-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Human Resource Management Research

p-ISSN: 2169-9607 e-ISSN: 2169-9666

2017; 7(1): 17-27

doi:10.5923/j.hrmr.20170701.02

Empirical Study of Corporate Governance on Public Listed Companies in Malaysia

Selvarajah Krishnan, Adib Muliyani Mohd Amin

International University of Malaya-Wales-Kuala Lumpur, Malaysia

Correspondence to: Selvarajah Krishnan, International University of Malaya-Wales-Kuala Lumpur, Malaysia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this study is to examine the relationship between corporate governance and non-technology firm performance. The empirical data on 14 public listed companies (PLCs) in Malaysia that is observed for year 2010-2014. The data was analyzed by using the simple linear and hierarchical regression analysis. Findings shown that there is a positive relationship between corporate governance and firm performance. Concludes that involvement and commitment are considered to be important characteristics that improves the firm performance for the firm’s performances. It’s become importance of corporate governance involvement on improving firm performance. Therefore, in order to achieve the Eleventh Malaysia Plan (2016-2020) targets and goals which includes strengthening the corporate governance mechanism, and strengthening the industry-academia collaboration. It is important for the board of directors to be involved to ensure effective and efficient decisions making. This would help increase the overall firm’s activities and performance in Malaysia.

Keywords: Corporate Governance, Non-Technology, Public Listed Companies

Cite this paper: Selvarajah Krishnan, Adib Muliyani Mohd Amin, Empirical Study of Corporate Governance on Public Listed Companies in Malaysia, Human Resource Management Research, Vol. 7 No. 1, 2017, pp. 17-27. doi: 10.5923/j.hrmr.20170701.02.

Article Outline

1. Introduction

- Malaysia is involved in a new stage of development which is towards developing country by 2020 and to enhance its ability in the changing domestic and global economic landscape (MATRADE, 2011). The productivity enabler is driven by one of the corporate enablers such as research and development (R&D) (Economic Planning Unit, 2010) which will further be improved in order for Malaysia to achieve its aim of translating the resource wealth and becoming an advanced country by 2020. Focusing on the governance mechanism strategy, the Malaysian government through the Eleventh Malaysia Plan has come out with some governance mechanisms such as the research management agency (RMA) and commercialization. These mechanisms are administered in order to increase effectiveness, maximize results and increase return on investment. Nevertheless, without the initiative and effort from the firm’s management to increase innovation inputs and outputs, the target for 2020 would not be achieved. Thus, the firms should have their own governance mechanisms to drive innovation investments and activities.

1.1. Theoretical Significance

- Agency theory is the relationship between the principle and agent (Jensen and Meckling, 1976) and it is developed on the assumptions that the agents have more information and knowledge on the firm’s operation compared to the principles (Adams, 1994). Mat Rabi et al. (2010) added that to avoid the agents from maximizing their self-interest, having good corporate governance practices through monitoring and controlling could reduce the managerial opportunism especially in making decisions on innovation investments. Besides that, Hillman and Dalziel (2003) address that the resource dependency theory is the capacity of the boards to contribute adequate resources to the firm. Thus, the significance of this study is to prove that both agency and resource dependency theories provide useful tool to help increase innovation investments and firm performance among the Malaysian public listed companies (PLCs).

1.2. Practical Significance

- This study could be a guide to solve the issues and challenges faced in the Tenth Malaysia Plan (2011-2015). In addition, this study provides an insight as to whether innovation has an impact on the performance of the technology and non-technology PLCs. Furthermore, this study provides an input on the effectiveness of involving corporate governance to enhance innovation investments and firm performance. This would help to gain the awareness of the Malaysian Board of Directors (BODs) and shareholders to get more involved with the management teams on the development of innovation strategies and activities as well as executing these strategies in order to increase their firm’s profitability and overall performances. As such, when both shareholders and the management teams understand the importance of conducting research and development (R&D) and also coming up with innovative products and services, it will help Malaysia to translate its innovation to wealth and the become an advanced nation by 2020 (Eleventh Malaysia Plan, Strategy 21: Translating Innovation to Wealth, 2016-2020).

2. Literature Review

2.1. Corporate Governance

- Governance mechanism that is closely related to companies is corporate governance. According to O’Sullivan (2000), corporate governance is about the control exercise on the distribution of resources in a particular firm. Corporate governance is a system on how the firms are being directed, engaged and controlled (OECD Principle of Corporate Governance, 1999). Mat Rabi, Zulkafli, and Che Haat (2010) stressed that there is an increasing attention given on monitoring and assessing the chief executive officers (CEO) and managers by the board of directors (BODs) as well as shareholders through corporate governance mechanisms. The theories related to corporate governance is the agency theory and resource dependency theory. The resource dependency theory focus on the board’s function as the resource provider for the firm and the agency theory emphasizes on the board’s function to supervise and control the CEOs and managers (Hillman and Dalziel, 2003) to ensure that the resources are being utilized for activities such as innovation investments that would increase firm value. With this, corporate governance was applied in most firms worldwide as a tool or system to monitor and control the decisions made by the management teams. This is because when the ownership and control activities within the firm are separated, it would result in the reduction of managerial opportunism. According to Filatotchev and Wright (2011), governance factors which include ownership structures, types of dominant owners, board characteristics, and managerial compensation would influence the internalization tactics and the outcomes of the strategic decision which in return increases firm performance. Therefore, this study focuses on specific corporate governance characteristics which include board independence (Chung, Wright and Kedia, 2003), number of board meetings (Vafeas, 1999) and director’s remuneration (Aggarwal and Samwick, 2006). In addition, there is increasing attention given on the education or academic role of the directors (Francis, Hasan, and Wu, 2015) and the number of females in the board (Marinova, Plantenga and Remery, 2016; Wagana and Nzulwa, 2016) as these board characteristics could also influence innovation investments and firm performance. In Malaysia, Deloitte (2015) reported that by 2016, 30 percent of boards and senior management positions should be comprised of women in both public and limited liability companies with more than 250 employees. This is in line with the effort of the Malaysian Cabinet to promote gender equality as of June 2011. Deloitte (2015) provided evidence that there were 10.4 percent of board seats held by women while there were 0 percent of board chairs that were held by women. Figure 1 demonstrate the top five industries with the highest percentage of women working in various positions which includes manufacturing (20%), technology, media and tele-communications (15%), energy and resources (10%), life sciences and health care (8%) and financial services (8%) (Deloitte, 2015).Looking further into corporate governance, the BODs has two main functions which is to monitor and provide resources for the firms they are in (Korn / Ferry, 1999) and in theory, it is correlated to firm performance (Hillman and Dalziel, 2003). This brings the need for the BODs and shareholders to get more involved in the firm especially towards the decisions on innovation investments. Honore, Munari and De La Potterie (2015) stated that having effective corporate governance practices would lead the interests of both the managers and shareholders together which would bring a positive impact on R&D investments. Several studies had researched on different aspects of innovation, corporate governance and firm performances including Chung et al. (2003), Le, Walters, and Kroll (2006), Mat Rabi et al. (2010), Shukeri, Ong, and Shaari (2012), Zhao (2013), Goh, Rasli, and Khan (2014), Zhang, Chen, and Feng (2014) and Marinova et al. (2016) and they suggested some future studies. Another study by Marinova et al. (2016) investigated on gender diversity and firm performance on Dutch and Danish boardrooms for year 2007 and recommended a number of future studies which includes analyzing more variables in particular referring to board characteristics, use of accounting measures (ROA) instead of market-based performance measures (Tobin’s Q), and to focus on non-financial indicators like innovation. Additionally, Zhang et al. (2014) suggested that future research could be done to examine the function of corporate governance and firm performance. This was supported by Goh et al. (2014) who proposed to extend studies to different industry settings, and also mentioned that the findings for corporate governance, composition of independent directors and role duality on firm performance. Furthermore, Shukeri et al. (2012) put forward the need for further research on the board’s characteristic in effect of the firm’s performance by comprising more than one year period in order to obtain a more general result. Mat Rabi et al. (2010) studied on the interaction effect of corporate governance on firm performance among Malaysian PLCs from 2005-2007 and suggest future studies to modify the length of performance.

2.2. Corporate Governance Characteristics (CGC)

- Corporate governance is a structure that is used to direct, control and manage the business activities and affairs of the firm in order to increase business success and corporate accountability (The Malaysian High Level Finance Committee, 1999 and retained by the Malaysian Code on Corporate Governance, MCCG 2012). The main objective of corporate governance is to realize shareholder’s value and at the same time taking the interest of the other stakeholders into account. The concept of corporate governance is defined as the system in which firms are controlled and monitored and an effective corporate governance mechanism has long been understood as board responsibility, shareholder’s rights and transparency (OECD Principles of Corporate Governance, 1999).One of the motivations to past studies on corporate governance and firm performance including the banking sectors in Malaysia was by the Governor of Bank Negara Malaysia, Zeti Akhtar Aziz (2003) who addressed that corporate governance involving an array of practices that covers appropriate conduct in ethics, business, values, and the overall culture of the organizational and employee behaviors (cited by Kim, Devinaga, and Rahayu, 2012). Corporate governance does not only include financial targets and processes that should be achieved to satisfy the interest of the shareholders but also includes the finest practice of conduct with the customers, depositors as well as other stakeholders of the firm (Kim et al., 2012). The Malaysian Code of Corporate Governance (MCCG) was issued in 2000 as a reform after the 1997 Asian Financial Crisis. The code was introduced in order to bring improvement to the corporate governance practices and performances of the listed companies in Malaysia. However, Abdul Rahman and Ali (2006) suggested that the introduction of the corporate governance code did not substantively improve the governance practices of the Malaysian listed companies. This brought the Malaysian Security Commission to revise the Malaysian Code of Corporate Governance (MCCG) in 2007 with the hope that the revised code will improve the general governance atmosphere in Malaysia (Abdifatah and Sanni, 2015). The Code of Corporate Governance that was reviewed in 2007 identified the best practices and principles of an effective and efficient governance mechanism and described the ideal corporate governance structures and internal processes that firms should incorporate. The MCCG 2007 includes the duties and accountabilities of the BODs where the BODs are expected to influence the firm’s performances. The Malaysian Code on Corporate Governance 2012 (MCCG 2012) highlights on the establishment of the board structure and composition in firms by recognizing the role of the BODs as dynamic and accountable fiduciaries. The directors are responsible to be good stewards and guardians in the firm. They are not only involved in setting the firm’s objectives, strategic direction and managing the operations but are also involved in safeguarding the company to make sure that it is being conducted in obedience with the rules and regulations. The directors must also maintain efficient governance structure in order to ensure proper management of risks and internal control. The code documents that both the boards and management must know, and to be mindful of their responsibilities to ensure that all their efforts and resources are directed towards the best interest of the shareholders and firm. They should guarantee that the interest of other stakeholders are taken into consideration and are not compromised. Moreover, Millstein and Macavoy (1998) describes corporate governance as generally the relationship between the managers, directors as well as shareholders. According to Fama and Jensen (1983), BODs is the most significant corporate governance mechanism as the BODs would be able to monitor, provide relevant resources and advises to the management to ensure that the management is carrying out responsibilities and making decisions that protects the overall shareholder’s interests. The characteristics of corporate governance that are commonly studied includes board size (Moscovici and Zavalloni, 1969; Khanchel, 2007), board independence (Chung et al., 2003; Chen, 2013), ethnic diversity, gender roles (Julizaerma and Sori, 2012; Wagana and Nzulwa, 2016), family ownership (Choi, Shaker, Yoshikawa, and Han, 2014), CEO duality (Pi and Timme, 1993; Yermark, 1996; Mat Rabi et al., 2010), number of board meetings (Vafeas, 1999; Al-Musali and Ismail, 2014), ownership structure (Choi, Park, and Hong, 2012) and director’s compensation (Kakabadse and Kakabadse, 2001; Aggarwal and Samwick, 2006). Corporate governance is even more important should companies focusing on innovation investments, and although these investments could help to build capabilities that enhances competitive advantage (Franco, 1989), it is subjected to serious threats that requires strong governance safeguard (Hill and Snell, 1988). This brings the need for effective corporate governance through the BODs to make effective decisions on the innovation investments of the firm to ensure that the resources are being used efficiently without causing any losses to the shareholders.

2.3. Firm Performance (FP)

- There are four distinct firm performance measurements used in the literatures which includes innovative performance, production performance, financial performance and market performance (Hornsby, Kuratko, and Zahra, 2002; Hagedoorn and Cloodt, 2003; Yilmaz, Alpkan, and Ergun, 2005; Marinova et al., 2016). The firm performance measures that are frequently used include sales, profits, export revenues and productivity (Zahra and Bogner, 2000). Subsequently, the extensively used financial measures includes the returns on assets (Roberts and Amit, 2003; Sher and Yang, 2005; Bessler and Bittelmeyer, 2008), return on equity (Kassim, Ishak and Manaf, 2013; Rahman, Ibrahim, and Zahid, 2014), return on investment (Combs, Crook and Shook, 2005; Richard and Shen, 2010) and earnings per share (Zahra and Bogner, 2000; Rahman et al., 2014). For this study the ROA and ROI is used as a proxy to measure firm performance. Prior and current studies have found that innovation has a positive relationship on firm performance. Walker (2004) elaborated that innovation has a large influence on firm performance as it enables firms to be at the right position in the market which leads to competitive advantage and greater firm performance. Loof (2000) found that there is a positive relationship between innovation and employment growth, sales of new products, value added per employee, operating profits per employee, sales per employee, and on return on assets (ROA) in Swedish manufacturing firms. Klomp and Van Leeuwen (2001) also reports a positive relationship between innovation and sales growth, however, they found that there is a negative relationship between innovation and employment growth in all the sectors in Netherlands. Past studies support that the greater the R&D investments, the greater would be the firm’s productivity and performance (Griliches, 1986; Lichtenberg and Siegel, 1991; Wakelin, 1998; Gunday et al., 2011; Sofian et al., 2014). Studies on the effect of corporate governance on firm performance have obtained much interest in both economic and finance literatures since the past years. This is due to the financial scandals like WorldCom, Enron and Lehman Brothers where it caused negative effects to the U.S economy (Black, Jang and Kim, 2006). According to Black et al. (2006), a firm that has strong corporate governance are able to achieve superior financial performance compared to firms without corporate governance and it is an important growth determinant in both empirical and theoretical studies (Ali, Salleh and Hassan, 2008; Shukeri et al., 2012; Skare and Hasic, 2016).The continuous ambiguity on numerous theoretical predictions and empirical outcomes had brought researchers to the conclusion that looking into firms as players in a multi-actor economic game was not enough to effectively comprehend firm’s innovation performance (Belloc, 2012). Fagerberg, Mowery, and Nelson (2005) reported that although they focused on an individual sector, the theoretical and empirical outcomes were not able to clarify the reason why firms with related external environments often show diverse innovation performance. This has caused many economists, researchers and academicians to look inside the particular firm’s structure to determine the innovation performance (Fagerberg et al, 2005). This resulted in new strands of research that was tied to relate firm’s innovation activities to the firm’s characteristics, management strategies and corporate governance (Belloc, 2012). Tseng, Wu and Lin (2013) also found that corporate governance is relevant to innovation ability. Filatotchev and Wright (2011) in their study concluded that governance factors such as board characteristics, ownership structures, executive compensation and types of dominant owners will not only have a significant impact on the internalization strategies of the multinational companies but would also influence the outcomes of the firm’s strategic decisions and in turn boost firm’s performance. There are a number of studies conducted on the different areas of innovation, corporate governance and firm performance. Chung et al. (2003) report that market valuation of the firm’s capital and R&D investments (innovation) depends crucially on the composition of the board and not on the institutional holdings based on the period of 1991-1995. Robeson and O’Connor (2013) studied on 98 Fortune 1000 firms based on the agency theory and found that decision-making boards mediates the relationship between BOD’s behavior and the firm’s overall innovativeness. Robeson and O’Connor reveal that the innovative decision-making boards promote innovative projects, exhibit tolerance with the firm’s financial results, integrate input from various constituencies within the firm and also engages in frequent communication with the project teams in the companies. Interestingly, Zhang et al. (2014) conducted an empirical study on the Chinese listed IT-firms for the period of 2007-2008 and reports that R&D investments mediates the relationship between corporate governance and firm performance. Alternatively, Mat Rabi et al. (2010) studied on 100 Malaysian PLCs in 2005-2007 and found that particular corporate governance’s characteristics (board compensation and number of board meetings) do have a moderating effect on innovation investments and firm performance but there was no interaction on board independence, board size and CEO duality.

2.4. Resource Dependency Theory

- Resource dependency theory views the BODs as the provider of resources for the firms (Pfeffer and Salancik, 2003). The resources could be any form of input or output that might be a strength or weakness to a particular organization (Wernerfelt, 1984). Nicholson and Kiel (2007) added that a board that has connection to the external environment is able to facilitate the access to various resources for the firm. Pfeffer and Salancik (2003) asserts four types of resources that could be provided by the board which includes advice and counsel, legitimacy, channels to transfer information between outside firms and better access to obtain support and commitments from the external institutions or environment. The specific board activities that is linked to resource provision and firm performance includes board size (Yermark, 1996) and board actions such as regularity of board meetings (Lipton and Lorsch, 1992) and board attendance (Brown and Caylor, 2006). Wu, Levitas, and Priem (2005) posit that R&D is associated with great ambiguity, complex tasks and tedious processes which lead to the demand of substantial resources such as knowledge, information, experience, financial capital and technology (Becker, 1964; Coleman, 1988; Chen and Hsu, 2009). Therefore, agency theory focuses on effective monitoring whereas, the resource dependency theory asserts on the provision of resources.

2.5. Hypotheses

- Number of Board MeetingsBoard activities that are linked to resource dependency theory include regularity of board meetings (Lipton and Lorsch, 1992) and board attendance (Brown and Caylor, 2006). Frequent BODs meetings could help to improve the effectiveness of the board. When there is a need or requirement for tight control and supervision, the board should be flexible to have regular meetings (Shivdasani and Zenner, 2004). Based on Shivdasani and Zenner’s findings, conclusion could be made that board meeting frequency and attendance of board members is one method which firms could use to discuss the important issues such making decisions on innovation investments and activities. Mat Rabi et al. (2010) found out that the number of BOD’s meetings does moderate the relationship between investments (R&D expenditure) and firm performance. Vafeas (1999) added that meetings would allow directors to effectively monitor and execute the firm’s strategy, thus, the more frequent the meetings, the closer control the BODs have over the managers which would in turn lead to a positive influence on firm performance. From the findings, Hypothesis (H1) is proposed:H1: There is a relationship between corporate governance and firm performance.Director’s RemunerationAccording to the agency theory framework, providing higher remuneration or rewards helps to reduce agency problems (Carter et al. 2003). Mat Rabi et al. (2010) reported that board compensation had a significant moderating effect on the relationship between innovation investments and firm performance. The outcome of their study is consistent with prior studies where board remuneration had positive association on firm performance (Kakabadse and Kakabadse, 2001; Brick et al, 2006; Aggarwal and Samwick, 2006). Attractive remuneration could be a source of incentive as well as motivation for directors to get more involved in the firm and to ensure that the significant decisions made will improve the firm’s performance (Brick et al., 2006). On the contrary, there were also researchers who found no relationship between board remuneration and firm performance (Dogan and Smyth, 2002; Chouaibi et al., 2010). Due to these inconsistencies in findings, Hypothesis H4 (T) (NT) is proposed as below:H2: There is a relationship between higher director’s remuneration and firm performance.

3. Methodology

- The mixed method was used in the development of the conceptual framework, hypothesis, data collection and analysis techniques of this study and supported by Mat Rabi et al., 2010; Zhao, 2013; Zhang et al., 2014; Marinova et al., 2016. Quantitative data is in a raw form and it has to be processed and analyzed to turn them into information that would be meaningful and useful to researchers (Saunders, Lewis, and Thornhill, 2009).

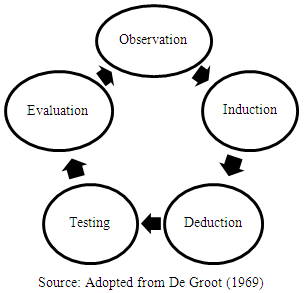

De Groot (1969) quoted by De Groot (2014) introduced the empirical cycle that begins with collecting the empirical facts to form the hypothesis (observation) followed by formulating the hypothesis base on the observation (induction), defining the hypothesis to ensure that variables are measureable and able to bring concrete predictions (deduction), testing and finally evaluating the hypothesis.

De Groot (1969) quoted by De Groot (2014) introduced the empirical cycle that begins with collecting the empirical facts to form the hypothesis (observation) followed by formulating the hypothesis base on the observation (induction), defining the hypothesis to ensure that variables are measureable and able to bring concrete predictions (deduction), testing and finally evaluating the hypothesis.3.1. Sampling Technique

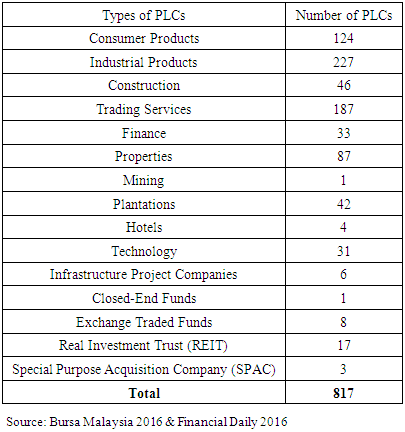

- The population of this study includes the 817 public listed companies (PLCs) on the Main Market of Bursa Malaysia and published on Financial Daily 2016. The population consist of PLCs from 15 industries. Table below shows the industries and number of PLCs listed on Bursa Malaysia.

|

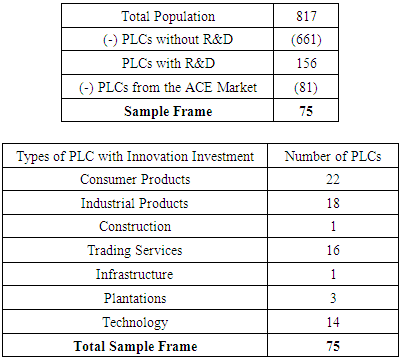

Based on the random sampling techniques with the sample frame PLCs is selected. PLCs market capital range of RM20 million to RM1500 million, a set of PLCs is selected. This helps to ensure that based PLCs are analyzed adequately without any bias. The sample frame based on the market capitalization range. Based on the sample frame, 14 PLCs are selected as they have already been listed and provided by Bursa Malaysia. The 14 technology PLCs selected are companies that have been operating and been listed for more than 5 years. The PLCs represent all sectors except for finance, banks and insurance companies due to their differences in corporate governance requirements. Finally, the relationship between the variables is tested on the selected samples.

Based on the random sampling techniques with the sample frame PLCs is selected. PLCs market capital range of RM20 million to RM1500 million, a set of PLCs is selected. This helps to ensure that based PLCs are analyzed adequately without any bias. The sample frame based on the market capitalization range. Based on the sample frame, 14 PLCs are selected as they have already been listed and provided by Bursa Malaysia. The 14 technology PLCs selected are companies that have been operating and been listed for more than 5 years. The PLCs represent all sectors except for finance, banks and insurance companies due to their differences in corporate governance requirements. Finally, the relationship between the variables is tested on the selected samples. 3.2. Data Collection

- The company’s annual reports is obtained from the main market of Bursa Malaysia. In addition, data on the market capitalization of the PLCs is attained from the Thomas Reuters Datastream. The R&D expenditure is collected from the Wharton Research Data Services (WRDS) database. The data on the financial variables, for instance, the ROA, ROI, firm age and company’s corporate governance characteristics is gathered manually from the annual reports. All data is collected and analyzed for year 2010-2014. The specific years are selected as the period is during the Tenth Malaysia Plan (2011-2015) and studying the effects during these years would determine if the strategy of strengthening governance mechanisms helps the Eleventh Malaysia Plan (2016-2020) to achieve its goal of fostering enterprise innovation.

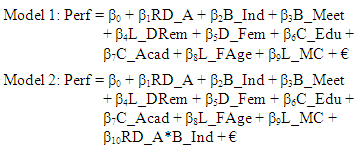

3.3. Analysis Technique

- The Statistical Package for Social Science (SPSS) software is used to analyze the data collected for this study. This study uses the secondary data (2010-2014) that is obtained from the selected PLCs annual reports and databases. The purpose of the data is to gauge the performance of the technology and non-technology based PLCs with innovation investments (R&D expenditure) and also to examine the moderating or interacting effects of the corporate governance characteristics. The secondary data and tests are parametric as it involves numeric data.

4. Findings and Discussion

- With regards to corporate governance, the PLCs have an average of 47% independent directors on the board. Therefore, this indicates that most of the firms prefer to have more inside rather than outside directors although there are studies that found that independent directors could be more effective monitors. The directors from the technology PLCs conducted a minimum of 4 and maximum of 14 board meetings with an average of 6 meetings yearly. Besides that, the average logarithm of director’s remuneration for the technology PLCs is 7.24. BODs of the technology PLCs consist of chairman with education from junior college to graduate school, and on average most of the chairman hold a Bachelor Degree. Furthermore, on average, 21% of the chairman is with academic background. The average logarithm of firm age and logarithm of market capital is 2.12 and 5.02 respectively. Outliers were removed using the winsorization technique as recommended in the study by Ghosh and Vogt (2012). The outliers are removed through the winzorization technique at 1% and 99% percentiles.The Pearson Correlation for H1: There is a relationship between corporate governance and firm shown there is a positive and significant association at 95% confidence level 0.765 (p < 0.05). H2: There is a relationship between higher director’s remuneration and firm performance. 0.879 (p>0.05). Therefore, Hypothesis 1 and 2 are supported. The number of board meetings and chairman with academic background show a significant and negative relationship on ROI. The results are in contrary to prior findings (Chen, 2013; Zona et al., 2013). However, there were past studies that obtained similar results (Le et al., 2006; Mat Rabi et al., 2010; Bhatt and Bhattacharya, 2015). Past studies reported that the monitoring role of the independent director is ambiguous on firm performance (Bhagst and Black, 2001; Kor, 2006; He and Wang, 2009; Devos et al., 2009). Kor (2006) reported that technology firms with higher percentage of independent directors do not lead to an effective governance mechanism in terms of expenditure. This is because the high monitoring cost of the independent directors could outweigh its benefits. In addition, independent directors especially in technology firms might not have the adequate competence to actually monitor the management as they may face difficulties in understanding the complicated corporate strategies and activities (Zajac and Westphal, 1994).

5. Conclusions

- The descriptive analysis shown is significant and this is followed by Pearson Correlation test. Correlation analysis was done to express the strength and direction of the relationship between two variables. The issue of multicollinearity was also tested and found not violated through the Pearson Correlation, Variance Inflation Factor (VIF) and Tolerance analysis. Generally, corporate governance and firm performance are significant for firms’ performance. Corporate governance is the system of rules, practices and processes by which a company is directed and controlled. Corporate governance essentially involves balancing the interests of a company's stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community. Since corporate governance also provides the framework for attaining a company's objectives, it encompasses practically every sphere of management, from action plans and internal controls to performance measurement and corporate disclosure.The board of directors is the primary direct stakeholder influencing corporate governance. The board is tasked with making important decisions, such as corporate officer appointments, executive compensation and dividend policy. In some instances, board obligations stretch beyond financial optimization, when shareholder resolutions call for certain social or environmental concerns to be prioritized.Boards are often comprised of inside and independent members. Insiders are major shareholders, founders and executives. Independent directors do not share the ties of the insiders, but they are chosen because of their experience managing or directing other large companies. Independents are considered helpful for governance, because they dilute the concentration of power and help align shareholder interest with those of the insiders.Good corporate governance creates a transparent set of rules and controls in which shareholders, directors and officers have aligned incentives. Most companies strive to have a high level of corporate governance. For many shareholders, it is not enough for a company to merely be profitable; it also needs to demonstrate good corporate citizenship through environmental awareness, ethical behaviour and sound corporate governance practices.Findings of this study reveal that there is a positive relationship between corporate governance and firm performance. It can also be concluded that involvement and commitment of board of directors are considered to be important characteristics that improve the firm performance. There is a growing importance of corporate governance involvement on improving firm performance. Therefore, this research is in line with the Eleventh Malaysia Plan (2016-2020) and provides solutions which include strengthening the corporate governance mechanism, and strengthening the industry-academia collaboration. The results may not be generalized for the periods before the governance reforms or crisis. Future study should focus on expenditures and corporate variables of interest. There may be an element of bias as only PLCs reporting on the details.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML