Ting-ting Liu , Qing Wu

Shanghai University of Engineering Science, Shanghai, 201600, China

Correspondence to: Ting-ting Liu , Shanghai University of Engineering Science, Shanghai, 201600, China.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

Housing security is a major livelihood project, the quality and quantity of indemnificatory housing have respect to the vital interests of the people, and the level of housing security decides the construction of indemnificatory housing. Firstly, this paper gives a scientific definition to housing security level and calculates the annual Shanghai housing security level value in the recent six years. Secondly, according to the stage of economic and social development level of Shanghai, the text introduces the inverted U curve hypothesis on level development of urban housing security. Finally, this text has the trend research of Shanghai housing security level in the long term. The trend research shows that the Shanghai government still has to enhance the investment in indemnificatory housing to solve people’s housing problem.

Keywords:

Housing security level, Housing investment, The trend research, The inverted U curve

Cite this paper: Ting-ting Liu , Qing Wu , The Trend Research of Shanghai City Housing Security Level, International Journal of Applied Sociology, Vol. 3 No. 5, 2013, pp. 109-113. doi: 10.5923/j.ijas.20130305.03.

1. Introduction

The eighteenth national congress of the communist party of China moves to protect and improve people's livelihood in a more prominent position, and this year's two sessions in march continue to push forward with the emphasis on indemnificatory housing projects, safeguard the people's livelihood, focus on the people’s life quality. The national urban indemnificatory housing construction target is 36 million sets during the "twelfth five-year", and it has started 10 million sets in 2011, more than 700 sets in 2012, planing to start 6 million sets in 2013. The construction of affordable housing provides material basises for the implementation of housing security system. On the one hand, the level of housing security instructs the starting amount of indemnificatory housing every year, on the other hand, it is limited by the government indemnificatory capital investment, influenced by the social and economic development level. Accordingly, this test studies the housing security level from the perspective of indemnificatory housing supply and demand, and this article of housing security level is a "quality" concept, the relative level for demand gap, rather than the absolute level of "quantity". The pertinence is not strong and the meaning is little to study a country's overall housing security level as the level of economic development varies greatly in different regions. And Shanghai is one of China's fastest growing economic regions with high population density, relative concentration population and relatively strong housing protection demand. Moreover, the Shanghai municipal government pays more attention to the indemnificatory housing construction with the housing construction in the national leading level and relatively complete indemnificatory housing construction data. Therefore, the study of Shanghai housing security level is not only the oretical but also has its practical operability.In recent years, Chinese scholars had a little research on the housing security level and Some discussed the housing security level is in theory. Guo Yukun (2008) measured the housing security level at the micro level with indicators such as the affordable housing construction quality standards and the average household size standards[1]. Xu Hong (2011) maped the housing supply and demand curve and the housing security level trend curve through the analysis of the factors affecting the housing security level supply and demand on the macro level of the indemnificatory housing supply and demand[2]. In quantitative research, most researches were learned from professor Chu Chaofu’s definition of housing security level with the housing security expenditure to GDP ratio to represent the level of housing value[3]. On this basis, Yao Yongpeng, Wu Ting (2012), determined the housing security level area and current level in Gansu province combining with the experience at home and abroad as well as the level of economic development in Gansu province[4]. Zhang Rui (2007) simply analyzed housing security level of China from the perspective of government supply and Came to the conclusion that the low-rent housing supply and demand gap is huge in China[5]. But on the basis of quantitative determination of housing security level, forecast research is almost in a blank state. If we can accurately predict housing security level, study its development and changes and find some laws, we can not only clarify the current level of housing security of the state, but also provides an objective basis for decision-making for indemnificatory housing construction to enhance its rationality and scientific nature.The grey system theory is proposed by Professor Deng Julong from Huazhong University of Science and Technology in 1982, which is suitable for the prediction, decision and control, etc., especially suitable for the forecast analysis[6]. But in the field of academic research, there is no scholars applying the grey prediction model GM (1, 1) to the researches on the change of housing security level. Meanwhile, considering the less sample size of housing investment with only five years of research data, it cannot meet the requirements of regression analysis which needs a big sample capacity and cannot make an accurate estimate for the future trend. The paper introduces the grey prediction model GM (1, 1) to forecast the housing security level for the next five years, because the grey prediction has advantages such as requiring less data samples, simple principle, convenient operation, high short-term forecasting accuracy and testing the adaptable. The application of this paper is going to be a very meaningful attempt.

2. The Measure of Shanghai Housing Security Level

2.1. The Definition of Housing Security Level

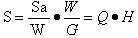

Housing security level is a concept of unity of quality and quantity and it reflects on the security level of residential housing of a country or region. From the quantitative aspect to consider, the housing security level has a difference between high and low and specifically to be measured through housing security expenditure as a percentage of GDP. From the qualitative side, there is moderate level of housing security or not, the standard is that the housing security expenditure need accommodate to the local economic development level and the bearing capabilities of all aspects[7]. At present, the related research of housing security level measurement is relatively less, mostly learned from the measure model of moderate social security level of professor Mu Huaizhong: | (1) |

Among them, S represents the level of social security; Sa represents total social security expenditure; W represents the total amount of wages; G is on behalf of the gross domestic product GDP; Q is the social security burden coefficient; H is for labor production factors investment proportional coefficient[8].Housing security system is an important part of the social security system, therefore, this paper also draws on the experience of this model with the housing security expenditure instead of the total social security expenditure The resulting formula: | (2) |

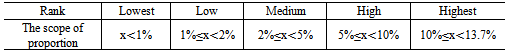

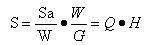

According to international experience, we analyze the proportion of housing and environmental investment in government spending and put this indicator divided into five categories: Lowest, Low, Medium, High, Highest. Measured the housing spending under the different grade, thus calculate the housing security level.

2.2. The Evaluation of Shanghai Housing Security Level

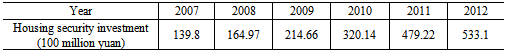

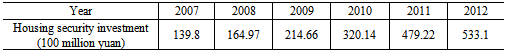

The indemnificatory housing construction is a hot topic to discuss in the NPC of Shanghai, at present, Shanghai is actively promoting the "four in one" housing security system construction, increasing the construction scale of low-rent housing, affordable housing, public housing and resettlement housing. From 2008 to the end of 2012, Shanghai has constructed and raised all kinds of indemnificatory housing around 56 million square meters, about 75 million units. While promoting the building of indemnificatory housing, indemnificatory housing investment has become the focus of the government and the social from all walks of life, housing construction investment projects include: the construction funds of low-rent housing and public rental housing, the rent subsidies and subtract, the land transfer and reduction of taxes in the course of the construction of affordable housing and resettlement housing, etc. At present, the Shanghai government housing construction funds are as follows: financial budget, net income of land transfer fund, appreciation income of accumulation fund, social donations, land transfer and reduce taxes and other funds that is transfered from the funds due to government fiscal revenue. In this study, all performance of indemnificatory housing construction fund invested from the government, regardless of funding sources, are included in the category of indemnificatory housing investment. Because of Shanghai's housing security system construction are relatively perfect to the national average and it is easy to obtain statistical data, we can obtain the Shanghai housing security investment in 2007-2012 through querying and calculating the statistical data such as the website of the central people's government of the People's Republic of China, Shanghai real estate operation review and second-hand data from the CREIS middle finger, as shown in Table 1. We only select the last six years of statistical data because that the construction of indemnificatory housing developed relatively late and the data only in recent years is more representative. In addition, it still exists many problems statistically although the Shanghai housing security system is relatively sound, such as: housing statistics project was incomplete, different statistical standards, lack of statistical data, etc. Thus, in Table 2, Shanghai housing security investment in each year is only a rough total investment value, this study can only predict the future of Shanghai housing security level based on this.Table 1. The scope of proportion of housing and environmental investment in government spending

|

| |

|

Table 2. The total investment in Shanghai housing security

|

| |

|

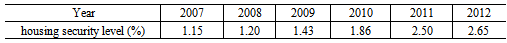

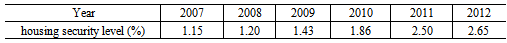

According to the 2008-2013 Shanghai Statistical Yearbook, we can get 2007-2012 annual GDP of Shanghai. Thus can calculate the Shanghai housing security level from 2007 to 2012, such as table 3:Table 3. Shanghai housing security level

|

| |

|

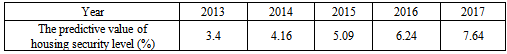

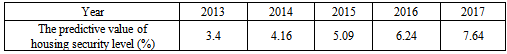

Table 4 shows that prediction accuracy of Shanghai housing security level based on GM (1, 1) model is very high and the predicted results have strong credibility.Table 4. The predictive value of Shanghai housing security level

|

| |

|

3. The Trend Research of Shanghai City Housing Security Level

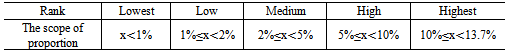

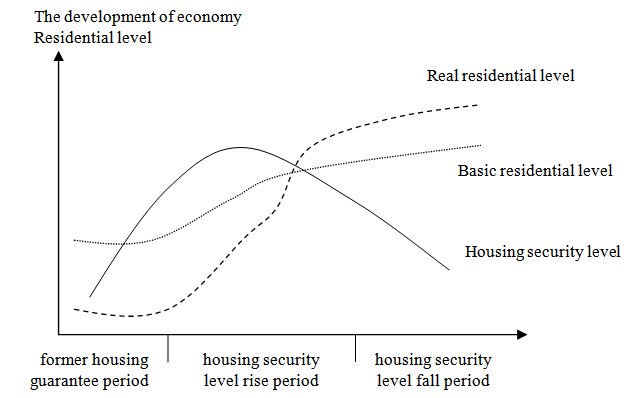

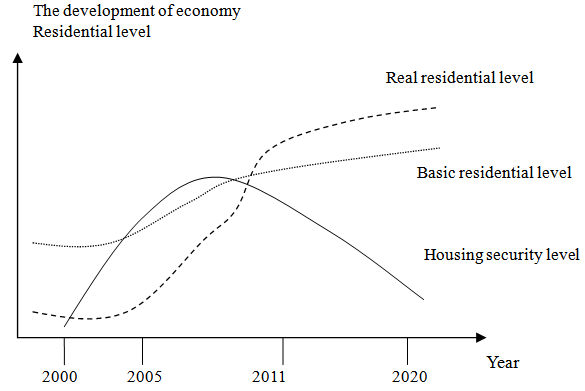

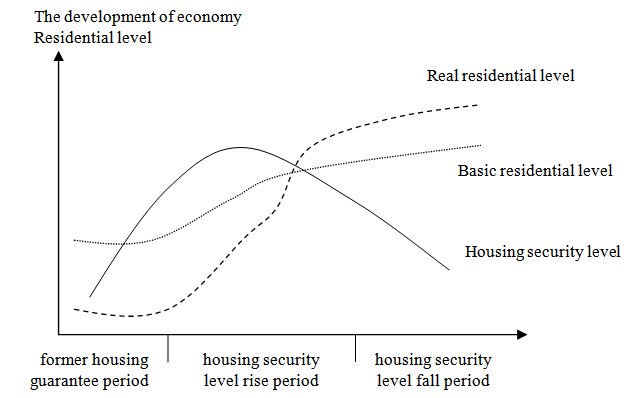

Theoretically speaking, in the pre-industrial agriculture society, the per capita GDP is very low, only can maintain the people's survival needs, residents dispersed choose to live, so there did not exist in the modern sense of the housing security, we call it the "former housing guarantee period". When the large-scale industrialization began, along with the economic development and the large-scale city, large rural population live in cities and towns, a large number of low-income residents produced and thus a housing security problem is in the modern sense, after the world war two, due to destruction of the war and the large number of retired soldiers, the urban housing problem is especially, the housing security is highly valued by governments, housing level rise rapidly, and reach a higher level, in this period, we can call the "housing security and security level rise period". When the development of the national economy to the middle classic counted for an absolute majority, impoverished population decreased gradually, housing security expenditure levels will decline, we can call the "housing security level fall period". From rise to fall, also formed a housing security level down .Type curve trajectory (Figure below). | Figure 1. Development of housing security level inverted U curve |

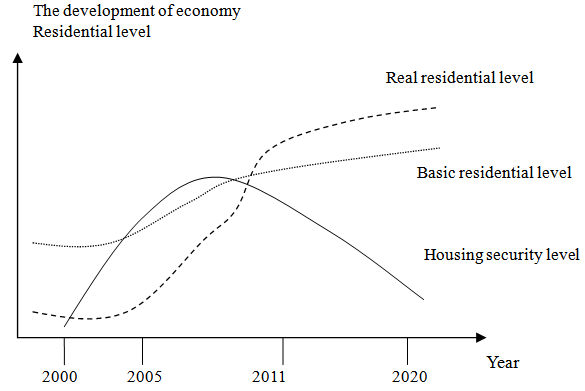

In Figure 1, the time is for the X axis, the level of economic development is for Y axis, urban residents living level can be subdivided into three curves: 1. Real residential level line: Real residential level line refers to urban residents actual living, will increase rapidly with the development of economy and the basic living level; 2 Basic residential level line: urban residents meet designed according to the economic and social development level of the basic living needs of the average, and the overall development trend is smooth; 3 Housing security level: It is the average level of urban housing security line housing needs and supply capacity based on the balance, presenting a "Inverted U" type curve.To the end of 2000, the per capita GDP of Shanghai city is close to $3000, according to household disposable income to measure, that is in the "Transition of the double top structure" period. In the design of housing security system, response to the middle-income family break down, will be part of middle-income families out of housing security. Will be shown in Figure 2 of the housing security level inverted U curve trajectory, the X axis is specifically authorized the year value, GDP value and Y axis to the per capita housing security level according to the development level of per capita GDP, "will be divided into three periods of time span: | Figure 2. Development of housing security level inverted U curve |

The 2000 to 2005 period: this period of economic development level, the per capita GDP from around $3000 in 2000, rose to around $5000 in 2005, equivalent to the so-called "off" period.The 2005 to 2011 period: this period of economic development level, the city's per capita GDP from dollars to 8000 dollars, equivalent to the "off" period. The 2011 to 2020 period: this period of economic development level, the city's per capita GDP will reach $8000 gradually grew to more than $15000, that is to say, when the level of the medium developed countries, or commonly referred to as the "Modernization" stage.

4. Conclusions

The trend shows that it will have a rapid growth of the Shanghai housing security level in the next future and it can be up to 7.64% by 2017, that is to say the housing investment can be accounted for 7.64% of GDP. But there is a big gap when contrasted with Singapore which has a relatively perfect housing security system. Shanghai's per capita GDP in 2012 was $ 13,385, it is at the same level with Singapore in1990 when its per capita GDP was $13210. But the investment which government of Singapore input in 1990 for the construction of indemnificatory housing has reached 9% of GDP, namely that the housing security level was 9%, however, the Shanghai municipal housing security level was only 2.65% in 2012, less than 8% in 2017. Therefore, the Shanghai municipal government still need enhance the investment in indemnificatory housing and speed up its supply on the basis of the existing to realize the ideal that everyone has a house to live in as soon as possible.

References

| [1] | Guo Yukun. Urban housing security level[J]. Research productivity, 2008(2):45-48. |

| [2] | Xu Hong. Analysis of development trend of housing security level[J]. Journal of Lanzhou, 2011(5):58-63. |

| [3] | Zhu Chaofu. The correlation analysis research of the influence factor to urban housing security scale[J]. Journal of zhejiang university, 2005, 35(4); 106-113. |

| [4] | Yao Yongpeng、 Wu Ting. Housing moderate level research of Gansu Province[J]. China's collective economy, 2012(1): 39-40. |

| [5] | Zhang Rui. Analysis of the level of our government housing security expenditure[J]. Journal of Shanxi University of Finance and Economics, 2007, 29(1):112-113. |

| [6] | Liu Sifeng, Dang Yaoguo, Fang Zhigeng. Grey system theory and its application[M]. Beijing: Science Press, 2005. 125-158. |

| [7] | Li Juan. The study of housing security moderate capability based on the government financial capacity[J]. China's real estate finance, 2008(1):41-44. |

| [8] | Wu Ting、Yao Yongpeng. Measure of the level of housing security in Northwest China and their comparative study[J]. The development of China, 2012, 12(1):30-36. |

| [9] | Guo Zhida, Zhang Hongyu, Zhang Guoyong. Gray prediction model GM (1, 1) used in the application of environmental protection investment in China[J]. Chinese Journal of Management Science, 2007, 15 (10): 366-369. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML