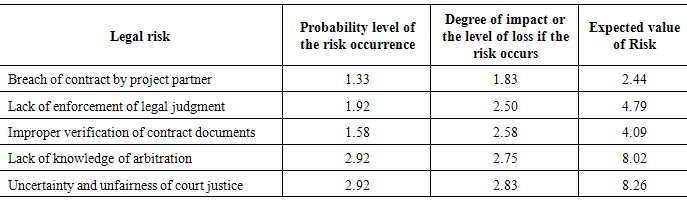

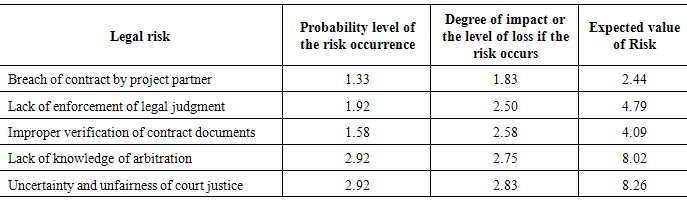

The uncertainty and unfairness of court of justice is ranked highest among the legal risk and considered as a medium risk and must be addressed within the shortest possible time frame. It is about 30% of the total legal risk distribution and followed by lack of knowledge of arbitration being 29% with an expected risk value of 8.02.As can be observed from the table, loss incurred due to political changes which is a political risk had the maximum risk rating. According to the firms interviewed many projects come to a standstill whenever there is a government change in power. Many of them have now resorted to finishing any incumbent project before general elections as much as possible. In countries like Libya, Angola and Sudan, some of these firms have to totally leave and discard their projects because of impending political unrests. With political issues in Ghana, a new government which comes to power seems to come with its own policies and plans for development. They tend to discontinue or become nonchalant in any on-going projects which were initiated by the previous government in order not to give political points to opposition parties. During the change in government in 2008 many on-going projects by the Chinese construction firms came to a standstill as the new government began to spell out new policies and plans for the new regime. Some of the projects were discontinued while others had to wait for a long period of time before making further progress. Table 5. Showing probability level of risk, degree of impact and expected value of legal risk

|

| |

|

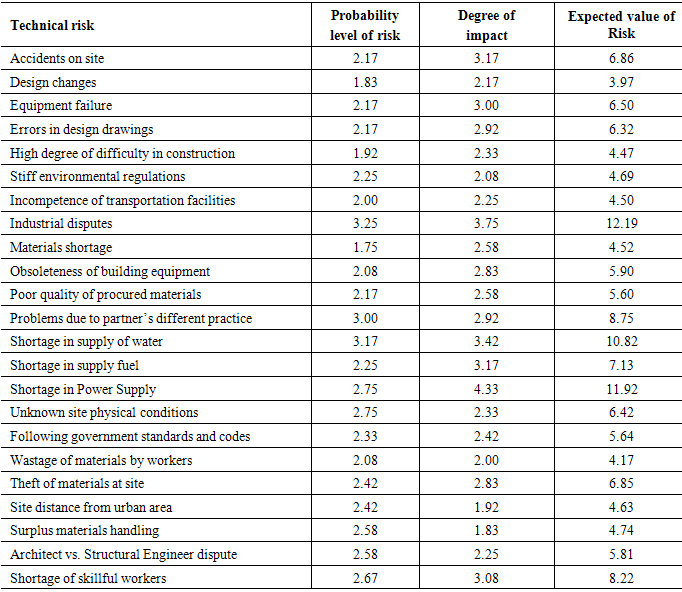

Table 6. Showing probability level, degree of impact and expected risk values of the technical risk factors

|

| |

|

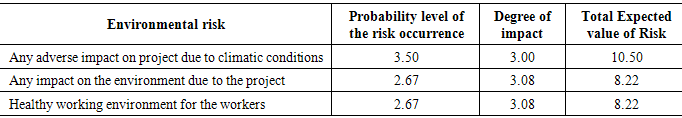

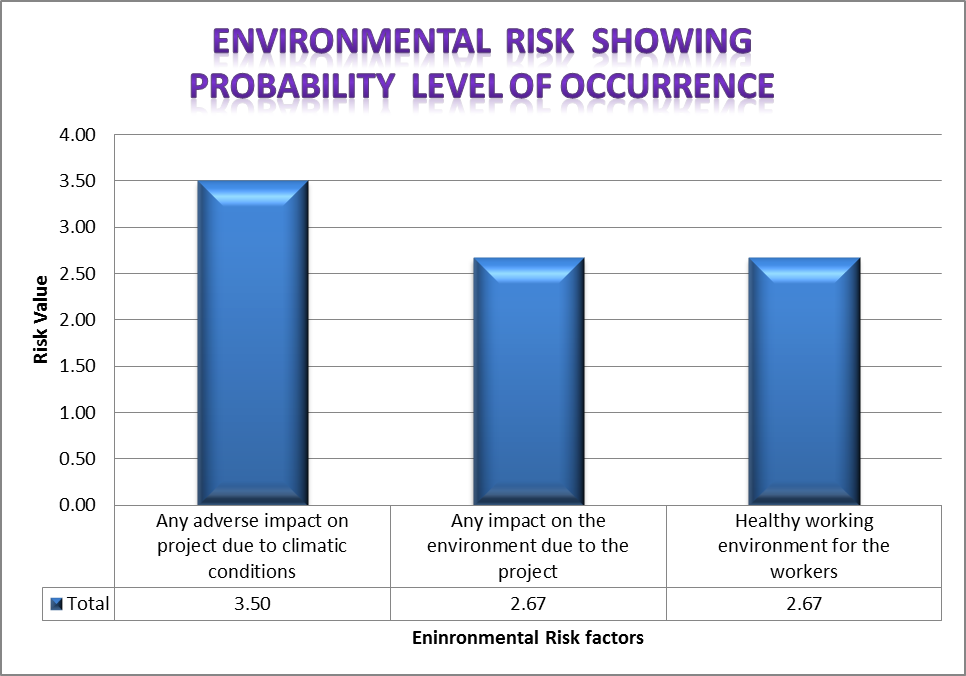

Table 7. Showing the values of environmental risk factors

|

| |

|

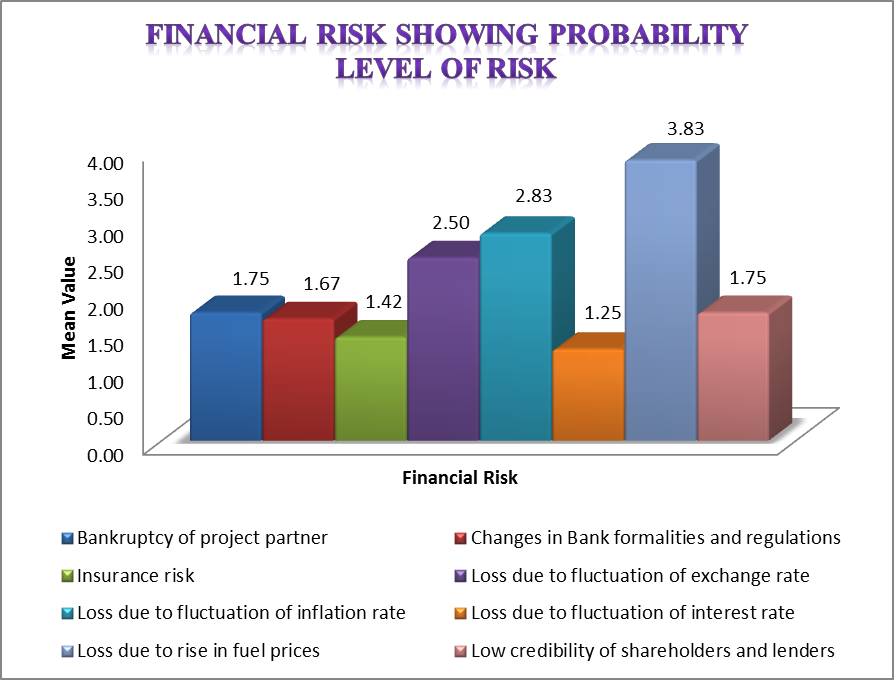

| Figure 7. Bar chart showing probability level of environmental risk |

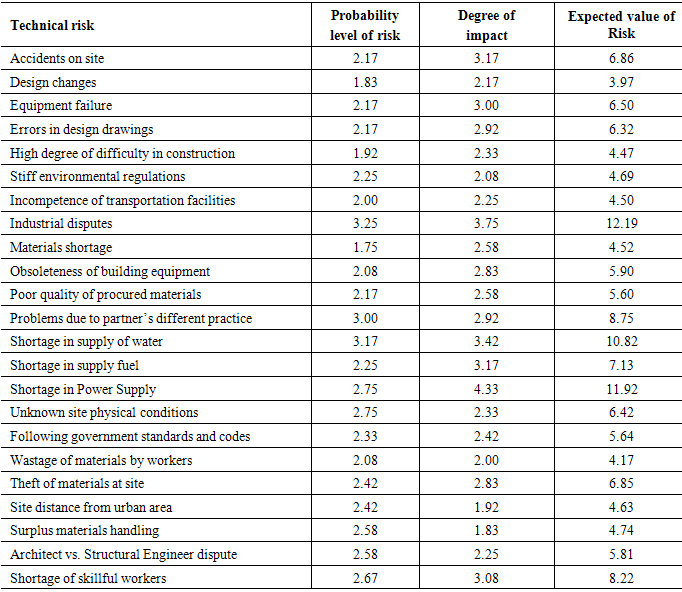

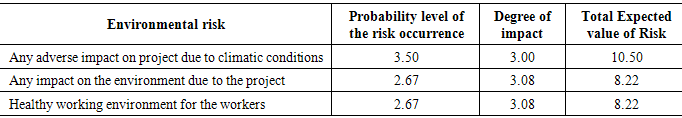

The top ten risks in the study included, loss incurred due to political changes, loss due to rise in fuel prices, Poor communication between clients, Difficulty in communication with local workers, Shortage in Power Supply, Industrial disputes, Increase of resettlement costs, Sub-contractor related problems, Shortage in supply of water, Any adverse impact on project due to climatic conditions. Some the least ranked risks from the study included Unfairness in tendering, Bankruptcy of project partner, Internal management problems, Low credibility of shareholders and lenders, Changes in Bank formalities and regulations, Insurance risk, Breach of contract by project partner and Loss due to fluctuation of interest rate.

6. Discussion of Results

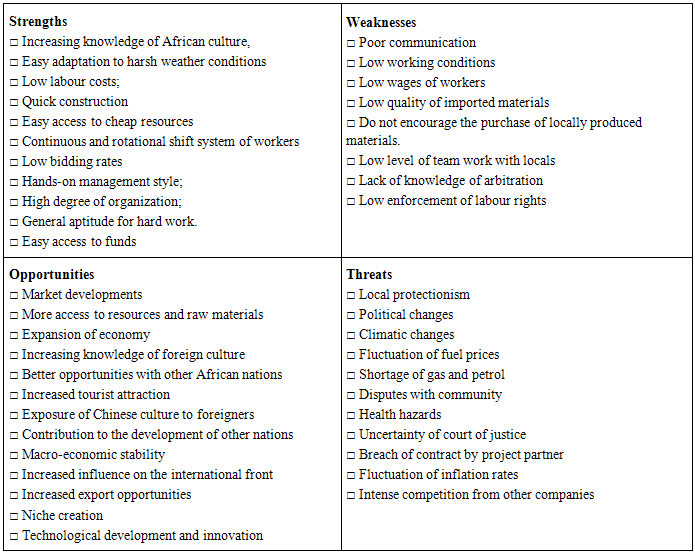

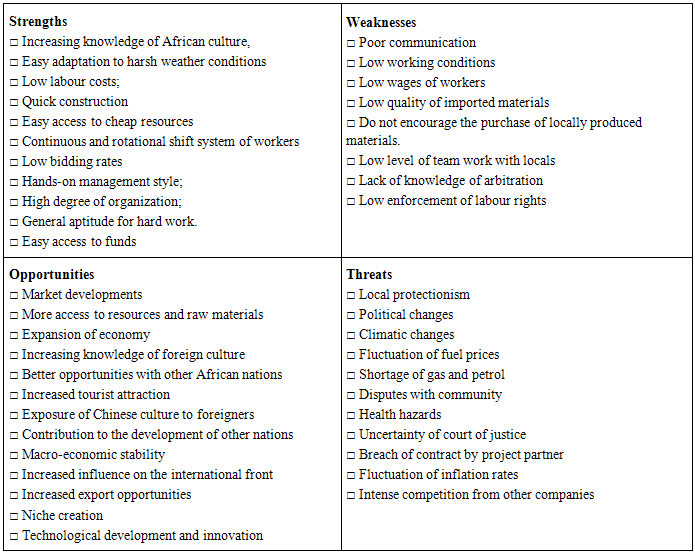

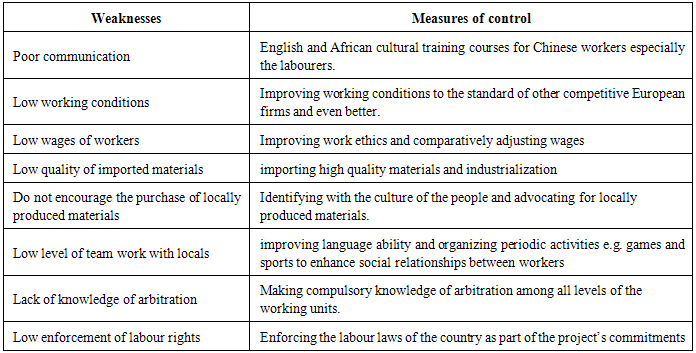

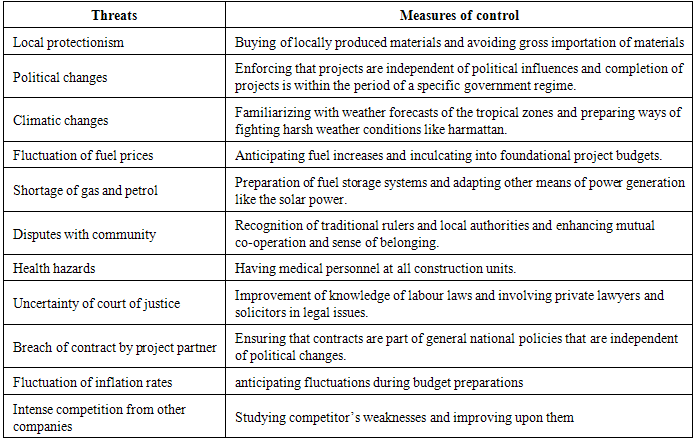

The SWOT is centered on examining its Strengths; Weaknesses; Opportunities and Threats of the Chinese firms. This allows for development of strategies in order to exploit its competitive advantages or defend against its internal weaknesses or provide possible remedial measures. In the SWOT Analysis matrix, Strengths and Weaknesses involve identifying the firm’s internal capabilities and / or disadvantages against its competitors, while Opportunities and Threats involve identifying external factors such as government policies, forces from competition, emergence of new technology, governmental intervention and/or domestic and international economic trends that influence the financial performance and business operations of an organization.

7. Conclusions

The assessment of risk is always an important part of effective construction for any on-going project. The top ten risks in the study included, loss incurred due to political changes, loss due to rise in fuel prices, Poor communication between clients, Difficulty in communication with local workers, Shortage in Power Supply, Industrial disputes, Increase of resettlement costs, Sub-contractor related problems, Shortage in supply of water, Any adverse impact on project due to climatic conditions. The various threats and challenges encountered by the Chinese construction companies venturing various projects in Africa have been outlined. These will help the firms get a clear picture of danger spots and thereby enhance construction quality through the kaleidoscopic view of its strength, weakness, opportunities and threats. It will also encourage more response from developers and investors for public-private partnerships projects. It was clear from the study that political changes are the major risk being faced by most of the Chinese firms. Change of government always tends to stunt the progress of on-going projects. The outlined threats from the study will help the firms get a clear picture of danger spots and thereby enhance construction quality through the kaleidoscopic view of its strength, weakness, opportunities and threats. It will also encourage more response from developers and investors for public-private partnerships projects.Table 8. Showing SWOT Matrix

|

| |

|

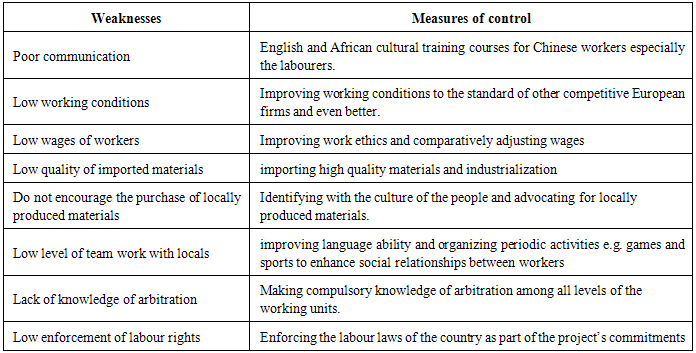

Table 9. Measures to deal with the Weaknesses of the Chinese firms

|

| |

|

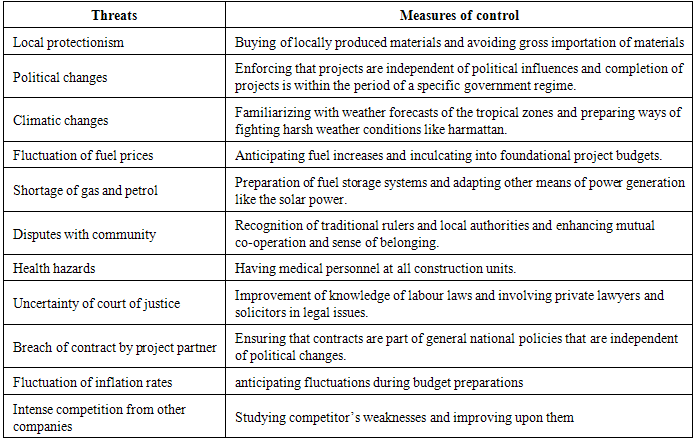

Table 10. Measures to deal with the Threats of the Chinese firms

|

| |

|

References

| [1] | Deng, Ping. 2003. “Foreign Investment by Multinationals from Emerging Countries: The Case of China”. Journal of Leadership and Organizational Studies. Fall. 10(2).pp. 115. |

| [2] | World Watch Institute. 5 January 2006. |

| [3] | Deng, Ping. 2003. “Foreign Investment by Multinationals from Emerging Countries: The Case of China”. Journal of Leadership and Organizational Studies. Fall. 10(2).pp. 121. |

| [4] | Bui Power Authority: Background, retrieved on May 7, 2011. |

| [5] | Oliver Hensengerth: Interaction of Chinese Institutions with Host Governments in Dam Construction: The Bui dam in Ghana, German Development Institute, Discussion Paper 3/2011, p. 9-13, retrieved on May 7, 2011 (full version not available on-line). |

| [6] | Bennett, D. and B. Basuglo.D. 1998. Final Report of the Aberdeen University Black Volta Expedition 1997. Viper Press, Aberdeen, Scotland. ISBN 0 9526632 3. |

| [7] | Anane, Mike. "Courting Mega disaster: Bui Dam May Cause Havoc". United Nations Environment Programme. Retrieved 7 May 2011. |

| [8] | Daniel Bennett, Aberdeen University Black Volta Project, letter to newspaper editor re. articles about Bui Dam, 8 November 1999, retrieved on May 9, 2011. |

| [9] | "Ghana: A dam at the cost of forests". World Rainforest Movement. January 2006. Retrieved 7 May 2011. |

| [10] | Oliver Hensengerth: Interaction of Chinese Institutions with Host Governments in Dam Construction: The Bui dam in Ghana, German Development Institute, Discussion Paper 3/2011, p. 27-33 and p. 43, retrieved on May 7, 2011 (full version not available on-line). |

| [11] | Dun-Arkhurst, Isaac (2008). Ghana's Relations with China. Johannesburg: South African Institute of International Affairs. Pg. 10-11 ISBN 1-919969-32-2. |

| [12] | Dr. Patrick. X.W. Zou, Dr. Guomin Zhang, and Professor Jia-Yuan Wang, Identifying Key Risks in Construction Projects: Life Cycle and Stakeholder Perspectives pp4. |

| [13] | Shen, Dayang, Maosong Sun, and Changning Huang. 1998. The application & implementation of local statistics in Chinese unknown word identification. Communications of COLIPS, Vol.8. |

| [14] | News on Ghanaweb published on October 3rd, 2011. |

| [15] | Bui Power Authority: Background of the Bui Resettlement, retrieved on May 7, 2011. |

| [16] | Bhagwati, Jagdish. "CEE: Protectionism". Concise Encyclopedia of Economics. Library of Economics and Liberty. Retrieved 2008-09-06. |

| [17] | The Mirror, issued on February 8, 2009. |

| [18] | www.cemweek.com |

| [19] | Harold Kezner (2011) Project Management Metrics, KPIs, and Dashboards - A Guide to Measuring and Monitoring Project Performance, pp. 11. |

| [20] | Geography and Climate data from Ghanaweb, www.ghanaweb. |

| [21] | Ghana News Agency, GNA. |

| [22] | Abd. Majid, M.Z. and McCaffer, R., (1997), “Factors of Non-Excusable Delays that Influence Contractor’s Performance”, Journal of Construction Engineering and Management, ASCE. |

| [23] | Lawrence J. Fennelly, Handbook of loss prevention and crime prevention. pp. 372. |

| [24] | Bajaj, D., Oluwoye, J. and Lenard, D. (1997) An analysis of contractor’s approaches to risk identification in New South Wales, Australia. Construction Management and Economics, 15, 363–9. |

| [25] | Shou Qing Wang Mohammed Fadhil Dulaimi and Muhammad Yousuf Aguria, Risk management framework for construction projects in developing countries. Construction Management and Economics (March 2004) 22, 237–252. |

| [26] | Gary Stoneburner, Alice Goguen, and Alexis Feringa, Risk Management Guide for Information Technology Systems. Pp. 8. |

| [27] | Low Sui Pheng and Jiang Hongbin, Internationalization of Chinese Construction Enterprises, Journal of Construction Engineering and Management, November/December 2003, p. 591. |

| [28] | http://www.crccasia.com/internship-sectors/architecture-real-estate/. |

| [29] | Angola’s Chamber of Commerce for Chinese Companies in Angola. |

| [30] | Karby Leggett. 2005. "China forges deep alliances with war-torn nations in Africa," The Wall Street Journal, 30 March. |

| [31] | Emmy Bosten, China’s Engagement in the Construction Industry of Southern Africa: The Case of Mozambique, Paper for the Workshop: Asian and Other Drivers of Global Change, St. Petersburg, Russia, January 19-21, 2006, p. 5. |

Graphical representation of risk ratings can be made by plotting graph between probability and degree of impact or seriousness, figure 2. gives a further explanation of this concept.

Graphical representation of risk ratings can be made by plotting graph between probability and degree of impact or seriousness, figure 2. gives a further explanation of this concept.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML