Joseph Ignatius Teye Buertey1, Stephen Kofi Asare2

1Lecturer, Department of Built Environment, Pentecost University College, Kaneshie, Ghana/ PhD Candidate, Open University of Malaysia (PMP, MGhIS, MQSi)

2Student, Accra Institute of Technology, PMB, Accra, Ghana

Correspondence to: Joseph Ignatius Teye Buertey, Lecturer, Department of Built Environment, Pentecost University College, Kaneshie, Ghana/ PhD Candidate, Open University of Malaysia (PMP, MGhIS, MQSi).

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The traditional procurement strategy for infrastructural delivery is one of the major reasons for the high infrastructural deficits in Africa. To bride this infrastructure gap; there is need for a consented effort to review our procurement and financing strategy. To this end, the main objective of this study is assesses how the concept of Public-Private Partnership (PPP) can be adopted as an alternative procurement strategy to help address the challenges to road infrastructure provision to bridge the existing infrastructure gap in Ghana. Based on findings, it was revealed that the financing of road infrastructure in Ghana is woefully inadequate and there is the need for other sources of financing. It was further revealed that the PPP model can be implemented and sustained to help overcome the challenges of the traditional procurement strategy to transform the infrastructure sector in Ghana. At 5% significance level, 85% of respondents held that the appropriate PPP model to be implemented in Ghana is the BOOT ahead of Design Build Finance Operate, which was ranked as the second most appropriate procurement models. The study concluded that though several PPP models exist, the most suitable model to be selected for a project must be based on the purpose of the project and the partners’ characteristics. Thus no single PPP model can satisfy all conditions concerning a project’s location setting and its technical and financial features. The research recommended that, for the profit maximizing interest of the private sector, the PPP involvement may only be limited to the construction of highways and trunk roads where road toll points can be stationed to serve as evident cost recovery machinery. It is worth noting that though the PPP model cannot provide a solution to the infrastructural deficit, but it can go a long way to reduce the deficit, taking into consideration the consented effort of the government and the masses.

Keywords:

Design bid build, Procurement strategy, Infrastructural deficit, Public private partnership, Road

Cite this paper: Joseph Ignatius Teye Buertey, Stephen Kofi Asare, Public Private Partnership in Ghana: A Panacea to the Infrastructural Deficit?, International Journal of Construction Engineering and Management , Vol. 3 No. 5, 2014, pp. 135-143. doi: 10.5923/j.ijcem.20140305.01.

1. Introduction

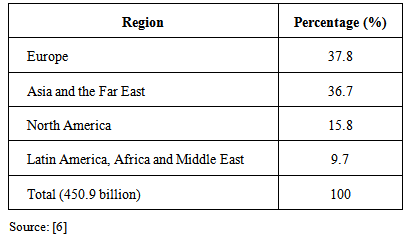

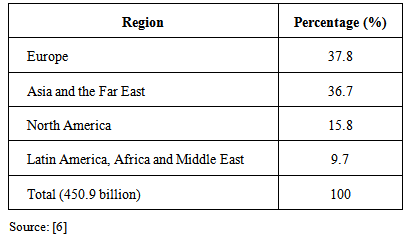

Private sector involvement in the delivery of public services is not a new concept. The PPP concept has been used for over four decades predating the contracting out initiatives of the 1970s in the USA. Initially focusing on economic infrastructure, PPPs have evolved to include the procurement of social infrastructure assets and associated non-core services such as facility management, maintenance and security. PPPs have extended to housing, health, corrective facilities, energy, water, and waste treatment [1]. Several fast developing countries such as China, Malaysia and South Africa have all taken keen advantage of PPP to speed up their infrastructure development. Attempts at formalizing Public Private Partnership (PPP) process in Ghana began in 2003. A national PPP policy was approved by Cabinet in June 2011 with necessary legal frameworks to support its efficient operation seriously under preparation since 2003 [2]. The study brings to light, how the adoption of the PPPs procurement strategy may enhance combination of resources from both private and public sector as an alternative funding to the traditional design bid build procurement method. According to [3], currently the approximate ratio of tarred to un-tarred road network in Ghana is 18.7% to 81.3%. Ref [4] holds that, at the current rate of 7.13% per annum of road infrastructural delivery, all things being equal, it would take the country Ghana close to 2 decades to reach optimum road development with respect to urban road network. [4] Held that to close the gap in the road sector, road financing in Ghana, this would require a joint effort from both the public and private sector to take advantage of the private sectors adequate resources in terms of finance, technology and expertise. For Ghana to be able to bridge the gap, procurement strategies that allow transfer or sharing of financial responsibilities and risks among government and private sector need to be employed in the delivery of road infrastructure projects. The traditional Design Bid Build (DBB) method which has been the main procurement method employed for the provision of public infrastructure in Ghana rely on the government for the provision of funds for the project. This means that, shortage of funds by the government means suspension or complete abandonment of project. Ghana requires a total investment of US$ 5,497 million to meet the growing demand for road infrastructure. Thus, it will not be out of place if road financing in Ghana adopts a joint effort of both the public and private sector to take advantage of the private sectors adequate resources in terms of finance, technology and expertise [4].It is also noted that, the traditional Design Bid Build method of project delivery commonly employed in Ghana, results in delay in completion, corruption, cost overrun and low quality [5]. Due to these, the objectives of the projects are not achieved causing the government’s desire to close road and other infrastructure gap to be moving at a “snail pace”. The above challenges mainly results from inadequate flow of funds for project delivery due to limited public financial resources. It is therefore imperative to investigate to know whether public private partnership procurement strategy could be the best option to address these challenges. This research therefore seeks to provide recommendations for policy improvement with respect to the existing PPP framework in Ghana and measures to be adopted to accelerate the rate of development of the road infrastructure project in Ghana through the implementation of the PPP scheme to help alleviate the challenges in road infrastructure provision.A public works financing database of worldwide projects between 1985 and 2004 shows that 1,121 PPP infrastructure projects (road, rail, airport, seaport, water, and building), representing $450.9 billion worth of investment, were funded and completed with the least of the projects (9.7%) being in Latin America, Africa and Middle East as shown in Table 1. Table 1. Regional Share of PPP Projects funded and completed between 1985 and 2004

|

| |

|

Through Private Finance Initiative (PFI), the UK government for instance makes use of partnership models to develop and deliver all manner of infrastructure, from schools to defense facilities. In a typical year, close to 100 PPP projects are initiated or completed in the United Kingdom. Private Finance Initiative projects now represent between 10 to 13 percent of all UK investment in public infrastructure. Yet, little more than ten years ago, PPPs were barely a blip on the radar screen, and decades of neglect had resulted in deteriorated schools, hospitals, and other public assets across Britain. The introduction of private finance initiative reversed this trend, as more transport and other infrastructure facilities have been realized through private finance initiative [7].

2. Empirical Review

2.1. Evolution of Public-Private Partnership (PPP)

The PPP policy has also evolved globally as public sectors develop the necessary skill base to procure infrastructure by way of PPP, including the capacity to create and maintain a regulatory framework. PPP have different names all over the world. Example of some countries and organizations and their reference to PPP are; • UK, Japan and Malaysia use Private Finance Initiative (PFI)• Australia use Private Finance Project (PFP), • North America use Public-Private Partnership (P3), • Development Banks use Private Sector Participation (PSP) and • The World Bank use Private Participation in Infrastructure (PPI) [8]. Despite all the different names, the main focus is on the combined service delivery methodology by the private and the public sector [9]. Governments have pursued this public procurement alternative for various reasons. Most industralised economies such as US, UK, Australia and Canada have tended to pursue public-private partnership in order to reduce the operating cost of public service whilst improving quality and customer satisfaction.In the UK, the PFIs have been used to develop and deliver all manner of infrastructure and services and now represent 10 to 13% of all UK investment in public infrastructure; close to 100 PFI projects are initiated or completed every year [10]. The growing use of PFIs has inspired governments worldwide to adopt PPP arrangements. • The Australian government has used PPPs to deliver several social infrastructure projects; Ireland has used the PPP for transport infrastructure. • In the Netherlands, social housing and urban regeneration programs have been delivered through PPP arrangements.• India is investing heavily in highways through PPPs. In Canada, 20% of new infrastructure are designed, built and operated by the private sector.• The USA is a pioneer with contracting out and have started experimenting with other forms of PPPs.• Emerging democracies from central Europe are also following suit. [11] holds that using the PPP mode in any market economy, is just like multiplying your economic potential and implementing projects for which the public sector alone has neither the strength nor the resources to adequately execute.In most developing countries, contracting out was introduced in the mid-1980s during the first wave of governmental privatisation of state enterprises, under structural adjustment programs in Ghana. Policies were adopted to address the perceived lack of managerial capacity in government, as well as the need to stop the continued dependence of state enterprises on state subsidies. According to [9], in Africa, between 1990 and 2004, approximately 14% of public sector infrastructure was provided through a PPP, the most common sectors being water, energy and transport. The PPP trend is global, accelerating and encompassing a broad range of infrastructure sectors. Applying PPPs in the social infrastructure sectors has to some extent reduced the concentration of PPP projects at the central government level. Increasing number of local authorities are engaging in PPP arrangements to procure the much needed local infrastructure [11].

2.2. Models of Public-Private Partnership (PPP)

A wide spectrum of PPP models have emerged which may vary mainly by ownership of capital assets, responsibility for investment, assumption of risks and duration of contract [12]. PPP models can be used for two broad infrastructure purposes: use for new infrastructure e.g. Greenfield projects and use for already existing infrastructure. According to [9], some of PPP models related to the new infrastructure projects includes • Build-Transfer (BT)• Design-Build-Maintain (DBM)• Design-Build-Operate (DBO)• Design-Build-Operate-Maintain (DBOM)• Build-Own-Operate-Transfer (BOOT)• Build-Own-Operate (BOO)• Design-Build-Finance-Operate/Maintain (DBFO, DBFM or DBFO/M)[13], argues that PPPs can also be used for existing services and facilities in addition to new ones under the following models:• Service Contract• Management Contract• Lease• Concession• DivestitureEven though, various model described above demonstrate a degree of partnership relationship between the public and private sector, per the Ghana’s PPP definition, only models that allow transfer of final ownership of the facility to public sector after the concession period is regarded as PPP. Therefore models described above that satisfies the Ghana’s PPP definition include; Concession, Lease, Management contract, Service contract, Design-Build (Build-Transfer), Design-Build-Maintain, Design-Build-Operate, Design- Build-Operate-Maintain (DBOM), Build-Own-Operate- Transfer (BOOT), and Design-Build-Finance-Operate / Maintain (DBFO, DBFM or DBFO/M).

2.3. Assessment of PPP Option for Infrastructure Projects

As indicated earlier, the selection of a suitable PPP model must be based on the purpose of the project and the partners’ characteristics. There is no single PPP model that can satisfy all conditions concerning a project’s locational setting and its technical and financial features [12]. According to [14], the Public sector and its advisers need to answer a set of key questions when choosing a particular PPP option. These questions include:• Is the project affordable? Will users or the Public sector (Authority), or both, pay for the project? How will they pay for the project (e.g. user charges, operating subsidies, public sector or EU grants)? Are the procurement costs significant if the project is procured using a PPP model?• What are the key sources of risk in the proposed project? What is the optimal risk allocation and risk management strategy?• What are the financing sources for the proposed project? Will the project be “bankable” (i.e. capable of raising debt finance)? Will it attract investors? Will it comply with the requisites for national public funding?• Even if the project is affordable and bankable, does the project represent value for money? In Ghana, the traditional Design Bid Build (DBB) is the main procurement method usually employed for the provision of road infrastructure and other public and private facilities such as schools, hospital, prison etc. However, some other procurement methods have emerged and gained recognition for the delivery of road infrastructures and other facilities. They include Design-Build-Operate and Transfer, Construction at Risk and Traditional with Project Manager. The advantages of the DBB are that the owner is provided opportunities to develop and maintain the technical expertise of the in-house professionals. Also new contractors and smaller, less-experienced firms will have opportunities to gain experience and prepare themselves for other methods of bidding. However, some disadvantages have been identified with the application of this procurement method. [5] postulates that the weakness of the model is that when the design team is not abreast with the prevailing market prices of items or construction costs, then any increase of the cost could increase project cost and also delay the project. [15] and [16], also discovered that, the traditional procurement system where competitive bidding emphasizes on construction cost and time, quality is usually compromised. Also, as the owner can choose the lowest bidder, it may be perceived to have the least initial estimated project cost during commencement, but may result in high cost overruns at the end, lower quality deliverables. In addition, in a traditional DBB, since the project contract is split into phases, among distinct entities, the delay of one phase or entity affects the commencement or progress of the next phase. This may lead to no corresponding time savings in the arrangement because the contractor often does not even bid, much less begin work, until the design professional has finalized the plans [17].

3. Methodology

The research applied the mixed method (qualitative and quantitative approach) during the survey. In terms of the quantitative methods, a survey questionnaire was designed according to the research questionnaires. The main research questions for this study included: 1. Is the PPP a panacea for Ghana’s infrastructural deficit? 2. What is the suitable PPP model for infrastructural delivery in Ghana?3. Can the PPP be implemented and sustained in Ghana?A sample size of 115 was determined from Kish method [18] from a population of 205. Based on table 2, a total of one hundred and fifteen (115) questionnaires were administered to four categories of respondents with a response rate of 91.3%.| Table 2. Questionnaire Distribution |

| | Item | Nomenclature | Questionnaire | | Issued | Received | Response Rate (%) | | A | Road Agencies | 30 | 30 | 100 | | B | Local Consultant | 55 | 50 | 90.9 | | C | Ministry of Finance and Economic Planning | 15 | 15 | 100 | | D | Donor Institution | 15 | 10 | 100 | | | Total | 115 | 105 | 91.3 |

|

|

4. Findings and Discussions from Field Survey

4.1. Knowledge on PPP as a Procurement Method

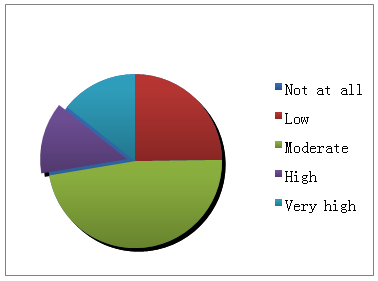

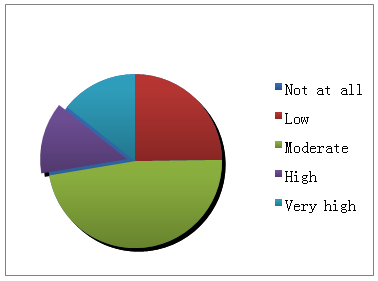

This section of the instrument sought to determine the respondents’ levels of knowledge on the PPP model. This section was relevant as it formed the basis for respondents to appropriately decipher the justification, types and level of adoption of PPP in road infrastructure provision in Ghana and also choose the best PPP option that will provides a win-win situation for all stakeholders. From figure 1, it was revealed that the 47.6% of respondents had moderate knowledge of the PPP concept. Some 14.3%, 13.3%, and 24.8% of the respondent described their knowledge on PPP as very high, high, and low respectively. This shows all the respondents had an average knowledge on the concept of PPP and its mode of operation. Out of the proportion indicated, 71.5% of respondent indicated that the means from which they gained knowledge on PPP was by reading about it. This was not surprising considering the fact that all respondent had attained tertiary education. Also, 25.5% of the responded held that they have been involved in projects outside Ghana that were procured through PPP. The remaining 3% also said they just heard about it through the media. However, the low level of respondents who have been involved in PPP projects gives an indication that, there is a low level of practical knowledge about PPP. | Figure 1. Respondents Level of Knowledge of PPP |

4.2. Performance Indicators of PPP Projects

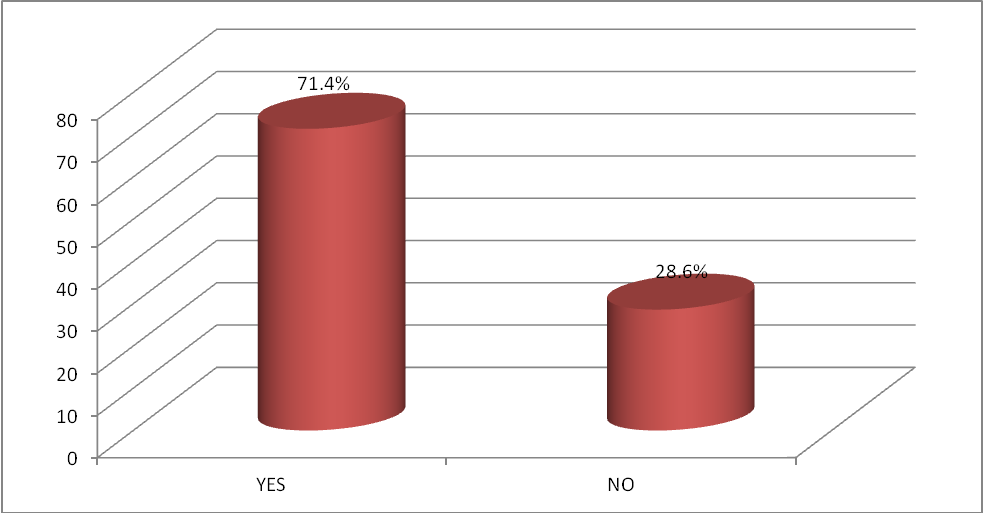

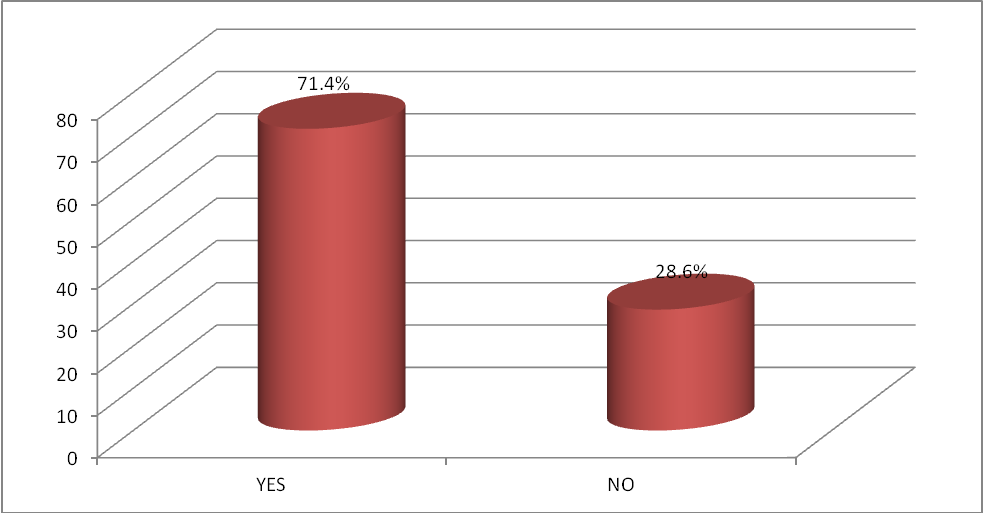

Value for money is one of the key motivations for every project implementation. Views of respondents were enquired on whether PPP procurement strategy for project implementation are successful and also give value for money. It was realized that 71.4% of the respondent were of the view that project delivered through PPP are successful and give value for money. On the other hand, 28.6% of the respondents indicated otherwise. They held that cost and budget overrun affects the performance of many project leading to project abandonment, quality deficiency. Hence it may be difficult for projects to recover cost | Figure 2. Do projects delivered through PPP successful and give value for money (VfM)? |

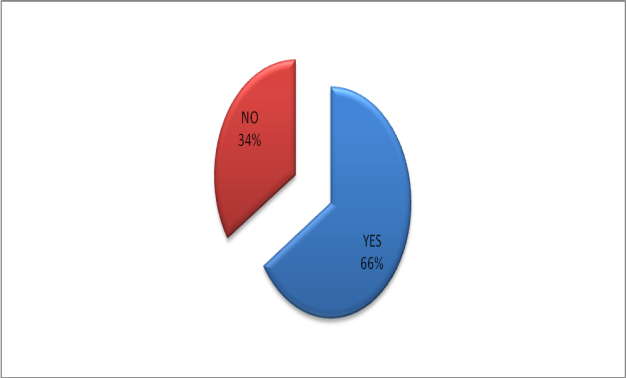

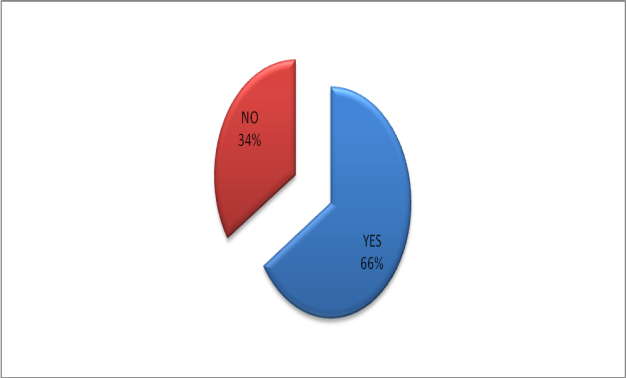

In order to find out the performance of PPP projects with respect to cost, respondent were also asked to indicate whether PPP projects are delivered within stipulated budget or cost. From the figure 3 below, shows that 65.8% of the respondent indicated that most PPP projects are delivered within stipulated cost, with the remaining 34.2% noting otherwise. Another key component of projects delivery is time. Every project is time bound and time overrun in project delivery affects the original objectives of the project. To ascertain the performance of PPP project with respect to time, respondents were asked to indicate whether projects procured through PPP are delivered within expected timeframe.  | Figure 3. Delivery of PPP Projects within stipulated cost |

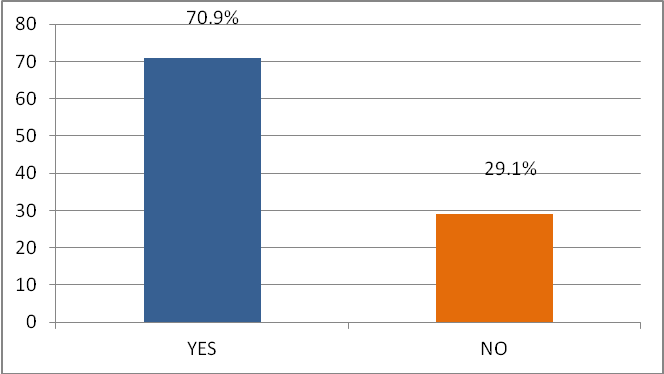

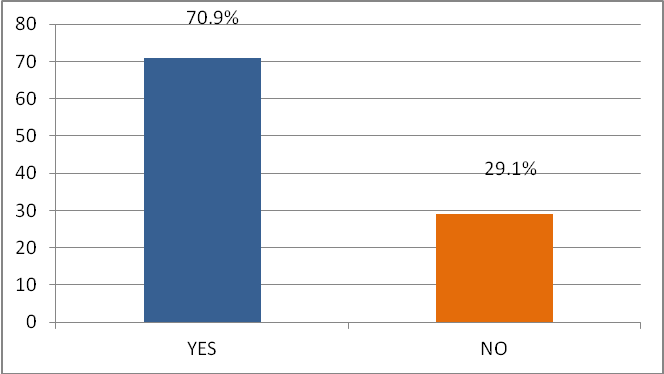

From the Figure 4 below, 70.9% of the respondent indicated that projects procured through PPP are delivered within the stipulated time, with the remaining holding otherwise.  | Figure 4. Delivery of PPP projects within Stipulated Time |

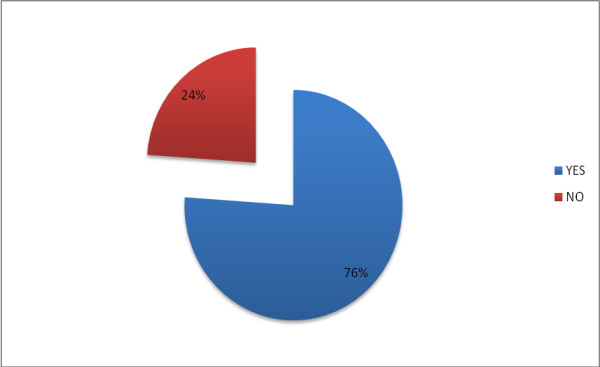

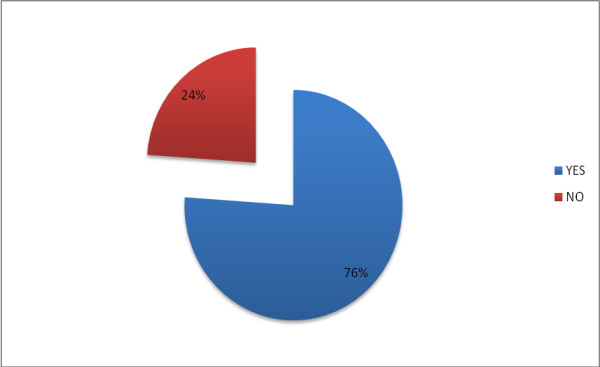

With quality as a key project performance indicator, respondents views were sought on the issue of quality performance of projects delivered through PPP scheme. From Figure 5 below, 76.1% of respondent indicated that projects procured through PPP produce quality results with some 23.9% holding otherwise. | Figure 5. Do PPP projects produce quality results? |

4.3. PPP as a Solution to Traditional Procurement Challenges

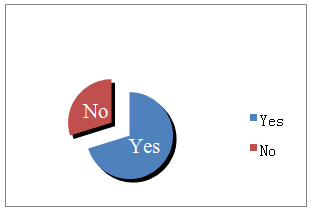

Respondents were asked to indicate their views on whether PPP can be a remedy to the traditional procurement challenges such as project abandonment and stoppage, poor quality and schedule slippage and cost overrun due to funding difficulties on most of our traditional DBB procurement delivery. The survey results indicated that 79% of the respondents held the view that PPP can be a remedy to the traditional procurement challenges in Ghana. The respondents believed that the main challenge of road infrastructure delivery in Ghana is inadequate finance and further held that PPP could provide adequate resources to boost the government’s effort since it combines resources from both public and private entities. The 21% of the respondents who hold diverging view on the use of PPP as a remedy to the challenges associated with traditional procurement strategy indicated that the PPP procurement processes are too long, complicated and expensive eventually and therefore need time for proper scrutiny and understanding.  | Figure 6. Can PPP can be a remedy to the traditional procurement strategy challenges in Ghana? |

4.4. Respondents’ Position on Road and Bridge User Charge System in Ghana

Using the current bridge and road toll as a case study, the survey sought the opinion of the user’s readiness to pay the appropriate tolls. From table 3, 57.1% of respondents agreed to the road toll system because they held that revenues that are generated can be used for the maintenance of existing roads, construction of new roads and also supplement the government’s budget on road financing. Thus road toll is also a very important source of funding for road infrastructure.| Table 3. Respondents’ Position on the Road and Bridge User Charge System in Ghana |

| | User Charge System | Frequency | Percentage (%) | | Agree | 60 | 57.1 | | Disagree | 45 | 42.9 | | Total | 105 | 100 |

|

|

4.5. Respondent’s Opinion on Preferred Means of Road Financing in Ghana

From table 4, 52.4% of respondents hold the view that road financing in Ghana should be a joint effort of both the public and private sector. This is because most private sectors have adequate resources in terms of finance, technology and expertise that can be used to supplement the efforts of the government. 38.1% of respondents were of the opinion that the public sector should finance road infrastructure while 9.5% went for total private sector financing. | Table 4. Prefer means of finance of road infrastructure development in Ghana |

| | Institution | Frequency | Percentage | | Private sector | 10 | 9.5 | | Public Sector | 40 | 38.1 | | Both parties | 55 | 52.4 | | Total | 105 | 100 |

|

|

4.6. Respondents Opinion on the Level Of Road Financing in Ghana

Road infrastructure financing in Ghana comes from two primary sources; loans and funds from donors and other international agencies and the Road Fund. While the loans and donor funding are used in road construction, money from the Road Fund is used for maintenance works. According to [3], the main sources of funding for the road sub-sector are:• Road Fund; dedicated for maintenance • Consolidated Fund for development works, minor rehabilitation and upgrading • Donor Funds for maintenance and major development works.These funds are expended on the three classes of roads - Trunk, Urban and feeder roads. Total funds released formed 69% of the required maintenance needs in 2010. The road tolls forms a significant portion of the road fund. With respect to road infrastructure financing in Ghana, 85.7% of respondents were of the view that financing road infrastructure was woefully inadequate as shown in table 5.| Table 5. The level of road infrastructure development financing in Ghana |

| | Perception | Frequency | Percentage (%) | | Adequate | 15 | 14.3 | | Inadequate | 90 | 85.7 | | Total | 105 | 100 |

|

|

The inadequate road finance has led to the abandoned of most roads and the delay in completing road projects in Ghana. The above has resulted in most agricultural produce being locked up in hinterlands resulting in worsening life condition of the rural dweller. Others were also of the view that, road infrastructure requirements far outweighs the resources available to be committed to it.

4.7. Implementation and Sustainability of PPP in Ghana

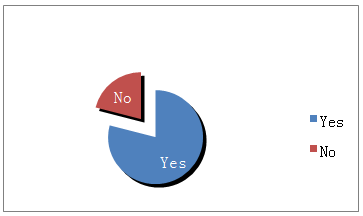

Implementing a sustainable PPP procurement policy requires adequate preparation such as institutional reform, legal framework, training etc. to ensure the adequate support during its implementation. PPP is a new procurement concept in Ghana yet to be implemented. It is therefore imperative to find out the possibility of implementing and sustaining PPP in Ghana. Respondents were asked to indicate their position whether PPP can be implemented and sustained. As illustrated in Fig 7 below, 70.2% of the respondents were of the view that PPP can be implemented and sustained in Ghana. They however indicated that there should be public sector institutional reform and legal framework that will protect the interest of both parties and also ensure accountability and transparency. On the other hand, 29.8% of the respondents were of the view that PPP cannot be implemented and sustained in Ghana because people will not be ready to pay for the high facility user fees and that will lead to investment capital recovery challenges. | Figure 7. Can PPP be implemented and sustained in Ghana? |

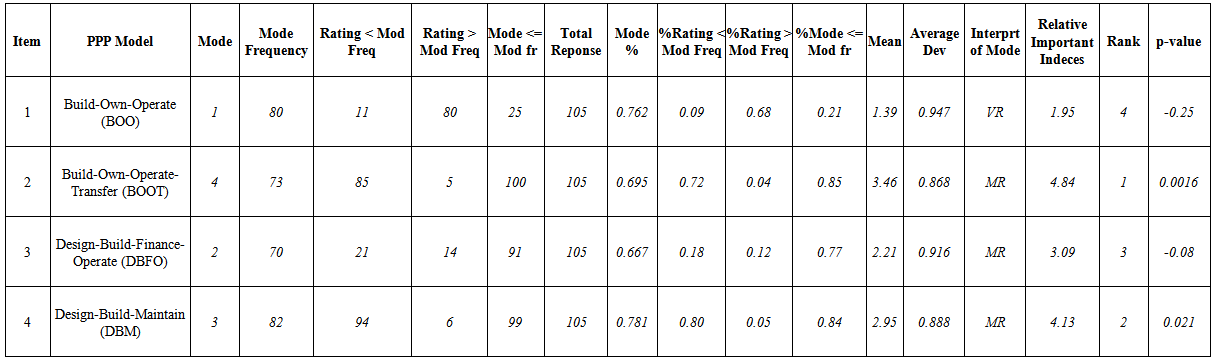

4.8. Suitable PPP Model for Ghana Infrastructure Delivery

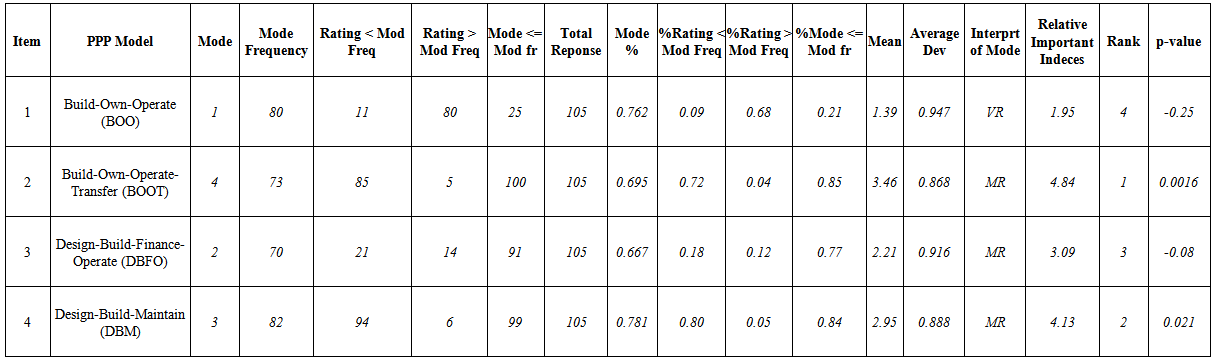

As revealed in literature, a very important factor in employing PPP as a method of project implementation and delivery is the level of maturity of the country’s PPP market. As a result, the research sought to sample the views of respondents on how best PPP should be employed in developing the three major road categories in the country (urban, feeder and trunk). According to table 6, at 5% level of significance, 83.2% of the respondents believed PPP procurement strategies could be employed for the delivery of all the road categories, with 16.8% having a different opinion. 74.6% of respondents saw urban and feeder roads to be low in yielding revenues to the government. However, trunk roads offer low risk levels due to the presence of tolls booths. This makes risk management comparatively lower and gives the high probability of cost recovery. | Table 6. Suitable PPP Procurement Methods for Road Infrastructure Project Delivery in Ghana |

To obtain further information on the best PPP procurement method, respondents were asked to rate selected PPP methods in order of suitability to Ghana’s road infrastructure delivery, as shown in table 6 above. At 5% level of significance, with a p-value or 0.0016, 69% of respondents agree that the best PPP module for infrastructural delivery in Ghana is the Build-Own- Operate-Transfer (BOOT). At 5% level of significance with a p-value of 0.0021, 85% of respondents hold the view that best alternative to the BOOT is DBM module.

5. Conclusions

An adequate road infrastructure is very vital for economic growth in every country. This is clearly manifested in the area of agriculture, health, education, politics, security, communication, engineering, and construction. Road and transport as a whole reduces poverty as it facilitates access to health thereby improving healthcare. It also opens up farming areas, increasing access to market centers, and improving farmers’ income. It also opens up rural areas, with a combination of other factors to creates alternative livelihood sources. In urban areas, road infrastructure and transport services connect towns and cities, facilitating the movement of people and goods and boosting trade. Traditionally, the government is responsible for the provision of necessary financial resources to enhance road infrastructure delivery, however, the road infrastructure projects are capital intensive and the revenue in many developing countries including Ghana are usually inadequate to meet the required investment needs.The paper has reviewed the concept of the PPP universally and its application in Europe and Asia. It has been revealed that even fast growing economies do not have adequate funds for all its infrastructure delivery hence applied the PPP model in one way or the other. The above notwithstanding, the traditional Design Bid Build method of project delivery commonly employed in Ghana, results in delay in completion, corruption, cost overrun and low quality [2], hence defeating the objectives of these projects. Currently, Ghana desire to close the road and other infrastructure gap is moving at a “snail pace”. At the current annual growth rate of 7.13%, all things being equal, it would take the country over 2 decades to meet its road needs in its major urban centres [4]. To close the gap in the road sector, road financing in Ghana would require a joint effort from both the public and private sector to take advantage of the private sectors adequate resources in terms of finance, technology and expertise since the DBB method is nothing to hinge our hopes on. Field survey has revealed that respondents have moderate knowledge of the PPP, with 85.6% of them agreeing that financing of road infrastructure in Ghana is woefully inadequate and hence need other sources of financing. Most respondents (70.2%) indicated that the PPP can be implemented and sustained in Ghana as an alternative procurement route to deliver project within stipulated cost, time and yield quality results. To provide revenue to pay off the initial capital invested in these projects, some 57.1% of respondents agree that our major roads and bridges must be tolled to pay for the capital injected into the projects.It can be deduced from the survey that the best PPP module that will ensure value for money for both parties to facilitate road infrastructure provision in Ghana is the BOOT ahead of Design Build Finance Operate, which was ranked as second. To accrue more revenue to develop road infrastructure, the government should ensure efficiency in the road toll collection mechanism through the engagement of the private sector for for effective collection, monitoring and reporting. For the PPP to work efficiently, the profit maximizing interest of the private sector will imply that, their involvement will be biased toward the construction of trunk roads where road toll points can be stationed to serve as evident cost recovery machinery. This is to the detriment of urban and feeder roads which are considered to be low revenue yielding sources accruing directly to the government. Thus the PPP cannot be panacea to the infrastructural deficit of Ghana, since not all projects can be implemented through the PPP scheme. It is therefore recommended that, private investors in such ventures should be given the opportunity to implement innovative cost recovery interventions not limited to road toll but parking fees and fees from flouting of traffic rules. The government should ensure efficiency in the toll collection system through effective monitoring and reporting. A survey of state PPP enabling legislation in the USA shows that approximately 21 states employ DBFO procurement for toll facilities [18] [6], and hence, privatization of road toll collection in Ghana will not be out of place and will ensure optimum returns.

References

| [1] | New South Wales Treasury (2009): NSW Public-Private Partnerships – An Evolution. A Publication from the office of financial management, research and information, New South Wales, UK. |

| [2] | Apenteng M. (2011). Report on the Public procurement consultation meeting on Ghana PPP Programme. Ministry of Finance and Economic Planning. |

| [3] | Road Infrastructure Development Annual Report, (2011). Ministry of Roads and Highways (MRH), Ghana. |

| [4] | Buertey, J.T.I., Asare S. K (2014). Road Infrastructural Delivery in Ghana: Trends and Projections, International Journal of Engineering and Technical Research (IJETR) ISSN: 2321-0869, Volume-2, Issue-11, November 2014. |

| [5] | Owusu G. A, 2010: Looking at the PPP and the traditional way of construction of projects in Ghana. An unpublished MSc Thesis submitted to the University of Agder, Kristainsand. |

| [6] | Ahmed, M. & Aziz, A. (2007). Successful delivery of Public-private partnership for infrastructure development. Journal of Construction Engineering and Management, 133 (12) 918-931. |

| [7] | Nossaman, G. K. and Elliot L. (2008). PPP enabling statutes for highway projects. Transport Institute, United States. |

| [8] | Abiodun D., 2011. PDP and Infrastructure Development. Vanguard Media Limited, Nigeria. |

| [9] | Osborne, S.P. (2000). Public-Private partnership: Theory and Practice in International Perspective. London, Routledge. |

| [10] | Deloitte Research (2006): Closing the Infrastructure Gap: The Role of Public-Private Partnerships. Global and US Report, Deloitte Development, USA. us_ps_PPPUS_final.pdf (accessed 4/10/2012) |

| [11] | Eggers, W. D. (2006). The new public-private landscape. In L. C. Gilroy (Ed.), Transforming Government through privatization: Annual privatization report 2006 (pp. 35-38). Los Angeles: The Reason Foundation |

| [12] | Economic and Social commission of Asia and the Pacific (ESCAP), (2011): Guide Book on Public-Private Partnerships in Infrastructure. |

| [13] | Palmer (2009) Public-Private Partnership- literature review, Privatisation in educational research initiative, http://www.periglobal.org/subject/public-private-partnerships?page=4 (accessed 17th June 2012). |

| [14] | European Investment Bank (2011), The Guide to Guidance. How to prepare, procure and deliver PPP projects, EPEC Centre. |

| [15] | Rwelamila P.D. & Hall, K.A (1995). The Total system intervention an integrated approach to time, cost and quality management. Construction Management and Economics. |

| [16] | Best, R., & Gerard De V. (1999). Building in Value Pre-design Issues. Arnold Publishers. |

| [17] | Bryan, S., Shapiro, H. & Knutson (2003). Design/ Build and Tunkey Contracts Pros and Cons. |

| [18] | Kish, L., (1965). Survey sampling. John Willey & sons Inc, New York. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML