-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Agriculture and Forestry

p-ISSN: 2165-882X e-ISSN: 2165-8846

2014; 4(1): 6-18

doi:10.5923/j.ijaf.20140401.02

Analysis of Monthly Price Transmission of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State, Nigeria (2005 to 2013)

Sunday B. Akpan, Ini-mfon V. Patrick, Samuel J. Udoka

Department of Agricultural Economics and Resources Management, Akwa Ibom State University

Correspondence to: Sunday B. Akpan, Department of Agricultural Economics and Resources Management, Akwa Ibom State University.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The study examined the price transmission and market integration of local and foreign rice in rural and urban markets of Akwa Ibom State in Southern region of Nigeria. Average monthly prices (measured in naira per kilogram) of local and foreign rice in rural and urban markets were used in the analysis. The data came from the quarterly publication of the Akwa Ibom State Agricultural Development Programme (AKADEP). The data covered January 2005 to June 2013. The findings show that, prices of local and foreign rice in rural and urban markets has constant exponential growth rate of 0.59% which suggests perfect co-movement for rural and urban prices of local and foreign rice in the study area. Also, the Pearson correlation coefficient matrix revealed that, the rural price of local and foreign rice has linear symmetrical relationships with their corresponding urban prices. The result connotes the existence of symmetric market information flows between the rural and urban rice markets in the state. The Granger causality test revealed bidirectional relationship between rural and urban price of local and foreign rice in Akwa Ibom State, Nigeria. The results of the co-integration test revealed the presence of co-integration between the rural and urban prices of local and foreign rice as well as support the hypothesis of perfect price transmission between the two markets in the study area. The coefficients of the price variable in the co-integration equations for local and foreign rice markets converge to unity which connotes perfect market integration in the long run. The results of the error correction model (ECM) also confirm the existence of the short run market integration between the rural and urban prices of local and foreign rice in the study area. In addition, the result shows that, the price of local rice in both rural and urban markets adjusted faster than prices of foreign rice once there is an exogenous shock in the marketing process of rice in Akwa Ibom State. The index of market concentration (IMC) supports the high short run market integration between prices in rural and urban markets for local and foreign rice commodities and the quick adjustment of rural price of local rice in relative to rural price of foreign rice. Based on the finding, it is recommended that, the state government should continue to provide marketing infrastructures to improve the symmetric nature of information among participants in rice marketing in the state. Attempt should be made to reduce excessive externality costs in rice marketing in order to fully reap the benefit of rice market integration in the state.

Keywords: Market, Rice, Integration, Agricultural, Akwa Ibom, Nigeria

Cite this paper: Sunday B. Akpan, Ini-mfon V. Patrick, Samuel J. Udoka, Analysis of Monthly Price Transmission of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State, Nigeria (2005 to 2013), International Journal of Agriculture and Forestry, Vol. 4 No. 1, 2014, pp. 6-18. doi: 10.5923/j.ijaf.20140401.02.

Article Outline

1. Introduction

- Parboiled rice, once a ceremonial food for few privileged homes is now one of the staple foods among rich and rural poor populace in Nigeria. According to the World Bank report in 1995, the poorest urban households obtained about 33% of their cereal-based calorie from rice in Nigeria. The share of rice in cereals consumed in the country has grown from 15% in 1970s to 26% in 1990s in Nigeria[15]. In addition, the per capita rice consumption has risen from 3kg in 1960s to 18kg in 1980s and 23kg-34kg in 1990s[8 and 15]. Average growth in per capita rice consumption is likely to continue for some times partly due to increase in population and the proliferation of varieties of processed forms[12]. Rice market in Nigeria consists of the local and predominantly foreign or imported rice. Market price is a major endogenous determinant of supply and demand for both local and foreign rice. Prices are signals that direct and coordinate not only the production and consumption decisions but also the marketing decisions over time, form, and space[27]. The magnitude of market or retailed price of rice serves as a signal to relative scarcity or abundance of the commodity at a particular time and place. Price differential among markets also serve as incentive to allocate resources among spatial markets[5]. Consequently, prices of agricultural products like rice varies from month to month; region to region and even from day to day, due to problems associated with seasonality, poor storage, consumer preference and marketing cost among others[17, 39 and 7]. From this perspective, rice marketing in a developing economy like Nigeria assumes an important economic activity.Agricultural commodity price fluctuations and deviations among markets are normal phenomena across Nigeria. In spatially separated markets, when there is significant price difference between homogenous goods in different markets, such that the differences exceed the transfer cost; the arbitrage activities will be stimulated. The arbitrageur will purchase commodities from lower-price markets and resale in higher-price markets. This is a situation where spatially separated markets are not integrated. On the other hand, market is integrated when there is co-movement or there exist a long-run relationship among prices due to the smooth transmission of price signals and information across spatially separated markets[32]. Market integration could be perfect if price changes in one market are fully reflected in the alternative markets[19]. Several literature have provided diverse opinions on agricultural commodities market integration in Nigeria[6; 11; 32; 33; 34]. Before and early 1990s, most of the researches on market integration in Nigeria employed correlation and trend analyses. For instance, Amusa,[42] in her study of the trend analysis of agricultural food prices in Nigeria reported that food items such as vegetable, grains and oil based crops experienced increase and fluctuations in their prices. Subsequently, time series analysis was employed in the study of agricultural commodity market integration. For example, Okoh and Egbon[32] examined the integration of Nigeria's rural and urban foodstuffs markets. The study concludes that, the rural and urban foodstuffs markets were well integrated. The results further suggested that the urban market price drives the rural market price. The size of the adjustment coefficient for the rural foodstuffs price showed that the speed of adjustment to disequilibrium was moderate. Akintunde et al.,[5] studied the long run price integration of grains in Oyo state, western Nigeria. Empirical results revealed that, the price series in all the markets were non-stationary at their levels at 5% significance level. The integration test showed that none of the markets examined had prices tied together in the long- run. The Index of market connection (IMC) indicated that, the markets exhibited low short run market integration. Also, Debaniyu,[46] investigated grain (cowpea) market integration in Niger State, northern Nigeria. He employed time series methodology and discovered that some markets in the study area were integrated in the long run. Elsewhere, Jezghani et al.,[43) used vector error correction model (VECM) to investigate the spatial market integration in Iranian rice market from March 2000 to February 2009. The result revealed significant market integration between Iran and Thailand rice market, with Thailand market been the lead market. Chirwa[9] studied the food marketing reforms and integration of maize and rice markets in Malawi. He discovered that the rice market was more integrated than maize market. Suryaningrum et al.,[44] investigated the spatial market integration of Thailand and Vietnam rice market in Indonesia by using real price monthly data expanded from January 2000 to December 2012. Johanson co-integration test approach was employed to examine the long-run price relationship, while the short-term relationship was examined by vector error correction model (VECM). The results showed that, the long-run relationships existed among Thailand, Vietnam, and Indonesian rice markets. Furthermore, Dawson and Dey[45] studied the spatial market integration among major domesticrice markets in Bangladesh. An integrated empirical framework tested long-run spatial market integration between price pairs using a dynamic vector autoregressive model and co integration. Hypotheses tests of market integration, perfect market integration, and causality were conducted sequentially using monthly prices from rice markets in Bangladesh since trade liberalization in 1992. The results showed that rice markets in Bangladesh were perfectly integrated with each other. Specifically in Nigeria, majority of these researches were conducted in the Western region of the country[3; 4; 11; 32; 33] and results were used to generalize for all regions in the country. This situation might give wrong signal to marketing policies for other regions in the country. To avert this phenomenon in South –South region, there is need to verify assertions postulated by studies conducted in western region and other regions in the country. Also, most of these researches neglect comparison analysis of various methods of measuring market integration. For instance, Mafimisebi [28], Adeoye et al.,[4], Ifeanyi et al.,[23], Akintunde[5], Abunyuwah[1) and Ifejirika et al.,[23]; have employed time series analysis, but there were no comparative results with the previous methodology used in the country. This study tried to bridge this gap in agricultural commodity market integration study in the country by employing correlation, trend and time series analyses simultaneously and making comparative results. Secondly, it will be the first attempt to use time series techniques in the study of price transmission in Akwa Ibom State, one of the oil rich States located in the South-South region of Nigeria. Fundamentally, spatial market integration contributes to efficiency of the market and also indicates the proficiency of marketing infrastructures in the region under consideration [14]. Understanding market integration is important particularly in needs assessments as policy makers need to avoid over-estimating or under-estimating the ability of markets to respond to price or any exogenous shock. Market integration helps in the optimization of resource use; increase in farm incomes; widening of markets; promote growth of agro-based industries, encourage value addition and also create employment[2]. The prevalence of spatial integrated markets also promotes production specialization among farmers and enhances economies of scale[40]. Market integration provides the basic data for understanding how specific markets work which is the basis for marketing policies. In addition, since markets integration implies that a deficit or surplus in one market will be transmitted to other markets, an improvement in spatial integration of food markets will ensure regional balance among food-deficit and food-surplus regions in the country[16]. The analysis of spatial market integration, thus, provides indication of competitiveness, the effectiveness of arbitrage, and the efficiency of pricing[38]. Contrary, markets that are not integrated may convey inaccurate price signal that may result in distortion in producers’ marketing decisions and inefficient product movement[19]. It could also increase poverty level among low income earners in the society and negate government objectives on self-food sufficiency[7; 37]. Rice is among staple foods whose price is highly unstable in Akwa Ibom State in the South-South region of Nigeria. The state government had initiated several policy interventions to boost the performance of the rice sub-sector in the state. Understanding the magnitude of rice market integration in the state will provide indispensable input to policy makers to formulate workable policies for the sub-sector in the state. This area of research had not received wide empirical patronage among researchers in the region. As such, a study like this will provide useful literature and serve as basis to stimulate wider researches on this issue in the region and the country at large. Hence, the study’s objectives were; to examine the trends in price of local and foreign rice in the State. The study also sought to determine the efficiency of information flow or price transmission between rural and urban markets in Akwa Ibom State. In addition, it accessed the extent of market integration between the rural and urban prices for local and foreign rice in the state.

2. Research Methodology

2.1. Study Area and Data Source

- The study was conducted in Akwa Ibom State which is located in the coastal South-South region of Nigeria. The region is popularly called the Niger Delta region or the oil rich region of Nigeria. The state is located between latitudes 4°321 and 5°331 north and longitudes 7°251 and 8°251 east. It has a total land area of areas of 7,246km2. The mean annual temperature of the state lies between 26°C and 29°C and average sunshine of about 1,450 hours per year. The mean annual rainfall ranges from 2,000mm to 3,000mm, depending on the area. Naturally, maximum humidity is recorded in July while the minimum occurs in January. The state is bordered on the east by Cross River State, on the west by Rivers State and Abia State, and on the South by the Atlantic Ocean. Akwa Ibom State has a population of about 3,902,051[29]. The state is basically an agrarian society where crops like maize, okra, cassava, yam and rice are cultivated in large quantities. Politically and for ease of administration, the state is divided into 31 Local Government Councils or Areas; it has six distinct Agricultural Development Project (ADP) Zones. These are: Oron, Abak, Ikot Ekpene, Etinan, Eket and Uyo zones.

2.2. Source of Data

- Secondary data were used in this study. The data came from the quarterly publication of the Akwa Ibom State Agricultural Development Programme (AKADEP). It consisted of the average monthly retailed price in naira per kilogram of local and foreign rice from sampled markets in rural and urban areas of Akwa Ibom State. The study period covered January 2005 to June 2013. A total of 102 weeks’ retailed average monthly prices (N/Kg) of local and imported rice from rural and urban markets were used in the study.

2.3. Analytical Techniques

- The study applied series of statistical and econometric techniques to test for the relationship between rural and urban prices of local and imported rice in Akwa Ibom State. The tests applied ranges from; the trend analysis, bi-variate correlation analysis, Granger causality tests, co-integration and Error Correction Model (ECM) as well as Index of Market Concentration analysis. Each of the tests is explained in both explicit and implicit forms as shown below:

2.4. The Trend Analysis of Average Monthly Retailed Prices of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State in Nigeria

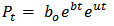

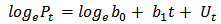

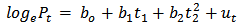

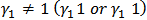

- To investigate the nature of growth rate in prices of local and foreign rice in Akwa Ibom State, we specified the exponential growth rate equation as thus:

| (1) |

| (2) |

. To ascertain whether the growth rate in prices of local and foreign rice did increase at accelerated or decelerated rates over the period considered, the quadratic exponential trend equation was specified as thus:

. To ascertain whether the growth rate in prices of local and foreign rice did increase at accelerated or decelerated rates over the period considered, the quadratic exponential trend equation was specified as thus: | (3) |

> 0; the variable investigated had accelerated growth rate: when

> 0; the variable investigated had accelerated growth rate: when  < 0; the variable has decelerated growth rate over time. In this study, “Pt” was represented by:

< 0; the variable has decelerated growth rate over time. In this study, “Pt” was represented by:  t = time trend (1, 2… 102)The exponential growth rate equation was adopted in this study to investigate the growth in prices of local and foreign rice because, several literature have supported continuous inflated prices of agricultural commodities for some years in Nigeria[7; 13, 30]. We proposed that, changes in prices of agricultural commodities like rice in Akwa Ibom State should also be tested in a non-linear form.

t = time trend (1, 2… 102)The exponential growth rate equation was adopted in this study to investigate the growth in prices of local and foreign rice because, several literature have supported continuous inflated prices of agricultural commodities for some years in Nigeria[7; 13, 30]. We proposed that, changes in prices of agricultural commodities like rice in Akwa Ibom State should also be tested in a non-linear form.2.5. Pearson Correlation Matrix of Average Monthly Retailed Prices of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State in Nigeria

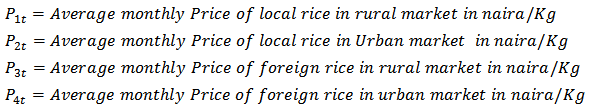

- To test for the symmetrical and linear relationship between rural and urban prices of local and foreign rice in Akwa Ibom State, the Pearson correlation coefficients were estimated. The formula is as described below:

| (4) |

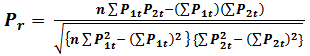

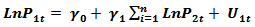

2.6. Bilateral Granger Causality Test on Average Monthly Retailed Prices of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State in Nigeria

- Granger causality test is one of the important econometric tools used to determine whether past change in time series variable say “X” has impact on the current variable “Y” or whether the relation works in the opposite direction[36]. The Granger causality test is a statistical hypothesis test for determining whether one time series is useful in forecasting another. A time series X is said to Granger-cause Y if it can be shown, usually through a series of t-tests and F- test on lagged values of X (and with lagged values of Y also included), that those X values provide statistically significant information about future values of Y[20]. If a time series is a stationary process, the test is performed using the level values of two (or more) variables. If the variables are non-stationary, then the test is done using first (or higher) differences. The number of lags to be included is usually chosen using an information criterion, such as the Akaike information criterion or the Schwarz information criterion. This test assumes that the information relevant to the prediction of X and Y is contained solely in the time series data on these variables[22]. In this study, the bilateral Granger Causality tests were conducted on the average monthly retailed prices of local and foreign rice in urban and rural markets in Akwa Ibom State. The primary model in Vector Autoregressive Regression forms are represented as thus:

| (5) |

| (6) |

| (7) |

| (8) |

= 0. Similarly, there is Granger causality from the rural market price to urban market price for local rice if

= 0. Similarly, there is Granger causality from the rural market price to urban market price for local rice if  = 0 and

= 0 and  ≠ 0. These situations imply asymmetric price movement between the two spatial markets. The causality is considered as mutual or bidirectional if β2 ≠ 0 and

≠ 0. These situations imply asymmetric price movement between the two spatial markets. The causality is considered as mutual or bidirectional if β2 ≠ 0 and  ≠ 0. Finally, there is no link between average monthly price of local rice in rural markets and average monthly price of local rice in urban markets if β2 = 0 and

≠ 0. Finally, there is no link between average monthly price of local rice in rural markets and average monthly price of local rice in urban markets if β2 = 0 and  = 0. The same interpretation follows for the rest of the equations. The variables are as defined previously in equation (3). A bidirectional Granger causality test indicates the presence of symmetric price movement or efficient price transmission between the two spatial markets. This connotes market integration or perfect price transmission between prices of rural and urban markets for local and foreign rice in Akwa Ibom State.

= 0. The same interpretation follows for the rest of the equations. The variables are as defined previously in equation (3). A bidirectional Granger causality test indicates the presence of symmetric price movement or efficient price transmission between the two spatial markets. This connotes market integration or perfect price transmission between prices of rural and urban markets for local and foreign rice in Akwa Ibom State.2.7. Co- integration Test for the Average Monthly Retailed Prices of Local and Foreign Rice in Rural and Urban Markets in Akwa Ibom State in Nigeria

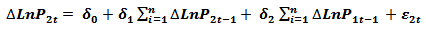

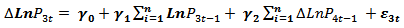

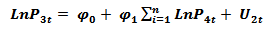

- The concept of co- integration as developed by Granger[21] involves the determination of the static or long-run associations among non-stationary time series. If the geographically separated markets are integrated, then there exists an equilibrium or long run relationship among these markets[19; 18; 38]. The study applied the Engle and Granger two-step technique and Johansen co-integration approach to examine the co-integration relationships between rural and urban market prices of local and foreign rice in the study area. For the local rice market,

and

and  represent prices of rural and urban at time t. If the two markets are perfectly spatially integrated, then

represent prices of rural and urban at time t. If the two markets are perfectly spatially integrated, then  . In this case, price changes in rural market are fully reflected in the urban market. When

. In this case, price changes in rural market are fully reflected in the urban market. When  , then the degree of integration needs to be determined by investigating the variance of

, then the degree of integration needs to be determined by investigating the variance of  from the threshold mark of 1. Hence, the time dependent rural price equation for local and foreign rice is specified as follows:

from the threshold mark of 1. Hence, the time dependent rural price equation for local and foreign rice is specified as follows:  | (9) |

| (10) |

| (11) |

| (12) |

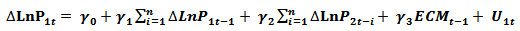

and

and  of the ECMt-1 (

of the ECMt-1 (

) measures the deviations from the long-run equilibrium in period (t-1) in both

) measures the deviations from the long-run equilibrium in period (t-1) in both  and

and  . In order to obtain a parsimonious dynamic ECM for the rural price equation, the study adopted Hendry’s (1995) approach in which an over parameterized model is initially estimated and then gradually reduced by eliminating insignificant lagged variables until a more interpretable and parsimonious model is obtained.

. In order to obtain a parsimonious dynamic ECM for the rural price equation, the study adopted Hendry’s (1995) approach in which an over parameterized model is initially estimated and then gradually reduced by eliminating insignificant lagged variables until a more interpretable and parsimonious model is obtained.2.8. Index of Market Concentration (IMC)

- The index of market concentration (IMC) was used to measure the degree of price transmission or price relationship between integrated markets. Following Oladapo and Momoh,[35] methodology, the relationship between the price of local and foreign rice in rural market and urban market is given by the equations below:

| (13) |

| (14) |

|

for local rice and =

for local rice and =  for foreign rice.When IMC < 1 implies high short run market Integration; IMC > 1 implies low short run market Integration; IMC = ∞ implies no market integration; IMC = 1 high or short run market integration. Other variables are as defined in equation 3.

for foreign rice.When IMC < 1 implies high short run market Integration; IMC > 1 implies low short run market Integration; IMC = ∞ implies no market integration; IMC = 1 high or short run market integration. Other variables are as defined in equation 3. 3. Result and Discussion

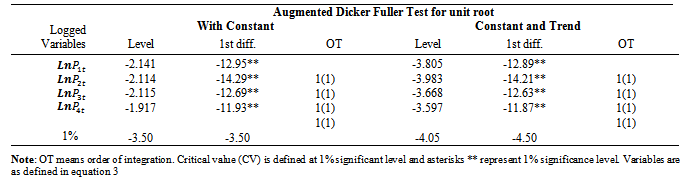

3.1. Augmented Dicker Fuller Unit Root Test Result

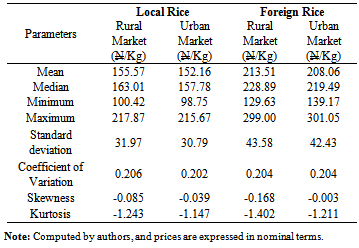

- In time series analysis, stationarity of series is examined by the unit root tests. One of the most commonly used tests in the literature to ascertain the stationary levels of series is ADF test developed by Dickey and Fuller in (10). The ADF test was conducted by including constant on one part and constant and trend on the other part. Only 1% critical value (or 99% of repeatability) was used to determine the unit root of variables used in the study. A price series is stationary if its mean and variance are constant over time under consideration. The result of the ADF root tests as presented in Table 1 shows that, all price variables were non-stationary at levels but stationary at first difference.The result implies that, the specified price variables should be tested for the existence of co-integration[25 and 26]. This result however conforms to the findings of Chirwa[9], Yusuff et al[41] and Acquah and Rebecca[2] that agricultural commodity prices in Sub-Saharan Africa are integrated at the first order. Descriptive Analysis of Urban and Rural average monthly Prices of Local and Foreign Rice in Akwa Ibom State (from January 2005 to June 2013) The descriptive statistics of price variables used in the analyses is shown in Table 2. The average prices of local and foreign rice in rural and urban markets in Akwa Ibom State were

155.57/kg and

155.57/kg and  152.16/kg respectively. Also, the average prices of foreign rice were

152.16/kg respectively. Also, the average prices of foreign rice were  213.51/kg and

213.51/kg and  208.06/kg in rural and urban markets respectively. The coefficient of variability in prices of local and foreign rice in both rural and urban markets was about 20% for each price variable.

208.06/kg in rural and urban markets respectively. The coefficient of variability in prices of local and foreign rice in both rural and urban markets was about 20% for each price variable.

|

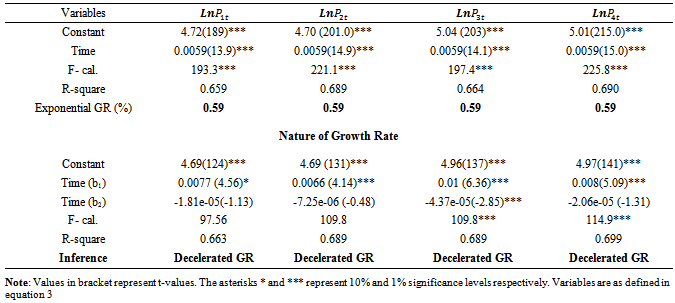

3.2. Exponential Trend Analysis of Average Monthly Prices of Local and Foreign Rice in Rural and Foreign Markets in Akwa Ibom State (2005 to 2013)

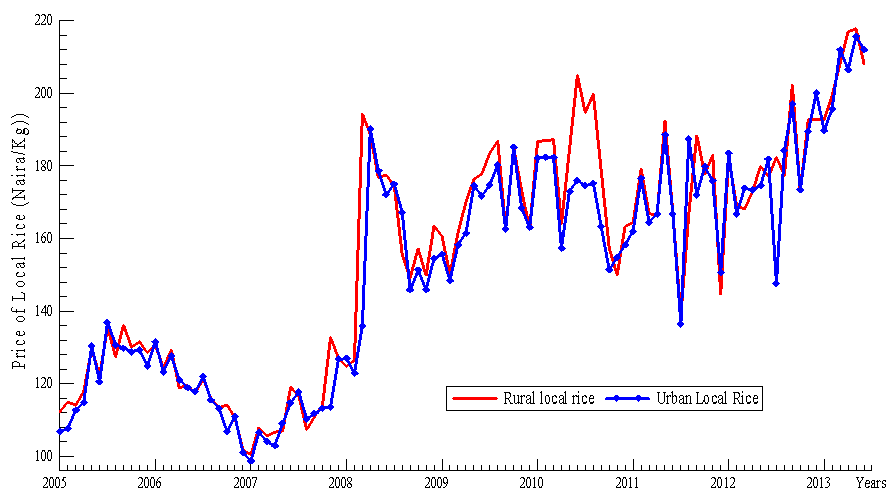

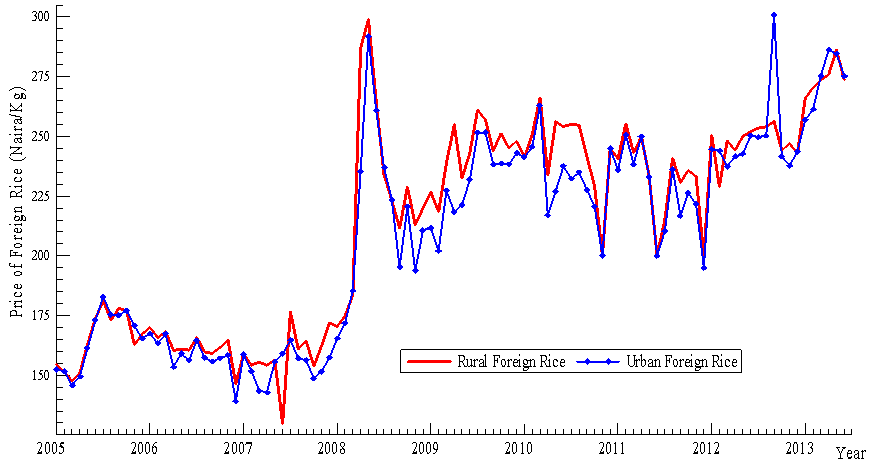

- The exponential trend equation for each of the price variables specified in equations 2 and 3 is shown in Table 3. The result also contains the calculated exponential growth rate for each of the price variables and the nature of such growth rate over time (i.e. from January 2005 to June 2013). The result revealed that, trends in prices of local and foreign rice in rural and urban markets in the study area showed positive significant linkage with time. This implies that, fluctuation in prices of local and foreign rice in rural and urban markets in Akwa Ibom State is affected by time. In the period under consideration, we discovered a constant exponential growth rate of 0.59% for all the four price variables investigated. This result suggests that, variance in prices of local and foreign rice in rural and urban markets in the study area has been relatively constant for some years now. Alternatively, the result has revealed that, the growth rate in price of local and foreign rice in both rural and urban markets are similar and relatively stable over time in Akwa Ibom State. This result further suggests the prevalence of perfect price transmission or market integration between rural and urban price of local and foreign rice in the state. The nature of growth in each price variable showed that, over time the price of local and foreign rice in rural and urban markets decline in the state, but it was statistically significant in rural price of foreign rice. To further substantiate the result graphically; Figure 1 shows the linear trend in average monthly prices of local rice in rural and urban markets in Akwa Ibom State. The price trends show undulated fluctuations throughout the study period. Both prices experienced steady decline from June 2005 to January 2007. On average the rural and urban price of local rice exhibited similar pattern of fluctuations in the study period; which further suggests that both prices move together or were co integrated in the period of investigation. This result is in consonance with the report of Amusa[42].Figure 2, shows the linear trend in price of foreign rice in rural and urban markets of Akwa Ibom State. The result is similar to what was obtained for the local rice. The pattern of fluctuations in price of foreign rice was similar for urban and rural markets in the study area. The fluctuations in price of foreign rice in both markets assumed an average downward trend from July 2005 to April 2007. Thereafter, both prices assumed upward trend till April 2008. From May 2008 to June 2013, fluctuations in both prices were undulated or did not exhibit any regular pattern. In summary, there was no significant deviation of rural market price from urban market price throughout the study period. The nature of fluctuation in rural and urban price of foreign rice, also suggests the existence of perfect price transmission mechanism for foreign rice marketing in the state.

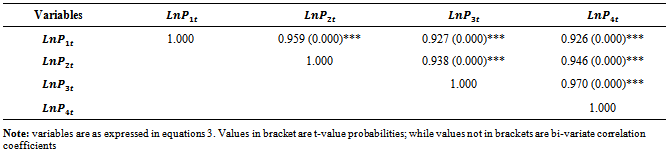

3.3. Pearson Correlation Matrix of Average Monthly Prices of Local and Foreign Rice ( /Kg) in Rural and Urban Markets in Akwa Ibom State, Nigeria

/Kg) in Rural and Urban Markets in Akwa Ibom State, Nigeria

- The linear and symmetric association between average monthly prices of local and foreign rice in rural and urban markets in Akwa Ibom State was captured by the estimation of the Pearson correlation coefficient presented in equation 4. Table 4 shows the correlation matrix of rural and urban average monthly prices of local and foreign rice from January 2005 to June 2013 in Akwa Ibom State, Nigeria. The result revealed that, prices of local and foreign rice in rural markets have positive significant (at 1% probability level) association with their corresponding prices in urban markets. This means that, the price of local rice in rural market has a strong linear relationship with its own price in urban market in Akwa Ibom State. The same result was also applicable to the foreign rice market. These results imply that, there is existence of price integration or perfect price transmission between rural and urban markets for local and foreign rice in the state. It could also be deduced from the result that, factors that influence price of local and foreign rice in the rural markets are similar to those in the urban markets in Akwa Ibom State. The result further indicates the insignificant roles of arbitrage activities and government interventions as well as activities of market/trade unions in the rice marketing business in Akwa Ibom State.

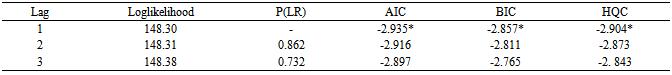

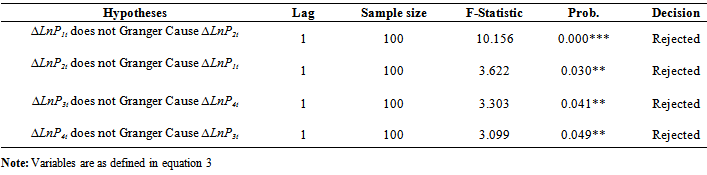

3.4. Bilateral Granger Causality Test for Prices of Local and Foreign rice in Rural and Urban Markets in Akwa Ibom State

- The long run causality relationship between rural and urban prices for local and foreign rice was investigated in Akwa Ibom State. The result of the analysis is presented in Table 6. The result in Table 5 shows the optimal lag period needed in the causality equations specified in equations 5 to 8. The asterisks below indicate the best (that is, minimized) values of the respective information criteria, AIC = Akaike criterion, BIC = Schwarz Bayesian criterion and HQC = Hannan-Quinn criterion.

| Figure 1. Trend in Prices of Local Rice in Rural and Urban Markets in Akwa Ibom State (2005-2013) |

| Figure 2. Trends in Prices of Foreign Rice in Rural and Urban Markets in Akwa Ibom State (2005-2013) |

|

|

|

|

|

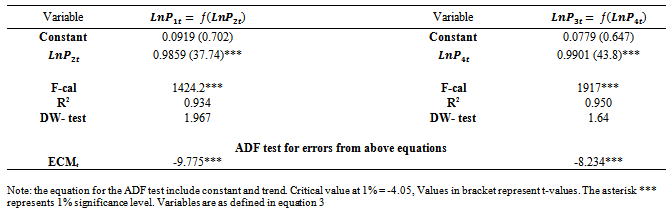

3.5. Co-integration Model for the Rural Price of Local and Foreign Rice in Akwa Ibom State

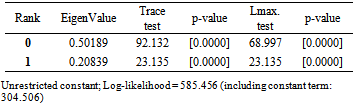

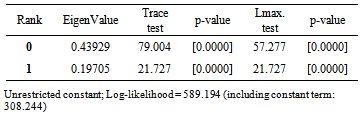

- The result of the Engle and Granger two-step technique of co-integration regression tests for the residuals (ECM) generated in the long run equations specified in equations 9 and 10 is presented in the lower portion of Table 7. The results show that at 1% probability level of significance, the ADF for the residuals is greater than the critical value (-4.05). Thus the Engle–Granger co-integration tests reject the null hypothesis of no co-integration for the two equations. Hence, there exist long run equilibrium relationships between the rural and urban prices of local and foreign rice in the study area.The Johansen co-integration test was used to verify the Engle Granger two-step methodology. The Johansen co-integration test result showed that, the trace and maximum eigenvalues were significant at first rank level. The result is presented in Table 8 for equation 9 and Table 9 for equation 10. The two results are similar, the calculated trace test and maximum eigenvalue test statistics are greater than the critical values at 1% probability level. These further confirm the presence of at least one co-integration relationship among the specified price variables in the two equations. The upper part of Table 7 presents the long run estimates of equation 9 and 10.

|

|

|

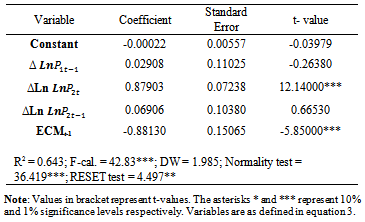

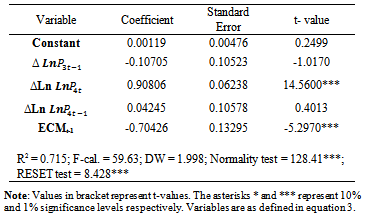

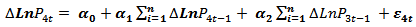

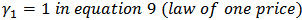

3.6. Error Correction Model for the Rural Price of Local and Foreign Rice in Akwa Ibom State

- The presence of the co-integration among specified variables demanded the specification of the Error Correction Model. Table 10 contains estimates of the error correction model (ECM) generated for equation 11; while Table 11 contains estimates of ECM generated for equation 12. For equation 11 and 12, coefficients of the error correction term is negative and statistically significant at 1% probability level respectively. The result validates the existence of the long-run equilibrium relationship between the rural and urban market prices of local and foreign rice in Akwa Ibom State. The result further implies that, the rural prices of local and foreign rice are sensitive to departure from their equilibrium states or levels in the previous periods. For the local rice, the slope coefficient of the error correction term (-0.881) represents the speed of adjustment and also is consistent with the hypothesis of convergence towards the long-run equilibrium once the price equation is disturbed. This means that, it will take the rural price of local rice about five weeks to adjust fully to equilibrium position in the long run due to disturbances in the marketing system in the study area. The diagnostic test for the ECM model revealed R2 value of 0.643 which means that the specified explanatory variables explained about 64.30% of the adjusted total variations in the rural price of local rice in Akwa Ibom state, Nigeria. The F-statistic of 42.83 is significant at 1% probability level, indicating that the R2 is significant and this implies that the equation has goodness of fit.

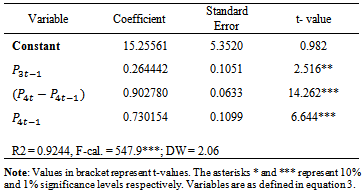

|

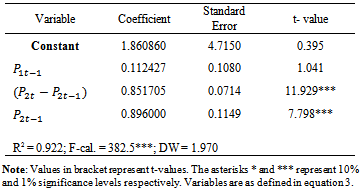

3.7. Index for Market Concentration (IMC) for Local and Foreign Rice in Akwa Ibom State, Nigeria

- The IMC was estimated for local and foreign rice commodities in the State. The estimates of IMC regression is shown in Tables 12 and 13 for local and foreign rice respectively. The IMC were 0.126 and 0.366 for local and foreign rice respectively.The IMC for these commodities were less than unity. This implies that, there is high short run market integration between rural and urban markets for local and foreign rice commodities in the state. The short run market integration was faster in the local rice relative to the foreign rice. This however confirms the ECM results discussed previously and further substantiates the perfect price transmission mechanism between rural and urban areas for rice market in Akwa Ibom State. Akintunde et al.,[5] had reported similar result for other grain crops in Nigeria.

|

|

4. Summary and Recommendations

- The study employed statistical and econometric techniques to analyze the price transmission and market integration of rural and urban prices of local and foreign rice in Akwa Ibom State, Southern Nigeria. The findings showed that, prices of local and foreign rice in rural and urban markets have positive relationship with time and constant exponential growth rate of 0.59%. The graphical analysis showed that, both rural and urban prices co-moved together with minimal deviations within the period under consideration. The result suggested the prevalence of efficient price transmission between rural and urban market for local and foreign rice in Akwa Ibom State. Also, the Pearson correlation coefficient matrix revealed that, the rural price of local and foreign rice have linear symmetric relationships with their corresponding urban prices in the study area. The result connotes the existence of symmetric market information flows between rural and urban markets in the state. The Granger causality test revealed bidirectional relationship between rural and urban price of local and foreign rice in Akwa Ibom State, southern Nigeria. This also suggested that, the price transmission mechanism between the rural and urban markets for rice commodities is efficient; and a high tendency for market integration for the rice sub-sector in the state. The results of the co-integration test revealed the presence of co-integration between the rural and urban prices of local and foreign rice as well as expressed support to the hypothesis of perfect or fast price transmission between the two markets in the study area. The coefficients of the price variable in the co-integration equations for local and foreign rice market converged to unity which connotes market integration in the long run. The results of the short run model or ECM also confirm the existence of the short run market integration between rural and urban prices of local and foreign rice in the study area. In addition, it shows that, the rural price of local rice adjusted faster than the rural price of foreign rice once there is exogenous shock in the marketing process of rice in Akwa Ibom State. It was discovered that, the urban price of local rice adjusted faster than its corresponding rural price. Also, the rural price of foreign rice responded faster than urban price. The estimation of index of market concentration (IMC) supported the high short run market integration between prices in rural and urban markets for local and foreign rice commodities and the quick adjustment of prices in rural and urban markets of local rice relative to prices in rural and urban markets of foreign rice. Based on the finding, it is recommended that, the Akwa Ibom State government should continue to improvise marketing infrastructures to improve the symmetric nature of information among participants in rice marketing in the state. The presence of excessive externality costs could distort the free flow of rice in rural and urban markets and bring about significant price differential between the two markets in the state; thus government should endeavor to dismount all sources of such costs in the state. The Akwa Ibom State is surrounded by rice producing areas and major commercial towns in the region. The uncontrolled infiltration to the state of rice commodities might induce undue competition on local producers. In as much as rice market integration is a healthy economic situation, there is overwhelming need to check excessive inflow of rice commodities from the neigbouring states in order to boost local production.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML