-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Applied Sociology

2012; 2(4): 41-46

doi: 10.5923/j.ijas.20120204.03

Demographic Influences on Rural Households’ Saving and Investment: A Study of Rural Households in the Ho Municipality of Ghana

Amu Manasseh Edison Komla

Department of VOTEC, Faculty of Education, University of Cape Coast, Ghana

Correspondence to: Amu Manasseh Edison Komla , Department of VOTEC, Faculty of Education, University of Cape Coast, Ghana.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

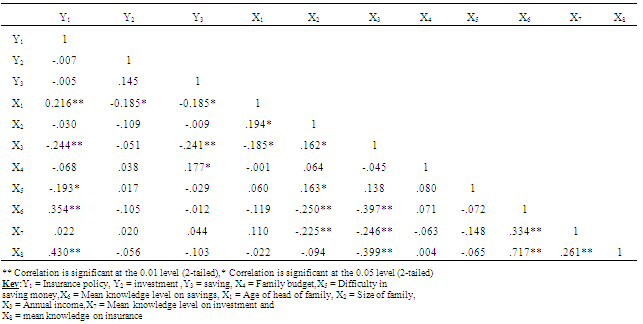

The main objective of the study was to explore the demographic characteristics of household heads in rural Ho Municipality and to find out how these demographic characteristics affect the savings and investment behaviour of the said household. The population used for the study was rural families in the Ho Municipality of the Volta Region of Ghana. The sample size of 160 households was drawn from the population using the multi-stage cluster sampling technique. Frequencies, percentages and correlations were used to present the demographic characteristics and correlation was used to establish relationship between the variables. The findings showed that there was a direct positive relationship between age of household head and insurance, knowledge of savings and insurance and family size and difficulty in savings. There is however a negative relationship between age of household head and savings and investment, income level and insurance and savings. It was concluded that there is s mixed influence of family characteristics on the family’s savings and investment behaviour. The findings have important policy implications for rural poverty alleviation among households in developing countries. Based on these findings it is concluded that demographic characteristics of rural families in the study area in one way or the other, have some influence on the households’ saving and investment behaviour.

Keywords: Rural, Ho Municipality, Saving, Investment, Family, Household, Volta Region, Ghana

Article Outline

1. Introduction

- Individuals and families attitude towards money vary greatly. Even within the same family, individuals vary in the way they perceive money; a person’s perception about money influences the person’s attitude towards money. People have different behaviour towards savings and disparities in income levels, orientation toward money and their future goals and aspirations for the future might influence this. There are people who believe that money obtained today must be used to meet present needs and the future will care for itself (spenders). There are others who also hold the view that no matter how little one’s income is, there is the need to save part of that income (savers). Savers compulsively save money only keeping very little free for essentials. On the other hand, spenders take delight in purchasing items[20].In Ghana with regards to savings with both formal and informal institutions[23] found that the proportion of house- holds who hold savings accounts is still very low and that children form over sixty percent of people with savingsaccount. The low savings in Ghana, as indicated by the above finding, could be due to the inadequate financial intermediaries as well as low incomes of the populace.Factors that Influence People’s Savings BehaviourThere have been great interests in people with low incomes who do not have access to financial intermediaries as financial intermediaries spend a considerable amount of time chasing after people with comparatively higher income levels. It observed that savings and investment behaviour among people of just below average incomes is mainly driven by age and that lasting savings habits seem to develop in childhood[26]. They also found that interest rates do not influence the savings behaviour of people in low-income categories. Other demographic factors have been identified by researchers as exerting significant influence on individual and household saving and investment habits. These include growth, age composition of the household and high birth rates. Normally, families who save little amounts save more frequently than those who save huge sum (27)Growth: The rate of growth is an obvious candidate for explaining the rate of saving for two reasons. First, saving and growth have been highly correlated over long time as well as for many regions and stages of development[4; 24] Secondly, saving is directly associated with output through investment higher domestic saving will generally result in higher growth.The main theoretical foundation for the link between growth and saving comes from Modigliani's life-cycle hypothesis, which tried to establish a relationship between income and savings by arguing that growth increases saving because it increases the income of the young relative to that of the elderly[17]. Growth and higher incomes raise more households above the subsistence level, below which they cannot save, and make households more responsive to changes in the interest rate[20]. The permanent-income hypothesis, however, suggests a negative link between growth and savings.Age Composition of the HouseholdThe effect of age and dependency ratio as demographic characteristics on saving is mainly derived from the life-cycle model which postulates that when the share of the working population relative to that of retired persons’ increases, savings is likely to increase[12; 4; 10]. Writing on the determinants of household savings in Nigeria,[2] observed that the youth and the elderly have low incomes and low savings. Those in middle age have higher productivity, income and save more. That is to say that aggregate savings of a household will be affected by the age distribution of the particular household. Studies on the relationship between dependency ratio and savings have a mix finding. While some studies found a positive relationship between dependency ratios and private savings[16], other such as those of[14] and[7] found that high dependency ratios have negative impact on savings. In their study of the situation in Nigeria, it was found that it has a robust negative influence on savings[2].High birth rates: Another demographic characteristic that has been identified to impede household savings especially in the rural areas is high birth rates. This viewpoint has been postulated several years ago in the late 60s by[13] in one of his hypothesis when he was conducting a study on the topic. The finding of this study was that disparity in aggregate savings rates between developing and developed countries is attributable to high dependency rates in developing countries. Factors influencing investment behaviour Like savings behaviour, investment behaviour of families is influenced by multifaceted factors. These factors in some cases are similar to those factors that influence the family’s savings decisions or behaviour.[22] In trying to investigate the push factors in private investment in Nigeria observed that two main factors are responsible for the private investment in Nigeria. These are the macroeconomic environment as determined by government policies on trade, monetary control, fiscal and exchange rates and the institutional factors such as administrative, legislative and regulatory framework. There are typically three types of investors. These are the aggressive investor who aimed at immediate, the long term investor who wants regular gain for a long period and the income investor who needs income for living expenses[25].There are some studies which also suggest that people’s investment behaviours are influenced by factors such as the culture and the personality of the individual. Socio-cultural theories and the personality trait theories of entrepreneurship have come from such studies. Both theories try to explain motivations behind individuals and families’ decision to invest. The personality trait theories are more related to investment behaviour of families than the socio-cultural theories.Culture: The aspects of culture that were found by Hofstede as cited in[11] as having an influence on a person’s investment behaviour are the power distance, individuality versus collectivism, uncertainty avoidance and masculinity versus ferminity. The personality trait theory identified individual characteristics such as need for achievement, locus of control and risk taking propensity as exerting some influence on the investment behaviour of families and individuals.The need for achievement trait can be inculcated in individuals during their childhood, if emphasis is placed on self-reliance, industriousness, initiative, maternal warmth and low father dominance among others. On the contrary, child upbringing practices that emphasizes loyalty, flattery and obedience, will not promote the need for achievement individuals[15]. Locus of control theory describes how individuals attribute responsibility for events that occur in their lives to factors within themselves and their control or to factors outside their control. Internal and external controls are the two kinds of control identified by Gibson, Ivancevich and Donnelly (1997). Internally controlled individuals believe that they are in control of their own lives. On the other hand, there are those who believe that their fate is controlled by outside forces and are beyond their control, these are the externally controlled people. These two categories of persons have different attitude toward investment. Whereas the externally controlled individuals are likely not to invest, the internally controlled person will invest to improve his or her living conditions. The third theory advanced as having an influence on the investment behaviour of people is the risk-taking propensity. The theory explains that some persons are more likely to take risk than others[1]. Although these theories purposely attempt to explain entrepreneurship, the theories have great bearing on the motives behind the decisions of individuals or families to invest. Several researches have been conducted on savings and investment in developing countries but all these focused on the influence of government policies on aggregate savings and investment. The units of investment, the family; have not been given much prominence in most of this studies. It was against this background that this study sought to find out how family characteristics influence the savings and investment behaviour of the families.

2. Objective of the Study

- The main objective of this study was to explore the relationships that exist between the demographic characteristics of rural families/households and the saving and investment behaviour of the families.

3. Methodology

- Population, Sample and Sampling ProcedureThe target population of the study was defined and restricted to include all families in rural Ho Municipality regardless of occupation, educational level among other socio economic indicators. The Municipality has two different types of communities– three Urban communities and over 100 rural communities. The total population of the entire Municipality is about 200,000 people. The population of the study area (Rural Ho Municipality) was about 126,107 people. Using the average family size of rural Ghana as indicated in[9], which stood at five members per family/household, the total number of families in the study area was estimated to be 25,221 households. Multi-stage cluster sampling method was adopted to select 160 families for the study. The stratified sampling procedure was used to put the study area into four main strata called zones; the Southern, Northern, Eastern and Western zones. This was followed by the use of cluster sampling or what is describe by[5], as area sampling was used to select one rural community from each of the four strata to serve as the clusters which were studied. The next step had to do with the selection of families/households from the four randomly selected communities to serve as the study units. In view of the lack of data on the population of the various communities to warrant the use of proportional method of selecting these families, the researcher used a disproportional method to choose 160 families from the four communities. For each community selected, the researcher used simple random technique to select fourty (40) families/households for the study. All families/households were numbered by the researcher separately in each of the four communities; the researcher then used the numbers assigned to the families to prepare a table of random numbers for each community and randomly selected the fourty (40) families from each community. Instrumentation: The main instrumentused to collect data from the sampled families was interview schedule. Interview schedules were found to be the most appropriate and effective tool for data collection from the sampled families because most families in rural Ghana and for that matter, rural Ho Municipality have low levels of education. That is to say that illiteracy is high among the population studied. Data Collection ProcedureResearch assistants were recruited and trained to assist in the data collection process. For a head of family to qualify to participate in the study, the head must be active economically, assume responsibility of the upkeep of the household and must be of sound mind. If in any household the supposed head did not meet these criteria, the researcher interviewed whoever assumed those responsibilities in the family; on condition that such a person is a permanent member of the selected family.

4. Findings

- Demographic characteristics of respondentsThe study identified the following demographic characteristics of the respondent families’: age of head of the household, sex of family head, occupation of the head of the household, type of crop cultivated if household head is a farmer and the annual income of the family head.Age of Head of studied Families

|

|

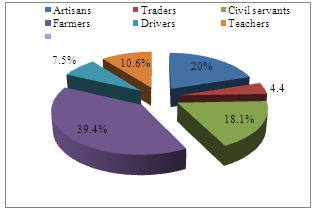

| Figure 1. Occupation of respondent household heads Annual income of heads of respondent families |

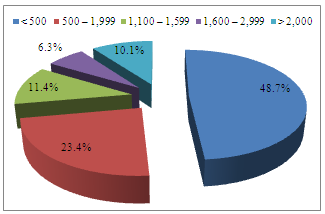

| Figure 2. Annual income level of respondent heads of families NB: GH¢ 1 = US$1.44 as at 1st February, 2011 |

|

5. Discussion

- The low income level of most of the respondents can be attributed to the fact that a large number of the respondents are peasant farmers who cultivate mainly food crops on subsistence basis. The caution over here is that though the respondents were probed well in the estimation of their incomes, some may also underestimate to paint a gloomy and sorry picture of their living conditions. The general low income of the studied families is a potential threat to their ability to save and invest. This is because the life-cycle hypothesis noted that higher incomes raise more households above the subsistence level, below which they cannot save. The data on the relationship between studied variable showed that there was a significant correlation between age and insurance at 0.01 a significant level. The data showed that there was a positive relationship between age and insurance, which means that, the older the head of a household; the more likely the household was to take an insurance policy. The relationship between age and savings and other types of investment was significant at 0.01. The correlation was however negative. This implies that the older a household head, the less likely that household was to save and also invest. In other words, as the head of a family grows, there was a correspondent decrease in the amount of savings and investment that the household engaged in. This means that savings among the studied families was affected by the age distribution of the household head. This finding is similar to that of[1] in their study of Nigerian Interestingly, the data from this study showed a negative relationship between family income and savings and investment (including insurance). From the study, it was found that there was a significant correlation between family income and saving at 0.01 significant levels. The correlation was, however, negative, indicating that the more income a family has, the less likely the families were to save. The possibility, however, was that those families who had more income and so had saved, did not consider their saving as income and so estimated their income based on what was at hand and so fell within low income households. This finding contradicts that of[1];[20] and[17], noted that low income earners had low savings whiles higher productivity and income saved more. Also it contradicts[28] when he found that there is a strong and positive correlation between income and saving in rural Ghana.The data also indicated that a family’s ability to save and invest was independent of the size of the family. This was Contrary to the finding of[12] concluded in his study that household savings especially, in the rural areas, was negatively affected by high birth rates (which dictate to a large extent family size). The finding of this study was that, there was no significant relationship between family size and savings and investment ability of the studied families. In the study,[13] concluded that disparity in aggregate savings rates between developing and developed countries was attributable to high dependency rates in developing countries. There was also no significant relationship between knowledge in saving and investment as against savings and investment of the respondents. This means that the respondents’ saving and investment behaviour was independent of the knowledge they had about the various saving and investment forms and outlets. Based on the above findings, it is concluded that demographic factors influence rural household saving in the Ho Municipality in one way or the other. The age of the head of the household, the size of family has a major bearing on the saving and investment behaviour of rural households in the study area. Family size and knowledge in saving and investment by household heads had no significant relationship with savings and investment of the rural households in the Ho Municipality. It was also recommended that financial counselling services be made available to the rural dwellers through community talks, radio programmes and religious groups. The inclusion of basic financial management concepts in Basic and Senior High School curricular was also recommended by the researcher.

6. Conclusions

- The savings and investment behaviour of rural households in the Ho Municipality cannot be said or described as the best. The age distribution of the population, coupled with the income levels of the families, is a major determinant of the savings and investment behaviour of the families in the study area. Age of household head however influences the households’ investment in contingent forms probably to secure the future of other family members in the event of death of the head. In general, various demographic characteristics exert some amount of influence on the savings and investment behaviour of rural households in varied ways.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML