Yousong Wang, Martin Henry Asare, Yufan Zhang, Jing Kuang Liu

South China University of Technology, Guangzhou, Guangdong, China

Correspondence to: Martin Henry Asare, South China University of Technology, Guangzhou, Guangdong, China.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The construction industry plays a very vital role in the economy of Ghana. It consist of about 20percent of the country’s Gross National Product (GDP). Recent interest of numerous Chinese companies in the Ghanaian economy cannot be underestimated. There have been manifest benefits on both sides but it’s also accompanied by arising risk issues that need to be addressed and pragmatic steps taken to curtail them. There are very few researches conducted to find out he environmental problems encountered as foreign construction firms work in Ghana and the adverse effects on these companies [1]. This paper looks specifically at the various environmental risk factors by Chinese firms with special reference to the drilling of offshore oil and gas and how they can be addressed with various recommendations. Various interviews were done at Domunli to bring some of these problems into perspective. It also points out how these factors are negatively influencing the Chinese stakeholders and how it can be resolved. The harmful effects on the Ghanaian community as a whole like the loss of rich fishing segments and arable land which most communities depend on as their main economic threshold for living are eventually outlined.

Keywords:

Construction, Drilling, Environment, Oil, Risk

Cite this paper: Yousong Wang, Martin Henry Asare, Yufan Zhang, Jing Kuang Liu, Environmental Risk Factors of Oil Drilling by Chinese Construction Firms in Ghana, International Journal of Construction Engineering and Management , Vol. 4 No. 2, 2015, pp. 44-51. doi: 10.5923/j.ijcem.20150402.02.

1. Introduction

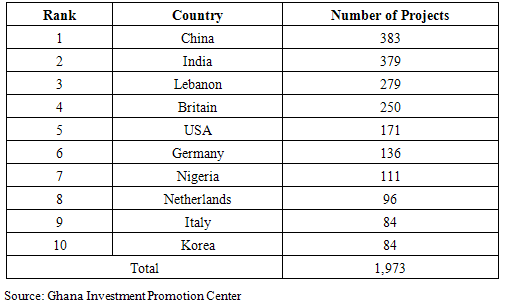

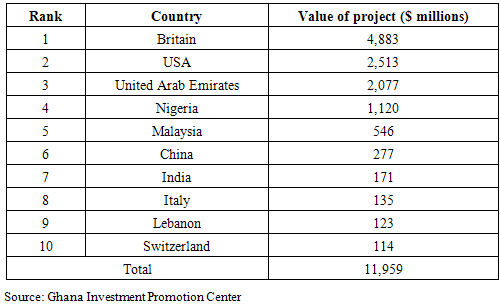

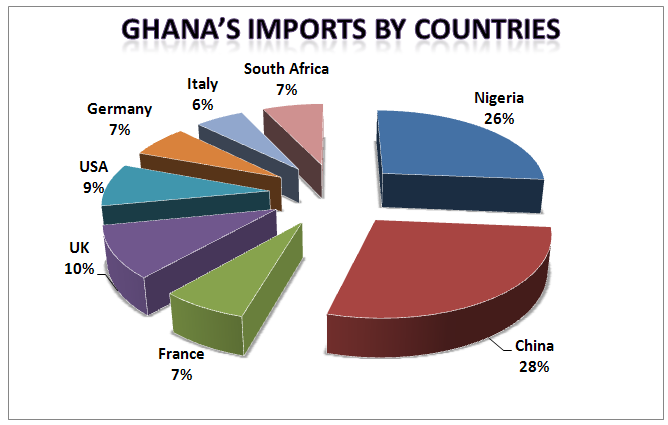

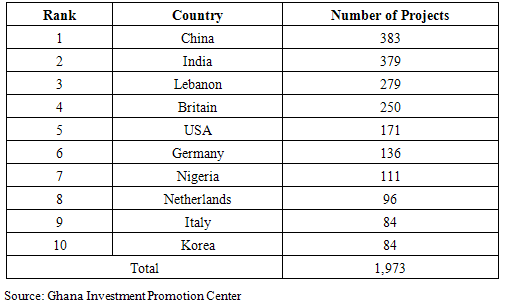

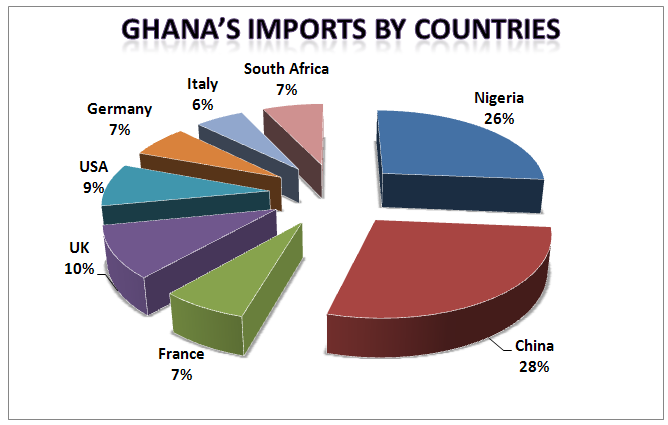

The benefits of oil to any particular nation are largely profitable. They grossly enhance development and improve the general social well-being of the country. However the engagement of offshore oil poses a great threat and may end up doing more harm than good. It’s very difficult for any country to get ready for oil when they’ve never had any reason to get ready for oil. With the discovery of oil in 2007, Ghana worked hard, parliamentarians, the civil society, to try to make sure that there’s proper legislation in place [2]. For example the government must discuss the payment they receive from oil companies and how much oil is produced on a quarterly basis. “This is the kind of transparency safeguard that very few countries have. There are some pieces of the frame work that are yet to be put in place. Also on the environmental side there are capacities that don’t exist. The Environmental Protection Agency has very little to monitor on the environmental impacts of the oil industry.” [3] Working Relationship between Ghana and ChinaGhana and China have been on economic relational terms since 1968 and have established strong economic ties with each other over the years. Construction companies have been on the increase especially as Ghana now depends so much on China in terms of goods and services. China is Ghana’s second largest source of imports, providing 13% of Ghana’s total imports. Only Nigeria provides a greater share-15.1%. China expanded its share of Ghana’s import market in 2003-2008, faster than Ghana’s traditional trading partners, Nigeria, the United Kingdom, and the United States [4]. This growth may reflect China’s competitive position in Ghana’s chief import sector of manufacturing. Trends in China’s foreign direct investment (FDI) in GhanaChina’s outward foreign direct investment has increased substantially in recent years especially in developing countries [5] in Africa. China’s share of Africa’s trade has jumped from 2 to 6 percent making it the continent’s third largest trading partner after the United States and France [6] [7]. Chinese investments in Ghana are low value and concentrated in small and medium enterprises, often owner-managed or branches of Chinese parent companies. China invested in more projects in Ghana from 1994 to 2012 than any other country (20% of the total), but the value of these investments ranked only sixth – 2% of the total.According to the United Nations Conference on Trade and Development (UNCTAD), in 2012, remittances from the Diaspora became Africa’s largest external source of finance, surpassing official development aid and foreign investment. According to the Ghana Investment Promotion Center (GIPC), registered FDI inflows to Ghana from September 1994 to December 2013 stood at US$25,941,679,947 from 3,621 projects. [8] [9]  | Figure 1. Ghana’s imports by countries of origin, 2000-20012 |

Table 1. Top 10 sources of foreign direct investment in Ghana by number of projects, 1994-2012

|

| |

|

Table 2. Top 10 sources of foreign direct investment in Ghana by cost of projects, 1994-2012

|

| |

|

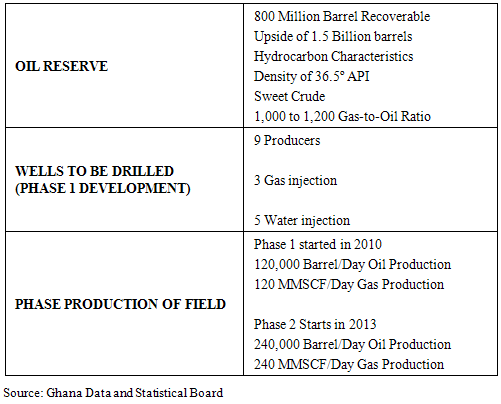

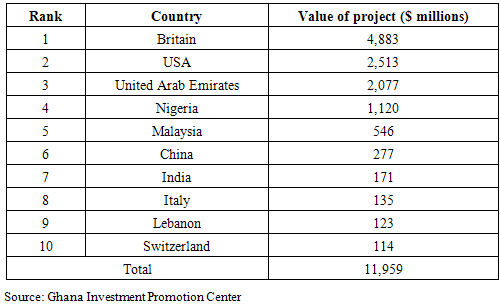

Table 3. The Oil Reserve Characteristics

|

| |

|

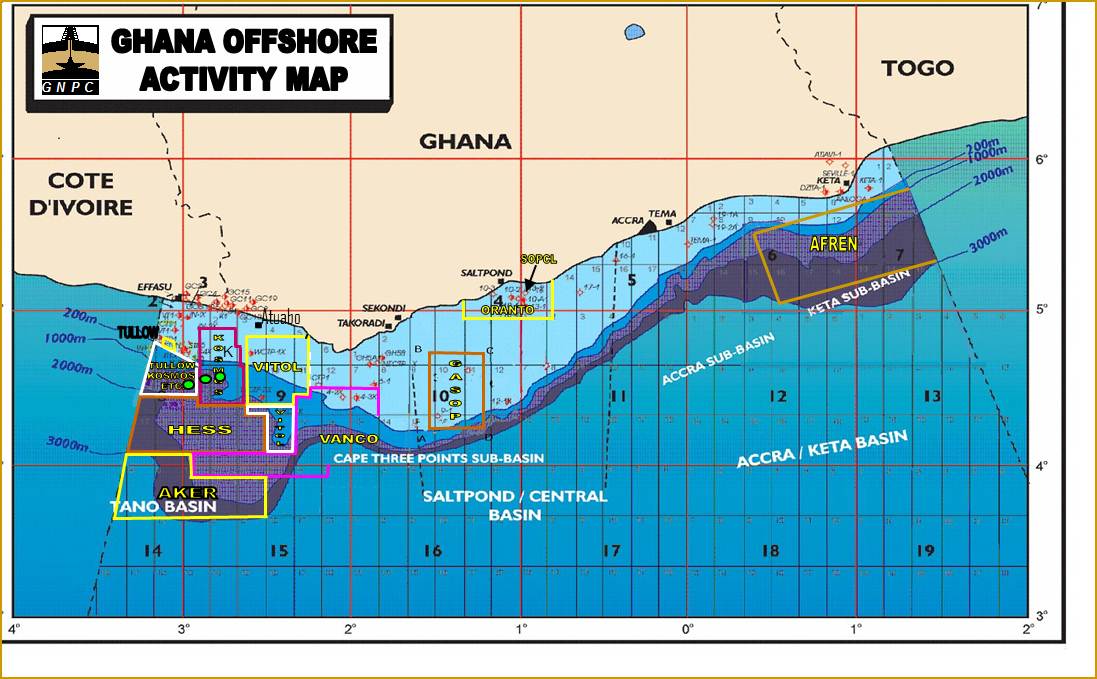

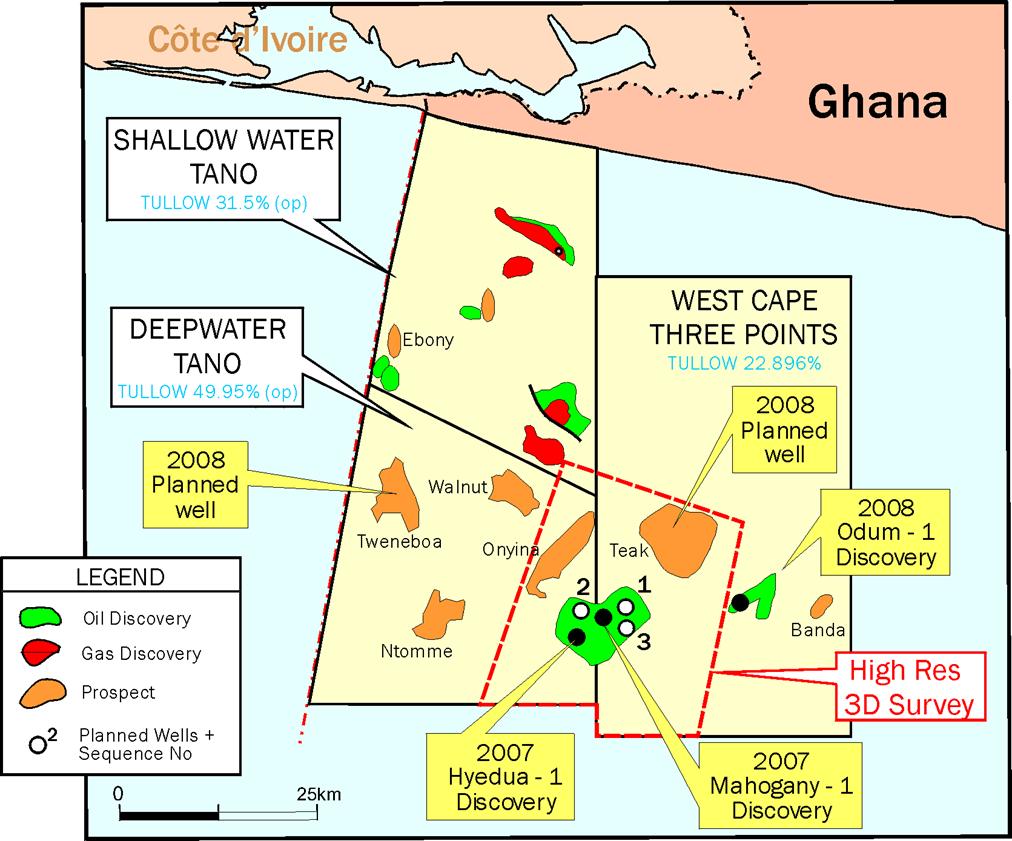

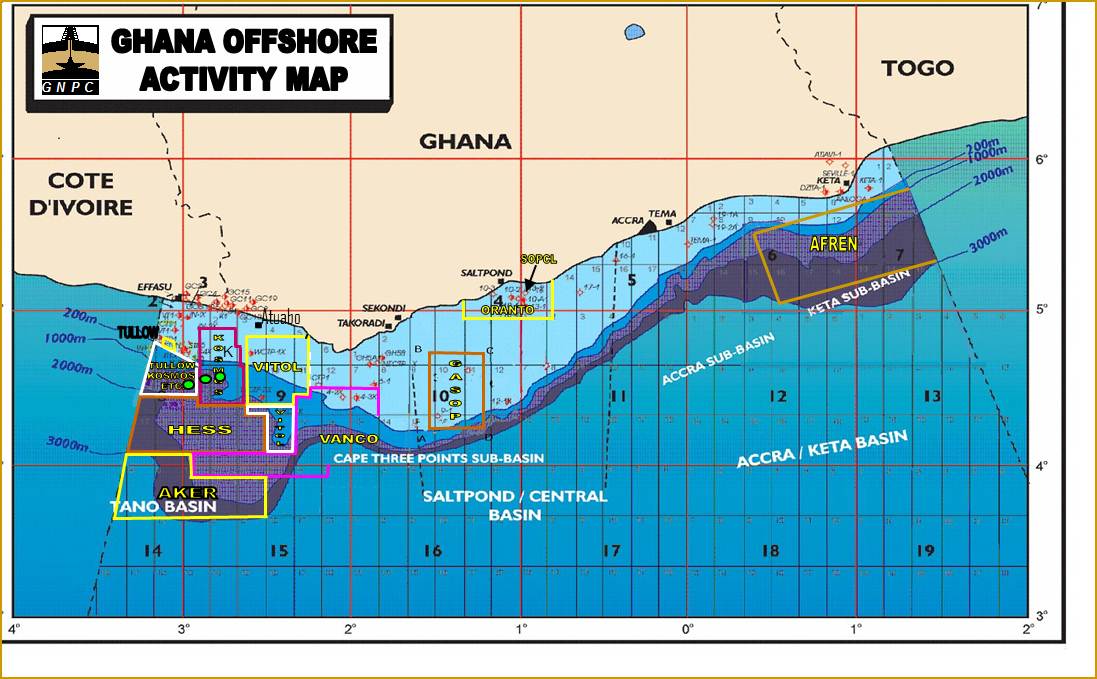

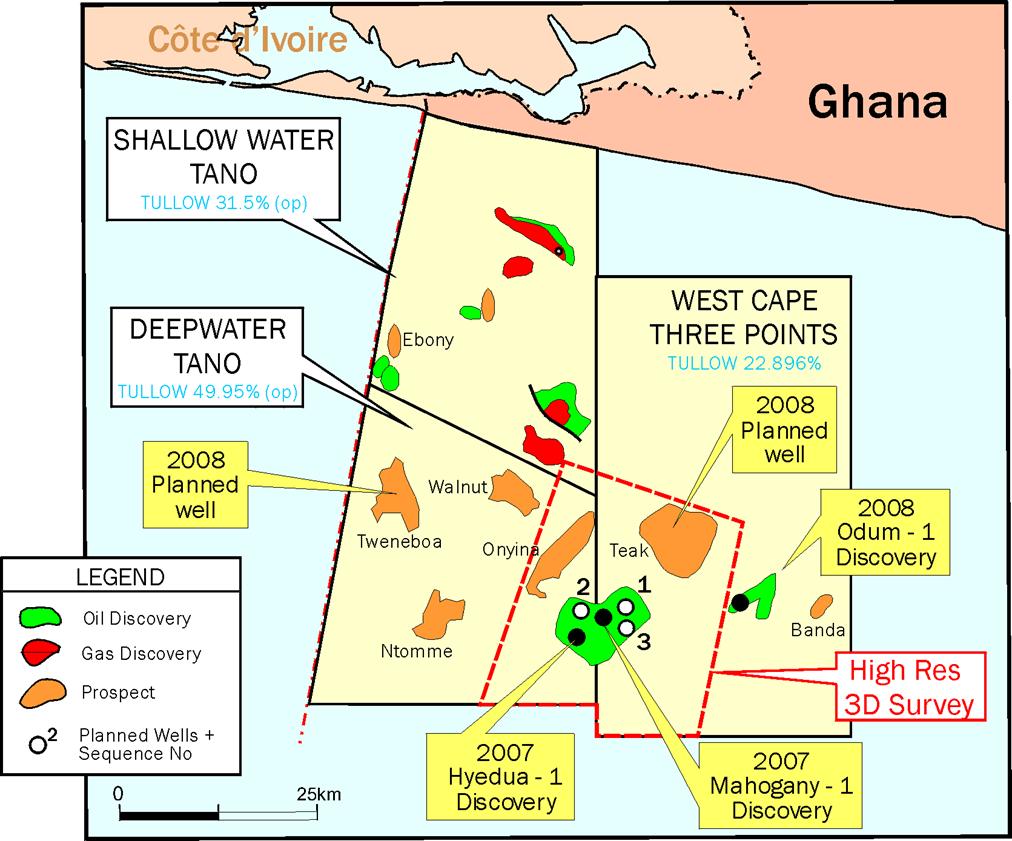

Case study: Oil Fields in GhanaThe oil field in Ghana known as the Jubilee Field was discovered in the Deepwater West Cape Three Points (WCTP)/Tano Block in June and August 2007 by a Consortium of Companies- Kosmos Energy Ghana (HC) - Anadarko Corporation- Tullow Oil (UK)- EO Group- Sabre Oil | Figure 2. Showing Ghana’s offshore Activity map |

| Figure 3. The Jubilee field of Ghana |

Some percentage of Produced Gas will be re-injected if technically prudent. Part of the gas would also be used on the Floating Production, Storage and Offloading (FPSO) for normal operation and the rest would be piped to shore for the proposed gas project [10].Situation at DonmunliIn the locality of Donmunli in the Western Region of Ghana, there was a dead whale which had been washed ashore during mid-November of 2013. The community members have reported with sadness that this has not been a rare occurrence with so far twenty-one whale carcasses appearing on their beaches since 2009. The dead whale has decayed and caused a bad odor which has made it very difficult for community members to go about regular activities. Even though investigation are underway, the people in the locality have expressed the concern that the gradual increase in the death of the whales can be traced to the exact timing and location of the offshore oil exploration and drilling off the coast of Cape Three Points, at the Jubilee oil field. Literature reviewThe Petroleum industry of Ghana is regulated by the state-owned Ghana National Petroleum Corporation (GNPC) and administered by the state-owned Ghana Oil Company (GOIL). The expected annual tremendous inflow of capital from crude oil and natural gas production into the Ghana economy began from the first quarter of 2011 when Ghana started producing crude oil and natural gas in commercial quantities in 2011 [11]. At the end of 2012, declining productivity at one of the country’s largest oil projects, the Jubilee oil field, led to a decline in revenues for the government, who had budgeted for oil revenue of more than $650 million, [12]. Ghana is believed to have up to 5 billion barrels (790,000,000 m3) to 7 billion barrels (1.1×109 m3) of petroleum in reserves [13]. which is the sixth largest in Africa and the 25th largest proven reserves in the world and Ghana has up to 6 trillion cubic feet of natural gas in reserves (Daily Graphic. 13 May 2013). The Government of Ghana has drawn plans to nationalize Ghana's entire petroleum and natural gas reserves [14]. Ghana’s oil fields has drawn a lot of interests all around the world especially with the Chinese companies. In 2010 Drew Hinshaw commented about this “”Exxon, the world's wealthiest oil company, is prepared pay $4 billion for the right to send deep-sea tankers and crews across ocean to pump at the deposit. However, China National Offshore Oil Corporation (CNOOC), the country's third largest national oil company, is also bidding on the site. Oil industry insiders widely agree that Exxon's main advantage over the government-owned Chinese company is the 140-year-old conglomerate's experience pumping oil upwards from hard-to-reach sea beds, experience still valued despite the Exxon-Valdez spill in 1989 [15].

2. Research Methodology

This study was conducted at the coastal community of Domunli, in the western region of Ghana through various qualitative research methods such as interviews, surveys and observations. Various interviews were made and observations about the effects of the oil mining were gathered. Direct phone calls, Skype, Wechat and Whatsapp interactions with people working with these companies in obtaining information for the research. A total of 243 Some of the questions asked during these interviews included:1. How old are you? Level of education? Do you have any experience with foreign workers?2. Does the oil drilling activity cause any hardship on the community or it’s beneficial to the community? 3. Are there any effects on quantity or amount of fish caught? 4. Do you have problems with accommodation because of the influx of foreigners? 5. Are there any crime or theft issues? 6. What is the general effect on the environment?

3. Analysis of Results

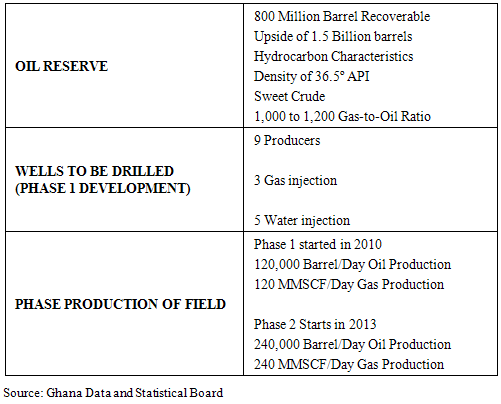

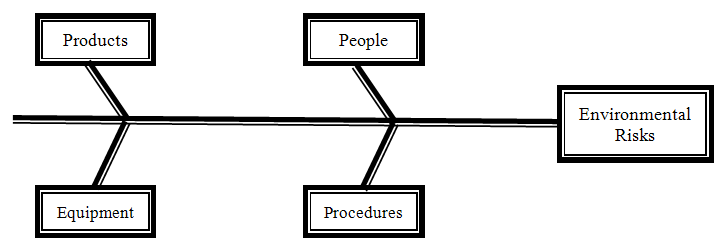

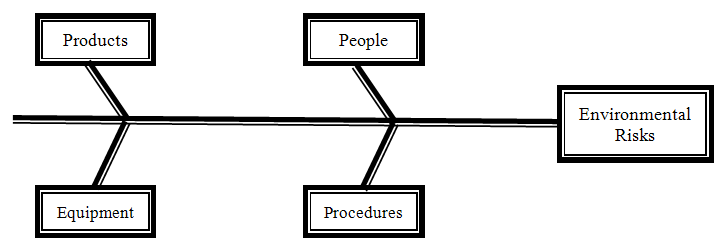

For the analysis of the results, the cause and effect diagram was used to identify, explore and graphically display all the possible causes related to the problem especially the root causes. In utilizing the “fish-bone diagram” [16] for the analysis the different questions were categorized into different sections as: Products, equipment, people, procedures and policies.1. Products – this was basically to find out about the adverse effects of the oil mining on the fish which is the basic product depended on by the community. Question: Does the oil drilling activity cause any hardship on the community or it’s beneficial to the community? 2. Equipment – The noise, space occupied, and the effects of the use of the rigging machine was also considered. Question: Does the oil drilling activity cause any hardship on the community or is it beneficial to the community? Are there any effects on quantity or amount of fish caught? 3. People – information about the people being interviewed was also obtained to know their level of thinking and the reason why they made certain observations. The influx of the foreign nationals also posed a huge threat to their accommodation because of the surge in rental rates. Question: How old are you? Level of education? Do you have any experience with foreign workers? How has the presence of foreigners affect your accommodation?4. Procedures and policies – Different procedures and policies in the area were also \ investigated to assess the situational dimension of the risk involved. Question: Are there any crime or theft issues? What is the general effect on the environment? | Figure 4. Cause and effect diagram of risk factors (fish-bone diagram) |

4. Discussion of Results

From the various observations and surveys made the results shows that there were negative influences on the community as a whole. Some of these set-backs are shown below: Hardships on the community: The fishermen complain bitterly that as a result of the oil industry and their activities they now have a “bad catch” which is a low quantity of fish. The community has been appealing to the authorities to help curb this situation which is grossly affecting their daily income and general lifestyle.

Hardships on the community: The fishermen complain bitterly that as a result of the oil industry and their activities they now have a “bad catch” which is a low quantity of fish. The community has been appealing to the authorities to help curb this situation which is grossly affecting their daily income and general lifestyle.  Reason for the low fish quantity by fishermenWhen the oil rig was placed in the sea, the fishermen were warned not to go near it during their fishing activities. However, the light on the oil rig always seems to attract the fish to it and so results in a lower population of fish in the areas where the fishermen are engaging in their harvest.

Reason for the low fish quantity by fishermenWhen the oil rig was placed in the sea, the fishermen were warned not to go near it during their fishing activities. However, the light on the oil rig always seems to attract the fish to it and so results in a lower population of fish in the areas where the fishermen are engaging in their harvest.  Increased accommodation rentDue to the influx of workers and foreign nationals in the oil community house rental prices have shot up. The house owners have taken advantage of the presences of the new arrivals and have increased and changed the housing rental procedures. Many tenants are now asking for yearly advanced payments instead of the previous monthly payments. This has become a big problem for the people in the community. The chiefs in the community are now also withholding the sale of lands for opulent clients so even buying of land which never used to be complicated has new become an issue to contend with.

Increased accommodation rentDue to the influx of workers and foreign nationals in the oil community house rental prices have shot up. The house owners have taken advantage of the presences of the new arrivals and have increased and changed the housing rental procedures. Many tenants are now asking for yearly advanced payments instead of the previous monthly payments. This has become a big problem for the people in the community. The chiefs in the community are now also withholding the sale of lands for opulent clients so even buying of land which never used to be complicated has new become an issue to contend with.  Pilfering and Robbery casesThe presence of the foreigners has also led to pilfering and robbery cases and has now required increased security surveillance and protection.

Pilfering and Robbery casesThe presence of the foreigners has also led to pilfering and robbery cases and has now required increased security surveillance and protection.  Bad odor and stale airOil spillage into the sea leads to the death of several fish and see creatures which are washed to the shore creating a bad odor for the people in the community. The air along the shorelines generally becomes stale and unpleasant for any kind of economic activities for the people.

Bad odor and stale airOil spillage into the sea leads to the death of several fish and see creatures which are washed to the shore creating a bad odor for the people in the community. The air along the shorelines generally becomes stale and unpleasant for any kind of economic activities for the people.  | Figure 5. Death of see creature which is washed to the shore |

| Figure 6. Chinese Companies clearing land for oil and Gas project |

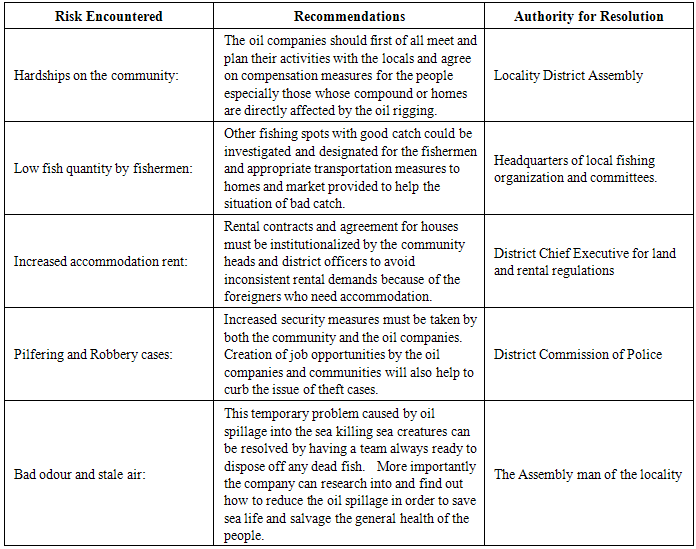

5. Recommendations

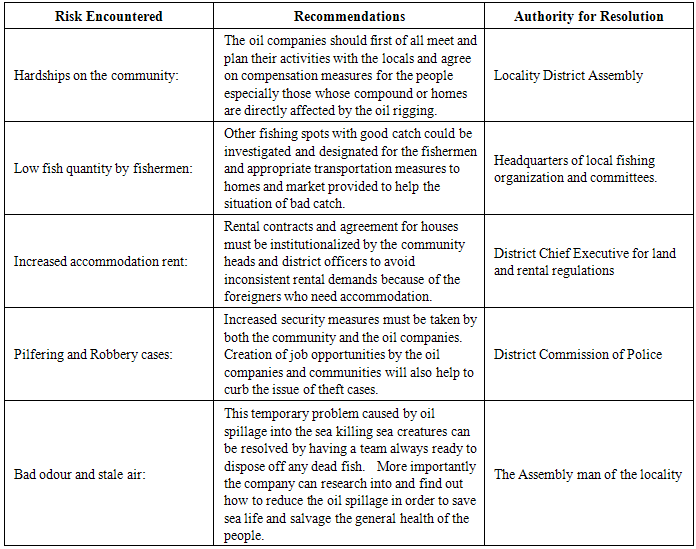

The activities of the oil companies obviously have a negative connotation on the community and affect the economic growth of the region [17]. Some recommendations for the various problems encountered are shown below:Hardships on the community: The oil companies should first of all meet and plan their activities with the locals and agree on compensation measures for the people especially those whose compound or homes are directly affected by the oil rigging. Low fish quantity by fishermen: Other fishing spots with good catch could be investigated and designated for the fishermen and appropriate transportation measures to homes and market provided to help the situation of bad catch. Increased accommodation rent: Rental contracts and agreement for houses must be institutionalized by the community heads and district officers to avoid inconsistent rental demands because of the foreigners who need accommodation. Pilfering and Robbery cases: Increased security measures must be taken by both the community and the oil companies. Creation of job opportunities by the oil companies and communities will also help to curb the issue of theft cases.Bad odor and stale air: This temporary problem caused by oil spillage into the sea killing sea creatures can be resolved by having a team always ready to dispose off any dead fish. More importantly the company can research into and find out how to reduce the oil spillage in order to save sea life and salvage the general health of the people. [18] [19]Table 4. Risks encountered and their recommendatory bulletins

|

| |

|

6. Conclusions

It’s a fact that oil rigging has become a major source of income for many foreign companies who come to Ghana especially Chinese nationals [20] [21]. These activities though adequately profitable for these foreign companies and Ghana also come with their setbacks, especially environmental effects [22]. This paper expounded on the environmental risk factors of oil at the Jubilee field and showed that the activities of the constructions firms for oil have created environmental risk especially to fishing activities for the community and also some risks to the firms themselves. The effects on the Chinese firms are that they are gradually losing the confidence of the local community and there are always tension between the people and the Chinese nationals. An outstanding risk factor for the community is that the economic state of the locality has been grossly affected by the activities of the firm. Environmentally, the community has to face up with the bad odor or stench as a result of the dead sea creatures that are brought to the shore of the sea. One of the main recommendations was that Chinese nationals consult local chiefs in the community before embarking on any project to avoid land litigation problems and tension among locals.

References

| [1] | Alden, C & Davies, M 2006, 'A profile of the operations of Chinese multinationals in Africa,’ South African Journal of International Affairs, vol. 13, no. 1, pp. 83-96. |

| [2] | Samuel Howard Quartey, Competitive Challenges Facing Chinese Mncs In Ghana. Asia Pacific Journal of Business and Management, 2013, Volume 4(2), 19-38. |

| [3] | (Ian Gary: Oil Specialist Oxfam America). |

| [4] | Dun-Arkhurst, Isaac (2008). Ghana's Relations with China. Johannesburg: South African Institute of International Affairs. Pg. 10-11 ISBN 1-919969-32-2. |

| [5] | Peter J. Buckley, Hinrich Voss, and Adam R. Cross, (2008). Thirty years of Chinese outward foreign direct investment. |

| [6] | Alden, C. Rothman, A. (2006) China and Africa Special Report, CLSA, September 2006. |

| [7] | Zhao, H & Wang, Y 2008, ‘Advantage exploitation and disadvantage avoidance: An empirical analysis of outward internationalization propensity of Chinese private Firms,’ Boston, Harvard, Kennedy School of Government, October. |

| [8] | Martin Henry Asare, Wang You Song, Risk assessment of Chinese construction and Engineering firms in Africa: An empirical survey of Ghana, Pg. 122-127. |

| [9] | Daily Guide, October 2014. |

| [10] | Ayoade M. A. (2002). Disused offshore installation and pipelines: towards sustainable decommissioning. Kluwer Law International. ISBN-13: 9789041117397. pp. 74–77. |

| [11] | Energy Foundation of Ghana. "Energy in Ghana". Retrieved 23 April 2013. |

| [12] | GNN Liberia, 2013, Tullow Oil’s projections cause budgetary worries in Africa, Liberia: |

| [13] | McLure, Jason. Ghana Oil Reserves to Be 5 billion barrels (790,000,000 m3) in 5 years as fields develop. Bloomberg Television. Wednesday, 1 December 2010. |

| [14] | Daily Graphic. 13 May 2013. |

| [15] | (allafrica.com. Retrieved 22 September 2013). |

| [16] | Kenneth H Rose, PMP, Project Quality Management pg. 115-116. |

| [17] | Dr. Patrick. X.W. Zou, Dr. Guomin Zhang, and Professor Jia-Yuan Wang, Identifying Key Risks in Construction Projects: Life Cycle and Stakeholder Perspectives pp4 http://teeic.anl.gov/er/oilgas/impact/drilldev/index.cfm. |

| [18] | Asafu-Adjaye N. B. (2011). Overview of market opportunity, Ghana. Presentation by Ghana. |

| [19] | Aberdeen, Scotland, National Petroleum Corporation at the Offshore Europe 2011,. 6–8, September. |

| [20] | Ghanaweb News published on October 3rd, 2011. |

| [21] | http://www.akmarine.org/our-work/protect-bristol-bay/risks-of-oil-gas-drilling |

| [22] | Akabzaa, T. and A. Darimani (2001) ‘Impact of Mining Sector Investment in Ghana: A Study of the Tarkwa Mining Region’. |

Hardships on the community: The fishermen complain bitterly that as a result of the oil industry and their activities they now have a “bad catch” which is a low quantity of fish. The community has been appealing to the authorities to help curb this situation which is grossly affecting their daily income and general lifestyle.

Hardships on the community: The fishermen complain bitterly that as a result of the oil industry and their activities they now have a “bad catch” which is a low quantity of fish. The community has been appealing to the authorities to help curb this situation which is grossly affecting their daily income and general lifestyle.  Reason for the low fish quantity by fishermenWhen the oil rig was placed in the sea, the fishermen were warned not to go near it during their fishing activities. However, the light on the oil rig always seems to attract the fish to it and so results in a lower population of fish in the areas where the fishermen are engaging in their harvest.

Reason for the low fish quantity by fishermenWhen the oil rig was placed in the sea, the fishermen were warned not to go near it during their fishing activities. However, the light on the oil rig always seems to attract the fish to it and so results in a lower population of fish in the areas where the fishermen are engaging in their harvest.  Increased accommodation rentDue to the influx of workers and foreign nationals in the oil community house rental prices have shot up. The house owners have taken advantage of the presences of the new arrivals and have increased and changed the housing rental procedures. Many tenants are now asking for yearly advanced payments instead of the previous monthly payments. This has become a big problem for the people in the community. The chiefs in the community are now also withholding the sale of lands for opulent clients so even buying of land which never used to be complicated has new become an issue to contend with.

Increased accommodation rentDue to the influx of workers and foreign nationals in the oil community house rental prices have shot up. The house owners have taken advantage of the presences of the new arrivals and have increased and changed the housing rental procedures. Many tenants are now asking for yearly advanced payments instead of the previous monthly payments. This has become a big problem for the people in the community. The chiefs in the community are now also withholding the sale of lands for opulent clients so even buying of land which never used to be complicated has new become an issue to contend with.  Pilfering and Robbery casesThe presence of the foreigners has also led to pilfering and robbery cases and has now required increased security surveillance and protection.

Pilfering and Robbery casesThe presence of the foreigners has also led to pilfering and robbery cases and has now required increased security surveillance and protection.  Bad odor and stale airOil spillage into the sea leads to the death of several fish and see creatures which are washed to the shore creating a bad odor for the people in the community. The air along the shorelines generally becomes stale and unpleasant for any kind of economic activities for the people.

Bad odor and stale airOil spillage into the sea leads to the death of several fish and see creatures which are washed to the shore creating a bad odor for the people in the community. The air along the shorelines generally becomes stale and unpleasant for any kind of economic activities for the people.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML