E. C. Merem 1, Y. A. Twumasi 2, J. Wesley 1, D. Olagbegi 1, M. Crisler 1, C. Romorno 1, M. Alsarari 1, P. Isokpehi 1, M. Alrefai 1, S. Ochai 3, E. Nwagboso 4, S. Fageir 5, S. Leggett 6

1Department of Urban and Regional Planning, Jackson State University, 101 Capitol Center, Jackson, MS, USA

2Department of Urban Forestry and Natural Resources, Southern University, Baton Rouge, LA, USA

3African Development Bank, AfDB, 101 BP 1387 Avenue Joseph Anoma, Abidjan, AB 1, Ivory Coast

4Department of Political Science, Jackson State University, 1400 John R. Lynch Street, Jackson, MS, USA

5Department of Criminal Justice and Sociology, Jackson State University, 1400 John R. Lynch Street, Jackson, MS, USA

6Department of Behavioral and Environmental Health, Jackson State University, 350 Woodrow Wilson, Jackson, MS, USA

Correspondence to: E. C. Merem , Department of Urban and Regional Planning, Jackson State University, 101 Capitol Center, Jackson, MS, USA.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

In the last several years, the choice of hydrological fracking as an alternative method of nonrenewable energy production in the US oil sector continues to gain currency across regions especially the Southeast and the West. In a country where fracking is no longer deemed as an exercise on the fringe amidst unprecedented expansion, economic boom, and ecological liabilities. The use of fracking techniques in shale fields remains so widespread across different states from California to Mississippi that it now constitutes 60% of the nation’s oil and gas output in the past two decades. This occurred in the face of favorable regulatory environments that catapulted the US atop global ranking of oil producers. While this has resulted in ample generation of revenues and job prospects in the respective states, communities in those places have endured grim impacts and risks on their ecosystems in the form of pollution, degradation, hydrological stress, induced seismicity, land disturbance and greenhouse gas emissions. Aside from efforts of the sector, regulatory agencies, and other stakeholders in the search for a common ground on the issues. The mounting ecological liabilities has in many cases aggravated tensions between affected communities and the oil sector. Yet, very little studies exist on the vulnerability of the study area to the impacts of hydraulic fracking using mix scale method of Geographic Information Systems (GIS) and energy statistics. Even when data is available, the sketchy nature tends to mar analytical proficiency given the lack of an accessible regional energy information system. Accordingly, this enquiry will fill that void by assessing the issues in hydraulic fracking in the study area. Emphasis are on the issues, trends, factors, impacts and efforts using techniques of GIS and descriptive statistics. Just as the results revealed a surge in production activities and revenues, the impacts consist of sizable use of water and chemicals together with extensive pollution, the disturbance of fragile landscapes and ecosystem decline. Additionally, GIS mappings pinpointed a gradual spread of production activities and concentration of risks across states in the zone due to several socio-economic and physical elements located withing the larger energy structure. To remedy the situation, the paper proffered solutions ranging from ecological monitoring to the design of a regional energy information system, effective policy, community participation/education of the public and the formation of an interagency task force.

Keywords:

GIS, Hydraulic fracking, Southeast and western region, Impacts, Factors, Changes, Production, Capacity

Cite this paper: E. C. Merem , Y. A. Twumasi , J. Wesley , D. Olagbegi , M. Crisler , C. Romorno , M. Alsarari , P. Isokpehi , M. Alrefai , S. Ochai , E. Nwagboso , S. Fageir , S. Leggett , Assessing Hydraulic Fracking Issues in the US South East and Western Region, Energy and Power, Vol. 11 No. 1, 2021, pp. 1-19. doi: 10.5923/j.ep.20211101.01.

1. Introduction

Considering the historical trends in key energy hubs of the study area, both horizontal drilling and hydraulic fracturing techniques [1,2,3] were initially blended in the state of Texas form late 1980s and the early 1990s around operating reservoirs in the Barnett Shale, in the North Texas locality. In the process, it comes as no surprise that as of 1999, the initial applications of fracking rose rapidly in Texas in a bid to unlock once unreachable natural gas wells [4,5,6]. While this stems from innovations in explorations and processing substances since their early uses in the period 2000. Between 2007 to 2009, fracking technique driven mostly by the introduction of brand-new processing liquids and additional components resulted in a surge in shale gas output in states from Texas to North Dakota and the others. These levels of advances enabled oil and gas prospectors to penetrate bedrocks deemed very impervious and expensive to drill through shale pool in a way that sparked confidence in energy ventures [7]. Consequently, in the last several years, the choice of hydrological fracking as an alternative method of non-renewable energy production in the US oil sector continues to gain currency across regions especially the Southeast and the West [8]. In a country where fracking can no longer be deemed as an exercise on the fringe amidst unprecedented expansion, economic boom, and ecological liabilities [9]. The use of fracking techniques in shale fields remains so widespread across different states from California to Mississippi, that it now constitutes 60% of the nation’s oil and gas output in the past 2 decades [10]. To buttress the potentials, hydraulic fracturing activities accounted for daily output of 6.44 million barrels of crude oil during the 2018 fiscal year in the US. This corresponds to 59% of combined overall output. Further along the years, by 2015, fracking generated 53 billion cubic feet of natural gas daily, estimated at over 2/3 of the national capacity. Just as production proliferated, fracked well records rose considerably from 26,000 out of a total of 276,000 natural gas wells by 2000, to 300,000 in 2015. Such a jump exceeded available gas reservoirs within a span of 15 years [11].Given the delivery patterns of oil and gas across the country, the effects of fracking activities are now so rampant that opponents in some quarters have advocated for a ban. The concerns emanate from ecological impacts like land clearing in natural areas to provide space for well locations and pipes [12], as well as leakages and discharges that often degrade lakes and water sources together with the widespread use of freshwater during fracking activities. Besides, there are also the risks from exposures to Green House Gas (GHG) emission associated with human induced climate change alongside the recurrent level of water stress in places actively involved in drilling [13-19]. This occurred amidst favorable regulatory settings that catapulted the US to the top of global ranking of producers [20,21]. Given that this led to ample generation of revenues in the respective states, affected communities have endured terrible impacts on their ecosystems in the form of pollution, degradation, hydrological stress, induced seismicity, land disturbance and GHG emissions [22-26]. In as much as current trends show that over 25,000 gas reservoirs in the Barnett shale discharge up to 60,000 kg in CH4 hourly, much of the Barnett field sites emit 544,000 tons annually deemed close to 8% of the total emissions in the nation [27]. So, by 2009 to 2014 when the state of Texas posted higher levels of shale gas output, the frequency of toxic discharges skyrocketed in the same period. Even though discharges from fracking cover a mixture of methane and different kinds of chemicals [28,29] like benzene, xylene, and toluene, they still trigger lethal medical complications made up of pulmonary issues and genetic abnormalities. Aside from the liabilities [30,31,32] fracking promoters often tout the fiscal benefits in terms of employment, sliced energy costs, economic development through generation of income and viable tariff base [33-36]. Building on the $548 billion which fracking injected into US overall GDP in 2016. The oil industry debunks the ecological risks by pointing at minimal linkages from fracking due to local regulations. To that effect, in 2019 proponents cautioned that any fracking prohibitions nationwide in lieu of the externalities could amount to a loss of 14 million employment positions with rise in energy and living costs, as well as dip in family wages to the tune of $873 billion in 2022. Despite the efforts of the sector, regulatory agencies, and other stakeholders in the search for a common ground on the issues. The rising ecological risks has on many occasions aggravated tensions between affected communities and the oil sector [37-40]. Yet, very little studies exist on the vulnerability of the study area to the impacts of fracking using mix scale approach integrated with temporal-spatial techniques of GIS and energy statistics [41,42,43]. Even when data exists, the sketchy nature tends to mar analytical proficiency given the lack of an accessible regional energy info system [44]. Accordingly, this enquiry will fill that void. The emphasis is on the issues, trends, factors, impacts and efforts using GIS and descriptive statistics. Hence, the paper has five objectives. The first aim entails the applications of geospatial technology to analyze non-renewable energy use and the changes and the effects of fracking, whereas the second objective is to design a decision support tool for managers. The third goal stresses the development of a new system for calibrating fracking index. The fourth aim is to advance a method for regional energy management with mix scale tool while the fifth one evaluates fracking related trends. Regarding organization, the paper is divided into five sections. The first part covers the introduction, while the second part highlights methods and materials. Section three presents the results of data analysis made up of descriptive statistics, spatial analysis of GIS mapping, factors, and impacts. Section four deals with discussions while section five provides the conclusions and recommendation.

2. Methods and Materials

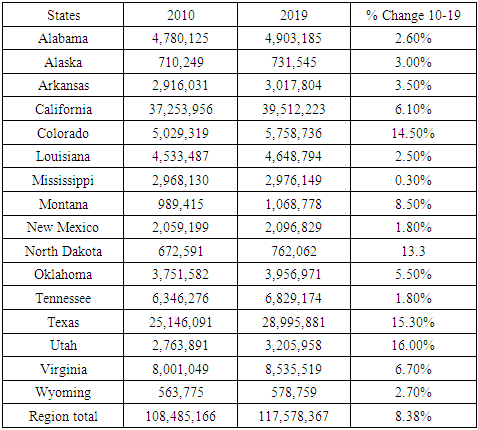

The study area located in the South and Western part of the country as a major energy hub, contains 16 states from Alabama, Wyoming to Alaska. The zone occupies extensive swath of land area measuring about 1,948,529.12 square miles. Being an area fully endowed with vast deposits of hydrocarbon resources of oil and natural gas, it boasts of large ground water aquifers adjacent to some of the most active shale plays as listed in the map. With a population of over 117 million [45,46] (Table 1); the study area traverses the moist South East sub region, the arid and Desert South west ecozone of the country. As an enormous site in a very complex ecology with massive tapestry of biodiversity. The environmental features of the region consist of deserts, sensitive wetlands, fish and wildlife streams, forested landscapes, and farmlands. Yet, the zone faces vast challenges from growing human settlements and pressures of water stress by accelerated fracking operations involving the injection of various types of chemicals leading to ecological risks like induced seismic shock, pollution, and land degradation [47,48]. All these have emerged as major issues regardless of the economic boom from fracking activities [11].Table 1. The Study Areas Population Distribution 2010-2109

|

| |

|

Accordingly, the population pressures and demands from farming, energy activities in the south west and the mountain west zones of the region are resulting in unparalleled infrastructure development alongside fracking [46]. The downsides stem from uncertainties and stress induced through drilling and changing climate, rising water usage, and hydrological insecurity between 1995-2010. Realizing, that alternative oil and natural gas activities play important part in the nation’s quest for sustainable energy future. The US contains sizable deposits of these assets with economic viability due to innovations in horizontal drilling and hydraulic fracking techniques. In fact, the direct economic benefits from increased gas production by fracking generated approximately $36 billion in economic activity in 2011. This amounted in a surge of about 8.5 trillion cubic feet in 2011 at an average price of $4.24 total in US natural gas output. Since fracking ensures more access to oil and natural gas in shale configurations. In the process, the development in shale gas resources currently driving fracking and the nation’s energy boom provided greater opportunities germane to fiscal and energy security, and ecological disbenefits as well [49]. Officially the study area’s geologic bed rock shale formation covers Haynesville shale under multiplicity of deep south states like Louisiana, Arkansas, and Texas responsible for 10% of US daily supply of natural gas. These places are among the main players in nationwide shale play under the orbit of global capital. Other segments of the shale play network active in the region involves a trio of larger fields in Texas made up of Permian [50], Eagle Ford, and Barnett. The remaining ones consist of Niobrara[51], Bakken, and Monterey shales deep in the Mountain West and the South west Desert ecozone and Pacific North West region in the country. Given the vast deposit of energy resources, the shale fields daily output therein ranged from 27.3 billion cubic feet in natural gas to 3.8 million barrels. Regardless of the rosy picture painted so far on shale fields energy potentials, as mentioned earlier, the magnitude of ongoing fracking operations in the zone lives in its wake significant footprint on the ecology which can no longer be ignored. This is the case seeing the scope of mounting water crisis, land disturbance and the encroachment on protected and fragile habitats in many western states from Wyoming to Colorado and Montana [52-55]. Furthermore, in the exploration phase during which wells undergo multiple splintering in intervals, the size of water utilized in the process are often unknown due to changes from sites and machinery. In a zone where Texas and Colorado require more than 3.6 million gallons of water for each fracture [56]. The fact that various lakes along west Texas area are operating at barely 25% of their normal volume. The gravity of water stress in the zone has been fully felt based on the declines in local aquifer levels in the Eagle Ford formation which plunged by around 300ft in the past years [57]. For that, many of the towns in the Texas oil and gas hub risk running out of water deposits. Consequently, other areas are also on the verge of exceeding their limits amidst the risks posed by high sequence of aridity and rising demands for water to meet hydraulic fracking activities. At a time in which close to three dozen communities in Texas were projected to experience water deficits in 3 months. In nearby western states of California and Colorado where almost the number of wells estimated at 96-97% operated in localities in which almost all the underground and surface water assets are by now stretched out between competing land uses and the towns. The pace of water requests for fracking within the state of Colorado rose by 6 billion gallons in 2015. This corresponds to two times the yearly water demands of the city of Boulder. Elsewhere, nearly all the wells in New Mexico, Utah and Wyoming appear within areas under intense hydrological stress indicative of the situation in other zones involved in the ongoing fracking boom [57].

2.1. Methods Used

The paper uses a mix scale approach involving descriptive statistics and secondary data connected to GIS to assess hydraulic fracking trends and the associated issues in the South and US Western region in the past few years. The spatial material for the study were found primarily through several organizations comprising of the United States Department of Energy Department (US DOE), The United States Energy Information Administration (US EIA) and the United States Geological Survey (USGS). Other sources of spatial info emanate from the United States Frack Focus organization, Duke University, Futurity, the Pacific Institute, the US Bureau of Economic Analysis, the Bureau of Land Management and Auburn University. In addition to the initial spatial info providers essential in this study, note that items from groups like the American Petroleum Institute, Earth Justice, Inside Climate News Research, Environment Texas, Environment America, Ballotpedia, Frontier Group, Google maps and Frack Tracker were also helpful. Besides, the US Environmental Protection Agency (EPA), the Green Peace, Texas Railroad commission and Texas environmental quality department offered other essential information in the research.Generally, while most fracking indices germane to the study area and its states were obtained from the US EIA, US Department of Energy, Institute for Energy Economics and Financial Analysis, US Bureau of Land Management (BLM) the Bureau of Economic Geology at the University of Texas, Texas Railroad commission, and Arkansas Energy Commission and Ballotpedia, the Frontier group and Environment Texas, and Environment America. The core of the group was also instrumental in the procurement of secondary data on the ranking, averages, and totals of capacity, percentages, production index as well as the time series, and physical information on fracking stocks on the key locations underlining the capacities in the region. On the one hand, the consultancy Dealogic, the city of Denton, Texas Oil and Gas Association and the Bureau of Economic Geology at the University of Texas respectively furnished sectorial info on equity and debt financing, frack wells and impacts and clusters of seismic activity within major oil and gas producing regions in both west and south Texas. On the other, the USGS, US BLM, the US Interior Department and the Sierra Club offered insights on approvals for fracking. In the same vein, the states in the west from to Colorado to Utah, the Western Energy Alliance and the Food and Water Watch and the institute for energy research provided the needed background documents on water pollution and spills. For additional data needs, the Congressional budget office, the US Census, American Petroleum Institute, and the American Enterprise Institute, were respectively critical in locating the information on the occurrence of fracking activities, production, prices, and econometric data highlighting usages and the changes. Data on ecological liabilities and impacts emerged from the National Academy of Sciences, Texas Commission on Environmental Quality (TCEQ), the Environmental Defense Fund and Environment America. Added to that are the vital presence in that category of the Pacific Institute on water contamination from fracking, followed by Wild Earth Guardians, the San Juan Citizens Alliance, the Western Environmental Law Center, and the Natural Resources Defense Council on issues regarding degraded natural habitats. Give that regional and federal geographic identifier codes of the nation were used to geo-code the info contained in the data sets. This information was processed and analyzed with basic descriptive statistics, and GIS with attention paid to the temporal-spatial trends at the national, state, and regional levels in the study area. The relevant procedures consist of two stages listed below.

2.2. Stage 1: Identification of Variables, Data Gathering and Study Design

The preliminary stage in this study includes the identification of variables necessary to analyze the scope of hydraulic fracking activities, oil and gas assets, capacity, output, and variations at the regional level from 2003 to 2019. The variables consist of socio-economic and environmental information, energy indicators, geologic, and hydrogeological markers. The complete breakdown of all socio-economic parameters shows nursing homes within 1 mile of fracked wells and shale play, hospitals, public schools, private schools within 1 mile of fracked wells, major shale wells, childcare facility within fracked wells and shale plays. While the others cover economic and housing data in the form of real GDP, housing units, housing permits, home value, per capita income, median household income and population. The environmental statistics consist of chemicals used and released such as hydrochloric acid, methane, land disturbance, land area, land disturbance percentage and water consumption percentage. Together with that, the geologic portion of the variables encompasses current and prospective shell plays, natural gas underground storage, natural gas storage region, fracking status, shale gas production percentage, number of fracked wells, crude oil and natural gas production volume, crude oil and gas production percentage and the number of crude oil wells. Lastly, the hydrogeological listing involves groundwater depletion, baseline water stress, wastewater from fracking, total water used, average volume of water used and water consumption percentage. These variables as mentioned earlier were derived from secondary sources made up of government documents, newsletters, and other documents from NGOs. This process was followed by the design of data matrices for socio-economic, environmental, and geological and hydrogeologic (energy) variables covering the periods from 2000, 2003, 2005, 2008, 2014, 2016, to 2019. The design of spatial data for the GIS analysis required the delineation of county boundary lines within the study area as well. Given that the official boundary lines with the country and its regions remained the same, a common geographic identifier code was assigned to each of the states’ area units for analytical coherency.

2.3. Stage 2: Step 2: Data Analysis and GIS Mapping

In the second stage, descriptive statistics and spatial analysis were employed to transform the original socio-economic and energy data into relative measures (percentages, ratios, averages, and rates). This procedure generated the parameters for indicating, the scope of fracking, production and usage, number of wells, and capacities, shale gas production, crude oil and gas production, area of land loss, and disturbance, water use during fracking, methane emissions and chemicals. Considering the correlation between these indicators and growing demands for non-conventional energy sources and the ongoing propensity in liabilities evident in the oil producing states in the US South and Western regions via measurement and comparisons across the years. The spatial units of analysis consist of counties, region, the boundary, and locations where hydraulic fracking activities operations and increasing production, potentials and drilling thrived. This method ensures the detection of change, while the graphics underscore the actual frequency and impacts, rankings, outputs, and the amount of usage and the trends as well as the economic, ecological costs and the associated risks. The remaining steps involve spatial analysis and output (maps-tables-text) covering the study period, using Arc GIS 10.4 and SPSS 20.0. With spatial units of analysis covered in the regions and counties (Figure 1), the study area map indicates boundary limits of the units and their geographic locations. The outputs for each state or units were not only mapped and compared across time, but the geographic data for the units which covered boundaries, also includes ecological data of land cover files, paper, and digital maps from 2003-2019. This process helped show the spatial evolution of location of various activities and shale plays on human environments, the trends, the ensuing fiscal and ecological shocks involved, coupled with changes in other variables and factors propelling the rise in hydraulic fracking and the effects. | Figure 1. The Study Area South West Region |

3. The Results

This portion of the study centers on temporal and spatial analysis of the fracking issues in the study area. There is an initial focus on the analysis of fossil fuel production based on the composition of fracked wells and shale gas using descriptive statistics. The other parts delve on crude oil and natural gas output in the study area. This is followed by the remaining aspects of the section comprising of impact assessment, GIS mappings, and the notation of the factors fuelling the proliferation of fracking in the region.

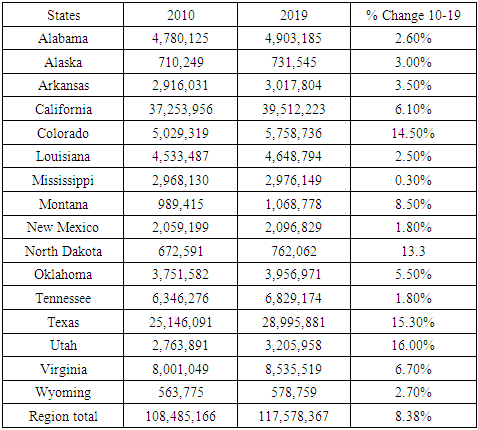

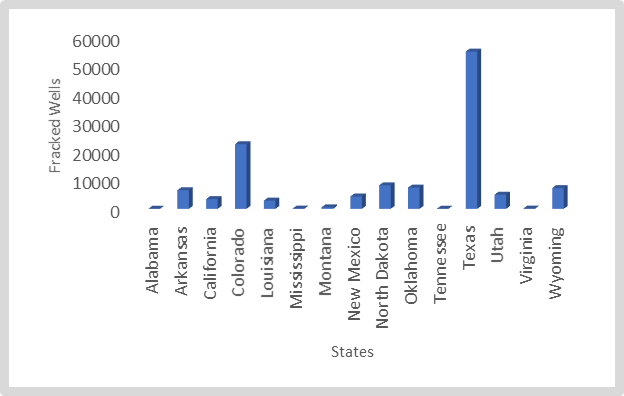

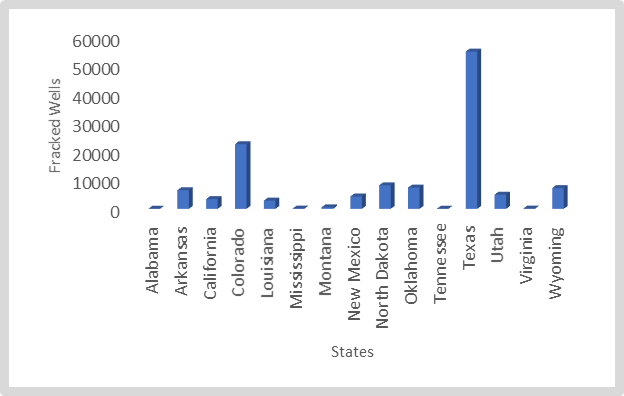

3.1. Production: Fracking Wells Since 2005

Going by the fracking activities in the study area, there exists a classification order of four diverse group of states highlighting the major ones when it comes to heavily fracked wells and the places with low number of wells linked to fracking in the producing areas over time. From the available info since the fiscal year 2005, the study area saw a total of 123,375 fracked wells emanating from intense explorations in all the states at an average of 8,225. Of the states with most fracked wells, Texas and Colorado stood out as the leading areas with 54,958 to 22,615 wells at the rate of 44.54 to 18.33% of the total, far ahead of other states. In the second tier of the producers, a quartet of states most notably North Dakota, Oklahoma, Wyoming, and Arkansas accounted for numerous fracked wells estimated in the thousands from 8,224-7421 to 7,277- 6,4967. Elsewhere, in the third grouping, a trio of Desert South Western states (Utah, New Mexico, California) and one out of the south East (Louisiana) had over 4000-3000 to 2000 plus fracked wells since 2005. In the same order, the other aspects of listed well activities shows close to half a dozen states from Montana, Virginia to Mississippi had fracked wells in the lower hundreds (539, 108, 103) as Alabama and Tennessee finished with meagre numbers of 49 to 30 fracked wells. Looking at the percentage distributions among the group of states, note the striking identical levels of 6.66-6.01% for North Dakota, Oklahoma together with 5.26 -5.89% for Arkansas and Wyoming. For that, in lieu of their relevance, the percentage values of fracked wells in the order of 4.01, 3.49, 2.75 and 2.33 among the third-tier states of Utah, New Mexico, California, and Louisiana are quite important herein to be overlooked even though the levels in the fourth and the lower states stayed less than one percentage points much of the time (Figure 2).  | Figure 2. Number of Fracked Wells Since 2005 |

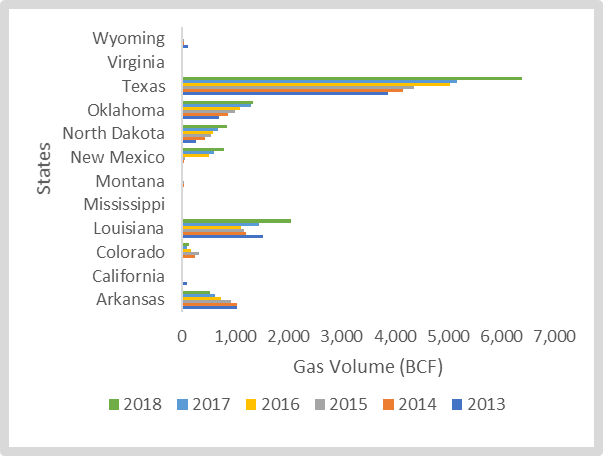

3.1.1. Shale Gas Production 2013-2018

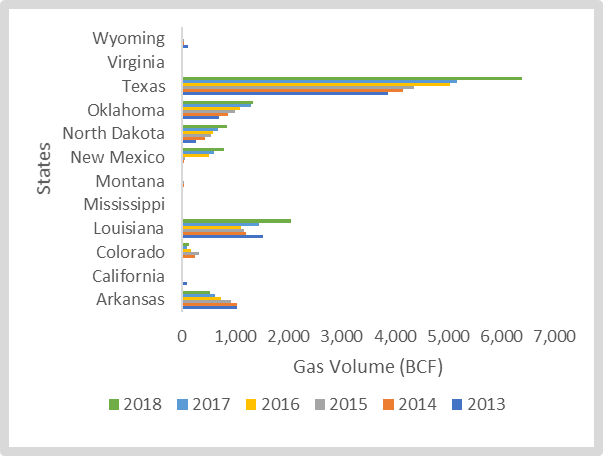

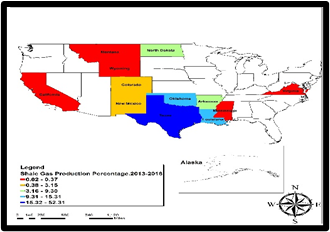

From the current trends, shale gas production totals in the study area not only stayed stable in terms of increments but between 2013 through 2018, the activities surged notably at the regional level. With an opening value of 7,630 to 8,023 BCF in 2013 to 2014 fiscal years, by the following periods 2015 to 2016, shale gas output for the entire South East and western region jumped further to 8,421 and 9,234 BCF. In the ensuing years 2017 to 2018, the growing trends in shale gas production reached all-time highs of 9,918 to 12,055 BCF. At the state levels, Texas appears to be on a different league of its own with rising volumes in shale gas production mostly at back-to-back levels beginning at 3,876-4,156 BCF to 4,353-5,029 BCF from 2013 to 2014, and 2015 to 2016. Such capacity in production was replicated by another huge rally of 5,171 to 6,392 BCF during the last periods in 2017 and 2018. The dominance of the South East in shale gas production seems further buttressed by the strong activities in a trio of states (Louisiana, Oklahoma, and Arkansas) during the span of six years. At that time, Louisiana’s shale gas output which was slightly above its two other neighbors started at 1,510-1,191 BCF to 1,153-1,111 BCF during the periods 2013 to 2014 and 2015 to 2016 until the sudden leap from 1,450 BCF to 2,044 BCF between 2017-2018. In the same zone, for its part, Oklahoma followed up through series of surges in shale gas production as manifested with the initial values of 698-869 BCF and 993-1,082 BCF in 2013, 2014, 2015 to 2016. Over time, the upward production trends in shale gas activities in the state of Oklahoma went unchanged as production rose again from 1,290 to 1,325 BCF in the periods 2017 through 2018 (Figure 3).  | Figure 3. Shale Gas Production 2013-2018 |

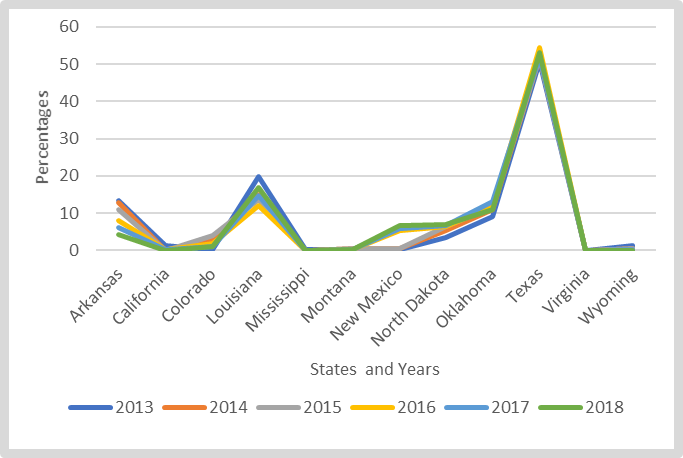

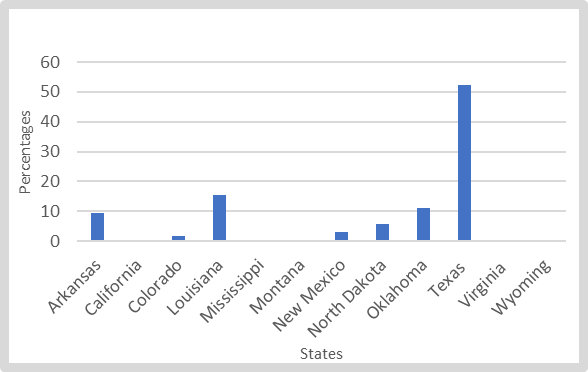

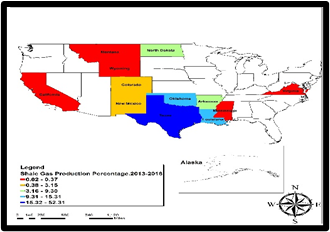

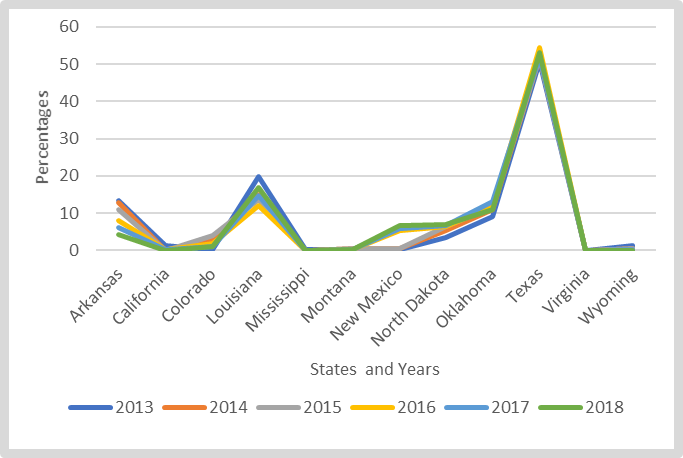

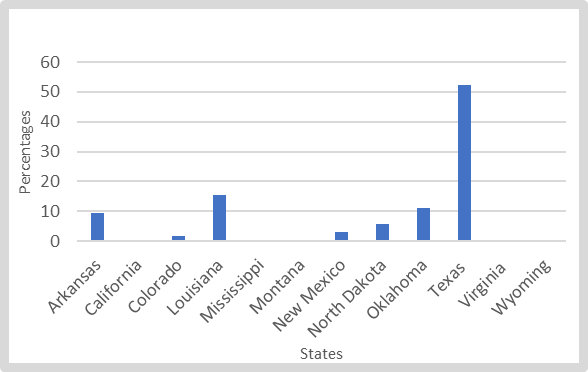

From the foregoing activities, Arkansas whose shale gas production volumes grew by 1,026 to 1,038 BCF in 2013 and 2014, saw those values fluctuate in the following years 2015- 2016 to 2017-2018 by 923 and 733 BCF to 618-521 BCF, respectively. In the third cadre of producing states in the West with slightly similar levels, North Dakota and New Mexico, and Colorado stayed at the center of activities therein. The common identical values in shale gas based on the temporal distribution for the first two states as indicated in the graph (North Dakota and New Mexico) stems from the pace of their increases in output over the years beginning in 2013-2018. In that way, resource prospectors in North Dakota wasted no time in their shale production ventures with about 268 to 426 BCF in 2013 and 2014, coupled with another batch estimated at 545-582 BCF in 2016 followed by 664 and 840 BCF deep into the ensuing years 2017-2018. New Mexico also held on to its position in the depth chart from the surge in production in shale gas (16-28 BCF, 46-497 BCF) that occurred in the state within 2013 to 2016. In the last years 2017-2018, the state’s shale output soared again by 592-785 BCF just as in the previous periods. While Colorado’s production volume rose notably (by 18 BCF to 236 BCF- 325 BCF) during the periods 2013-2015, followed by a temporary slide to 164 BCF in 2016. Between 2017 through 2018, shale production activities in Colorado rebounded visibly from 97 BCF to 126 BCF. The remining group of five states spread across the South East and the mountain west and the Desert South West sub zone (California, Mississippi, Montana, Virginia, Wyoming) rounded out in the lower echelon of shale gas producers in the study area beneath those in the first order as already indicated in the analysis. Aside from Virginia where the numerical values in shale gas output appeared somewhat stable at 3-4 BCF from 2013-2017. In the other places, the temporal distribution patterns went completely back and forth in Wyoming given that the state commenced at 102- 29 BCF and 36, 5 to 6 BCF by 2013 to 2017. Consistent with such patterns were the same trends that emerged in California, Montana, and Mississippi. In the Magnolia state, shale gas production hovered at around 5, 2 to 3 BCF in the opening three years (2013, 2014 and 2015) but stable at 2 BCF in the last years 2016 -2017. Both Montana and California in the West each produced shale gas (19-42 BCF to 39- 19 BCF and 89-3 BCF to 2-6 BCF) proportional to their capacities in the first four years together with 18-18 BCF and 6-4 BCF during the later times (Figure 3).As an indication of the supremacy and leverage of the South East from the foregoing analysis, a quartet of leading states in the area Texas, Louisiana and Oklahoma and Arkansas held higher percentage averages over the years. In fact, the combined average value of 88.16% in the percentage of shale gas production in the four states between 2013 to 2018 in the study area does affirm the intense level of activities in the zone (Figure 4). From the individual average proportion in the distribution of shale gas output, Texas maintains over 50% (or 52.31%) together with Louisiana at 15.31% and Oklahoma and Arkansas closely around low double digits. Such concentration in the proportion of shale gas output in the four states under 6 years not only surpassed the rates in the other eight states, but they are indicative of some stability over the different periods with Texas being the most consistent amidst the surge therein (Figure 5).  | Figure 4. Shale Gas Production Percentages 2013-2018 |

| Figure 5. Shale Gas Production Average Percentages 2013-2018 |

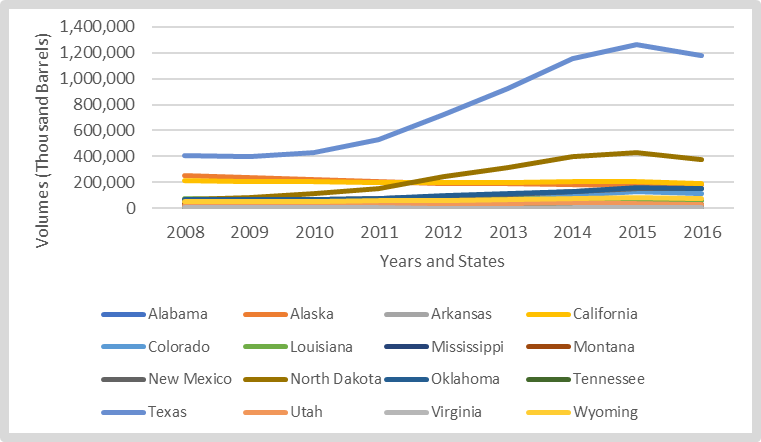

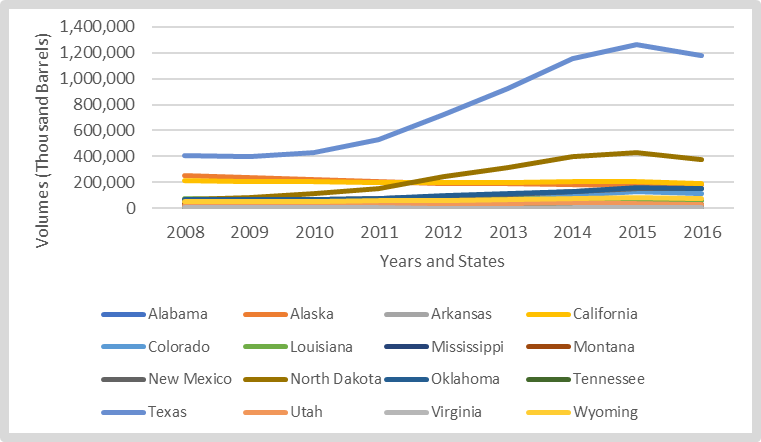

3.1.2. Crude Oil Production 2008-2016

The temporal profile of crude oil production shows that despite the frequency of fluctuations at the national, regional, and state levels. At an average of 1,912,510 thousand barrels of the total 17,212,507 Mbbl between 2008 to 2016, the study area held 75.46% of the US overall output of 22,809,206 Mbbl in almost a decade. In those periods, the crude oil production capacity in the South east and west vacillated between the 1 million plus barrel levels in the first five years 2008-2012 at 2 million and over mark from 2013 through 2016. Following the output levels of 1,305,487 - 1,285,999 Mbbl and 1,334,742-1,480,737 Mbbl from 2008 to 2011. The region’s productivity reached its highest peak of 1,810,956 Mbbl by 2012. Towards the last 4 periods during which crude output rose to 2,145,615 and over 2,500,000 Mbbl in 2013, 2014 and 2016. The regional total of 2,755,319 in 2015 Mbbl outpaced the levels attained in the previous years (Figure 6).  | Figure 6. Crude Oil Production 2008-2016 |

At the state level, Texas maintained its dominance again, ahead of the other producers with volumes of crude oil at 406,007 Mbbl-399,344 Mbbl to 426,749-528,806 Mbbl during 2008-2011 periods. From then on, a major shift ensues during 2012 and 2013 in the distribution patterns estimated at close to the million barrels (724,187-923,561 Mbbl). In the same vein, a new wave in output crept in through a surge in the million plus barrel range (1,157,262 Mbbl, 1,263,585 Mbbl, and 1,176,072 Mbbl) in 2014, 2015 and 2016. Even though the crude oil production outlook of none of the states in the zone came nearer to the same levels as Texas throughout the years. The two western states of Alaska and California still juggled closely for the second spot with 249,874 Mbbl-204,829 Mbbl to 214,465 Mbbl-194,194 Mbbl of crude oil in the ranking ahead of North Dakota from 2008 to 2011. By 2012 to 2016, North Dakota’s production levels of 243,831Mbbl-313,905 Mbbl in 2012 through 2013 rose by 396,749 Mbbl to 429,447 Mbbl ahead of Alaska and California. This occurred even though the slight drop to 378,428 Mbbl in output for North Dakota, stayed below the other two Western states (Figure 6). In the group of other states, Oklahoma and New Mexico in the south and western hubs present an interesting contrast with slightly similar averages of 104,401 to 95,799 Mbbl and total production measures at 921,607 to 862,192 Mbbl in the 9 years of activities. Considering the identical volumes in crude output at 60,000 Mbbl plus to over 70,000 Mbbl for both states during 2008-2011. The trend remained overly tight at 92,988 Mbbl - 85,218 Mbbl to 113,610 Mbbl - 101,373 Mbbl during the later years as Oklohoma widened its production edge with more gains by 124,253 Mbbl - 153,650 Mbbl in 2014 to 2016 compared to 123,6230 Mbbl - 147,283 Mbbl for New Mexico during the same period. In the trio of other states represented by Louisiana, Colorado, and Wyoming, the group’s combined totals and average of 1,755,372 Mbbl to 65,014 Mbbl by 2008 -2016, points to the primacy of Louisiana followed by Colorado. Besides being ahead in much of the categories, Louisiana maintained both average and overall crude oil output volumes of 67,401 Mbbl to 606,608 Mbbl while Colorado held on to about 582,407 Mbbl-64,712 Mbbl of those values in the second spot. Wyoming in the 3rd string among the group, had a total and average of 566,357 Mbbl to 62,929 Mbbl from 2008-2016. From the time series info as outlined in the figure, Louisiana still consolidated its prime spot in the classification. The state posted higher production levels of over 70,000 Mbbl to plus 60,000 Mbbl at unprecedented levels from 2008 to 2016. With all these in place despite late surge (of 94,414 Mbbl, 126,232 Mbbl and 115,365 Mbbl) for Colorado and Wyoming’s crude oil output (of 76,072, 84,499 to 72,313 Mbbl) in 2014 to 2016. The trio of other producers like Mississippi, Montana, and Utah, posted identical levels in output mostly in the lower tens of thousands Mbbl category. Clearly, they were practically no march for those in the top three tier list of producers from Texas, Alaska, North Dakota, California and not to talk of New Mexico, Oklahoma, and the others in the mix (Louisiana and Colorado) in the study area. The quartet of other Lower Southern Eastern states (Alabama, Arkansas Tennessee, and Virginia) in the bottom of the pile among crude oil producers in the zone accounted for the lowest levels in output from 2008 to 2016 (Figure 6).

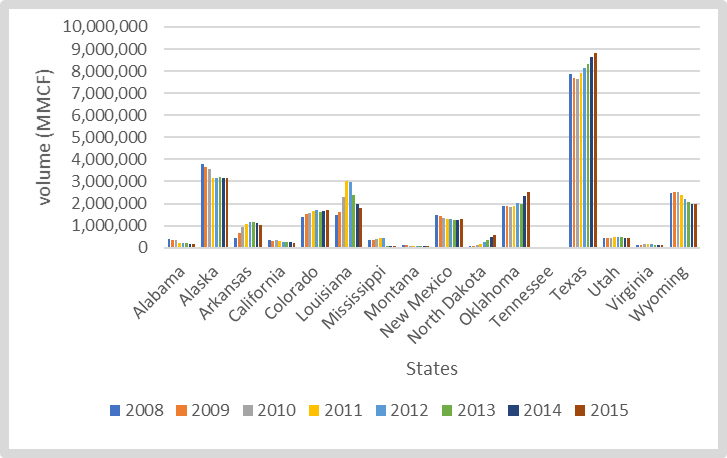

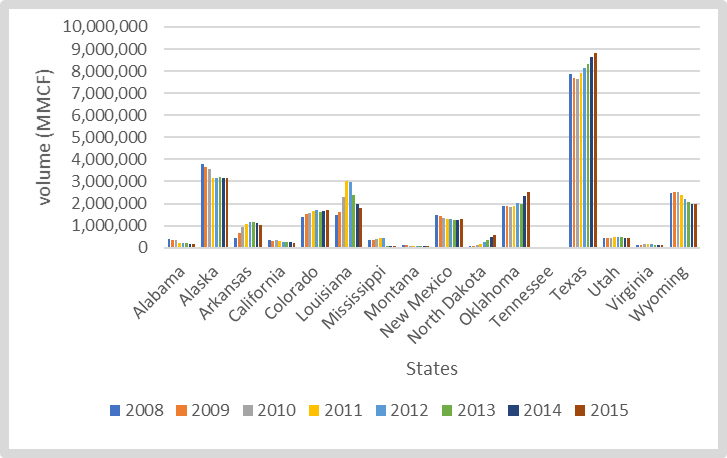

3.1.3. Natural Gas Production 2008-2015

The study area’s potential as the frontier of natural gas production in the US stems partly from the activities that culminated in widespread turnaround in the sector in the past years. This involved the total of 188,975,052 Million Cubic Feet at an average of 23,621,882 MMCF. While this represents 82.03% in a national average level of 28,794,154 MMCF out of an accumulated total of 230,353,233 MMCF from 2008-2015. The US South and the West together still account for 82.03% in production among the states in the zone during the eight-year span. At the same time, the volume of natural gas production during 2008 to 2015 reveals some level of stability at the regional level valued at over 22 million cubic feet (MMCF) in the first two periods 2008-2009. By 2010 through 2012, the natural gas output in the entire region rose further from 23,543,953 MMCF to 24,528,253 MMCF followed by a minor slide in 2013. In 2014-2015, gas production therein increased by 23,748,911 MMCF-23,911,118 MMCF in the entire region. Texas as the major player and biggest natural gas source appears to be at its peak up from where it left off before with both average and total output of 8,124,914 MMCF -64,999,311 MMCF far above all its neighbors from the 2008 to 2015 fiscal years. Under the state’s production levels that held firm at over 7,000,000 MMCF all through 2008-2011 with the jump to 7,934,689 MMCF a turning point. In the following years 2012-2013 and 2014 -2015, the output for Texas rose further at levels closer to its 8-year average by 8,143,510 MMCF- 8,299,472 MMCF and 8,659,188 MMCF -8,801,282 MMCF. Next to Texas in the hierarchy of natural gas production are the two key western states of Alaska and Wyoming, who despite an identical level of stability, had impressive output total and averages (of 26,928,113 MMCF -18,170,176 to 3,366,014 MMCF -2,271,272 MMCF) during 2008-2015. In as much as natural gas in both states appeared less fluid in those periods, worthy of note is Wyoming’s production which exceeded over 2,000,000 MMCF in 6 of 8 years notwithstanding the sudden fall to 1.9 million MMCF in 2014 -2015. Of the third-tier group of natural gas producers in 4 different states (Louisiana, Oklahoma, Colorado, and New Mexico) located in the South east and Western zones from 2008-2015. The states of Louisiana and Oklahoma posted much higher averages and combined totals of 2,116,610 MMCF-33,865,745 MMCF ahead of Colorado and New Mexico at 1,465,057 MMCF-23,444,057 MMCF correspondingly. The individual total production estimates (of 17,513,381 MMCF-16,352,364 MMCF and 2,189,173-2,044,046 MMCF) for the two southern states of Louisiana and Oklahoma again surpasses Colorado and New Mexico where overall separate output capacities in terms of the core parameters reached12,816,028-10,628,029 MMCF and 1,602,004-1,328,504 MMCF during the same periods. This in turn affirms the relative gaps in production among the leading states in the South and US Western zone. Given the emergent temporal patterns from the data metrics as outlined in the graph, Louisiana’s vibrant performance in production began at 1,473,920 MMCF-1,635,024 MMCF in 2008 -2009 fiscal years. With time, the state’s production hit over 2 million MMCF (2,288,119-3,040,523 MMCF to 2,955,437-2,366,943 MMCF) in four consecutive years despite finishing at 1,968,618-1,784,797 MMCF from 2014-2015. The natural gas production in the other southmost state of Oklahoma shows over 1.8 million MMCF in capacity much of the time especially in 2008 to 2011 and this later jumped to the 2,000,000 million MMCF mark throughout the 2012 to 2015 fiscal years. At such overwhelming levels of activities, both Colorado and New Mexico despite their notable operations in gas output never quite closed the gaps with Louisiana and Oklahoma during those years. Although the remaining states from Alabama to Utah were active in natural gas prospecting in the region, at no time did they show signs of surpassing the leading producers in Texas and host of the other states over time (Figure 7). | Figure 7. Natural Gas Production 2008-2015 |

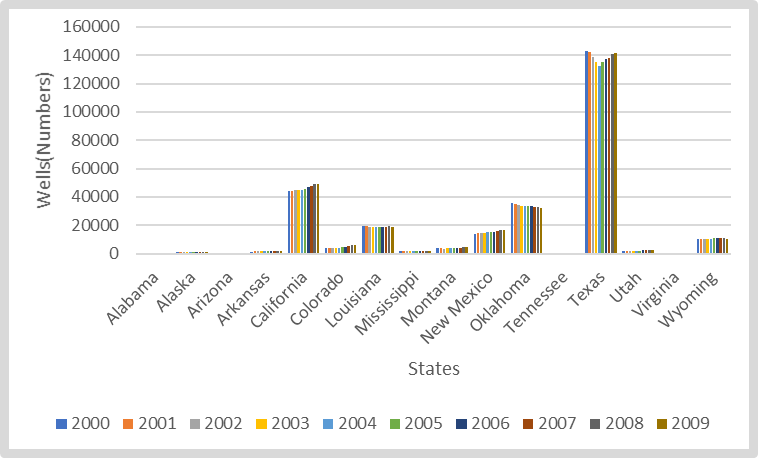

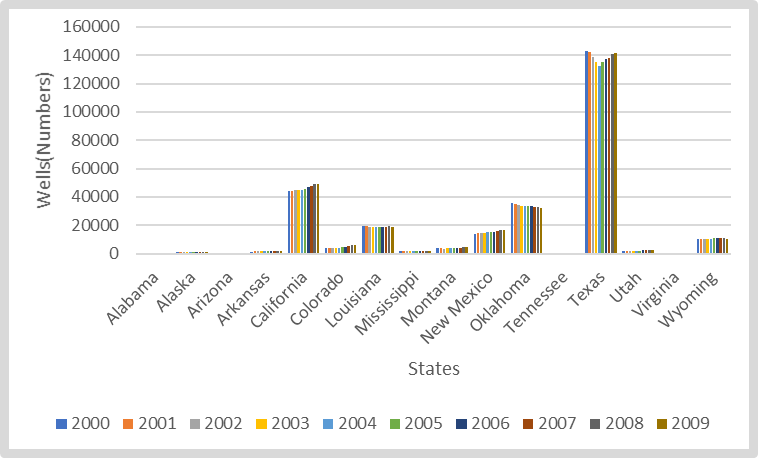

3.1.4. The Number of Crude Oil Wells 2000-2009

The number of active crude oil wells in the study area points to a total of 2,794,047 reservoirs in place during a ten-year span from 2000-2019 at an average of 279,404. This represents 79.05% of US total and average crude oil wells of 353,431-3,534,310. From a seemingly ample level of stability in the temporal distribution values of over 200,000 wells. The highest concentration of oil wells therein occurred in 2000-2001 when the actual number of operating oil reservoirs ranged from 282,241-281,119 with additional wells in the region at over 280,000 mark by 2007-2009. In the case of Texas which had average and total crude oil well numbers of 138,466-1,384,656 and 49.55% of the regional total, the state still accounted for 39.17% of the entire number of oil and gas from 2000-2009. In the process, of the number of wells for Texas, listed mostly in the hundreds of thousands. The values for the first two years at 143,008-142,131 in 2000-2011, together with the identical well numbers of 141,886 -141,562 in the last two years 2008-2009, exceeded the other years in the zone. For the other states, both California and Oklahoma’s crude oil well average numbers and the totals over the years stood in the high tens of thousands (46,239-33,649) and 462,385-336,493 respectively. In the same order, Louisiana, New Mexico, and Wyoming, posted combined averages of 14,882 and 5.32% of regional total for a decade. The individual state breakdown of the of the numbers in crude oil well distribution in those years puts the values for the trio of them (Louisiana, New Mexico, and Wyoming at 18,830, 15,206, 10,609, respectively (Figure 8). | Figure 8. Number of Crude Oil Wells |

3.2. Impact Assessment

The environmental impacts of fracking in the US South East and Western region demands a much closer scrutiny of the liabilities. This is based on the accumulated pressures involving land disturbance, water stress, CH4 emission, the dumping of large volumes of chemicals in the process and the proliferation of pollution risks. For purposes of analysis, these effects are assessed briefly below.

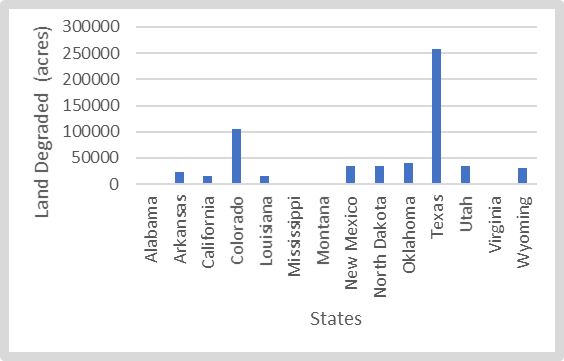

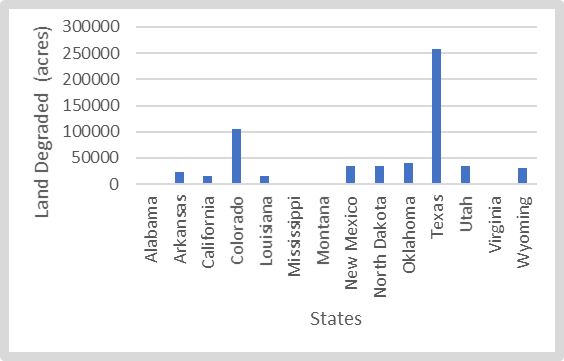

3.2.1. Land Disturbance

Considering that the earth-shattering force unleashed by heavy duty machineries, deployed in the bulldozing of fragile landscapes during the search for subterrain geologic assets, in the name of right of way, amounts to disturbance. They are known to accelerate the eventual displacement of wildlife species in the ecosystem. Consequently, fracking induced land disruption in the study area took out a total of 597,014 acres during the activities. This represents a regional average of 42,643 acres at 7.13%. Regarding the regional profile of the groupings, among the leading states, Texas and Colorado being the most impacted states, combined for a total of 363,138 acres at 60.82% in the size of degraded landscape in the zone from fracking. The fact that a quartet of other states (New Mexico, North Dakota, Utah, Oklahoma) in the 2nd order mostly in the US Western region experienced land disturbance on 145,679 acres estimated at 24.38%. There was no exception for other group (Arkansas, Wyoming, California, and Louisiana) in the 3rd ranking with a total of 84,644 acres to 14.15% of the cases in the zone.From the individual states, Texas’ land disturbance size and rate at 257,272 acres and 43.09% outpaces the other producers including Colorado which incurred 105,866 acres and 17.73% in the pace of degraded landscape. Apart from a few other areas (Alabama, Mississippi, Virginia, and Montana) where land disturbance size was mostly in the low thousand and hundreds of acreages from 153-2,210. In most of the remaining states from California to Oklahoma, fracking induced land stress areas were in order of 15,940 to 41,210 acres. The scale of these ecological footprints mostly in the single digit percentage levels lower than Colorado and Texas, are still damaging enough to stall biodiversity conservation in the affected places (Figure 9). Therefore, the negative impacts of these practices during fracking activities cannot be underestimated.  | Figure 9. Fracking Induced Landscape Destruction |

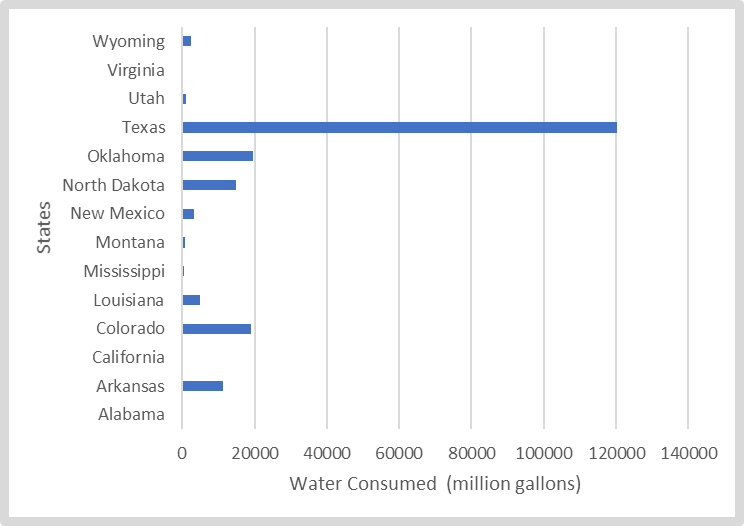

3.2.2. Water Use in Fracking

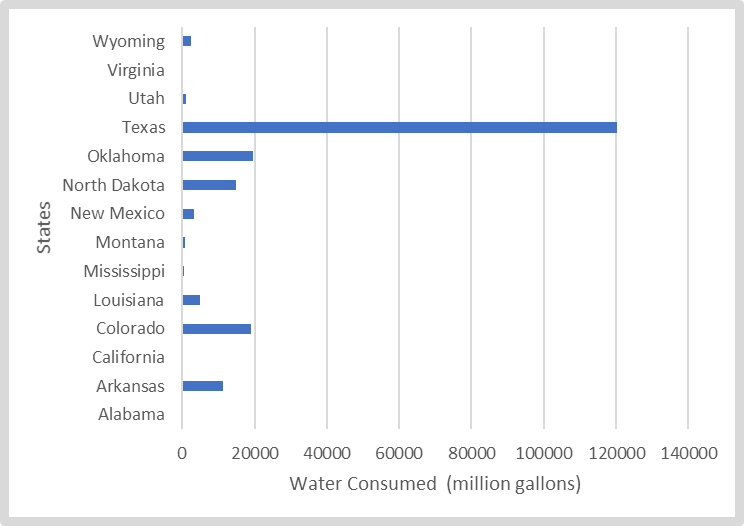

Knowing the high propensity to drought in the face of declining aquifers and the threats of water insecurity along the geologic basins in the South West over the years. Water demands for fracking activities continues to be on the rise. Accordingly, another major effect of fracking stems from the connection to hydrological stress, with the 198,098 million gallons consumed in the process across the region at an average of 14,149 million gallons. Of the states, Texas’s water consumption level of 120,215 million gallons alone as usual represented up to 60.68% of the entire sprinkling carried across the zone during fracking. At that pace and given rising demands overtime in the sector, the water devoted to fracking in four states Oklahoma, Colorado, North Dakota, and Arkansas in the region under a combined total of 64,905 million gallons at 32.74% and average of 16,226 million gallons still pales in comparison to Texas in that category. While the remaining quartet of states (Louisiana, Mississippi, Montana, and New Mexico) used only 9,278 million gallons estimated at 4.67% and average of 2,320 million gallons. In that way, the fracking induced water use levels for the other low consuming states from Alabama to Wyoming lags the major users as shown in the analysis (Figure 10).  | Figure 10. Water Use Volume During Fracking |

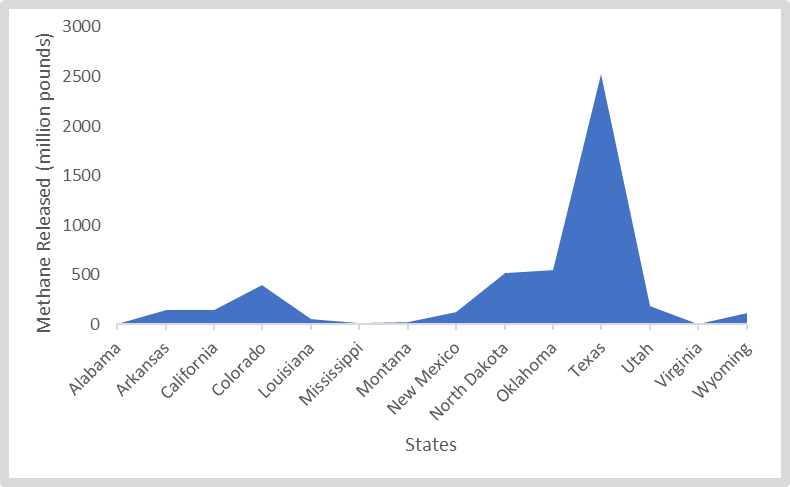

3.2.3. Methane Emissions

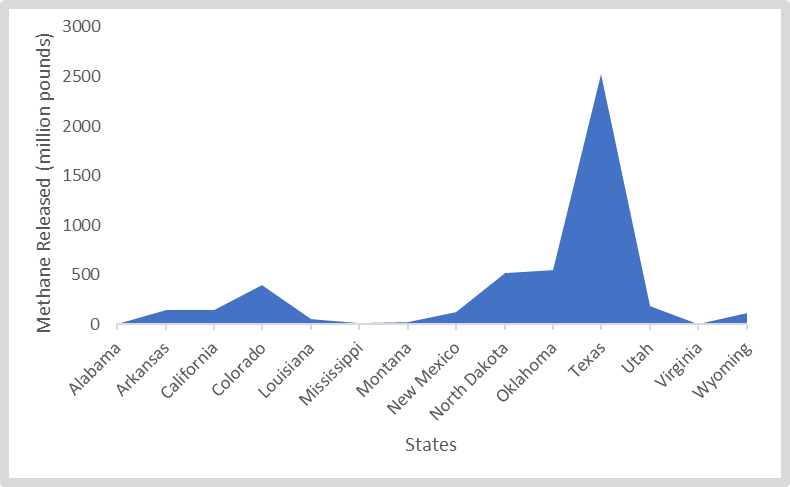

The volume of methane releases from fracking through well completion by 2014, in the region reached the tune of (4,630,671,650) 4,781 million pounds at an average of 429,970,150 pounds to 341.5 million pounds. As part of the overall methane releases during well designs in which Texas, Oklahoma and North discharged 77.38% (74.95%) of methane gases in circulation during the layout of reservoirs. Texas as the leading state and producer with 2,521 million pounds based on its activities was the source of over 50% or half of all the methane emissions in the study area. By the same year, North Dakota and Oklahoma rounded out the 2nd and 3rd spots at 11.16%-11.79% in the regional emission ranking with 500 million plus pounds (517,195,250-546,011,950) of the cases. Similarly, a group of other states (Utah, and Colorado) mostly with individual single digit emission levels of combined for 22.95% and 500 million plus in the actual discharges that occurred. Added to that, among the other producers are the 7.95% to 395,476,950 million pounds (381 million pounds) in methane discharge for the Western states of California, New Mexico, and Wyoming where emission in these places stood at an average of over 2% in 2014. In terms of the equivalence of methane discharge from the region and states to those from cars on the road. Note that of the total of 15,034,530 pounds of emitted methane from completed wells across the region, Texas not only emerged as the biggest emitter estimated at 8,184,404 pounds during that period, but North Dakota, together with Oklahoma and Colorado accounted for over a million pounds as the equivalent to emissions from certain number of cars in the respective states (Figure 11).  | Figure 11. Methane Emission From Fracked Well Completion, 2014 |

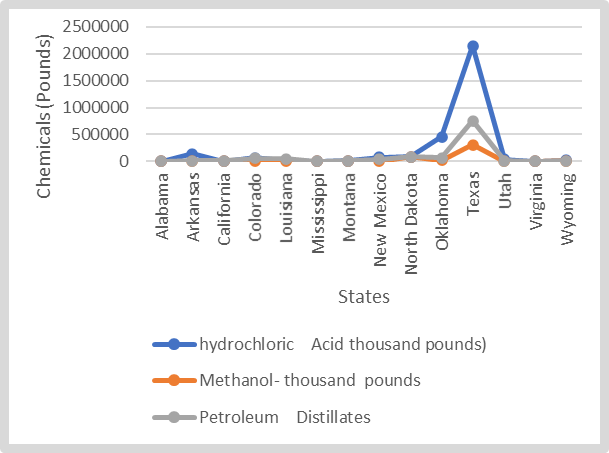

3.2.4. Use of Chemicals

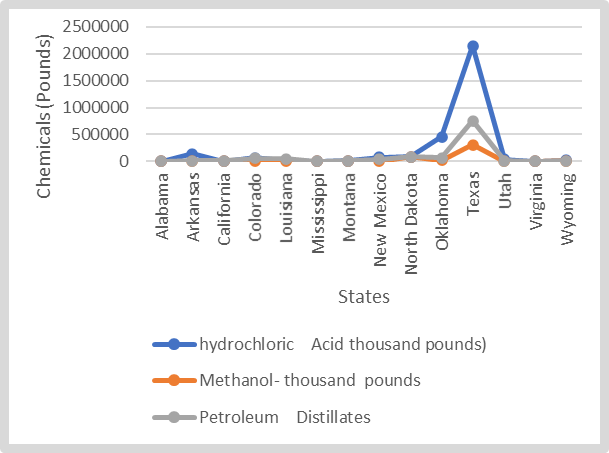

Another twist to the impacts of hydraulic fracking touches on the use of different types of chemicals made up of hydrochloric acid, methanol and petroleum distillates in the region’s oil producing states. In the process, the overall volume of substances used in the zone involved 3,045,883- 438,262 and 1,081,193 thousand pounds of hydrochloric acid, methanol, and petroleum distillates. Whereas this brings the total amount of all chemicals dumped during hydraulic fracking in the region to 4,565,338 pounds of materials. In comparison to that, the producers in Texas used up about 3,202,443 pounds (70.14%) of those items as Oklahoma only accounted for 540,884 thousand pounds (11.84%). Accordingly, Texas appears to have applied more chemicals than the rest of the states based on the accumulated substances (2,148,789- 302,501 and 751,153 pounds) in the three major chemical indicators from hydrochloric acid to petroleum at the rates of 70.54% to 69% plus respectively during the production process. In the case of Oklahoma, the volume of chemicals (hydrochloric acid, methanol, and hydrocarbon extracts) used under the trio of indicators, ranged from 455,225-17,147 and 68,512 thousand pounds (Figure 12).  | Figure 12. Frack Chemical Use |

3.3. GIS Mapping and Spatial Analysis

The GIS analysis entails the visual presentation of spatial forms highlighting various dimensions illustrating the dispersion of fracking activities. This is anchored in the status, shale play sites, gas output level, the aspects of hydrological stress, depletion trends and the impacts on built up environment in the zone. From the state of fracking and the burdens associated with the practices like production and the attendant liabilities over the years. The info as highlighted by the geo visual analytics under various dimensions embody the extent of operations and the actual footprints in the human environments across the zone. The ability to trace the geographic paths of these trends via GIS as a useful analytical device, provides opportunities for mitigation. The map in question in figure 4 highlights the status of hydraulic fracking under different themes and contrasting colors in the states under the study area from the mid-Atlantic area of Virginia to Texas in the south west and California in the Pacific West and South West Desert ecozone. With the content of the map as covered in the legend, calibrated under the colors of yellow and its light form representing states where fracking activities are active and soon to begin. Additional dimensions to the info contained in the legend, consists of mostly squared and oval images depicting spots in the map known for none economically feasible or viable reserves for fracking, those that are banned, others, and areas where fracking activities are under moratoria. In lieu of the prefoliations over time in the United States, the spatial distribution of the trends based on the map shows the growing pace of fracking activities at a glimpse across the country and the states in the study area in the period 2015. Notwithstanding the active operations of hydraulic fracking evident in over a dozen plus states in the study area in yellow colors beginning in the lower south east states on the right side of the map from Virginia, Alabama, Mississippi, Arkansas to Louisiana. There exists a major surge in fracking activities given the vast spatial concentration of operations all over the southern states of Texas and Oklahoma and Desert and Pacific states of New Mexico, California, and Utah, together with the west central state of Colorado, the Mountain states of Montana and Wyoming and North Dakota. Furthermore, in line with cases of fracking bans or moratoria as manifested in some states in the North East and the US mid-west region in 2015, a group of four states in the study area (Texas, New Mexico, Colorado, and California) where fracking is still active saw pockets of bans or moratoria as well (Figure 13).  | Figure 13. The Distribution of Fracking status |

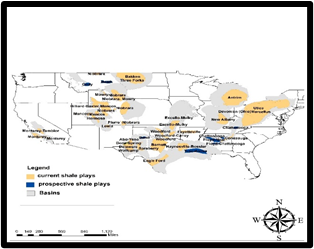

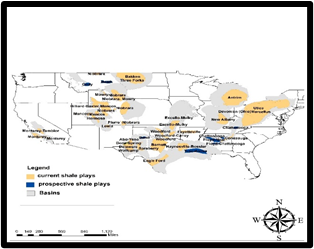

Seeing the significance of shale plays in current energy discourse of the country and the region, the map legend outlines locations of current and prospective shale plays as well as the basins under the colors of yellow, blue, and beige in 2019 relevant to the spatial dispersion of fracking activities across time and space. Given that hydraulic fracking entails securely collecting shale and additional tense tight fused bed rock structures via puncturing. The practice of secure hydraulic fracking under shale formations in the various locations under analysis are quite integral to the rudiments of US energy revival on the global scene. To that extent, fracking continues to enable the study area extract huge oil and gas assets that were formerly confined to shale or in shale and bedrock shapes. While some of the listed shale plays on the map contain enough oil and natural gas to drive the US economy over a century among the other ones in various regions of the nation. One need not loose site of the fact that some of the biggest shales in the nation are found in the region. The geography of shale plays currently driving energy surge in the US points to visible concentration in the study area from the South East to the West coast. This involves complex networks of bedrock spots and formations synonymous with hydraulic fracking beginning with Haynesville play that stretches from the South East areas of Louisiana, Arkansas to Texas and the Tuscaloosa prospective shale play. Moving further into the south west in Texas, also note the presence of two of the largest shale plays in the country where Barnett and the Eagle Ford in the south Texas, and the greater Texas axis gained prominence over the years with the largest deposits of oil and gas in Western Texas. Under the same pathways outside of Texas, the shale sites extend further into Bakken (in Montana and North Dakota) the upper mountain west, Niobrara and Monterey onto some parts of Colorado and California currently booming in fracking activities (Figure 14.1). Considering the significance of shale gas production in the region over the years. The geographic dimensions of the distribution patterns between the five-year span of 2013-2018 shows vast concentration of activities in the Lower south side of the map. Therein, Texas in the blue colors exceeds the others at the scale of 15.32-52.31%, followed by the spots in light blue and green (Oklahoma, Louisiana, Arkansas, North Dakota) under the 9.31%- 15.31% to 3.16-9.30% category. The spatial patterns in shale gas production in the individual years reflects the forms in the former to some degree (Figure 14.2). | Figure 14. The Spatial Distribution of Shale Plays In 2019 along Geologic basins |

| Figure 14.1. Dispersion of Shale Gas Production Rate |

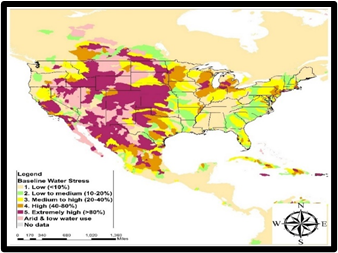

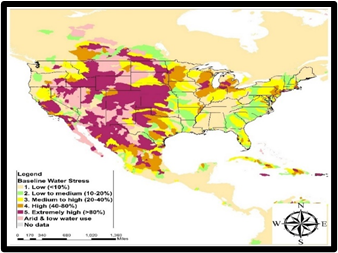

Bearing in mind that significant volumes of water are often needed during hydraulic fracking activities, it does expose limited water assets to stress. Thus, the linkages between water stress and fracking within sites in the various shale plays should not be underestimated. Accordingly, the maps in Figures 15 and 15.1 illustrates the scope of hydrological stress over the years. To that effect, while it requires 1-8 million gallons to carry out each fracking activity in states such as Wyoming and Texas, water access remains deeply stressed like in the other states. Under the water-energy interface based on the interactions between hydrology and fracking, the emergent risks are highlighted in the maps. Since 50% of the US shale gas and oil output occur in areas of the nation deemed water stressed. The indicators of baseline water stress contained in the map legend comes under different colors (light pink, green, yellow, light yellow and purple, light purple) of which low and medium stress in light yellow and green corresponds to the percentage level of < 10% -10-20% while the yellow color highlights medium to high stress measured at 20-40%. The light purple/orange box which covers high stress at a proportion of 40-80% comes next to the extremely high form of water stress in the purple color of > 80% together with the arid and low water use box in light purple color (Figure 15).  | Figure 15. The Geography of Water Stress from Fracking |

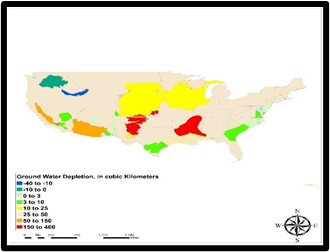

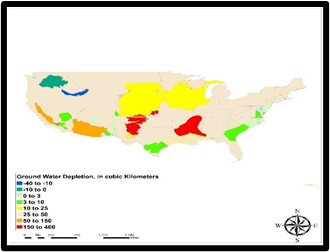

| Figure 15.1. The Spatial Distribution of Water Depletion |

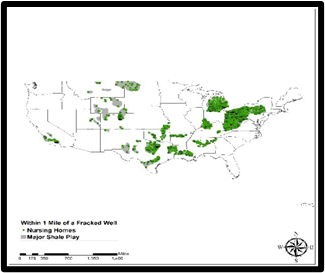

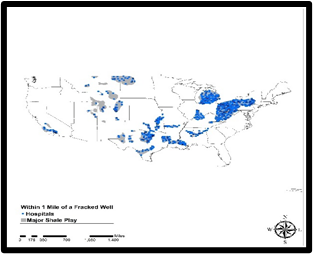

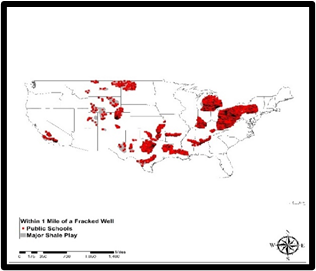

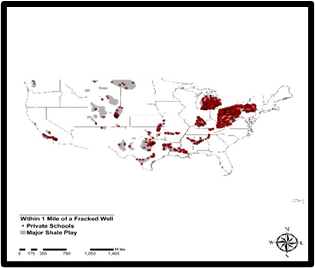

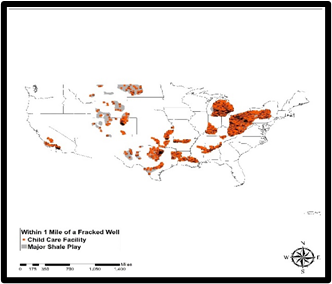

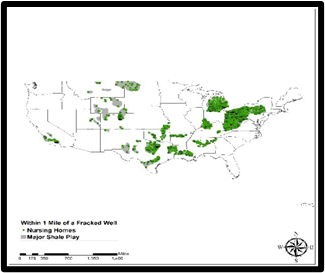

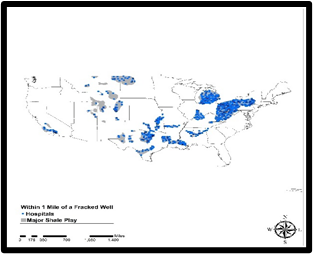

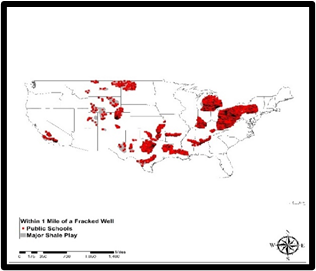

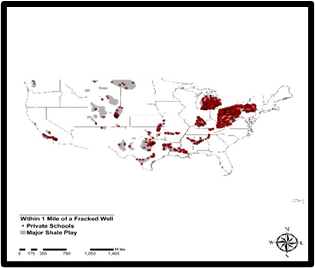

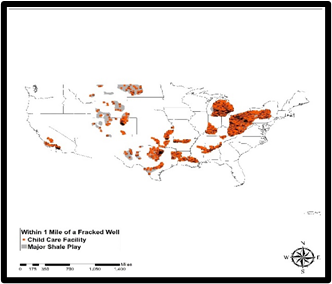

From the map there exists a gradual presence of low stress and low to medium stress of both < 10% -10-20% range in water stress along the south east axis of the map at Haynesville-Bossier shale along the states of Louisiana, Texas followed by the mix of medium to high type of stress in the Fayetteville shale in the nearby areas in the South West near Alabama and Mississippi in the deep south. From there comes further spread of medium to high water stress conditions in yellow orange (orange and red spots) of the map representing a trio of shale sites in the South West state of Texas most notably the Barnett and Permian in the upper sides of the state coupled with Eagle Ford in the Southern tip of Texas. Together with that are the instances of low stress and low to medium stress and clusters of high stress all through Bakken shales in the mountain zone, Niobrara along the Colorado axis and Monterey shale in the Pacific North west side of California at the scales of 10-20% -40-80%. Even at that, there are notable pockets of aridity and low use spread across the left side of the map in the South West Desert ecozones near to shale play sites in that part of the country. The depletion indicators as presented in the map clearly buttresses the levels of water depletion risks in different spots where hydraulic fracking is quite prominent. The indicators therein in the legend under different colors captures the depth of water depletion near the operating shales and major aquifers in the zone under the scales in blue to the red. Being closer to Haynesville-Bossier shale, the ground water depth in dark red color at 150-400 cubic km deep on the lower side of the map did outpace the other. See also the risk levels in the adjoining areas and aquifer in green near Eagle Ford shale in lower Texas at 3-10km and further up near Permian basin in red and the collection of sites along Niobrara shale region in yellow with ground water depletion levels of 150-400km to 10-25km coupled with additional spreading of groundwater depletion size of 50-150km deep into the Desert South west and Pacific ecozone near Monterey shale in the Californian axis of the study area (15.1). Pertaining to the built environment, the operation of fracking wells and their interactions with public facilities and shale play sources denoted in colors of green, red, orange, and blue, and grey occur at a regular frequency across the study area with threats to community wellbeing (Figures 16-16.4). Considering the nature of land use uses in place, from the maps, fracking activities in the shale fields has the capacity to inflict indelible mark on the ecology of the zone especially the various amenities that serve communities. These includes nursing homes, hospitals, schools (private and public) and childcare centers (Figures 16-Figures 16.4). From the indiscriminate locations within 1-mile radius of a fracked well and major shale play to a community facility. The matter remains compounded by the proximity of hydraulic fracking activities to at risk amenities like schools. The others include hospitals, and day care centers. Accordingly, localities under different land uses (day-care to hospitals) affected by fracking as represented in the various shades of colors, stretches all the way from the lower mid Atlantic side of the maps covering Virginia, on to the clusters of areas in the deep south east adjacent to the quartet of states made up of Alabama, Mississippi, Louisiana, and Arkansas. From there on, the spatial patterns along the South West hub of Texas, Oklahoma and up to the Mountain west corner near to a couple of states including Colorado and the others, reveals a dispersion of similar risks involving exposures to unwanted fracking liabilities threatening public amenities to as far as the Pacific North West zone in California. | Figure 16. Impacts on built environment Nursing Homes |

| Figure 16.1. The threats to Hospitals |

| Figure 16.2. The Vulnerability to Public Schools |

| Figure 16.3. The Dangers To Private Schools |

| Figure 16.4. The Exposures to Child Care Facility |

3.4. Factors Responsible for the Surge In Fracking

The reasons behind the proliferation of fracking activities and their ecological footprints across the geological basins known for active shale plays are not isolated. They are associated to some extent with physical with economic, policy and physical-geologic factors. These elements are presented fully below.

3.4.1. Economic Elements

In terms of factors that fuelled the uptick in hydraulic fracking, one must consider the socio-economic forces at play in the entire region like the percentage change in Real GDP all through 2018-2019. The fact that the distribution of the figures covers places in the region where energy resources including oil and gas ranked high, it came as no surprise that the states (Alaska, New Mexico, North Dakota, Texas, and Wyoming) that stood out posted much higher proportions of change in their respective real GDP. With Alaska’s and Wyoming’s real GDP figures of 2.35% -1.91% during the fiscal years 2018-2019 ahead of the other states. The GDP values for Southwest Desert state of New Mexico at 1.69% upstaged both Texas and North Dakota who finished at identical values of 1.41%-1.42%. Even though the GDP values in the states seemed somewhat disparate in the twelve-month period, the continual surge in this economic indicator provided favorable grounds that catapulted hydraulic fracking through investments in the sector, hence the change as witnessed in the zone. Another twist to the elements involved in the hydraulic fracking surge, can be seen from the display of the percentage change in the respective Real Gross Domestic Products of the states from 2016 -2019. The order of ranking nationally among the highly placed states, puts 5 states (Texas, Utah, New Mexico, and Wyoming) in prime spots of 1-3,4 to 5-6 in 2019. Aside from 2016 when the percent change in real Gross GDP in 11 of 16 states in the study area stayed in positive columns and on the rise. Between 2017 through 2019, the indicator rose notably in the states. At that regional level, all through 2016 to 2019, the average change in the real GDP rose from 0.53%-16% to 2.6% -2.5%. Such a remarkable turnaround in the GDP index for the region, may have sparked the resurgence in hydraulic fracking activities in a manner that impacted the surrounding ecology in the process.

3.4.2. Policy Initiatives

Considering the chaotic regulatory enforcement, and the uncooperative industry reluctant to comply with standards germane to ecological protection in hydraulic fracking activities over the years. The enabling policy environment created by the previous US administrations from Barak Obama to Donald Trump offered the needed impetus. This enabled the ongoing boom in the sector built on access to innovative technologies at the disposal of the industry, and those involved in hydraulic fracking related investments. Surely, the Obama administration loosened the ruling regulating fracking on federal land while congress also omitted fracking from regulations enforced by the Environmental Protection Agency. Under such conditions, the fracking sector grew promptly in the past years as Wall Street financiers put their money on the rising need for oil and gas. To some extent, such optimism came through. Thus, many years since Congress moved to beef up the nation’s supplies amidst the possibilities of oil scarcity, the US extracted large amount of crude oil and hydraulic fracked gas in such a way that the Obama administration ended the export prohibition promulgated at time of the 1970s energy crisis. This as well accorded the US new global geopolitical power as it temporarily surpassed Saudi Arabia as the leading exporter of oil. In drawing from opportunities created under very favorable policy instruments that benefited the energy sector, financiers took advantage of available subsidies, loopholes, investment portfolios, support from lending agencies and the financial industry. This in turn positioned the energy industry to remain competitive and absorb eventual shocks from market volatilities in a way that made hydraulic fracking a promising venture amidst production surpluses and increases that saw the US emerge as the number one oil producing nation in global ranking.

3.4.3. Physical and Geologic Attributes

Seeing how innovations in established precision technology are delivering new prospects in oil and natural gas output in the region and 60% of US capacity through fracking. The alternative technique of hydraulic fracking clearly injected an era of energy security that ensured some independence for the US in a way that minimizes the influence of the Organization of Petroleum Exporting Countries (OPEC) in creating volatility. Also, considering the study area’s location in the energy hub of the nation dominated by major producing states of Texas, Oklahoma and Colorado and others with the largest and most active shale plays operations. The ingredients for recurrent surge in fracking exploration were already in place, hence the major turnaround in the sector. With the increased production and spreading of the technique across the region made possible by the large hydrocarbon deposits buried beneath swaths of areas stretched along the major geologic basins from South east, South west to the Mountain west, and Pacific west and Desert South west ecozone. The study area now has at its disposable more access to millions of oil and gas wells in a manner not seen before. Accordingly, the rapid inventions in fracking expertise allowed energy prospectors in the zone to tap into vast oil and natural gas assets in shale plays previously deemed inaccessible. This partly spurred the widespread activities in the sector and the resultant impacts.

4. Discussion

Judging from the assessment undertaken herein, the research stressed the issues pertaining to the growing preference of fracking as an alternative production technique in the nonrenewable energy sub-sector of the United States. Part of the initial appraisal touched on the potentials of fracking and the way it was gaining currency among producers and investors through the intensity of drilling and exploratory initiatives in the study area. These are based on a host of alternative energy indices that are indicative of the current turn around and state of hydraulic fracking. They comprise of fracking wells, shale play gas production, natural gas production, the number of crude oil wells, shale plays production rate, oil and gas wells, together with percentages and averages, the GDP of oil and gas and the others. Seeing that these emergent tendencies encapsulate interactions between various factors from policy to physical and environmental forces germane to hydraulic fracking across the Southeast and the US Western region. Mix scale tools of descriptive statistics and GIS underpinned these interactions via varying indices including production, the core fracking parameters human-environment, socio-economic, geologic and hydrogeologic interface in the study area. Besides, the string of visible geographical patterns signifying distribution of shale plays, fracking status, water stress from fracking, and shale gas production rate. These configurations serve as a proof of the intensity of operations in the study area. For that, the spatial visualization pinpointed in-depth clusters and dispersion patterns of the diverse hydrologic fracking indices like shale play impacts on built environment, day-care, nursing homes, public and private schools, and hospitals across the various periods. In the process, some of the ensuing spatial forms among the indicators held steady in certain points but only to evolve over time. While these frameworks steered identifications of hydraulic fracking activities and potentials of the sector pertaining to output, geologically active basins moratoria spots, current shale plays and prospective plays. They showed the production rates, baseline water stress of different scales as well as the proximity of and interactions of shale play activities within human environment in the study area. This includes geological basins containing portions of the nation’s existing and untapped hydraulic fracking capacity across 16 states producing 27.3 Billion Cubic Feet (BCF) to 3.8 Million Barrels Daily (MBD) in natural gas and oil production with Texas ranked as the number one source. This happened in the face of rising significance of hydraulic fracking technique in fossil fuel energy production along with unparalleled growth, fiscal surplus, employment opportunities and some ecological challenges. This appears in line with the widespread penetration of fracking as the preferred production technique in the existing shale fields all through California in the Monterey basin in the west to Barnett, Eagle Ford, and the Permian shales in Texas down south. During the same time, the number of fracked wells also increased exponentially in the hundreds of thousands by 2000 to 2015. From the opportunities offered by the half a trillion $ injected into the GDP from fracking in 2012. It is pertinent to underline the extent to which fiscal and market appeal associated with fracking, enhanced revenue generation that benefited from an enabling policy environment. Notwithstanding all the rosy economic picture painted so far about hydraulic fracking techniques, environmental liabilities have been occurring from these activities across the study area over the years. To that effect, many communities that are adjacent to fracking activities experienced greater exposures to negative ecological footprints. In study area also, cases of pollution, water stress, the threats of fracking induced seismic activities, land degradation and Green House Gas emissions have been reported. Given the correlation between the volume of oil and gas output and negative carbon footprint over time in the study area. Texas as the leading producer not only outpaced the rest of the states, but it used up more water, chemicals and cleared out more land areas under the right of way clause for fracking. In the context of factors ranging from several socio-economic and physical elements located withing the larger energy structure. The enabling pro industry policy setting played major role in sparking the fracking boom and expansion in the region. Hence, the accumulated economic benefits reflect the revenue generation potentials and contributions to both US and the respective state GDPs. Additionally, the presence of essential geological basins with vast energy assets and shale plays spread across the states with new technologies underscores the potential for hydraulic fracking therein. Drawing on latest innovations in technology and boundaries of endless possibilities in fracking-based fossil fuel production. The geography of shale plays currently driving energy surge in the US, points to visible concentration in the study area from the South East to West coast. This involves complex networks of bedrock spots and formations synonymous with hydraulic fracking beginning with Haynesville play in the South to the Monterey basin in the West. To remedy the situation, the paper proffered solutions ranging from ecological monitoring to the design of regional energy information system, effective policy, community participation/education of the public and the establishment of interagency task force.

5. Conclusions