-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Human Resource Management Research

p-ISSN: 2169-9607 e-ISSN: 2169-9666

2016; 6(4): 91-98

doi:10.5923/j.hrmr.20160604.02

The Progressive Development of India’s Insurance Industry from Ancient to Present Times

Syed Ahmed Salman1, Hafiz Majdi Ab. Rashid2, Sheila Nu Nu Htay3

1Ph.D. Candidate at International Islamic University Malaysia, Institute of Islamic Banking and Finance, Malaysia

2Associate Professor at Kulliyyah of Economics and Management Sciences in International Islamic University Malaysia, Malaysia

3Professor at Humber College and York University, Canada

Correspondence to: Syed Ahmed Salman, Ph.D. Candidate at International Islamic University Malaysia, Institute of Islamic Banking and Finance, Malaysia.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Financial security has become a basic need in contemporary human societies. This is a clear development since ancient times where food, clothing, and shelter were the only real basic human needs. Due to the changes in our lifestyles, we have greater basic needs including health and financial security. Insurance has been used as an innovative and creative tool for our security. The objective of this paper is to revisit the important role of insurance in assisting the policyholders at the personal level and in supporting the development of economy in India. The documentary approach is used in this paper. The literature evidences that during ancient times, insurance in India started with general insurance for flood and fire. During the colonial period, Oriental Life Insurance was the first British company and was established in 1818. During the period, the Insurance Act (1938) was the only reference for the insurance industry until its nationalisation. Life insurance industry was nationalised in 1956 and the general insurance industry was nationalised in 1972. Upon the recommendation of the Malhotra Committee, the industry was liberalised in 2000 and Insurance Regulatory and Development Authority Act became the new Act governing the industry. Currently, there are 27 general insurance companies and 24 life insurance companies and only one government owned Reinsurance Company. Therefore, it can be concluded that the progress of the insurance industry is tremendous and it has been playing its significant role as the backbone of the Indian economy.

Keywords: Development, History, Insurance and India

Cite this paper: Syed Ahmed Salman, Hafiz Majdi Ab. Rashid, Sheila Nu Nu Htay, The Progressive Development of India’s Insurance Industry from Ancient to Present Times, Human Resource Management Research, Vol. 6 No. 4, 2016, pp. 91-98. doi: 10.5923/j.hrmr.20160604.02.

Article Outline

1. Introduction

- Insurance is defined as “social device for minimizing risk of uncertainty regarding loss by spreading the risk over a large enough number of similar exposures to predict the individual chance of loss” (Life Insurance Company of India, 2004). In the arrangement of insurance contract, the policy holders are required to pay the premium to the insurance companies and in return, the companies are supposed to pay the defined amount of claims which can be all or part of the loss incurred in the future (Anderson & Brown, 2005). They further state that by nature, people tend to seek for security. Financial support and security can be managed by buying the insurance policy. Insurance is not only assisting the financial burden of the policy holders but also improving the country economy. Insurance is one of the booming economic sectors in India. It is the major sector where household income is accumulated in the economy and it will be utilized for the investment in other different economic sectors (Ghosal, 2012; Jain, 2013). This sector is vital in the process of economic development in India (Prakash & Kumar, 2012; Verma & Bala, 2013). One of the main distinguished factor of insurance industry is the saving factor and that is the important contributor for the better economy (Brainard, 2008; Rao & Srinivasulu; 2013).Since insurance is a significantly contributing tool in assisting us by offering insurance coverage and in supporting the Indian economy, it is believed that the history of insurance should be revisited as a documentary approach. The rest of the paper discusses the evolution of insurance. Second section presents the first phase of insurance evolution starting from the early days until the end of the colonial period. Third section elaborates on the second phase starting from independence until the nationalization of the insurance industry. Fourth section mentions the third phase focusing after nationalization until liberation of the industry. Fifth section states the last phase, i.e. after liberation until present. Sixth section concludes this paper.

2. Historical Development of Insurance until the End of the Colonial Period

- The early history of insurance in India can be referred to as Manu (Manusmrithi), Yagnavalkya (Dharmasastra) and Kautilya (Arthasastra). The pooling of resources can be redistributed in cases of flood, fire and other emergencies. Later, it was practiced in the form of trade loans or marine or carrier’s contracts (IRDA, 2007; Rahul, 2012). During the colonial period, the Oriental Life Insurance was the first British company established in 1818. Later, the Bombay Assurance Company and Madras Life Insurance were established in 1823 and 1829 respectively (Sinha, 2005; 2013). In the case of general insurance, Triton Insurance Company Ltd., which is British owned, was established in 1850. In 1907, the first Indian general insurance company, namely Indian Mercantile Insurance was set up (Sharma, 2010; Bhatt, 2012).In 1905, the Swadeshi Movement which propagated, “Be Indian Buy Indian Movement” led to the establishment of many life insurance companies (Shinde, 2012; Bhatt, 2012; Noronh & Shinde, 2012). However, until 1912, the insurance industry was yet to be regulated. Two legislations, i.e. the Indian Life Insurance Companies Act and the Provident Insurance Societies Act were then passed in 1912. However, both legislations did not cover general corporate insurance. Furthermore, these acts placed restriction on the activities of Indian insurance companies but not on foreign insurance companies. With World War I, all the progress of the Indian legislations is disrupted. In 1928, the Indian Insurance Companies Act was passed to allowing the Indian government to gather the data of Indian insurance companies operating in India as well as overseas and foreign insurance companies in India (Sinha, 2002; 2007).There was no comprehensive act for the insurance industry until The Insurance Act passed in 1938. This act covers both life and general insurance (Govind, Patil and Kuldeep, 2011; Sinha, 2007).

3. After Colonization until Nationalization of the Insurance Industry

- The Insurance Act (1938) has been widely used as a reference by the insurance industry until the industry was nationalized. The life insurance industry was nationalized in 1956 and general insurance industry nationalized in 1972 (Kracher, Chatterjee & Lundquist, 2002; Dasgupta, & Sengupta, 2002; Sinha, 2002).

3.1. Life Insurance Industry

- According to Sharma (2010), the life insurance industry was nationalized. The main reasons are: (a) insurance companies should be “cooperative enterprises” under the socialist form of government, (b) the insurance products are expensive, (c) there is no improvement in services delivered to the policyholders in particular and the society at large, (d) the lapse ratios are very high and hence it leads to the waste of economic resources, (e) there is no improvement in protecting public health, medical check-up and hazard prevention activities and (f) failure of many insurance companies due to the mismanagement is not healthy for the country’s financial system.Nationalization took place with the hope that with the economies of scale, the cost can be cut down and the lower premium can be offered to the market. In addition, the government can promote the life insurance products to the rural areas, which are not the interest of the private insurance companies due to non-profitability. The main purpose of nationalization of the life insurance industry is to meet the social objective of insurance and introduce it to the neglected rural areas.Due to the nationalization in 1956, 245 companies including foreign own companies were taken over by the government (Life Insurance Corporation of India, 2004). Henceforth, life insurance operated under the publicly owned Life Insurance Corporation (LIC) of India based on the Life Insurance Corporation Act 1956.

3.2. General Insurance Industry

- General insurance is under the Tariff Committee under the control of the General Insurance Council of the Insurance Association of India. Under this committee, the insurance related to motor, fire, marine and miscellaneous are covered. In 1968, the Tariff Committee was replaced with the Tariff Advisory Committee, as validated with the amendment of Insurance Act 1839. The main task of this committee is to set the floor price and it should be periodically reviewed to suit the current market situation. Based on the price set by this committee, the general insurance companies set their own prices. This advisory committee is working independently until the nationalization of general insurance companies in 1972. Nationalization of general insurance is enforced by the General Insurance Business (Nationalization) Act 1972.Before 1973, there are 107 companies, including foreign companies offering general insurance. They were amalgamated and formed into four subsidiaries under the General Insurance Corporation of India (Sharma, 2010).

4. After Nationalization until Liberation of the Industry

- After nationalization of the insurance industry, the Malhotra Committee was established in 1993. The Chairperson of this committee is R.N. Malhotra who is the retired Governor of the Reserve Bank of India. The aims of this committee are (a) to suggest the structure of insurance industry by assessing the strength and weakness of the industry, coverage of the insurance products, quality of insurance services, efficiency and variability, (b) to recommend for changes in the structure of insurance industry and changes in general policy framework, (c) to suggest LIC and GIC to improve their functioning, (d) make recommendation on regulation and supervision of the insurance sector, (e) to make recommendation on the role and functioning of the agents and (f) to recommend on any matter for the development of the insurance industry in India (Sinha, 2002). This committee conducted a survey examining the impact of nationalisation. For life insurance, LIC was able to provide a satisfactory level of service according to the customers’ satisfactory survey. LIC managed to attract 60 to 70 million policyholders and expanded into rural areas (Sinha, 2002).However, in the case of general insurance, a few unfavourable issues were faced after nationalization of the general insurance companies. In 1972, General Insurance Corporation (GIC) of India was incorporated under the Companies Act 1965 to control and operate the business of general insurance of India after nationalization. GIC is re-organized with four fully owned subsidiary companies: National Insurance Company Limited, New India Assurance Company Limited, Oriental Insurance Company Limited and United India Insurance Company Limited. The performance of GIC was criticized by the Malhotra Committee by pointing out the unavailability of complete and up-to-date data. In addition, with the amendment of the Motor Vehicles Act 1939, there as an increase in third party liability and hence, the premium should be higher. However, due to political pressure, the premium cannot be increased and thus it does not reflect the market price. Therefore, GLC incurred huge losses in motor insurance. This led to the abolishment of the Tariff Advisory Committee on 1st April 2006. Moreover, the efficiency of four subsidiaries is questioned and it has been suggested that these subsidiaries should be independent companies and GLC should not be the holding company and should focus solely on reinsurance. Interestingly, the report from Price Waterhouse Coopers was contrary to the suggestions of the Malhotra Committee. Price Waterhouse Cooper’s recommended merging the four subsidiaries for greater efficiency. These companies came out with the “voluntary retirement scheme” to reduce the number of staff since they were overstaffed (Sharma, 2010). In 1995, the Mukherjee Committee was set up. The purpose of this committee is to provide a concrete plan for newly formed insurance companies. The report of this committee is not disclosed to the public. This committee also focuses on the transparent disclosure of the financial information (Sinha, 2002). After the report from the Malhotra Committee, the political instability slowed the process to liberalize the insurance industry. The Indian Cabinet approved the Insurance Regulatory Authority (IRA) Bill on 16th March 1999. After the new government came into existence, the Insurance Regulatory and Development Authority Act (which is now called the Insurance Regulatory and Development Authority) was passed on 7th December 1999, aimed at liberalizing the insurance industry. Starting from early 2000, private companies are given licenses for insurance, according to life, general and reinsurance.

5. After Liberalization until Present

- This section explains Indian insurance in the global context and the evolution of insurance in India.

5.1. Indian Insurance in the Global Context

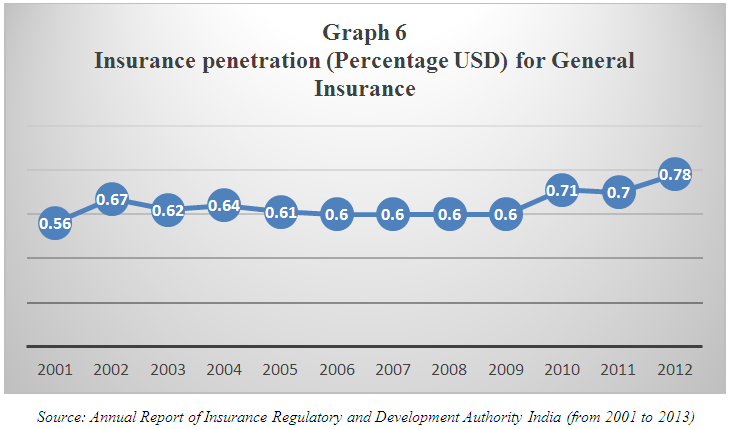

- According to Annual Report of Insurance Regulatory and Development Authority India (2012-13), 56.8% of the total insurance premium worldwide belongs to life insurance premium. From that percentage, Indian life insurance premium contributes 80.2% of the entire Indian insurance market premium. In addition, Indian life insurance is ranked 10th among 88 countries. During 2012, India’s share in the global life insurance market was 2.03% and in 2011, its share was 2.30%. In 2011, the Indian life insurance penetration rate was 3.4% while the global rate was 3.8%. In 2012, the Indian life insurance penetration rate was 3.2% while the global rate was 3.7%.In the case of general insurance, 43.2% of the total insurance premium worldwide belongs to the general insurance premium. From that percentage, Indian general insurance premium contributed 19.8% of the entire Indian insurance market premium. It saw significant growth of 10.25% in 2012. Its performance is much better than the growth of global general premium which was only 2.6%. However, in terms of market share, Indian general insurance premium had only 0.66% of global general insurance and ranked 19th in the global general insurance market. Indian non-life insurance penetration rate was 0.7% while the global rate was 2.8%. In 2012, the Indian non-life insurance penetration rate was 0.8% while the global rate was 2.8% (Annual Report of Insurance Regulatory and Development Authority India (2012-13).

5.2. Number of Insurance Companies and Offices (2001- 2013)

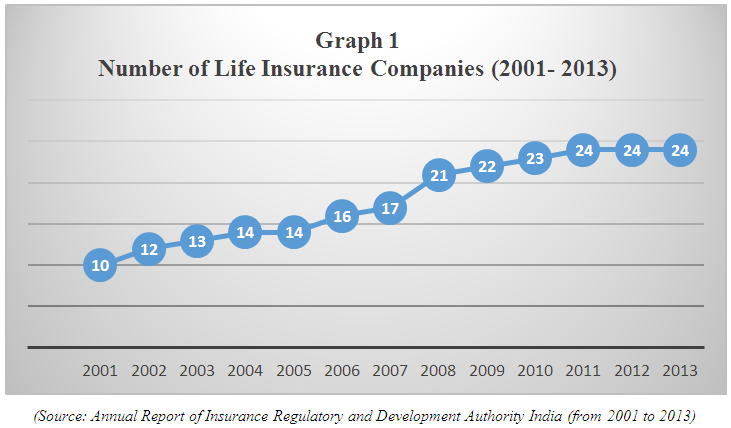

- Graph 1 shows the number of life insurance companies over the period of 13 years (2001-2013). The trend shows that the number is increasing over the period of 10 years (2001-2010) withe same number of life insurance companies from 2011 until 2013.

| Graph 1. |

| Graph 2. |

| Graph 3. |

| Graph 4. |

5.3. Insurance Density and Penetration (2001-2013)

- Insurance penetration is measured as ratio of premium (in USD) to GDP (in USD). Graph 5 shows the insurance penetration as a percentage of USD for life insurance over the period of 12 years (2001-2012). The trend is showing that the penetration of life insurance is not stable since there is an increase from 2001 to 2002, decrease in 2003 and then increase in 2004 and in 2005; it has the same penetration rate as 2004. From 2005 to 2006, there is a big jump in penetration since it increases from 2.53% to 4.1%. In 2007, there is a slight decrease to 4% and it maintains the same penetration in 2008. In the case of 2009, it increases to 4.6%. However, starting from 2010 until 2012, life insurance penetration is decreasing.

| Graph 5. |

| Graph 6. |

| Graph 7. |

| Graph 8. |

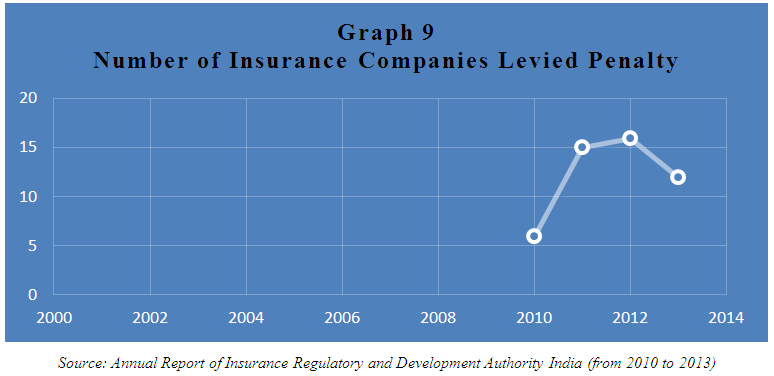

5.4. Other Issues in the Indian Market: Number of Insurance Companies Levied Penalties

- Graph 9 shows the number of insurance companies’ levied penalty over the period of four years (2010-2013). In 2010, six companies had penalties imposed on them, and 15 companies in 2011, 16 in 2012 and 12 companies in 2013.

| Graph 9. |

6. Conclusions

- This paper uses the documentary approach to highlight the evolution of insurance in India. History reveals that the insurance sector should be appreciated for its contribution for the development of Indian economy. Four phases of its historical development have been elaborated in this paper. By comparing the milestones of its development, the Indian insurance industry seems to have more improvement after liberalization. Therefore, this paper will be the interests of the researchers to refer it as a useful document for future research. In addition, for the industrial players and regulators can capture quickly the progressive development of insurance in India.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML