Nada Shouman1, Ramez Al Tanbour2

1Ph.D. Candidate, Faculty of Business Administration, Al-Jinan University, Lebanon

2Professor, Al-Jinan University, Lebanon

Correspondence to: Nada Shouman, Ph.D. Candidate, Faculty of Business Administration, Al-Jinan University, Lebanon.

| Email: |  |

Copyright © 2026 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This study aims to analyze the effect of total quality management dimensions (budget review, assessment and correction of deviations, development and analysis of indicators) on financial performance by reducing costs and increasing production. To achieve the objectives of the study, the researcher developed a questionnaire and distributed it to a sample of financial managers from 61 small-sized companies in Beirut in 2022. The study used a number of analyzes to test the hypotheses and concluded that there is a statistically significant effect at the significance level (α < 0.05) between the application of the dimensions of total quality management and financial performance. And it was found that there is a positive relationship with statistical significance for each of the budget review, the evaluation and analysis of deviations, the development and correction of indicators on the financial performance. The study also showed that there were no statistically significant differences between quality in its dimensions and demographic variables, and any statistically significant differences between financial performance and these variables (gender, age, number of years of experience). In light of the statistical results, the study made a recommendation to increase the interest of senior management in companies to instill a culture of applying the dimensions of total quality, which will have a positive impact on the development of their financial performance.

Keywords:

Total quality management, Financial performance, Budget review, Assessment of deviations, Setting indicators, Small businesses

Cite this paper: Nada Shouman, Ramez Al Tanbour, The Impact of Quality on the Financial Performance of Economic Institutions – Beirut, Human Resource Management Research, Vol. 15 No. 1, 2026, pp. 1-12. doi: 10.5923/j.hrmr.20261501.01.

1. Introduction

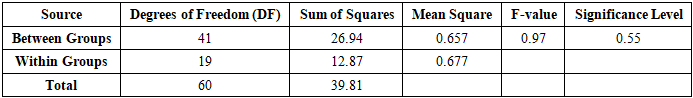

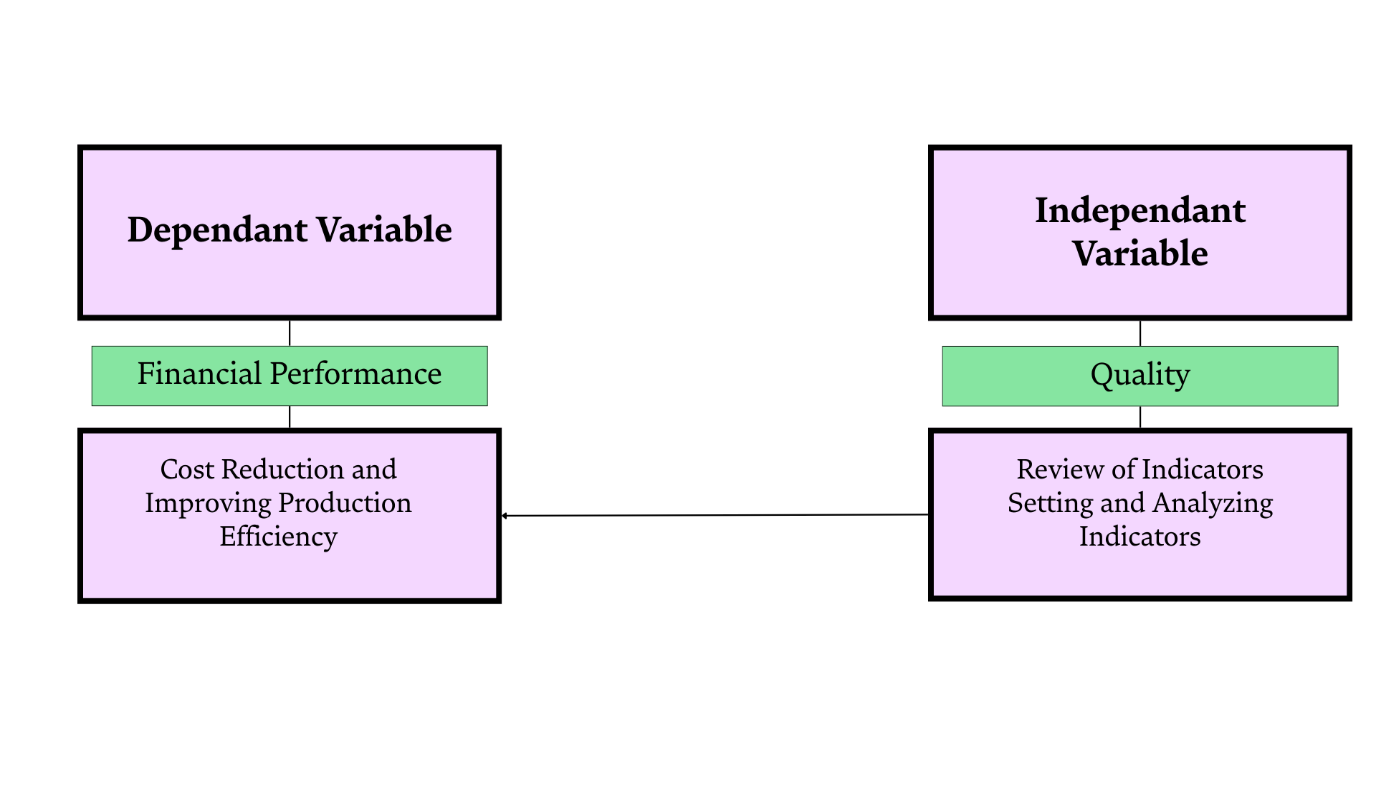

The world has witnessed radical changes that have been reflected in the business sector. On one hand, the major scientific revolution in all fields- especially in communications and technology, along with the emergence of globalization, has created challenges for business organizations in their efforts to survive. On the other hand, privatization has opened new investment opportunities for the private sector that had previously been restricted [1]. In light of these developments and changes of the era, intense competition that has emerged in the production and service sectors and other fields through different technologies and methods, and organizations have become in a constant search and continuous effort to secure their position in the market. At the same time, enterprise profitability is maintained by offering multiple advantages to consumers through diversification of services or products. Thus, price is no longer the only driver of the customer’s desires and behaviors. This brought into focus one of the contemporary managerial approaches known as Total Quality Management (TQM). TQM has heightened competition between organizations, services, and factories because customers have become more conscious in selecting appropriate high-quality goods and services.Consequently, an increased interest has been noticed among international communities in improving and managing quality [2] and the culture in which they operate [3].Total Quality Management is basically defined as a management approach aimed at long-term success through customer satisfaction. Within the framework of TQM efforts, process improvements involve products and services as well as all members of the organization. Organizations will only earn profits if it can keep high quality at a low cost through proper use and utilization of available resources. The survival and sustainability of the organization are mainly based on the efficiency of financial performance, which again depends upon the application of scientific methods and rational practices in managing adequately long-term as well as short-term needed financial resources. The ideal way to assess an organization's success in achieving its goals while still using justified means is to measure its results against preset indicators/standards such as financial performance indicators that help provide the organization with a comprehensive picture of its current financial status or its development over time [4].According to all of the above, this study will be divided into four chapters. The first chapter contains the background information, statement of the problem, significance and methodology. The second chapter expands the theoretical aspect of this research which also includes the basic concepts in this study. Results obtained from a fieldwork shall be presented in chapter three, while discussions on results together with some recommendations form the last and final chapter.Importance of the StudyTotal Quality Management (TQM) is considered among the strategic factors of success or failure in many business organizations which attempt to survive within today’s competitive environment. The industrial organizations in Lebanon have applied quality standards and continue facing economic, social, and political difficulties. Due to all of that, applying quality standards becomes one of the major challenges for these organizations, particularly small ones.This study derives its importance from the following points:• Elaborating the concept and approach of Total Quality Management inside a sample of small companies in Lebanon.• Determining the effect that application of quality standards has on the financial performance of these companies.• Developing a new vision for applying TQM principles in order to enhance the financial performance of these companies.Research Problem and QuestionsStudies that investigate the effect of Total Quality Management (TQM) on firm financial performance could be divided into two groups. One group relies on subjective data-the perception of managers-and the other group uses objective data, such as reported profit figures. While research based on subjective data continues to show a positive relationship between the implementation of TQM practices and good financial performance, research based on objective measures remains inconclusive since studies have reported mixed results [3]. While proponents of TQM practices claim that their effects are positively correlated for all types of firms, this conclusion is based mainly on studies carried out on large organizations. There is scarce evidence relating to the effect of implementing TQM on the financial performance of small and medium enterprises.Therefore, the main question this study seeks to answer can be stated as follows:What is the effect of applying quality—through its elements such as budget review, setting and analyzing indicators, and evaluating and correcting deviations—on financial performance, represented by cost reduction and improved production, in small companies?From this, the following sub-questions emerge:1. Does budget review have an effect on financial performance?2. Is there an effect of setting and analyzing indicators on financial performance?3. Does evaluating and analyzing deviations have an effect on financial performance?Study ObjectivesThe main purpose of this study is to find out the effect of applying quality practices on financial performance, particularly in reducing costs and improving production. While the sub-objectives are:• To find out the effect of budget review on financial performance.• To find out the impact of setting and analyzing indicators on financial performance.• To show the extent of the effect of evaluating deviations on financial performance.• To examine the variation of quality dimensions by demographic variables (gender, age, experience).Study HypothesesIn order to achieve the objectives of this study and in line with its problem, the following main hypothesis was formulated:H₀: There is a positive and statistically significant relationship between quality practices and financial performance among small companies in Lebanon.Several sub-hypotheses are developed from the main hypothesis:- There is a positive relationship between budget review and financial performance. The relationship is statistically significant.- There is a positive significant statistical relationship between setting and analyzing indicators and financial performance.- There is a positive significant statistical relationship between evaluating and correcting deviations and financial performance.- There are statistical differences of significance in the dimensions of quality according to demographic variables (gender, age, experience).Study ScopeObjective Scope:This study seeks to define Total Quality Management and shed light on the importance of applying it in small enterprises in Beirut, in addition to displaying the benefits that may be resulted through its application to enhance financial performance.Geographical Scope:The study has been carried out on a sample of small enterprises located within Beirut. The questionnaire was filled out online by the financial managers of these companies.Human Scope:A random sample of 61 financial managers has been selected.Temporal Scope:This study is limited within the period from February 20 to March 11, 2022, which is when data collection and completion of the questionnaire took place. | Figure 1. Conceptual Framework |

Study Resources: The study depended on the following sources:A. Primary sources: These include gathering information from its original sources through a questionnaire developed by the researcher specifically for this purpose and analyzing this information to answer the research questions and test the validity of hypotheses.B. These include available references and resources in libraries to build the theoretical framework of the study, such as books, articles, studies, and academic theses.Data AnalysisAfter gathering the information through the questionnaire, data were coded and entered into the computer through the software package of Statistical Package for Social Sciences (SPSS) to obtain:1. Cronbach’s Alpha reliability coefficient to measure internal consistency among scale items.2. Descriptive statistical measures used to describe the study sample and show its characteristics involving means and standard deviations.3. Various analyses to either confirm or reject the proposed hypotheses.Study Population and SampleThe study population included financial officers working in small-sized companies in Beirut. The total number of these institutions is 61.Study InstrumentThe study instrument was the questionnaire. A five-point Likert scale (Strongly Agree, Agree, Neutral, Disagree, Strongly Disagree) was used for answering the statements in the questionnaire with respect to the dimensions of Total Quality Management. As far as statements related to financial performance are concerned, responses were based on determining the effect of each TQM dimension on financial performance- represented by cost reduction and increased production- using the same scale (Strongly Agree, Agree, Neutral, Disagree, Strongly Disagree).The questionnaire contains twenty-four questions in two main parts.The first part includes data related to demographic characteristics: gender, age, and years of experience.The second part is again divided into two sections:Total Quality Management dimensions form the first section which comprises three criteria: budget review (four statements), setting and analyzing indicators (five statements), and evaluating and correcting deviations (five statements). Seven statements in the questionnaire reflected cost reduction and increased output as financial performance.Study LimitationsFindings of this study should be viewed within the following limitations.Primarily, there is recall bias-which is inherent in all studies based on questionnaires. A probable better assessment of attitudes and practices would have been obtained if interviews were conducted since responses pertaining to the practice of total quality management may not necessarily reflect the actual practices of the companies; they represent only the participants’ reports. In addition, responses pertaining to financial performance may lack accuracy in the absence of exact figures on the percentage of cost reduction and percentage increase in output after adopting total quality management.Another limitation is the lack of previous studies undertaken in this research domain in Lebanon. The absence of data reflecting financial performance before the implementation of Total Quality Management standards makes it difficult to analyze and compare changes in financial performance after their application.One of the main limitations related to the factors that affected in collecting the questionnaires. The main aim of this study is to determine the impact of applying Total Quality Management standards on the financial performance of small companies located in Beirut, but other factors exist mainly economic and political factors in Lebanon that affect and interact with financial performance especially costs and volume of production.Study TerminologyQuality:According to international standards, quality is defined as “a set of technical rules agreed upon by producers—and in some cases users and customers—with the aim of specifying, facilitating, and standardizing the product or service provided” [5].Budget:A budget is the attainment of certain specific financial goals in the future through the analysis of income, expenses and situation of a particular project for a defined period. It is one of the most important managerial tools that facilitates judgment about the efficiency of work performance and also in attaining financial objectives. It helps in overcoming disasters and previously expected financial situations [6].Indicators (Key Performance Indicators – KPI):"The definition of KPI is as follows:- Key is the main contributor to success or failure. - Performance is a measurable, quantifiable, adjustable and controllable measure. - The indicator shall be a logical and realistic depiction of current and future performance" [7].Performance Deviation Correction:"Identifying performance deviations means determining the differences between actual performance as it is and the established standards. In other words, performance deviation is the difference between the established standards and actual performance (an interpretation of the indicator)" [8].Financial Performance:“It is a major aspect of the general performance of the institution linked to the financial function performance inside the organization and depends on using financial indicators such as profitability and growth in evaluating this function’s work” [9].Previous StudiesPrevious studies form an important body of knowledge and a rich source for all scholars and researchers, helping them to build scientific background related to the subjects of their studies and research. Reviewed below are the most relevant Arabic and international studies examined.Othmani & Latrech (2020) [10] aimed to analyze the nature of the relationship between Total Quality Management (TQM) and financial performance in Algerian companies. The results found that there is a high level of awareness among companies about the dimensions and principles of TQM, besides firms attaining growth rates to levels considered satisfactory by them which will inevitably result in an enhancement of financial performance for the firm on a long-term basis. It recommended adopting TQM and committing to its dimensions while emphasizing its role in business planning and execution.The study conducted by Al-Kasasbeh (2011) [9] analyzed the relationship between Total Quality Management and financial performance. This study helps to understand and analyze the nature of relationship between TQM, through its concepts and strategic dimensions, with an improvement and enhancement in the potential for strategic financial performance of pharmaceutical companies in Jordan. The results from the financial analysis clearly depicted a high positive significant statistical relationship between TQM, in its conceptual as well as strategic dimensions, with improved financial performance. A high positive significant statistical relationship was also found between independent variables like implementation and adoption of TQM philosophy, maintaining strong customer relations, usage of benchmarking with competitors, organizational openness and interaction, continuous training and development for employees, continuous improvement, employee participation, measurement and analysis, and ISO standards; and improved strategic financial performance for companies included within sample used by the study.The study by Al-Da’as (2010) [11] aimed to find out the effect of total quality management on enhancing financial performance in one of the Jordanian commercial banks. The findings of the study were as follows:1. Employees perceive the importance of every dimension of TQM in enhancing financial performance.2. Many statistically significant relationships exist between all dimensions of TQM and enhanced financial performance thatched roof observed in Jordanian commercial banks.Maswadeh & Al Zu’mot (2021) [1] conducted their study to assess the influence of TQM dimensions represented by top management support, customer focus, process management, employee participation and empowerment as well as continuous improvement on financial performance with organizational culture playing the role of a moderating variable. Until the end of 2019, nine transportation companies listed at Amman Stock Exchange were included in this study. Results showed that there is a statistically significant effect at 0.05 level for top management support; customer focus; employee participation and empowerment on financial performance measured through return on assets in Jordanian transportation companies. Based on statistical results achieved by this research work several recommendations have been presented among which increasing top management’s commitment towards fostering deep organizational culture-based learning oriented towards development, performance excellence (service quality improvement), attracting customers, differentiating organization from others, eventually enhancing its financial performance.Shrivastava et al. (2006) [12] determined the relationship between factors influencing electronic Total Quality Management (e-TQM) and organizational performance through a methodological framework proposed by the researchers themselves, with findings of a strong correlation between them. The study offers concluding statements that can be used to enhance and manage TQM programs in meeting organizational needs.The study by Agus & Sagir (2001) [13] attempted to identify the relationship between total quality management (TQM), competitive advantage and achieving good financial performance. The study concluded that TQM is important and that competitive advantage plays a significant role as a mediating variable in the relationship between TQM and financial performance.These studies and many others have emphasized how Total Quality Management (TQM) elements play a role in the success stories of international companies across financial performances, which is is what we also aim to display in this paper. However, these previous studies were conducted on large corporations while this paper will study small firms.Previous studies were based on the following quality implementation elements: enhancing customer relations, using competitor benchmarking, organizational interaction and openness, continuous training and development of employees, improvement and development, employee participation, measurement and analysis, ISO standards. The present study is adopting three completely different quality elements which are budget review, setting indicators and analyzing them, evaluating deviations and corrections. As for better financial performance, former studies considered increasing revenues of the company to measure it, while in this study we will consider reduced costs and improved production as the two elements that will reflect the state of financial performance.

2. Literature Review

Section One: Total QualityMost people consider that quality means good type or original material, referring to how well something is made rather than the quantity produced. Several definitions of quality have been suggested by pioneers in the field throughout history, the most important being:• Total customer satisfaction, meaning that quality is defined by the needs of the customer and not by the needs of designers, marketers or top management [14].• Capability of the product to meet particular needs [15].• Fitness for use as perceived by the beneficiary as expressed by Joseph Juran [16].• A predictable degree of uniformity and reliability suitable to the market at a low cost [17].This implies that quality is associated with the customer’s viewpoint and anticipation; it shows how satisfied customers are toward a certain product. The American National Standard Institute defines quality as “the set of characteristics and attributes of a product or service that make it capable of meeting specified expectations, suitability of purpose, and the needs of its users.” [15].Total Quality (TQ) is considered one of the modern concepts that emerged as a result of intense global competition between Japanese manufacturing companies on one hand, and American and European companies on the other—all aiming to achieve customer satisfaction. This movement began with Dr. W. Edwards Deming, who is known as the “Father of Total Quality” [18].Total Quality Management (TQM) is defined as a set of continuous improvement activities in which every individual in the organization, both managers and employees, participate. However, integrated fully to improve performance at all levels with an attempt directed towards multifunctional objectives that include quality, cost, schedule, need and suitability. TQM integrates fundamental management techniques; present efforts for improvements; technical tools within a disciplined approach oriented on continuous process improvement. The end result activity aims increased customer/user satisfaction [19].Section Two: Total Quality Management There is no single unified official definition of TQM, every researcher defines it from their own point of view. According to the definition by the Federal Quality Institute, “doing the job right the first time,” total quality management relies on customer evaluations to determine how well performance has improved toward achieving complete customer satisfaction. TQM is therefore considered a comprehensive applied approach aimed at meeting and fulfilling customer needs and expectations through continuous use of quantitative methods to improve TQM is also viewed as a management approach involving every activity within the organization, including human activities and the organizational environment, to articulate and fulfill quality objectives derived from customer requirements [20].TQM practices have evolved from the production process to other functions of the company, such as environmental systems, human resources, information systems, and project management. It also includes supply chain management and research & development.Quality management standards specify an agreed method for carrying out a task—whether manufacturing a product, managing a process, or delivering a service. These standards outline requirements, guidelines, and characteristics that products, processes, and services must consistently meet to ensure their quality. Quality management systems cannot function without such standards [21].There is no universal quality standard, as standards differ by project and context. They may be highly specific—applying to a certain product type—or broad, such as general management practices. For example, there are quality standards in auditing, in management, in social responsibility, and others. In this section, we will address the standards examined in this project.Section Three: Objectives of Total Quality ManagementThe organization aims to achieve several objectives through TQM, including reducing production costs by minimizing wasted time and effort; meeting customer needs and expectations so that products comply with specifications; enhancing competitiveness and strengthening the organization’s position in the market; and improving employee productivity, teamwork, and sense of belonging to the institution [22].Section Four: Budget ReviewFor some companies, keeping a project within budget is considered a key measure of quality. This principle aligns with the project triangle, also known as the “iron triangle” or “triple constraint”: quality – time – cost – scope.One of the key concepts in TQM is the Cost of Quality, an essential and integral part of any quality program in organizations or production facilities. Studying costs related to quality provides the following main advantages:It acts as a strong indicator to convince top management of the importance of implementing quality-cost concepts. As it also helps reduce, control, and manage total product costs effectively, thereby increasing profit.Another benefit is that it improves the accuracy of cost estimation and realistic budget setting. Converting quality into simple tangible numbers through direct loss ratios helps both management and employees realize the importance of doing things right the first time.Types of quality costs include:1. Conformance Costs or Quality Control Costs 2. Non-Conformance Costs or Quality Failure Costs Conformance costs involve all preventive efforts ensuring the product is produced without defects. Non-conformance costs arise from defects discovered either inside the organization or after delivery to the customer [23].Thus, budget review also includes reviewing:• Prevention CostsThese are expenses incurred to prevent defects in the product and to prevent non-conformance with required specifications Prevention costs are associated with the design, implementation, and maintenance of the quality system within the organization. They are spent to prevent non-conformance or failure in the product or service.Examples of prevention costs include:• Cost of planning, designing and developing the quality system• Cost of control over production processes• Training employees in quality practices• Reviewing and analyzing quality-related data• costs associated with quality improvement programs- Appraisal Costs include costs spent on testing and inspection operations used to evaluate product quality and identify issues within the production process. Appraisal costs are associated with measuring, evaluating, auditing, and inspecting products or materials to ensure their compliance with adopted specifications and quality requirements. They represent the value of all efforts made to determine the degree of conformity to quality standards during first-time production.- Internal Failure Costs which are the costs associated with products that fail to meet quality specifications and are identified within the organization before delivery to the customer. They represent losses incurred due to defective items found during internal inspections.- External Failure Costs are the costs of defective products discovered after they have been delivered to the customer or consumer. They often include returns, warranty claims, repairs, and reputational damage.The level of quality has a direct effect on the cost of manufacturing a product and on its value. Achieving a high level of quality requires higher manufacturing and inspection costs, as well as high-quality raw materials, advanced production machinery, and skilled labor. Although this increases production costs and, consequently, the selling price, it reduces failure-related costs due to fewer defective products.This overall concept represents what is known as the “value of quality” [24].Section Five: Establishing Indicators and Analyzing ThemCompany managers need key performance indicators (KPIs) for several reasons:1. To determine where the organization has been and what past performance reveals2. To track progress achieved as a result of changes or improvements.3. To plan and prepare for the future, defining where the organization is heading, what success will look like, and how that success can be achieved [25].Accordingly, key performance indicators (KPIs) are the data points with the greatest impact, and they are generally divided into two main types:• Financial Indicators: measure actual financial performance and show whether business operations are moving in the right direction toward organizational goals. Most financial KPIs derive from income statements or balance sheets and may report sales growth by product group, channel, customer segment, or expense category [26].• Non-Financial Indicators: these are leading indicators or performance drivers. They show what must be done to achieve goals and influence the alignment of organizational activities. Typical examples include metrics related to customers, employees, operations, quality, cycle time, supply chain, or project pipelines [26].Financial indicators are often the result of underlying non-financial indicators, forming a cause-and-effect relationship.Financial indicators are often the outcome of preceding non-financial indicators through a clear cause-and-effect relationship. However, despite the high importance of non-financial indicators, they may also contribute to failure in applying the balanced scorecard in practice if not used correctly.Accordingly, Key Performance Indicators (KPIs) are characterized by the following:• They include both financial and non-financial measures.• They are used to measure performance repeatedly over short time intervals—quarterly, monthly, daily, or even hourly.• They must be clearly understood by employees, meaning users should grasp the informational content and the corrective direction indicated whenever negative deviations occur.• They should have a significant impact on the organization’s strategic direction.• They should produce positive effects on other performance measures.Section Six: Evaluating and Correcting DeviationsIndicators must serve as accountability tools, functioning as performance standards through which activities are evaluated [27].The main purpose of any organizational system is to ensure alignment between actual and planned performance and to take corrective action when deviations occur. Monitoring is only complete once corrective actions have been taken promptly and objectively.Identifying deviations alone is insufficient. Corrective action must accompany deviations to realign operations with planned objectives. Correction involves addressing the root causes of deviations rather than their symptoms [28].• Maintaining the current situation.• Taking remedial action.• Adjusting standards.The control process does not yield results simply by setting standards or comparing actual output with those standards. Results are achieved through taking corrective action. Adjusting working conditions means revising the standards so that they align with the capacities of employees and the organization. The more conditions change, the more actual results deviate from their natural course, and the further achieved objectives drift from the originally intended goals. Therefore, as much as possible, efforts must be made to adjust working conditions so they match the assumptions on which the plan was built.This also includes improving the methods used to select, train, and guide workers. This requires creating effective training programs that equip employees with the necessary skills and developing an appropriate work system. Generally, an employee performs duties according to physical and practical abilities, and in proportion to the level of training and supervision received.Plans should also be adjusted when necessary. Plans are not rigid laws; they result from personal judgment and interpretation of environmental factors. Thus, the same plans cannot be expected to continue indefinitely in the future. They are subject to error, and managers must review and reassess them regularly.Enhancing motivation tools is equally important—meaning the review and development of an effective system of wages, rewards, and incentives. Good planning, modifying plans when necessary, or offering training, guidance, and counseling are not sufficient by themselves to achieve desired goals. Management must give genuine attention to the human element and motivate employees to exert their best efforts to meet organizational objectives.Finally, when taking corrective action, the manager must search for the underlying causes rather than the symptoms. The responsible person should distinguish between root causes and surface-level signs before taking any corrective action, ensuring that the true source of the deviation is addressed—not merely its outward appearance [29].Section Seven: The Importance of Financial PerformanceFinancial performance evaluation is critical as it verifies the efficient use of available resources and determines whether planned objectives have been achieved [30].Organizational financial efforts focus on improving strategic outcomes, reflected in:• The survival of the organization in the market, demonstrated by maintaining sufficient liquidity to meet all obligations.• The success of the organization, achieved through improving the profitability of its investments and sales.• The growth of the organization, reflected in increasing its market share and generating returns for shareholder [9].

3. Statistical Analysis and Hypothesis Testing

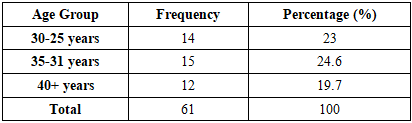

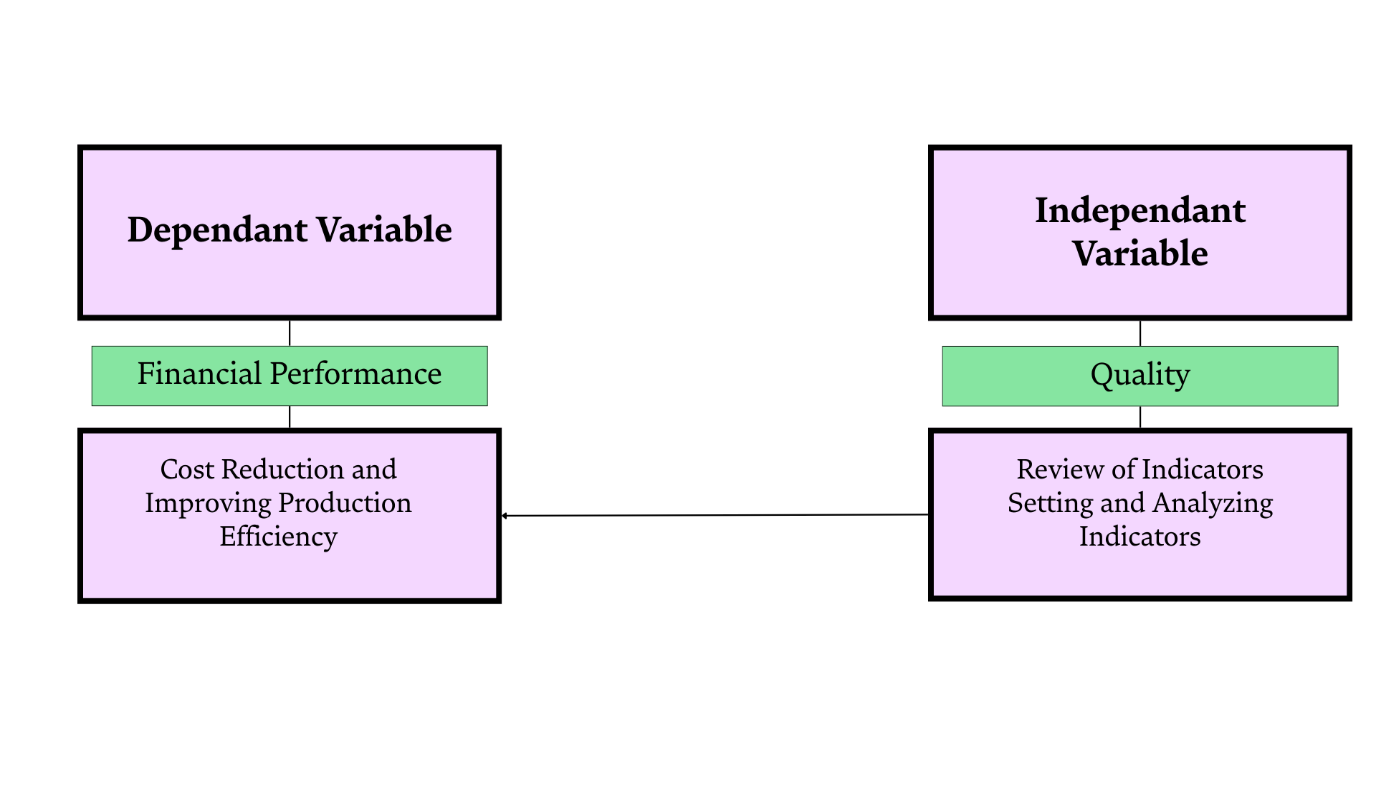

61 questionnaires were fully completed and valid for analysis.Instrument Validity and ReliabilityTo check reliability, Cronbach’s Alpha coefficient of internal consistency was computed and found to be high for all the study variables (91.1%), which is quite a good percentage compared with the least accepted level of 60%.Characteristics of the Study SampleThe financial managers of 61 small firms located within Beirut. Participant characteristics were defined by the following personal information: age, gender, and years of experience.1. GenderMost of the sample were males as they constituted 42 out of the total respondents (69%) while 19 (31 %) were females Thus it can be deduced that the position of financial manager is mostly dominated by males in most companies.2. Age The study indicates that the age group above 40 years ranked first with 33%, followed by the age group 31–35 years with 25%. Table 1 presents the distribution of participants according to age groups.Table 1. Distribution of Study Sample Members According to Age Group

|

| |

|

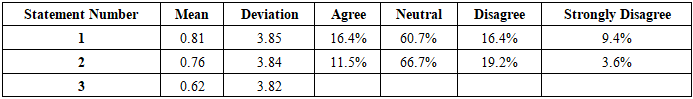

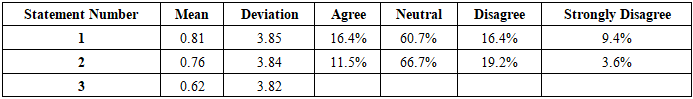

3. Years of ExperienceThe analytical results indicated that those with more than ten years of experience constituted 49% of the sample, ranking first. In second place were respondents with six to ten years of experience (28%), followed by one to five years (23%). This distribution is a good indicator of response credibility since most respondents have apparent experience and competence in their work.Descriptive Results Related to Statements on Total Quality ManagementTotal Quality Management (TQM) was examined by determining frequency distributions (percentages, means, and standard deviations) for three criteria: budget review, setting and analyzing indicators, and evaluating and correcting deviations.Budget review was measured through four statements using a five-point Likert scale (1 = Strongly Disagree, 5 = Strongly Agree). This variable recorded a mean of 3.89 with a standard deviation of 0.73 (Table 2). High levels of agreement were noted: 66.8% Agree, followed by 14.35% Strongly Agree. Very low levels of disagreement were recorded (3.68% Disagree, 1.64% Strongly Disagree). The results prove how important financial managers consider the budget review—especially in studying employee training costs and machine maintenance (Statement 4: The institution studies the costs of employee training and machine maintenance).Table 2. Describing the Statements of Total Quality Management: Focusing on Review of Evaluation Criteria

|

| |

|

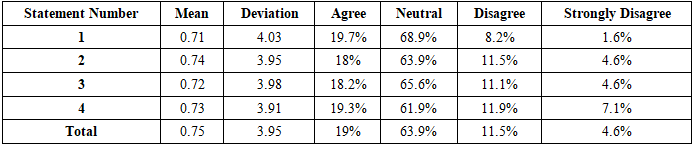

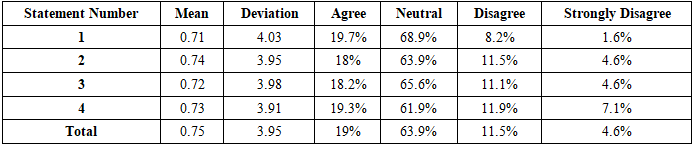

Setting up and Analyzing Indicators was measured by five statements with a mean value of 3.95 and a standard deviation of 0.75 as shown in Table 3. The highest percentage response stood at 63.9% on the option Agree followed by Strongly Agree at 19% while Neutral responses accounted for 11.5%. Minimal levels of disagreement were recorded (4.6% Disagree, 1% Strongly Disagree). The results confirm that managers see the importance that setting and analyzing indicators is emphasized especially when improvement planning for production is being set (Statement2) and programs are prepared to reduce costs as well as avoid wastages (Statement4) since there was no strong disagreement against these statements.Table 3. Describing the Statements of Total Quality Management: Focusing on the Setting and Analysis of Indicators

|

| |

|

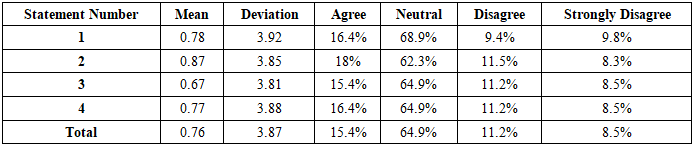

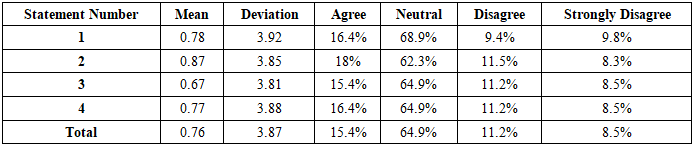

The last set of five statements, under the final TQM criterion-assessment and adjustment of deviations recorded no responses at the ‘Strongly Disagree’ point on any statement in this set. Most respondents- 64.9% selected either ‘Agree’ or ‘Strongly Agree’ to this important criterion (Table 4). Therefore, assessment and adjustment of deviations can also be considered a major component emphasized by most participants as being core to TQM.Table 4. Describing the Statements of Total Quality Management: Focusing on Evaluating and Analyzing Discrepancies

|

| |

|

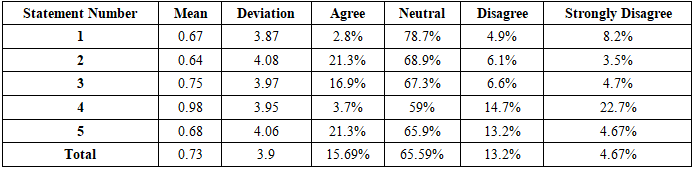

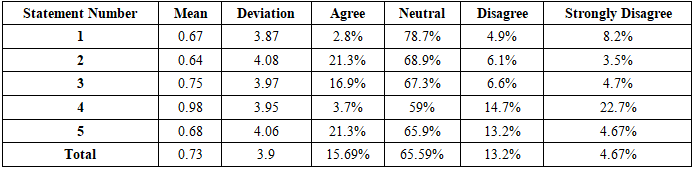

Descriptive Results on Statements Related to Financial Performance ImprovementParticipants' responses regarding the relationship between the dimensions of TQM and financial performance improvement through cost reduction and increased production are outlined in Table 5. The mean score for their responses on the relationship between TQM dimensions and financial performance was 3.9. For increasing opportunities to enter new markets (Statement 1), the mean was 3.87, with 78.7% agreeing with the statement. On the increasing customer satisfaction and trust (Statement 2), 68.9% agreed while 21.3% strongly agreed hence making it the most supported statement. The highest disagreement was recorded on Statement 4-Enhancing employees’ financial well-being and reducing turnover-(4.9% Strongly Disagree, 6.6% Disagree). Generally, 65.59% agreed on applying TQM dimensions to improve financial performance while 15.69% strongly agreed.Table 5. Responses of the Study Sample Regarding the Dimensions of Total Quality Management in Improving Financial Performance

|

| |

|

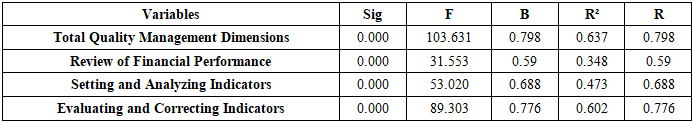

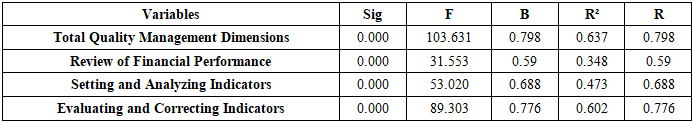

Hypothesis TestingTable 6 shows results on the relationship between Combined and Individual TQM dimensions with Financial Performance (through Cost Reduction and Increased Production) in small companies in Lebanon. Table 6. The Relationship Between the Dimensions of Total Quality Management and Improving Financial Performance

|

| |

|

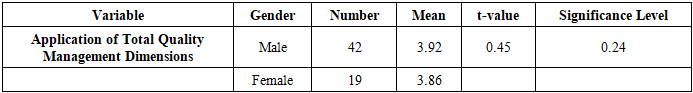

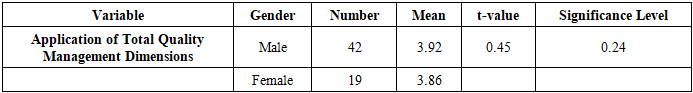

Main hypothesis: There is a statistically significant positive relationship between TQM application and financial performance in small companies.Statistical analysis revealed a positive correlation between the combined TQM dimensions (budget review, setting and analyzing indicators, evaluating and correcting deviations) and financial performance. Correlation coefficient=0.798 at a significance level of 0.000. The coefficient of determination is 0.637 which means that 63.7% of the change in financial performance is explained by TQM dimensions. Effect size B=0.798 F-value =103.63.This confirms that the implementation of TQM increases financial performance through increased production and reduced costs, hence supporting the main hypothesis.Sub-hypothesis 1: There is a statistically significant positive relationship between budget review and financial performance.The results indicated a positive significant correlation between firms’ commitment toward reviewing budgets and financial performance (r = 0.59, Sig = 0.000). This finding supports sub-hypothesis 1.Sub-hypothesis 2: A statistically significant positive relationship exists between setting and analyzing indicators and financial performance.A correlation significant at 0.688 was found between setting/analyzing indicators and financial performance. (Sig = 0.000) This supports the second sub-hypothesis.Sub-Hypothesis 3: A statistically significant positive relationship exists between evaluating and correcting deviations, and financial performance.A relatively high correlation was registered at r = 0.776 with a significance of Sig = 0.000, which means that assessment and correction of deviations strongly improve financial performance to make sub-hypothesis 3 valid.Sub-Hypothesis 4There are statistically significant differences in TQM dimensions by demographic variables (gender, age, experience).Gender: Using the t-test, results showed no significant differences (Sig = 0.24).Age: Using one-way ANOVA, no significant differences were found (Sig = 0.384).There were no significant differences (Sig > 0.05). This means that the perception of TQM application is not affected by any demographic variable.Table 7. Results of t-test for Gender Differences

|

| |

|

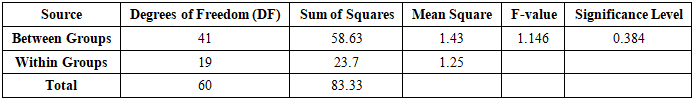

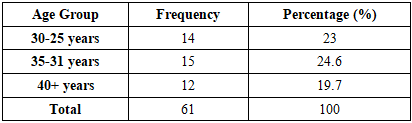

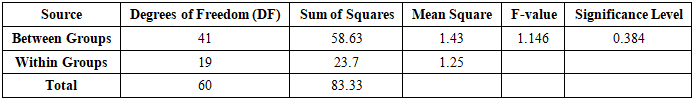

A one-way ANOVA test was conducted on the age variable to check if any differences were significant at the 0.05 level of significance. The result returned a significance value of 0.384, thus failing to reject the hypothesis since there is no statistically significant difference between the mean views of individuals from small enterprises on the levels of implementation of total quality management dimensions by age variable. This can be interpreted as irrespective of their ages, employees believe that companies pay minimal attention to reviewing budgets, setting indicators, and evaluating and correcting deviations which are integral elements within total quality management.Table 8. Results of ANOVA Analysis for Age-Based Differences

|

| |

|

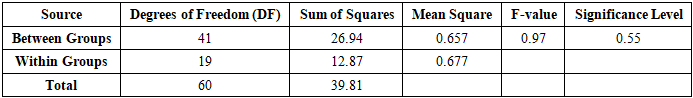

A one-way ANOVA test was run on the age variable to check if any differences were significant at the 0.05 level of significance. The result returned a significance value of 0.384, thus failing to reject the hypothesis since there is no statistically significant difference between the mean views of individuals from small enterprises on the levels of implementation of total quality management dimensions by age variable. This can be interpreted as irrespective of their ages, employees believe that companies pay minimal attention to reviewing budgets, setting indicators, and evaluating and correcting deviations which are integral elements within total quality management.Table 9. Results of ANOVA Analysis for Differences Based on Years of Experience

|

| |

|

Sub-Hypothesis 5: There are statistically significant differences in financial performance based on demographic variables.Tested using t-test and ANOVA:Gender: Sig = 0.45Age: Sig = 0.384Experience: Sig = 0.55All greater than 0.05, there are no statistically significant differences. The levels of financial performance in small companies are not influenced by the demographic variables of their financial managers.

4. Conclusions and Recommendations

Discussion of the Study ResultsResults revealed the effect that dimensions of Total Quality Management have on improved financial performance after statistical analysis between the relationship of TQM dimensions with financial performance in a sample group of small companies located within Beirut, accompanied by an assessment confirming that there are no statistically significant differences related to demographic factors among financial managers.The study showed that the majority of financial managers in small firms perceive TQM standards as being applied in their companies. They also confirmed the role of applying these standards in improving financial performance. This result differs from that of Kober et al. (2012) [3], whose analysis of financial data from 3,776 small firms found no evidence that TQM improves the financial performance of small companies.The study also showed that the dimensions of Total Quality Management collectively have a statistically significant relationship with improved financial performance. This finding is consistent with Hansson & Eriksson (2002) [31], which indicated that financial performance—measured through indicators—becomes more beneficial for companies that have successfully implemented TQM. It also aligns with Al-Da’as (2010) [11], which confirmed a statistically significant correlation between TQM dimensions and improved financial performance.Additionally, the results demonstrated a statistically significant positive relationship between the application of individual TQM standards—budget review, setting and analyzing indicators, and evaluating and correcting deviations—and improved financial performance. Regarding budget review, this result agrees with Onduso [32], which highlighted the importance of budgeting and its review in positively affecting the financial performance of manufacturing firms in Nairobi. As for setting and analyzing indicators, this finding supports Chapman et al. (1997) [33], who emphasized the role of indicators in improving financial performance.Furthermore, the study found no statistically significant differences between the mean responses of financial managers regarding levels of TQM implementation across demographic factors such as gender, age, and years of experience.RecommendationsBased on these findings, the study recommends adopting the Total Quality Management approach and committing to its dimensions—particularly budget review, setting and analyzing indicators, and evaluating and correcting deviations—in order to improve financial performance through reducing costs and increasing production.The researcher also recommends conducting a follow-up study using objective data such as financial records, cost‑reduction percentages, and production‑increase rates to validate the results of this study, which relied on the self‑reported responses of financial managers in small companies in Beirut.

References

| [1] | Maswadeh S, Al Zumot R. The effect of total quality management on the financial performance by moderating organizational culture. Accounting. 2021; 441–50. |

| [2] | National Research Council (U.S.). Rising to the challenge: U.S. innovation policy for the global economy. Washington, D.C: National Academies Press; 2012. 1 p. |

| [3] | Kober R, Subraamanniam T, Watson J. The impact of total quality management adoption on small and medium enterprises’ financial performance. Account Finance. 2012 June; 52(2): 421–38. |

| [4] | Kabbaji Damo, Awad Daba. The Impact of Using Total Quality Management System on Improving Financial Performance in Public Joint Stock Industrial Companies. Journal of the Open University of Jerusalem for Humanities and Social Research [Internet]. 2014 [cited 2025 Dec 11]; 2(32). Available from: https://journals.qou.edu/index.php/jrresstudy/article/view/8985. |

| [5] | Hubérac JP. Guide des méthodes de la qualité: Choisir et mettre en oeuvre une démarche qualité qui vous convienne dans l’industrie ou les services. Nouv. ed. Paris: Maxima-Laurent du Mesnil éditeur; 1999. |

| [6] | "Mawdoo3. Concept of Budget. [cited 2025 Dec 11]. Available from: https://mawdoo3.com/مفهوم_الميزانية". |

| [7] | Berrah L. L’indicateur de performance: concepts et applications. Toulouse: Cépadues. Ed.; 2002. |

| [8] | Shaib Ma'a. Hospital Management: An Applied Perspective: Contemporary Management: Performance Evaluation: Total Quality: Hospital Accreditation: Part Seven. Al Manhal; 2014. 470 p. |

| [9] | Al-Kasasbeh Wa'a. Enhancing Organizational Performance Effectiveness Through Information Technology. First Edition. Amman: Jordan: Al-Yazouri; 2011. 336 p. |

| [10] | Othmani M, Latresh W. The Impact of Total Quality Management on the Financial Performance of Economic Institutions – A Case Study of “NCA” Rouiba. Journal of Economics and Human Development. 2020 Aug 3; 10(3): 661–77. |

| [11] | Al-Da'as A. Total Quality Management and Its Impact on Improving Financial Performance: An Applied Study on a Sample of Jordanian Commercial Banks. Studies — Administrative Sciences. 2010; 37(1): 93.12. |

| [12] | Shrivastava RL, Mohanty RP, Lakhe RR. Linkages between total quality management and organisational performance: an empirical study for Indian industry. Prod Plan Control. 2006 Jan; 17(1): 13–30. |

| [13] | Agus A, Sagir RM. The structural relationships between total quality management, competitive advantage and bottom line financial performance: An empirical study of Malaysian manufacturing companies. Total Qual Manag. 2001 Dec; 12(7–8): 1018–24. |

| [14] | Feigenbaum AV. Dr. Armand V. Feigenbaum | The Feigenbaum Foundation [Internet]. The Feigenbaum Foundation | Dedicated to improving the quality of life in the Berkshires. 2013 [cited 2025 Dec 11]. Available from: https://www.feigenbaumfoundation.org/about/dr-armand-v-feigenbaum/. |

| [15] | Brinkman R. Quality assurance in analytical laboratories: Practical guidelines for soil and plant laboratories. Food and Agriculture Organization of the United Nations. |

| [16] | Best M, Neuhauser D. Joseph Juran: overcoming resistance to organisational change. Qual Saf Health Care. 2006 Oct 1; 15(5): 380–2. |

| [17] | Deming WE. Out of the Crisis. Cambridge: MIT Press; 2000. 1 p. (MIT Press Ser). |

| [18] | Saunders RR, Saunders JL. W. Edwards Deming, Quality Analysis, and Total Behavior Management. Behav Anal. 1994 Apr; 17(1): 115–25. |

| [19] | Goetsch DL, Davis SB. Quality management for organizational excellence: introduction to total quality. 7. ed. Harlow: Pearson Education Limited; 2014. 468 p. (Always learning). |

| [20] | Kamiske G, Brauer JP. Management de la qualité de A à Z. Paris: Masson; 1997. |

| [21] | Invest Northern Ireland. What are quality management standards? [Internet]. INI; n.d. Available from: https://www.nibusinessinfo.co.uk/content/what-are-quality-management-standards#:~:text= Quality%20management%20standards%20are%20details,the%20needs%20of%20their%20users. |

| [22] | Sarn R. Total Quality Management - Functions and Tools Approach. Rslan Publishing, Printing, and Distribution House; 2016. |

| [23] | Duffy GL. The ASQ Quality Improvement Pocket Guide: Basic History, Concepts, Tools, and Relationships. 1st ed. La Vergne: Quality Press; 2013. 1 p. |

| [24] | Mostafa H. Quality Costs [Internet]. [cited 2025 Dec 12]. Available from: https://ae.linkedin.com/pulse/%D8%AA%D9%83%D8%A7%D9%84%D9%8A%D9%81-%D8% A7%D9%84%D8%AC%D9%88%D8%AF%D8%A9-quality-costs-hossam-mostafa. |

| [25] | Pacific Crest Group. Applying key performance indicators to build your business [Internet]. Pacific Crest Group; 2012. Available from: https://www.pcg-services.com/wp- content/uploads/2012/12/Applying_Key_Performance_Indicators_to_Build_Your_Business.pdf. |

| [26] | Cokins G. KPIs – financial and non-financial. 2013. |

| [27] | Lee AHI, Chen WC, Chang CJ. A fuzzy AHP and BSC approach for evaluating performance of IT department in the manufacturing industry in Taiwan. Expert Syst Appl. 2008 Jan; 34(1): 96–107. |

| [28] | AlFerjany AA, Salama A, Abu Amuna Y, Shobaki M, Abu Naser S. The Relationship between Correcting Deviations in Measuring Performance and Achieving the Objectives of Control - The Islamic University as a Model. Int J Eng Inf Syst. 2018 Jan; 2(1): 74–89. |

| [29] | Rabeh Ram. Principles of Business Management. Al Manhal; 2014. |

| [30] | Khadiri S, Saadani A, Nini Aa. The Impact of Corporate Governance on Financial Performance in Algerian Economic Institutions: A Field Study (Sonelgaz-Wadi Company). 2018 [cited 2025 Dec 11]; Available from: https://dspace.univ-eloued.dz/handle/123456789/1908. |

| [31] | Hansson J, Eriksson H. The impact of TQM on financial performance. Meas Bus Excell. 2002 Dec 1; 6(4): 44–54. |

| [32] | Onduso EO. The effect of budgets on financial performance of manufacturing companies in Nairobi County [Internet] [Thesis]. University of Nairobi; 2013 [cited 2025 Dec 12]. Available from: http://erepository.uonbi.ac.ke/handle/11295/63511. |

| [33] | Chapman RL, Murray PC, Mellor R. Strategic quality management and financial performance indicators. Int J Qual Reliab Manag. 1997 June; 14(4): 432–48. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML