-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Human Resource Management Research

p-ISSN: 2169-9607 e-ISSN: 2169-9666

2018; 8(2): 23-33

doi:10.5923/j.hrmr.20180802.01

Role of Budgeting Practices in Service Delivery in the Public Sector: A Study of District Assemblies in Ghana

George Kojo Scott1, Francis Enu-Kwesi2

1Secretary General, African Association for Public Administration and Management (AAPAM)

2Institute for Development Studies, University of Cape Coast, Cape Coast

Correspondence to: George Kojo Scott, Secretary General, African Association for Public Administration and Management (AAPAM).

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This research analysed the role played by budgeting as practiced in the district assemblies of Ghana towards service delivery. The research adopted a mixed-method research design where qualitative and quantitative data were gathered using questionnaires, interviews, focus group discussions and document analysis. The study used multistage sampling to pick the respondents for the questionnaires, key interview informants and the participants in the focus group discussions. Thirty four out of 170 district assemblies which existed by 2008 were sampled. Participants in the study included 612 District Assembly (DA) officials, 1020 citizens, 28 national/regional officials and 20 participants in focus group discussions. Quantitative data, measured by using scaled-items, were analysed using descriptive statistics and regression while qualitative data were examined thematically. The findings showed that citizens rated service delivery poorly, while district assembly officials rated service delivery as satisfactory. The study established that budgeting practices had positive significant influence on service delivery. The study findings have significant implication on the public administrators, citizens and scholars as it established the importance of having in place proper budgeting practices if the public sector decentralised governments and agencies will be able to deliver satisfactory services to the public especially in the African context.

Keywords: Public Financial Management, Budgeting, Service Delivery, District Assemblies and Equity

Cite this paper: George Kojo Scott, Francis Enu-Kwesi, Role of Budgeting Practices in Service Delivery in the Public Sector: A Study of District Assemblies in Ghana, Human Resource Management Research, Vol. 8 No. 2, 2018, pp. 23-33. doi: 10.5923/j.hrmr.20180802.01.

Article Outline

1. Introduction

- The need for prudent public financial management for development objectives to be achieved is emphasised in many circles. For example, while underlining the importance of favourable environment for undertaking productive economic activities as necessary for development, the World Bank (2011) emphasizes the need for developing countries to ensure efficient management of funds. In the same vein, Jordaan (2013) observes that understanding public financial management is imperative as it forms an integral element in national development and growth which is central to the existence of functional governments.Budgeting which is one of the key components of the public financial management has been termed as the genesis of functional public administration. Tyer and Willand (1997) define budgeting as valuation of receipts and expenditures or a public balance sheet, and as a legislative act establishing and authorizing certain kinds and amounts of expenditures and taxation. Horngren et al. (2004) described a budget as the quantitative expression of a proposed plan of action by management for a specified period, while Blumentritt (2006) defines budgeting as the process of allocating an organization's financial resources to its units, activities and investments. In many countries, governments are utilizing decentralization tools for poverty reduction, improving representation of the poor and better targeting of service delivery (Jütting et al., 2004). Decentralized budgeting has thus become crucial, and the need for proper budgeting practices has been identified as essential for developing nations, including those in Africa. Siswana (2007) notes that proper budgeting assists public sector entities to ensure that expenditure patterns in relation to programmes and projects occur within a budgeted vote. Furthermore, as noted by Russell and Bvuma (2009) there is a need to plan, budget for and implement actions which have the potential of radically improving the reach, accessibility and quality of service delivery in the African public sector. According to Tsheletsane and Fourie (2014), financial management fulfils an important role in the South African public sector, because without public funds to cover operational and capital costs, and without appropriate personnel, no public institution can render effective services. This paper looked at budgeting as practiced in the DAs where issues on budgeting policies, processes, persons involved as well as public dissemination of the budgets were analyzed and how they influence service deliver.The case for decentralization and decentralized budgeting remains strong especially in Africa (Hope, 2014) where countries such as Kenya, Tanzania, Uganda, Ghana, Nigeria and South Africa have adopted varied strategies to strengthen decentralization (Finch, 2015). These strategies have covered several areas of decentralization including human resource management and financial management (Kinemo et al., 2015). In Ghana, decentralization has taken the form of District Assemblies since 1992. Decentralized budgeting practices in Ghana have been linked to attempts to reduce inequity, since over time citizens have not gotten the desired fruits of equitable resource allocation. Inkoom (2011) highlights the agency problems, noting that there is conflict in the budgeting process because district assemblies are required to budget and report by integrating all the decentralized sectors, while the sector ministries execute financial reports on sectoral lines. In addition, Inkoom observes that the national budgeting and accounting systems are difficult to align with the accounting needs at the local levels. Moreover, on the basis of allocative efficiency, Speer (2012) argues that though large amounts of financial resources are allocated for service provision to the decentralized governments, financial management practices have remained the weak link.Despite the benefits that can accrue from a clear understanding of the link between budgeting and service delivery in public sector entities, available studies on this subject are still in their infancy. Ahmad and Brosio (2009) noted that the question of how to improve public sector service delivery remains a key concern for scholars and policy makers in line with the New Public Management (NPM) and allocative efficiency tenets. This is reinforced by Essuman and Akyeampong (2011) as well as Inkoom (2011) who contended that after more than two decades since the adoption of decentralization in Ghana, there remained valid concerns which need to be studied through continuous robust theoretical and empirical analysis. It is from this perspective that the study assessed the influence of budgeting practices adopted by District Assemblies in Ghana on service delivery, with the main proposition that the budgeting practices do not significantly affect service delivery.

2. Literature Review

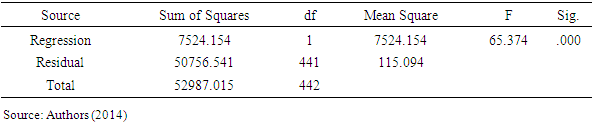

- Norton (2006) creates the link between budgeting and planning, indicating that planning is an intelligent behavior that involves visualizing the future, imagining what results one expects to achieve and determining the activities and resources needed to achieve those results. In addition, Jordaan (2007) defines a budget as a quantified, planned course of action over a definitive time period, comprising estimating inputs and the costs of inputs along with associated outputs and revenues from outputs. Achim (2009) as cited by Pintea et al. (2013) on the other hand indicates that budgeting is the activity of recording financial and/or non-financial elements into the budget. According to Hyde (1992) as cited by Khan and Hildreth (2002), budgeting is partly political, partly economic, partly accounting and partly administrative. Michel (2002) adds that the budget is also a communication tool. As a political document, it allocates the scarce resources of a society among multiple, and competing interests (Wang, 2002), while as an economic document, it serves as the primary instrument for evaluating a jurisdiction’s economic growth and development, and that as an accounting document, it provides a ceiling on government spending and makes it legally binding for it to live within the allocated funds (Bartle & Shields, 2008). As an administrative document, the budget specifies the ways and means by which public services are provided, and establishes criteria by which the services are monitored, and evaluated (He, 2011). The budget as a communication tool helps decision makers to make informed choices about the provision of services and capital assets and to promote stakeholder participation. As a communications device, the budget allows public officials to interact and engage with citizens and taxpayers (Lapsley & Ríos, 2015). Lu and Willoughby (2015) argue that administrative and communication capacities of budgets are important in ensuring transparency and accountability in the management of public funds. The importance of budgeting was emphasized by Ekholm and Wallin (2000) who noted that budgets, as a control practice, have always played a key role in managing institutions by providing a roadmap for future activities and to set a series of goals to be achieved and the means by which to achieve those goals (Awio & Northcott, 2001). Additionally, Pintea et al. (2013) insist that rigorous planning of any economic activity is an essential element for the success of those activities. The importance of budgeting can be linked to the new public management (NPM), the allocative efficiency, transaction cost, the principal agent and systems theoretical perspectives. Hamid (2013) based on the tenets of NPM approach, notes that efficient resource management is essential in accelerating the pace of economic growth and development, as well as improving the general wellbeing of the society. NPM framework was developed in response to inadequacies of the traditional paradigm of public administration and advocates for entrenching of private sector management best practices into public sector to enhance service delivery (Goldfinch & Roberts, 2013). Accordingly, NPM has led to integration of private sector financial management practices into budgeting such as cost benefit analysis, measuring and comparison of outputs (Van Dooren et al., 2015).Unlike the NPM approach, the primary focus of the allocative efficiency theory, according to Avkiran (2001), is the optimal allocation of resources that maximizes well-being of the society. Kahkonen and Lanyi (2001) held the position that allocative efficiency is better achieved through matching of public services to local preferences during the budgeting process. Arguing in similar viewpoint, Robinson (2007) indicates that the allocative efficiency argument is that productivity of health, education and other services can be maximized by enhancing public participation during the budgeting process. Kruk and Freedman (2008) explain that public spending has to be technically and allocatively efficient to reflect social objectives in the form of better services or other socio-economic benefits.The agency and the transaction cost theories are also relevant to budgeting practices in public entities as there are numerous stakeholders who have vested interests posing agency and information problems which have to be addressed to minimize opportunistic behaviors (Marino & Matsusaka, 2005). Paul and Leruth (2006) as well as Inkoom (2011) have applied the agency theory to expose agency problems in the financial management process, noting that at the budgeting stage public officers usually want to commit resources to projects that will benefit them or their proxies once the resources are allocated and thus it is incumbent upon the parliament, public, donors and the civil society to play their respective oversight roles. Under the systems approach the study holds that the budgeting issues in public entities are interrelated amongst themselves and also with service delivery.Bhatia (2009), while studying public financial management in India, unearthed a dilemma with regard to finding the right balance between the extent of information disclosures and ensuring that the budgeting process is accomplished within the set timelines. Gonçalves (2014) investigated whether the use of participatory budgeting in Brazilian municipalities during 1990–2004 affected the expenditures pattern and had any impact on living conditions. The authors used econometric analysis, specifically panel data regression, based on data for the period 1990 to 2004. They found that adoption of participatory budgeting is associated with increased expenditure on basic sanitation and health services thus ensuring better water and sewage connections, waste removal in addition to significant reduction in the infant mortality rates. The study concluded that budgeting is more effective in determining the quality of services delivered when the citizens are more actively engaged and participate in the process.Similarly, Nayak and Samanta (2014) evaluated the role of public participation on decision making in the budget making process in West Bengal, India. Nayak and Samanta found that all forms of participation offered the citizens a forum to ‘raise their voices’ on matters concerning projects in their localities. Imuezerua and Chinomona (2015) also analysed the budgeting and service delivery patterns of Sedibeng Municipality in South Africa. Thirty four participants comprising heads of department in the budget and integrated development plan, managers, assistant managers and municipal officials involved with budget preparation and integrated development plan within the municipality provided data for the analysis. The study found skills inadequacy among budgeting staff as having led to the poor services offered by the municipalities, which could explain the service delivery protests which have been experienced in the South African Municipalities since 1994.Based on the various views and the theories, a conceptual framework for budgeting and service delivery (Figure 1) has been suggested to show the link between budgeting practices and services in public sector entities. The framework holds that budgeting practices as indicated by policies, procedures, involvement of public officials, information and public participation have a role to play in the nature of services offered. The services offered by public entities are indicated by their availability to the citizens, their quality and the cost of these services. In line with the systems approach the conceptual framework emphasizes the inter-linkages among the issues studied.

| Figure 1. Conceptual Framework for Budgeting and Service Delivery (Source: Authors (2017) based on various views from literature) |

3. Methodology

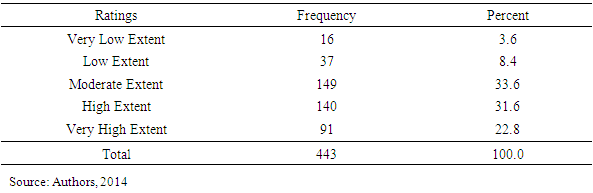

- The study was conducted within the pragmatic research philosophy and using mixed method research design where both quantitative and qualitative tools were used. This was because the design tested a research hypothesis and also provided deeper explanations into budgeting practices and their influence of service delivery. The study utilized research questionnaire, developed through the use of scaled items measured on 1-5, to gather quantitative data, while qualitative data were gathered using interviews and focus group discussions. The quantitative items on the research questionnaires were probed further through the interviews with key informants and focus group discussions. According to Mangan et al. (2004), methodological triangulation and using mixed methodologies increasingly provide multidimensional insights into diverse research problems. In this study, the correlational design enabled the accurate portrayal of budgeting practices and its linkage to service delivery in the sampled Ghana DAs. The study population was the 170 DAs that were in existence in Ghana as at 2008 with a population of 23.11 million. The study used multistage sampling to pick the respondents for the questionnaires, key interview informants and the participants in the focus group discussions. First, 20% proportionate sampling was applied to select 34 DAs which were representative of the diverse characteristics of the DAs in Ghana based on characteristics such as geographical, rural-urban, and poverty levels. Based on these 34 DAs two officials from each of the nine key departments in each DA were selected yielding a total of 612 respondents in this category. Convenience sampling was applied to select 30 respondents from each of the 34 sampled DAs based on the Central Limit Theory, which brought the total number of citizen respondents to 1,020. Purposive sampling was applied to select participants for 28 key informants who comprised of officers from the national and regional levels whose work is directly related to budgeting and service delivery of the DAs. Lastly purposive sampling was used to select 20 focus group participants for the two focus group discussions. A total of 963 out of 1020 questionnaires from citizens and 443 out of 612 from the DA officials were retrieved. The sampling methods employed in selecting the participants ensured that there is no biasness and every member in the groups had equal chance of being selected. Descriptive statistics and regression analysis tools from Statistical Product and Service Solutions (SPSS) version 21 were used to analyze the data. The descriptive statistics especially mean, standard deviation, maximum, minimum and range are some of the measures of central tendency which were employed to study the behavior of the collected data. The regression analysis further assisted in ensuring that the relationship between budgetary practices and service delivery is well articulated and effects of the former to later identified.The analysis was based on information obtained from the questionnaires, key informants’ interviews, focus group discussions, observations and review of documents such as DAs budgets, strategic plans as well as public notices. These sources of information provided a very good data which aided in ensuring that there is quality information whose interpretation yields viable results. Efficiency of the existing budgeting and planning practices were rated on a four-point rating scale (1-Very Inefficient, 2-Inefficient, 3-Efficient and 4-Very Efficient). The nature of budgeting practices and their link to service delivery was assessed on a five-point Likert Scale (1-Strongly Disagree, 2-Slightly Disagree, 3-Neutral, 4-Slightly Agree and 5-Strongly Agree). The extent that budgeting and planning practices influenced service delivery was assessed on a five-point Likert Scale (1-Very Low Extent, 2-Low Extent, 3-Moderate Extent, 4-High Extent and 5-Very High Extent). This enabled the respondents to give structured responses on their opinion on the subject matter hence making the study effective since it was easy to get required information. Data analysis for quantitative data was conducted using percentages, mean scores, standard deviations and regression while for qualitative data, thematic analysis was utilized.

4. Results and Discussions

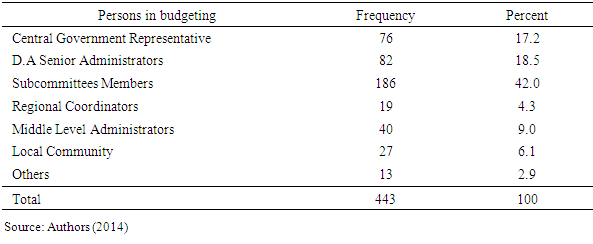

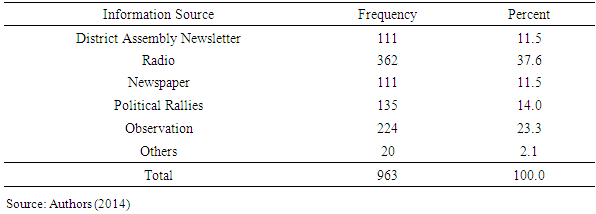

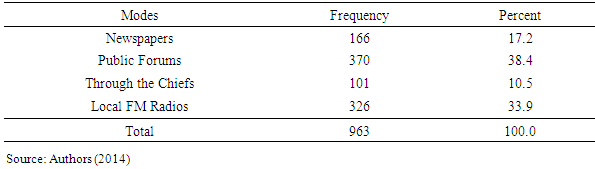

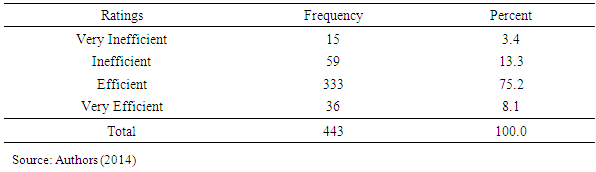

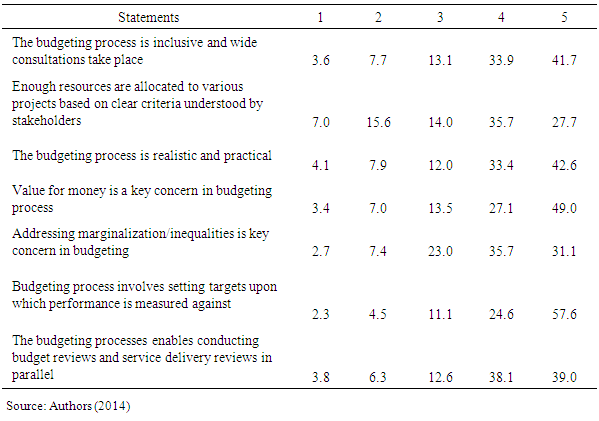

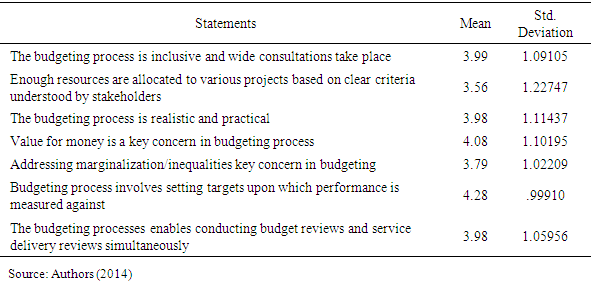

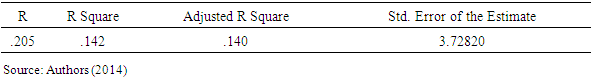

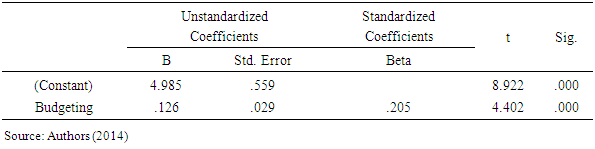

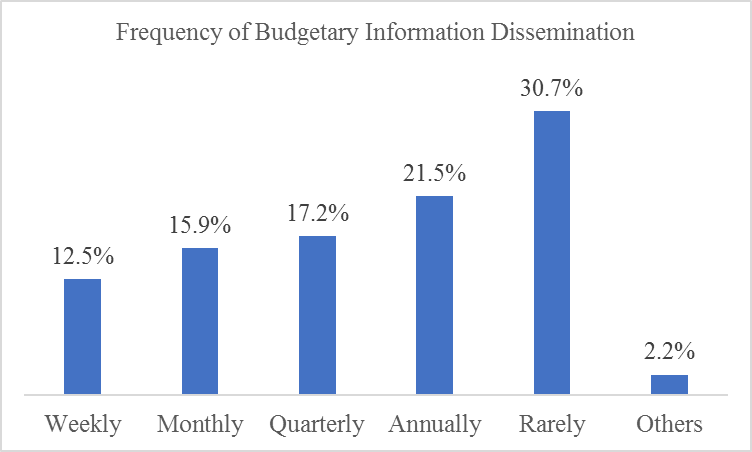

- This section of the study presents the analyses and results for the research. In studying budgeting as a component of Public Financial Management (PFM), and its influence on service delivery, the various aspects of the analyses and discussions as presented in this section have been broadly grouped as follows: (a) Budgeting policies and procedures.(b) Efficiency of budgeting practices in the DAs. (c) Link between budgeting practices and service delivery. (d) Result of the hypothesis test is also presented. Budgeting Policies and ProceduresThe study results revealed that majority (95.5%) of the DA officials indicated that there were laid down policies to guide the budgeting process in the District Assemblies. The results imply that all the DAs had guidelines indicating that the devolved government units in Ghana attach much importance to policies. These findings relate with the explanation by Ma and Yu (2012) that policies are important in setting limits and giving guidelines to stakeholders involved in the budget process and thus the need for all stakeholders to be aware of such policies. A synthesis of the responses by DA officials interviewed indicated that the policies were uniform, implying that the DAs have been sharing the budgeting best practices. This finding is in line with the observation by Bhatia (2009) that many best practices which are useful in making budgets efficient are generic. Bhatia advises that a budget should follow systematic processes in order to make it efficient. The systematic process will ensure that efficiency and transparency are achieved. This prevents misuse of resources since all budgets are in line with the guidelines. The findings also correspond with the findings by Bartle and Ma (2004) who indicated that many of the values of the normative best practices framework of public funds management, such as budgeting, are manifestations of the transaction cost theory.The indication from the interview transcripts of the DA officials is that a budgeting committee is formed by the assembly for the designing of the budget plan. Furthermore, the responding DAs indicated that action plans for the year are prepared and a fee fixing resolution passed before the budget is prepared. All budgets of the assemblies start from sub-committees to the Executive Committee level. In order to facilitate the participation in the budgeting process, the responding DA officials indicated that information gathered from stakeholders forms the basis for preparing the budget. These results correspond with DfID’s (2001) position that in public agencies, certain laid down procedures in budgeting must be followed to standardize the process and ensure that personal discretion in the process does not occur. According to the DA officials, all departmental budgets are brought together and a composite budget formed out of them. They indicated that all districts develop their budget plans with guidance to conform to that of the National Development Planning Commission (NDPC) out of which the budget is drawn. This practice ensures that there is equality in resources distribution among various departments making service delivery effective and efficient. All medium-term development plans (MTDP) of all DAs are harmonized with national policies which serve as a guide to budgeting. These findings indicate that the procedure for budgeting seems to follow the bottom-up approach as espoused by DfID (2001). This ensures that budgets of lower units are scrutinized and sanctioned by higher authorities and unnecessary spending thwarted.The study investigated the existence of district assemblies’ strategic plans where majority (92.8%) of the DA officials indicated that the District Assemblies have strategic plan while 7.2 percent indicated that there was no strategic plan in place. This shows that majority of the DAs follow those laid down strategies to achieve their set goals and objectives which are basically service delivery. The results show that majority of the DAs have adopted strategic planning in their operations. These findings imply that the DAs had strategic plans, but a few officials were not aware of them. This indicates that the DAs were observing a critical step in budgeting, as indicated by Lee (2012) that strategic planning is the second important stage in budgeting which entails setting expenditure patterns and targets on the basis of macro-economic projections, ideally over 3 to 5 years. The social media platforms such as WhatsApp, Facebook and twitter among others could be used to create awareness among the officials about the existence of those strategic plans. This effort will promote collective responsibility among the officials towards achievement of such strategic plans. The strategic plans are further viewed as the operational guide in most of the devolved units as symbolized by the District assemblies in Ghana.The results in Figure 2 show that 49.2 percent of the DAs review their plans annually, 40.4 percent review their plans quarterly while 10.4 percent of the DAs review their plans semi-annually. These findings convey adherence to best practices in budgeting which indicates the need to regularly review budgets to align them with changing conditions and circumstances as noted by Latema (2013). The study findings on budget review in the DAs are also in line with Welham et al. (2013) observation that reviews are important to facilitate enactment of new laws, adjustments in macroeconomic parameters and mostly change in resources availabilities. Due to the dynamic nature of economies as witnessed by various business cycles, the review of plans is an important consideration specifically to conform to the changes occurring in the economy. The plans are reviewed after some set durations such as annually, quarterly or semi annually which provides sometime for evaluation of the impact of the plans which have been in place.

| Figure 2. Frequency at which DAs review their plans (Source: Authors (2014)) |

|

|

| Figure 3. Frequency of Information Dissemination (Source: Authors (2014)) |

|

|

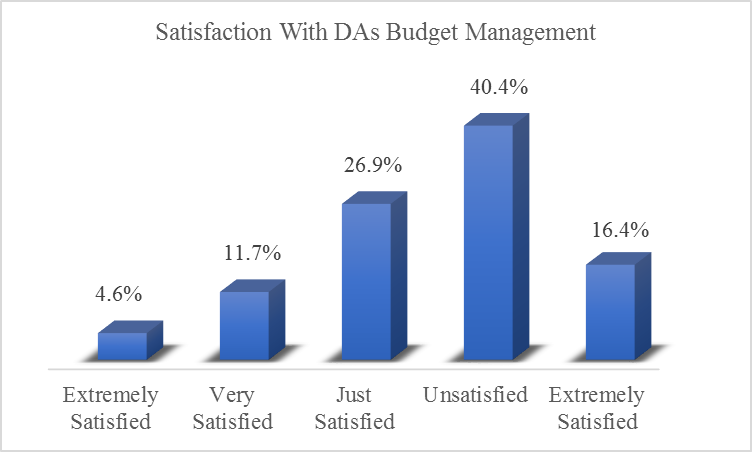

| Figure 4. Satisfaction with DAs Management of the Budget (Source: Authors (2014)) |

|

|

|

|

|

|

5. Conclusions and Policy Implications

- Budgeting practices in the district assemblies in Ghana follow laid-down procedures, with information provided as part of the process, even though the citizens are dissatisfied with how the budgets are managed due to over emphasis on non-essential expenditures. Officials on the other hand, regard the budgeting practices as efficient, and also feel that the processes are inclusive, realistic with target setting which facilitate service delivery. Improved budgeting practices lead to improved service delivery, while the reverse holds true. The timely review of plans by the officials is very essential since it helps in conforming to the dynamic nature of the economy. The citizens’ dissatisfactions would be mitigated through increased public participations in the budgetary processes and planning. This will assist in creating awareness among the public and enhancing rate of participation. The implications are that the district assemblies should continue to apply laid-down procedures, provide information, but manage the budgets properly by focusing on activities that are included in the budgets instead of spending funds on non-essentials. Adherence to the budgetary guidelines would ensure that there is proper utilization of resources by the management. Adoption of the budgetary guidelines also would be responsible for effective service delivery to the public. This could be done through broad stakeholders’ input and feedback which can be achieved by integrating and enhancing the use of innovative communication tools such as websites, email, Facebook, Twitter and WhatsApp to supplement the stakeholders’ meetings, discussions and conferences. This is in line with Naidoo (2017) position that social media tools offer a great opportunity for optimizing public participation in service deliver processes. For instance, photos shared on Facebook, Twitter or WhatsApp accounts and groups of the public officials on ongoing or stalled projects in their locality will create awareness, motivate citizen action, and improve stakeholders’ contribution to the budgeting process. Further, dissemination of information through these platforms which are widely accessible by citizens enhances transparency, accountability and efficiency among the stakeholders due to public scrutiny. This will also reduce information asymmetry and thereby harmonize the interface between the citizens as principal and the DAs officials as agents.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML