Egwunatum I. Samuel1, Akpokodje I. Ovie2

1Department of Quantity Surveying, Delta State Polytechnic, Ozoro, Nigeria

2Department of Civil Engineering, Delta State Polytechnic, Ozoro, Nigeria

Correspondence to: Egwunatum I. Samuel, Department of Quantity Surveying, Delta State Polytechnic, Ozoro, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

Construction cost overrun has occupied a sufficient space in construction journals. Inspite of the extensive research works directed towards this subject, it continues to change form in manifestations. This paper did a survey of literatures on cost overruns and showed that research findings are becoming symmetrically identical with transitory or volatile answers to the causes. On the basis of Olawale’s Relative Importance index (RII) number, this paper employed the repetitive inquiry method to extend the work by generating a unified weight by Ginni’s mean measure of dispersion for the index numbers and subjecting the mean value to the Lebesgue integral measure on greatest lower bound and least upper bound to identify a value within the (RII) calibration as a stationary cause of cost overruns in construction projects.

Keywords:

Relative importance index, Ginni’s measure of dispersion, Cost overruns, Stationary cause, Lebesgue integral

Cite this paper: Egwunatum I. Samuel, Akpokodje I. Ovie, Iterating a Stationary Cause of Cost Overruns in Construction Projects, International Journal of Construction Engineering and Management , Vol. 4 No. 2, 2015, pp. 52-59. doi: 10.5923/j.ijcem.20150402.03.

1. Introduction

There is a growing consciousness within the construction industry that time and cost overruns of construction projects are almost becoming a search for a “viral cure” considering the amount of energy dissipated by researchers in search for the “cure” to cost overruns in construction projects. This is because literatures in support of this claim are becoming recurring and symmetrically identical in their opinions and views. The work of Arcila (2012) on the subject is highly commendable in content and context with respect to findings. Again the bibliographies investigated in this work suggest that the concept of cost overruns in construction projects is becoming a dynamically replicating construction virus in terms of form and structure. Form in the sense that stochastic and non stationary (volatile) reasons are responsible for its causes and structure in the sense that it’s occurrence takes different dimensions.However, this work is guided by the various definitions offered by Arcila (2012), Olawale (2010) on cost overruns and that by McCabe (2003), Chen, Zhang, Liu and Mo (2011), Kog and Loh (2012), Takim (2005), and Belassi and Tukel (1996) on successful construction project.

2. Literature Survey

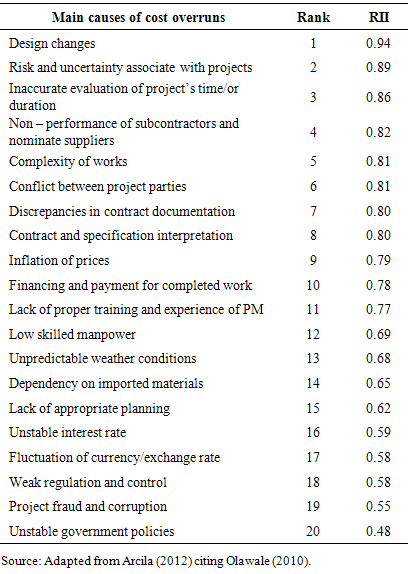

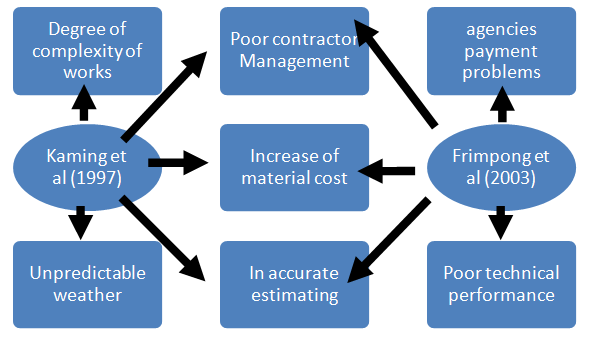

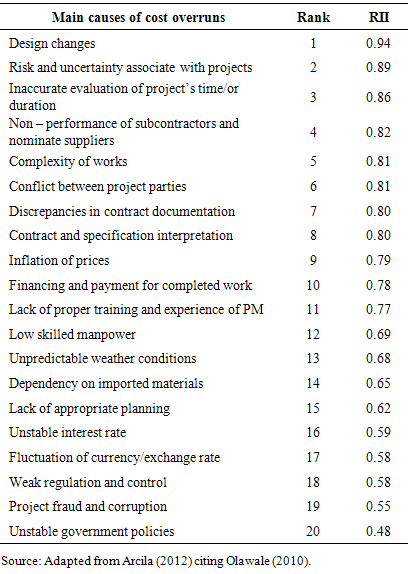

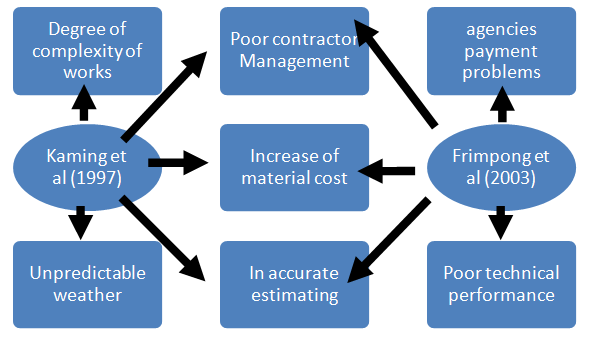

Causes of cost overruns in developing economiesConstruction project cost overrun has continued to remain a subject of interest in construction project circle. This is as a result of the perspective of the accessories with respect to client, contractor and consultants. At various point in time, several studies conducted adduced several reasons for the causes of cost overruns in construction projects within the national and international arena. Notably, in Nigeria, Okpala and Aniekwu (1988) study showed that, shortage of materials, finance and payment for completed works, poor contract management, price fluctuations and fraudulent practices are responsible for cost overruns at least in the South Eastern part of Nigeria. An empirical support is needed in the findings of Okpala and Aniekwu (1988) study hence, Elinwa and Buba (1993) subjected the Okpala and Aniekwu (1988) study to test in the Northern part of Nigeria and came up with the findings that finance and payment for completed works, price fluctuation, fraudulent practices, cost of materials and high cost of machineries were responsible for construction project cost overruns in Nigeria. To consolidate the results of Okpala and Aniekwu (1988) and Elinwa and Buba (1993) studies, Mansfield, Ugwu and Doran (1994) investigated the South Western Nigeria and showed that, again, shortage of materials, finance and payment for completed works, poor project management, and inadvertently, inaccurate estimates leading to delays, lack of geotechnical studies before starting the construction project and delays caused by the involvement of complicated rules are the causes of cost overruns in construction projects. However, these views have been isolated to show recurrence in terms of consistency of amongst the three authors by Arcila (2012) that majorly, finance and payment for completed works and price fluctuations showed symmetries in the findings above. Earlier before the Okpala and Aniekwu study of (1988), the situation in Turkey has been well reported by Arditi, Akan and Gurdamar (1985) that increase in the prices of construction materials, fast growth of inflation, delays caused by changes in design specification, financial problems and under estimation of cost at the moment of preparing the tender of the project are responsible for cost overruns in Turkey construction project.Later studies by Kaming, Olomalaiye, Holt and Harris (1997) in Indonesia, on the scale of time and cost overruns, showed some essential correlation with the Arditi et al (1985) study that lack of materials due to inaccurate planning and estimating, increase of materials’ cost, complexity of works, poor contractor’s management and unpredictable weather were responsible. This has been collaborated by Frimpong, Oluwoye and Crawford (2003) on the same scale in Ghana with the addition of agencies payment problems and poor technical performance. The perspectives of Kaming et al (1997) and Frimpong et. al. (2003) have been illustrated by Arcila (2012) in the framework shown under. | Figure 1. Source: Adapted from Arcila (2012) on main causes of cost overruns |

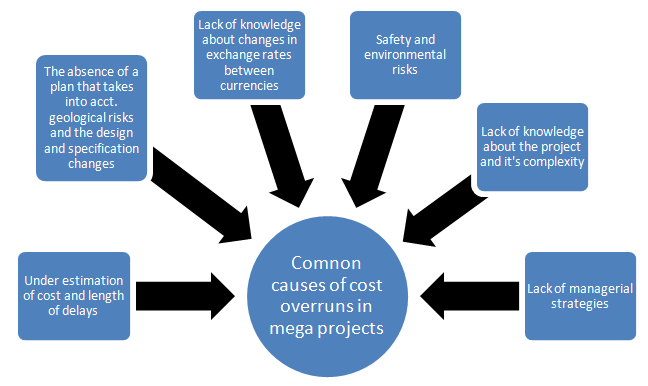

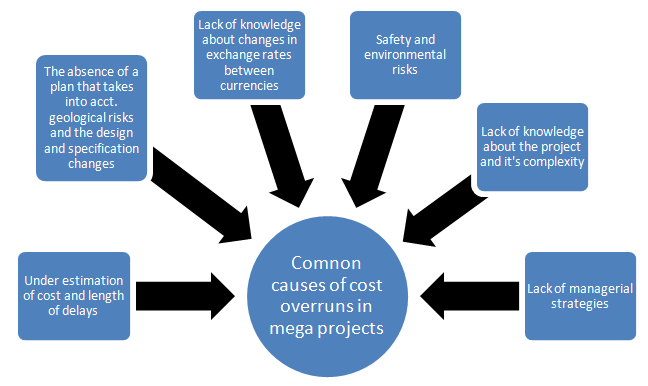

From Frimpong et. al. (2003) study, there has been a consistent bibliography on the subject of construction cost overruns notably in the middle East State of Kuwait by Koushki, Al-Rashid and Kartam (2005) that owner’s financial constraints, financial difficulties of contractors, contractors inability to meet the specifications of the job and delays caused by design changes and change orders are prevalent in the causes of cost overruns. Le-Hoai, Lee and Lee (2008) study in Vietnam showed that lack of supervision, owner’s financial resources, financial difficulties of contractors, changes in the design of the project, and poor project management are traceable to Vietnam’s construction project overruns. In Zambia, Kaliba, Muya, and Mumba (2009) observed that, inclement weather, inflation, changes in the scope of the project, delays in schedule and lack of managerial and technical knowledge are recurring reasons for project cost overruns. In Gaza Strip, Enshassi, Mohamed and Abushabau (2009) showed a recurrence affirmation that increase in cost of construction materials, shortages in material’s supply, inexperience and knowledge of workers and lack of leadership skill in the company’s managerial positions are responsible for cost overruns in construction projects.On a mega projects scale (projects in excess of one billion dollar cost, Arcila, (2012) )have been investigated by Jergeas and Ruwanpura (2010) in Canada and Flyvbjerg, Bruzelius and Rothengatter (2003). Their independent survey showed some mirror image answers as to the reasons for cost overruns in mega projects. This inexhaustively include lack of knowledge of the project and its complexity, inaccurate estimation of costs, the absence of a plan that accommodates changes in design and the lack of managerial strategies.These reasons for mega projects cost overruns have been validated in Arcila (2012) as adapted from Flyvbbjerg et. al., 2003 and Jergeas and Ruwanpura, 2010 illustrated in fig. 2. hereunder. | Figure 2. Source: Adapted from Arcila (2012) on common causes of cost overruns in mega projects |

Causes of cost overruns in developed economiesIn the United Kingdom, the studies of Jackson (2002) and Olawale, (2010) are well validated on the grounds of their analysing instruments on the causes of cost overruns. Moreover, there was a lateral displacement of their findings from the routine results investigated in developing countries. Particularly, Jackson (2002) observed that the main reason for cost overruns in UK projects are traceable to Unanticipated changes in the scheme design arising from owner’s instruction and by extension incomplete designs, absence of design details during the execution stage, lack of proper information at the planning stage and inaccurate estimates as the severe factors responsible for cost overruns. The Jackson (2002) study is replete with those factors that could affect cost overruns in the UK. On the basis of relative importance index (RII), Olawale (2010) was able to rank the main causes of cost overruns in the UK construction projects having unstable government policies at the least important factor. The credibility of the Olawale (2010) research instrument have been favoured by Chan and Kumaraswamy (1997) and later, Iyer and Jha (2005).However, great credit is due to the work of Arcila (2012) of the need to distinguish causes of cost overruns with respect to the project definition levels. In the work, Arcila (2012) harmonized the views of past and present work up to Olawale (2010) and did an isolation of projects with poor cost performance and those with good cost performance. This is owing to initial basic assumptions that not all projects in term of financial health have the same tendency of cost overruns. The study investigated 3 poor cost performance projects and 3 good cost performance project and thereafter did a cross context analysis on the good and poor cost performance projects. Some of the findings are in tandem or somewhat a replate of the Olawale (2010) findings. Arcila (2012) observed that the main causes of cost overruns in the UK construction projects are incompetency of the project manager, poor relationship between client and contractor, client’s indisposition, client’s variation in the scheme design, poor initial project planning and inability to interpret contract clause specifications. Table 1. Main causes of cost overruns in UK construction projects

|

| |

|

On this note, Arcila’s (2012) study reinforces the Olawale’s (2010) investigation on the common grounds of; lack of proper training and experience of project manager, conflict between project parties, design changes, contract and specification interpretation and lack of appropriate planning that may cause efficiency losses.Research Gap Identified and objective of this studyOlawale (2010) study made a conscious effort in the construction industry literature to show causes of cost overruns in the construction industry, ditto Arcila (2012). With the instrument of relative importance index (RII) number, the study was able to rank the causes in order of least to most important in terms of their index numbers.Relying on the two (2) definitions of index numbers by Wheldon that “Index number is a statistical device for indicating the relative movement (dynamics) of data where measurement of actual movement is difficult or incapable of being made”; and Edgeworth; “Index number shows by its variations (being dynamical) the changes in a magnitude which is not susceptible either of accurate measurement in itself or direct valuation in practice”.A second look at Olawale (2010) study for further treatment is exigent in the light of the definitions above and in an attempt to specify a major cause. Olawale (2010) index numbers exhibits a generalizable statistical distribution, suggesting that the results are worthy of further mathematical treatment. Index numbers constructed in Olawale (2010) study is spurious in certain dimensions ditto Arcila (2012). This is owing greatly to the weight lessness associated with the measurement, non – decisive and affairmative remarks on the basis of objective cause. In fact, the credibility of an index number is greatly dependent on the weights used for measurements (Gupta, 2004). In effect the result of Olawale (2010) are only approximate indicators and does not exactly represent changes in the relative level of cost overrun causes. As presented in Arcila (2012) citing Olawale (2010), cause of cost overruns in construction projects are not of equal importance with respect to the ranking. In order that the Olawale (2010) RII construction is representative of the average change in the level of the causes of cost overruns, proper weights should be assigned to different causes according to their relative importance in the group. Gupta (2004) noted two (2) types of index numbers. These are basically weighted and unweighted index numbers. Gupta (2004) continued that the system of weighting and the question of allocation of appropriate weights for analysis is of fundamental importance and constitutes an important aspect of the construction of index numbers. Given the weightlessness situation of Olawale (2010) index number, the spuriousity is evident in its failure to comply with the consistency test of index numbers, particularly the Fisher’s Factor Reversal Test (FRT) and the Westergaard’s Circular Test (WCT).Accordingly the need to generate a standard and unified weight from Olawale’s (2010) result is exigent and by extension applying it to the index numbers for a static/stationary value to identify the specific major cause of cost overruns from the Olawale’s (2010) calibration is the thrust of this paper.

3. Methodology

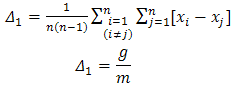

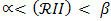

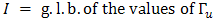

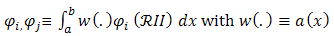

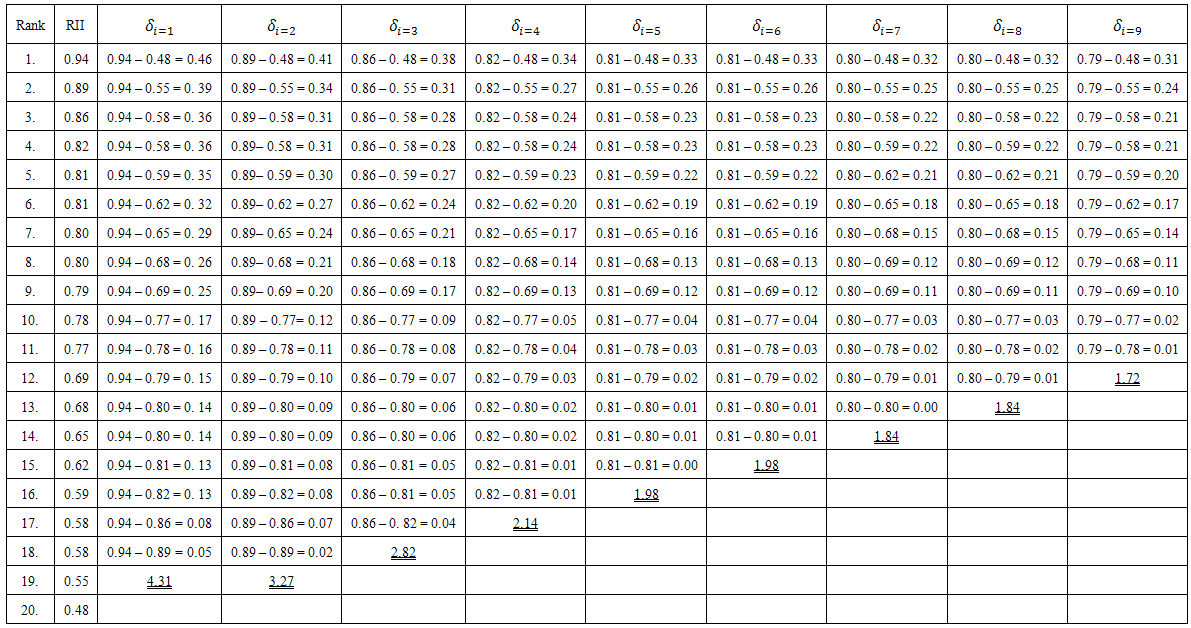

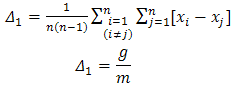

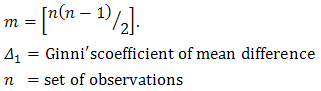

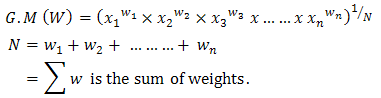

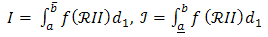

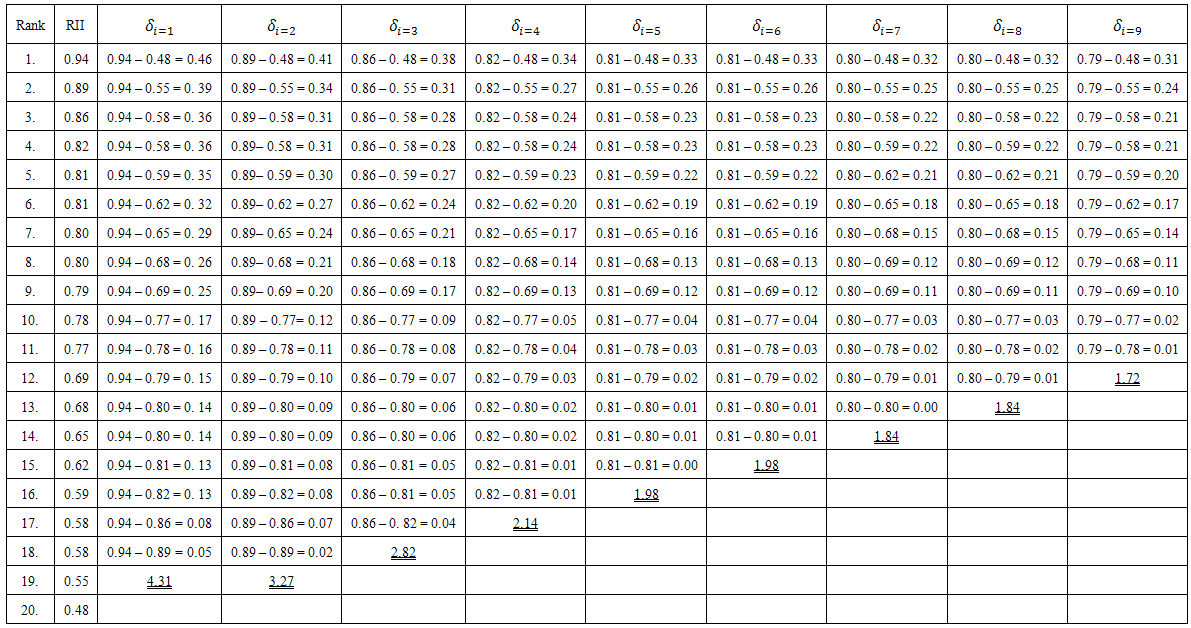

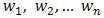

It is the objective of this paper to derive a rigid value with recourse to RII calibration of Olawale (2010). This is with the aim of identifying a specific major cause of cost overruns. In doing so, this study employed the repetitive enquiry method in continuation or extension of the Olawale (2010) study. Therefore the major source of data is a secondary data on relative importance index numbers (RII) on the causes of cost overruns by Olawale (2010) as shown in table 1.0. On the basis of the gap identified above, this study will generate a unified weight value using the Ginni’s mean difference measure of dispersion from | (1) |

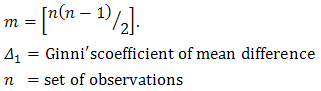

Where g = is the sum of positive differences of all possible pairs of observations to disperse same on the basis of proportion to all RII values as a measure of their weight. With the weight of the items tied to their RII value, a generalized weighted geometric mean is computed from

to disperse same on the basis of proportion to all RII values as a measure of their weight. With the weight of the items tied to their RII value, a generalized weighted geometric mean is computed from | (2) |

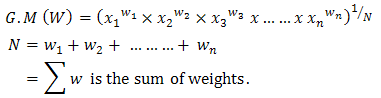

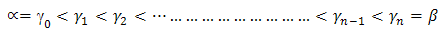

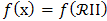

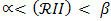

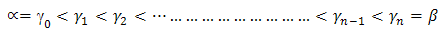

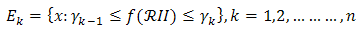

We consider the RII calibrations of Olawale (2010) to be a function of index values bounded and measureable on the interval (a, b) with respect to the ranking size, given that  are any two real numbers such that

are any two real numbers such that  . By dividing

. By dividing  into “n” subintervals and choosing values,

into “n” subintervals and choosing values,  so that

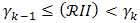

so that  With, Ek, K = 1, 2, ……………………, n, be the set of all

With, Ek, K = 1, 2, ……………………, n, be the set of all  in (a, b) such that

in (a, b) such that

| (3) |

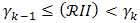

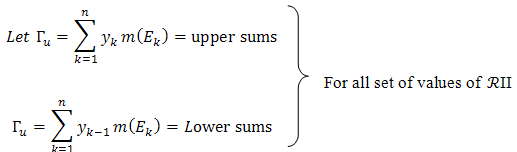

| (4) |

Taking  for all possible subdivisions

for all possible subdivisions  of the values of

of the values of  for all possible subdivisions since

for all possible subdivisions since  and

and  exist always as upper and lower lebesgue integrals of

exist always as upper and lower lebesgue integrals of  , then,

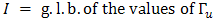

, then, | (5) |

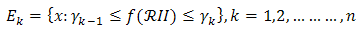

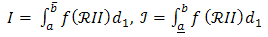

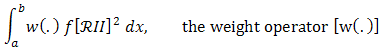

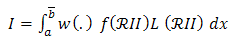

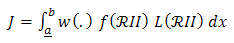

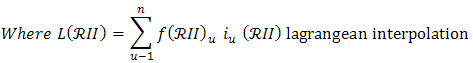

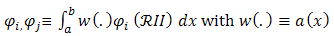

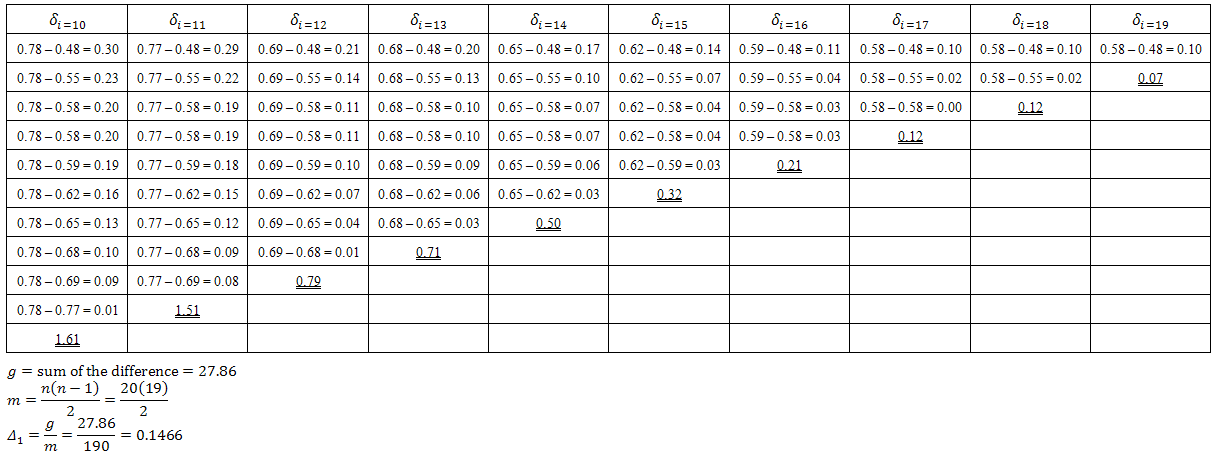

With the Ginni’s difference measure vanishing at the 20th recurrence operation, the  value shows semblance with an orthogonal function, wherein a proposed non – negative weight function operator w(.) exist in the interval of the

value shows semblance with an orthogonal function, wherein a proposed non – negative weight function operator w(.) exist in the interval of the  ranking (a, b) given that the scalar product of value of any of the variables (causes of cost overruns) is associated more appropriately with Stieltjes integral;

ranking (a, b) given that the scalar product of value of any of the variables (causes of cost overruns) is associated more appropriately with Stieltjes integral; | (6) |

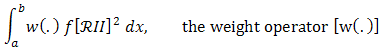

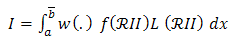

In compliance with the Lebesgue integral  distributes over the function

distributes over the function

| (7) |

and | (8) |

is computed at Certain static balue

is computed at Certain static balue  of

of  .With the ‘a’ value of

.With the ‘a’ value of  as 0.94 and ‘b’ value as 0.48 been the interval measure of I and J, the associated weight

as 0.94 and ‘b’ value as 0.48 been the interval measure of I and J, the associated weight  value of

value of  been 0.1466 from the Ginni’s dispersion measure, it is customary to write the interpolation distribution over;

been 0.1466 from the Ginni’s dispersion measure, it is customary to write the interpolation distribution over; | Table 2. Ginni’s difference measure iteration table |

| Table 3. Ginni’s difference measure iteration table |

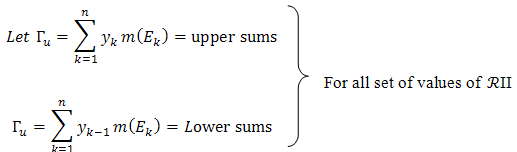

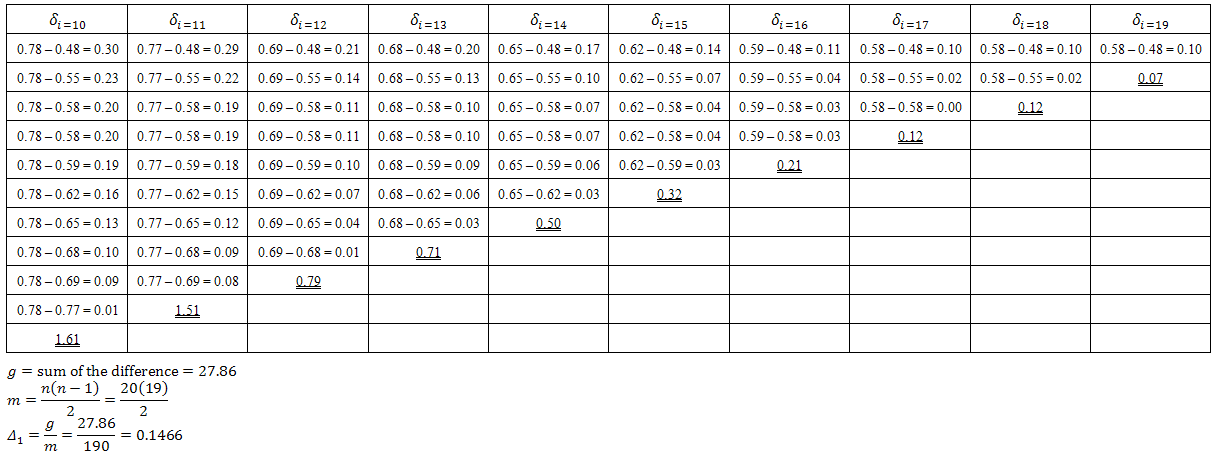

The justification for the use of weighted geometric mean stems from the findings of Arcila (2012) that all the causes (being variables) of cost overruns are not of equal importance. Therefore this study responded by assigning different weights;  respectively according to their proportion of importance to compute their geometric mean being a rigidly defined value, as a stationary central number which is fitted on the

respectively according to their proportion of importance to compute their geometric mean being a rigidly defined value, as a stationary central number which is fitted on the  calibration to reflect a responding major cause of cost overruns.

calibration to reflect a responding major cause of cost overruns.

4. Results

On the basis of the methodology presented above, this section aims at presenting the results from the analysis of the instruments used. Arising there from, the findings will be discussed and inferences are made in accordance with the result.

5. Findings

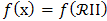

The outcome of the result in this analysis gave an anti log value of 0.7355. This value on the  calibration as shown in table 1.0 is a stationary value between the boundary variables of inexperience project management having

calibration as shown in table 1.0 is a stationary value between the boundary variables of inexperience project management having  value of 0.77 and low skilled manpower having value of 0.69 with recourse to

value of 0.77 and low skilled manpower having value of 0.69 with recourse to  and

and  solution of equation (7) and (8). With 0.7355 as a stationary value between the bounded variables, this suggests that the stationary cause of cost overruns in construction project is stationary between inexperience project management factor and low skilled manpower factor used in the construction project.

solution of equation (7) and (8). With 0.7355 as a stationary value between the bounded variables, this suggests that the stationary cause of cost overruns in construction project is stationary between inexperience project management factor and low skilled manpower factor used in the construction project.

6. Recommendations

A cursory look at table 1.0 shows 20 possible factors responsible for construction project cost overruns. This study showed that the causes of cost overruns from existing literature are volatile and as such a representative factor lies at a stationary boundary between inexperience project management and low skilled manpower. It is therefore recommended that contractors at the point of tender should show cause for superiority why his project management capabilities and the company’s historical/contemplating labour output with reference to project time scale.

ACKNOWLEDGEMENTS

We are indebted of thanks to Dr. Olawale, Y.A for providing the basic framework from which the data on relative importance index was used for this work.

References

| [1] | Arcila, S.G. (2013). Cost Overruns in major construction projects in the UK. The University of Warwick. |

| [2] | Arditi, D., Akan, G.T and Gurdamar, S. (1985). Cost overruns in public projects. International Journal of Project Management 3(4). |

| [3] | Belassi, W. and Tukel, O.I. (1996). A new Framework for determining critical success/failure factors in projects. International Journal of Project Management 14(3). |

| [4] | Chan, A.P.C., Scott, D. and Chan, A.P.L. (2004). Factors affecting the success of a construction project. Journal of Construction Engineering and Management 130. |

| [5] | Chan D.W.M. and Kumaraswamy, M.M. (1997). A comparative study of causes of time overruns in Hong Kong Construction projects. International journal of project management 15(1). |

| [6] | Chen, Y.Q., Zhang, Y.B., Liu, J.Y. and Mo, P. (2011). Interrelationships among Critical Success Factors of Construction Projects Based on Structural Equation Model. Journal of Management in Engineering 1. |

| [7] | Elinwa, A.U. and Buba, S.A. (1993). Construction Cost Factors in Nigeria. Journal of Construction Engineering and Management 119(4). |

| [8] | Enshassi, A., Mohamed, S. and Abushaban, S. (2009). Factors affecting the performance of construction projects in the Gaza strip. Journal of Civil Engineering and Management 15(3). |

| [9] | Flyvbjerg, B., Bruzelius, N. and Rothengatter, W. (2003). Megaprojects and risk: an anatomy of ambition. Cambridge: Cambridge University Press. |

| [10] | Frimpong, Y., Oluwoye, J. and Crawford, L. (2003). Causes of delay and cost overruns in construction of groundwater projects in a developing countries; Ghana as a case study. International Journal of Project Management 21(5). |

| [11] | Gupta, S.C. (2004). Fundamentals of statistics, 6th ed. Himalaya publishing, house India. |

| [12] | Iyer, K.C. and Jha, K.N. (2005): Factors affecting cost performance: evidence from Indian construction projects. International Journal of Project Management 23(4). |

| [13] | Jackson, S. (2002): Project cost overruns and risk management. The University of Reading. |

| [14] | Jergeas, G.F. and Ruwanpura,, J. (2010). Why Cost and Schedule Overruns on Mega Oil Sands Projects? Practice Periodical on Structural Design and Construction 15(1). |

| [15] | Kaming, P.F., Olomolaiye, P.O., Holt, G.D. and Harris, F.C. (1997). Factors influencing construction time and cost overruns on high-rise projects in Indonesia. Construction Management and Economics 15(1). |

| [16] | Kong Y.C. and Loh, P.K. (2012). Critical Success Factors for Different Components of Construction Project. Journal of Construction Engineering and Management 138(4). |

| [17] | Koushki, P.A., Al-Rashid, K. and Kartam, N. (2005): Delays and Cost increases in the construction of private residential projects in Kuwait. Construction Management and Economics 23(3). |

| [18] | Le-Hoai, L., Lee, Y. and Lee, J. and (2008): Delay and cost overruns in Vietnam large construction projects: A comparison with other selected countries. KSCE Journal of Civil Engineering 12(6). |

| [19] | Mansfield, N.R., Ugwu, O.O. and Doran, T. (1994). Causes of Delay and Cost Overruns in Nigerian Construction Projects. International Journal of Project Management 1(1). |

| [20] | McCabe, B. (2003). Monte Carlo simulation for schedule risk. |

| [21] | Okpala, D.C. and Aniekwu, A.N. (1988). Causes of High Costs of Construction in Nigeria. Journal of Construction Engineering and Management 114(2). |

| [22] | Olawale, Y.A. (2010). Cost and Time Control Practice of Construction Projects in the UK: The Pursuit of effective management control. University of the West of England. |

| [23] | Takim, R. (2005). A framework for Successful construction Project Performance. Glasgow Caledonian University. |

to disperse same on the basis of proportion to all RII values as a measure of their weight. With the weight of the items tied to their RII value, a generalized weighted geometric mean is computed from

to disperse same on the basis of proportion to all RII values as a measure of their weight. With the weight of the items tied to their RII value, a generalized weighted geometric mean is computed from

are any two real numbers such that

are any two real numbers such that  . By dividing

. By dividing  into “n” subintervals and choosing values,

into “n” subintervals and choosing values,  so that

so that  With, Ek, K = 1, 2, ……………………, n, be the set of all

With, Ek, K = 1, 2, ……………………, n, be the set of all  in (a, b) such that

in (a, b) such that

for all possible subdivisions

for all possible subdivisions  of the values of

of the values of  for all possible subdivisions since

for all possible subdivisions since  and

and  exist always as upper and lower lebesgue integrals of

exist always as upper and lower lebesgue integrals of  , then,

, then,

value shows semblance with an orthogonal function, wherein a proposed non – negative weight function operator w(.) exist in the interval of the

value shows semblance with an orthogonal function, wherein a proposed non – negative weight function operator w(.) exist in the interval of the  ranking (a, b) given that the scalar product of value of any of the variables (causes of cost overruns) is associated more appropriately with Stieltjes integral;

ranking (a, b) given that the scalar product of value of any of the variables (causes of cost overruns) is associated more appropriately with Stieltjes integral;

distributes over the function

distributes over the function

is computed at Certain static balue

is computed at Certain static balue  of

of  .With the ‘a’ value of

.With the ‘a’ value of  as 0.94 and ‘b’ value as 0.48 been the interval measure of I and J, the associated weight

as 0.94 and ‘b’ value as 0.48 been the interval measure of I and J, the associated weight  value of

value of  been 0.1466 from the Ginni’s dispersion measure, it is customary to write the interpolation distribution over;

been 0.1466 from the Ginni’s dispersion measure, it is customary to write the interpolation distribution over;

respectively according to their proportion of importance to compute their geometric mean being a rigidly defined value, as a stationary central number which is fitted on the

respectively according to their proportion of importance to compute their geometric mean being a rigidly defined value, as a stationary central number which is fitted on the  calibration to reflect a responding major cause of cost overruns.

calibration to reflect a responding major cause of cost overruns.

calibration as shown in table 1.0 is a stationary value between the boundary variables of inexperience project management having

calibration as shown in table 1.0 is a stationary value between the boundary variables of inexperience project management having  value of 0.77 and low skilled manpower having value of 0.69 with recourse to

value of 0.77 and low skilled manpower having value of 0.69 with recourse to  and

and  solution of equation (7) and (8). With 0.7355 as a stationary value between the bounded variables, this suggests that the stationary cause of cost overruns in construction project is stationary between inexperience project management factor and low skilled manpower factor used in the construction project.

solution of equation (7) and (8). With 0.7355 as a stationary value between the bounded variables, this suggests that the stationary cause of cost overruns in construction project is stationary between inexperience project management factor and low skilled manpower factor used in the construction project. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML