-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Human Resource Management Research

p-ISSN: 2169-9607 e-ISSN: 2169-9666

2019; 9(2): 23-32

doi:10.5923/j.hrmr.20190902.01

The Effects of Human Resources Practices in Libyan Banks Sector Effects on Client Behaviour Intention to Subscribe in Islamic Finance System

Khairi Mohamed Omar1, Abdullah Hj Abdul Ghanib2, Adel Ali Yassin Alzyoud1, Belal Sadiq Hamed Rababh1

1Assistant Professors at Business Administration Department, College of Administrative Science, Applied Science University, Bahrain of Kingdom

2Professors at School of Business Management, UUM College of Business, University Utara Malaysia, Kedah, Malaysia

Correspondence to: Khairi Mohamed Omar, Assistant Professors at Business Administration Department, College of Administrative Science, Applied Science University, Bahrain of Kingdom.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study aims to investigate the human resources practices in Libyan public banks and the moderating effects of the government support on the relationship of human resources practices in Libyan banks sector (service quality) and the intention to subscribe in the Islamic finance system in the banking sector. The study looks into the bank’s human resources management, service quality provided by the banks. The study reported results of surveys taken by Libyan’s bank clients. Using a primary data collection method 400 questionnaires were distributed to target respondents comprising of Libyan banking subscribers from several cities in Libya. 226 questionnaires returned representing 56.5% response rate. The data were analyzed using Structural Equation Modeling (SEM) version 22. The study proposes one direct causal effects and one moderating effect variable in the structural model. Service quality provided by banks found to be significantly affected on clients’ intention, where government support found to be a valid construct in the prediction of the intention to subscribe in the Islamic finance system in the Libyan banking sector. The study results may lack generalizability. Further research need to be considered using different variables.

Keywords: Islamic finance system, Human Resources Management, Banking Sector, Libya, Behavior Intention

Cite this paper: Khairi Mohamed Omar, Abdullah Hj Abdul Ghanib, Adel Ali Yassin Alzyoud, Belal Sadiq Hamed Rababh, The Effects of Human Resources Practices in Libyan Banks Sector Effects on Client Behaviour Intention to Subscribe in Islamic Finance System, Human Resource Management Research, Vol. 9 No. 2, 2019, pp. 23-32. doi: 10.5923/j.hrmr.20190902.01.

Article Outline

1. Introduction

- Sharia Compliant Financial System (SCFS) is a financial system which is governed by Islamic law (Sharia) principles. The fundamental feature of the Sharia Compliant Financial System is the prohibition in the Quran of the payment and receipt of interest usury (Riba). The strong disapproval of interest of Islam and the vital role of interest in modern commercial banking systems led Muslim thinkers to explore ways and means by which commercial banking could be organized on an interest-free basis.Basically, unlike conventional finance system, SCFS undertakes its operations with no paying either receiving any Riba “Interest”. The first developed of the Sharia compliant financial system was in the 1950s and lead to the establishment of the first generation of the Sharia compliant investment banks in Egypt as well as Malaysia in the early 1960s. There are a big difference between the two systems (Conventional and the Sharia Compliant Financial System) in terms of profitability (Bakar, 2010; Hanif, 2011; Loghod, 2007). This system has spread to become an increasingly significant segment within the global financial market, it has been recognized as a viable model and competitive financial intermediation in the Muslim countries as well as outside the Muslim world and offers a wide range of financial products and services. SCFS has shown that began on a modest scale since its inception as a new vision of Islamic finance banking system in the mid-1970s rapid expansion and development over the past three decades, which become one of the fastest growing industries recorded an annual growth rate of double-digit for almost 30 years (Al-omar & Iqbal, 2011; Macmillan, 2006; Molyneux, 2005). The amount of the Sharia compliant finance system organization “Institutions/ banks” around the globe are goes above 500 (The Banker, 2010). More than 284 financial institutions operating as a fully-fledged of Islamic finance system” in 38 countries and manage more than 250 billion US dollars (CIBAFI, 2016). This does not include conventional banks that offer financial products and services through the Islamic window operations “dual-system”, which appreciates CIBAFI to manage about 200 billion US dollars (Oseni, 2013). Sharia-compliant finance system has proved its existence as a new strong competitor to play important role in the financial market. Hence, an amount of conventional banks such as Citibank, Barclays, and so on, offering Sharia compliant products and services (Karbhari, Naser, & Shahin, 2004). The recent unprecedented achievements of Islamic banking have led the International Monetary Fund (IMF) and the World Bank to recognize Islamic financial products as valid means of financial mediation and have published studies and papers to this effect. In Libya, for hundreds of years Islam has been the official religion (Lapidus, 2002). During the 1970s, Islam in Libya played a major role in legitimizing spheres of political and social reform, but not in the realm of economics and finance. Soon after taking office, the revolutionary government expressed a clear desire to exalt Islam and restore it to its proper central place. Several steps have been taken by successive governments trying to prove themselves as a devout Islamic government. During the time of the previous government, Libyan banking sector witnessed the significant transformation, characterized for more than three decades by massive state intervention in the commercial banking sector (Omar & Abdul Ghani, 2016). This transformation has led the sector to unacceptable performance and to be less diverse in term of its banking services and products compared to other developing countries. This study aimed to explore the possibility of practicing the SCFS and its banking method’s in Libyan context by analyzing it within the larger body of Libyan banking and the transformation it has taken. The study analysis is purely academic and does not suggest or imply a certain path for the state and monetary authorities to follow. The research simply describes the situation as it is and explains how they could appear in the event of Islamic banking establishing a presence.

2. Research Issue

- The market power and pure technical inefficiency that has largely resulted in the overall inefficiency of Islamic banks, does not significantly impact on efficiency in the Middle East; there still ambiguity for that assumption whether Sharia Compliant banks from outside the Middle East region are relatively new and very much supported by their regulators (Tahir, Bakar, & Haron, 2011; Yudistira, 2004). There are very limited studies confined themselves to the conventional bank’s clients’ satisfaction and leave unanswered questions about the actual reason behind on-going practices and effective use and adopting of the SCFS in the banking sector. Gait, (2009) stated that, there is a need to investigate the relationship between service quality and clients’ intention and satisfaction in developing countries. The relationship between service quality CARTER model, behavioral intention to subscribe the SCFS, is inconclusive, in consequence studies provide mixed results with regard to this relationship. A study conducted by Gait and Worthington, (2008), resulted that around 72.3% of the Libyan business firms have the tendency to use the SCFS productions, regardless of informal practice of the SCFS institutions in the country.In the context of Libyan banking sector, without the cooperation between the government and the banking sector, low development of Sharia financial system industry will arise which will render them unable to tackle the challenges and the issues that are hindering local brand development (Numan, 2008). Kaynak, (2000) revealed how companies in Bangladesh receive government supervision for them to serve the consumers’ needs in a superior manner. Several studies have established a positive and negative relationship of perceived behavioural control and purchase behaviour (e.g. Antonia et al., 2009; Marie et al., 2009; Morven et al., 2007). Besides, there is a part of the research problem which is the mixed and inconsistency of findings regarding the service quality (CARTER Model) factors influencing client satisfaction as well as clients' behavior intentions (Ranjbarian et al., 2010; Karim, 2012; Osman, Ali, Ramdhani, Ramdhani, & Kurniati, 2011; Estiri, Hosseini, Yazdani, & Nejad, 2011; Gan et al., 2011).Moreover, inconsistent findings were found regarding the effect and relationship of CARTER Model and clients' behavior intentions, while some authors indicated a positive relationship between these variables (Marie et al., 2009; Ramdhani et al., 2011; Mangku Rasywal, 2009; Othman & Owen, 2001), others reported a negative relationship and effect (Klein et al., 1998). In addition, the findings regarding the mediating role of purchase intention of the product showed inconsistencies of results (Kaynak et al., 2000; Marie et al., 2009; Lee, et al., 2010; Margaret & Thompson, 2000; Klein et al., 1998). It’s worthy to address the issue of the lack of studies regarding client satisfaction as well as behavior intention to subscribe the SCFS (Zolait et al, 2009; Morven et al., 2007). Further theoretical and empirical research on the new intervening factors that might effect on consumers’ financial decision and economic making is needed (Gait & Worthington, 2008). Trust, human resource service quality dimensions provided by the banks, uncertainty in many aspects and government support in general are seems to be the main challenges’ facing the adopting or developing of any new system in most of the organizations and countries facilities (Omar & Abdul Ghani, 2016). Unfortunately, there are limited studies related to this assumption especially in the case of Libyan banking system.

3. Research Objectives

- Driving from the aforementioned research issue formulation, this study devoted to achieving the following research objectives:1. To determine the effects of the human resource management service quality dimensions (CARTER model) on the behavioral intention to subscribe the SCFS.2. To what extent government support effects on the relationship between the SERVQUAL (CARTER model) and behavioral intention to subscribe the SCFS.

4. Literature Review

- The following reviewing of the relevant studies and underpinning theories which addressed the client behavior intention, as well as the relationship between targeted variable’s, in this study.

4.1. Underpinning Theories of Study

- Where the behavior intention discussed in several theories such as (e.g. Theory of Reasoned Action, Theory of Planned Behavior), however, this study focuses on the CARTER Model and used as the main underpinning theory of the study, which will be discussed in the following discussion:

4.2. Service Quality Theory and (CARTER Model)

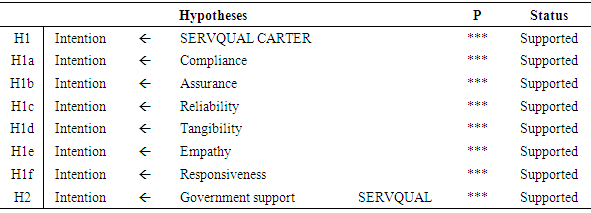

- CARTER is an extension of the SERVQUAL model, this new model was developed by Othman & Owen, (2001); it is the outcome of an effort to implement the achievement of service quality measurement in the banking services business based on Sharia principles. The CARTER model contribute by adding a one dimension to the five dimensions model of SERVQUAL; namely (Compliance) which defined as “the ability to fulfill with Islamic law, and operate under the principles of Islamic Banking and economies” (Ramdhani, Ramdhani, & Kurniati, 2011). However, as to the traditional interpretation the quality definition’s refers to compliance with internal prescriptions and standard; then it was identified with suitability for use; in the most current interpretation of the word, quality means not just meeting/exceeding consumer or clients’ needs, rather than meeting/exceeding environmental, social expectation see figure 1.

| Figure 1. The interpretation development of quality (Source: Becser, (2007), Kormos & Dörnyei, (2000)) |

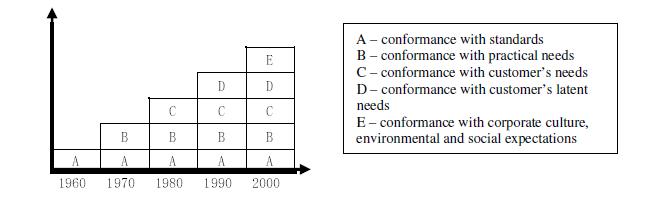

| Figure 2. A multidimensional and hierarchical model of mobile service quality (Source: Lu. Zhang, & Wang, (2009)) |

4.3. Behavior Intention and the Service Quality

- Behavioral intention has been defined by Swan and Trawick, (1981) as an individual’s planned future behavior. It has been associated with observed behavior by Ajzen & Fishbein, (1977), which is grounded on three constructs, namely attitude, subjective norm and perceived behavioral control. However, the literature is reach of several studies and theories which have been addressing the behavior intention in different aspects (Ajzen, Lcek & Fishbein’s, 1992; Ajzen, 1991b; Ajzen & Madden, 1986; Netemeyer & Bearden, 1992; Netemeyer & Ryn, 1991). Nevertheless, in comparative study between these well pronounced theories: theory of reasoned action, theory of planned behavior and the Miniard and Cohen Model, conducted by Netemeyer, Andrews, and Durvasula, (1993) reported that, intention represents the direct antecedent to behavior the perceived behavioral control component of Theory of Planned Behavior (TOPB), as stated by the Theory of Reasoned Action Behavior (TRAB) (Wungwanitchakorn, 2002). Taylor and Todd, (1995) studied the consumer adoption intentions for a new product, they offer an alteration of TRA by classifying attitudinal beliefs into relative advantage, compatibility and complexity, which were found to be related to attitude, which in turn is related to costumers’ purchase intention.According to ZeithamI et al., (1996) they suggested a conceptual model discusses the behavioural intention of the clients as one of the service quality elements consequences. However, in their model; they argue that the level of the client and propose service quality elements as well as the behavioural intentions are related; therefore, services quality are contributing factors of whether a client in the end will remains with or abandoned/defects from a company. However, ZeithamI et al., (1996) proposed that; positive behavioural intentions are associated with several quality elements' of service. Moreover, the authors suggested that more research on this regard need to be done specially; when it comes to the reliability and the measurement scale and items. It’s worthy to mention that clients usually seats more weight on the moderators factors and issues such “bank’s reputation, good dealing of bank staff act..” (Othman & Owen, 2001). All of these elements give the impression to be basis probably influence the level of client behavior intention in both systems either conventional or Islamic finance system banks/institutions. Furthermore, once the clients’ perception of any service quality is high; the behavioural intentions will be high as well, which will make relationship with the organization stronger and vice versa.This intention of the behavioural assumed to be an indication of clients' behaviour which can be as consequences of the attitude based behavioural. Valarie, Leonard Berry, & Parasuraman, (1996), recommended behavioural intentions to be indicators, which showed whether clients had remained with or had defected from the organization. Hence, the concept of behavioural intention is a vital part of the model. Yet, the relationship between service quality dimensions and the multi-dimensional model of behavioural intention has not been adequately investigated in the service quality literature (Baker & Crompton, 2000; Bloemer et al., 1998). Contradictory results were reported in terms of the relationship between the overall service quality and behavioural intention (Bloemer et al., 1998) Ravichandran et al., 2010; Cronin, & Taylor, 1992). According to Boulding, Kalra, Richard Staelin, & Zeithaml, (1993), overall service quality perception has a positive relationship with willingness to recommend, and negatively related to switching and complaining behaviour. Research in regarding service quality using other service qualify scale to examine the relationship between service quality of behavioral intentions is needed. Furthermore, the relationship between service quality dimension and the multi-dimension model of behavioural intentions is still limited (Valarie et al., 1996; Liu et al., 2013). Actually, this controversy left the door opened and have generated a new call for research. Indeed, there is little empirical research demonstrating the importance of service quality dimensions in determining behavior intention of clients (Baker & Crompton, 2000; Bloemer et al., 1998). The causal relationship among service quality and behavior intention is still an area under discussion of great academic debated and no consensus has been reached (Joseph Cronin et al., 2000; Theodorakis & Alexandris, 2008). Nonetheless, there are several studies which had identified several dimensions which can determine client behavior intentions’ in the banking industry as well as other sectors in a variety of countries. Therefore, based on the previous discussion, the following hypothesis was formulated to be empirically tested:Hypothesis 1: Service quality dimensions (CARTER model) will have a direct relationship with the client behavior intention to subscribe the Sharia compliant financial system.Hypothesis 1a: Compliance will have a direct relationship with the intention to subscribe the Sharia compliant financial system.Hypothesis 1b: Assurance will have a direct relationship with the intention to subscribe the Sharia compliant financial system.Hypothesis 1c: Reliability will have a direct relationship with the intention to subscribe the Sharia compliant financial system.Hypothesis 1d: Tangibles will have a direct relationship with the intention to subscribe the Sharia compliant financial system.Hypothesis 1e: Responsiveness will have a direct relationship with the intention to subscribe the Sharia compliant financial system.Hypothesis 1f: Empathy will have a direct relationship with the intention to subscribe the Sharia compliant financial system.

4.4. The Relationship between Government Support and Behavioral Intentions

- Mahul and Stutley, (2010) defined the government support as the market and regulatory impediments which are often invoked to justify public intervention in the provision of any new market or industry, which need to be identifying and address by the government support of its impediments to help the industry in order to complement their risk management activities with potentially cost-effective financial tools such as insurance. Offering government’s support for certain industry is part of the government’s overall policy, which may seek to correct the market and regulatory inefficiencies and be part of broader objectives. In the other hand, Triandis, (1979), defined the government support as facilitation of the condition which translates into how available the resources which are needed for the behaviour are to be carried out. Nor, Bin, Rafi, and Yaacob, (2010) stated that, business support can be divided into two categories:1. Government or organization can financing "financial support" the institution as a sort of support (e.g. Property loan, working capital and grant, etc.) and;2. The nonfinancial support such as courses, advisory, management, distribution, research and development (Yusoff & Yaacob, 2010).The variables for government business support will be measured in terms of the extent of Sharia-compliant financial institutions support business management, encourage business innovation and expansion; improve business efficiency (Gait & Worthington, 2009). The government use to have a significant influence on the development of any emerging financial business or service e.g. Sharia-compliant banking products (Hamid, 2006). This study hypothesizes that business support of Sharia-compliant financial banks and agencies that provide Sharia-compliant financial system will moderate the relationship of SERVQUAL (CARTER) dimensions the level of the users of Sharia-compliant financial system productions satisfaction which will shed light on the intention to subscribe within the Sharia-compliant financial system as well. However, as suggested by Kaynak et al., (2000) through their conducted in Bangladesh, financial institutions and banks can get government supervision so that they can serve the needs of consumers in a better way. Based on Antonia et al., (2009) reported that, economies may exhibit a competitive outcome in the global market in cases where government policies promote the local product brand. Government policies facilitating the promotion of local product brand’s development and dynamic innovation provide firms with an environment characterized as competitive for survival as well as the labor laws and appropriate staff legislation. Both elements can impact employment and economic progress viability. Gary and Knight (1999) stated that, national governments are desirous of reducing imported products through their influence on consumer purchase behaviours and actual behaviours to purchase local products. Knight suggests that, “consumers provide a little consideration to the importance of a given product to the national manufacturing base”. Hence, education programmers should maximize consumers’ awareness of the importance of production. However, in the context with Libya, without the cooperation between the government and the banking sector, low development of Sharia financial system industry will arise which will render them unable to tackle the challenges and the issues that are hindering local brand development (Numan, 2008). In addition, Kaynak et al., (2000) revealed that, how companies in Bangladesh receive government supervision for them to serve the consumers’ needs in a superior manner. Amin, Rahman, and Hwa, (2011), conducted study by using two full-fledged Sharia compliant banks in system in Malaysia and concluded that; more similar research is hoped to be carried on regards to the use of the emerging Islamic financial product. Other potential determinants of the intention to use Islamic personal financing have to be considered (Amin et al., 2011). Previous study emphasized on the need of study the on the culture moderation effect in the relationship between service quality and behavioral intention (Theodorakis & Alexandris, 2008; Yavas, Benkenstein, & Stuhldreier, 2004). On the basis of the above discussion, the following hypotheses was formulated:Hypothesis 2: Government support will moderate the relations between SERVQUAL dimension’s (CARTER model) and the intention to subscribe the Sharia compliant financial system.Based on that, this study addresses the following assumptions which will be formulated as study's hypothesis, Figure 3 displays the direct hypotheses testing of research structural model before and after fit.

| Figure 3. Research framework (Direct Hypotheses Testing Model) |

5. Research Methodology

- The study employed quantitative research design by administering primary data collection via a questionnaire. The study conducted in Libya. Out of 400 questionnaires distributed to Libyan bank subscribers, 226 respondents completed and returned the questionnaires, represents about 56.5% percent response rate.

5.1. Instrument

- In order to examine the research questions of the study and testing the hypothesis, the questionnaire was used as a medium to obtain the data needed, which was developed depending upon the previous instruments as follows: Behavior Intention to subscribers the Sharia Compliant Financial System, CARTER Model elements, Government support, measures were adopted from several sources such as: Triandis, (1979); Amin, Rahman, & Hwa, (2011); Othman, & Owen, (2001); Sadek et al., (2010); Parasuraman et al., (1988); Ananth et al., (2011); Kumar et al., (2009). The questionnaire comprised of five pages divided into four parts comprise of 7-point Likert scale to evaluate the level of agreement of respondents with the variables.

5.2. Data Analysis Procedures

- The data were analyzed through Structural Equation Modeling (SEM) AMOS version (21). The confirmatory factor analysis of measurement models indicates adequate goodness of fit after the elimination of few items through modification indices verifications.

6. Findings

6.1. Demographic Profile of the Respondents:

- The respondents’ ages ranged from nineteen to forty-six years old averaging 31 years old. The male respondents were 86.9% and the female respondents were 13.1%. Most of The respondents were government staff with (64.2%) followed by private sector bank subscribers (21.2%) and self-employed (14.6%). Their education varies from the tertiary school certificate (48.6%), Master’s degree (18, 5%), Bachelor’s degree (18.7%), PhDs (9.3%) others (4.9%).

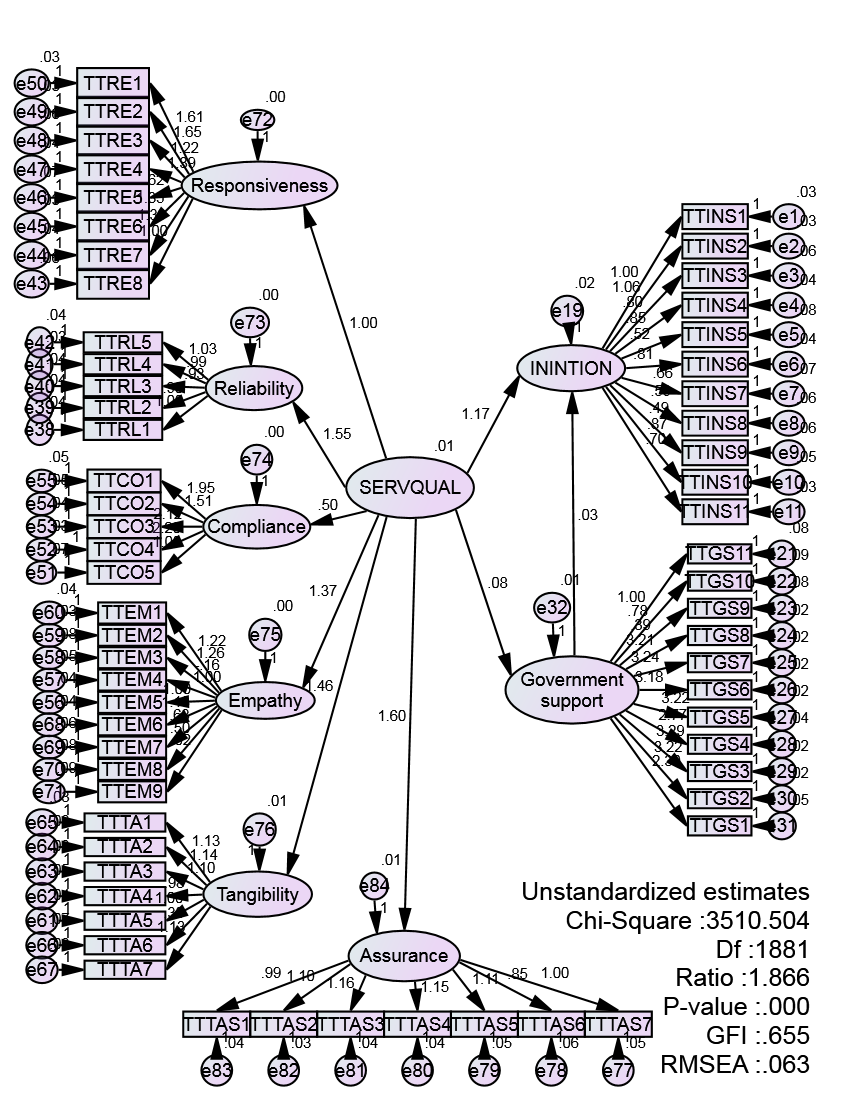

| Figure 4. Research framework (Direct Hypotheses Testing Model before fit with all items) |

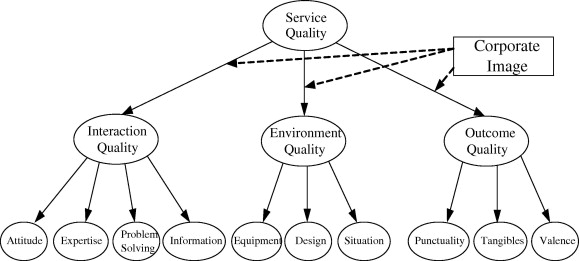

6.2. Goodness of Fit of Structural Model

- To arrive to the structural model, Confirmatory Factor Analysis (CFA) was conducted on every construct and measurement models. The goodness of fit is the decision to see the model fits into the variance-covariance matrix of the dataset. The CFA, measurement and structural model have a good fit with the data based on assessment criteria such as Goodness Fit Index (GFI), Comparative Fit Index (CFI), Tucker Lewis Index (TLI), Root mean square Error Approximation (RMSEA) (Bagozzi & Yi, 1988). All CFAs of constructs produced a relatively good fit as indicated by the goodness of fit indices such as CMIN/df ratio (<2); p-value (>0.05); Goodness of Fit Index (GFI) of >0.95; and root mean square error of approximation (RMSEA) of values less than 0.08 (<0.08) (Hair et al., 2006). Finally, the goodness of fit of generated or revised model is achieved see figure 4. GFI of the revised structural model is 0.936; Root Mean Square Error Approximation (RMSEA) is 0.006; p-value is 0.460, CMIN/df ratio is 1.007.

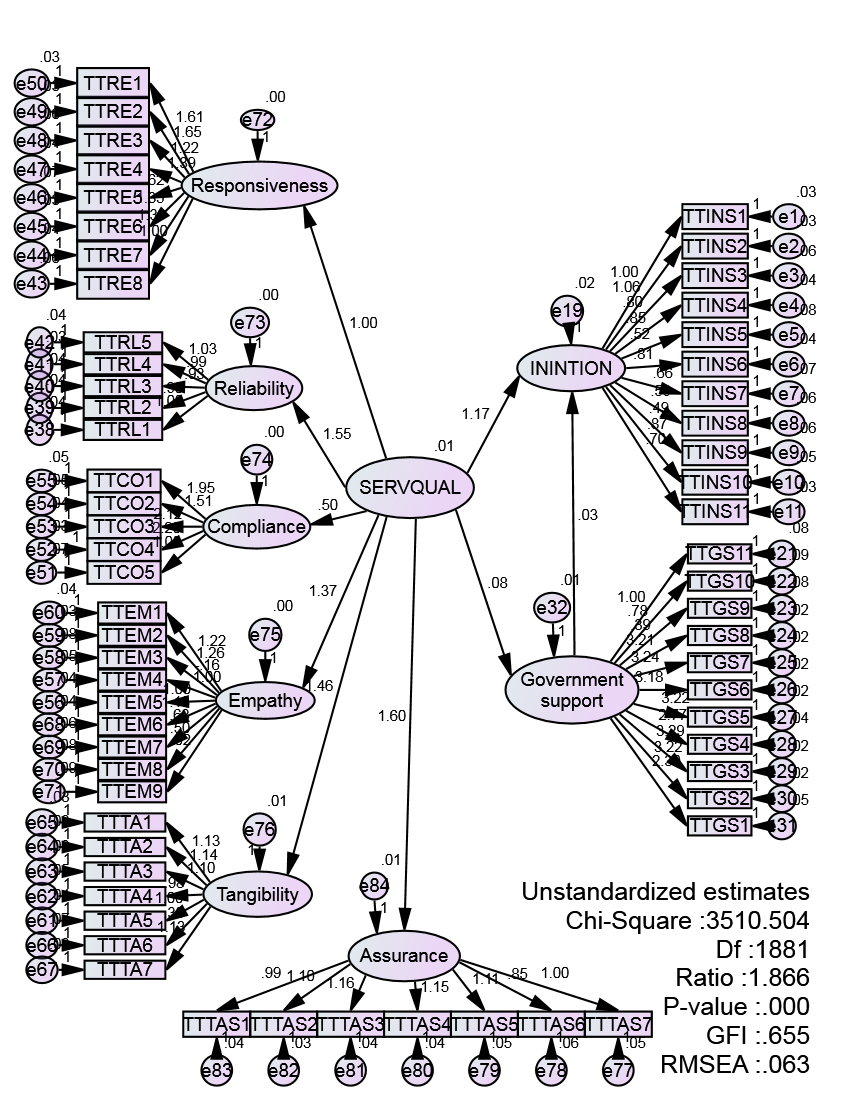

6.3. Hypotheses Testing

- From the analysis result of the hypotheses, it can be conclude that out of five porposed hypotheses three hypotheses were founded to be positively, where the behavioral intention found to be have no relationship with clients compliance, this however, it can be explained in the view that; people do not have enough confidence to be copolined with the IFS in Libyan banks contact. Table 1, was made as summary to these hypotheses result:

|

7. Discussion and Conclusions

- To recapitulate, the main objective of this study was to investigate the direct relationship between SERVQUAL (CARTER model) and the behavioral intention to subscribe the SCFS in Islamic countries such as Libya, where the paper aimed as well to understand the moderation role of government support in between this relationship. The study has established three direct causal effects: 1) SERVQUAL (CARTER model), and behavioral intention to subscribe the SCFS; 2) and behavioral intention to subscribe the SCFS; and 3) and government support and behavioral intention to subscribe the SCFS. Interestingly, this study also managed to present first-time findings on two moderating effects: 1) government support, moderating the relationship between SERVQUAL (CARTER model), and behavioral intention to subscribe the SCFS; and 2) moderating the relationship between SERVQUAL (CARTER model) and behavioral intention to subscribe the SCFS. Empirical evidence from this study shows that there is a significant and positive relationship between overall SERVQUAL (CARTER model), and behavioral intention to subscribe the SCFS in Libya wich aligen with severl studies e.g Boulding et al., (1993), Valarie et al., (1996) and Ravichandran et al., (2010).This result indicates that Libyan consumers have high intention to subscribe SCFS. The study has some limitations which could create opportunities for future research. A dealer of a particular type of SCFS production categories (e.g. Mudarabah) needs to be investigated. Therefore, product categories should be examined in future research. Hence, the findings of this empirical study hoped to provide insights for literature and even to the decision-makers in Libyan banking sector. The findings of this study is an important in terms of the theoretical view as well, it is due to its contribution in the way of insight on how human resource management in the banks deals with such new promising system that being adopted either dual or fully Islamic banking systems in order to give further consideration to it is clients, where it is obvious from the study result that clients are becoming more conscious about SCFS. Finally, there are limited studies on SCFS, particularly in North Africa countries, a lack of studies regarding clients intention in the human resource perspectives is very obvious; whereby, few studies limited themselves on the client's behaviors in terms of market needs from the management and government support. This study has applied CARTER model in order to explain client’s intention to subscribe SCFS. The study reported that service quality elements have an important role in the clients’ intention to join the SCFS. The Libyan government should give more intention to such market, where it is indicated that there is a very low support to this industry. It is important that, government has to work in line with the private sector in the way to motivate them to operate in a smooth way and invest in this promising system.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML