-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Applied Psychology

p-ISSN: 2168-5010 e-ISSN: 2168-5029

2015; 5(4): 83-89

doi:10.5923/j.ijap.20150504.01

Risk Taking in Financial Decisions as a Function of Age, Gender: Mediating Role of Loss Aversion and Regret

Muskaan Arora, Santha Kumari

School of Humanities and Social Sciences, Thapar University, Patiala

Correspondence to: Muskaan Arora, School of Humanities and Social Sciences, Thapar University, Patiala.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The present study investigated how age and gender affect risk taking ability of the investors in their financial decisions through psychological biases such as loss aversion and regret. A total of 450 investors (372 Males, 93 Females) of two age groups (25-40 years and 41-55 years) from northern part of India participated in the study. Conceptual framework was formulated and tested using AMOS 20 to understand the relationship of age, gender and risk taking ability through loss aversion and regret. The results supported our proposed hypotheses. Main results have confirmed the proposed model of analysis, pointing that the impact of age, gender on risk taking ability operates through behavioral biases (loss aversion and regret) of the investors.

Keywords: Age, Gender, Loss aversion, Regret, Risk Taking Ability

Cite this paper: Muskaan Arora, Santha Kumari, Risk Taking in Financial Decisions as a Function of Age, Gender: Mediating Role of Loss Aversion and Regret, International Journal of Applied Psychology, Vol. 5 No. 4, 2015, pp. 83-89. doi: 10.5923/j.ijap.20150504.01.

Article Outline

1. Introduction

- The recent fluctuations in the stock market from the past few years have made financial decisions more crucial task for investors. Lot of research was conducted with respect to financial decision-making under risk and uncertainty. Risk tolerance was found to be a crucial factor affecting financial decisions of the investors. Moreover, enormous array of studies found that age and gender influence risk tolerance in the financial decisions of the individuals. Dwyer, Gilkeson and List (2002) investigated gender differences in with respect to most recent, largest and riskiest mutual fund investment decisions. They found that women take less risk as compared to men. Women more likely hold risky assets if women are employed, hold higher net worth and envisaged inherited property. However, men invested in risky assets if they were risk seekers, divorced, older, and college educated (Embrey & Fox, 1997). Age, gender, income have nonlinear relation with risk tolerance (Hallahan, Faff & McKenzie, 2009). Hallahan, Faff and McKenzie (1999) found that gender, income and wealth are positively related with risk tolerance while marital status and age are negatively related. It shows that demographic variables such as age and gender are the important contributing factors that explain risk aversion or risk tolerance tendency of the investors. Though financial advisors take in to account risk tolerance of the individuals while allocating the assets to the investors but in 2008 many investors who were assigned equities in their portfolios according to their risk taking capacity were not able to book their profits. This makes the practitioners and researchers to look beyond risk tolerance. Various researchers suggested that different psychological biases such as loss aversion and regret also affects risk aversion tendency of the individuals. Kahnemann and Lovallo (1993) reported that loss aversion explain widespread risk aversion. In addition to this, various other studies reported that loss aversion also explains a wide range of anomalies such as endowment effect, disposition effect, equity premium puzzle and the overtime premium puzzle, the status quo bias, anticipated and experienced regret. Investors’ behavior of taking risks when confronted with losses and avoiding risk when confronted with gains is called Loss aversion. Loss aversion refers to the fact that people tend to be more sensitive to losses as compared to gains. The pain of losing any amount of money is more painful as compared to pleasure of gaining the same amount of money. Similarly, Josephs, Larrick Steele and Nisbett (1992) reported that anticipated regret leads to risk aversion. According to Zeelenberg “Regret is a negative, cognitively determined emotion that we experience when realizing or imagining that our present situation would have been better, had we acted differently (1996, p. 6)”. Bell, 1982; Loomes & Sugden, 1982 found that investors base their decision not only on expected value of payoffs but also on expected regret. It is evident from the above studies that loss aversion and regret also affects risk tolerance or risk aversion tendency of the investors. It is evident from the above that risk tolerance in financial decision making is affected by various biases such as loss aversion, regret, and many others. But the level of biases varies from individual to individual. Gender, age and other demographic factors can have differential effect on these biases. There are very few studies which address the relationship between gender, age and psychological biases of the individuals. Johnson, Gachter and Herrmann (2006) found that individuals who are older and less educated are more likely to be more loss averse than the young individuals. However, researcher have not come across any study which investigated the effect of gender and age on loss aversion and regret and their subsequent effect on the extent risk taking ability of the individuals in investment decisions. Moreover, there is paucity of such studies in the Indian context.

2. Research Gap

- Previous studies have shown that age and gender affects risk tolerance and the psychological biases of the investors. As the age increases individuals become more risk averse and loss averse. Similarly, females show more loss aversion and take less risk as compared to males (Beckmann, Lutje and Rebeggiani, 2007; Wang and Hanna, 1997; Hallahan, Faff and McKenzie, 2009; Johnson, Gachter and Herrmann (2006). While studying the influence of age and gender on risk taking ability, the second matter of concern is about the channels how this works. To take a step further, the present study tried to summarize the mechanisms that how age and gender influences on individual risk taking ability. Therefore, a mediational analysis was considered in order to understand the complexities of the relationship between age, gender, behavioral biases, risk taking ability of the investors. Mediation occurs when a given variable function as a mediator between the predictor variable and the outcome variable (Baron & Kenny, 1986). In this case, the predictor variable are age and gender, the possible mediating variables is behavioral biases such as loss aversion and regret and the outcome variable is risk taking ability of the investors.

3. Rationale for the Study

- For a long period of time, investors relied on various theories and models of efficient markets and standard finance for calculating risk while taking financial decisions. However, now a day’s deviation from rational decision making has been observed in nearly every facet of financial activity. It has been previously discussed that there are numerous factors such as age, gender and behavioral biases influence risk taking ability. But the search of variables influencing the risk preferences of investors continues in the empirical front. All these factors motivated the experimenters to endeavor this study. The present study focuses on to investigate the path, how demographic factors such as age and gender influence risk taking ability of the investors through behavioral biases such as loss aversion and regret. In order to improve financial stability of the investors, we need to understand the behavioral and affective patterns of the investors and how they influence their risk taking ability in their investment decisions. Surely we live in a society that makes a lot of demand on us, but investment decision are never meant to be easy. It takes a lot of effort, hard work and time to study various financial products and services yet investors are not able to book profits. Therefore, it is our responsibility to monitor the impact of various factors on investment decisions to improve the financial well-being of the investors. The importance of explicating, the mechanisms through age and gender influence risk taking ability of the investors is that by understanding these mechanisms leads to the advancement of knowledge and will help in all appropriate portfolios to the investors.

4. Conceptual Framework

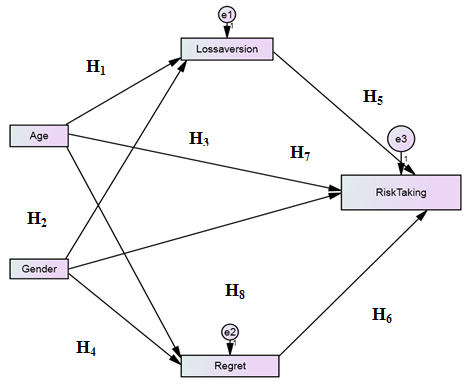

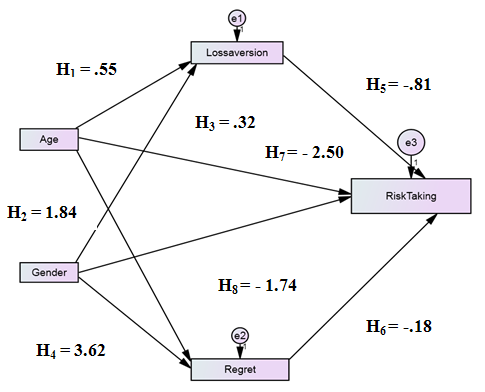

- The aim of the present study is not to find an exhaustive list of potential correlates of age and gender to risk aversion and loss aversion but rather to construct conceptual framework where loss aversion and regret act as mediator variable between the relationship of age and gender with risk taking ability of the individuals in their financial decisions. Therefore, the present study formulated the following conceptual model to investigate the path, how gender and age affects risk taking ability of the investors through psychological biases such as loss aversion and regret. It is clear from Fig. 1 that age and gender act as antecedents of psychological biases such as loss aversion and regret and these psychological biases further influence the risk taking ability in financial decisions of the investors’.

| Figure 1. |

5. Results

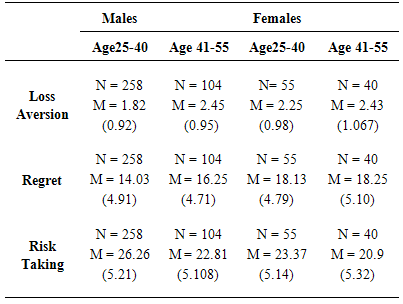

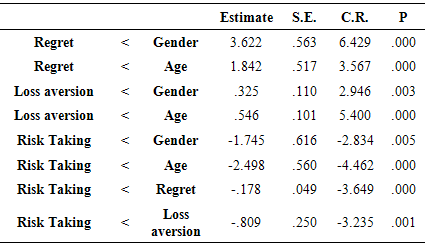

- The present study used maximum likelihood method to measure the estimates of different variables. Table 1 shows mean and standard deviation scores of endogenous variables which are loss aversion, regret, and risk taking. Estimates and standard errors of the parameters are shown in Table 2.

|

|

| Figure 2. |

6. Discussion

- The main goal of this study was to propose a mediational model for explaining the path between age, gender and risk taking ability of the investors. The results of the present study provide an integration of several important aspects of age, gender, behavioral biases and risk taking ability, by examining their interactions and relations. The variations in behavioral biases play a significant mediating role in the relationships of age, gender to risk taking ability of the investors. Main results have confirmed the proposed model of analysis, pointing that the impact of age, gender on risk taking ability operates through behavioral biases of the investors.Findings of the study confirmed all hypotheses. Individuals with age group 41-55 years show more loss aversion as compared to individuals with age group 25-40 years. One of the reasons for this could be due to the fact that older individuals have less number of years to recover from losses. Moreover, they don’t have enough income to lose and they have to save for their retirement. These findings are in line with earlier work done on age and loss aversion. Johnson, Gachter and Herrmann (2006) found that in both riskless and risky choice tasks loss aversion increases with age, income, and wealth while decreases with education. Similarly, the present study found that individuals with age group 41-55 years regret more as compared to individuals of age group 25-40 years. Therefore, this tendency of more loss aversion and regret in older individuals make them to take less risk in their investments as confirmed in the present study. Gender also proves to be an important determinant of loss aversion and regret. Females show more loss aversion and regret more as compared to males. In addition to this, it was also found that females make less risky choice in their investments as compared to males. This difference can be attributed to the loss aversive and regret minimizing tendency of females which further plummet their self-image in the event of a failure. Lastly, we conclude by saying that to the best of our knowledge the present study is first to confirm that psychological biases such as loss aversion and regret act as mediating factors which influence the linkage between age, gender and risk taking ability of the individuals.

7. Implications

- These results have several important implications for investors, researchers and others. One of the most important implications is that the investment industry should not consider investors as homogenous groups instead every individual should be treated as unique and different strategies according to their characteristics while taking financial decisions. Financial advisors should take into account the impact of loss aversion and regret on risk taking ability while formulating investment portfolios of the various individuals. And also practitioners and researchers, family economists and resource management professionals should design financial products according to the profile and characteristics of every individual. Moreover, investors would not only be cognizant about their own psychological biases but will also be cautious while selecting their investment managers for their investment decisions. Investment companies and other financial institutions may also be benefitted while recruiting the fund managers whose decisions can influence the profits of their esteemed customers.

8. Future Research

- The present study will pave the way for researchers and practitioners for future research in investigating the psychological or neuro-physiological mechanisms explaining why and how risk taking ability, loss aversion and regret are associated with age and gender. One possibility is that age declines the cognitive scores of the individual (Dohmen etal, 2007). It is also likely that investors with low cognitive ability are more prone to emotions and feelings. This is consistent with the prior findings which indicated that behavioral biases are significantly more pronounced for individuals with low cognitive abilities (Oechssler, Roider and Schmitz, 2008). Dohmen, Falk, Huffmann and Sunde (2007) reported that lower cognitive ability is associated with greater risk aversion and more impatience. Therefore, decline in the abilities due to increase in age results in more proneness to behavioral biases which further makes them to take less risk in their investment decisions. Researchers and practitioners for future research can take a different sample frame so as to prove the generalizability of these findings in other populations. Similar studies can also be attempted taking additional demographics factors, such as income, family background and culture, and other factors affecting loss aversion and regret. Moreover, the researchers can also study the effect of gender and age on other psychological biases such endowment effect, anchoring, others and their subsequent effect on financial decisions. Learning more about psychological biases will enable financial professionals to further explore how this dimension of personality affects complex investment decisions that shape financial well-being of the individual.

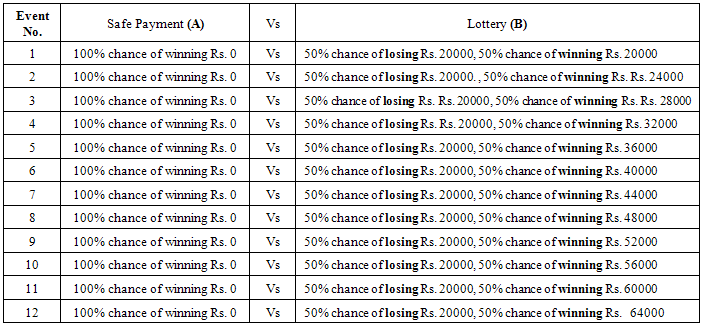

Appendix (A) for Loss Aversion

- Instructions: Assume that you are given 12 set of events where you have to choose either option (A) or option (B) for each event (1-12). Start from Row 1 and proceed further. Tick Mark the option you choose in every event (that is option A or option B).

Appendix (B) for Regret

- Assume that you have Rs. 50000 to invest with one of two brokers (Broker A or Broker B). Broker A has a 43% chance of success, that your investment will increase by 15% after one year and Broker B has a 54% chance of success; that your investment will increase by 12% after one year. Which of the two brokers you would like to invest the Rs. 50000? Please circle the option you choose.1. Broker A 2. Broker BIf the broker chosen by you in above question get failed,Please show how strongly agree or disagree with these statements by circling number 1 (strongly agree) to 5 (strongly disagree) which best fits your decision in the above question?1. It was the right decision a) Strongly agree b) Agree c) Neither agree nor disagree d) Disagree e) Strongly disagree.2. I regret the choice that was madea) Strongly agree b) Agree c) Neither agree nor disagree d) Disagree e) Strongly disagree.3. I would go for the same choice if I had to do it for againa) Strongly agree b) Agree c) Neither agree nor disagree d) Disagree e) Strongly disagree.4. The choice did me a lot of harma) Strongly agree b) Agree c) Neither agree nor disagree d) Disagree e) Strongly disagree.5. The decision made was wise onea) Strongly agree b) Agree c) Neither agree nor disagree d) Disagree e) Strongly disagree

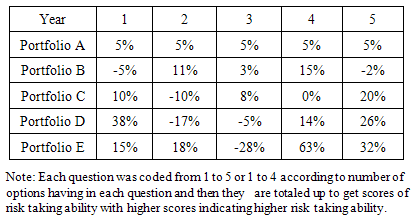

Appendix (C) Questionnaire for Risk Taking Ability

- Instructions: You have to choose one of the five or four options for each question which suits you the best. Q1. What proportion of your assets would you wish to invest in instruments other than risk-free deposits?a) 0% b) Between 1 and 25% c) Between 25% and 50% d) Between 50% and 75%e) More than 75%Q2. You have saved the equivalent of 10% of your gross annual salary and it is proposed that you invest this sum in a risky stock. You have a 50/50 chance that the value of your investment will triple over the next three years or that you will lose the entire amount invested. What will you do?a) will automatically refuse the proposal.b) will carefully examine the proposal and then refuse.c) will have difficulty making a decision.d) will carefully examine the proposal and then accept.e) will automatically accept the proposal.Q3. If you had to invest 2, 00000 which of the following investment choices would you find most appealing?a) 60% in low-risk investments 30% in medium-risk investments 10% in high-risk investmentsb) 30% in low-risk investments 40% in medium-risk investments 30% in high-risk investments c) 10% in low-risk investments 40% in medium-risk investments 50% in high-risk investments.Q4.You are on a TV game show and can choose one of the following. Which would you take?a) 10,000 in cash b) A 75% chance of winning 25000c) A 50% chance at winning 50,000 d) A 25% chance at winning 1,00,000e) A 5% chance at winning 1,000,000Q5. What minimum/maximum potential value would you choose for Rs.10,000 invested over a 1-year period?Minimum value after 1 year: - Maximum value after 1 year: - a) Rs. 9900 a) Rs. 10300b) Rs. 9500 b) Rs.11000 c) Rs. 9000 c) Rs. 11500d) Rs. 12000 d) Rs. 8500e) Rs. 12500 e) Rs. 8000Q6. Suppose the markets go through a difficult period, what decrease in the value of your investments could you tolerate?a) No decrease b) Less than 5%c) Between 5% and 10% d) Between 10% and 20%e) Over 20%Q7. From August 31, 2000 through March 31, 2001, stocks lost more than 25%. If you owned a stock investment that fell more than 25% in seven months, you would... (If you owned stocks during this period, please select the answer that matches your actions at that time.) a) Sell all of the remaining investmentb) Sell some of the remaining investmentc) Hold on to the investment and sell nothingd) Buy more of the investmentQ8. Investments carrying a higher risk come with a bigger chance of achieving higher returns, but also a bigger chance of incurring substantial losses. Each investor has a different appetite for risk. Suppose you had 1 crore to invest which of following return scenarios would be most attractive?a. Between a loss of 2% and a gain of 13% b. Between a loss of 12% and a gain of 28%c. Between a loss of 26% and a gain of 46% d. Between a loss of 50% and a gain of 100% Q9. Please tick which of the following portfolio volatilities would you be most comfortable with? (Assume an inflation rate of say 3% p.a.)

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML